Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

September 03 2024 - 2:45PM

Edgar (US Regulatory)

Free Writing Prospectus

VanEck Merk Gold ETF

2024-09-03 ounz-fund-profile (VanEck)

0001546652

Pursuant to 433/164

333-274643

vaneck.com | 800.826.2333 1 SEPTEMBER 2024 OUNZ ® | VanEck ® Merk ® Gold ETF VanEck Merk Gold ETF seeks to provide investors with a convenient and cost - efficient way to buy and hold gold through an exchange traded product with the option to take physical delivery of gold if and when desired. Why Invest in Gold? Gold has long been used in investor portfolios as a safe haven investment but gold has exhibited many features that make it a compelling investment option: ▪ Inflation hedge ▪ Diversification potential ▪ Risk mitigation ▪ U.S. dollar hedge ▪ Safe haven asset ▪ Appreciation potential VanEck Gold Investments VanEck Merk Gold ETF (OUNZ) VanEck Gold Miners ETF (GDX ® ) VanEck Junior Gold Miners ETF (GDXJ ® ) International Investors Gold Fund (INIVX) The Gold ETF that Delivers *A delivery applicant must submit a delivery application and payment for the processing and delivery fees to cover the cost of preparing and transporting the gold. The delivery of physical gold to applicants may take considerable time and the delay in delivery could result in losses if the price of gold declines. A share submission is irrevocable. Investor files a delivery application * 1 2 3 Investor instructs broker to submit OUNZ shares to take delivery of their gold Gold sent to Investor Investor Submits Delivery Application and Shares of OUNZ Gold Is Delivered to Investor Investor OUNZ Shareholder owns pro - rata share of gold held by VanEck Merk Gold ETF Investor receives coins and/or bars without experiencing a taxable event VanEck Merk Gold ETF VanEck Merk Gold ETF holds gold in the form of allocated London Bars Gold is converted into coins and/ or bars as requested by Investor

Exchange - Traded Funds Mutual Funds Institutional Funds Model Delivery Separately Managed Accounts UCITS Funds UCITS Exchange - Traded Funds Van Eck Securities Corporation, Distributor A wholly - owned subsidiary of Van Eck Associates Corporation 666 Third Avenue | New York, NY 10017 vaneck.com | 800.826.2333 2 VanEck Merck Gold ETF (OUNZ) This material must be preceded or accompanied by a prospectus . Before investing, you should carefully consider the Trust’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by visiting www.vaneck.com/etfs or calling 800.826.2333. Please read the prospectus carefully before you invest. Investing involves significant risk, including possible loss of principal. The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity pool for the purposes of the Commodity Exchange Act. Shares of the Trust are not subject to the same regulatory requirements as mutual funds. Because shares of the Trust are intended to reflect the price of the gold held in the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value (“NAV”). Brokerage commissions will reduce returns. The request for redemption of shares for gold is subject to a number of risks including but not limited to the potential for the price of gold to decline during the time between the submission of the request and delivery. Delivery may take a considerable amount of time depending on your location. Commodities and commodity - index linked securities may be affected by changes in overall market movements and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities. The sponsor of the Trust is Merk Investments LLC (the “Sponsor”). Van Eck Securities Corporation provides marketing services to the Trust. VanEck Vectors Gold Miners ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ) An investment in the VanEck Gold Miners ETF may be subject to risks which include, among others, investing in gold and silver mining companies, Canadian issuers, foreign securities, foreign currency, depositary receipts, small - and medium - capitalization companies, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/ discount risk and liquidity of fund shares, non - diversified and concentration risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s return. Small - and medium - capitalization companies may be subject to elevated risks. An investment in the VanEck Junior Gold Miners ETF may be subject to risks which include, among others, investing in gold and silver mining companies, investing in Australian and Canadian issuers, foreign securities, foreign currency, depositary receipts, small - and medium - capitalization companies, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non - diversified, concentration and tax reform legislation risks, all of which may adversely affect the Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s return. Small - and medium - capitalization companies may be subject to elevated risks. VanEck International Investors Gold Fund (INIVX) You can lose money by investing in the Fund. Any investment in the Fund should be part of an overall investment program, not a complete program. The Fund is subject to risks which may include, but are not limited to, risks associated with active management, commodities and commodity - linked instruments, commodities and commodity - linked instruments tax, derivatives, direct investments, emerging market issuers, ESG investing strategy, foreign currency, foreign securities, gold and silver mining companies, market, non - diversified, operational, regulatory, investing in other funds, small - and medium - capitalization companies, special risk considerations of investing in Australian and Canadian issuers, subsidiary investment risk, and tax risks (with respect to investments in the Subsidiary), all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small - and medium - capitalization companies may be subject to elevated risks. Derivatives may involve certain costs and risks such as liquidity, interest rate, and the risk that a position could not be closed when most advantageous. Investments in the gold industry can be significantly affected by international economic, monetary and political developments. The Fund’s overall portfolio may decline in value due to developments specific to the gold industry. Diversification does not assure a profit or protect against loss. Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing. ©2024 Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation. ©Merk Investments LLC. All rights reserved. All trademarks, service marks or registered trademarks are the property of their respective owners. OUNZPROFILE (2024.09) Trust Details Merk Investments LLC Sponsor OUNZ Ticker Van Eck Securities Corporation Marketing Agent 921078101 CUSIP The Bank of New York Mellon Trustee 5/16/2014 Inception Date JPMorgan Chase Bank, N.A. Custodian 0.25% Expense Ratio

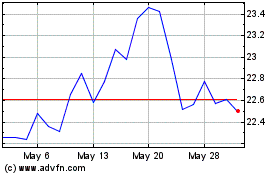

VanEck Merk Gold ETF (AMEX:OUNZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

VanEck Merk Gold ETF (AMEX:OUNZ)

Historical Stock Chart

From Nov 2023 to Nov 2024