Is BONK Rally In Jeopardy? Technical Indicators Confirm Weakness

November 28 2024 - 8:00AM

NEWSBTC

BONK is facing mounting bearish pressure as technical indicators

signal growing weakness in the market. After a brief attempt to

stabilize, the token appears to be losing momentum dropping again

toward the $0.00004002 for another test, with key metrics pointing

to further downside. As BONK navigates these challenging

conditions, speculations are on whether the meme coin can reclaim

its footing or if deeper losses are inevitable. This analysis

dives into BONK’s current market performance under bearish

conditions, highlighting the technical indicators that signal

potential weakness. Furthermore, we will assess the likelihood of a

recovery or a continuation of BONK’s downward trajectory by

analyzing critical support levels, market trends, and the broader

outlook, Technical Indicators Signal Growing Weakness For

BONK On the 4-hour chart, BONK exhibits negative sentiment, trading

below the 100-day Simple Moving Average (SMA) as it trends downward

toward the $0.00004002 support level. A continued descent to this

support suggests that selling pressure is intensifying, and if the

support fails to hold, the asset could experience more declines.

Also, an analysis of the 4-hour chart reveals that the Relative

Strength Index (RSI) has now declined to the 44% level following a

previous attempt to rally, which peaked at 49% before losing

strength. A declining RSI, particularly as it remains below the

neutral 50% level, indicates that bearish momentum is building. If

the RSI continues to dip, it could further validate the downtrend,

potentially leading to more significant price drops as selling

pressure intensifies. Related Reading: BONK In Trouble As Sharp

Decline Hints At An Impending Pullback On the daily chart, the meme

coin displays notable downward movement, highlighted by a bearish

candlestick with a strong rejection wick that has emerged after a

failed recovery attempt. The inability to sustain an upside

direction implies a lack of buyer confidence and a prevailing

negative sentiment in the market. As BONK aims at the $0.00004002

support level, the pressure from sellers could intensify, raising

concerns about the possibility of a breakdown. Finally, the 1-day

RSI shows increasing negative pressure on the cryptocurrency, with

the signal line dropping sharply from the overbought zone to 56%.

This decline marks a shift in momentum, indicating that buying

strength is weakening and selling pressure is rising. Should the

RSI continue to fall, it could signal sustained pessimistic

sentiment and declines for BONK. Bounce Back Or Further Decline?

Two potential scenarios are likely as BONK faces bearish pressure:

a bounce back or further decline. If the meme coin can hold the

critical $0.00004002 support level and attract renewed buying

interest, it could spark a recovery, possibly reversing the current

downtrend and pushing the price to the $0.00006247 resistance range

and beyond. Related Reading: Bonk Downward Drift To $0.00002635,

Can Bulls Ignite A Trend Reversal? However, if selling pressure

persists and BONK fails to sustain the $0.00004002 support level, a

deeper decline may follow, with the price potentially dropping to

lower support zones, including $0.00002962, $0.00002320, and below.

Featured image from X, chart from Tradingview.com

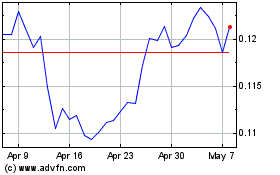

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024