Senseonics Holdings, Inc. (NYSE-American: SENS), a medical

technology company focused on the development and commercialization

of a long-term, implantable continuous glucose monitoring (CGM)

system for people with diabetes, today reported financial results

for the second quarter ended June 30, 2018.

RECENT HIGHLIGHTS & ACCOMPLISHMENTS:

- Received FDA approval for the

Eversense® CGM System, the first and only long-term implantable

continuous glucose monitoring system

- Completed first commercial insertion in

the U.S.

- Secured first U.S. payor coverage of

Eversense from Horizon Blue Cross Blue Shield of New Jersey

- Eversense Mobile Clinic traveling

across the U.S. training physicians

- Eversense® XL System introduced across

the existing European markets

- Strengthened balance sheet with

additional $150 million of gross proceeds through completion of

underwritten equity offering

“Second quarter was a very significant period for Senseonics. We

received FDA approval for the Eversense System, began our U.S.

commercial launch at ADA, and subsequently, in just six weeks,

secured reimbursement from BCBS New Jersey. Additionally, our

penetration in the EMEA market continues to grow as we have

expanded availability of the Eversense XL across Europe,” said Tim

Goodnow, President and Chief Executive Officer of Senseonics. “As

we go forward in the balance of 2018, we will continue to execute

on our commercial strategy and clinical development programs as we

work toward label expansion and additional regulatory

approvals.”

SECOND QUARTER 2018 RESULTS:

Revenue was $3.6 million for the second quarter of 2018,

compared to $0.8 million for the second quarter of 2017 and $2.9

million for the first quarter of 2018.

Second quarter 2018 sales and marketing expenses increased $2.7

million versus first quarter 2018, to $6.2 million. The increase in

sales and marketing expenses was primarily driven by an increase in

compensation expense associated with adding additional sales

resources to prepare for a United States launch in 2018, as well as

to support and expand the distribution of Eversense in Europe.

Second quarter 2018 research and development expense was

essentially flat compared to first quarter 2018 and $2.7 million

greater than second quarter 2017. The year-over-year increase in

research and development expenses was primarily driven by the

on-going support of our pre-market approval application including

the completion of the Advisory Panel activity.

Second quarter 2018 general and administrative expenses

increased $1.4 million over first quarter 2018 and increased $1.5

million over second quarter 2017, to $5.4 million. The

year-over-year increase in general and administration expenses was

primarily driven by an increase in compensation, legal and other

administrative expense associated with supporting operational

growth.

Net loss was $32.5 million, or $0.23 per share, in the second

quarter of 2018, compared to $12.4 million, or $0.12 per share, in

the second quarter of 2017. This compares to a first quarter 2018

net loss of $22.3 million or $0.16 per share. The increase in net

loss in the second quarter of 2018 compared to the first quarter of

2018 was driven primarily by a $5.3 million increase in the loss

from the change in fair value of the derivative liability and a

$4.1 million increase in operating expense. Excluding the change in

the increase of the derivative liability during the second quarter

2018, net loss for the three months ended June 30, 2018 would have

been $22.3 million or $0.16 per share. Second quarter 2018 net loss

per share for the three months ended June 30, 2018 was based on

138.8 million weighted average shares outstanding, compared to

103.7 million weighted average shares outstanding in the second

quarter of 2017.

As of June 30, 2018, cash, cash equivalents, and marketable

securities were $191.9 million and outstanding indebtedness was

$72.7 million.

CONFERENCE CALL AND WEBCAST INFORMATION

Company management will host a conference call at 4:30 pm

(Eastern Time) today, August 8, 2018, to discuss these financial

results. This conference call can be accessed live by telephone or

through Senseonics’ website.

Live

Teleconference Information:

Live Webcast

Information:

Dial in number: (877)883-0383

Visit http://www.senseonics.com and select

the “Investor Relations” section

International dial in: (412)902-6506

A replay of the call can be accessed on Senseonics’ website

http://www.senseonics.com under “Investor Relations.”

About Senseonics

Senseonics Holdings, Inc. is a medical technology company

focused on the development and commercialization of

transformational glucose monitoring products designed to help

people with diabetes confidently live their lives with ease.

Senseonics' CGM systems, Eversense and Eversense XL, include a

small sensor inserted completely under the skin that communicates

with a smart transmitter worn over the sensor. The glucose data are

automatically sent every 5 minutes to a mobile application on the

user's smartphone.

