TIDMKASH

21 December 2022

KASEI HOLDINGS PLC

("Kasei" or the "Company")

Posting of Annual Report and Notice of AGM

Kasei Holdings PLC (AQSE: KASH) is pleased to announce its Annual Report and

financial statements for the year ended 31 July 2022 (the "Annual Report"),

Notice of Annual General Meeting (the "AGM"), and Form of Proxy for the AGM

have each been post to shareholders today and are available on the Company's

website https://kaseiholdings.com/ .

The Company's AGM will be held at 72 Charlotte Street, London W1T 4QQ on 24

January 2023 at 4.00pm.

For further information please contact:

Jai Patel info@kaseiholdings.com

Chief Investment Officer

First Sentinel

Corporate Adviser +44 7876 888 011

Brian Stockbridge brian@first-sentinel.com

About Kasei:

The Company is a technology specialist investor that focuses on

cryptocurrencies and blockchain technologies.

The Company's goal is to provide investors with broad based exposure to the

fast-growing ecosystem of digital assets, managed using traditional financial

portfolio construction techniques. The Company also intends to invest in

venture capital and private equity investments in the blockchain ecosystem.

The Company will leverage the Board's expertise, experience, and networks in

the cryptocurrency sector and management of digital assets and decentralised

finance, to drive value creation and to establish the business. The Board has a

proven capability in portfolio management to achieve significant growth.

The Company's website is located at https://kaseiholdings.com

Group Strategic Report

For the Period Ended 31 July 2022

Introduction

Kasei Holdings PLC (AQSE: KASH) is a digital asset and Web 3.0 investment

company established in July 2021 to provide investors with broad based exposure

to the digital asset ecosystem.

Business review

The company began trading on the Aquis Stock Exchange on 3rd November 2021 with

a goal of deploying capital into the digital ecosystem in accordance with its

investment strategy. The company began deployment in a buoyant market using

drawdowns towards the end of 2021 to average down as macro uncertainties began

to surface.

2022 saw a significant shift in the macro environment that has had a drastic

effect on all asset prices. Persistent inflation due to COVID19 was exacerbated

by the war in Ukraine and central banks across the globe began embarking on a

significant tightening of monetary policy after years of accommodation. As a

result, equity and bond markets have suffered dramatic falls and the nascent

digital asset ecosystem has similarly seen significant drawdowns.

The steep declines in asset prices have brought into sharp focus many of the

unsustainable business models in the space. The collapse of the Terra Luna

ecosystem triggered a sharp deleveraging that led to the insolvency of large

hedge funds such as 3 Arrows Capital in addition to the halting of withdrawals

from centralised yield providers such as Celsius.

Kasei Holdings did establish a position in Terra (LUNA) as the ecosystem began

to see significant growth. However, as the sustainability of some of the

ecosystem's protocols began to diminish, the company began exiting its

positions and had liquidated approximately 70% of its exposure prior to the

collapse of the ecosystem.

The company has also avoided exposure to any providers purporting to provide

yields which in retrospect were merely credit exposures to questionable

business models. The company does however stake its assets where participating

in network security is rewarded.

Finally, the recent collapse of FTX has shone an even harsher light on the

entire sector and has triggered a liquidation cascade across the board. The

company is pleased to report that it has not suffered any adverse impact due to

any of the insolvencies and does not have any direct credit exposures. Our

internal operational and risk management practices have stood up well in the

face of a significant test and we hope to weather these turbulent times

accordingly.

The directors are satisfied with the performance to date given the overall

decline in the market and we have continued to maintain outperformance versus

the largest two assets Bitcoin and Ethereum. The drawdown has also enabled us

to add exposure to high conviction ecosystems. Given the external environment

the company has reduced overheads where possible to ensure the company has

sufficient working capital to weather the crypto winter. Approximately £280,000

of initial fixed costs due to the formation and listing of the company are

non-recurring leaving the company enough scope to take advantage of new

opportunities as they arise.

