Spartan Capital Securities, LLC Serves as Sole Placement Agent in 1847 Holdings LLC’s $11.424 Million Private Placement

December 16 2024 - 5:00PM

Spartan Capital Securities, LLC, a leading investment banking

firm, is pleased to announce its role as the sole placement agent

in 1847 Holdings LLC’s (NYSE American: EFSH) $11.424 million

private placement of units.

1847 Holdings LLC, a diversified acquisition holding company

specializing in overlooked, deep-value investment opportunities,

raised $11.424 million in gross proceeds through this private

placement, prior to deducting placement agent fees and other

expenses payable by the Company.

The private placement consisted of 42,311,118 units. Each unit

comprised one common share and/or a pre-funded warrant to purchase

one common share at an exercise price of $0.01, one series A

warrant to purchase one common share at an exercise price of $0.81

(subject to adjustments), and one series B warrant to purchase one

common share at an exercise price of $0.54 (subject to

adjustments).

The proceeds from the offering will support 1847 Holdings’

previously announced planned acquisition of a millwork, cabinetry,

and door manufacturer based in Las Vegas, Nevada. The acquisition,

which reported unaudited revenue of $33.1 million and net income of

$10.4 million for the trailing twelve months ended September 30,

2024, is expected to close imminently as final steps are

completed.

Further details on the transaction will be available in the

Company's Form 8-K, to be filed with the U.S. Securities and

Exchange Commission and accessible at www.sec.gov.

Sichenzia Ross Ference Carmel LLP represented Spartan Capital

Securities, LLC in the transaction.

“This private placement marks an important milestone for 1847

Holdings, enabling the company to execute its strategic acquisition

plan,” said John Lowry, CEO of Spartan Capital Securities. “We are

honored to have served as the sole placement agent in this

transaction, and we look forward to supporting 1847 Holdings as it

continues to execute its vision for long-term value creation.”

The common shares and the common shares issuable upon the

conversion of the pre-funded warrants, series A warrants, and

series B warrants have not been registered under the Securities Act

of 1933, as amended, or any state securities laws. Until

registered, they may not be offered or sold in the United States or

any state absent registration or an applicable exemption from

registration requirements.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction where such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under applicable securities laws.

About Spartan Capital Securities, LLCSpartan

Capital Securities, LLC is a premier full-service investment

banking firm offering a comprehensive range of advisory services to

institutional clients and high-net-worth individuals. Known for its

expertise in capital raising, strategic advisory, and asset

management, Spartan Capital delivers tailored solutions to meet

clients' financial goals.

For more information about Spartan Capital Securities, visit

www.spartancapital.com.

Contact:Spartan Capital Securities, LLC45

Broadway, 19th FloorNew York, NY

10006investmentbanking@spartancapital.com

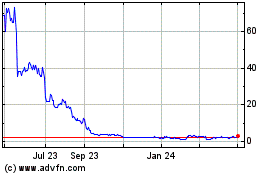

1847 (AMEX:EFSH)

Historical Stock Chart

From Jan 2025 to Feb 2025

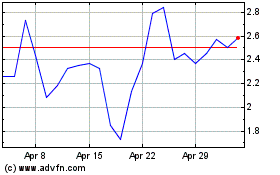

1847 (AMEX:EFSH)

Historical Stock Chart

From Feb 2024 to Feb 2025