Table of Contents

Registration No. 333-235312

Filed Pursuant to Rule 424(b)(5)

PROSPECTUS SUPPLEMENT

(to Prospectus dated June 3, 2020)

Up to $75,000,000

GOLD RESOURCE CORPORATION

Shares of Common Stock

We have entered into an At-The-Market Offering Agreement, or the Offering Agreement, with H.C. Wainwright & Co., LLC, or Wainwright, as agent. In accordance with the terms of the Offering Agreement, this prospectus supplement, and the accompanying prospectus, we may from time to time offer and sell shares of our common stock having an aggregate offering price of up to $75,000,000 through the agent.

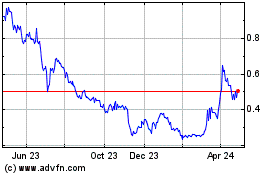

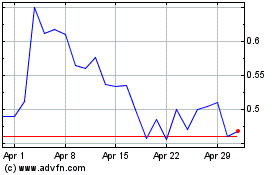

Our shares of common stock trade on the NYSE American under the symbol “GORO.” On June 12, 2020, the last sale price of the shares as reported on the NYSE American was $3.84 per share. We have applied to the NYSE American for the listing of the shares of our common stock being offered by this prospectus supplement and the accompanying prospectus. Listing will be subject to us fulfilling all the listing requirements of the NYSE American and is a condition of sales under the Offering Agreement.

Sales of common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in transactions that are deemed to be “at-the-market” offerings as defined in Rule 415(a)(4) under the Securities Act of 1933, as amended, or the Securities Act. Wainwright will make all sales using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between Wainwright and us. Sales of the shares of our common stock, if any, through Wainwright or directly to Wainwright acting as principal will be made by means of ordinary brokers’ transactions on the NYSE American, the existing trading market for our common stock, or any other existing trading market in the United States for our common stock, sales made to or through a market maker other than on an exchange or otherwise, directly to the sales agent as principal, in negotiated transactions with our prior approval at market prices prevailing at the time of sale or at prices related to prevailing market prices, or any other method permitted by law. If we and Wainwright agree on any method of distribution other than sales of shares of our common stock into the NYSE American or another existing trading market in the United States at market prices, we will file a further prospectus supplement providing all information about such offering as required by Rule 424(b) under the Securities Act. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Wainwright will receive from us a commission of up to 3% of the gross sales price of all shares sold through it under the Offering Agreement. In connection with the sale of the common stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Wainwright will be deemed to be underwriting commissions or discounts.

Investing in our common stock involves risks including those described in the “Risk Factors” section beginning on page S-4 of this prospectus supplement and page 4 of the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement and the accompanying prospectus to which it relates are truthful or complete. Any representation to the contrary is a criminal offense.

H.C. Wainwright & Co.

The date of this prospectus supplement is June 15, 2020.

Table of Contents

We are responsible for the information contained and incorporated by reference in this prospectus supplement, the accompanying prospectus and any related free writing prospectus we prepare or authorize. Neither we nor the agent has authorized anyone to provide you with different information, and neither we nor the agent take any responsibility for any other information that others may give you. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. The information in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference and any written communication from us specifying the final terms of the offering is only accurate as of the date of the respective documents in which the information appears. Our business, financial condition, results of operations and prospects may have changed since those dates. Information in this prospectus supplement updates and modifies the information in the accompanying prospectus.

S-ii

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of our common stock and updates certain other matters relating to our business. The second part is the accompanying prospectus, which gives more general information, some of which applies to this offering. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or any document incorporated by reference, you should rely on the information in this prospectus supplement. If, however, any statement in one of these documents is inconsistent with a statement in another document having a later date, for example, a document incorporated by reference in this prospectus supplement, the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates. You should read this prospectus supplement and the accompanying prospectus as well as the additional information described under “INFORMATION INCORPORATED BY REFERENCE” on page S-9 of this prospectus supplement before investing in our common stock. Also see “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION” on page ii of this prospectus supplement.

The prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 (File No. 333-235312) that we have filed with the Securities and Exchange Commission (“SEC”) with respect to the shares offered hereby and that became effective on June 3, 2020. This prospectus supplement and the accompanying prospectus do not contain all of the information set forth in the registration statement, parts of which are omitted in accordance with the rules and regulations of the SEC. For further information with respect to us and the shares offered hereby, please refer to the registration statement and the exhibits that are a part of the registration statement.

Copies of documents incorporated by reference in this prospectus supplement or the accompanying prospectus are available without charge, upon written or oral request by a person to whom this prospectus supplement has been delivered. Requests should be made to: Gold Resource Corporation, 2886 Carriage Manor Point, Colorado Springs, Colorado 80906; telephone number: (303) 320-7708; Attention: Jessica Browne, Vice President Legal, General Counsel and Secretary; email: jessica.browne@grc-usa.com.

As used in this prospectus supplement, unless the context requires otherwise, the terms “Gold Resource Corporation,” the “Company,” “we,” “our,” and “us” refer to Gold Resource Corporation and, where the context requires, our subsidiaries. Unless otherwise stated, currency amounts in this prospectus are stated in U.S. dollars, or “$.”

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein contains certain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. Such statements are based on assumptions and expectations which may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial and otherwise, may differ materially from the results, performance, transactions or achievements expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not limited to:

· Commodity price fluctuations;

· The effects of pandemics such as COVID-19 on health in our operating jurisdictions and the world-wide, national, state and local responses to such pandemics;

· Political and/or regulatory changes in our operating jurisdictions;

· Mine protests and work stoppages;

S-iii

Table of Contents

· Rock formations, faults and fractures, water flow and possible CO2 gas exhalation or other unanticipated geological situations;

· Decisions of foreign countries and banks within those countries;

· Unexpected changes in business and economic conditions, including the rate of inflation;

· Changes in interest rates and currency exchange rates;

· Timing and amount of production;

· Technological changes in the mining industry;

· Our costs;

· Access and availability of materials, equipment, supplies, labor and supervision, power and water;

· Results of current and future feasibility studies;

· Changes in investor perception of our industry;

· The level of demand for our products;

· Changes in our business strategy, plans and goals;

· Adverse or downward revisions in securities analysts’ recommendations;

· Interpretation of drill hole results and the geology, grade and continuity of mineralization;

· Acts of God such as floods, earthquakes and any other natural disasters;

· Lawsuits;

· The uncertainty of mineralized material estimates and timing of mine construction expenditures; and

· Other risks identified in the section entitled “Risk Factors” in this prospectus supplement, the accompanying prospectus, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, or 2019 Form 10-K, and, from time to time, in other reports we file with the SEC or in other documents that we publicly disseminate.