Our portfolio as of 31st October was as follows:

Asset Quantity Price Valuation (USD)

BTC 28.21 20,375.00 574,823.58

ETH 145.78 1,565.00 228,151.18

BETH 105.98 1,535.00 162,679.30

QNT 2,500.00 165.00 412,500.00

SOL 494.82 32.85 16,254.67

LINK 5,000.00 8.00 40,000.00

DAG 2,150,000.00 0.07 145,125.00

AR 1,750.00 10.15 17,762.50

AVAX 1,000.00 19.15 19,150.00

ZONE 742,187.50 0.00 2,968.75

HBAR 250,000.00 0.01 1,500.00

HNT 2,502.18 4.00 10,008.72

LTX 74,975.00 0.42 31,114.63

ALGO 4,000.00 0.35 1,400.00

ADS 125,000.00 0.13 16,062.50

Principal risks and uncertainties

The digital asset industry is in an early stage of growth and adoption and as

such carries significant risk. Asset prices are highly volatile and many of the

protocols may ultimately fail. As such it is imperative for a diversified

approach to be adopted as currently the winners are unclear. In addition, a

stringent risk management framework is essential. We believe that the board's

expertise in managing volatile asset classes stands us in good stead to

navigate the volatile landscape. The company continues to believe that

significant growth and adoption lies ahead and intends to navigate the many

pitfalls diligently.

Security of holding digital assets also remains challenging. However, more and

more institutional grade custody solutions are appearing and the company

continues to monitor the landscape in order to ensure all measures are taken to

maximise security and custody of its assets using trusted partners and

regulated entities.

Bear markets and crypto winters are the perfect time for protocols to

concentrate on building and for investors to analyse which projects have been

battle tested and yet remain. As such we see the current malaise as an

opportunity to concentrate resources and focus on the opportunities that will

arise.

Financial key performance indicators

The company's business objective is to provide investors with broad based

access to the digital asset ecosystem. Holding assets in a diversified manner

and using yield generating strategies and stringent risk management has led to

outperformance vs a core strategy of holding BTC or ETH. The price performance

of Quant network (QNT), the company's largest altcoin position has been a key

highlight and has enhanced the company's commitment to focus on utility within

the asset class.

Directors' statement of compliance with duty to promote the success of the

Group

This statement is intended by the Board of Directors to set out how they have

approached and met their responsibilities under s172(1)(a) to (f) of the

Companies Act 2006 in the year ending 31 July 2022.

Stakeholders of the Company include employees, shareholders, suppliers,

creditors of the business and the community in which it operates.

The Directors, both collectively and individually, consider that they have

acted in good faith to promote the success of the Company for the benefit of

its stakeholders as a whole (having regard to the matters set out in s172 of

the Act) in the decisions taken during the period. In particular:

To ensure that the Board take account of the likely consequences of their

decisions in the long-term, they receive regular and timely information on all

the key areas of the business including financial performance, operational

matters, health and safety, environmental reports, risks and opportunities. The

Company's performance and progress is also reviewed regularly at Board

meetings.

The Directors' intentions are to behave responsibly towards all stakeholders

and treat them fairly and equally, so that they all benefit from the long-term

success of the Company.

The Directors have overall responsibility for determining the Company's

purpose, values and strategy and for ensuring high standards of governance. The

primary aim of the Directors is to promote the long-term sustainable success of

the Company, generating value for stakeholders and contributing to the wider

society. In the future, the Board will continue to review and challenge how the

Company can improve its engagement with its stakeholders.

This report was approved by the board and signed on its behalf.

Brendan Kearns

Director

19th December 2022

Directors' Report

For the Period Ended 31 July 2022

The directors present their report and the financial statements for the period

ended 31 July 2022.

Direcors' responsibilities statement

The directors are responsible for preparing the Group Strategic Report, the

Directors' Report and the consolidated financial statements in accordance with

applicable law and regulations.

Company law requires the directors to prepare financial statements for each

financial year. Under that law the directors have elected to prepare the

financial statements in accordance with applicable law and United Kingdom

Accounting Standards (United Kingdom Generally Accepted Accounting Practice),

including Financial Reporting Standard 102 'The Financial Reporting Standard

applicable in the UK and Republic of Ireland'. Under company law the directors

must not approve the financial statements unless they are satisfied that they

give a true and fair view of the state of affairs of the Company and the Group

and of the profit or loss of the Group for that period.

