false

0000887396

0000887396

2024-11-18

2024-11-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_________________

FORM

8-K

_________________

Current

Report

Pursuant

To Section 13 or 15 (d)

of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported):

NOVEMBER 18, 2024

_______________________________

EMPIRE

PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware |

001-16653 |

73-1238709 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

2200

S. Utica Place, Suite 150,

Tulsa, Oklahoma

74114

(Address of Principal Executive Offices) (Zip

Code)

Registrant’s telephone number, including area

code: (539) 444-8002

(Former name or former address,

if changed since last report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

Common

Stock $0.001 par value

|

EP

|

NYSE

American

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01. | Entry

into a Material Definitive Agreement. |

As

previously reported on the Current Report on Form 8-K of Empire Petroleum Corporation (the “Company”) filed on January 5,

2024, Empire North Dakota LLC, a Delaware limited liability company (“Empire North Dakota”) and wholly owned subsidiary of

the Company, and Empire ND Acquisition LLC, a Delaware limited liability company and wholly owned subsidiary of the Company (“Empire

ND Acquisition” and, collectively with Empire North Dakota, the “Borrowers”), entered into that certain Revolver Loan

Agreement dated as of December 29, 2023 with Equity Bank, as lender (the “Loan Agreement”).

On

November 18, 2024, the Borrowers and Equity Bank entered into that certain first amendment to the Loan Agreement (the “First Amendment”).

The First Amendment amended the Loan Agreement to, among other things: (a) amend certain definitions; (b) increase the revolver commitment

amount to $20,000,000 from an initial revolver commitment amount of $10,000,000; and (c) increase the monthly commitment reduction amount

from $150,000 to $250,000, commencing on December 31, 2024, and occurring on the last day of each calendar month thereafter. The Loan

Agreement continues to mature on December 29, 2026 and be guaranteed by the Company.

The

foregoing summary of the First Amendment is qualified in its entirety by reference to the full terms and conditions of the First Amendment,

a copy of which is filed as Exhibit 10 to this Current Report on Form 8-K and is incorporated by reference into this Item 1.01.

| Item

2.03. | Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant. |

The

information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

| Item

7.01. | Regulation

FD Disclosure. |

On

November 22, 2024, the Company issued a press release announcing the First Amendment. A copy of the press release is furnished as

Exhibit 99 to this Current Report on Form 8-K.

This

information is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the

Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item

9.01. | Financial

Statements and Exhibits. |

| (d) | | Exhibits. |

| | | |

| The following exhibits

are filed or furnished herewith. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

EMPIRE

PETROLEUM CORPORATION

|

|

| Date:

November 22, 2024 |

By: |

/s/ Michael

R. Morrisett |

|

| |

|

Michael

R. Morrisett

President

and Chief Executive Officer |

|

3

EXHIBIT

10

FIRST

AMENDMENT TO REVOLVER LOAN AGREEMENT

THIS

FIRST AMENDMENT TO REVOLVER LOAN AGREEMENT (this "First Amendment") is entered into effective as of November 18, 2024,

between EMPIRE NORTH DAKOTA LLC, a Delaware limited liability company ("END"), and EMPIRE ND ACQUISITION LLC, a Delaware

limited liability company ("Acquisition", and, together with END, collectively, "Borrowers"), and EQUITY

BANK, a Kansas banking corporation (the "Bank"). END and Acquisition are sometimes collectively referred to herein as

a "Borrower" and collectively as the "Borrowers".

W

I T N E S S E T H:

WHEREAS,

Borrowers and Bank are parties to that certain Revolver Loan Agreement dated as of December 29, 2023 (the "Existing Loan Agreement"),

pursuant to which Bank established a revolving line of credit facility in the maximum principal amount of $15,000,000.00 for the benefit

of Borrowers (the "Existing Commitment") until the maturity date of December 29, 2026 (the "Existing Maturity

Date").

WHEREAS,

Borrowers have requested, and Bank has agreed to (i) increase the Revolver Commitment in the increased maximum principal amount of $20,000,000.00

(subject to the Revolver Commitment Amount and the Collateral Borrowing Base limitations), (ii) increase the MCR from $150,000.00 to

$250,000.00 and (iii) make certain other modifications to the existing Loan Agreement by amending the Existing Loan Agreement, all upon

the terms and conditions herein set forth.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements contained herein, and other good and valuable consideration, receipt

of which is acknowledged by the parties hereto, the parties agree as follows:

| 1. | Definitions.