This list, together with the factors identified under the section entitled “RISK FACTORS,” is not an exhaustive list of the factors that may affect any of our forward-looking statements. You should read this prospectus supplement, the accompanying prospectus, and any documents incorporated by reference in any of those documents completely and with the understanding that our actual future results may be materially different from what we expect. These forward-looking statements represent our beliefs, expectations and opinions only as of the date on which they were made.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from forecasted results. We do not undertake to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, other than to reflect a material change in the information previously disclosed, as required by applicable law. You should review our subsequent reports filed from time to time with the SEC on Forms 10-K, 10-Q and 8-K and any amendments thereto. We qualify all of our forward-looking statements by these cautionary statements.

Prospective investors are urged not to put undue reliance on forward-looking statements.

S-iv

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information incorporated by reference into or contained elsewhere in this prospectus supplement and the accompanying prospectus. This summary may not contain all of the information that may be important to you. You should read carefully all of the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus, including the information set forth under the caption “Risk Factors” beginning on page S-4 of this prospectus supplement and in our 2019 Form 10-K, and our consolidated financial statements and the related notes thereto incorporated by reference herein before making a decision to purchase our shares.

Overview of Our Business

We were organized under the laws of the State of Colorado on August 24, 1998. We are a multi-jurisdictional producer of metal with two operating mining units in North America: the Oaxaca Mining Unit (“OMU”) located in State of Oaxaca, Mexico and the Nevada Mining Unit (“NMU”) located in State of Nevada, United States. We produce concentrates that contain gold, silver, copper, lead and zinc, and doré containing gold and silver at our Arista and Mirador mines in the OMU. We also produce gold and silver in the form of doré from our Isabella Pearl open pit mine at our NMU. We also perform exploration and evaluation work on our portfolio of precious and base metal exploration properties at both mining units and continue to evaluate other properties for possible acquisition.

The OMU includes the Aguila processing facility which produces metal concentrates and doré from ore mined from both the Arista underground mine at our Aguila project and the Mirador underground mine at our Alta Gracia project. The Arista mine, our most prolific, contains precious metal products of gold and silver, and by-products of copper, lead and zinc. The Mirador mine contains silver and gold, the ore from which is processed at our Aguila facility. The Aguila project includes approximately 30,074 hectares of mining concessions, an access road from a major highway, haul roads, a mill facility and adjoining buildings, an assay lab, an open pit and underground mine, tailings pond and other infrastructure.

The NMU includes the Isabella Pearl open pit mine, heap leach pad and processing facilities and several exploration-stage properties. The Isabella Pearl mine produces primarily gold, with silver as a by-product, each in the form of doré. We commenced construction on the Isabella Pearl mine in June 2018, began selling gold in May 2019 and declared commercial production in October 2019. In December 2019, we completed construction of the ADR plant at the Isabella Pearl mine and commenced producing doré on-site.

Our operations in the OMU are conducted through our Mexican subsidiary, Don David Gold Mexico S.A. de C.V. (“DDGM”). Exploration and development in the NMU is done through our wholly-owned subsidiaries, GRC Nevada Inc. and Walker Lane Minerals Corp.

Our principal executive offices are located 2886 Carriage Manor Point, Colorado Springs, Colorado 80906, and our telephone number is (303) 320-7708. We maintain a website at www.goldresourcecorp.com and through a link on our website you can view the periodic filings that we make with the SEC, as well as certain of our corporate governance documents such as our code of ethics. Unless specifically incorporated herein by reference, the information on our website is not part of this prospectus supplement.

Oaxaca Mining Unit

The Arista underground mine is our primary source of ore to feed the Aguila mill at present. We mine numerous veins in two primary vein systems for mill feed using long-hole stoping, cut-and-fill and mine development ore extraction techniques. We haul up to 2,000 tonnes per day of ore from the Arista mine to the Aguila mill for processing through the mill’s flotation circuit. The haul distance from the Arista mine portal to the Aguila mill is approximately 3 kilometers or 1.8 miles. We commenced production of metals from this mine in 2011.

We have also developed the Mirador Mine at our Alta Gracia project. This is a small-scale mine, improving on historic underground workings, from which we truck up to 200 tonnes per day to the Aguila mill for processing through

S-1

Table of Contents

the agitated leach circuit. The hauling distance from the Mirador mine to the Aguila processing facility is approximately 32 kilometers or 20 miles.

Nevada Mining Unit

Our properties in Nevada are located in the Walker Lane Mineral Belt which is known for gold and silver production. In August 2016, we acquired Walker Lane Minerals Corp., which entity holds all of the assets related to the Isabella Pearl mine in Mineral County, Nevada. With that acquisition, we acquired a total of 341 unpatented mining claims covering approximately 6,800 acres.

Isabella Pearl is an open pit, heap leach operation which began producing gold in May 2019. Construction in 2018 and early 2019 included the completion of haul roads, office and laboratory buildings, construction of and liner placement on the heap leach pad, the pregnant and barren solution ponds, and the crushing facility. As noted above, we completed construction of the ADR plant in December 2019.

In January 2017, we purchased 100% interest in the East Camp Douglas gold property, located in proximity to the Isabella Pearl mine. The property covers an area of approximately 5,300 acres and consists of 277 unpatented claims, 12 patented claims and additional fee lands. During 2018 and 2019, we continued exploration of the property and evaluation of historic data in an effort to determine the development potential of the property.

We own interests in other exploration-stage properties in Nevada which we continue to explore and evaluate for potential development.

THE OFFERING

|

Issuer

|

|

Gold Resource Corporation

|

|

|

|

|

|

Size of offering

|

|

Up to $75,000,000 of shares of our common stock

|

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

Up to 89,557,277 shares, assuming a sales price of $3.84 per share, which was the closing price of our common stock on the NYSE American on June 12, 2020. The actual number of shares issued will vary depending on the sales price at which shares may be sold from time to time during this offering.

|

|

|

|

|

|

Plan of Distribution

|

|

“At-the-market” offering that may be made from time to time through our agent, H.C. Wainwright & Co., LLC. See “Plan of Distribution” on page S-8 of this prospectus supplement.

