AMP Won't Pay Interim Dividend with Life Sale Derailed

July 14 2019 - 6:44PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Financial services provider AMP Ltd.

(AMP.AU) warned Monday it doesn't plan to pay a first-half dividend

in anticipation the proposed sale of its Australian and New Zealand

wealth-protection and mature businesses won't go ahead.

The Australian company said a deal with Resolution Life Group

Holdings LP was highly unlikely to proceed on the terms agreed due

to the challenges of meeting conditions set by the Reserve Bank of

New Zealand for approval.

AMP said it was working with Resolution Life to determine if

there is a solution that would address policyholders' interests and

regulatory requirements, but that will require the negotiation of

new terms and isn't certain.

As part of a sweeping overhaul unveiled last October, AMP agree

to sell its AMP Life unit to Resolution Life for 3.3 billion

Australian dollars (US$2.32 billion), including A$1.9 billion in

cash.

New Zealand's central bank earlier this month notified AMP that

it didn't expect to approve the company's application for approval

of the deal.

On Monday, AMP said it currently expected a Level 3 capital

surplus above the minimum regulatory requirement for the first half

of its financial year, but that given the uncertainty around the

AMP Life sale it now didn't anticipate paying an interim

dividend.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

July 14, 2019 18:29 ET (22:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

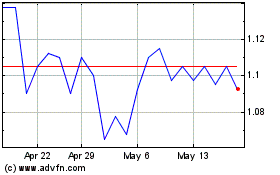

AMP (ASX:AMP)

Historical Stock Chart

From Jan 2025 to Feb 2025

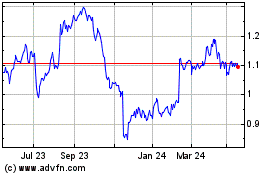

AMP (ASX:AMP)

Historical Stock Chart

From Feb 2024 to Feb 2025