TIDMCHRT

RNS Number : 5891W

Cohort PLC

12 December 2019

12 December 2019

COHORT PLC

HALF YEAR RESULTS

FOR THE SIX MONTHSED 31 OCTOBER 2019

Cohort plc, the independent technology group, today announces

its half year results for the six months ended 31 October 2019

Operational highlights

-- Revenue up to GBP60.2m (2018: GBP39.5m). On a like-for-like basis, revenues grew by 17%.

-- Adjusted* operating profit up significantly to GBP4.0m (2018:

GBP1.0m). On a like-for-like basis, adjusted operating profit grew

by 120%.

-- Adjusted* earnings per share up to 6.94 pence (2018: 1.99 pence).

-- Order intake up to GBP77.2m (2018: GBP45.6m).

-- Closing order book of GBP206.7m (30 April 2019: GBP190.9m).

-- Net debt of GBP6.8m (31 October 2018: net funds GBP4.7m; 30 April 2019: net debt GBP6.4m).

-- Interim dividend increased by 12% to 3.20 pence per share (2018: 2.85 pence per share).

-- Initial first half contribution from Chess and an improvement

in the remainder of the Group, particularly at MASS.

-- Agreement to acquire Wärtsilä ELAC Nautik GmbH for a headline

price of EUR11.25m announced today. Expected to complete before 30

June 2020.

Looking forward

-- Second half weighting expected again this year.

-- The half year order book of GBP206.7m underpins over GBP60m

of revenue deliverable in the second half, which, added to revenue

delivered to date, is 83% (2018: 71%) of consensus forecast revenue

for the full year.

-- Prospects for more orders in the second half to further

underpin this year and next year are good.

-- Full year performance expected to be in line with market expectations.

-- The acquisition of ELAC represents a significant strategic

step, furthering our expansion in defence products and export

markets, particularly the naval sector.

Nick Prest, Chairman, commenting on the results, said:

"Cohort delivered an improved result compared to the same period

last year, due to a combination of an initial first half

contribution from Chess and an improvement in the underlying Group,

particularly at MASS. The order book of nearly GBP207m underpins a

significant proportion of the second half revenue, and, as in

recent years, we expect a stronger second half. The Board expects

Cohort's performance in 2019/20 will be in line with market

expectations."

"The acquisition of ELAC will represent a significant expansion,

adding a profitable and growing sixth stand-alone business to

Cohort's portfolio. It furthers our strategy of expanding in

defence products and export markets."

* Adjusted figures exclude the effects of marking forward

exchange contracts to market value, other exchange gains and

losses, amortisation of other intangible assets and exceptional

items.

For further information, please contact:

Cohort plc 0118 909 0390

Andy Thomis, Chief Executive

Simon Walther, Finance Director

Investec Bank Plc 020 7597 5970

Daniel Adams / Chris Baird

MHP Communications 020 3128 8771

Reg Hoare / Ollie Hoare / Alice cohort@mhpc.com

McLaren

NOTES TO EDITORS

Cohort plc (www.cohortplc.com) is the parent company of five

innovative, agile and responsive businesses based in the UK and

Portugal, providing a wide range of services and products for

domestic and export customers in defence and related markets.

Chess Technologies, through its operating businesses Chess

Dynamics and Vision4ce, offers systems and technologies for

detecting, tracking, classifying and disrupting naval, land and air

threats. It was acquired by Cohort plc in December 2018.

www.chess-dynamics.com & www.vision4ce.com

EID designs and manufactures advanced communications systems for

the defence and security markets. Cohort acquired a majority stake

in June 2016. www.eid.pt

MASS is a specialist defence and technology business, focused on

electronic warfare, information systems and cyber security.

Acquired by Cohort in August 2006. www.mass.co.uk

MCL - an expert in sourcing, design and integration of

communications and surveillance technology, as well as support and

training for UK end users including the MOD and other government

agencies. MCL has been part of the Group since July 2014.

www.marlboroughcomms.com

SEA is an advanced electronic systems and software house

operating in the defence, transport and offshore energy markets.

Acquired by Cohort in October 2007. www.sea.co.uk

Cohort (AIM: CHRT) was admitted to London's Alternative

Investment Market in March 2006. It has its headquarters in

Reading, Berkshire and employs in total around 950 core staff there

and at its other operating company sites across the UK and in

Portugal.

Chairman's statement

Nick Prest CBE

Cohort delivered an improved result in the first half compared

to the same period last year, due to a combination of an initial

first half contribution from Chess and an improvement in the

underlying Group, particularly at MASS. The order book of nearly

GBP207m underpins a significant proportion of the second half

revenue, and, as in recent years, we expect a stronger second

half.

The Group's 2019/20 first half adjusted operating profit was

GBP4.0m (2018: GBP1.0m) on higher revenue of GBP60.2m (2018:

GBP39.5m). Order intake was over 50% up at GBP77.2m (2018:

GBP45.6m).

MASS was again the largest contributor to the Group's adjusted

operating profit, with a much stronger performance than last year.

As expected, EID's performance also improved, with higher revenue

resulting in a small trading profit. EID is expected to have a

strong second half as it delivers against contracted orders. MCL

also delivered a better first half performance on higher revenue.

SEA's revenue was slightly down and as a result of this and

investment in its anti-submarine warfare system, including a sea

trial with the Portuguese Navy, its first half result was a small

trading loss. SEA is expected to return to profit in the second

half, delivering an annual performance similar to last year. Chess

contributed a good initial performance to the Group's first half

trading performance, following its acquisition in December last

year.