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering for general corporate purposes which may include operating expenses, working capital, future acquisitions, capital expenditures or repayment of debt. See “Use of Proceeds.”

|

S-2

Table of Contents

|

NYSE American symbol

|

|

“GORO”

|

|

|

|

|

|

Dividend policy

|

|

We have paid a dividend each month since commencement of commercial production at our Aguila project in Mexico in 2010. The monthly dividend in 2019 through October of that year was one-sixth cent per share, increased to one-third cent per share effective in November 2019. See “Dividend Policy” for additional information.

|

|

|

|

|

|

Risk factors

|

|

An investment in our common stock involves certain risks. We urge you to carefully consider all of the information described in the section entitled “Risk Factors” beginning on page S-4 of this prospectus supplement and the risk factors incorporated by reference from our filings with the SEC.

|

The information above regarding the number of shares of our common stock outstanding is based on 70,026,027 shares of common stock outstanding as of June 12, 2020. The number of shares of our common stock outstanding as of that date does not include 4,699,092 shares reserved for issuance under our equity compensation plans, 4,299,735 of which are issuable upon the exercise of outstanding options to purchase common stock and 399,357 shares which are issuable upon exercise of restricted stock units. Our outstanding options have a weighted average exercise price of $8.12 per share as of June 12, 2020.

S-3

Table of Contents

RISK FACTORS

An investment in our common stock offered by this prospectus supplement and the accompanying prospectus involves a high degree of risk. You should carefully consider the following risk factors in addition to the remainder of this prospectus supplement and the accompanying prospectus, including the information incorporated by reference, including under the heading “RISK FACTORS” in the accompanying prospectus, in our 2019 Form 10-K and any reports subsequently filed by us with the SEC before making an investment decision. The risks and uncertainties described in these incorporated documents and described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or which we currently consider to be immaterial may also impair our business operations. If any of these risks actually occurs, our business, financial condition and results of operations would suffer. In that event, the trading price of our shares could decline, and you may lose all or part of your investment in our shares. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. Please see the section entitled “Cautionary Statement Regarding Forward-Looking Statements” in this prospectus supplement.

Risks Relating to the Offering and Our Common Stock

Sales of substantial amounts of our common stock or the perception that such sales may occur could cause the market price of our common stock to drop significantly, even if our business is performing well.

Future sales of substantial amounts of our common stock, or securities convertible or exchangeable into shares of our common stock, into the public market, including shares of our common stock issuable upon exercise of options and warrants, or perceptions that those sales could occur, could adversely affect the prevailing market price of our common stock and our ability to raise capital in the future. Additionally, the market price of our common stock could decline as a result of sales of shares of our common stock by, or the perceived possibility of sales by, our existing shareholders in the market after this offering. These sales might also make it more difficult for us to sell equity securities at a time and price that we deem appropriate.

We may sell additional equity or debt securities in the future to fund our operations, which may result in dilution to our shareholders and impose restrictions on our business.

In order to raise additional funds to support our operations, we may sell additional equity or debt securities, which, in the case of equity securities, would result in dilution to all of our shareholders or, in the case of debt securities, impose restrictive covenants that adversely impact our business. The sale of other incurrence of indebtedness would result in increased fixed payment obligations and could also result in restrictive covenants, such as limitations on our ability to incur additional debt and certain operating restrictions that could adversely impact our ability to conduct our business. We have an effective shelf registration statement from which additional shares of common stock and other securities can be offered. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering. If the price per share at which we sell additional shares of our common stock or related securities in future transactions is less than the price per share in this offering, investors who purchase our common stock in this offering will suffer a dilution of their investment. If we are unable to expand our operations or otherwise capitalize on our business opportunities, our business, financial condition and results of operations could be materially adversely affected.

Past payments of dividends on our common stock are not indicators of future payments of dividends.

In 2011, we instituted a monthly cash dividend payable to holders of our common stock. However, our ability to continue to pay dividends in the future will depend on a number of factors, including cash flow, mine construction requirements and strategies, other acquisition and/or construction projects, spot gold and silver prices, taxation, government imposed royalties and general market conditions. Further, a portion of our cash flow is expected to be retained to finance our operations and development of mineral properties. Any material change in our operations may

S-4

Table of Contents

affect future dividends which may be modified or canceled at the discretion of our Board of Directors. Any decrease in our monthly dividend would likely have an adverse impact on the price of our common stock.

Our management will have broad discretion in the use of the net proceeds from this offering and may allocate the net proceeds from this offering in ways that you and other shareholders may not approve.

Our management will have broad discretion in the use of the net proceeds, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. All of the net proceeds will be used at the discretion of management to fund working capital and for general corporate purposes. The failure of our management to use these funds effectively could have a material adverse effect on our business, cause the market price of our common stock to decline and delay the exploration or development at any of our mines or exploration projects. Pending their use, we intend to invest the net proceeds in a variety of capital preservation instruments, including short-term, investment-grade, interest-bearing instruments and U.S. government securities. These investments may not yield a favorable return to our stockholders.

The common stock offered hereby will be sold in “at-the-market” offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or maximum sales price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices they paid.

The actual number of shares we will issue under the Offering Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Offering Agreement and compliance with applicable law, we have the discretion to deliver a sales notice to Wainwright at any time throughout the term of the Offering Agreement. The number of shares that are sold by Wainwright after delivering a sales notice will fluctuate based on the market price of our common stock during the sales period and limits we set with Wainwright. Because the price per share of each share sold will fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage to predict the number of shares that will be ultimately issued.

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate sales proceeds of up to $75,000,000 from time to time. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any shares under or fully utilize the offering agreement with the agent as a source of financing.

We intend to use the net proceeds from this offering for working capital and general corporate purposes.

The expected use of the net proceeds from the sale of common stock offered by this prospectus supplement represents our intentions based upon our current plans and business conditions. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors and, as a result, our management will retain broad discretion over the allocation of the net proceeds from this offering. Until we use the net proceeds from this offering for the purposes described above, we may invest them in a variety of capital preservation investments, including short-term, investment-grade, interest-bearing instruments and U.S. government securities.

DIVIDEND POLICY

Since commencing mining operations at our Aguila Project, one of management’s primary goals has been to make cash dividend distributions to shareholders. Since commercial production began in July 2010, we have returned over $112

S-5

Table of Contents

million back to shareholders in consecutive monthly dividends. Regular dividends should not be considered a prediction or guarantee of future dividends.

For the last two fiscal years and up to October 2019, we have paid a monthly dividend of one-sixth cent per share or $0.02 per share per year. In October 2019, that dividend was increased to $0.04 per share per year, or one-third cent per share per month. The dividend may be modified or discontinued at any time and the declaration of any special dividend is determined at the discretion of our Board of Directors, depending on variables such as, but not limited to, operating cash flow, mine construction requirements and strategies, other construction projects, spot gold and silver prices, taxation, government royalties and general market conditions. At the present time, we are not a party to any agreement that would limit our ability to pay dividends.