Capitalized terms used herein and not otherwise defined shall have the meaning given in the

Existing Loan Agreement. |

| a. | The

definition of "Letters of Credit" shall be amended as follows: |

"Letters

of Credit" shall mean any and all letters of credit issued by Bank pursuant to the request of Borrowers in accordance with the

provisions of Sections 2.1 and 2.7 hereof which at any time remain outstanding and subject to draw by the beneficiary, whether

in whole or in part.

| b. | The

definition of "MCR" shall be amended as follows: |

"MCR"

shall have the meaning assigned thereto in Section 2.12.

| c. | The

definition of "Revolver Commitment Amount" shall be amended as follows: |

"Revolver

Commitment Amount" shall be the maximum outstanding principal amount plus Letter of Credit Exposures the Bank agrees from time

to time to make available under the Revolver Commitment (initially stipulated to be equal to $20,000,000.00).

| 2. | Revolver

Commitment. The Revolver Commitment is hereby renewed and increased in the increased

maximum principal amount of $20,000,000.00 until the existing Revolver Final Maturity Date. |

| 3. | Replacement

Revolver Note. All of the Indebtedness created pursuant thereto shall be evidenced by

that certain Promissory Note (Revolver Note) dates as of even date herewith, from the Borrowers

payable to the order of Bank in the existing maximum principal amount of $20,000,000.00 (the

"Replacement Revolver Note"), in form, scope and substance acceptable to

the Bank. The Replacement Revolver Note shall bear interest on unpaid balances of principal

from time to time outstanding at a variable rate equal from day to day to the Base Rate plus

one hundred and fifty basis points (1.50%), and in no event lower than 8.50%. The Replacement

Revolver Note shall be payable as set forth therein and in Section 2.2 of the Existing

Loan Agreement. All references to the Revolver Note in the Existing Loan Agreement and other

Loan Documents shall hereafter refer to the Replacement Revolver Note. |

| 4. | Monthly

Commitment Reductions. Section 2.12 of the Existing Loan Agreement shall be amended as

follows: |

2.12.

Monthly Commitment Reductions. Commencing on December 31, 2024, and occurring on the last day of each calendar month thereafter,

the Revolver Commitment Amount shall be automatically reduced by $250,000.00 (the "MCR"). From time to time thereafter,

the MCR will be subject to adjustment by the Bank in its discretion at each semi-annual Collateral Borrowing Base redetermination. To

the extent the outstanding principal balance of the Revolver Note (including Letter of Credit Exposure) is in excess of the adjusted

amount of the Revolver Commitment Amount, Borrowers shall make a mandatory principal prepayment on the Revolver Note in such amount as

is necessary to reduce the outstanding principal balance of the Revolver Note (including Letter of Credit Exposure) to an amount less

than or equal to the adjusted Revolver Commitment Amount, which such mandatory principal prepayment shall be made within five (5) days

of the applicable MCR principal payment. Any such payments shall be in addition to the regularly scheduled interest payment.

| 5. | Loan

Origination Fee. Section 2.4 of the Existing Loan Agreement shall be amended as follows: |

2.4 Loan

Origination Fee. Borrowers shall pay to the Bank a fully earned and non-refundable loan origination fee equal to $69,000.00.

| 6. | Guaranty

Ratification. Borrowers shall cause the Guarantor to execute and deliver to the Bank

the Guarantor Acknowledgment and Ratification attached hereto (the "Guarantor Ratification"). |

2

| 7. | Conditions

Precedent. Borrowers shall execute and deliver, or cause to be executed and delivered

to the Bank, each of the following as express conditions precedent to the effectiveness of

the amendments and modifications contemplated by this First Amendment: |

| b. | Replacement

Revolver Note; |

| c. | The

Guarantor Ratification; |

| d. | Closing

certificates from Borrowers and Guarantor in form, scope and substance acceptable to the

Bank; and |

| e. | Such

updated financial statements and information on Borrowers and the Guarantor as the Bank shall

request. |

| 8. | Ratification

and Continuation. The remaining terms, provisions and conditions set forth in the Existing

Loan Agreement shall remain in full force and effect as long as any Indebtedness of the Borrowers

is owing to the Bank and/or the Commitment remains in effect. The Borrowers restate, confirm

and ratify the warranties, covenants and representations set forth in the Existing Loan Agreement

(except the representations and warranties that specify a specific date or period of time)

and further represents to the Bank that, as of the date hereof, no Default or Event of Default

exists under the Loan Agreement (including this First Amendment). All references to the "Loan

Agreement" appearing in any of the Loan Documents shall hereafter be deemed references

to the Existing Loan Agreement as amended, modified and supplemented by this First Amendment.

