As filed with the Securities and Exchange Commission

on February 13, 2025

Registration No. 333-

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Northann Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

|

88-1513509 |

|

(State or other jurisdiction of incorporation or

organization) |

|

(I.R.S. Employer Identification No.) |

2251 Catawba River Rd

Fort Lawn, SC 29714

T: (916) 573 3803

(Address of Principal Executive Offices) (Zip Code)

Northann Corp. 2023 Equity Incentive Plan

(Full title of the plan)

Vcorp Services, LLC

701 S. Carson Street, Suite 200

Carson City, NV 89701

(Name, Address, Including Zip Code, and Telephone

Number, Including Area Code, of Agent for Service)

Copies to:

|

Henry Yin, Esq.

Loeb & Loeb LLP

2206-19 Jardine House

1 Connaught Place

Central, Hong Kong SAR

(852) 3923-1111 |

Xiaoqin (Sherry) Li, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, NY 10154

(212) 407-4000 |

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer |

¨ |

|

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

|

Smaller reporting company |

x |

| |

|

|

Emerging growth company |

x |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Northann Corp. (the “Registrant”) has prepared this registration

statement in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended, to register 8,000,000 additional

shares of common stock, $0.001 par value of the Registrant (“Common Stock”), under the Northann Corp. 2023 Equity Incentive

Plan, which Common Stock is in addition to the 4,000,000 shares of Common Stock registered on the Registrant’s Form S-8 filed with

the Securities and Exchange Commission (the “Commission”) on March 8, 2024 (Commission File No. 333-277808) (the “Prior

Registration Statement”).

This registration statement relates to securities of the same class as

that to which the Prior Registration Statement relates, and is submitted in accordance with General Instruction E to Form S-8 regarding

Registration of Additional Securities. Pursuant to General Instruction E of Form S-8, the contents of the Prior Registration Statement

are incorporated herein by reference and made part of this registration statement, except as amended hereby.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 8. Exhibits

The following is a list of all exhibits filed as part

of this Registration Statement or, as noted, incorporated by reference into this Registration Statement:

Exhibit

Number |

|

Description |

| 3.1 |

|

Articles of Incorporation (incorporated by reference to Exhibit 3.1 to the Registration Statement on Form S-1 filed on July 14, 2023, as amended) |

| 3.2 |

|

Certificate of Amendment to the Articles of Incorporation (incorporated by reference to Exhibit 3.2 to the Registration Statement on Form S-1 filed on July 14, 2023, as amended) |

| 3.3 |

|

Certificate of Designation of Series A Preferred Stock (incorporated by reference to Exhibit 3.3 to the Registration Statement on Form S-1 filed on July 14, 2023, as amended) |

| 3.4 |

|

Certificate of Amendment to the Certificate of Designation of Series A Preferred Stock (incorporated by reference to Exhibit 3.4 to the Registration Statement on Form S-1 filed on July 14, 2023, as amended) |

| 3.5 |

|

Bylaws (incorporated by reference to Exhibit 3.5 to the Annual Report on Form 10-K filed on April 16, 2024) |

| 5.1 |

|

Opinion of Fennemore Craig, P.C. |

| 10.1 |

|

Northann Corp. 2023 Equity Incentive Plan (incorporated by reference to Exhibit 10.17 to the Registrant’s Registration Statement on Form S-1 (File No. 333-273246) |

| 23.1 |

|

Consent of Fennemore Craig, P.C. (contained in Exhibit 5.1) |

| 23.2 |

|

Consent of WWC, P.C., Independent Registered Public Accounting Firm |

| 24.1 |

|

Power of Attorney (included in the signature page) |

| 107 |

|

Calculation of Filing Fee Table |

SIGNATURES

Pursuant to the requirements of the Securities Act

of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing

on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

on February 13, 2025.

| |

Northann Corp. |

| |

|

| |

By: |

/s/ Lin Li |

| |

|

Lin Li |

| |

|

Chairman of the Board, Chief Executive Officer, President, Secretary, and Treasurer |

POWER OF ATTORNEY

Each person whose signature appears

below constitutes and appoints Lin Li as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and

re-substitution, for him or her and in his or her name, place, and stead, in any and all capacities, to sign any and all amendments (including

post-effective amendments, exhibits thereto and other documents in connection therewith) to this Registration Statement, and to file the

same, with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto said attorneys-in-fact

and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the

premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said

attorneys-in-fact and agents, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons and in the capacities

and on the dates indicated.