Physical Dividend Program

In 2012, we launched a physical dividend program pursuant to which our shareholders have the option to convert the cash dividends that we pay into physical gold and silver bullion. As part of our overall strategy to diversify our treasury and to facilitate this program, we may periodically purchase gold and silver bullion. In order for a shareholder to convert their cash dividend into physical gold and/or silver, the shareholder must opt-in to the physical dividend program and request the conversion of their cash dividend, or portion thereof, into physical gold and/or silver. For those shareholders who elect to convert their cash dividend into gold and/or silver bullion, the gold and silver will be delivered in the form of gold or silver Gold Resource Corporation one-ounce bullion rounds. No action is required by any shareholder who elects not to participate in the physical metals program. For those shareholders who wish to convert any portion of their cash dividend into gold and/or silver bullion, the process is summarized as follows:

· Shareholders must register and hold their Gold Resource Corporation common stock in their name directly with our transfer agent, Computershare Trust Company, N.A., and not through a brokerage house or other intermediary held in a “street name”. This is a requirement so that we can locate and validate the shareholder’s position in our common stock.

· Shareholders must set up an individual account with Gold Bullion International (“GBI”), 1325 Avenue of the Americas, 7th Floor, Suite 0703-2, New York, NY 10019. GBI facilitates the cash to gold and silver conversion.

· Shareholders then direct their cash dividend check issued by Computershare to be electronically deposited to the shareholder’s GBI account for the option to have it, or any portion thereof that denominates, into a one-ounce gold or silver bullion round. The election to convert all or any portion of the shareholder’s cash dividend into bullion is governed by an agreement between the shareholder and GBI.

· Shareholders with accounts at GBI who wish to change their current gold, silver or cash allocations for their cash dividend must do so by midnight Eastern Time on the date preceding the monthly dividend record date. We issue a press release with details of each dividend declaration, and the dividend record and payment dates.

· On the dividend record date, the number of bullion ounces to be converted and distributed to the shareholder’s individual account on the dividend payment date is calculated as the dollar value of that portion of the cash dividend the shareholder elected to convert to bullion, divided by the London Bullion Market PM gold fix plus gold bullion minting cost factors on the record date or the London Bullion Market silver fix plus silver bullion minting cost factors on the record date.

Only whole ounces of gold and silver bullion are credited to a shareholder’s individual account on the dividend payment date. The cash value attributable to fractional ounces will remain in the shareholder’s individual account as cash until such time as future dividends provide the shareholder with sufficient cash to convert to whole ounces of gold or silver based on the London PM gold fix and silver fix on a future dividend record date, and based on the shareholder’s self-directed gold, silver or cash allocations in effect at that time. The shareholder may also choose to move their cash out

S-6

Table of Contents

of their GBI account. Shareholders cannot move cash into their GBI account for conversion into gold and silver. Only the shareholder’s cash dividend sent from Computershare is eligible for conversion.

DILUTION

If you purchase any of the shares of common stock offered by this prospectus supplement, you will experience dilution to the extent of the difference between the price per share of common stock you pay in this offering and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book value as of March 31, 2020 was approximately $157 million, or $2.25 per share of common stock. Net tangible book value per share represents our total tangible assets (which excludes intangible assets such as deferred taxes), less our total liabilities, divided by the aggregate number of shares of our common stock outstanding as of March 31, 2020.

After giving effect to the assumed sale of $75,000,000 of shares of common stock in this offering at the assumed public offering price of $3.84 per share (the closing sales of our common stock on the NYSE American on June 12, 2020), and after deducting the commissions and other estimated offering expenses payable by us, our as adjusted net tangible book value as of March 31, 2020 would have been approximately $229 million, or $2.57 per share. This amount represents an immediate increase in net tangible book value of $0.32 per share to existing stockholders as a result of this offering and immediate dilution of approximately $1.27 per share to new investors purchasing our common stock in this offering.

The following table illustrates this dilution on a per share basis. The as-adjusted information below is illustrative only and will adjust based on the actual price to the public, the actual number of shares sold and other terms of the offering determined at the time shares of our common stock are sold pursuant to this prospectus supplement. The shares sold in this offering, if any, will be sold from time to time at various prices.

|

Assumed public offering price per share

|

|

$

|

3.84

|

|

|

Net tangible book value per share as of March 31, 2020 (unaudited)

|

|

$

|

2.25

|

|

|

Increase in net tangible book value per share attributable to new investors

|

|

$

|

0.32

|

|

|

As-adjusted net tangible book value per share after this offering

|

|

$

|

2.57

|

|

|

Dilution per share to new investors participating in this offering

|

|

$

|

1.27

|

|

A $1.00 increase in the assumed public offering price of $3.84 per share (the closing sales of our common stock on the NYSE American on June 12, 2020), would increase the as-adjusted net tangible book value by $0.13 per share and would increase the dilution to new investors by $0.87 per share, after deducting commissions and offering expenses payable by us in connection with this offering.

The per share data appearing above is based on 69,541,527 shares of common stock outstanding as of March 31, 2020, and excludes:

· 4,299,735 shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2020, with a weighted-average exercise price of $8.12 per share;

· 399,357 shares of common stock issuable upon vesting of restricted stock units outstanding as of March 31, 2020; and

· 3,621,974 additional shares of common stock reserved for future issuance under our stock incentive plans and our employee stock purchase plans as of March 31, 2020.

To the extent that outstanding options are exercised or outstanding restricted stock units vest, investors purchasing our common stock in this offering will experience further dilution. In addition, we may choose to raise additional capital because of market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

S-7

Table of Contents

PLAN OF DISTRIBUTION

We have entered into an At-The-Market Offering Agreement with Wainwright, under which we may issue and sell our common stock having an aggregate gross sales price of up to $75,000,000 from time to time through Wainwright acting as agent. The Offering Agreement provides that sales of our common stock, if any, under this prospectus supplement may be made in sales deemed to be “at-the-market” equity offerings as defined in Rule 415(a)(4) promulgated under the Securities Act. If we and Wainwright agree on any method of distribution other than sales of shares of our common stock into the NYSE American or another existing trading market in the United States at market prices, we will file a further prospectus supplement providing all information about such offering as required by Rule 424(b) under the Securities Act. No sales will be made in Canada or into any trading market in Canada.

