UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-38638

NIO

Inc.

(Registrant’s Name)

Building 20, 56 Antuo Road

Jiading District, Shanghai 201804

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

NIO Inc. Adopted 2024

Share Incentive Plan

The board of directors

of NIO Inc. (the “Company”) and the compensation committee of the board of directors of the Company have recently approved

and authorized the adoption of its 2024 Share Incentive Plan (the “2024 Plan”). Under the 2024 Plan, the maximum aggregate

number of shares that may be issued shall be (i) 19,288,470 shares, which shall be automatically increased each year by the number

of shares representing 1.2% of the then total issued and outstanding share capital of the Company as of the last day of the immediately

preceding fiscal year during the term of the 2024 Plan commencing with the fiscal year starting from January 1, 2025, plus (ii) the

number of shares subject to awards that were not granted under the Company’s 2015 Share Incentive Plan, 2016 Share Incentive Plan,

2017 Share Incentive Plan, and 2018 Share Incentive Plan (collectively, the “Prior Plans”), and the number of shares subject

to awards granted under the Prior Plans that have expired or otherwise been terminated without having been exercised in full and the shares

issued pursuant to awards granted under the Prior Plans that have been forfeited to or repurchased by the Company due to failure to vest.

The 2024 Plan will become effective on February 7, 2024 and will continue in effect for a term of five years.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

NIO Inc. |

| |

|

| |

By |

: |

/s/ Wei Feng |

| |

Name |

: |

Wei Feng |

| |

Title |

: |

Chief Financial Officer |

| |

|

|

| Date:

February 7, 2024 |

|

|

Exhibit 99.1

NIO

Inc.

2024

Share Incentive Plan

(Adopted

by the Board of Directors of NIO Inc. (the “Company”) on February 7, 2024)

1. Purposes

of the Plan. The purpose of this Plan is to attract and retain the best available personnel for positions of substantial responsibility,

to provide additional incentives to selected Employees, Directors, and Consultants and to promote the success of the Company’s business

by offering these individuals an opportunity to acquire a proprietary interest in the success of the Company or to increase this interest,

by permitting them to acquire Shares of the Company or granting Options to purchase Shares of the Company. The Plan provides both for

the direct award or sale of Shares and for the grant of Options to purchase Shares. Options granted under the Plan may be Incentive Stock

Options or Non-statutory Stock Options, as determined by the Administrator at the time of grant.

2. Definitions.

For the purposes of this Plan, unless the context otherwise requires, the following terms shall have the following meanings:

(a) “Acquisition

Date” means, with respect to Shares, the respective dates on which the Shares are issued under the Plan pursuant to the exercise

of an Option or in accordance with the Restricted Share Purchase Agreement.

(b) “Administrator”

means the Board or any of its Committees as shall be administering the Plan in accordance with Section 4 hereof.

(c) “Applicable

Law” means any applicable legal requirements relating to the administration of and the issuance of securities under equity securities-based

compensation plans, including, without limitation, the requirements of laws of the state securities laws, U.S. federal law, the Code,

and the requirements of any stock exchange or quotation system upon which the Shares may then be listed or quoted and the applicable laws

of any other country or jurisdiction where Awards are granted under the Plan. For all purposes of this Plan, references to statutes and

regulations shall be deemed to include any successor statutes or regulations, to the extent reasonably appropriate as determined by the

Administrator.

(d) “Award”

means an Option or a Restricted Share Purchase Right or other types of award approved by the Administrator and granted to an Awardee pursuant

to this Plan.

(e) “Awardee”

means a recipient of an Award.

(f) “Board”

means the Board of Directors of the Company.

(g) “Cause”

means, as determined by the Board and unless otherwise provided in an applicable agreement with the Company or a Subsidiary, the Service

Provider (i) is proved to be incompetent during the probationary period, (ii) is in material breach of the rules and regulations

of the Group Companies (including without limitation labor discipline) (for avoidance of doubt, commercial bribery and bribery shall be

regarded as material breaches of rules and regulations in any event), (iii) commits serious dereliction of duty or malpractice,

which causes material damages to the Group Companies, (iv) comes into employment relationship with other employer at the same time,

which has material negative effects on the completion of his/her work at the Group Companies, or refuses to make correction as required

by the Group Companies; (v) uses such means as fraud, coercion or taking advantage of the unfavorable position of the Group Companies

to have the Group Companies execute or modify the employment contract against its true intention, which renders such employment contract

invalid, or (vi) is prosecuted.