In the event of any inconsistency between the terms of this First Amendment and the terms

of the Existing Loan Agreement, the terms of this First Amendment shall control and govern,

and the agreements shall be interpreted so as to carry out and give full effect to the intent

of this First Amendment. Each of the Borrowers and the Bank hereby adopt, ratify and confirm

the Loan Agreement, as amended hereby, and acknowledge and agree that the Loan Agreement

and all other Loan Documents, are and remain in full force and effect. Borrowers acknowledge

and agree that its liabilities and obligations under the Loan Agreement and all other Loan

Documents, including the Security Instruments, are not impaired in any respect by this First

Amendment. Borrowers further ratify, confirm, and continue the mortgage liens and security

interests granted thereby pursuant to the Existing Loan Agreement and Loan Documents and

hereby grants and regrants such mortgage liens and security interests in favor of the Bank. |

| 9. | Fees

and Expenses. The Borrowers agree to pay to the Bank on demand all costs, fees and expenses

(including without limitation reasonable attorneys' fees and legal expenses) incurred or

accrued by the Bank in connection with the preparation, negotiation, execution, closing,

delivery, and administration of the Loan Agreement (including this First Amendment) and the

other Loan Documents (including Security Instruments),

or any amendment, waiver, consent or modification thereto or thereof, or any enforcement thereof. |

3

| 10. | SUBMISSION

TO JURISDICTION. BORROWERS AND THE BANK HEREBY CONSENT TO THE JURISDICTION OF ANY OF

THE LOCAL, STATE, AND FEDERAL COURTS LOCATED WITHIN TULSA COUNTY, OKLAHOMA AND WAIVE ANY

OBJECTION BASED ON IMPROPER VENUE OR FORUM NON CONVENIENS TO THE CONDUCT OF ANY PROCEEDING

IN ANY SUCH COURT. |

| 11. | WAIVER

OF JURY TRIAL. BORROWERS AND THE BANK FULLY, VOLUNTARILY AND EXPRESSLY WAIVE ANY RIGHT

TO A TRIAL BY JURY IN ANY ACTION OR PROCEEDING TO ENFORCE OR DEFEND ANY RIGHTS UNDER THE

LOAN AGREEMENT (INCLUDING THIS FIRST AMENDMENT) OR UNDER ANY AMENDMENT, INSTRUMENT, DOCUMENT

OR AGREEMENT DELIVERED (OR WHICH MAY IN THE FUTURE BE DELIVERED) IN CONNECTION THEREWITH

OR ARISING FROM ANY BANKING RELATIONSHIP EXISTING IN CONNECTION WITH THE EXISTING LOAN AGREEMENT,

THE SECURITY INSTRUMENTS AND/OR ANY OTHER LOAN DOCUMENT. BORROWERS AND THE BANK AGREE THAT

ANY SUCH ACTION OR PROCEEDING SHALL BE TRIED BEFORE A COURT AND NOT BEFORE A JURY. |

| 12. | Counterparts.

This First Amendment may be executed in multiple counterparts, each of which, when so executed,

shall constitute an original copy. Transmission by facsimile or electronic transmission (e.g.,

pdf format) of an executed counterpart of this First Amendment by any party shall be deemed

to constitute due and sufficient delivery of such counterpart and such facsimile or electronic

transmission shall be deemed to be an original counterpart of this First Amendment. |

| 13. | Governing

Law. This First Amendment shall be deemed to be a contract made under and shall be governed

by and construed in accordance with the laws of the State of Oklahoma. |

| 14. | Release.

In consideration of the amendments contained herein, Borrowers hereby waive and release the

Bank from any and all claims and defenses, known or unknown, as of the effective date of

this First Amendment, with respect to the Loan Agreement (including this First Amendment)

and the Loan Documents and the transactions contemplated thereby. |

[Signature

page follows.]

4

IN

WITNESS WHEREOF, the parties hereto have caused this First Amendment to Revolver Loan Agreement to be duly executed and delivered by

the respective duly authorized representatives of Borrowers to the Bank in Tulsa, Oklahoma, effective as of the day and year first above

written.

| BORROWERS: |

EMPIRE

NORTH DAKOTA LLC,

a Delaware limited liability company

By:

/s/ Michael R. Morrisett

Name:

Michael R. Morrisett

Title:

Chief Executive Officer

|

| |

|

| |

EMPIRE

ND ACQUISITION LLC,

a Delaware limited liability company

By:

/s/ Michael R. Morrisett

Name:

Michael R. Morrisett

Title:

Chief Executive Officer

|

| |

|

Loan Agreement Signature

Page

| BANK: |

EQUITY

BANK,

a

Kansas banking corporation

By:

/s/ Terry Blain

Terry

Blain, Senior Vice

President/Energy |

| |

|

Loan Agreement Signature

Page

GUARANTOR

ACKNOWLEDGMENT AND RATIFICATION

The

undersigned guarantor (the "Guarantor") hereby acknowledges, ratifies, confirms, restates and continues in full force

and effect in favor of EQUITY BANK (the "Bank") the continuing validity, effectiveness and enforceability of that certain