Wainwright will offer the common stock subject to the terms and conditions of the Offering Agreement on a daily basis or as otherwise agreed upon by us and Wainwright on any day that: (i) is a trading day for the NYSE American; (ii) we have instructed Wainwright by telephone to make such sales; and (iii) we have satisfied the conditions under Section 6 of the Offering Agreement. We will designate the maximum amount of common stock to be sold through Wainwright on a daily basis. Subject to the terms and conditions of the Offering Agreement, Wainwright will use its commercially reasonable efforts to sell on our behalf all of the common stock so designated or determined. We or Wainwright may suspend the offering of common stock being made through Wainwright under the Offering Agreement upon proper notice to the other party.

We will pay Wainwright commissions, in cash, for its services in acting as agent in the sale of our common stock. Wainwright will be entitled to a placement fee of up to 3% of the gross sales price of the shares sold. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed to reimburse Wainwright for certain specified expenses, including the fees and disbursements of its legal counsel, in an amount not to exceed $30,000, as provided in the Offering Agreement. Additionally, pursuant to the terms of the Offering Agreement, we agreed to reimburse Wainwright for the fees and disbursements of its legal counsel in connection with Wainwright’s ongoing diligence, drafting and other filing requirements arising from the transactions contemplated by the Offering Agreement in an amount not to exceed $2,500 in the aggregate per calendar quarter. We estimate that the total expenses for the offering, excluding compensation and reimbursements payable to Wainwright under the terms of the Offering Agreement, will be approximately $50,000.

Settlement for sales of common stock will occur at 10:00 a.m. (New York City time), or at some other time that is agreed upon by us and Wainwright in connection with a particular transaction, on the second trading day following sale of the shares, in return for payment of the net proceeds to us. Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and Wainwright may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

Wainwright has agreed to use its commercially reasonable efforts consistent with its normal trading and sales practices and applicable law and regulations to sell on our behalf all of the common stock requested to be sold by us, subject to the conditions set forth in the Offering Agreement. In connection with the sale of the common stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Wainwright will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to Wainwright against certain civil liabilities, including liabilities under the Securities Act.

The offering of our common stock pursuant to the Offering Agreement will terminate upon the earlier of (i) the issuance and sale of all of the common stock subject to the Offering Agreement, (ii) the three year anniversary of the effective date of the registration statement of which this prospectus supplement forms a part, and (iii) the termination of the Offering Agreement as permitted therein. We may terminate the Offering Agreement at any time upon five business days’ prior notice.

Wainwright and its affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees,

S-8

Table of Contents

although we have no current agreements to do so. To the extent required by Regulation M, Wainwright will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus supplement.

We have applied to list the shares of common stock sold in this offering on the NYSE American, and approval for such listing is a condition for sales under the Offering Agreement.

This prospectus in electronic format may be made available on a website maintained by Wainwright and Wainwright may distribute this prospectus electronically.

LEGAL MATTERS

The validity of the shares of common stock offered by this prospectus supplement will be passed upon for us by Polsinelli PC, Denver, Colorado. Certain legal matters will be passed upon for the agent by Ellenoff Grossman & Schole LLP, New York, New York.

EXPERTS

Our financial statements as of December 31, 2019 and for each of the two years then-ended included in our Annual Report on Form 10-K for the year ended December 31, 2019 has been incorporated by reference in this prospectus in reliance upon the reports of Plante & Moran PLLC, Denver, Colorado, our independent registered public accounting firm for those years. The financial statements as of December 31, 2017 and for the year ended December 31, 2017 included in our Annual Report on Form 10-K for the year ended December 31, 2019, has been incorporated by reference in this prospectus in reliance upon the reports of EKS&H LLLP, Denver, Colorado, our independent registered public accounting firm for that year.

These financial statements have been incorporated herein by reference upon the authority of said firms as experts in accounting and auditing.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to incorporate by reference information into this prospectus supplement. This means we can disclose information to you by referring you to another document we filed or will file with the SEC. This prospectus supplement incorporates by reference the following documents (other than any portion of the respective filings furnished, rather than filed, under the applicable SEC rules) that we have filed or will file with the SEC (File No. 001-34857) but have not included or delivered with this prospectus supplement:

· Our Annual Report on Form 10-K for the fiscal year ended December 31, 2019;

· Our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2020;

· Our Current Reports on Form 8-K filed on February 10, 2020, April 2, 2020, April 22, 2020 and May 22, 2020;

· Our Definitive Proxy Statement on Schedule 14A filed April 10, 2020 (solely those portions that were incorporated by reference into Part III of our Annual Report on Form 10-K for the year ended December 31, 2019);

· The description of our capital stock contained in the registration statement on Form 8-A filed with the SEC on August 25, 2010; and

· All documents, or portions thereof, filed by us subsequent to the date of this prospectus supplement under Section 13(a), 13(c), 14 or 15 of the Exchange Act, prior to the termination of this offering.

S-9

Table of Contents

Documents, or portions thereof, furnished or deemed furnished by us are not incorporated by reference into this prospectus supplement or the accompanying prospectus. Information that we file later with the SEC will automatically update and supersede the previously filed information. For information with regard to other documents incorporated by reference in the accompanying prospectus, see “Incorporation by Reference” in the accompanying prospectus.

We will make those documents available to you without charge upon your oral or written request. Requests for those documents should be directed to:

Gold Resource Corporation

2886 Carriage Manor Point

Colorado Springs, Colorado 80906

Telephone: (303) 320-7708

Attention: Jessica Browne, Vice President Legal,

General Counsel and Secretary

Email:jessica.browne@grc-usa.com

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the Exchange Act, which means that we are required to file reports, proxy statements, and other information with the SEC. The SEC maintains an Internet website at www.sec.gov where you can access reports, proxy information and registration statements, and other information regarding registrants that file electronically with the SEC through the EDGAR system.

We have filed a registration statement on Form S-3 to register the shares to be issued pursuant to this prospectus supplement. As allowed by SEC rules, this prospectus supplement does not contain all of the information you can find in the registration statement or the exhibits to the registration statement because some parts of the registration statement are omitted in accordance with the rules and regulations of the SEC. You may obtain a copy of the registration statement from the SEC or from the SEC’s website.

Our filings with the SEC, as well as additional information about us, are also available to the public through our website at www.goldresourcecorp.com and are made as soon as reasonably practicable after such material is filed with or furnished to the SEC. Information contained on, or that can be accessed through, our website is not incorporated into this prospectus or our other securities filings and does not form a part of this prospectus.

S-10

Table of Contents

PROSPECTUS

GOLD RESOURCE CORPORATION

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Subscription Receipts

Units

This prospectus will allow us to offer and sell, from time to time at prices and on terms to be determined at or prior to the time of the offering, up to $200,000,000 of any combination of the securities described in this prospectus, either individually or in units. We may also offer common stock upon conversion of or in exchange for debt securities or subscription receipts; common stock or debt securities upon the exercise of rights or warrants; or any combination of the foregoing.