(h) “Corporate

Transaction” unless otherwise defined in an Award Agreement, means any of the following transactions, provided, however, that

the Board or the Committee shall determine under (iv) and (v) whether multiple transactions are related, and its determination

shall be final, binding and conclusive:

(i) an

amalgamation, arrangement or consolidation or scheme of arrangement (a) in which the Company is not the surviving entity, except

for a transaction the principal purpose of which is to change the jurisdiction in which the Company is incorporated or (b) following

which the holders of the voting securities of the Company do not continue to hold more than 50% of the combined voting power of the voting

securities of the surviving entity;

(ii) the

consummation of the sale, transfer or other disposition of all or substantially all of the Company’s assets;

(iii) the

complete liquidation or dissolution of the Company;

(iv) any

reverse takeover or series of related transactions culminating in a reverse takeover (including, but not limited to, a tender offer followed

by a reverse takeover) in which the Company is the surviving entity but (a) the Company’s equity securities outstanding immediately

prior to such takeover are converted or exchanged by virtue of the takeover into other property, whether in the form of securities, cash

or otherwise, or (b) in which securities possessing more than fifty percent (50%) of the total combined voting power of the Company’s

outstanding securities are transferred to a person or persons different from those who held such securities immediately prior to such

takeover or the initial transaction culminating in such takeover, but excluding any such transaction or series of related transactions

that the Board or the Committee determines shall not be a Corporate Transaction; or

(v) acquisition

in a single or series of related transactions by any person or related group of persons (other than the Company or by a Company-sponsored

employee benefit plan) of beneficial ownership (within the meaning of Rule 13d-3 of the Exchange Act) of securities possessing more

than fifty percent (50%) of the total combined voting power of the Company’s outstanding securities but excluding any such transaction

or series of related transactions that the Board or the Committee determines shall not be a Corporate Transaction.

(i) “Code”

means the U.S. Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder.

(j) “Committee”

means a committee of Directors appointed by the Board in accordance with Section 4 hereof.

(k) “Company”

means NIO Inc., a company organized under the laws of the Cayman Islands, or any successor corporation thereto.

(l) “Consultant”

means any natural person who is engaged by the Company, or any Parent, Subsidiary or variable interest entity whose financial statements

are intended to be consolidated with the Company, any Parent or Subsidiary to render consulting or advisory services to such entity and

who is compensated for the services; provided that the term “Consultant,” does not include (i) Employees or (ii) securities

promoters.

(m) “Date

of Grant” means the date an Award is granted to an Awardee in accordance with Section 13 hereof.

(n) “Director”

means a member of the Board or board of directors of any Parent, Subsidiary or Related Entity.

(o) “Disability”

means total and permanent disability as defined in Section 22(e)(3) of the Code.

(p) “Employee”

means any person, including officers and Directors, employed by the Company, any Parent, Subsidiary or Related Entity. A Service Provider

shall not cease to be an Employee in the case of (i) any leave of absence approved by the Company or any Parent or Subsidiary, including

sick leave, military leave, or any other personal leave, or (ii) transfers between locations of the Company or between the Company

or any Parent or Subsidiary, or any successor. For purposes of Incentive Stock Options, no such leave may exceed ninety (90) days, unless

reemployment upon expiration of such leave is guaranteed by statute or contract. If reemployment upon expiration of a leave of absence

approved by the Company is not so guaranteed, then three (3) months following the 91st day of such leave, any Incentive

Stock Option held by the Optionee shall cease to be treated as an Incentive Stock Option and shall be treated for tax purposes as a Non-statutory

Stock Option. Neither service as a Director nor payment of a director’s fee by the Company or any Parent or Subsidiary shall be

sufficient to constitute “employment” by the Company or any Parent or Subsidiary.

(q) “Exercise

Price” means the amount for which one Share may be purchased upon exercise of an Option, as specified by the Administrator in

the applicable Option Agreement in accordance with Section 6(d) hereof.

