0001358190

false

CN

NYSEAMER

0001358190

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August

10, 2023

IT TECH PACKAGING, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

| 001-34577 |

|

20-4158835 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

|

Science Park, Juli Road

Xushui District, Baoding City

Hebei Province, People’s Republic of China |

|

072550 |

| (Address of principal executive offices) |

|

(Zip Code) |

(86) 312-8698215

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ITP |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 10, 2023, IT Tech Packaging, Inc. (the “Company”)

issued a press release announcing its unaudited financial results for the six and three months ended June 30, 2023. A copy of the press

release making the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant

to this Item 2.02, including Exhibit 99.1, shall not be deemed as “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended

(the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

IT TECH PACKAGING, INC. |

| |

|

|

|

| Date: August 10, 2023 |

By: |

/s/ Zhenyong Liu |

| |

|

Name: |

Zhenyong Liu |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit 99.1

IT Tech Packaging,

Inc. Announces Second Quarter 2023 Unaudited Financial Results

BAODING, China, Aug.

10, 2023 /PRNewswire/ -- IT Tech Packaging, Inc. (NYSE American: ITP) (“IT Tech Packaging” or the “Company”),

a leading manufacturer and distributor of diversified paper products in North China, today announced its unaudited financial results for

the six and three months ended June 30, 2023.

Mr. Zhenyong Liu, Chairman

and Chief Executive Officer of the Company, commented, “For the first half of 2023, revenue of the Company was $49.81 million, representing

an increase of 5.37% from the same period last year, with a gross profit of $0.9 million. For the six months ended June 30, 2023, because

of the weak domestic market demand of the paper products, the price of paper products kept falling and the average selling price of our

products was significantly lower than the same period of last year. Although the Company continues to optimize the cost, the raw material

inventory of the first half of 2023 was still high due to the impact of the procurement cycle, resulting in a decrease in the net profit

of the current period. In the future, the Company anticipates to continue improving the profit efficiency by adjusting utilization rate

of assets, developing new market channels and other ways. It is expected that the profitability of the Company will be effectively recovered

in the second half of the year.”

Second Quarter 2023 Unaudited Financial Results

| | |

For the Three Months Ended June 30, | |

| ($ millions) | |

2023 | | |

2022 | | |

% Change | |

| Revenues | |

| 30.02 | | |

| 31.79 | | |

| -5.56 | % |

| Regular Corrugating Medium Paper (“CMP”)* | |

| 21.93 | | |

| 25.85 | | |

| -15.17 | % |

| Light-Weight CMP** | |

| 4.54 | | |

| 5.44 | | |

| -16.41 | % |

| Offset Printing Paper | |

| 3.16 | | |

| - | | |

| - | |

| Tissue Paper Products | |

| 0.34 | | |

| 0.41 | | |

| -16.30 | % |

| Face Masks | |

| 0.04 | | |

| 0.09 | | |

| -49.48 | % |

| Gross profit | |

| 1.18 | | |

| 0.63 | | |

| 86.09 | % |

| Gross profit (loss) margin | |

| 3.93 | % | |

| 1.99 | % | |

| 1.94 pp | **** |

| Regular Corrugating Medium Paper (“CMP”)* | |

| 6.81 | % | |

| 4.28 | % | |

| 2.53

pp | **** |

| Light-Weight CMP** | |

| 7.14 | % | |

| 5.95 | % | |

| 1.19

pp | **** |

| Offset Printing Paper | |

| 2.42 | % | |

| - | | |

| 2.42

pp | **** |

| Tissue Paper Products*** | |

| -206.06 | % | |

| -197.95 | % | |

| -8.11

pp | **** |

| Face Masks | |

| -8.07 | % | |

| 20.79 | % | |

| -28.86pp | **** |

| Operating income(loss) | |

| -0.52 | | |

| -1.24 | | |

| 58.03 | % |

| Net income (loss) | |

| -1.25 | | |

| -0.29 | | |

| -335.37 | % |

| EBITDA | |

| 2.83 | | |

| 3.55 | | |

| -20.28 | % |

| Basic and Diluted earnings(loss) per share | |

| -0.12 | | |

| -0.03 | | |

| -300 | % |

| *** | Products

from PM8 and PM9 |

| **** | pp

represents percentage points |

| ● | Revenue decreased by 5.56% to approximately $30.02

million, mainly due to the decrease of average selling prices of corrugating medium paper (“CMP”), partially offset by the increase