As announced separately today, Cohort has signed an agreement to

acquire the entire share capital of Wärtsilä ELAC Nautik GmbH

(ELAC) from its parent, Wärtsilä Corporation. The headline price is

EUR11.25m (GBP9.5m) with no earn out, and is subject to adjustments

for working capital and a pension liability under a defined benefit

scheme. The completion of the deal is subject to conditions

including satisfaction of regulatory requirements in Germany. We

expect completion of the acquisition to be concluded on or before

30 June 2020. The purchase will be funded entirely from the Group's

own cash and debt resources.

ELAC adds a range of sophisticated active and passive sonar

systems to the Group's portfolio of naval systems and products,

complementary to the existing capabilities at SEA. ELAC also brings

a presence in the German domestic market and is active in export

markets, including some that are new to the Group.

Key financials

For the six months ended 31 October 2019 the Group's revenue was

a total of GBP60.2m (2018: GBP39.5m), including GBP19.9m from MASS,

GBP13.9m from Chess, GBP13.4m from SEA, GBP6.0m from EID and

GBP7.0m from MCL.

The Group's adjusted operating profit in the period was GBP4.0m

(2018: GBP1.0m). This included contributions from MASS of GBP3.7m

(2018: GBP2.2m), Chess of GBP1.8m, MCL of GBP0.5m (2018:

break-even), EID of GBP0.1m (2018: loss of GBP0.3m) and a loss of

GBP0.3m at SEA (2018: trading profit of GBP0.4m). Central costs

were just over GBP1.7m (2018: GBP1.3m).

Cohort's operating profit, after recognising amortisation of

intangible assets (GBP3.7m) was GBP0.4m (2018: loss of GBP1.9m

after an exceptional charge of GBP0.5m and amortisation of

intangible assets of GBP2.3m).

Adjusted earnings per share for the six months ended 31 October

2019 increased to 6.94 pence (2018: 1.99 pence). The tax rate in

respect of the adjusted operating profit was 16.0% (2018: 18.0%).

Basic earnings per share were 1.00 pence (2018: loss per share of

3.52 pence).

The net funds outflow in the first half has been lower than we

expected due to the timing of payments. Before taking into account

the acquisition of ELAC, we expect the second half operating cash

flow to be flat, in line with the expectations stated in July.

The operating cash inflow of GBP4.8m (2018: outflow of GBP3.8m)

has been used in paying dividends (GBP2.5m), capital expenditure

(GBP1.8m) and net investment in the Employee Benefit Trust

(GBP0.7m). The net tax refund in the first half (GBP0.7m) was a

result of research and development credits in Portugal.

Our order intake for the first half was GBP77.2m (2018:

GBP45.6m), excluding foreign exchange movements, resulting in a

closing order book of GBP206.7m (30 April 2019: GBP190.9m).

Chess

Chess made a strong initial contribution to the Group's first

half performance following its acquisition last December,

reflecting the Group's 81.84% ownership.

Chess delivered an adjusted operating profit of GBP1.8m on

revenue of GBP13.9m with good contributions from sales of its

counter-drone system to military customers in the United States and

Norway. Chess also completed deliveries of naval systems for both

the UK and export customers.

Chess's order book of GBP16.0m at 31 October 2019 along with

good short-term order prospects give us confidence that Chess will

have a profitable second half.

Chess's long-term prospects for naval, land and counter-drone

systems remain strong.

EID

EID's operating profit for the six months ended 31 October 2019

of under GBP0.1m (2018: loss of GBP0.3m) was due to an increase in

revenue from GBP3.7m to GBP6.0m.

EID's stronger performance was mostly in its Tactical (Land)

division, delivering the first part of a large order to a Middle

East customer.

The mix of work, with lower naval systems activity, and further

investment in its new vehicle intercom system account for its lower

net margin (1%) compared with its historical levels.

The Group owned 80% of EID throughout the first half of the year

(2018: 80% owned).

EID's order book of GBP37.1m at 31 October 2019 (2018: GBP23.5m)

underpins a high percentage of its expected second half revenue and

gives us confidence that EID will deliver a stronger performance in

the second half, ahead of last year, returning EID's net margin to

more appropriate levels.

EID has good prospects of securing further significant orders in

the second half, providing a good base for 2020/21 and beyond.

MASS

MASS's adjusted operating profit of GBP3.7m (2018: GBP2.2m) was

significantly above last year on higher revenue of GBP19.9m (2018:

GBP16.0m). Its first half net margin also improved to 19% (2018:

14%), a level we expect to be maintained in the second half.

The higher revenue was a result of work commencing on new

electronic warfare operational support projects for export

customers.

Following significant order intake in 2018/19, MASS secured

further renewals in the first half of 2019/20 and we expect it to

maintain its order book into 2020/21.

MCL

MCL's first half contribution of GBP0.5m (2018: break-even) on

higher revenue of GBP7.0m (2018: GBP5.5m) was a result of increased

activity in supplying equipment to the UK MOD, particularly the

Royal Navy.

MCL's order book of GBP13.2m (2018: GBP10.0m) and a good

pipeline of opportunities give us confidence that MCL will have a

stronger second half.

We expect MCL's overall annual performance to be in line with

last year.

SEA

SEA's adjusted operating loss of GBP0.3m (2018: profit of

GBP0.4m) was on slightly lower revenue of GBP13.4m (2018:

GBP14.3m).

