Graphex Group Limited Announces Pricing of Upsized $11.7 Million Public Offering and NYSE American Listing

August 16 2022 - 7:08PM

Graphex Group Limited (NYSE American: GRFX), and Graphex

Technologies, LLC its wholly owned US subsidiary (collectively

“Graphex”, or the “Company”), a global leader in mid-stream

processing of specialized natural graphite used for electric

vehicle (EV) lithium-ion (Li-ion) batteries, today announced the

pricing of its upsized public offering of 4,695,653 American

depositary shares (ADSs), each ADS representing 20 ordinary shares,

par value HK$0.01 per share, of the Company, at a public offering

price of $2.50 per ADS, for aggregate gross proceeds of

approximately $11.7 million before deducting underwriting

discounts, commissions, and other offering expenses. In addition,

Graphex has granted the underwriters a 45-day option to purchase up

to an additional 704,347 ADSs at the public offering price per ADS,

less the underwriting discounts and commissions, to cover

over-allotments, if any.

The ADSs are expected to begin trading on the NYSE American

Exchange on August 17, 2022, under the ticker symbol “GRFX” and the

offering is expected to close on or about August 19, 2022, subject

to satisfaction of customary closing conditions.

EF Hutton, division of Benchmark Investments, LLC, is acting as

sole book-running manager for the offering.

A registration statement on Form F-1 (File No. 333-263330), was

filed with the Securities and Exchange Commission ("SEC") and was

declared effective on August 16, 2022, and a registration statement

on Form F-1MEF (File No. 333-266925 ), was filed with the SEC and

became effective upon filing. A final prospectus relating to

the offering will be filed with the SEC and will be available on

the SEC's website at http://www.sec.gov. Electronic copies of the

final prospectus relating to this offering, when available, may be

obtained from EF Hutton, division of Benchmark Investments, LLC,

590 Madison Avenue, 39th Floor, New York, NY 10022, Attention:

Syndicate Department, or via email at syndicate@efhuttongroup.com

or telephone at (212) 404-7002.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any of the securities described

herein, nor shall there be any sale of these securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About GraphexGraphex Group Limited is a Cayman

Island company with principal and administrative offices in Hong

Kong and subsidiary office in Royal Oak, Michigan. Graphex is a

global leader in the industry, proficient in commercial deep

processing of graphite, and is currently producing over 10,000

metric tons of spherical graphite annually. Graphex possesses

patents and utility models covering various technological, design,

and processing applications in addition to trade secrets and

technological expertise.

Forward Looking StatementsThis press release

contains statements that constitute "forward-looking statements,"

including with respect to the proposed public offering.

Forward-looking statements are subject to numerous conditions, many

of which are beyond the control of the Company, including those set

forth in the Risk Factors section of the Company's registration

statement and preliminary prospectus for the Company's offering

filed with the SEC. Copies of these documents are available on the

SEC's website, www.sec.gov. The Company undertakes no obligation to

update these statements for revisions or changes after the date of

this release, except as required by law.

Media Inquiries:FischTank

PRgraphex@fischtankpr.com

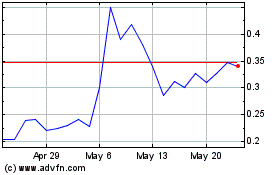

Graphex (AMEX:GRFX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Graphex (AMEX:GRFX)

Historical Stock Chart

From Feb 2024 to Feb 2025