Injective (INJ) Skyrockets 21% As Proponents Weigh In On New Developments

August 24 2024 - 3:30PM

NEWSBTC

Injective piques investors’ interest as on-chain developments

continue on the platform. These new integrations and information

excite investors, bumping the token’s price by over 21%. The

continuous positive developments are expected to further steer the

INJ on the bullish path. Related Reading: Stacks: New Developments

Push STX Price 18% Higher – Details Given the conditions and

positive developments of Injective, its investors and traders have

chosen the status of INJ as a prime crypto for its native token,

providing values to users and traders. ‘Fastest Layer 1 Blockchain’

Slashed Blocktimes To Just 0.65 Seconds Injective recently posted a

thread detailing the platform’s most recent achievement: slashing

finality times to just 0.65 seconds. The platform’s finality times

were compared to other layer 1 blockchains like Near, BNB, and

Ethereum. According to the thread, the network’s finality times are

caused by “carefully engineered optimizations focused on several

key areas from optimized state synchronization and data handling to

enhanced resource management.” 1/5 Injective continues to push the

boundaries of blockchain scalability, with recent upgrades

delivering the fastest speeds imaginable. Injective block times

have now been slashed to just 0.65 seconds, making it one of the

fastest layer 1 blockchains ever created ⚡️

pic.twitter.com/lFN3W1w2Ve — Injective 🥷 (@injective) August 21,

2024 This helps improve user experience on-chain while providing

developers with a robust platform to build on. Another aspect that

Injective is looking towards is the institutional aspect of crypto.

The extremely low block times will help attract traditional

financial institutions to the platform with speeds rivaling that of

the top crypto networks. Injective Integrates With Balance,

Expanding Network Services This week, Injective also announced the

integration of Balance, a cross-chain decentralized finance

platform (DeFI), on the Injective mainnet. The integration opens

new opportunities for investors and traders as it introduces new

assets like bnUSD, Balance’s native stablecoin. The

partnership also enables overcollateralized loans on the platform.

This enables users to use any asset as collateral, giving them up

to two-thirds of the collateral’s value as a loan. With a low 2%

fixed interest, users on the platform can flexible loan terms with

fast block time finality with Injective. INJ Faces Rejection

On This Level, But With A Possible Rebound As of press time, the

token’s momentum, although still significantly bullish, is facing

rejection on the $0.39 ceiling, trapping the token in the narrow

$0.36-$0.39 range. This range might pressure the bulls to lose

momentum in the short term. Related Reading: Floki Has ‘More

Room To Climb,’ Targets 96% Rally – Analyst At this point, the

token’s correlation with Bitcoin and its most recent developments

has squeezed the last bit of bullishness out of INJ, possibly

opening the doors to a downward trajectory in the coming

days. With the relative strength index signaling that the

bulls are nearly or already exhausted, investors and traders should

expect the bears to attempt a breakthrough on the $0.36 floor

before stabilizing on the token’s current trading range. If the

bulls are unsuccessful in defending this trading range, the price

floor of Injective might move back to $0.32 soon. Featured

image from Snopes, chart from TradingView

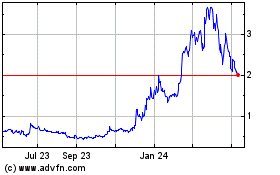

Stacks (COIN:STXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

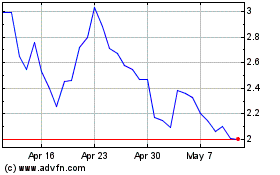

Stacks (COIN:STXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024