This prospectus provides a general description of these securities and the general manner in which these securities may be offered. We will provide the specific terms of any offering in one or more supplements to this prospectus. This prospectus may not be used to offer and sell the securities unless accompanied by a prospectus supplement. A prospectus supplement may add, update or change information contained in this prospectus. You should read this prospectus and the applicable prospectus supplement, as well as the information incorporated by reference in this prospectus and in any accompanying prospectus supplement, carefully before you invest in any of these securities.

We may offer these securities in amounts, at prices and on terms determined at the time of offering. The securities may be sold directly to you, through agents, or through underwriters and dealers. If agents, underwriters or dealers are used to sell the securities, we will name them and describe their compensation in a prospectus supplement.

Our common stock is listed on the NYSE American under the symbol “GORO.” On May 7, 2020, the closing price of our common stock was $3.90 per share on the NYSE American.

Investing in our securities involves risks. See “Risk Factors” on page 4 herein and included in any accompanying prospectus supplement and in the information incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated June 3, 2020.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC utilizing a “shelf” registration process. Under this process, Gold Resource Corporation and, where the context requires, our subsidiaries (which we generally refer to collectively as “we,” “us,” “Gold Resource” or the “Company” in this prospectus, as applicable) may, from time to time, offer, sell and issue any of the securities or any combination of the securities described in this prospectus in one or more offerings up to a total dollar amount of $200,000,000. This prospectus provides you with a general description of the securities we may offer, sell or issue. Each time we offer securities, we will provide a prospectus supplement and attach it to this prospectus. The prospectus supplement will contain specific information about the terms of the securities being offered, sold or issued at that time. The prospectus supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and in a prospectus supplement, you should rely on the information in that prospectus supplement. You should read both this prospectus, any post-effective amendment, any prospectus supplement, and any information incorporated by reference into the prospectus, any post-effective amendment, and prospectus supplement, together with the information described under the headings, “WHERE YOU CAN FIND MORE INFORMATION” and “INFORMATION INCORPORATED BY REFERENCE” and any additional information you may need to make your investment decision.

This prospectus incorporates by reference documents containing important business and financial information about our Company that are not presented or delivered with this prospectus. Copies of these documents are available without charge, upon written or oral request by a person to whom this prospectus has been delivered. Requests should be made to: Gold Resource Corporation, 2886 Carriage Manor Point, Colorado Springs, Colorado 80906, Telephone number: (303) 320-7708; Attention: Jessica Browne, Vice President Legal, General Counsel and Secretary; email: jessica.browne@grc-usa.com.

To ensure timely delivery of the documents, requests should be made no later than five business days prior to the date on which a final investment decision is to be made.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the content of the actual documents. Copies of some of the documents referred to herein have been filed, will be filed, or will be incorporated by reference as exhibits to the registration statement to which this prospectus is a part and you may obtain copies of those documents as described later in this prospectus under the heading “WHERE YOU CAN FIND MORE INFORMATION.”

Do not rely on or assume the accuracy of any representation or warranty in any agreement that we have filed or incorporated by reference as an exhibit to the registration statement because such representation or warranty may be subject to exceptions and qualifications contained in separate disclosure schedules, may have been included in such agreement for the purpose of allocating risk between the parties to the particular transaction, and may no longer continue to be true as of any given date.

We are responsible for the information contained and incorporated by reference in this prospectus, any post-effective amendment or any prospectus supplement. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information that others may give you. Readers should assume that the information appearing in this prospectus, any post-effective amendment or any prospectus supplement is accurate only as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

Unless otherwise stated, currency amounts in this prospectus are stated in U.S. dollars, or “$.”

ii

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated herein by reference contain certain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such statements are based on assumptions and expectations which may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial and otherwise, may differ materially from the results, performance, transactions or achievements expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not limited to:

· Commodity price fluctuations;

· Political and/or regulatory changes in our operating jurisdictions;

· The effects of pandemics such as COVID-19 on health in our operating jurisdictions and the world-wide, national, state and local responses to such pandemics;

· Mine protests and work stoppages;

· Rock formations, faults and fractures, water flow and possible CO2 gas exhalation or other unanticipated geological situations;

· Decisions of foreign countries and banks within those countries;

· Unexpected changes in business and economic conditions, including the rate of inflation;

· Changes in interest rates and currency exchange rates;

· Timing and amount of production;

· Technological changes in the mining industry;

· Our costs;

· Changes in exploration and overhead costs;

· Access and availability of materials, equipment, supplies, labor and supervision, power and water;

· Results of current and future feasibility studies;

· Changes in investor perception of our industry;

· The level of demand for our products;

· Changes in our business strategy, plans and goals;

· Adverse or downward revisions in securities analysts’ recommendations;

· Interpretation of drill hole results and the geology, grade and continuity of mineralization;

1

Table of Contents

· Acts of God such as floods, earthquakes and any other natural disasters;

· Lawsuits;

· The uncertainty of mineralized material estimates and timing of mine construction expenditures; and

· Other risks identified in the section entitled “RISK FACTORS” in any post-effective amendment or prospectus supplement hereto, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, and, from time to time, in other reports we file with the SEC or in other documents that we publicly disseminate.

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. You should read this prospectus, any post-effective amendment, any prospectus supplement, and any documents incorporated by reference in any of those documents completely and with the understanding that our actual future results may be materially different from what we expect. These forward-looking statements represent our beliefs, expectations and opinions only as of the date of this prospectus, any post-effective amendment and any prospectus supplement.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from forecasted results. We do not undertake to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, other than to reflect a material change in the information previously disclosed, as required by applicable law. You should review our subsequent reports filed from time to time with the SEC on Forms 10-K, 10-Q and 8-K and any amendments thereto. We qualify all of our forward-looking statements by these cautionary statements.

Prospective investors are urged not to put undue reliance on forward-looking statements.

2

Table of Contents

THE COMPANY

The following summary highlights information found in this prospectus and the documents incorporated by reference in this prospectus. It does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus carefully, including the sections entitled “RISK FACTORS” and “INFORMATION INCORPORATED BY REFERENCE.”

Overview

Gold Resource Corporation was organized under the laws of the State of Colorado on August 24, 1998. We are a multi-jurisdictional producer of metal with two operating mining units in North America: the Oaxaca Mining Unit (“OMU”) located in the State of Oaxaca, Mexico and the Nevada Mining Unit (“NMU”) located in the State of Nevada, United States. We produce concentrates that contain gold, silver, copper, lead and zinc, and doré containing gold and silver at our Arista and Mirador mines in the OMU. We also produce gold and silver in the form of doré from our Isabella Pearl open pit mine at our NMU. We also perform exploration and evaluation work on our portfolio of precious and base metal exploration properties at both mining units and continue to evaluate other properties for possible acquisition.