in sales volume of CMP and offset printing paper. |

| ● | Gross profit increased by 86.09% to approximately

$1.18 million. Total gross margin increased by 1.94 percentage point to 3.93%. |

| ● | Loss from operations was approximately $0.52 million,

compared to approximately $1.24 million for the same period of last year. |

| ● | Net loss was approximately $1.25million, or loss

per share of $0.12, compared to net loss of approximately $0.29million, or loss per share of $0.03, for the same period of last year. |

| ● | Earnings before interest, taxes, depreciation and

amortization (“EBITDA”) was approximately $2.83million, compared to$3.55 million for the same period of last year. |

Revenue

For the second quarter of

2023, total revenue decreased by 5.56%, to approximately $30.02 million from approximately $31.79 million for the

same period of last year. The decrease in total revenue was mainly due to the decrease of average selling prices of corrugating medium

paper (“CMP”), partially offset by the increase in sales volume of CMP and offset printing paper.

The following table summarizes

revenue, volume and ASP by product for the second quarter of 2023and 2022, respectively:

| | |

For the Three Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| | |

Revenue

($’000) | | |

Volume

(tonne) | | |

ASP

($/tonne) | | |

Revenue

($’000) | | |

Volume

(tonne) | | |

ASP

($/tonne) | |

| Regular CMP | |

| 21,932 | | |

| 60,063 | | |

| 365 | | |

| 25,853 | | |

| 53,943 | | |

| 479 | |

| Light-Weight CMP | |

| 4,544 | | |

| 12,877 | | |

| 353 | | |

| 5,437 | | |

| 11,642 | | |

| 467 | |

| Offset Printing Paper | |

| 3,156 | | |

| 5,403 | | |

| 584 | | |

| - | | |

| - | | |

| - | |

| Tissue Paper Products | |

| 344 | | |

| 293 | | |

| 1,175 | | |

| 411 | | |

| 383 | | |

| 1,074 | |

| Total | |

| 29,976 | | |

| 78,636 | | |

| 381 | | |

| 31,701 | | |

| 65,968 | | |

| 481 | |

| | |

| Revenue

($’000) | | |

| Volume

(thousand

pieces) | | |

| ASP

($/thousand

pieces) | | |

| Revenue

($’000) | | |

| Volume

(thousand

pieces) | | |

| ASP

($/thousand

pieces) | |

| Face Masks | |

| 44 | | |

| 1,411 | | |

| 31 | | |

| 88 | | |

| 1,852 | | |

| 47 | |

Revenue from CMP, including

both regular CMP and light-Weight CMP, decreased by 15.39%, to approximately $26.48 million and accounted for 88.19% of total

revenue for the second quarter of 2023, compared to approximately $31.29million, or 98.43% of total revenue for the same period of

last year. The Company sold 72,940tonnes of CMP at an ASP of $363/tonne in the second quarter of 2023, compared to 65,585 tonnes

at an ASP of $477/tonne in the same period of last year.

Of the total CMP sales,

revenue from regular CMP decreased by 15.17%, to approximately $21.93million for the second quarter of 2023, compared to revenue of approximately

$25.85 million for the same period of last year. The Company sold 60,063tonnes of regular

CMP at an ASP of $365/tonne during the second quarter of 2023, compared to 53,943tonnes at an ASP of $479/tonne for the same

period of last year. Revenue from light-weight CMP decreased by 16.41%, to approximately $4.54 million for the second quarter of

2023, compared to revenue of approximately $5.44 million for the same period of last year. The Company sold12,877 tonnes of

light-weight CMP at an ASP of $353/tonne for the second quarter of 2023, compared to11,642 tonnes at an ASP of $467/tonne for

the same period of last year.

The Company sold 5,403tonnes

of offset printing paper at an ASP of $584/tonne in the second quarter of 2023. Revenue from offset printing paper was $nil for the

second quarter of 2022.

Revenue from tissue paper

products decreased by 16.30%, to approximately $0.34 million for the second quarter of 2023, from approximately $0.41 million for

the same period of last year. The Company sold 293 tonnes of tissue paper products at an ASP of $1,175/tonne for the second quarter

of 2023, compared to 383tonnes at an ASP of $1,074/tonne for the same period of last year.

Revenue from face masks

decreased by 49.48%, to approximately $0.04 million for the second quarter of 2023, from $0.09

million for the same period of last year. The Company sold 1,411 thousand pieces of face masks for the second quarter of 2023,

compared to 1,852 thousand pieces of face masks for the same period of last year.

