Dexus Offers Sweetener to A$2.6 Billion Investa Office Bid - Update

March 29 2016 - 9:05PM

Dow Jones News

By Rebecca Thurlow

SYDNEY--Australia's biggest office landlord Dexus Property Group

(DSX.AU) has offered a sweetener to its 2.6 billion Australian

dollar (US$2.0 billion) bid for Investa Office Fund (IOF.AU), in an

attempt to get a deal across the line amid strong demand for

commercial property in Australia.

Investa Office said Wednesday its shareholders will receive an

additional 7 Australian cents for each share in the fund by way of

a special distribution conditional on the success of the merger,

which would entrench Dexus's dominance of the listed office trust

sector in Australia after it snapped up rival Commonwealth Property

Office Fund in 2014 following a takeover fight with GPT Group.

The distribution is in addition to Dexus's existing offer of

0.424 Dexus shares and A$0.8229 in cash per Investa Office share.

The proposal already has the backing of the Investa Office board

but in an usual turn of events, is being opposed by the fund's

manager Investa Commercial Property Fund Group.

ICPF recently took over the management of Investa Office from

Morgan Stanley as part of a move by the U.S. investment bank to

divest its Australian commercial property business Investa Property

Group. In a rare misalignment between the advice of a real estate

trust's manager and that of its board, ICPF is urging shareholders

to reject the Dexus offer and instead buy half the management

platform.

Dexus has asked the Takeovers Panel to intervene in the deal by

preventing Morgan Stanley's real estate investing arm, which still

controls an 8.9% stake in Investa Office, be prevented from voting

when shareholders meet to decide on the deal, arguing it is

conflicted because it is related to ICPF.

The move sparked retaliatory proceedings from Morgan Stanley in

the Supreme Court of New South Wales, which on Thursday found no

reason why the investment bank should be prevented from voting. The

Takeovers Panel is yet to say whether it will conduct proceedings

into the matter.

Dexus said Wednesday it agreed to the special distribution after

calculating that its transaction costs associated with the takeover

would be A$19 million lower than expected, primarily due to a

reduction in financing costs, and because it believes the payment

"will further enhance the appeal of the Dexus Proposal to Investa

Office Fund unitholders."

Drawing a line in the sand, Dexus said it doesn't intend to

increase the takeover bid or consent to any further distributions

in the absence of a competing transaction.

Pouring water on speculation in local media that a consortium

including Australian property developer Mirvac Group (MGR.AU),

China Investment Corp. and Blackstone Group (BX) may be preparing a

competing offer, Investa Office said it hadn't received such an

offer and isn't aware of a competing proposal from any party.

Investa said the shareholder meeting scheduled for April 8 will

be postponed to enable shareholders to consider the implications of

the additional payment. A new date will advised in the

soon-to-be-released Supplementary Explanatory Memorandum.

-Write to Rebecca Thurlow at rebecca.thurlow@wsj.com

(END) Dow Jones Newswires

March 29, 2016 20:50 ET (00:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

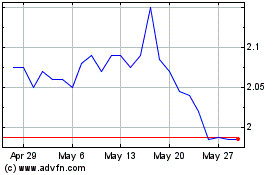

Mirvac (ASX:MGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

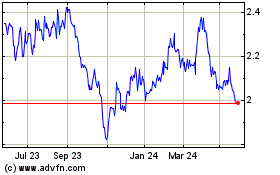

Mirvac (ASX:MGR)

Historical Stock Chart

From Dec 2023 to Dec 2024