Current Report Filing (8-k)

August 13 2021 - 3:05PM

Edgar (US Regulatory)

false000084251800008425182021-08-132021-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of report (Date of earliest event reported):

|

|

August 13, 2021

|

Evans Bancorp, Inc.

_______________________________________

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

New York

|

001-35021

|

16-1332767

|

|

______________________________

(State or Other Jurisdiction

|

_______________

(Commission

|

___________________

(I.R.S. Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

6460 Main Street, Williamsville, New York

|

|

14221

|

|

_____________________________________________

(Address of Principal Executive Offices)

|

|

____________

(Zip Code)

|

|

|

|

|

|

|

|

|

|

Registrant’s Telephone Number, Including Area Code:

|

|

716-926-2000

|

Not Applicable

____________________________________________________

Former Name or Former Address, if Changed Since Last Report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.50 par value

|

EVBN

|

NYSE American

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 13, 2021, Evans Bancorp, Inc. (the “Company”) entered into a change in control agreement with Aaron Whitehouse, who is employed by The Evans Agency, LLC (the “Agency”), a wholly owned subsidiary of the Company.

The initial term of the agreement is for 24 months which automatically renews daily so that the unexpired term shall always be 24 months, until the date that the Company gives Mr. Whitehouse written notice of non-renewal, in which case, the term will end on the date 24 months after the date of the non-renewal notice.

The agreement provides that if Mr. Whitehouse’s employment with the Agency or the Company is terminated either involuntarily for a reason other than for cause (as such term is defined in the Agreement) or voluntarily for good reason (as such term is defined in the Agreement) within 24 months after the occurrence of a change in control of the Company, then within 30 days following the date of termination of employment, Mr. Whitehouse will receive a lump sum cash severance payment equal to two times the highest rate of gross base salary earned by Mr. Whitehouse during the prior 12-month period, provided Mr. Whitehouse executes a general release, and in addition, for a period of 24 months following Mr. Whitehouse’s termination of employment, the Agency will continue to provide, under the same cost-sharing arrangement as is in effect upon Mr. Whitehouse’s termination of employment, life and non-taxable medical and health insurance coverage substantially comparable to the coverage maintained by the Agency for Mr. Whitehouse prior to his termination of employment. Notwithstanding the foregoing, the payments required under the agreement will be reduced to the extent necessary to avoid penalties under Section 280G of the Internal Revenue Code.

The agreement further provides that for a period of one year following his termination of employment Mr. Whitehouse will be subject to noncompetition and nonsolicitation covenants with the Agency or the Company.

The foregoing description of the agreement is not complete and is qualified in its entirety to reference the agreement, which are attached hereto as Exhibit 10.1 and incorporated by reference herein.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits

ExhibitDescription

Exhibit 10.1Change in Control Agreement by and between Evans Bancorp, Inc. and Aaron Whitehouse

Exhibit 104The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Evans Bancorp, Inc.

|

|

|

|

|

|

|

|

August 13, 2021

|

|

By:

|

|

/s/ David J. Nasca

|

|

|

|

|

|

Name: David J. Nasca

|

|

|

|

|

|

Title: President and Chief Executive Officer

|

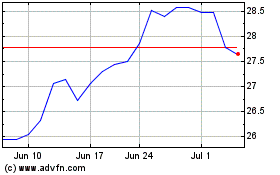

Evans Bancorp (AMEX:EVBN)

Historical Stock Chart

From Aug 2024 to Sep 2024

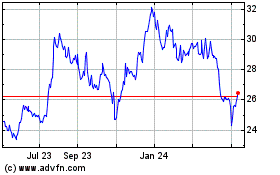

Evans Bancorp (AMEX:EVBN)

Historical Stock Chart

From Sep 2023 to Sep 2024