Cohort PLC AGM Statement & First Quarter Update (9637Y)

September 15 2020 - 2:00AM

UK Regulatory

TIDMCHRT

RNS Number : 9637Y

Cohort PLC

15 September 2020

One Waterside Drive

Arlington Business Park

Reading

Berks

RG7 4SW

15 September 2020

COHORT PLC

("Cohort" or "the Group")

AGM STATEMENT & FIRST QUARTER UPDATE

Cohort, the independent technology group, is today holding its

Annual General Meeting (AGM) and accordingly issues the following

AGM Statement and first quarter update:

Cohort continued to make good progress in its financial year

ended 30 April 2020, achieving a record adjusted operating profit

despite the impact of COVID-19 restrictions in the final two

months. A full year contribution from Chess, a record performance

at MASS and improvement at EID offset weaker trading at MCL and

SEA. Following the lifting of lockdown, we have successfully

completed a phased process of returning colleagues safely to work

and the majority are now back on site on a part time or regular

basis.

As expected, the restrictions on international travel continue

to constrain our ability to develop new export opportunities, which

generated over 30% of Cohort's revenues in 2019/20. Nevertheless,

the Group entered the 2020/21 financial year with a substantial

long-term order book and a strong pipeline of order prospects, and

we have continued to win new business since we reported the 2020

final results in July. At 31 August 2020, the Group's order book

stood at GBP210.0m, compared to GBP183.3m at our 30 April 2020

financial year end. This underpins approximately 83% (or GBP113m)

of the new financial year's consensus forecast revenue, compared to

76% at the same time last year.

Cohort remains soundly financed: net debt at 31 August 2020

stood at GBP1.4m, compared to GBP4.7m at 30 April 2020. The Group's

cash and readily available credit was just over GBP38m at 31 August

2020 providing significant financing headroom for current

anticipated commitments, including the completion of the

transaction to acquire Wärtsilä ELAC Nautik ("ELAC") announced on

12 December 2019. The acquisition of ELAC remains subject to

approval by the German Federal Government. This process has been

delayed by COVID-19 and other factors, but a meeting is now planned

for later this month and we expect to have a clearer idea of the

completion timetable after that.

We continue to expect that our trading performance for 2020/21

financial year will be in line with that achieved in the year ended

30 April 2020, as indicated at the time of the final results

announcement in July. We expect net debt to remain flat for the

year, after taking account of the acquisition of ELAC.

In the longer term, the Group continues to expect to return to

growth, as it recovers the orders and revenue delayed due to

COVID-19, whilst benefiting from the acquisition of ELAC.

Ends

For further information, please contact:

Cohort plc 0118 909 0390

Andrew Thomis, Chief Executive

Simon Walther, Finance Director

and Company Secretary

Investec Bank plc 020 7597 5970

Daniel Adams / Chris Baird

MHP Communications 020 3128 8100

Reg Hoare / Pete Lambie

NOTES TO EDITORS

Cohort plc ( www.cohortplc.com ) is the parent company of five

innovative, agile and responsive businesses based in the UK and

Portugal, providing a wide range of services and products for

domestic and export customers in defence and related markets.

Chess Technologies, through its operating businesses Chess

Dynamics and Vision4ce, offers electro-optical and

electro-mechanical systems to the defence and security markets. It

was acquired by Cohort plc in December 2018. www.chess-dynamics.com

& www.vision4ce.com

EID designs and manufactures advanced communications systems for

the defence and security markets. Cohort

acquired a majority stake in June 2016. www.eid.pt

MASS is a specialist data technology company serving the defence

and security markets, focused on electronic warfare, digital

services and training support. Acquired by Cohort in August 2006.

www.mass.co.uk

MCL designs, sources and supports advanced electronic and

surveillance technology for UK end users including the MOD and

other government agencies. MCL has been part of the Group since

July 2014. www.marlboroughcomms.com

SEA delivers products and services into the defence, transport

and offshore energy markets alongside performing specialist

research, training and product support. Acquired by Cohort in

October 2007. www.sea.co.uk

Cohort (AIM: CHRT) was admitted to London's Alternative

Investment Market in March 2006. It has headquarters in Reading,

Berkshire and employs in total around 900 core staff there and at

its other operating company sites across the UK and in

Portugal.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGMGPURUBUPUPGC

(END) Dow Jones Newswires

September 15, 2020 02:00 ET (06:00 GMT)

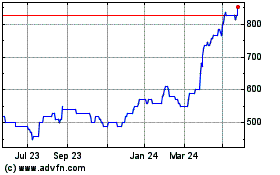

Cohort (AQSE:CHRT.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

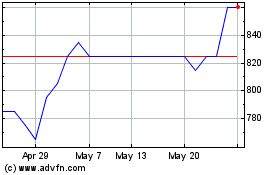

Cohort (AQSE:CHRT.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024