Another quarter of strong growth:

- A very strong Q31 with revenue up 39% at constant exchange

rates (+30% like-for-like2)

- Forward momentum driven by PlanetArt’s robust gains (+ 55%

at constant exchange rates) and Avanquest’s return to top line

growth

- €373 million in revenue for the first nine months, up 28% at

constant exchange rates (+20% like-for-like)

This press release presents unaudited Group

consolidated revenue, prepared in accordance with IFRS.

Regulatory News:

Q3 2020-2021 (January-March 2021) was Claranova’s (Paris:CLA)

17th consecutive quarter of growth with revenue of €96 million, up

39% at constant exchange rates and 30% like-for-like from the same

period last year.

This quarterly momentum reflected robust gains by the

personalized e-commerce activities (PlanetArt), up 55% at constant

exchange rates and the return to growth by the software publishing

activities (Avanquest). Based on this particularly strong third

quarter performance, Claranova reported revenue of €373 million for

the first nine months (July 2020-March 2021) or growth of 28% at

constant exchange rates and 20% like-for-like.

Revenue by division for Q3 2020-2021:

In €m

Jan. to Mar. 2021 (3

months)

Jan. to Mar. 2020 (3

months)

Change

Change at constant exchange

rates

Change at const. consolidation

scope

Change at const. consolidation

scope and exchange rates

PlanetArt

72

50

45%

55%

35%

42%

Avanquest

23

22

4%

7%

4%

7%

myDevices

1

1

-34%

-28%

-34%

-28%

Revenue

96

73

31%

39%

24%

30%

Revenue by division for the first nine months of FY

2020-2021:

In €m

Jul. 2020 to Mar. 2021 (9

months)

Jul. 2019 to Mar. 2020 (9

months)

Change

Change at constant exchange

rates

Change at constant consolidation

scope

Change at constant consolidation

scope and exchange rates

PlanetArt

306

236

30%

37%

20%

27%

Avanquest

65

68

-5%

-1%

-5%

-1%

myDevices

3

4

-14%

-8%

-14%

-8%

Revenue

373

307

22%

28%

14%

20%

PlanetArt: Q3 revenue up more than 50% at constant exchange

rates

PlanetArt, Claranova’s personalized e-commerce division

registered another quarter of very strong growth with revenue of

€72 million, up 55% at constant exchange rates. All geographies

(the United States and Europe) and e-commerce activities (web and

mobile), including both photo products and personalized gifts,

benefited from this strong growth momentum. This performance

notably reflects both the successful integration of the Personal

Creations businesses and the successful launch in the US market at

the beginning of the year of FreePrints Gifts, the new mobile app

in the FreePrints range for creating personalized gifts. The

excellent results achieved by FreePrints Gifts over the first nine

months of FY 2020-2021 highlight PlanetArt’s ability to monetize

its existing customer base.

PlanetArt’s revenue exceeded €300 million (€306 million) for the

first nine months of FY 2020-2021 with growth of 37% at constant

exchange rates. On a like-for-like basis (at constant consolidation

scope and exchange rates), PlanetArt’s revenue grew 27% over the

period.

Avanquest: software publishing activities back on track in

Q3

Avanquest, Claranova’s software publishing division, was back on

a track of top line growth in Q3 2020-2021 with revenue of €23

million, up 7% at constant exchange rates. This completes the

transition to a software subscription-based model (SaaS)3 with the

division’s proprietary software (PDF, Security, Photo) now

accounting for more than three quarters of its revenue. As a

result, Avanquest’s recurring revenue (including SaaS) are

increasing steadily, reaching 60% of total revenue in Q3 (up from

56% in Q1 2020-2021).

Growth in overall sales continues to be impacted by decreasing

contributions from non-strategic activities, and notably the

residual volume of physical software sales whose percentage in

Avanquest’s revenue mix continues to decline. Outside of these

legacy revenues, the rest of the division registered double-digit

growth in Q3 2020-2021.

On that basis, revenue from software publishing activities

remained steady for the first nine months of the period at €65

million, (-1% at constant exchange rates).

myDevices: sales momentum continues to be impacted by the

pandemic

myDevices’ IoT activities had revenue of close to €1 million in

Q3 2020-2021, down 28% at constant exchange rates. This third

quarter trend reflects a further slowdown in the pace of deployment

in the division’s main industry sectors in response to the current

health situation. It also reflects an unfavorable comparison base

in relation to Q3 2019-2020, a period that included non-recurring

revenue from commercial agreements with certain of its channel

partners (including the US phone carrier, T-Mobile/Sprint). The

increasingly rapid pace of vaccination rollouts, notably in the

United States where one third of the population is now already

fully vaccinated, should contribute to a reacceleration in

myDevices’ commercial deployment in the upcoming months.

myDevices had revenue of €3 million in the first nine months,

down 8% at constant exchange rates.

“After a second quarter that confirmed the potential for

profitability of our personalized e-commerce activities within an

environment of reduced marketing investments, this third quarter

offered yet another demonstration of Claranova’s growth potential.

With nearly €100 million in revenue in this quarter and growth at

constant exchange rates of 39%, Claranova registered another

quarter of very strong growth and confirmed the relevance of our

target for revenue of €700 million by 2023”, commented Pierre

Cesarini, CEO of Claranova group.

Financial calendar: August 4, 2021: FY

2020-2021 revenue.

About Claranova:

Claranova is a high-growth international technology group with a

long-term vision and resilient business models operating in high

potential markets. As the leader in personalized e-commerce

(PlanetArt), Claranova provides added value through technological

expertise in software publishing (Avanquest) and the Internet of

Things (myDevices). These three business divisions share a common

mission to simplify access to new technologies through solutions

combining innovation and ease of use. Based on these strengths,

Claranova has maintained an average annual rate of growth for the

past three years of more than 45% and in FY 2019-2020 had revenue

of €409 million.

For more information on Claranova group:

https://www.claranova.com or

https://twitter.com/claranova_group

CODES Ticker : CLA ISIN : FR0013426004

www.claranova.com

Disclaimer:

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements.

1 Q3 2020-2021 covers the period from January to March 2021 2

Like-for-like (organic) growth equals the increase in revenue at

constant consolidation scope and exchange rates. Like-for-like

growth for the first nine months of FY 2020-2021 was restated to

eliminate the effects of acquisitions, i.e. the CafePress

businesses integrated in September 2020 and the Personal Creations

businesses acquired in August 2019. As a result, this excludes the

months of September 2020 to March 2021 for CafePress and July 2020

for Personal Creations. Revenue from recent acquisitions by the

Avanquest division (PDFescape, Gamulator, Kubadownload) was not

restated in calculating growth at constant scope as the impact of

these amounts on revenue of the division and the Group over the

periods in question was not material. 3 Software as a Service.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210511005875/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATIONS +33 1 75 77 54 65

ir@claranova.com

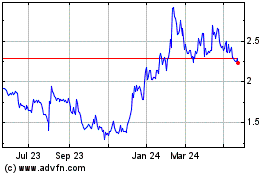

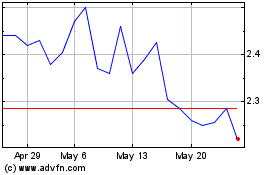

Claranova (EU:CLA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Claranova (EU:CLA)

Historical Stock Chart

From Dec 2023 to Dec 2024