The OMU includes the Aguila processing facility which produces metal concentrates and doré from ore mined from both the Arista underground mine at our Aguila project and the Mirador underground mine at our Alta Gracia project. The Arista mine, our most prolific, contains precious metal products of gold and silver, and by-products of copper, lead and zinc. The Mirador mine contains silver and gold, the ore from which is processed at our Aguila facility. The Aguila project includes approximately 30,074 hectares of mining concessions, an access road from a major highway, haul roads, a mill facility and adjoining buildings, an assay lab, an open pit and underground mine, tailings pond and other infrastructure.

The NMU includes the Isabella Pearl open pit mine, heap leach pad and processing facilities and several exploration-stage properties. The Isabella Pearl mine produces primarily gold, with silver as a by-product, each in the form of doré. We commenced construction on the Isabella Pearl mine in June 2018, began selling gold in May 2019 and declared commercial production in October 2019. In December 2019, we completed construction of the ADR plant at the Isabella Pearl mine and commenced producing doré on-site.

Our operations in the OMU are conducted through our Mexican subsidiary, Don David Gold Mexico S.A. de C.V. (“DDGM”). Exploration and development in the NMU is done through our wholly-owned subsidiaries, GRC Nevada Inc. and Walker Lane Minerals Corp.

Our principal executive offices are located 2886 Carriage Manor Point, Colorado Springs, Colorado 80906, and our telephone number is (303) 320-7708. We maintain a website at www.goldresourcecorp.com and through a link on our website you can view the periodic filings that we make with the SEC, as well as certain of our corporate governance documents such as our code of ethics. Unless specifically incorporated herein by reference, the information on our website is not part of this prospectus or the accompanying prospectus supplement.

Oaxaca Mining Unit

The Arista underground mine is our primary source of ore to feed the Aguila mill at present. We mine numerous veins in two primary vein systems for mill feed using long-hole stoping, cut-and-fill and mine development ore extraction techniques. We haul up to 2000 tonnes per day of ore from the Arista mine to the Aguila mill for processing through the mill’s flotation circuit. The haul distance from the Arista mine portal to the Aguila mill is approximately 3 kilometers or 1.8 miles. We commenced production of metals from this mine in 2011.

We have also developed the Mirador mine at our Alta Gracia project. This is a small-scale mine, improving on historic underground workings, from which we truck up to 200 tonnes per day to the Aguila mill for processing through the agitated leach circuit. The hauling distance from the Mirador mine to the Aguila processing facility is approximately 32 kilometers or 20 miles.

3

Table of Contents

Nevada Mining Unit

Our properties in Nevada are located in the Walker Lane Mineral Belt which is known for gold and silver production. In August 2016, we acquired Walker Lane Minerals Corp., which entity holds all of the assets related to the Isabella Pearl mine in Mineral County, Nevada. We acquired a total of 341 unpatented mining claims covering approximately 6,800 acres.

Isabella Pearl is an open pit, heap leach operation which began producing gold in May 2019. Construction in 2018 and early 2019 included the completion of haul roads, office and laboratory buildings, construction of and liner placement on the heap leach pad, the pregnant and barren solution ponds, and the crushing facility. As noted above, we completed construction of the ADR plant in December 2019.

In January 2017, we purchased 100% interest in the East Camp Douglas gold property, located in proximity to the Isabella Pearl mine. The property covers an area of approximately 5,300 acres and consists of 277 unpatented claims, 12 patented claims and additional fee lands. During 2018 and 2019, we continued exploration of the property and evaluation of historic data in an effort to determine the development potential of the property.

We own interests in other exploration-stage properties in Nevada which we continue to explore and evaluate for potential development.

RISK FACTORS

An investment in our securities involves significant risks. Before you invest in any of our securities, you should carefully consider the information included and incorporated by reference in this prospectus and any applicable prospectus supplement, including the risk factors incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2019, as updated by our quarterly reports on Form 10-Q and other filings we make with the SEC. Each of the risks described in these sections and documents could materially and adversely affect our business, financial condition, results of operations and prospects, and could result in a loss of your investment. Additional risks and uncertainties not known to us or that we deem immaterial may also impair our business, financial condition, results of operations and prospects.

USE OF PROCEEDS

Unless we specify otherwise in a prospectus supplement, we intend to use the net proceeds from sales of securities by us for general corporate purposes. If net proceeds from a specific offering will be used to repay indebtedness, the applicable prospectus supplement will describe the relevant terms of the debt to be repaid.

DESCRIPTION OF CAPITAL STOCK

Authorized Capital Stock

Our authorized capital stock consists of:

· 100,000,000 shares of common stock, par value $0.001 per share; and

· 5,000,000 shares of preferred stock, par value $0.001 per share.

As of May 7, 2020, we had 70,026,027 shares of common stock, and no shares of preferred stock, outstanding. Our common stock is listed on the NYSE American under the symbol “GORO.”

Common Stock

Holders of our common stock are each entitled to cast one vote for each share held of record on all matters presented to the shareholders. Cumulative voting is not allowed; hence, the holders of a majority of our outstanding common stock can elect all directors.

4

Table of Contents

Holders of our common stock are entitled to receive such dividends as may be declared by our Board of Directors out of funds legally available and, in the event of liquidation, to share pro rata in any distribution of our assets after payment of liabilities. Our Board of Directors is not obligated to declare a dividend.

Holders of our common stock do not have preemptive rights to subscribe to additional shares if issued. There are no conversion, redemption, sinking fund or similar provisions regarding the common stock. All outstanding shares of common stock are fully paid and non-assessable.

The transfer agent for our common stock is Computershare Trust Company, N.A., and can be contacted at 8742 Lucent Blvd., Suite 300, Highlands Ranch, Colorado 80129 or by telephone at (303) 262-0600.

Preferred Stock

Shares of preferred stock may be issued from time to time in one or more series as may be determined by our Board of Directors. The voting powers and preferences, the relative rights of each such series (including any right to convert the preferred stock into common stock, rights, or warrants) and the qualifications, limitations and restrictions of each series will be established by the Board of Directors. Our directors may issue preferred stock with multiple votes per share and dividend rights which would have priority over any dividends paid with respect to the holders of our common stock. The issuance of preferred stock with these rights may make the removal of management difficult even if the removal would be considered beneficial to shareholders generally, and will have the effect of limiting shareholder participation in transactions such as mergers or tender offers if these transactions are not favored by our management. As of the date of this prospectus, no shares of preferred stock are outstanding.