In preparing these financial statements, the directors are required to:

* select suitable accounting policies for the Group's financial statements

and then apply them consistently;

* make judgments and accounting estimates that are reasonable and prudent;

* state whether applicable UK Accounting Standards have been followed,

subject to any material departures disclosed and explained in the financial

statements;

* prepare the financial statements on the going concern basis unless it is

inappropriate to presume that the Group will continue in business.

The directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions and disclose with

reasonable accuracy at any time the financial position of the Company and the

Group and to enable them to ensure that the financial statements comply with

the Companies Act 2006. They are also responsible for safeguarding the assets

of the Company and the Group and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

Principal activity

The principal activity of the Company in the year under review was that of an

investment company providing investors with broad based exposure to the digital

asset ecosystem.

Results and dividends

The loss for the period, after taxation, amounted to £513,273.

The Directors do not propose a dividend in respect of the year ended 31st July

2022..

Directors

The directors who served during the period were: B Coyne (appointed 9 July

2021)

S Davis (appointed 5 August 2021)

B Kearns (appointed 28 July 2021)

J Patel (appointed 9 July 2021)

J Thomason (appointed 4 August 2021)

Future developments

The company intends to continue to leverage the Board's expertise to identify

compelling investments within the digital asset ecosystem.

Disclosure of information to auditors

Each of the persons who are directors at the time when this Directors' Report

is approved has confirmed that:

* so far as the director is aware, there is no relevant audit information of

which the Company and the Group's auditors are unaware, and

* the director has taken all the steps that ought to have been taken as a

director in order to be aware of any relevant audit information and to

establish that the Company and the Group's auditors are aware of that

information.

Auditors

Under section 487(2) of the Companies Act 2006, Brindley Goldstein LTD will be

deemed to have been reappointed as auditors 28 days after these financial

statements were sent to members or 28 days after the latest date prescribed for

filing the accounts with the registrar, whichever is earlier.

This report was approved by the board and signed on its behalf.

Brendan Kearns

Director

19th December 2022

Independent Auditors' Report to the Members of KASEI HOLDINGS PLC

Opinion

We have audited the financial statements of KASEI HOLDINGS PLC (the 'parent

Company') and its subsidiaries (the 'Group') for the period ended 31 July 2022,

which comprise the Group Statement of Comprehensive Income, the Group and

Company Balance Sheets, the Group Statement of Cash Flows, the Group and

Company Statement of Changes in Equity and the related notes, including a

summary of significant accounting policies. The financial reporting framework

that has been applied in their preparation is applicable law and United Kingdom

Accounting Standards, including Financial Reporting Standard 102 'The Financial

Reporting Standard applicable in the UK and Republic of Ireland' (United

Kingdom Generally Accepted Accounting Practice).

In our opinion the financial statements:

* give a true and fair view of the state of the Group's and of the parent

Company's affairs as at 31 July 2022 and of the Group's loss for the period

then ended;

* have been properly prepared in accordance with United Kingdom Generally

Accepted Accounting Practice; and

* have been prepared in accordance with the requirements of the Companies Act

2006.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing

(UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards

are further described in the Auditors' responsibilities for the audit of the

financial statements section of our report. We are independent of the Group in

accordance with the ethical requirements that are relevant to our audit of the

financial statements in the United Kingdom, including the Financial Reporting

Council's Ethical Standard and we have fulfilled our other ethical

responsibilities in accordance with these requirements. We believe that the

audit evidence we have obtained is sufficient and appropriate to provide a

basis for our opinion.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the directors' use

of the going concern basis of accounting in the preparation of the financial

statements is appropriate.

Based on the work we have performed, we have not identified any material

uncertainties relating to events or conditions that, individually or

collectively, may cast significant doubt on the Group's or the parent Company's

ability to continue as a going concern for a period of at least twelve months

from when the financial statements are authorised for issue.