(r) “Exchange

Act” means the U.S. Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

(s) “Fair

Market Value” means, as of any date, the value of the Shares determined as follows:

(i) if

the Shares are listed on any established stock exchange or a national market system, including, without limitation, The New York Stock

Exchange, The Nasdaq Global Market or The Nasdaq Capital Market of The Nasdaq Stock Market, Hong Kong Stock Exchange, Singapore Exchange

Securities Trading Limited and the London Stock Exchange (Main Listing or Alternative Investment Market), the Fair Market Value shall

be the closing sales price for the Shares (or the closing bid, if no sales were reported) as quoted on such exchange or system on the

day of determination, as reported in The Wall Street Journal or such other source as the Administrator deems reliable;

(ii) if

the Shares are regularly quoted by a recognized securities dealer but selling prices are not reported, the Fair Market Value shall be

the mean of the high bid and low asked prices for the Shares on the day of determination, as reported in The Wall Street Journal

or any other source as the Administrator deems reliable; or

(iii) in

the absence of an established market for the Shares, the Fair Market Value thereof shall be determined in good faith by the Administrator

in accordance with Applicable Law.

(t) “Group

Companies” means the Company, NIO Inc., and / or any of their Subsidiary.

(u) “Hong

Kong Listing Rules” means the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as

amended or supplemented from time to time.

(v) “Incentive

Stock Option” means an Option intended to qualify as an incentive stock option within the meaning of Section 422 of the

Code, as designated in the applicable Option Agreement.

(w) “Non-statutory

Stock Option” means an Option not intended to qualify as an Incentive Stock Option, as designated in the applicable Option Agreement,

or an Incentive Stock Option that does not so qualify.

(x) “Option”

means an option to purchase Shares that is granted pursuant to the Plan in accordance with Section 6 hereof.

(y) “Option

Agreement” means a written or electronic agreement between the Company and an Optionee, the form(s) of which shall be approved

from time to time by the Administrator, evidencing the terms and conditions of an individual Option granted under the Plan, and includes

any documents attached to or incorporated into the Option Agreement, including, but not limited to, a notice of option grant and a form

of exercise notice. The Option Agreement shall be subject to the terms and conditions of the Plan.

(z) “Optioned

Shares” means the Shares subject to an Option.

(aa) “Optionee”

means the holder of an outstanding Option granted under the Plan.

(bb) “Parent”

means a “parent corporation” with respect to the Company, whether now or hereafter existing, as defined in Section 424(e) of

the Code.

(cc) “Plan”

means this 2024 Share Incentive Plan, as amended from time to time.

(dd) “PRC”

means the People’s Republic of China, which, for the purpose of this Plan, shall exclude Hong Kong Special Administrative Region

of the PRC, Macau Special Administrative Region of the PRC and Taiwan.

(ee) “Purchase

Price” means the amount of consideration for which one Share may be acquired pursuant to a Restricted Share Purchase Right,

as specified by the Administrator in the applicable Restricted Share Purchase Agreement in accordance with Section 7(c) hereof.

(ff) “Purchaser”

means the holder of Shares purchased pursuant to the exercise of a Restricted Share Purchase Right.

(gg) “Qualified

Former Employee” means any former employee of the Company or any Parent or Subsidiary who is eligible for the grant of Awards

as approved by the Board.

(hh) “Related

Entity” means any business, corporation, partnership, limited liability company or other entity in which the Company, a Parent

or Subsidiary of the Company holds a substantial ownership interest, directly or indirectly, but which is not a Subsidiary and which the

Board designates as a Related Entity for purposes of the Plan.

(ii) “Restricted

Share Purchase Agreement” means a written or electronic agreement between the Company and a Purchaser, the form(s) of which

shall be approved from time to time by the Administrator, evidencing the terms and conditions of an individual Restricted Share Purchase

Right, and includes any documents attached to or incorporated into the Restricted Share Purchase Agreement. The Restricted Share Purchase

Agreement shall be subject to the terms and conditions of the Plan.

(jj) “Restricted

Share Purchase Right” means a right to purchase Restricted Shares pursuant to Section 7 hereof.

(kk) “Restricted

Shares” means Shares acquired pursuant to a Restricted Share Purchase Right (if subject to rights of redemption, repurchase

or forfeiture).

(ll) “Securities

Act” means the U.S. Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

(mm) “Service

Provider” means an Employee, Director, or Consultant.

(nn) “Share”

means an Class A Ordinary Share of the Company, as adjusted in accordance with Section 12 hereof.

