Form 8-K - Current report

March 04 2024 - 8:45AM

Edgar (US Regulatory)

false

0000727273

0000727273

2024-02-28

2024-02-28

0000727273

cdzi:CommonStockCustomMember

2024-02-28

2024-02-28

0000727273

cdzi:DepositarySharesCustomMember

2024-02-28

2024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

CADIZ INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

0-12114

|

|

77-0313235

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification No.)

|

| |

|

|

|

550 S. Hope Street, Suite 2850

|

|

|

|

Los Angeles, California

|

|

70071

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (213) 271-1600

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

CDZI

|

|

The NASDAQ Global Market

|

|

Depositary Shares (each representing 1/1000th fractional

interest in share of 8.875% Series A Cumulative

Perpetual Preferred Stock, par value $0.01 per share

|

|

CDZIP

|

|

The NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

☐

|

Emerging growth company

|

| |

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 1.01 Entry into a Material Definitive Agreement

On February 28, 2024, Cadiz Inc. (the “Company” or “Cadiz”) entered into (i) an Agreement for the Delivery of Water Made Available by Cadiz Inc. and Fenner Gap Mutual Water Company to Public Water Systems, among Cadiz, Cadiz Real Estate LLC, a wholly-owned subsidiary of Cadiz, Fenner Gap Mutual Water Company (“FGMWC”) and Fontana Water Company (“FWC”), an investor-owned utility serving the City of Fontana, California (the “FWC Agreement”), and (ii) a Term Sheet for the Delivery of Water Made Available by Cadiz Inc. and Fenner Gap Mutual Water Company to Santa Margarita Water District in the Northern Pipeline (the “SMWD Term Sheet,” and collectively with the FWC Agreement, the “Agreements”), among Cadiz, FGMWC and Santa Margarita Water District (“SMWD”).

The Agreements provide for the purchase of a cumulative annual supply of 10,000 acre-feet of water from the Company’s Water Conservation, Supply and Storage project (the “Project”) with conveyance through the Company’s 30-inch diameter, 220-mile, existing steel pipeline originating at Cadiz with a terminus at Wheeler Ridge (the “Northern Pipeline”).

The FWC Agreement provides that FWC will purchase 5,000 acre-feet per year (AFY) of water from the Project made available to FWC via the East Branch of the State Water Project through an exchange with one or more contractors under the California State Water Project, a state water management project under the supervision of the California Department of Water Resources.

The SMWD Term Sheet provides that SMWD will exercise its right to purchase 5,000 AFY pursuant to a Purchase & Sale Agreement entered into by the Company and SMWD in 2012 and that the Company will facilitate delivery to SMWD through the Company’s Northern Pipeline via an exchange of water with a State Water Project contractor.

Under the terms of the Agreements, FWC and SMWD will each pay a maximum of $1,650 per AFY as the “as delivered” price for Project water delivered to designated points of delivery. The payments will be subject to an agreed upon annual adjustment pegged to an agreed upon index (e.g., CPI Water and Sewer Index). In addition, SMWD will reserve the right to acquire specified carry-over storage in the Project for $1,500 per AF and an annual management fee of $20 per AF of acquired storage capacity.

Under both Agreements, the parties have agreed to exercise good faith and reasonable best efforts to jointly pursue federal, state, and local grant funding to offset the capital costs for development of pipeline conveyance and appurtenant facilities. Any grant funding received by public water systems will be credited against the “as delivered” price for water to the purchasers. The target price to public water systems, including incremental capital and operating costs for conveyance, less grant funding, is $1,000 and in any event, will not exceed $1,650 per AFY.

Cadiz expects to receive net revenue of $850 per AFY, subject to annual inflation adjustments, for producing conserved water to be conveyed to each of the parties under the Agreements through the Northern Pipeline.

The Company’s Northern Pipeline has a delivery capacity of 25,000 AFY. The Agreements are anticipated to represent 40% of the delivery capacity of the Northern Pipeline. In addition to the Agreements, the Company holds option agreements with several public water systems and is in negotiations with those public water systems to exercise and/or amend those option agreements to take delivery of water from the Northern Pipeline via direct delivery or by exchange with State Water Project contractors. Annual payments for water supply made available from the Project under the Agreements would begin when conditions precedent are met, construction is complete, and water deliveries begin.

No binding obligations will be created with respect to the transactions contemplated by the SMWD Term Sheet until the execution of written definitive agreements.

The foregoing description of the FWC Agreement and the SMWD Term Sheet does not purport to be complete and is qualified in its entirety by the full text of such documents, each of which is filed as Exhibits 10.1 and 10.2, respectively, to this Current Report and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

10.1*

|

|

| |

|

|

10.2*

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

* Portions of this exhibit have been omitted because such portions are both (i) not material and (ii) customarily and actually treated by the registrant as private or confidential.

INFORMATION RELATING TO FORWARD LOOKING STATEMENTS

This current report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the Company’s expectation to enter into a definitive agreement reflecting the terms in the SMWD Term Sheet and the expected benefits to be derived from the Agreements and option agreements held by the Company. Such statements are subject to significant risks and uncertainties, including the Company’s ability to fulfill the required contractual conditions and complete the needed construction for water delivery to occur. Although the Company believes that the expectations reflected in our forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Factors that could cause actual results or events to differ materially from those reflected in the Company’s forward-looking statements include delays in the supply chain for materials, whether the parties to the Agreements will be able to obtain the contemplated grant funding, and other factors and considerations detailed in the Company’s Securities and Exchange Commission filings. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

| |

CADIZ INC.

|

| |

|

| |

By: /s/ Stanley E. Speer

|

| |

Stanley E. Speer

Chief Financial Officer

|

Date: March 4, 2024

v3.24.0.1

Document And Entity Information

|

Feb. 28, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CADIZ INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 28, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

0-12114

|

| Entity, Tax Identification Number |

77-0313235

|

| Entity, Address, Address Line One |

550 S. Hope Street

|

| Entity, Address, Address Line Two |

Suite 2850

|

| Entity, Address, City or Town |

Los Angeles

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

70071

|

| City Area Code |

213

|

| Local Phone Number |

271-1600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000727273

|

| CommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CDZI

|

| Security Exchange Name |

NASDAQ

|

| DepositaryShares Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares

|

| Trading Symbol |

CDZIP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=cdzi_CommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=cdzi_DepositarySharesCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

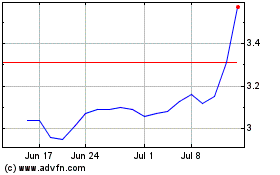

Cadiz (NASDAQ:CDZI)

Historical Stock Chart

From Mar 2024 to Apr 2024

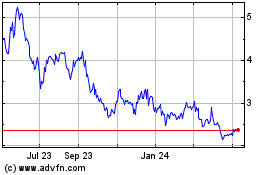

Cadiz (NASDAQ:CDZI)

Historical Stock Chart

From Apr 2023 to Apr 2024