Global Bioenergies: net loss reduced to €2.8m in first-half 2024

September 10 2024 - 11:45AM

PRESS RELEASE

Global Bioenergies: net loss reduced to

€2.8min first-half 2024

Net loss reduced to -2.8 M€ compared to

-€4.1 million in H1 2023and -€5.8 million for H1

2022

Gross cash position of €7.7 million as of

30 June 2024vs €11.7 million as of 31 December

2023

Evry, 10 September 2024 – 05:45

p.m.: Global Bioenergies' Board of Directors today

approved the financial statements for the first half of 2024, which

have been audited by the Statutory Auditor.

Samuel Dubruque, Chief Financial

Officer, comments: « Our result is improved compared to

previous years: the half-year loss is limited to €2.8 million, due

in particular to the recording of an operating subsidy for the

Isoprod program financed by ADEME. We started the year with a gross

cash position of €11.7 million, and had a cash position of €7.7

million at 30 June 2024. The first half of the year saw us

consolidate our plant project: improvements in process performance

at pilot scale, receipt of letters of intent exceeding the plant's

production capacity, completion of the basic engineering and

pre-selection of the site in France. One year ago we obtained the

support of the French government with a €16.4 million grant from

Bpifrance. Since then, we have been striving to find additional

debt and equity investors in a particularly adverse climate due to

the political and economic uncertainties that are complicating the

project’s completion. In this context, we are nevertheless pleased

to announce that we have passed the first selection stage of a

European financing package worth a total of €17.5 million for the

financing of this plant, the final result of which is expected in

H1 2025”.

Marc Delcourt, Co-founder and

CEO, adds: “The progress made in our cosmetics plant

project translate directly into the strategic field of SAF

(Sustainable Aviation Fuels). Improved performance and the

identification of a new resource, acetic acid, open the door to the

production of e-SAF via our process, and reaffirm Global

Bioenergies' potential to become a key player in this field of

aviation, which is currently in search of solutions.”

Group Profit & Loss

Account

|

€ thousands |

from 01/01/24to 30/06/246

months |

from 01/01/23to 30/06/236

months |

from 01/01/22to 30/06/226

months |

|

|

|

|

|

| Operating

income |

4.612 |

7,326 |

1,059 |

| Operating

expenses |

7,504 |

11,264 |

6,632 |

|

Operating profit (loss) |

-2,892 |

-3,938 |

-5,573 |

| |

|

|

|

|

EBITDA1 |

-976 |

-3,026 |

-5,024 |

|

Financial profit (loss) |

144 |

23 |

-61 |

| Exceptional

profit (loss) |

-42 |

-169 |

-124 |

| Income tax |

NA |

NA |

NA |

|

|

|

|

|

|

Net profit (loss) |

-2,789 |

-4,084 |

-5,759 |

|

€ thousand |

from 01/01/24to

30/06/20246 months |

from 01/01/23to

30/06/20236 months |

from 01/01/22to

30/06/20226 months |

|

|

|

|

|

|

Operating income |

4,612 |

7,326 |

1,059 |

| |

|

|

|

| Revenue |

339 |

3,102 |

144 |

| Operating

subsidies |

4,091 |

1,184 |

894 |

| Change in the

inventory of finished products |

-263 |

1,917 |

-34 |

|

Other income |

445 |

1,123 |

55 |

Operating income includes recognition of subsidy

income from two projects supported by ADEME: the end of the Isoprod

project validating isobutene derivatives in cosmetics, and subsidy

income from the ongoing Prénidem project.

|

€ thousand |

from 01/01/24to

30/06/20246 months |

from 01/01/23to

30/06/20236 months |

from 01/01/22to

30/06/20226 months |

|

|

|

|

|

|

Operating expenses |

7,504 |

11,264 |

6,632 |

| |

|

|

|

| Staff

costs |

2 231 |

2 194 |

2 309 |

| Average number

of employees (No.) |

45.2 |

47.6 |

47.3 |

|

Industrialisation expenses |

1,191 |

2,687 |

2,597 |

| Change in IBN

and derivatives inventories |

-97 |

2,461 |

-584 |

| Laboratory

costs |

170 |

192 |

185 |

| Rent, servicing

& maintenance |

536 |

518 |

423 |

| Intellectual

property |

178 |

186 |

137 |

| Depreciation,

amortisation and provisions |

2,361 |

2,028 |

559 |

|

Other structural costs |

934 |

997 |

1,006 |

The industrialisation expenses were mainly used

to demonstrate the success of the process scale-up within at our

ARD-operated facilities in Pomacle-Bazancourt.