Gross Profit and Gross

Margin

Total cost of sales decreased

by 7.43%, to approximately $28.84 million for the second quarter of 2023 from approximately $31.15 million for the

same period of last year. The decrease in overall cost of sales was mainly due to the decrease in unit material costs of CMP, partially

offset by the increase in sales quantity of CMP and offset printing paper. Costs of sales per tonne for regular CMP, light-weight

CMP, offset printing paper, and tissue paper products were $340, $328,$570 and $3,597, respectively, for the second quarter of 2023, compared

to $459, $439,$nil and $3,200, respectively, for the same period of last year.

Total gross profit was approximately

$1.18 million for the second quarter of 2023, compare to the gross profit of approximately $0.63 million for the same period

of last year as a result of factors described above. Overall gross margin was 3.93% for the second quarter of 2022, compared to 1.99%

for the same period of last year. Gross profit(loss) margins for regular CMP, light-weight CMP, offset printing paper, tissue paper products

and face mask products were 6.81%, 7.14%, 2.42%, -206.06% and -8.07%, respectively, for the second quarter of 2023, compared to 4.28%,

5.95%, nil%, -197.95% and 20.79%, respectively, for the same period of last year.

Selling, General and

Administrative Expenses

Selling, general and administrative

expenses (“SG&A”) decreased by 29.22%, to approximately $1.32 million for the second quarter of 2023 from approximately

$1.87 million for the same period of last year.

Loss from Operations

Loss from operations was

approximately $0.52million for the second quarter of 2023, a decrease of 58.03%, from loss from operations of approximately $1.24 million

for the same period of last year. Operating loss margin was 1.73% for the second quarter of 2023, compared to operating income margin

of 3.89% for the same period of last year.

Net Loss

Net loss was approximately

$1.25 million, or loss per share of $0.12, for the second quarter of 2023, compared to net loss of approximately $0.29 million, or loss

per share of $0.03, for the same period of last year.

EBITDA

EBITDA was approximately

$2.83 million for the second quarter of 2023, compared to approximately $3.55 million for the same period of last year.

Note 1: Non-GAAP Financial

Measures

In addition to our U.S.

GAAP results, this press release includes a discussion of EBITDA, a non-GAAP financial measure as defined by the Securities and Exchange

Commission (“SEC”). The Company defines EBITDA as net income before interest, income taxes, depreciation and amortization. EBITDA

is a key measure used by management to evaluate our results and make strategic decisions. Management believes this measure is useful to

investors because it is an indicator of operational performance. Because not all companies use identical calculations, the Company’s presentation

of EBITDA may not be comparable to similarly titled measures of other companies, and should not be viewed as an alternative to measures

of financial performance or changes in cash flows calculated in accordance with the U.S. GAAP.

Reconciliation of Net Income to EBITDA

(Amounts expressed in US$)