(oo) “Shareholders

Agreement” means any agreement between an Awardee and the Company or members of the Company or both.

(pp) “Singapore

Listing Manual” means the listing manual of Singapore Exchange Securities Trading Limited, as amended, modified or supplemented

from time to time.

(qq) “Subsidiary”

means a “subsidiary corporation” with respect to the Company, whether now or hereafter existing, as defined in Section 424(f) of

the Code. For purposes of the Plan, any “variable interest entity” that is consolidated into the consolidated financial statements

of the Company under applicable accounting principles or standards as may apply to the consolidated financial statements of the Company

shall be deemed a Subsidiary.

(rr) “Ten

Percent Owner” means a Service Provider who owns more than 10% of the total combined voting power of all classes of outstanding

securities of the Company or any Parent or Subsidiary.

(ss) “United

States” means the United States of America, its territories and possessions, any State of the United States, and the District

of Columbia.

3. Shares

Subject to the Plan.

(a)

Basic Limitation. Subject to the provisions of Section 12 hereof,

the maximum aggregate number of Shares that may be issued under the Plan shall be (i) 19,288,470 Shares, which shall be

automatically increased each year by the number of shares representing 1.2% of the then total issued and outstanding share capital

of the Company as of the last day of the immediately preceding fiscal year during the term of the Plan commencing with the fiscal

year starting from January 1, 2025, plus (ii) the number of Shares subject to awards that were not granted under the

Company’s 2015 Share Incentive Plan, 2016 Share Incentive Plan, 2017 Share Incentive Plan, and 2018 Share Incentive Plan

(collectively, the “Prior Plans”), and the number of Shares subject to awards granted under the Prior Plans that have

expired or otherwise been terminated without having been exercised in full and the Shares issued pursuant to awards granted under

the Prior Plans that have been forfeited to or repurchased by the Company due to failure to vest.

(b) Additional

Shares. If an Award expires, becomes unexercisable, or is cancelled, forfeited, or otherwise terminated without having been exercised

or settled in full, as the case may be, the Shares allocable to the unexercised portion of the Award shall again become available for

future grant or sale under the Plan (unless the Plan has terminated). Shares that actually have been issued under the Plan, upon exercise

of an Option or delivery under a Restricted Share Purchase Right, shall not be returned to the Plan and shall not become available for

future distribution under the Plan, except that in the event that Shares issued under the Plan are reacquired by the Company pursuant

to any forfeiture provision, right of repurchase or redemption, or are retained by the Company upon the exercise of or purchase of Shares

under an Award in order to satisfy the Exercise Price or Purchase Price for the Award or any withholding taxes due with respect to the

exercise or purchase, such Shares shall again become available for future grant under the Plan.

4. Administration

of the Plan.

(a) Administrator.

The Plan shall be administered by the Board or a Committee appointed by the Board. Any Committee of the Board shall be constituted to

comply with Applicable Law.

(b) Powers

of the Administrator. Subject to the provisions of the Plan and, in the case of a Committee, the specific duties delegated by the

Board to such Committee, and subject to the approval of any relevant authorities, the Administrator shall have the authority in its discretion:

(i) to

determine the Fair Market Value, in accordance with Section 2(s) hereof;

(ii) to

select the Awardees to whom Awards may from time to time be granted hereunder;

(iii) to

determine the number of Shares to be covered by each Award granted hereunder;

(iv) to

approve and update the form(s) of agreement for use under the Plan;

(v) to

determine the terms and conditions of any Award granted hereunder including, but not limited to, the Exercise Price, the Purchase Price,

the time or times when Options may be exercised (which may be based on performance or other criteria as the Board may deem necessary or

advisable), the time or times when repurchase or redemption rights shall lapse, any vesting acceleration or waiver of forfeiture restrictions,

and any restriction or limitation regarding any Award or the Shares relating thereto, based in each case on such factors as the Administrator,

in its sole discretion, shall determine;

(vi) to

implement a program where (A) outstanding Awards are surrendered or cancelled in exchange for Awards of the same type (which may

have lower Exercise/Purchase Prices and different terms), Awards of a different type, or cash, or (B) the Exercise/Purchase Price

of an outstanding Award is reduced, based in each case on terms and conditions determined by the Administrator in its sole discretion;