SEA's revenue mix was similar to last year. However, the

combination of slightly lower revenue, investment in its products,

particularly its anti-submarine warfare Krait Defence System, and

extensive bidding activities on export opportunities for naval

systems, account for its weaker profit performance. We expect this

investment to deliver stronger order intake in the second half,

providing good underpinning for 2020/21 and beyond.

For 2019/20, SEA is reasonably well underpinned with a closing

order book of GBP34.6m (2018: GBP40.7m) including GBP13m of revenue

to be delivered in the second half. Overall, we expect SEA's

performance in 2019/20 to be profitable and similar to last

year.

Dividend

The Board is declaring an interim dividend increased by 12% to

3.20 pence per share (2018: 2.85 pence per share). This increase

reflects the Board's confidence in the outlook for Cohort and its

commitment to a progressive dividend policy. The dividend is

payable on 26 February 2020 to shareholders on the register at 31

January 2020.

Auditor

After ten years as our auditor, KPMG LLP is stepping down.

Following a competitive tender process, we are appointing RSM UK

AUDIT LLP as our new auditor and it will undertake our 30 April

2020 year end audit. We will seek approval of this appointment from

shareholders at the Annual General Meeting next September.

Outlook

After a strong year in 2018/19, especially in terms of order

intake, the first half of 2019/20 has started well with over GBP77m

of orders secured and we expect a similar second half for order

intake. We expect these orders to include important first steps

into some key markets and programmes which will provide good

revenue streams for many years to come, particularly at SEA and

Chess.

At 31 October 2019 our order book was GBP206.7m (30 April 2019:

GBP190.9m), providing good underpinning for the second half. We

therefore expect, as seen in the last few years, a stronger

performance in the second half, though we still need to win and

deliver some important orders to achieve our targets for the

year.

As previously stated, we do not expect any direct effects upon

Cohort from the Brexit process, as our UK into EU business remains

small. The result of today's UK General Election is not expected to

have a material impact on UK defence spending in the short term,

notwithstanding a range of potential long term outcomes. In all

scenarios, the responsibility of the Cohort Board is to manage our

affairs so that our businesses prosper whatever the political and

economic backdrop.

Overall, the Board expects Cohort's performance in 2019/20 will

be in line with market expectations.

The acquisition of ELAC will represent a significant expansion,

adding a profitable and growing sixth stand-alone business to

Cohort's portfolio. It furthers our strategy of expanding in

defence products and export markets, particularly in the naval

sector. The naval export markets the Group is focused on are

expected to reach US$150 billion of spend over the next decade in

the Asia Pacific region (excluding China) alone.

Nick Prest CBE

Chairman

12 December 2019

Consolidated income statement

for the six months ended 31 October 2019

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

---------------------------------------- ----- ----------- ----------- ----------

Revenue 2 60,151 39,493 121,182

Cost of sales (39,161) (26,406) (78,143)

---------------------------------------- ----- ----------- ----------- ----------

Gross profit 20,990 13,087 43,039

Administrative expenses (20,626) (15,005) (37,095)

---------------------------------------- ----- ----------- ----------- ----------

Operating profit/(loss) 2 364 (1,918) 5,944

---------------------------------------- ----- ----------- ----------- ----------

Operating profit/(loss) comprises:

Adjusted operating profit 2 4,034 968 16,164

Credit/(charge) on marking forward

exchange contracts to market

value at the period end (included

in cost of sales) 7 (64) 33

Amortisation of other intangible assets

(included in administrative expenses) (3,677) (2,322) (9,514)

Exceptional items:

Research and development expenditure

credits (RDEC) (included in cost of

sales) - - 744

Cost of acquiring Chess (included in

administrative expenses) - - (1,000)

Cost of acquiring EID (included in

administrative expenses) - - 17

Reorganisation of SEA (included in

administrative expenses) 2 - (500) (500)

---------------------------------------- ----- ----------- ----------- ----------

Operating profit/(loss) 364 (1,918) 5,944

Finance income 12 12 27

Finance costs (379) (57) (296)

---------------------------------------- ----- ----------- ----------- ----------

(Loss)/profit before tax (3) (1,963) 5,675

Income tax credit/(expense) 3 125 353 (584)

---------------------------------------- ----- ----------- ----------- ----------

Profit/(loss) for the period 122 (1,610) 5,091

---------------------------------------- ----- ----------- ----------- ----------

Attributable to:

Equity shareholders of the parent 407 (1,433) 5,447

Non-controlling interests (285) (177) (356)

---------------------------------------- ----- ----------- ----------- ----------

122 (1,610) 5,091

---------------------------------------- ----- ----------- ----------- ----------

Earnings/(loss) per share Pence Pence Pence

-------------------------- ----- ------ -----

Basic 4 1.00 (3.52) 13.37

Diluted 4 1.00 (3.52) 13.29

-------------------------- ----- ------ -----

All profit for the period is derived from continuing

operations.

