0001172222false00011722222024-02-162024-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 16, 2024

HAWAIIAN HOLDINGS INC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-31443 | | 71-0879698 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

3375 Koapaka Street, Suite G-350

Honolulu, HI 96819

(Address of principal executive offices, including zip code)

(808) 835-3700

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock | HA | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On December 3, 2023, Hawaiian Holdings, Inc. (“Hawaiian”) announced its entry into an Agreement and Plan of Merger, dated as of December 2, 2023 (the “Merger Agreement”), by and among Alaska Air Group, Inc. (“Alaska”), Marlin Acquisition Corp. (“Merger Sub”) and Hawaiian. The Merger Agreement provides for Merger Sub to be merged with and into Hawaiian, with Hawaiian surviving as a wholly owned subsidiary of Alaska (the “Merger”).

In connection with the Merger, Hawaiian held a special meeting of stockholders on February 16, 2024, at 11:30 a.m., Hawaiʻi time (the “Special Meeting”).

As of January 3, 2024, the record date for the Special Meeting (the “Record Date”), there were 51,824,365 shares of Hawaiian’s capital stock issued, outstanding and entitled to vote at the Special Meeting, consisting of 51,824,362 shares of Hawaiian’s common stock and one share each of Hawaiian’s Series B Special Preferred Stock, Hawaiian’s Series C Special Preferred Stock and Hawaiian’s Series D Special Preferred Stock (collectively, the “Shares”). Each Share was entitled to one vote on each proposal at the Special Meeting. At the Special Meeting, 34,374,610 Shares were present in person or represented by proxy.

The following are the voting results of the proposals considered and voted on at the Special Meeting, each of which is described in Hawaiian’s definitive proxy statement, dated January 9, 2024, filed by Hawaiian with the Securities and Exchange Commission (the “Proxy Statement”).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOR | | AGAINST | | ABSTAIN | | BROKER NON-VOTES |

| Proposal 1: To adopt the Merger Agreement. | | 33,714,935 | | 574,520 | | 85,155 | | 0 |

| Proposal 1 was approved | | | | | | | | |

| | | | | | | | |

| Proposal 2: To approve, on a non-binding, advisory basis, the compensation that will or may become payable by Hawaiian to its named executive officers in connection with the Merger. | | 28,630,166 | | 3,366,737 | | 2,377,707 | | 0 |

| Proposal 2 was approved | | | | | | | | |

Proposal 3 described in the Proxy Statement (relating to the adjournment of the Special Meeting, if necessary or appropriate) was rendered moot and was not presented at the Special Meeting as a result of the approval of Proposal 1.

Item 8.01 Other Events.

On February 16, 2024, Hawaiian issued a press release announcing approval of the Merger Agreement by its stockholders. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference in its entirety.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: February 20, 2024 | |

| | |

| | HAWAIIAN HOLDINGS, INC. |

| | |

| | | | |

| | By: | /s/ Aaron J. Alter |

| | | Name: | Aaron J. Alter |

| | | Title: | Executive Vice President, Chief Legal Officer and Corporate Secretary |

NEWS

| | | | | | | | |

FOR IMMEDIATE RELEASE

February 16, 2024 | | Contact: Hawaiian Airlines Public Relations News@HawaiianAir.com |

Hawaiian Holdings Stockholders Approve Acquisition by Alaska Air Group

HONOLULU – Hawaiian Holdings, Inc. (“Hawaiian”) (NASDAQ: HA) today announced that its stockholders have voted to adopt the merger agreement with Alaska Air Group, Inc. (“Alaska”) (NYSE: ALK). A substantial majority of the holders of Hawaiian’s stock voted in favor of the merger, according to preliminary results from the special meeting held earlier today. Hawaiian will file the final voting results, as tabulated by an independent inspector of elections, on a Form 8-K with the U.S. Securities and Exchange Commission.

“Stockholder approval of our transaction with Alaska is an important milestone toward combining our airlines,” said Hawaiian Airlines President and CEO Peter Ingram. “Together, we will bring stronger competition to the U.S. airline industry, deliver more value to our guests and the communities that we serve, and provide greater job opportunities for our employees.”