FORWARD LOOKING STATEMENTS

Any statements in this press release about future expectations,

plans and prospects for Senseonics, including statements about the

clinical development of future generations of Eversense, the

expanded commercialization of Eversense and Eversense XL in Europe,

label expansion, additional regulatory approvals, and other

statements containing the words “expect,” “intend,” “may,”

“projects,” “will,” and similar expressions, constitute

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995. Actual results may differ

materially from those indicated by such forward-looking statements

as a result of various important factors, including: uncertainties

inherent in the regulatory approval process, uncertainties inherent

in the expanded commercial launch of Eversense and Eversense XL in

Europe and such other factors as are set forth in the risk factors

detailed in Senseonics’ Annual Report on Form 10-K for the year

ended December 31, 2017, Senseonics’ Quarterly Report on Form 10-Q

for the quarter ended June 30, 2018, and Senseonics’ other filings

with the SEC under the heading “Risk Factors.” In addition, the

forward-looking statements included in this press release represent

Senseonics’ views as of the date hereof. Senseonics anticipates

that subsequent events and developments will cause Senseonics’

views to change. However, while Senseonics may elect to update

these forward-looking statements at some point in the future,

Senseonics specifically disclaims any obligation to do so except as

required by law. These forward-looking statements should not be

relied upon as representing Senseonics’ views as of any date

subsequent to the date hereof.

FINANCIAL STATEMENTS TO FOLLOW:

Senseonics Holdings, Inc.

Condensed Consolidated Balance Sheets (in

thousands, except share and per share data) June

30, December 31, 2018 2017

(unaudited)

Assets Current assets: Cash and cash equivalents

$ 183,928 $ 16,150 Marketable securities 7,954 20,300 Accounts

receivable, primarily from a related party 2,988 3,382 Inventory,

net 8,400 2,991 Prepaid expenses and other current assets

4,195 2,092 Total current assets 207,465

44,915 Deposits and other assets 205 176 Property and

equipment, net 998 853 Total assets $

208,668 $ 45,944

Liabilities and

Stockholders’ Equity Current liabilities: Accounts payable $

5,172 $ 7,712 Accrued expenses and other current liabilities 9,863

5,428 Notes payable, current portion 10,000

10,000 Total current liabilities 25,035 23,140 Notes

payable, net of discount 9,619 14,414 Convertible senior notes, net

of discount 34,469 — Derivative liability 32,312 — Notes payable,

accrued interest 1,444 1,054 Other liabilities 73

69 Total liabilities 102,952 38,677

Commitments and contingencies (Note 8) Stockholders’ equity:

Common stock, $0.001 par value per share; 450,000,000 and

250,000,000 shares authorized, 175,897,790 and 136,882,735 shares

issued and outstanding as of June 30, 2018 and December 31, 2017

177 137 Additional paid-in capital 424,131 270,953 Accumulated

deficit (318,592 ) (263,823 ) Total stockholders'

equity 105,716 7,267 Total liabilities

and stockholders’ equity $ 208,668 $ 45,944

Senseonics Holdings, Inc. Unaudited Condensed

Consolidated Statement of Operations and Comprehensive Loss

(in thousands, except share and per share data)

Three Months Ended Six Months Ended June 30,

June 30, 2018 2017 2018 2017

Revenue, primarily from a related party $ 3,623 $ 814 $ 6,569 $

1,367 Cost of sales 3,839 1,714

7,147 2,759 Gross profit (216 ) (900 ) (578 )

(1,392 ) Expenses: Sales and marketing expenses 6,177 1,249

9,618 2,389 Research and development expenses 8,289 5,604 16,402

12,602 General and administrative expenses 5,382

3,888 9,393 7,655

Operating loss (20,064 ) (11,641 ) (35,991 ) (24,038 ) Other income

(expense), net: Interest income 241 37 425 58 Interest expense

(2,236 ) (767 ) (4,007 ) (1,451 ) Change in fair value of 2023

derivative (10,166 ) — (15,013 ) — Other expense (271 )

(3 ) (183 ) (16 ) Total other expense, net

(12,432 ) (733 ) (18,778 ) (1,409 )

Net loss (32,496 ) (12,374 ) (54,769 ) (25,447 ) Total

comprehensive loss $ (32,496 ) $ (12,374 ) $ (54,769 ) $ (25,447 )

Basic and diluted net loss per common share $ (0.23 ) $

(0.12 ) $ (0.40 ) $ (0.26 ) Basic and diluted weighted-average

shares outstanding 138,767,873 103,689,994

137,923,135 98,825,088

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180808005748/en/

INVESTOR CONTACTSenseonics Holdings, Inc.R. Don Elsey,

301-556-1602Chief Financial Officerdon.elsey@senseonics.com

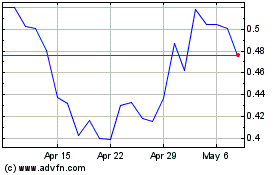

Senseonics (AMEX:SENS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Senseonics (AMEX:SENS)

Historical Stock Chart

From Jan 2024 to Jan 2025