| | |

For the Three Months Ended June 30, | |

| ($ millions) | |

2023 | | |

2022 | |

| Net loss | |

| -1.25 | | |

| -0.29 | |

| Add: Income tax | |

| 0.35 | | |

| -0.24 | |

| Net interest expense | |

| 0.27 | | |

| 0.26 | |

| Depreciation and amortization | |

| 3.46 | | |

| 3.82 | |

| EBITDA | |

| 2.83 | | |

| 3.55 | |

First Half of 2023 Unaudited Financial Results

| | |

For the Six Months Ended June 30, | |

| ($ millions) | |

2023 | | |

2022 | | |

% Change | |

| Revenues | |

| 49.81 | | |

| 47.27 | | |

| 5.37 | % |

| Regular Corrugating Medium Paper (“CMP”)* | |

| 38.40 | | |

| 38.95 | | |

| -1.42 | % |

| Light-Weight CMP** | |

| 7.60 | | |

| 7.36 | | |

| 3.27 | % |

| Offset Printing Paper | |

| 3.16 | | |

| - | | |

| - | |

| Tissue Paper Products | |

| 0.57 | | |

| 0.81 | | |

| -29.95 | % |

| Face Masks | |

| 0.08 | | |

| 0.14 | | |

| -44.59 | % |

| | |

| | | |

| | | |

| | |

| Gross profit | |

| 0.90 | | |

| 0.94 | | |

| -4.41 | % |

| Gross profit (loss) margin | |

| 1.81 | % | |

| 2.00 | % | |

| -0.19 pp | **** |

| Regular Corrugating Medium Paper (“CMP”)* | |

| 4.71 | % | |

| 4.64 | % | |

| 0.07 pp | **** |

| Light-Weight CMP** | |

| 5.86 | % | |

| 6.52 | % | |

| -0.66 pp | **** |

| Offset Printing Paper | |

| 2.42 | % | |

| - | | |

| 2.42pp | **** |

| Tissue Paper Products*** | |

| -249.58 | % | |

| -170.19 | % | |

| -79.39 pp | **** |

| Face Masks | |

| -8.02 | % | |

| 24.19 | % | |

| -32.21 | **** |

| | |

| | | |

| | | |

| | |

| Operating loss | |

| -3.29 | | |

| -4.23 | | |

| -322.13 | % |

| Net loss | |

| -3.99 | | |

| -2.78 | | |

| 43.61 | % |

| EBITDA | |

| 4.03 | | |

| 4.75 | | |

| -15.16 | % |

| Basic and Diluted lossper share | |

| -0.40 | | |

| -0.28 | | |

| -242.86 | % |

| *** | Products

from PM8 and PM9 |

| **** | pp

represents percentage points |

Revenue

For the first half of 2023,

total revenue increased by 5.37%, to approximately $49.81 million from approximately $47.27 million for the same period

of last year. The increase in total revenue was mainly due to the increase in sales volume of CMP and offset printing paper and tissue

paper products, partially offset by the decrease in ASP of CMP.

The following table summarizes

revenue, volume and ASP by product for the first half of 2023 and 2022, respectively:

| | |

For the Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| | |

Revenue

($’000) | | |

Volume

(tonne) | | |

ASP

($/tonne) | | |

Revenue

($’000) | | |

Volume

(tonne) | | |

ASP

($/tonne) | |

| Regular CMP | |

| 38,399 | | |

| 101,726 | | |

| 377 | | |

| 38,953 | | |

| 79,188 | | |

| 492 | |

| Light-Weight CMP | |

| 7,604 | | |

| 20,896 | | |

| 364 | | |

| 7,364 | | |

| 15,483 | | |

| 476 | |

| Offset Printing Paper | |

| 3,156 | | |

| 5,403 | | |

| 584 | | |

| - | | |

| - | | |

| - | |

| Tissue Paper Products | |

| 567 | | |

| 484 | | |

| 1,172 | | |

| 810 | | |

| 780 | | |

| 1,038 | |

| Total | |

| 49,726 | | |

| 128,509 | | |

| 387 | | |

| 47,127 | | |

| 95,451 | | |

| 494 | |

| | |

| Revenue

($’000) | | |

| Volume

(thousand

pieces) | | |

| ASP

($/thousand

pieces) | | |

| Revenue

($’000) | | |

| Volume

(thousand

pieces) | | |

| ASP

($/thousand

pieces) | |

| Face Masks | |

| 79 | | |

| 2,516 | | |

| 32 | | |

| 144 | | |

| 3,012 | | |

| 48 | |

Revenue from CMP, including

both regular CMP and light-Weight CMP, decreased by 0.68%, to approximately $46.00 million and accounted for 92.36% of total

revenue for first half of 2023, compared to approximately $46.32million, or 97.98% of total revenue for the same period of last year.

The Company sold 122,622tonnes of CMP at an ASP of $375/tonne in first half of 2023, compared to 94,671 tonnes at an ASP of $489/tonne

in the same period of last year.

Of the total CMP sales,

revenue from regular CMP decreased by 1.42%, to approximately $38.40 million for first half of 2023, compared to revenue of approximately

$38.95 million for the same period of last year. The Company sold 101,726tonnesof regular CMP at an ASP of $377/tonne during the

first half of 2023, compared to 79,188tonnes at an ASP of $492/tonne for the same period of last year. Revenue from light-weight

CMP increased by 3.27%, to approximately $7.60 million for the first half of 2023, compared to revenue of approximately $7.36

million for the same period of last year. The Company sold 20,896tonnes of light-weight CMP at an ASP of $364/tonne for the first

half of 2023, compared to 15,483 tonnes at an ASP of $476/tonne for the same period

of last year.

Revenue from offset printing

paper was $3.16 million for the first half of 2023. The Company sold 5,403tonnes of offset printing paper at an ASP of $584/tonne in the

first half of 2023. Revenue from offset printing paper was $nil for the first half of 2022.