The transaction remains subject to receipt of required regulatory approvals, along with other customary closing conditions. Hawaiian and Alaska continue to expect to complete the transaction within 12 to 18 months of announcement of the transaction, which occurred on December 3, 2023.

About Hawaiian Airlines

Now in its 95th year of continuous service, Hawaiian is Hawaiʻi's biggest and longest-serving airline. Hawaiian offers approximately 150 daily flights within the Hawaiian Islands, and nonstop flights between Hawaiʻi and 15 U.S. gateway cities – more than any other airline – as well as service connecting Honolulu and American Samoa, Australia, Cook Islands, Japan, New Zealand, South Korea and Tahiti.

Consumer surveys by Condé Nast Traveler and TripAdvisor have placed Hawaiian among the top of all domestic airlines serving Hawaiʻi. The carrier was named Hawaiʻi's best employer by Forbes in 2022 and has topped Travel + Leisure's World's Best list as the No. 1 U.S. airline for the past two years. Hawaiian has also led all U.S. carriers in on-time performance for 18 consecutive years (2004-2021) as reported by the U.S. Department of Transportation.

The airline is committed to connecting people with aloha. As Hawai'i's hometown airline, Hawaiian encourages guests to Travel Pono and experience the islands safely and respectfully.

Hawaiian Airlines, Inc. is a subsidiary of Hawaiian Holdings, Inc. (NASDAQ: HA). Additional information is available at HawaiianAirlines.com. Follow Hawaiian's Twitter updates (@HawaiianAir), become a fan on Facebook (Hawaiian Airlines), and follow us on Instagram (hawaiianairlines). For career postings and updates, follow Hawaiian's LinkedIn page.

Forward-Looking Statements

This communication contains forward-looking statements subject to the safe harbor protection provided by the federal securities laws, including statements relating to the expected timing of the closing of the pending acquisition (the “Transaction”) of Hawaiian by Alaska and the benefits of the Transaction. There can be no assurance that the Transaction will in fact be consummated. Risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements include: the risk that a condition to closing of the Transaction may not be satisfied (or waived); the ability of each party to consummate the Transaction; that either party may terminate the merger agreement or that the closing of the Transaction might be delayed or not occur at all; possible disruption related to the Transaction to Alaska’s or Hawaiian’s current plans or operations, including through the loss of customers and employees; the diversion of management time and attention from ongoing business operations and opportunities; the response of competitors to the Transaction; a failure to (or delay in) receiving the required regulatory clearances for the Transaction; the outcome of any legal proceedings that could be instituted against Hawaiian, Alaska or others relating to the Transaction; legislative, regulatory and economic developments affecting the business of Alaska or Hawaiian; general economic conditions including those associated with pandemic recovery; the possibility and severity of catastrophic events, including but not limited to, pandemics, natural disasters, acts of terrorism or outbreak of war or hostilities; and other risks and uncertainties detailed in periodic reports that Alaska and Hawaiian file with the U.S. Securities and Exchange Commission. All forward-looking statements in this communication are based on information available to Hawaiian as of the date of this communication. Alaska and Hawaiian each expressly disclaim any obligation to publicly update or revise the forward-looking statements, except as required by law.

v3.24.0.1

Cover Page Cover Page

|

Feb. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 16, 2024

|

| Entity Registrant Name |

HAWAIIAN HOLDINGS INC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-31443

|

| Entity Tax Identification Number |

71-0879698

|

| Entity Address, Address Line One |

3375 Koapaka Street,

|

| Entity Address, Address Line Two |

Suite G-350

|

| Entity Address, City or Town |

Honolulu,

|

| Entity Address, State or Province |

HI

|

| Entity Address, Postal Zip Code |

96819

|

| City Area Code |

808

|

| Local Phone Number |

835-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

HA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001172222

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

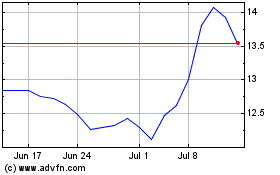

Hawaiian (NASDAQ:HA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hawaiian (NASDAQ:HA)

Historical Stock Chart

From Apr 2023 to Apr 2024