Consolidated statement of comprehensive income

for the six months ended 31 October 2019

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------------------- ----------- ----------- ----------

Profit/(loss) for the period 122 (1,610) 5,091

----------------------------------------------------- ----------- ----------- ----------

Foreign currency translation differences on net

assets of EID (19) 113 (21)

----------------------------------------------------- ----------- ----------- ----------

Other comprehensive (expense)/income for the period,

net of tax (19) 113 (21)

----------------------------------------------------- ----------- ----------- ----------

Total comprehensive income/(expense) for the period 103 (1,497) 5,070

----------------------------------------------------- ----------- ----------- ----------

Attributable to:

Equity shareholders of the parent 382 (1,321) 5,559

Non-controlling interests (279) (176) (489)

----------------------------------------------------- ----------- ----------- ----------

103 (1,497) 5,070

----------------------------------------------------- ----------- ----------- ----------

Consolidated statement of changes in equity

for the six months ended 31 October 2019

Attributable to the equity shareholders

of the parent

--------------------------------------------------------------------------------------

Share Share Non-

Share premium Own option Other Retained controlling Total

capital account shares reserve reserves earnings Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

At 1 May 2018 4,096 29,657 (1,190) 626 - 39,253 72,442 2,554 74,996

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

Loss for the period - - - - - (1,434) (1,434) (176) (1,610)

Other comprehensive income for

the period - - - - - 113 113 - 113

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

Total comprehensive income for

the period - - - - - (1,321) (1,321) (176) (1,497)

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

Transactions with owners of

the

Group and non-controlling

interests

recognised directly in equity:

Equity dividend - - - - - (2,299) (2,299) - (2,299)

Vesting of Restricted Shares - - - - - 178 178 - 178

Own shares purchased - - (631) - - - (631) - (631)

Own shares sold - - 587 - - - 587 - 587

Net loss on selling own shares - - 678 - - (678) - - -

Share-based payments - - - 150 - - 150 - 150

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

At 31 October 2018 (as

restated) 4,096 29,657 (556) 776 - 35,133 69,106 2,378 71,484

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

At 1 May 2018 4,096 29,657 (1,190) 626 - 39,253 72,442 2,554 74,996

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

Profit for the year - - - - - 5,447 5,447 (356) 5,091

Other comprehensive income for

the year - - - - - 112 112 (133) (21)

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

Total comprehensive income for

the year - - - - - 5,559 5,559 (489) 5,070

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

Transactions with owners of

the

Group and non-controlling

interests,

recognised directly in equity

Equity dividends - - - - - (3,464) (3,464) - (3,464)

Vesting of Restricted Shares - - - - - 178 178 - 178

Own shares purchased - - (631) - - - (631) - (631)

Own shares sold - - 743 - - - 743 - 743

Net loss on selling own shares - - 730 - - (730) - - -

Share-based payments - - - 291 - - 291 - 291

Deferred tax adjustment in

respect

of share-based payments - - - (76) - - (76) - (76)

Transfer of share option

reserve

on vesting of options - - - (238) - 238 - - -

Acquisition of 81.84% of Chess - - - - (4,350) - (4,350) 4,214 (136)

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

At 30 April 2019 4,096 29,657 (348) 603 (4,350) 41,034 70,692 6,279 76,971

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

At 1 May 2019 4,096 29,657 (348) 603 (4,350) 41,034 70,692 6,279 76,971

------------------------------ ------- ------- ------- ------- --------

Profit/(loss) for the period - - - - - 407 407 (285) 122

Other comprehensive income for

the period - - - - - (25) (25) 6 (19)

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

Total comprehensive expense

for

the period - - - - - 382 382 (279) 103

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

Transactions with owners of

the

Group and non-controlling

interests

recognised directly in equity:

Equity dividend - - - - - (2,544) (2,544) - (2,544)

Vesting of Restricted Shares - - - - - 210 210 - 210

Own shares purchased - - (1,830) - - - (1,830) - (1,830)

Own shares sold - - 1,104 - - - 1,104 - 1,104

Net loss on selling own shares - - 577 - - (577) - - -

Share-based payments - - - 150 - - 150 - 150

Adoption of IFRS 16 - - - - - (29) (29) - (29)

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

At 31 October 2019 4,096 29,657 (497) 753 (4,350) 38,476 68,135 6,000 74,135

------------------------------ ------- ------- ------- ------- -------- -------- ------- ----------- ----------

Consolidated statement of financial position

as at 31 October 2019

31 October

31 October 2018 30 April

2019 Unaudited 2019

Unaudited (restated) Audited

Notes GBP'000 GBP'000 GBP'000

---------------------------------------- ----- ---------- ----------- --------

Assets

Non-current assets

Goodwill 42,254 39,156 41,354

Other intangible assets 16,911 3,846 20,588

Right of use asset 8 5,745 - -

Property, plant and equipment 12,111 9,490 10,956

Deferred tax asset 361 640 365

---------------------------------------- ----- ---------- ----------- --------

77,382 53,132 73,263

---------------------------------------- ----- ---------- ----------- --------

Current assets

Inventories 12,889 6,316 13,452

Trade and other receivables 41,673 30,543 42,971

Derivative financial instruments - 72 -

Cash and cash equivalents 18,371 11,935 18,763

---------------------------------------- ----- ---------- ----------- --------

72,933 48,866 75,186

---------------------------------------- ----- ---------- ----------- --------

Total assets 150,315 101,998 148,449

---------------------------------------- ----- ---------- ----------- --------

Liabilities

Current liabilities

Trade and other payables (32,909) (21,189) (35,225)

Current tax liabilities (1,234) - -

Derivative financial instruments (118) (179) (99)

Bank borrowings (51) (7,253) (61)

Lease liability in respect of right of

use asset 8 (1,060) - -

Provisions (1,730) (1,018) (818)

