Ethereum Is Consolidating After The Flush Last Weekend – The Calm Before A Big Move?

February 07 2025 - 6:00PM

NEWSBTC

Ethereum experienced one of the most aggressive sell-offs in its

history on Monday, plunging 25% in a single day amid market-wide

panic. The rapid decline sent shockwaves through the crypto space,

marking one of the most volatile trading sessions ever recorded for

ETH. Related Reading: Bitcoin Support Sits At $90,6K

Short-Term Holder Realized Price – Expert Reveals Key Resistance

Level However, within hours, the price rebounded, erasing nearly

the entire drop and stabilizing above key support levels. Despite

this swift recovery, Ethereum now faces serious risks as it trades

slightly below a crucial resistance level, leaving investors

uncertain about its next move. Top analyst Daan shared a technical

analysis on X, revealing that both Bitcoin and Ethereum are

currently in consolidation, attempting to form a higher low after

the dramatic market flush from this weekend. He noted that this

phase is critical for determining the next major trend, as holding

above current levels could signal the beginning of a new bullish

leg. Failure to establish strong support could lead to

further downside, putting Ethereum at risk of another correction.

With uncertainty still looming, all eyes are on ETH’s ability to

reclaim lost ground and establish momentum for a potential breakout

in the coming days. Ethereum Prepares for a Decisive Move Amid

Uncertainty Ethereum is currently trading below the $2,800 mark,

struggling to gain momentum after last week’s historic volatility.

The recent price action has left investors frustrated, as hopes for

a strong rally continue to fade. While Bitcoin has shown relative

strength, Ethereum remains stuck in a tight range, unable to break

above key resistance levels. The uncertainty in the market has led

to a decline in investor confidence, with many questioning whether

ETH will be able to reclaim its bullish structure anytime soon. Top

analyst Daan shared a technical analysis on X, revealing that

consolidations are forming everywhere. He noted that BTC, ETH, and

most altcoins are displaying similar patterns—attempting to

establish a higher low after the aggressive flush from the weekend.

According to Daan, if Ethereum successfully breaks above its

consolidation channel, it could gain the momentum needed to push

above key supply levels and start a new bullish phase. However,

failure to do so could lead to more downside pressure. The coming

weeks will be crucial for Ethereum’s price trajectory. If ETH can

hold above $2,700 and push toward $3,000, it may spark renewed

interest from investors. However, continued failure to reclaim key

resistance levels could push Ethereum into deeper consolidation,

further frustrating market participants. Related Reading: Ethereum

Is Testing Key Support on the ETH/BTC Chart – A Parabolic Move

Could Be Next Despite short-term uncertainty, institutions are

continuing to accumulate ETH, recognizing its long-term value.

Historically, these periods of consolidation have been followed by

explosive price movements. Price Struggles Below $2,900

Ethereum is currently trading at $2,750 after days of consolidation

below the $2,900 mark. Despite multiple attempts to push higher,

ETH has struggled to reclaim key resistance levels that would

signal a shift in momentum. The price action remains uncertain,

with bulls attempting to hold the $2,700 support zone while looking

for a breakout above the $2,800 mark to regain short-term control.

The most critical resistance level remains the $3,000 mark. If

Ethereum can successfully push above this price and turn it into

support, it will open the door for a rally into higher supply

levels. This would strengthen the bullish case and potentially

trigger a move toward $3,300 or higher. Related Reading: Solana

Could Target $220 If It Holds Current Levels – Analyst Expects

Short-Term Bullish Momentum On the downside, holding above $2,700

is crucial for avoiding further selling pressure. If ETH fails to

defend this level, a drop toward $2,600 or even $2,500 could be the

next move. However, as long as Ethereum remains within this

consolidation range, traders will continue to watch for a decisive

breakout. A close above $2,800 in the coming days would be the

first sign that bulls are gaining momentum and that a new uptrend

is beginning. Featured image from Dall-E, chart from TradingView

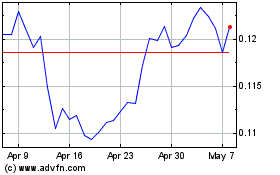

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025