(vii) to

prescribe, amend, and rescind rules and regulations relating to the Plan, including rules and regulations relating to sub-plans

established for the purpose of satisfying applicable laws of jurisdictions other than the United States;

(viii) to

allow Awardees to satisfy withholding tax obligations by electing to have the Company withhold from the Shares to be issued under an Award

that number of Shares having a Fair Market Value equal to the minimum amount required to be withheld. The Fair Market Value of the Shares

to be withheld shall be determined on the date that the amount of tax to be withheld is to be determined. All elections by Awardees to

have Shares withheld for this purpose shall be made in such form and under such conditions as the Administrator may deem necessary or

advisable;

(ix) to

modify or amend each Award (subject to Section 17 hereof and Awardee's consent if the modification or amendment is to the Awardee’s

detriment);

(x) to

construe and interpret the terms of the Plan and Awards granted pursuant to the Plan; and

(xi) to

make any other determination and take any other action that the Administrator deems necessary or desirable for the administration of the

Plan.

(c) Delegation

of Authority to Officers. Subject to Applicable Law, the Administrator may delegate limited authority to specified officers of the

Company to execute on behalf of the Company any instrument required to effect an Award previously granted by the Administrator.

(d) Effect

of Administrator’s Decision. All decisions, determinations, and interpretations of the Administrator shall be final and binding

on all Awardees.

5. Eligibility.

(a) General

Rule. Only Service Providers, or trusts or companies established in connection with any employee benefit plan of the Company (including

the Plan) for the benefit of a Service Provider, or Qualified Former Employees, shall be eligible for the grant of Awards. Incentive Stock

Options may be granted to Employees only.

(b) Members

with Ten-Percent Holdings. A Ten Percent Owner shall not be eligible for the grant of an Incentive Stock Option unless (i) the

Exercise Price is at least 110% of the Fair Market Value on the Date of Grant, and (ii) the Incentive Stock Option by its terms is

not exercisable after the expiration of five (5) years from the Date of Grant. For purposes of this Section 5(b), in determining

ownership of securities, the attribution rules of Section 424(d) of the Code shall apply.

(c) Jurisdictions.

In order to assure the viability of Awards granted to Awardees employed in various jurisdictions, the Committee may provide for such special

terms as it may consider necessary or appropriate to accommodate differences in local law, tax policy, or custom applicable in the jurisdiction

in which the Awardees resides or is employed. Moreover, the Committee may approve such supplements to, or amendments, restatements or

alternative versions of, the Plan as it may consider necessary or appropriate for such purposes without thereby affecting the terms of

the Plan as in effect for any other purpose; provided, however, that no such supplements, amendments, restatements or alternative versions

shall increase the share limitations contained in Section 3(a) hereof. Notwithstanding the foregoing, the Committee may not

take any actions hereunder, and no Awards shall be granted, that would violate any Applicable Law.

6. Terms

and Conditions of Options.

(a) Option

Agreement. Each grant of an Option under the Plan shall be evidenced by an Option Agreement between the Optionee and the Company.

Each Option shall be subject to all applicable terms and conditions of the Plan and may be subject to any other terms and conditions that

are not inconsistent with the Plan and that the Administrator deems appropriate for inclusion in an Option Agreement. The provisions of

the various Option Agreements entered into under the Plan need not be identical.

(b) Type

of Option. Each Option shall be designated in the Option Agreement as either an Incentive Stock Option or a Non-statutory Stock Option.

However, notwithstanding a designation of an Option as an Incentive Stock Option, to the extent that the aggregate Fair Market Value of

the Shares with respect to which Incentive Stock Options are exercisable for the first time by an Optionee during any calendar year (under

all plans of the Company and any Parent or Subsidiary) exceeds US$100,000, such Options shall be treated as Non-statutory Stock Options.

For purposes of this Section 6(b), Incentive Stock Options shall be taken into account in the order in which they were granted.

The Fair Market Value of the Shares shall be determined as of the Date of Grant.

(c) Number

of Shares. Each Option Agreement shall specify the number of Shares that are subject to the Option and shall provide for the adjustment

of such number in accordance with Section 12 hereof.