---------------------------------------- ----- ---------- ----------- --------

(37,102) (29,639) (36,203)

---------------------------------------- ----- ---------- ----------- --------

Non-current liabilities

Deferred tax liability (3,134) (1,170) (4,041)

Bank borrowings (25,114) (13) (25,126)

Lease liability in respect of right of

use asset 8 (4,722) - -

Provisions (608) - (608)

Other creditors (5,500) - (5,500)

---------------------------------------- ----- ---------- ----------- --------

(39,078) (1,183) (35,275)

---------------------------------------- ----- ---------- ----------- --------

Total liabilities (76,180) (30,822) (71,478)

---------------------------------------- ----- ---------- ----------- --------

Net assets 74,135 71,176 76,971

---------------------------------------- ----- ---------- ----------- --------

Equity

Share capital 4,096 4,096 4,096

Share premium account 29,657 29,657 29,657

Own shares (497) (556) (348)

Share option reserve 753 776 603

Other reserves (4,350) - (4,350)

Retained earnings 38,476 35,133 41,034

---------------------------------------- ----- ---------- ----------- --------

Total equity attributable to the equity

shareholders of the parent 68,135 69,106 70,692

Non-controlling interests 6,000 2,070 6,279

---------------------------------------- ----- ---------- ----------- --------

Total equity 74,135 71,176 76,971

---------------------------------------- ----- ---------- ----------- --------

Consolidated cash flow statement

for the six months ended 31 October 2019

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

-------------------------------------------- ----- ----------- ----------- ----------

Net cash generated from/(used in) operating

activities 6 4,844 (3,830) 8,635

-------------------------------------------- ----- ----------- ----------- ----------

Cash flow from investing activities

Interest received 12 12 27

Purchases of property, plant and equipment (1,823) (445) (2,058)

Acquisition of Chess (including net

debt acquired) - - (20,885)

-------------------------------------------- ----- ----------- ----------- ----------

Net cash used in investing activities (1,811) (433) (22,916)

-------------------------------------------- ----- ----------- ----------- ----------

Cash flow from financing activities

Equity dividends paid (2,544) (2,299) (3,464)

Repayment of borrowings (23) (2,000) (2,027)

Drawdown of borrowings - 12 18,017

Purchase of own shares (1,830) (631) (631)

Sale of own shares 1,104 587 743

-------------------------------------------- ----- ----------- ----------- ----------

Net cash (used in)/generated from financing

activities (3,293) (4,331) 12,638

-------------------------------------------- ----- ----------- ----------- ----------

Net decrease in cash and cash equivalents (260) (8,594) (1,643)

-------------------------------------------- ----- ----------- ----------- ----------

Represented by:

Cash and cash equivalents brought forward 18,763 20,511 20,511

Cash flow (260) (8,594) (1,643)

Exchange (132) 18 (105)

-------------------------------------------- ----- ----------- ----------- ----------

Cash and cash equivalents carried forward 18,371 11,935 18,763

-------------------------------------------- ----- ----------- ----------- ----------

Net debt reconciliation

Effect of

foreign

exchange

At 1 May rate At 31 October

2019 changes Cash flow 2019

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- --------- --------- -------------

Cash and cash equivalents 18,763 (132) (260) 18,371

-------------------------- -------- --------- --------- -------------

Loan (25,028) (1) - (25,029)

Finance leases (159) - 23 (136)

-------------------------- -------- --------- --------- -------------

Bank borrowings (25,187) (1) 23 (25,165)

-------------------------- -------- --------- --------- -------------

Net debt (6,424) (133) (237) (6,794)

-------------------------- -------- --------- --------- -------------

Notes to the interim report

for the six months ended 31 October 2019

1. Basis of preparation

The financial information contained within this Interim Report

has been prepared applying the recognition and measurement

requirements of International Financial Reporting Standards (IFRS)

as adopted by the EU and expected to apply at 30 April 2020. As

permitted, this Interim Report has been prepared in accordance with

the AIM Rules for Companies and is not required to comply with IAS

34 "Interim Financial Reporting" to maintain compliance with IFRS.

This Interim Report is presented in Sterling and all values are

rounded to the nearest thousand pounds (GBP'000) except where

otherwise indicated.

For management and reporting purposes, the Group, for the period

just ended, operated through its five subsidiaries: Chess, EID,

MASS, MCL and SEA. These subsidiaries are the basis on which the

Company, Cohort plc, reports its primary segmental information.

Going concern

The Company has considerable financial resources together with

long-term contracts with a number of customers and suppliers across

different geographic areas and industries. As a consequence, the

Directors believe that the Company is well placed to manage its

business risks successfully.

The Directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future. Thus, they continue to adopt the going concern

basis of accounting in preparing this Interim Report.

The Group's UK bank facility was renewed during November 2018

for four years until November 2022. The new facility of GBP30m is

with NatWest and Lloyds.

The facility is for debt (including overdraft) and is in

addition to separate bilateral facilities with each bank for trade

finance items such as guarantees and foreign exchange

instruments.

In accordance with Section 434 of the Companies Act 2006, the

unaudited results do not constitute statutory financial statements

of the Company. The six months' results for both years are

unaudited.

(A) Statutory accounts

The financial information set out above does not constitute the

Group's statutory accounts for the year ended 30 April 2019. KPMG

LLP has reported on these accounts; its report was (i) unqualified,

(ii) did not include a reference to any matters to which the

auditor drew attention by way of emphasis without qualifying its

report and (iii) did not contain a statement under Sections 498(2)

or (3) of the Companies Act 2006.

