The energy sector once again has become a popular segment, as

surging oil prices and a continued increase in U.S. oil production

have put the space into focus. Since the start of the second half

of the year, oil is moving higher on improving global economic

growth conditions and tight supply in key producing areas around

the globe.

The ongoing tension in Syria and the resulting threat of supply

disruption in the Middle East is also pushing oil prices higher

(read: Oil ETFs Jump on Syria Turmoil), leading to a sudden jump in

many oil producing stocks.

Recent Trends: Oil Demand & Supply

Demand for oil in the U.S. is also rising rapidly this year, adding

to the commodity strength. In fact, the data from the International

Energy Agency (IEA) shows that the demand has increased in four of

the first six months of 2013, marking the strongest run in more

than two years.

Oil production in the U.S, the largest oil consumer, soared to

levels not seen in decades. According to the Energy Information

Administration (EIA), U.S. crude oil production would jump 14% this

year and 22% in the next (read: Oil ETFs Surge on Strong Data).

With this upward trend expected to continue, the U.S. is expected

to surpass both Russia and Saudi Arabia and become the world’s

biggest producer of oil within the next five years. Further, the

U.S. could become energy independent by 2035 and a net exporter of

natural gas by the end of this decade.

However, the current oil production is showing little signs of

waning and the ongoing turbulence in Algeria, Nigeria, Egypt and

Syria could take a toll on the total oil supply going forward.

This, coupled with rising oil demand on the back of improving

global conditions, would lead to higher oil prices and the

resultant upsurge in the oil producer companies, at least for the

short term.

Given the optimism and promising growth outlook, investors seeking

to ride this sudden move might want to tap the space in ETF form.

For these investors, we have highlighted the top performing energy

ETFs over the past few weeks. Investors could enjoy smooth trading

in the months ahead, should oil price rise or remain firm thanks to

global issues and increased demand (see: all the energy ETFs

here).

This trio of funds could be excellent plays for investors who

believe that oil will continue to move upward, and finally lead the

commodity world higher (read: Time for This Top Ranked Energy

ETF?).

Market Vectors Oil Services ETF

(OIH)

This fund provides exposure to the 26 most liquid firms by tracking

the Market Vectors US Listed Oil Services 25 Index. With AUM of

more than $1.5 billion and average daily volume of about 4 million

a day, this is one of the largest and most popular in the

energy ETF space.

The product is concentrated across its top 10 securities at more

than 62% of total assets and is tilted towards large cap stocks.

Schlumberger (SLB) takes the top spot at 21.7%, closely followed by

Halliburton (HAL) and National Oilwell (NOV) at 8.5% and 6.44%,

respectively.

Apart from the U.S. companies, the fund also provides exposure to

Switzerland, Bermuda, Luxembourg, United Kingdom and the

Netherlands. The ETF charges a fee of 35 bps annually and added

over 5% in the past two months. OIH is up 18.35% so far this year

(read: More Trouble for Oil Services ETFs?).

iShares U.S. Oil Equipment & Services ETF

(IEZ)

This fund follows the Dow Jones U.S. Select Oil Equipment &

Services Index, holding 50 stocks in its portfolio. It has amassed

$401.4 million in its asset base and trades in good volume of more

than 110,000 shares per day. The ETF charges 46 bps in annual fees

from investors.

Like its Market Vectors counterpart, IEZ allocates 68.76% of the

assets in top 10 holdings, with Schlumberger, Halliburton and

National Oilwell holding the top three spots. While large caps

stocks account for nearly 66% of the assets, mid and small caps

take the remaining portion in the basket (read: Energy ETFs Rise on

Schlumberger Earnings Beat).

The fund gained nearly 5.2% over the past two months and is up

19.5% in the year-to-date period.

iShares U.S. Oil & Gas Exploration & Production ETF

(IEO)

This ETF tracks the Dow Jones U.S. Select Oil Exploration &

Production Index and holds 61 securities in total. The product has

been able to manage assets worth $375.3 million and trades in good

volume of 117,000 shares per day.

Here again, company-specific risk is high as indicated by a

concentration level of 62.80% of assets in the top 10 holdings. In

fact, the top firm – Occidental Petroleum (OXY) – dominates the

fund return with a 13.24% share, followed by Anadarko Petroleum

(APC) and EOG Resources (EOG) at 8.57% and 7.97%, respectively (see

more in the Zacks ETF Center).

The fund gained over 5.6% in the past two months and has delivered

strong returns of 20.5% in the year-to-date period.

Bottom Line

These energy ETFs could be worthwhile when natural resource prices

are rising. This is especially true with the dollar showing some

weakness of late and investors regaining confidence in the broad

commodity world, suggesting any of these funds could be interesting

choices to play oil strength in the near term (read: 3 Metal ETFs

to Buy on the Commodity Upswing).

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ANADARKO PETROL (APC): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

ISHARS-US O&G (IEO): ETF Research Reports

ISHARS-US OIL E (IEZ): ETF Research Reports

MKT VEC-OIL SVC (OIH): ETF Research Reports

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

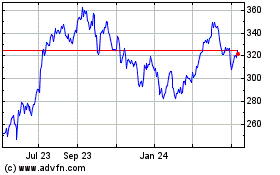

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Dec 2024 to Jan 2025

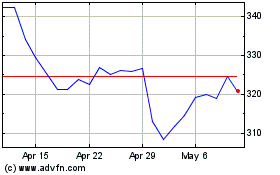

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Jan 2024 to Jan 2025