| Name |

|

Title |

|

Date |

| /s/ Lin Li |

|

Chairman of the Board, Chief Executive Officer, President, Secretary, and Treasurer |

|

February 13, 2025 |

| Lin Li |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Sunny S. Prasad |

|

Interim Chief Financial Officer |

|

February 13, 2025 |

| Sunny S. Prasad |

|

(Principal Financial Officer and Interim Principal Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Kurtis W. Winn |

|

Chief Operating Officer and Director |

|

February 13, 2025 |

| Kurtis W. Winn |

|

|

|

|

| |

|

|

|

|

| /s/ Bradley C. Lalonde |

|

Director |

|

February 13, 2025 |

| Bradley C. Lalonde |

|

|

|

|

| |

|

|

|

|

| /s/ Umesh Patel |

|

Director |

|

February 13, 2025 |

| Umesh Patel |

|

|

|

|

| |

|

|

|

|

| /s/ Jing Zhang |

|

Director |

|

February 13, 2025 |

| Jing Zhang |

|

|

|

|

Exhibit 5.1

|

|

9275 W. Russell Road, Suite 240

Las Vegas, Nevada 89148

PH

(702) 692-8026 | FX (702) 692-8075

fennemorelaw.com |

February 13, 2025

Northann Corp.

2251 Catawba River Road

Fort Lawn, South Carolina

29714

| Re: | Northann Corp./Registration Statement on Form S-8 |

Ladies and Gentlemen:

We have acted as special Nevada counsel to Northann

Corp., a Nevada corporation (the “Company”), in connection with the registration by the Company of 12,000,000 shares (the

“Shares”) of its common stock, $0.001 par value per share (the “Common Stock”) that have been or may be issued

pursuant to the Company’s 2023 Equity Incentive Plan, as amended (the “Plan”) on Form S-8 (the “Registration Statement”)

under the Securities Act of 1933, as amended (“Securities Act”), as filed with the Securities and Exchange Commission (“Commission”).

For purposes of these opinions, we have examined

originals or copies of:

| (a) | the Registration Statement; |

| (c) | certain actions of the Board of Directors and stockholders of

the Company relating to the adoption of the Plan and such other matters as relevant. |

We have obtained from officers

and agents of the Company and from public officials, and have relied upon, such certificates, representations, and assurances as we have

deemed necessary and appropriate for purposes of rendering this opinion letter. We have also examined such other corporate charter and

other documents, records, certificates, and instruments (collectively with the documents identified in (a) through (c) above, the “Documents”)

as we deem necessary or advisable to render the opinions set forth herein.

Northann Corp.

February 13, 2025

Page 2

In our examination we have assumed:

| (a) | the legal capacity and competency of all natural persons executing

the Documents; |

| (b) | the genuineness of all signatures on the Documents; |

| (c) | the authenticity of all Documents submitted to us as originals,

and the conformity to original documents of all Documents submitted to us as copies; |

| (d) | that the parties to such Documents, other than the Company, had

the power, corporate or other, to enter into and perform all obligations thereunder; |

| (e) | that such Documents are enforceable in accordance with their

terms with respect to all parties thereto; |

| (f) | that at the time of issuance of any Shares, the Company validly

exists and is duly qualified and in good standing under the laws of Nevada; and |

| (g) | other than with respect to the Company, the due authorization

by all requisite action, corporate or other, of the execution and delivery by all parties of the Documents. |

We have relied upon the accuracy and completeness

of the information, factual matters, representations, and warranties contained in such documents.

In rendering the opinions set forth below, we

have also assumed that:

| (a) | at or prior to the time of issuance and delivery, the Shares

will be registered by the transfer agent and registrar of such Shares; |

| (b) | the Company will keep reserved a sufficient number of shares

of its Common Stock to satisfy its obligations for issuances of Shares under the Plan; |

| (c) | upon issuance of any of the Shares, the total number of shares

of the Company’s Common Stock issued and outstanding will not exceed the total number of shares of Common Stock that the Company

is then authorized to issue under its charter documents; and |

| (d) | each stock grant, stock option, or other security exercisable

or exchangeable for a Share under the Plan has been, or will be, duly authorized, validly granted, and duly exercised or exchanged in

accordance with the terms of the Plan, at the time of any grant of a Share or exercise of such stock option or other security under the

Plan. |

Northann Corp.