(B) Statement of compliance

The accounting policies applied by the Group in its consolidated

financial statements for the year ended 30 April 2019 are in

accordance with IFRS as adopted by the European Union. The

accounting policies have been applied consistently to all periods

presented in the consolidated financial statements.

The Interim Report was approved by the Board and authorised for

issue on 12 December 2019.

2. Segmental analysis of revenue and adjusted operating

profit/(loss)

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------------------- ----------- ----------- ----------

Revenue

Chess 13,917 - 10,674

EID 6,050 3,671 11,530

MASS 19,856 16,055 38,951

MCL 7,024 5,485 21,715

SEA 13,775 14,303 38,731

Inter-segment revenue (471) (21) (419)

--------------------------------------------- ----------- ----------- ----------

60,151 39,493 121,182

--------------------------------------------- ----------- ----------- ----------

Operating profit comprises:

Trading profit/(loss) of:

Chess 1,787 - 1,682

EID 56 (274) 1,357

MASS 3,754 2,181 8,175

MCL 468 32 2,282

SEA (302) 381 5,492

Central costs (1,729) (1,352) (2,824)

--------------------------------------------- ----------- ----------- ----------

Adjusted operating profit 4,034 968 16,164

Charge on marking forward exchange contracts

to market value at the period end 7 (64) 33

Amortisation of intangible assets (3,677) (2,322) (9,514)

Exceptional items - (500) (1,483)

Research and development expenditure credits

(RDEC) - - 744

--------------------------------------------- ----------- ----------- ----------

Operating profit/(loss) 364 (1,918) 5,944

--------------------------------------------- ----------- ----------- ----------

All revenue and adjusted operating profit is in respect of

continuing operations.

The operating profit as reported under IFRS is reconciled to the

adjusted operating profit as reported above by the exclusion of

marking forward exchange contracts to market value at the period

end, other exchange gains and losses, exceptional items and the

amortisation of other intangible assets.

The adjusted operating profit is presented in addition to the

operating profit to provide the trading performance of the Group as

derived from its constituent elements on a comparable basis from

period to period.

The Group's adjusted operating profit includes the cost of share

options of GBP150,000 for the six months ended 31 October 2019 (six

months ended 31 October 2018: GBP150,000; year ended 30 April 2019:

GBP291,000). This figure is reported within the central costs for

the six months ended 31 October 2019 and 31 October 2018. For the

year ended 30 April 2019 the share option cost is applied to each

reporting segment in proportion to the number of employees in the

Group's various share option schemes.

The chief operating decision maker as defined by IFRS 8 has been

identified as the Board.

The operating profit and interest charge for the six months

ended 31 October 2019 include the impact of applying IFRS 16

'Leases' from 1 May 2019. The comparatives have not been restated

(see note 8).

Revenue analysis by sector and type of deliverable

Six months ended Year ended

Six months ended 31 October 2018 30 April 2019

31 October 2019 Unaudited Audited

Unaudited

------------------- ------------------- -----------------

GBPm % GBPm % GBPm %

------------------------- ---------- ------- ---------- ------- ---------- -----

By sector

UK defence 28.1 47 22.3 56 62.3 51

Portugal defence 1.5 2 1.7 4 4.4 4

Export defence customers 21.5 36 6.8 17 30.8 26

Security 4.0 7 1.9 6 9.0 7

------------------------- ---------- ------- ---------- ------- ---------- -----

Defence and security

revenue 55.1 92 32.7 83 106.5 88

------------------------- ---------- ------- ---------- ------- ---------- -----

Transport 2.8 3.9 9.2

Offshore energy 0.9 0.9 2.1

Other commercial 1.4 2.0 3.4

------------------------- ---------- ------- ---------- ------- ---------- -----

Non-defence revenue 5.1 8 6.8 17 14.7 12

------------------------- ---------- ------- ---------- ------- ---------- -----

Total revenue 60.2 100 39.5 100 121.2 100

------------------------- ---------- ------- ---------- ------- ---------- -----

The defence and security revenue is further analysed into the

following:

Six months ended Year ended

Six months ended 31 October 2018 30 April 2019

31 October 2019 Unaudited Audited

Unaudited

------------------- ------------------ -----------------

GBPm % GBPm % GBPm %

------------------------ ------------ ----- ----------- ----- ----------- ----

By market segment

Combat systems 8.9 15 9.3 24 22.9 19

C4ISTAR 29.2 49 10.4 26 51.1 42

Cyber security and

secure networks 7.6 13 7.2 18 15.5 13

Simulation and training 4.1 7 2.3 6 6.5 5

Research, advice

and support 5.1 8 3.3 8 9.3 8

Other 0.2 - 0.2 1 1.2 1

------------------------ ------------ ----- ----------- ----- ----------- ----

Total defence and

security revenue 55.1 92 32.7 83 106.5 88

------------------------ ------------ ----- ----------- ----- ----------- ----

The Group's total revenue in terms of type of deliverable is

analysed as follows:

Six months ended Year ended

Six months ended 31 October 2018 30 April 2019

31 October 2019 Unaudited Audited

Unaudited

------------------- ------------------- -----------------

GBPm % GBPm % GBPm %

-------------- ---------- ------- ---------- ------- ---------- -----

Product 34.3 57 16.6 42 65.2 54

Services 25.9 43 22.9 58 56.0 46

-------------- ---------- ------- ---------- ------- ---------- -----

Total revenue 60.2 100 39.5 100 121.2 100

-------------- ---------- ------- ---------- ------- ---------- -----

3. Income tax (credit)/expense

The income tax (credit)/expense comprises:

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------------ ----------- ----------- ----------

UK corporation tax: in respect of this period 531 195 2,729

UK corporation tax: in respect of prior periods - - (10)

Portugal corporation tax: in respect of this

period 57 (90) (410)

Portugal corporation tax: in respect of prior

periods - - 1

Other foreign corporation tax: in respect of

this period - - 31

------------------------------------------------ ----------- ----------- ----------

588 105 2,341

------------------------------------------------ ----------- ----------- ----------

Deferred taxation: in respect of this period (713) (458) (1,713)

Deferred taxation: in respect of prior periods - - (44)

------------------------------------------------ ----------- ----------- ----------

(713) (458) (1,757)

------------------------------------------------ ----------- ----------- ----------

(125) (353) 584

------------------------------------------------ ----------- ----------- ----------

The income tax credit for the six months ended 31 October 2019

is based upon the anticipated charge for the full year ending 30

April 2020. As it is an estimate, the impact of research and

development credits (RDEC) is not shown separately.

4. Earnings per share

The earnings per share are calculated as follows:

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------------- ----------- ----------- ----------

Earnings

Basic and diluted earnings/(loss) 407 (1,433) 5,447

(Credit)/charge on marking forward exchange

contracts to market at the period end (net

of income tax) (6) 52 (27)

Exceptional items (net of income tax):

Reorganisation of SEA - 405 405

Cost of acquisition of EID - - (17)

Cost of acquisition of Chess (net of income

tax) - - 926

Group's share of amortisation of intangible

assets (net of income tax) 2,420 1,787 6,956

-------------------------------------------- ----------- ----------- ----------

Adjusted basic and diluted earnings 2,821 811 13,690

-------------------------------------------- ----------- ----------- ----------

Number Number Number

----------------------------------------------- ---------- ---------- ----------

Weighted average number of shares

For the purposes of basic earnings per share 40,633,341 40,666,957 40,749,551

Share options 200,712 213,513 224,086

----------------------------------------------- ---------- ---------- ----------

For the purposes of diluted earnings per share 40,834,053 40,880,470 40,973,637

----------------------------------------------- ---------- ---------- ----------

The weighted average number of ordinary shares for the six

months ended 31 October 2019 excludes 109,383 ordinary shares held

by the Cohort plc Employee Benefit Trust (which do not receive a

dividend) for the purposes of calculating earnings per share (six

months ended 31 October 2018: 156,411; year ended 30 April 2019:

98,053).

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

Unaudited Unaudited Audited

Pence Pence Pence

---------------------------- ----------- ----------- ----------

Earnings/(loss) per share

Basic 1.00 (3.52) 13.37

Diluted 1.00 (3.52) 13.29

---------------------------- ----------- ----------- ----------

Adjusted earnings per share

Basic 6.94 1.99 33.60

Diluted 6.91 1.98 33.41

---------------------------- ----------- ----------- ----------

5. Dividends

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

Unaudited Unaudited Audited

Pence Pence Pence

------------------------------------------- ----------- ----------- ----------

Dividends per share proposed in respect of

the period

Interim 3.20 2.85 2.85

Final - - 6.25

------------------------------------------- ----------- ----------- ----------

The interim dividend for the six months ended 31 October 2019 is

3.20 pence (six months ended 31 October 2018: 2.85 pence) per

ordinary share. This dividend will be payable on 26 February 2020

to shareholders on the register at 31 January 2020.

The final dividend charged to the income statement for the year

ended 30 April 2019 was 8.50 pence per ordinary share, comprising

2.85 pence of interim dividend for the six months ended 31 October

2018 and 5.65 pence of final dividend for the year ended 30 April

2018.

6. Net cash generated from/(used in) operating activities

Six months Six months

ended ended Year ended

31 October 31 October 30 April

2019 2018 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------------ ----------- ----------- ----------

Profit/(loss) for the period 122 (1,610) 5,091

Adjustments for:

Tax (credit)/expense (125) (353) 584

Depreciation of property, plant and equipment 654 550 1,147

Amortisation of intangible assets 3,677 2,322 9,514

Net finance costs 367 45 269

Share-based payment 150 150 291

Derivative financial instruments and foreign

exchange movements (7) 64 (33)

Increase/(decrease) in provisions 11 (574) (1,186)

------------------------------------------------ ----------- ----------- ----------

Operating cash flow before movements in working

capital 4,849 594 15,677

------------------------------------------------ ----------- ----------- ----------

Decrease/(increase) in inventories 563 111 (2,812)

Decrease/(increase) in receivables 1,020 2,580 (794)

Decrease in payables (2,086) (6,418) (451)

------------------------------------------------ ----------- ----------- ----------

(503) (3,727) (4,057)

------------------------------------------------ ----------- ----------- ----------

Cash generated from/(used in) operations 4,346 (3,133) 11,620

Tax received/(paid) 784 (640) (2,689)

Interest paid (286) (57) (296)

------------------------------------------------ ----------- ----------- ----------

Net cash generated from/(used in) operating

activities 4,844 (3,830) 8,635

------------------------------------------------ ----------- ----------- ----------

7. IFRS 15 'Revenue from Contracts with Customers'

The impact of IFRS 15 was fully reported on by the Group in the

Annual Report and Accounts for the year ended 30 April 2019.