Guaranty Agreement from Guarantor, dated as of December 29, 2023 (the "Guaranty Agreement"), issued by Guarantor to

the Bank pursuant to that certain Revolver Loan Agreement dated as of December 29, 2023 (the "Existing Loan Agreement"),

between EMPIRE NORTH DAKOTA LLC, a Delaware limited liability company ("END"), by and between EMPIRE ND ACQUISITION

LLC, a Delaware limited liability company ("Acquisition", and together with END, collectively, the "Borrowers"),

as borrowers, and the Bank, as lender, as therein described and defined, including as amended and modified by virtue of the First Amendment

to Revolver Loan Agreement between Borrowers and the Bank dated effective as of November 18, 2024 (the "First Amendment",

and together with the Existing Loan Agreement, collectively, the "Loan Agreement"), all as more particularly described

and defined in the First Amendment, with the same force and effect as if such Guaranty Agreements were fully restated herein.

The

undersigned Guarantor acknowledges, approves and consents to the terms and provisions of the First Amendment.

A

facsimile signature page may be delivered to the Bank with the same force and effect as a manually executed signature page and delivery

of such facsimile signature page shall constitute a covenant of Guarantor that a manually executed signature page will be promptly and

timely delivered to the Bank.

[Signature

Page Follows]

Guarantor Acknowledgment

- 1

IN

WITNESS WHEREOF, Guarantor has caused this Guaranty to be executed and delivered to Bank in Tulsa, Oklahoma, effective as of the date

first above written.

EMPIRE

PETROLEUM CORPORATION,

a

Delaware corporation

By:

/s/ Michael R. Morrisett

Michael R. Morrisett, President

Guarantor

Acknowledgment - 2

EXHIBIT

99

Empire

Petroleum Increases Revolver Loan Facility with Equity Bank to

$20 Million in Support of Strategic Growth Initiatives

| • | Amended

current revolver commitment from $10 Million to $20 Million |

| • | Initially

provides additional financial capacity of over $11 Million |

TULSA,

OK – (November 22, 2024) – Empire Petroleum Corporation (NYSE American: EP) (“Empire” or the “Company”)

today announced that it has entered into an amendment to its Revolver Loan Agreement with Equity Bank (Equity Bancshares, Inc. NYSE:

EQBK), increasing the total principal commitment to $20.0 million, up from an initial $10.0 million through December 29, 2026. Currently,

Empire has approximately $8.4 million borrowed on the $20.0 million facility.

The

loan is secured by assets from two of the Company’s subsidiaries, Empire North Dakota, LLC, and Empire ND Acquisition, LLC. The

increase highlights Empire’s strong operational and financial progress, supported by ongoing strategic initiatives, including the

successful completion of an oversubscribed $10.0 million rights offering earlier this year.

“I

would like to express my appreciation to Equity Bank’s energy team for their continued support,” said Mike Morrisett, President

and CEO. “This revolver increase provides us with additional financial resources to further execute our North Dakota development,

drive growth, and deliver value to our shareholders.”

ABOUT

EMPIRE PETROLEUM

Empire

Petroleum Corporation is a publicly traded, Tulsa-based oil and gas company with current producing assets in New Mexico, North Dakota,

Montana, Texas, and Louisiana. Management is focused on organic growth and targeted acquisitions of proved developed assets with synergies

with its existing portfolio of wells. More information about Empire can be found at www.empirepetroleumcorp.com.

SAFE

HARBOR STATEMENT

This

release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements involve a wide variety of risks and uncertainties, and include, without limitations,

statements with respect to the Company’s estimates, strategy, and prospects. Such statements are subject to certain risks and uncertainties

which are disclosed in the Company’s reports filed with the SEC, including its Form 10-K for the fiscal year ended December 31,

2023, and its other filings with the SEC. Readers and investors are cautioned that the Company’s actual results may differ materially

from those described in the forward-looking statements due to a number of factors, including, but not limited to, the Company’s

ability to acquire productive oil and/or gas properties or to successfully drill and complete oil and/or gas wells on such properties,

general economic conditions both domestically and abroad, uncertainties associated with legal and regulatory matters, and other risks

and uncertainties related to the conduct of business by the Company. Other than as required by applicable securities laws, the Company

does not assume a duty to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances,

changes in expectations, or otherwise.

CONTACTS

Empire

Petroleum Corporation

Mike

Morrisett

President

& CEO

539-444-8002

Info@empirepetrocorp.com

Kali

Carter

Communications

& Investor Relations Manager

918-995-5046

IR@empirepetrocorp.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

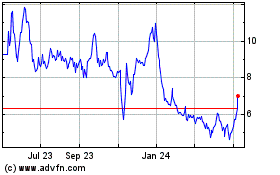

Empire Petroleum (AMEX:EP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Empire Petroleum (AMEX:EP)

Historical Stock Chart

From Feb 2024 to Feb 2025