Our responsibilities and the responsibilities of the directors with respect to

going concern are described in the relevant sections of this report.

Other information

The other information comprises the information included in the Annual Report

other than the financial statements and our Auditors' Report thereon. The

directors are responsible for the other information contained within the Annual

Report. Our opinion on the financial statements does not cover the other

information and, except to the extent otherwise explicitly stated in our

report, we do not express any form of assurance conclusion thereon. Our

responsibility is to read the other information and, in doing so, consider

whether the other information is materially inconsistent with the financial

statements or our knowledge obtained in the course of the audit, or otherwise

appears to be materially misstated. If we identify such material

inconsistencies or apparent material misstatements, we are required to

determine whether this gives rise to a material misstatement in the financial

statements themselves. If, based on the work we have performed, we conclude

that there is a material misstatement of this other information, we are

required to report that fact.

We have nothing to report in this regard.

Opinion on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

* the information given in the Group Strategic Report and the Directors'

Report for the financial period for which the financial statements are

prepared is consistent with the financial statements; and

* the Group Strategic Report and the Directors' Report have been prepared in

accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the Group and the parent

Company and its environment obtained in the course of the audit, we have not

identified material misstatements in the Group Strategic Report or the

Directors' Report.

We have nothing to report in respect of the following matters in relation to

which the Companies Act 2006 requires us to report to you if, in our opinion:

* adequate accounting records have not been kept by the parent Company, or

returns adequate for our audit have not been received from branches not

visited by us; or

* the parent Company financial statements are not in agreement with the

accounting records and returns; or

* certain disclosures of directors' remuneration specified by law are not

made; or

* we have not received all the information and explanations we require for

our audit.

Responsibilities of directors

As explained more fully in the Directors' Responsibilities Statement set out on

page 4, the directors are responsible for the preparation of the financial

statements and for being satisfied that they give a true and fair view, and for

such internal control as the directors determine is necessary to enable the

preparation of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the directors are responsible for

assessing the Group's and the parent Company's ability to continue as a going

concern, disclosing, as applicable, matters related to going concern and using

the going concern basis of accounting unless the directors either intend to

liquidate the Group or the parent Company or to cease operations, or have no

realistic alternative but to do so.

Auditors' responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial

statements as a whole are free from material misstatement, whether due to fraud

or error, and to issue an Auditors' Report that includes our opinion.

Reasonable assurance is a high level of assurance, but is not a guarantee that

an audit conducted in accordance with ISAs (UK) will always detect a material

misstatement when it exists. Misstatements can arise from fraud or error and

are considered material if, individually or in the aggregate, they could

reasonably be expected to influence the economic decisions of users taken on

the basis of these Group financial statements.

Irregularities, including fraud, are instances of non-compliance with laws and

regulations. We design procedures in line with our responsibilities, outlined

above, to detect material misstatements in respect of irregularities, including

fraud. The extent to which our procedures are capable of detecting

irregularities, including fraud is detailed below:

The objectives of our audit are to identify and assess the risks of material

misstatement of the financial statements due to fraud or error; to obtain

sufficient appropriate audit evidence regarding the assessed risks of material

misstatement due to fraud or error; and to respond appropriately to those

risks. Owing to the inherent limitations of an audit, there is an unavoidable

risk that material misstatements in the financial statements may not be

detected, even though the audit is properly planned and performed in accordance

with the ISAs (UK).

* In identifying and assessing risks of material misstatement in respect of

irregularities, including fraud and non- compliance with laws and

regulations, our procedures included the following:

* We obtained an understanding of the legal and regulatory frameworks

applicable to the Group and the industry

in which it operates. We determined that the following laws and regulations

were most significant: FRS 102 and the Companies Act 2006.

* We obtained an understanding of how the Group is complying with those legal

and regulatory frameworks by making enquiries of management.

* We challenged assumptions and judgments made by management in its

significant accounting estimates.

We did not identify any key audit matters relating to irregularities, including

fraud.