The terms and conditions, if any, upon which any series of preferred stock is convertible into common stock or other securities will be set forth in the prospectus supplement relating to the offering of those shares of preferred stock. These terms typically will include

· the number of shares of common stock or other securities into which the preferred stock is convertible;

· the conversion price (or manner of calculation);

· the conversion period;

· provisions as to whether conversion will be at the option of the holders of the preferred stock or at our option;

· the events, if any, requiring an adjustment of the conversion price; and

· provisions affecting conversion in the event of the redemption of that series of preferred stock.

We will identify the transfer agent and registrar for any series of preferred stock offered by this prospectus in a prospectus supplement.

Anti-Takeover Provisions

Provisions of Colorado law, our Articles of Incorporation and Bylaws could make it more difficult to acquire our company by means of a tender offer, a proxy contest or otherwise, or to remove incumbent officers and directors. These provisions are expected to discourage certain types of coercive takeover practices and takeover bids that our Board of Directors may consider inadequate and to encourage persons seeking to acquire control of our company to first negotiate with our Board of Directors. We believe that the benefits of increased protection of our ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us outweigh the disadvantages of discouraging takeover or acquisition proposals because, among other things, negotiation of these proposals could result in an

5

Table of Contents

improvement of their terms. These provisions could adversely affect the price of our common stock. Among other things, our Articles of Incorporation and Bylaws:

· permit our Board of Directors to issue up to 5,000,000 shares of preferred stock, with any rights, preferences and privileges as they may designate (including the right to approve an acquisition or other change in our control);

· provide that the authorized number of directors may be fixed only by our Board of Directors from time to time;

· do not provide for cumulative voting rights (thereby allowing the holders of a majority of the shares of our common stock entitled to vote in any election of directors to elect all of the directors standing for election, if they should so choose); and

· provide that special meetings of our shareholders may be called only by our President, Board of Directors, or by the holders of at least 10% of the stock entitled to vote at such meeting.

In addition, as a matter of Colorado law, certain significant transactions require the affirmative vote of a majority of the shares eligible to vote at a meeting of shareholders, which requirement could result in delays to, or greater cost associated with, a change in control of our company.

DESCRIPTION OF DEBT SECURITIES

We may issue debt securities from time to time under this prospectus. We will issue any such debt securities under one or more separate indentures that we will enter into with a trustee to be named in the indenture and specified in the applicable prospectus supplement. The specific terms of debt securities being offered will be described in the applicable prospectus supplement, which, along with other offering material relating to such offering, will describe the specific terms relating to the series of debt securities being offered, including a description of the material terms of the indenture (and any supplemental indentures) governing such series. These terms may include the following:

· the title of the series of the offered debt securities and whether the securities are senior securities, senior subordinated securities or subordinated securities;

· the ranking of the debt securities;

· the subordination provisions, if any, relating to the securities;

· any security for repayment of the securities;

· the price or prices at which the offered debt securities will be issued;

· any limit on the aggregate principal amount of the offered debt securities;

· the date or dates on which the principal of the offered debt securities will be payable;

· the rate or rates (which may be fixed or variable) per year at which the offered debt securities will bear interest, if any, or the method of determining the rate or rates and the date or dates from which interest, if any, will accrue;

· whether the interest is payable in cash or in kind;

6

Table of Contents

· if the amount of principal, premium or interest with respect to the offered debt securities of the series may be determined with reference to an index or pursuant to a formula, the manner in which these amounts will be determined;

· the date or dates on which interest, if any, on the offered debt securities will be payable and the regular record dates for the payment thereof;

· any sinking fund requirements for the securities;

· the place or places, if any, in addition to or instead of the corporate trust office of the trustee, where the principal, premium and interest with respect to the offered debt securities will be payable;

· the period or periods, if any, within which, the price or prices of which, and the terms and conditions upon which the offered debt securities may be redeemed, in whole or in part, pursuant to optional redemption provisions;

· the terms on which we would be required to redeem or purchase the offered debt securities pursuant to any sinking fund or similar provision, and the period or periods within which, the price or prices at which and the terms and conditions on which the offered debt securities will be so redeemed and purchased in whole or in part;

· the denominations in which the offered debt securities will be issued;

· the form of the offered debt securities and whether the offered debt securities are to be issued in whole or in part in the form of one or more global securities and, if so, the identity of the depositary for the global security or securities;

· the portion of the principal amount of the offered debt securities that is payable on the declaration of acceleration of the maturity, if other than their principal amount;

· if other than U.S. dollars, the currency or currencies in which the offered debt securities will be denominated and payable, and the holders’ rights, if any, to elect payment in a foreign currency or a foreign currency unit other than that in which the offered debt securities are otherwise payable;

· any addition to, or modification or deletion of, any event of default or any covenant specified in the indenture;

· whether the offered debt securities will be convertible or exchangeable into other securities, and if so, the terms and conditions upon which the offered debt securities will be convertible or exchangeable;

· whether the offered debt securities will be senior or subordinated debt securities;

· any trustees, authenticating or paying agents, transfer agents or registrars or other agents with respect to the offered debt securities; and

· any other specific terms of the offered debt securities.

We may issue debt securities at less than the principal amount payable upon maturity. We refer to these securities as “original issue discount securities.” If material or applicable, we will describe in the applicable prospectus supplement special U.S. federal income tax, accounting and other considerations applicable to original issue discount securities.

The indenture and debt securities will be governed by and construed in accordance with the laws of the State of New York. We intend to disclose the relevant restrictive covenants for any issuance or series of debt securities in the applicable

7

Table of Contents

prospectus supplement. Unless otherwise indicated in the applicable prospectus supplement, the debt securities will not be listed on any securities exchange. As of the date of this prospectus, we have no outstanding registered debt securities.

DESCRIPTION OF WARRANTS

We may offer warrants for the purchase of our debt securities, common stock, preferred stock, or other securities. We may issue warrants separately or together with any other securities offered by means of this prospectus, and the warrants may be attached to or separate from such securities. Each series of warrants may be issued under a separate warrant agreement to be entered into between us and a warrant agent specified therein. The warrant agent will act solely as our agent in connection with the warrants of such series and will not assume any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants.

The applicable prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this prospectus is being delivered:

· the title of such warrants;

· the aggregate number of such warrants;

· the price or prices at which such warrants will be issued;

· the currencies in which the price or prices of such warrants may be payable;