(d) Exercise

Price. Each Option Agreement shall specify the Exercise Price. The Exercise Price of an Incentive Stock Option shall not be less than

100% of the Fair Market Value on the Date of Grant, and a higher percentage may be required by Section 5(b) hereof. Subject

to the preceding sentence, the Exercise Price of any Option shall be determined by the Administrator in its sole discretion. For the avoidance

of doubt, to the extent not prohibited by applicable laws or any exchange rule, a downward adjustment of the exercise prices of Options

mentioned in the preceding sentence shall be effective without the approval of the Company’s shareholders or the approval of the

affected Awardees. The Exercise Price shall be payable in accordance with Section 9 hereof and the applicable Option Agreement. Notwithstanding

anything to the contrary in the foregoing or in Section 5(b), in the event of a transaction described in Section 424(a) of

the Code, then, consistent with Section 424(a) of the Code, Incentive Stock Options may be issued at an Exercise Price

other than as required by the foregoing and Section 5(b).

(e) Term

of Option. The Option Agreement shall specify the term of the Option; provided, however, that the term shall not exceed ten (10) years

from the Date of Grant, and a shorter term may be required by Section 5(b) hereof. Subject to the preceding sentence, the Administrator

in its sole discretion shall determine when an Option is to expire.

(f) Exercisability.

Each Option Agreement shall specify the date when all or any installment of the Option is to become exercisable. The exercisability provisions

of any Option Agreement shall be determined by the Administrator in its sole discretion. Unless otherwise set forth in the Option Agreement

or as determined by the Administrator, no Option shall become exercisable unless and until (i) such Option has been fully vested

according to the vesting terms provided under the Option Agreement, and (ii) all applicable legal requirements with respect to the

exercise of Options, including without limitation the filing requirements of the State Administration of Foreign Exchange of the PRC,

shall have been fully performed and complied with by the applicable Awardee.

(g) Exercise

Procedure. Any Option granted hereunder shall be exercisable according to the terms hereof at such times and under such conditions

as may be determined by the Administrator and as set forth in the Option Agreement; provided, however, that an Option shall not be exercised

for a fraction of a Share.

(i) An

Option shall be deemed exercised when the Company receives (A) written or electronic notice of exercise (in accordance with the Option

Agreement) from the person entitled to exercise the Option, (B) full payment for the Shares with respect to which the Option is exercised,

and (C) all representations, indemnifications, and documents reasonably requested by the Administrator including, without limitation,

any Shareholders Agreement. Full payment may consist of any consideration and method of payment authorized by the Administrator in accordance

with Section 9 hereof and permitted by the Option Agreement.

(ii) Shares

issued upon exercise of an Option shall be issued in the name of the Optionee or, if requested by the Optionee, in the name of the Optionee

and his or her spouse. Subject to the provisions of Sections 8, 9, 14, and 15, the Company shall issue (or cause to be issued) certificates

evidencing the issued Shares promptly after the Option is exercised. Notwithstanding the foregoing, the Administrator in its discretion

may require the Company to retain possession of any certificate evidencing Shares acquired upon the exercise of an Option, if those Shares

remain subject to repurchase or redemption under the provisions of the Option Agreement, any Shareholders Agreement, or any other agreement

between the Company and the Awardee, or if those Shares are collateral for a loan or obligation due to the Company.

(iii) For

purpose of the Plan (in accordance with Section 3(b), exercise of an Option in any manner shall result in a decrease in the number

of Shares thereafter available, by the number of Shares as to which the Option is exercised.

(h) Termination

of Service (other than by death).

(i) If

an Optionee ceases to be a Service Provider for any reason other than because of death, then the Optionee’s Options shall expire

on the earliest of the following occasions:

(A) The

expiration date determined by Section 6(e) hereof;

(B) The

day on which the Optionee's relationship as a Service Provider is terminated for Cause;

(C) The

date of termination of the Optionee’s relationship as a Service Provider for the following reasons other than for Cause.

(1) The resignation of

the Optionee with the consent of the Group Companies results in the termination of his/her employment contract, (2) the Optionee

does not apply to renew his/her employment contract and leaves the Group Companies upon the expiration of his/her employment contract,

(3) the employment contract of the Optionee is rescinded by the Group Companies for any of the following circumstances on the part

of the Optionee (i.e., the circumstances stipulated in Article 40 of the Labor Contract Law of the People's Republic of China): (x) the

Optionee is sick or suffers from work-related injury and is unable to resume his/her original work or engage in other work otherwise arranged

by the Group Companies upon the completion of the specified medical treatment period, (y) the Optionee is incompetent in his/her

work and fails to be competent in his/her work even after training or an adjustment of post, and (z) the objective conditions based

on which the employment contract was signed between the Optionee and the Group Companies have undergone material changes, which results

in the impossibility to perform such employment contract, and the parties fail to reach an agreement in respect of modification to such

labor contract through negotiation.