Revenue from tissue paper

products decreased by 29.95%, to approximately $0.57million for the first half

of 2023, from approximately $0.81 million for the same period of last year. The Company sold 484tonnes of tissue

paper products at an ASP of $1,172/tonne for the first half of 2023, compared to 780tonnes at an ASP of $1,038/tonne for the same

period of last year.

Revenue from face masks

decreased by 44.59%, to approximately $0.08 million for the first half of 2023, from $0.14 million for the same period of last year. The

Company sold 2,516 thousand pieces of face masks for the first half of 2023, compared to 3,012 thousand pieces of face masks for the same

period of last year.

Gross Profit and Gross

Margin

Total cost of sales increased

by 5.57%, to approximately $48.91 million for the first half of 2023 from approximately $46.33 million for the same

period of last year. The increase was mainly a result of the increase in sales volume of CMP and offset printing paper, partially offset

by the decrease of material costs of CMP. Costs of sales per tonne for regular CMP, light-weight CMP, offset printing paper, and

tissue paper products were $360, $343,$570 and $4,097, respectively, for the first half of 2023, compared to $469, $445, $nil

and $2,805, respectively, for the same period of last year.

Total gross profit was approximately

$0.90 million for the first half of 2023, compare to the gross profit of approximately $0.94 million for the same period

of last year as a result of factors described above. Overall gross margin was 1.81% for the first half of 2023, compared to 2.0% for the

same period of last year. Gross profit(loss) margins for regular CMP, light-weight CMP, offset printing paper, tissue paper products and

face mask products were 4.71%, 5.86%, 2.42%, -249.58% and -8.02%, respectively, for the first half of 2023, compared to 4.64%, 6.52%,

nil%, -170.19% and 24.19%, respectively, for the same period of last year.

Selling, General and

Administrative Expenses

Selling, general and administrative

expenses (“SG&A”) decreased by 26.15%, to approximately $3.82 million for the first half of 2023 from approximately $5.17

million for the same period of last year.

Loss from Operations

Loss from operations was

approximately $3.29 million for the first half of 2023, representing a decrease of 22.13%, from loss from operations of approximately

$4.23 million for the same period of last year. Operating loss margin was 6.61% for the first half of 2023, compared to operating loss

margin of 8.94% for the same period of last year.

Net Loss

Net loss was approximately

$3.99million, or loss per share of $0.40, for the first half of 2023, compared to net loss of approximately $2.78 million, or loss per

share of $0.28, for the same period of last year.

EBITDA

EBITDA was approximately

$4.03million for the first half of 2023, compared to approximately $4.75 million for the same period of last year.

Note 1: Non-GAAP Financial

Measures

In addition to our U.S.

GAAP results, this press release includes a discussion of EBITDA, a non-GAAP financial measure as defined by the Securities and Exchange

Commission (“SEC”). The Company defines EBITDA as net income before interest, income taxes, depreciation and amortization. EBITDA

is a key measure used by management to evaluate our results and make strategic decisions. Management believes this measure is useful to

investors because it is an indicator of operational performance. Because not all companies use identical calculations, the Company’s presentation

of EBITDA may not be comparable to similarly titled measures of other companies, and should not be viewed as an alternative to measures

of financial performance or changes in cash flows calculated in accordance with the U.S. GAAP.

| Reconciliation of Net Income to EBITDA |

| |

| (Amounts expressed in US$) |

| | |

| |

| | |

For the Six Months Ended

June 30, | |

| ($ millions) | |

2023 | | |

2022 | |

| Net loss | |

| -3.99 | | |

| -2.78 | |

| Add: Income tax | |

| 0.35 | | |

| -0.59 | |

| Net interest expense | |

| 0.52 | | |

| 0.53 | |

| Depreciation and amortization | |

| 7.15 | | |

| 7.59 | |

| EBITDA | |

| 4.03 | | |

| 4.75 | |

Cash, Liquidity and Financial

Position

As of June 30, 2023, the

Company had cash and bank balances, short-term debt (including bank loans, current portion of long-term loans from credit union and related

party loans), and long-term debt (including related party loans) of approximately $11.98million, $10.31million and $7.44 million, respectively,

compared to approximately$9.52million, $11.16million and $4.20million, respectively, as of December 31, 2022.