A further description of our responsibilities for the audit of the financial

statements is located on the Financial Reporting Council's website at:

www.frc.org.uk/auditorsresponsibilities. This description forms part of our

Auditors' Report.

Use of our report

This report is made solely to the Company's members, as a body, in accordance

with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been

undertaken so that we might state to the Company's members those matters we are

required to state to them in an Auditors' Report and for no other purpose. To

the fullest extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company and the Company's members, as a body, for our

audit work, for this report, or for the opinions we have formed.

Charles Goldstein (Senior Statutory Auditor)

Brindley Goldstein LTD

Chartered Accountants and Statutory Auditors 103 High Street

Waltham Cross London

EN8 7AN

Date: 19/12/2022

Company Balance Sheet As at 31 July 2022

2022

Note £

Fixed assets

Intangible assets 11 1,460,292

Investments 12 50,250

1,510,542

Current assets

Debtors: amounts falling due within one year 13 189,058

Cash at bank and in hand 14 648,338

837,396

Creditors: amounts falling due within one year (264,490)

Net current assets 572,906

Total assets less current liabilities 2,083,448

Net assets excluding pension asset 2,083,448

Net assets 2,083,448

Capital and reserves

Called up share capital 17 290,617

Share premium account 3,639,253

Other reserves (1,333,596)

Loss/(profit) for the period (512,826)

Profit and loss account carried forward (512,826)

2,083,448

The financial statements were approved and authorised for issue by the board

and were signed on its behalf on

B Kearns

Director

19/12/2022

Consolidated Statement of Changes in Equity For the Period Ended 31 July 2022

Share

Called up premium Other Profit and

share account reserves loss account Total equity

capital £ £ £ £

£

Loss for the period - - - (513,273) (513,273)

Other movement - - (1,333,596) - (1,333,596)

Shares issued during the 290,617 3,639,253 - - 3,929,870

period

Other reserves movement - - 157,500 - 157,500

At 31 July 2022 290,617 3,639,253 (1,176,096) (513,273) 2,240,501

Company Statement of Changes in Equity For the Period Ended 31 July 2022

Share

Called up premium Other r Profit and

share account eserves loss account Total equity

capital £ £ £ £

£

Loss for the period - - - (512,826) (512,826)

Other movement - - (1,333,596) - (1,333,596)

Shares issued during the 290,617 3,639,253 - - 3,929,870

period

At 31 July 2022 290,617 3,639,253 (1,333,596) (512,826) 2,083,448

Consolidated Statement of Cash Flows For the Period Ended 31 July 2022

2022

£

Cash flows from operating activities

(Loss)/profit for the financial period (513,273)

Adjustments for:

Impairments of fixed assets 1,468,358

Loss on disposal of intangible assets 110,358

Taxation charge (171,091)

(Increase)/decrease in debtors (17,967)

Increase in creditors 57,437

Net fair value gains/(losses) recognised in OCI (1,333,595)

Net cash generated from operating activities (399,773)

Cash flows from investing activities

Purchase of intangible fixed assets (3,958,693)

Sale of intangible assets 919,685

Purchase of unlisted and other investments (250)

Net cash from investing activities (3,039,258)

Cash flows from financing activities

Issue of ordinary shares 4,087,369

Net cash used in financing activities 4,087,369

Net increase in cash and cash equivalents 648,338

Cash and cash equivalents at the end of period 648,338

Cash and cash equivalents at the end of period comprise:

Cash at bank and in hand 648,338

648,338

END

(END) Dow Jones Newswires

December 21, 2022 08:23 ET (13:23 GMT)

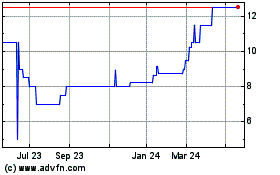

Kasei (AQSE:KASH)

Historical Stock Chart

From Oct 2024 to Nov 2024

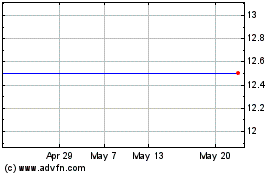

Kasei (AQSE:KASH)

Historical Stock Chart

From Nov 2023 to Nov 2024