3 ETF Winners from Earnings Season - ETF News And Commentary

May 07 2014 - 1:00PM

Zacks

The Q1 2014 earnings season is currently in the halfway mark and

the growth picture looks uninspiring, with lack of top-line

surprises and weak management guidance for the second quarter

(read: 3 Hit and Flop ETFs of April).

Total earnings for the S&P 500 companies that have reported so

far are up 1.4% on an annual basis with a beat ratio of 68% while

revenues have increased 2.2% with a beat ratio of 44.1%. While the

earnings beat ratio is trending better than the recent quarterly

averages, the revenue beat ratio is lagging.

From a sector perspective, utilities is the star performer, having

delivered the highest earnings median surprise of 8.3% and revenue

surprise of 9.1%. The sector is also the key contributor to

earnings and revenues, accounting for 19.9% of overall earnings

growth with beat ratio of 80% and revenue growth of 10.9% with beat

ratio of 72% (see: all the utilities ETFs here).

On the other hand, autos remained the biggest laggard on the

earnings front as 100% of the sector’s market cap has reported,

with earnings declining 22.1% on 2.1% higher revenues. If we go

only by earnings beat ratio, conglomerates have fared better with

83.3% ratio followed by 81% for consumer discretionary as per the

Zacks Earnings Trends.

Considering all the key metrics, several equity ETFs have impressed

with their performances and generated handsome returns over the

trailing one month. While there are winners in every corner of the

space, below we have highlighted the top three ETFs that buoyed up

on robust earnings results and are easily leading the broad market

in the same time period:

SPDR S&P Oil & Gas Exploration & Production ETF

(XOP)

This fund follows the S&P Oil & Gas Exploration &

Production Select Industry Index, holding 84 stocks in its

portfolio. It has amassed $915.7 million in its asset base and

trades in heavy volume of more than 4.5 million shares per day. The

ETF charges 35 bps in annual fees from investors (read: Energy

Exploration ETFs: A Bright Spot in The Choppy Market).

The product provides equal weight exposure across a number of firms

as none holds more than 1.9% of total assets. Further, it is widely

diversified across various market caps – small caps (42%), large

caps (32%) and mid caps (26%). However, more than three-fourths of

the portfolio goes to the exploration and production firms while

refining and marketing, and integrated oil & gas take the

remainder.

The ETF gained over 6% in the trailing one-month period and has a

Zacks ETF Rank of 4 or ‘Sell’ rating with a High risk outlook.

SPDR S&P Pharmaceuticals ETF (XPH)

This fund provides exposure to the pharma segment of the broad

healthcare space by tracking the S&P Pharmaceuticals Select

Industry Index. The product has AUM of about $852.7 million and

trades in volume of more than 123,000 a day. It charges 35 bps a

year in fees from investors.

Holding 34 securities in its basket, the product is well spread

across each security as none of these holds more than 4.52% share

in the basket. In addition, the ETF is also diversified across

various market caps with large caps accounting for 45% and small

and mid caps making up for 36% and 19%, respectively.

The product added over 6% over the past month and has a Zacks ETF

Rank of 1 or ‘Strong Buy’ rating with Medium risk outlook (read:

Pharma ETFs: A Safe Haven from the Biotech Stock Slump?).

First Trust ISE-Revere Natural Gas Index Fund

(FCG)

This ETF offers exposure to the U.S. stocks that derive a

substantial portion of their revenues from the exploration and

production of natural gas. It follows the ISE-REVERE Natural Gas

Index and holds 30 stocks in its basket, which are well spread out

across a single component as none of these holds more than 5.37% of

assets.

Like the other two, this ETF has also diversified across various

market cap levels with 44% in large caps, 38% in small caps and the

rest in mid caps. The fund has amassed $539 million in its asset

base while sees solid volume of nearly 516,000 shares per day.

Expense ratio came in at 0.60%.

FCG was up about 5.2% over the trailing one month and has a Zacks

ETF Rank of 3 or ‘Hold’ rating with High risk outlook.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

FT-ISE R NAT GA (FCG): ETF Research Reports

SPDR-SP O&G EXP (XOP): ETF Research Reports

SPDR-SP PHARMA (XPH): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

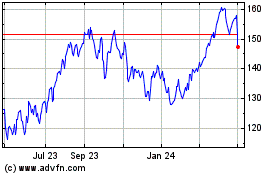

SPDR S&P Oil and Gas Exp... (AMEX:XOP)

Historical Stock Chart

From Feb 2025 to Mar 2025

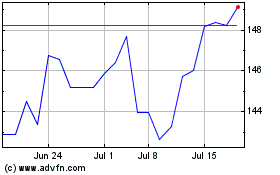

SPDR S&P Oil and Gas Exp... (AMEX:XOP)

Historical Stock Chart

From Mar 2024 to Mar 2025