Net accounts receivable

was approximately $2.42 million as of June 30, 2023, compared to $nil as of December 31, 2022. Net inventory was approximately $6.57 million

as of June 30, 2023, compared to approximately$2.87 million as of December 31, 2022. As of June 30, 2023, the Company had current assets

of approximately$47.69 million and current liabilities of approximately$17.30million, resulting in a working capital of approximately$30.39

million. This was compared to current assets of approximately $47.17 million and current liabilities of approximately $17.64 million,

resulting in a working capital of approximately $29.53 million as of December 31, 2022.

Net cash provided by operating

activities was approximately$5.75million for the first half of 2023, compared to approximately $3.95 million for the

same period of last year. Net cash used in investing activities was approximately$5.57 million for the first half of 2023, compared

toapproximately$7.32 million for the same period of last year. Net cash provided by financing activities was approximately $2.82

million for the first half of 2023, compared to approximately $6.67million for the

same period of last year.

About IT Tech Packaging,

Inc.

Founded in 1996, IT Tech

Packaging, Inc. is a leading manufacturer and distributor of diversified paper products and single-use face masks in North China. Using

recycled paper as its primary raw material (with the exception of its tissue paper products), ITP produces and distributes three categories

of paper products: corrugating medium paper, offset printing paper and tissue paper products. With production based in Baoding and Xingtai

in North China’s Hebei Province, ITP is located strategically close to the Beijing and Tianjin region, home to a growing base of industrial

and manufacturing activities and one of the largest markets for paper products consumption in the country. ITP has been listed on the

NYSE American since December 2009. For more information, please visit: http://www.itpackaging.cn/.

Forward-looking Statement

This release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. Forward-looking statements give our current expectations, opinion, belief or forecasts of future events and performance.

A statement identified by the use of forward-looking words including “will,” “may,” “expects,” “projects,”

“anticipates,” “plans,” “believes,” “estimate,” “should,” and certain of the other foregoing

statements may be deemed forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties

and assumptions, including market and other conditions. More detailed information about the Company and the risk factors that may affect

the realization of forward-looking statements is set forth in the Company’s filings with the SEC. Investors and security holders are urged

to read these documents free of charge on the SEC’s web site at http://www.sec.gov. The Company undertakes no obligation to

update any such forward-looking statements after the date hereof to conform to actual results or changes in expectations, except as required

by law.

IT

TECH PACKAGING, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF JUNE 30, 2023 AND DECEMBER 31, 2022

(unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and bank balances | |

$ | 11,980,759 | | |

$ | 9,524,868 | |

| Restricted cash | |

| - | | |

| - | |

Accounts receivable (net of allowance for doubtful

accounts of $48,646 and $881,878 as of June 30,

2023 and December 31, 2022, respectively) | |

| 2,416,572 | | |

| - | |

| Inventories | |

| 6,569,323 | | |

| 2,872,622 | |

| Prepayments and other current assets | |

| 19,263,853 | | |

| 27,207,127 | |

| Due from related parties | |

| 7,459,079 | | |

| 7,561,858 | |

| | |

| | | |

| | |

| Total current assets | |

| 47,689,586 | | |

| 47,166,475 | |

| | |

| | | |

| | |

| Prepayment on property, plant and equipment | |

| 2,668,992 | | |

| 1,031,502 | |

| Operating lease right-of-use assets, net | |

| 648,404 | | |

| 672,722 | |

| Finance lease right-of-use assets, net | |

| 1,796,034 | | |

| 1,939,970 | |

| Property, plant, and equipment, net | |

| 142,023,762 | | |

| 151,569,898 | |

| Value-added tax recoverable | |

| 1,916,111 | | |

| 2,066,666 | |

| Deferred tax asset non-current | |

| - | | |

| - | |

| Total Assets | |

| | | |

| | |

| | |

$ | 196,742,889 | | |

$ | 204,447,233 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Short-term bank loans | |