Group Balance Sheet

|

Assets (€ thousand) |

30/06/24 |

31/12/23 |

31/12/22 |

|

Liabilities (€ thousand) |

30/06/24 |

31/12/23 |

31/12/22 |

|

|

|

|

|

|

|

|

|

|

| Intangible

assets |

204 |

327 |

539 |

|

Capital |

908 |

906 |

749 |

| Tangible

assets |

647 |

2,471 |

3,612 |

|

Share

premium |

|

10,538 |

16,029 |

| Assets under

construction |

394 |

77 |

401 |

|

Balance carried

forward |

-940 |

-2,769 |

-2,708 |

| Financial

assets |

347 |

341 |

1,546 |

|

Profit

(loss) |

-2,789 |

-8,656 |

-11,986 |

| |

|

|

|

|

Equipment subsidies |

2 675 |

2 758 |

463 |

|

|

|

|

|

|

|

|

|

|

|

NON CURRENT ASSETS |

1,591 |

3,217 |

6,097 |

|

EQUITY |

-146 |

2,778 |

2,547 |

|

|

|

|

|

|

|

|

|

|

| IBN and

derivatives inventories |

209 |

219 |

2,342 |

|

PROVISIONS |

210 |

53 |

110 |

| Consumables

inventories |

372 |

350 |

250 |

|

|

|

|

|

|

Receivables |

3,338 |

2,247 |

3,647 |

|

Conditional

advances and loans |

10,443 |

12,451 |

11,486 |

| Cash |

7,515 |

11,673 |

8,768 |

|

Trade

payables |

2,507 |

2,411 |

5,580 |

| Marketable

securities |

171 |

171 |

173 |

|

Tax and social

securities liabilities |

625 |

559 |

502 |

| Prepaid

expenses |

451 |

378 |

300 |

|

Other debts and

deferred income |

8 |

3 |

1,352 |

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS |

12,055 |

15,038 |

15,480 |

|

PAYABLES |

13,583 |

15,423 |

18,921 |

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

13,647 |

18,254 |

21,577 |

|

TOTAL LIABILITIES |

13,647 |

18,254 |

21,577 |

Gross cash flow amounts to €7.7 million as of 30

June 2024, compared to €11.7 million as of 31 December 2023.

Highlights of the first half of 2024,

recent events and outlook

-

Technical and commercial progress in the cosmetics plant

project

The first half of the year was marked by

progress made on the technical and commercial aspects of the

project to build a plant with a capacity of 2,500 tonnes/year to

address the cosmetics markets. On the technical side, scale-up

tests demonstrated that performance would hold up well in larger

fermenters, thus confirming the assumptions made in the plant's

business plan. The preliminary design, which was successfully

completed, confirmed the nominal CAPEX of €65 million (i.e. a

maximum CAPEX of around €80 million taking contingencies into

account). On the commercial side, potential customers showed their

interest with letters of intent from several geographies, far

exceeding the plant's production capacity.

-

Development of the technological process for e-SAF

production

Global Bioenergies has successfully extended its

bio-SAF production process to the production of e-SAF in the

laboratory by replacing plant resources with a synthetic resource,

acetic acid. This e-SAF approach stands out for its selectivity of

over 95%, meaning that more than 95% of the molecules resulting

from the process can be marketed as jet fuel. This selectivity

exceeds that of other existing e-SAF technologies.

As a reminder, e-SAFs, produced solely from CO2

and renewable electricity, maximize the decarbonisation potential

of SAF. Bio-SAF and e-SAF are regulated by the European Union's

ReFuelEU Aviation regulation, which imposes dedicated mandates for

these two fuels. By 2030, all aircraft taking off from the European

Union must carry at least 4.8% bio-SAF and 1.2% e-SAF in their fuel

tanks.

About GLOBAL BIOENERGIES

As a committed player in the fight against

global warming, Global Bioenergies has developed a unique process

to produce SAF and e-SAF from renewable resources, thereby meeting

the challenges of decarbonising air transport. Its technology is

one of the very few solutions already certified by ASTM. Its

products also meet the high standards of the cosmetics industry,

and L'Oréal is its largest shareholder with a 13.5% stake. Global

Bioenergies is listed on Euronext Growth in Paris (FR0011052257 -

ALGBE).

Contacts

|

GLOBAL BIOENERGIES+33 (0)1 64 98 20

50invest@global-bioenergies.com Follow our

news Receive information about Global Bioenergies

directly by subscribing to our news feed on

https://www.global-bioenergies.com/inscription-newsletter/ Follow

us on LinkedInGlobal Bioenergies |

|

NewCap – Investor

relationsLouis-Victor DelouvrierAurélie

Manavarereglobalbioenergies@newcap.eu+33 (0)1 44 71 94

94 NewCap – Media relations Nicolas

Merigeauglobalbioenergies@newcap.eu+33 (0)1 44 71 94 98 |

1 EBITDA is calculated as operating income plus

depreciation, amortisation and provisions and minus reversals of

depreciation, amortisation and provisions. It highlights the result

generated by the activity without taking into account the entries

related to the valuation of the asset.

- Global Bioenergies_net loss reduced to €2.8m in first half

2024_EN

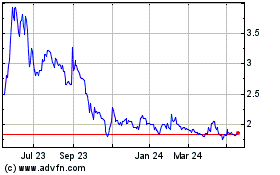

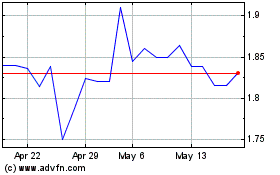

Global Bioenergies (EU:ALGBE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Global Bioenergies (EU:ALGBE)

Historical Stock Chart

From Nov 2023 to Nov 2024