February 13, 2025

Page 3

Based on the foregoing and in reliance thereon,

and subject to the assumptions, limitations and qualifications set forth herein, we are of the opinion that:

| (a) | the Shares that have been or may be issued under the Plan are

duly authorized shares of the Company’s Common Stock; and |

| (b) | if, as, and when issued against receipt of the consideration

therefor in accordance with the provisions of the Plan and in accordance with the Registration Statement, the Shares will be validly

issued, fully paid, and nonassessable. |

The opinions expressed herein are limited to the

matters specifically set forth herein and no other opinion shall be inferred beyond the matters expressly stated. We disclaim any undertaking

to advise you of any subsequent changes in the facts stated or assumed herein or any changes in applicable law that may come to our attention

after the date the Registration Statement is declared effective.

While certain members of this firm are admitted

to practice in certain jurisdictions other than Nevada, in rendering the foregoing opinions we have not examined the laws of any jurisdiction

other than Nevada. Accordingly, the opinions we express herein are limited to matters involving the laws of the State of Nevada (other

than the securities laws and regulations of the State of Nevada, as to which we express no opinion). We express no opinion regarding the

effect of the laws of any other jurisdiction or state, including any securities laws related to the issuance and sale of the Shares.

We hereby consent to the filing

of this opinion as an exhibit to the Registration Statement and we consent to the reference of our name under the caption “Legal

Matters” in the Prospectus forming a part of the Registration Statement. In giving the foregoing consent, we do not hereby admit

that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of

the Commission thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ Fennemore Craig, P.C. |

| |

|

| |

Fennemore Craig, P.C. |

tmor/cdol

Exhibit 23.2

To the Board of Directors and Stockholders of

Northann Corp.

Consent of Independent Registered Public Accounting

Firm

We hereby consent to the incorporation by reference

in this Registration Statement on Form S-8 of Northann Corp and its subsidiaries (collectively the “Company”) of our reports

dated April 15, 2024 relating to the audit of the consolidated balance sheets of Northann Corp and its subsidiaries (collectively the

“Company”) as of December 31, 2023 and 2022, and the related consolidated statements of income and comprehensive income (loss),

stockholders’ equity (deficit) and cash flows for each of the years in the two-year period ended December 31, 2023, and the related

notes (collectively referred to as the financial statements), which appear in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023.

We also consent to the Company’s reference

to WWC, P.C., Certified Public Accountants, as experts in accounting and auditing.

| |

|

| |

|

| San Mateo, California |

WWC, P.C. |

| February 13, 2025 |

Certified Public Accountants |

| |

PCAOB ID: 1171 |

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

Northann Corp.

(Exact Name of Registrant as Specified in its Charter)

Newly Registered Securities

|

Security

Type |

|

Security

Class

Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

|

Proposed

Maximum

Offering

Price

Per

Share(2) |

|

|

Maximum

Aggregate

Offering

Price |

|

Fee Rate |

|

Amount of

Registration

Fee |

|

| Equity |

|

Common Stock, $0.001 par value |

|

Rule 457(c) and Rule 457(h) |

|

|

8,000,000 |

(3) |

|

$ |

0.26225 |

|

$ |

2,098,000.00 |

|

$153.10 per $1,000,000 |

|

$ |

321.20 |

|

| Total Offering Amounts |

|

|

|

|

|

$ |

2,098,000.00 |

|

|

|

$ |

321.20 |

|

| Total Fee Offsets |

|

|

|

|

|

|

|

|

|

|

$ |

0.00 |

|

| Net Fee Due |

|

|

|

|

|

|

|

|

|

|

$ |

321.20 |

|

| |

(1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers any additional securities of Northann Corp. (the “Registrant”) that may become issuable under the Registrant’s 2023 Equity Incentive Plan, as amended (the “Plan”) as a result of any future stock splits, stock dividends or similar adjustments of the Registrant’s outstanding ordinary shares. |

| |

(2) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h)(1) of the Securities Act. The proposed maximum offering price per share is estimated to be $0.26225, based on the average of the high sales price ($0.267) and the low sales price ($0.2575) for the Registrant’s common stock as reported by NYSE American on February 10, 2025. |

| |

(3) |

These 8,000,000 shares of common stock to be registered are reserved for future grants under the Plan. |

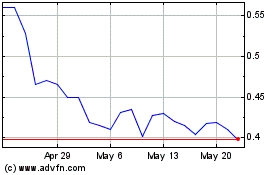

Northann (AMEX:NCL)

Historical Stock Chart

From Jan 2025 to Feb 2025

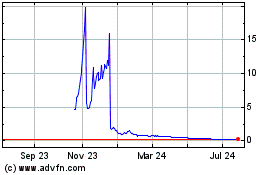

Northann (AMEX:NCL)

Historical Stock Chart

From Feb 2024 to Feb 2025