$ | 5,741,925 | | |

$ | 5,598,311 | |

| Current portion of long-term loans | |

| 3,761,521 | | |

| 4,835,884 | |

| Lease liability | |

| 108,227 | | |

| 224,497 | |

| Accounts payable | |

| 127,543 | | |

| 5,025 | |

| Advance from customers | |

| 10,192 | | |

| - | |

| Due to related parties | |

| 810,631 | | |

| 727,462 | |

| Accrued payroll and employee benefits | |

| 308,903 | | |

| 165,986 | |

| Other payables and accrued liabilities | |

| 6,095,806 | | |

| 5,665,558 | |

| Income taxes payable | |

| 337,681 | | |

| 417,906 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 17,302,429 | | |

| 17,640,629 | |

| | |

| | | |

| | |

| Long-term loans | |

| 7,437,239 | | |

| 4,204,118 | |

| Deferred gain on sale-leaseback | |

| 7,203 | | |

| 52,314 | |

| Lease liability - non-current | |

| 559,031 | | |

| 579,997 | |

| Derivative liability | |

| 660,692 | | |

| 646,283 | |

| | |

| | | |

| | |

| Total liabilities (including amounts of the consolidated VIE without recourse to

the Company of $19,100,011 and $16,784,878 as of June 30, 2023 and December 31, 2022, respectively) | |

| 25,966,594 | | |

| 23,123,341 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Common stock, 50,000,000 shares authorized, $0.001 par value per share, 10,065,920 shares issued

and outstanding as of June 30, 2023 and December, 31, 2022. | |

| 10,066 | | |

| 10,066 | |

| Additional paid-in capital | |

| 89,172,771 | | |

| 89,172,771 | |

| Statutory earnings reserve | |

| 6,080,574 | | |

| 6,080,574 | |

| Accumulated other comprehensive loss | |

| (14,075,479 | ) | |

| (7,514,540 | ) |

| Retained earnings | |

| 89,588,363 | | |

| 93,575,021 | |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 170,776,295 | | |

| 181,323,892 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Equity | |

$ | 196,742,889 | | |

$ | 204,447,233 | |

IT TECH PACKAGING, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 30,019,914 | | |

$ | 31,788,884 | | |

$ | 49,810,791 | | |

$ | 47,270,502 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| (28,840,056 | ) | |

| (31,154,847 | ) | |

| (48,907,932 | ) | |

| (46,326,020 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 1,179,858 | | |

| 634,037 | | |

| 902,859 | | |

| 944,482 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (1,323,405 | ) | |

| (1,869,802 | ) | |

| (3,818,767 | ) | |

| (5,170,683 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss on impairment of assets | |

| (375,136 | ) | |

| - | | |

| (375,136 | ) | |

| - | |

| Loss from Operations | |

| (518,683 | ) | |

| (1,235,765 | ) | |

| (3,291,044 | ) | |

| (4,226,201 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 53,637 | | |

| 4,924 | | |

| 189,905 | | |

| 8,379 | |

| Interest expense | |

| (270,681 | ) | |

| (259,106 | ) | |

| (519,850 | ) | |

| (529,919 | ) |

| Gain on acquisition | |

| - | | |

| (1,840 | ) | |

| - | | |

| 32,163 | |

| Gain (Loss) on derivative liability | |

| (166,506 | ) | |

| 960,045 | | |

| (14,409 | ) | |

| 1,346,633 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before Income Taxes | |

| (902,233 | ) | |

| (531,742 | ) | |

| (3,635,398 | ) | |

| (3,368,945 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for Income Taxes | |

| (351,260 | ) | |

| 243,829 | | |

| (351,260 | ) | |

| 592,818 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| (1,253,493 | ) | |

| (287,913 | ) | |

| (3,986,658 | ) | |

| (2,776,127 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Comprehensive Loss | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (9,063,695 | ) | |

| (11,524,747 | ) | |

| (6,560,939 | ) | |

| (10,598,609 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total Comprehensive Loss | |

$ | (10,317,188 | ) | |

$ | (11,812,660 | ) | |

$ | (10,547,597 | ) | |

$ | (13,374,736 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Losses Per Share: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted Losses per Share | |

$ | (0.12 | ) | |

$ | (0.03 | ) | |

$ | (0.40 | ) | |

$ | (0.28 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Outstanding – Basic and Diluted | |

| 10,065,920 | | |

| 9,915,920 | | |

| 10,065,920 | | |

| 9,915,920 | |

IT TECH PACKAGING, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(Unaudited)