The reported results for the six months ended 31 October 2018

were initial estimates at the publication of the 2018 Interim

Report. These figures have now been updated and reported as final

figures for the six months ended 31 October 2018.

The impact of the changes is that the total equity of the Group

at 1 May 2018 has increased by GBP66,000 from that reported in the

2018 Interim Report of 12 December 2018. The 31 October 2018

balance sheet has been restated accordingly with an increase in the

trade and other receivables by GBP66,000. The Consolidated income

statement, Consolidated statement of comprehensive income and

Consolidated cash flow statement for the six months ended 31

October 2018 are unaffected.

8. IFRS 16 'Leases'

The Group has adopted IFRS 16 'Leases' as from 1 May 2019 using

the modified retrospective methodology. This has resulted in the

Group recognising right of use assets and liabilities as

follows:

Property Other plant

and equipment Total

Right of use asset GBP'000 GBP'000 GBP'000

------------------------------------------- -------- -------------- --------

At 1 May 2019 5,405 466 5,871

Additions 336 54 390

As at 31 October 2019 5,741 520 6,261

------------------------------------------- -------- -------------- --------

Depreciation charge (429) (87) (516)

------------------------------------------- -------- -------------- --------

Net book value at 31 October 2019 5,312 433 5,745

------------------------------------------- -------- -------------- --------

Lease liability in respect of right of use

asset:

At 1 May 2019 5,900

New loans 390

Interest 93

Payments (601)

------------------------------------------- -------- -------------- --------

At 30 April 2019 5,782

------------------------------------------- -------- -------------- --------

Due within one year 1,060

Due after one year 4,722

------------------------------------------- -------- -------------- --------

5,782

------------------------------------------- -------- -------------- --------

The impact on the operating profit and profit before tax for the

six months ended 31 October 2019 is as follows:

GBP'000

---------------------------------- --------

Depreciation charge (516)

Operating lease cost 601

------------------------------------ --------

Net increase in operating profit 85

Interest charge (93)

------------------------------------ --------

Net decrease in profit before tax (8)

------------------------------------ --------

The impact of this change in accounting policy on basic earnings

per share is 0.02 pence for the six months ended 31 October

2019.

Shareholder information, financial calendar and advisers

Advisers

Nominated adviser and broker

Investec

30 Gresham Street

London EC2V 7QP

Auditor

KPMG LLP

Chartered Accountants

Arlington Business Park

Theale

Reading RG7 4SD

Tax advisers

Deloitte LLP

Abbots House

Abbey Street

Reading RG1 3BD

Legal advisers

Shoosmiths LLP

Apex Plaza

Forbury Road

Reading RG1 1SH

Registrars

Link Asset Services

The Registry

34 Beckenham Road

Beckenham

Kent BR3 4TU

Public and investor relations

MHP Communications

6 Agar Street

London WC2N 4HN

Bankers

Lloyds Bank

The Atrium

Davidson House

Forbury Square

Reading RG1 3EU

NatWest Bank

Abbey Gardens

4 Abbey Street

Reading RG1 3BA

Shareholders' enquiries

If you have an enquiry about the Company's business, or about

something affecting you as a shareholder (other than queries which

are dealt with by the registrars), you should contact the Company

Secretary by letter to the Company's registered office or by email

to info@cohortplc.com.

Share register

Link Asset Services maintains the register of members of the

Company.

If you have any questions about your personal holding of the

Company's shares, please contact:

Link Asset Services

Shareholder Solutions

The Registry

34 Beckenham Road

Beckenham

Kent BR3 4TU

Telephone: 0871 664 0300 (calls are charged at 12 pence per

minute plus your phone provider's access charge). (From outside the

UK: +44 371 664 0300 calls will be charged at the applicable

international rate.) Lines are open 9.00am to 5.30pm, Monday to

Friday, excluding public holidays in England and Wales.

Email: shareholderenquiries@linkgroup.co.uk

If you change your name or address or if details on the envelope

enclosed with this report, including your postcode, are incorrect

or incomplete, please notify the registrars in writing.

Daily share price listings

-- The Financial Times - AIM, Aerospace and Defence

-- The Times - Engineering

-- The Daily Telegraph - AIM section

-- London Evening Standard - AIM section

Financial calendar

Annual General Meeting

15 September 2020

Final dividend payable

16 September 2020

Expected announcements of results for the year ending 30 April

2020

Preliminary full year announcement

7 July 2020

Half year announcement

December 2020

Registered office

Cohort plc

One Waterside Drive

Arlington Business Park

Theale

Reading RG7 4SW

Registered company number of Cohort plc

05684823

Cohort plc is a company registered in England and Wales.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR MMMMZLMFGLZM

(END) Dow Jones Newswires

December 12, 2019 02:01 ET (07:01 GMT)

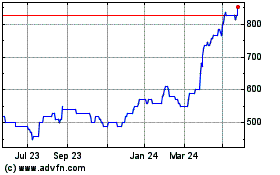

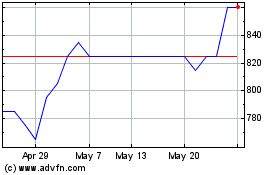

Cohort (AQSE:CHRT.GB)

Historical Stock Chart

From Jul 2024 to Jul 2024

Cohort (AQSE:CHRT.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024