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash Flows from Operating Activities: | |

| | |

| |

| Net income | |

$ | (3,986,658 | ) | |

$ | (2,776,127 | ) |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 7,150,057 | | |

| 7,592,319 | |

| (Gain) Loss on derivative liability | |

| 14,409 | | |

| (1,346,633 | ) |

| (Gain) Loss from disposal and impairment of property, plant and equipment | |

| 501,934 | | |

| - | |

| Allowance for bad debts | |

| (830,847 | ) | |

| (14,731 | ) |

| Gain on acquisition | |

| - | | |

| (33,178 | ) |

| Deferred tax | |

| - | | |

| (821,225 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (1,674,665 | ) | |

| 845,450 | |

| Prepayments and other current assets | |

| 7,634,922 | | |

| 1,963,348 | |

| Inventories | |

| (3,940,417 | ) | |

| (1,111,160 | ) |

| Accounts payable | |

| 127,215 | | |

| 7,588 | |

| Advance from customers | |

| 10,567 | | |

| - | |

| Related parties | |

| (90,617 | ) | |

| - | |

| Accrued payroll and employee benefits | |

| 154,398 | | |

| (49,534 | ) |

| Other payables and accrued liabilities | |

| 743,936 | | |

| 553,308 | |

| Income taxes payable | |

| (67,515 | ) | |

| (859,643 | ) |

| Net Cash Provided by Operating Activities | |

| 5,746,719 | | |

| 3,949,782 | |

| | |

| | | |

| | |

| Cash Flows from Investing Activities: | |

| | | |

| | |

| Purchases of property, plant and equipment | |

| (5,565,713 | ) | |

| (681,640 | ) |

| Acquisition of land | |

| - | | |

| (6,642,665 | ) |

| | |

| | | |

| | |

| Net Cash Used in Investing Activities | |

| (5,565,713 | ) | |

| (7,324,305 | ) |

| | |

| | | |

| | |

| Cash Flows from Financing Activities: | |

| | | |

| | |

| Proceeds from short term bank loans | |

| 860,919 | | |

| - | |

| Proceeds from long term loans | |

| 2,582,756 | | |

| - | |

| Repayment of bank loans | |

| (507,942 | ) | |

| - | |

| Payment of capital lease obligation | |

| (112,136 | ) | |

| (102,902 | ) |

| Loan to a related party (net) | |

| - | | |

| 6,776,889 | |

| | |

| | | |

| | |

| Net Cash Provided by Financing Activities | |

| 2,823,597 | | |

| 6,673,987 | |

| | |

| | | |

| | |

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | |

| (548,712 | ) | |

| (156,999 | ) |

| | |

| | | |

| | |

| Net Increase in Cash and Cash Equivalents | |

| 2,455,891 | | |

| 3,142,465 | |

| | |

| | | |

| | |

| Cash, Cash Equivalents and Restricted Cash - Beginning of Period | |

| 9,524,868 | | |

| 11,201,612 | |

| | |

| | | |

| | |

| Cash, Cash Equivalents and Restricted Cash - End of Period | |

$ | 11,980,759 | | |

$ | 14,344,077 | |

| | |

| | | |

| | |

| Supplemental Disclosure of Cash Flow Information: | |

| | | |

| | |

| Cash paid for interest, net of capitalized interest cost | |

$ | 199,014 | | |

$ | 165,629 | |

| Cash paid for income taxes | |

$ | 418,775 | | |

$ | 1,088,049 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Cash and bank balances | |

| 11,980,759 | | |

| 14,344,077 | |

| Restricted cash | |

| - | | |

| - | |

| Total cash, cash equivalents and restricted cash shown in the

statement of cash flows | |

| 11,980,759 | | |

| 14,344,077 | |

For more information, please

contact: Email: ir@itpackaging.cn, Tel: +86 312 8698215

10

v3.23.2

Cover

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 10, 2023

|

| Entity File Number |

001-34577

|

| Entity Registrant Name |

IT TECH PACKAGING, INC.

|

| Entity Central Index Key |

0001358190

|

| Entity Tax Identification Number |

20-4158835

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

Science Park, Juli Road

|

| Entity Address, Address Line Two |

Xushui District

|

| Entity Address, Address Line Three |

Baoding City

|

| Entity Address, City or Town |

Hebei Province

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

072550

|

| City Area Code |

86

|

| Local Phone Number |

312-8698215

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ITP

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

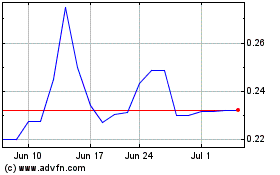

IT Tech Packaging (AMEX:ITP)

Historical Stock Chart

From Feb 2025 to Mar 2025

IT Tech Packaging (AMEX:ITP)

Historical Stock Chart

From Mar 2024 to Mar 2025