(ii) Following

the termination of the Optionee’s relationship as a Service Provider for reasons set forth in Section 6(h)(i), such Optionee

may (a) exercise all or part of such Optionee’s Option at any time before the expiration of the Option as set forth in Section 6(h)(i) hereof,

but only to the extent that the Option was vested and exercisable as of the date of termination of such Optionee’s relationship

as a Service Provider (or became vested and exercisable as a result of the termination), and subject to the provisions under Section 6(f);

and (b) the balance of the Shares subject to the Option shall be forfeited on the date of termination of the Optionee’s relationship

as a Service Provider, in the event such Optionee has prepaid any Exercise Price for such Optioned Shares, the Company shall or shall

designate any other Group Company to repay to such Optionee such Exercise Price.

(iii) For

the avoidance of any doubt, Sections 6(h)(i) and 6(h)(ii) shall not apply to Qualified Former Employees.

(i) Leave

of Absence. Unless otherwise determined by the Administrator, for purposes of this Section 6, the service of an Optionee as a

Service Provider shall be deemed to continue while the Optionee is on a bona fide leave of absence, if such leave was approved by the

Company in writing. Unless otherwise determined by the Administrator and subject to Applicable Law, vesting of an Option shall be suspended

during any unpaid leave of absence or unreasonable leave of absence as determined by the Administrator.

(j) Death

of Optionee.

(i) If

an Optionee dies or was declared dead, then the Optionee’s Option shall expire on the expiration date determined by Section 6(e) hereof

(ii) If

an Optionee dies or was declared dead, all or part of the Optionee’s Option may be exercised at any time before the expiration of

the Option as set forth in Section 6(j)(i) hereof by the executors or administrators of the Optionee’s estate or by any

person who has acquired the Option directly from the Optionee by beneficiary designation, bequest, or inheritance, but only to the extent

that the Option was vested and exercisable as of the date of the Optionee’s death or had become vested and exercisable as a result

of the death. The balance of the Shares subject to the Option shall be forfeited upon the Optionee’s death. Any Optioned Shares

subject to the portion of the Option that are vested as of the Optionee’s death but that are not purchased prior to the expiration

of the Option pursuant to this Section 6(j) shall be forfeited immediately following the Option’s expiration.

(k) Special

Adjustment

(i) If

the Optionee or his/her affiliate violates the non-compete obligation with the Group Companies (including that the Optionee or his/her

affiliate engages in business competing with the Group Companies through the enterprise he/she invests in), then (A) the unexercised

Option held by the Optionee (including the Option that has been or has not been vested) shall expire upon receipt of a written notice

from the Group Companies. If the Optionee has prepaid the Exercise Price for such expired Option, the Company shall by itself or cause

other Group Companies to repay such prepaid Exercise Price; (B) if the Optionee holds any Optioned Shares at the time, the Optionee

shall, within ten (10) business days upon his/her receipt of the written notice from the Company, sell the Optioned shares to the

Company or a third party designated by the Company at the Exercise Price of such Optioned Shares. For the purpose of this Section, “affiliate”

means the spouse and lineal descendants (whether with blood relationship or adoptive relationship) of a natural person and any trust created

and maintained solely for the benefits of such person, his/her spouse, parents or children. In addition, the Optionee shall pay the Group

Companies or the designated person of the Group Companies liquidated damages if he/she breaches the non-compete obligation, which liquidated

damages shall be calculated as follows: the compensation for non-compete already paid to such Optionee by the Group Companies ×

2 + the annual income of such Optionee for the year immediately prior to his/her resignation (before tax) × 10. If the Optionee

signs a separate non-compete agreement with the Group Companies, and the liquidated damages for breach of non-compete obligation agreed

therein is higher than those of this clause, then the liquidated damages payable by the Optionee to the Group Companies shall be subject

to those provided by such non-compete agreement.

(ii) If

the Optionee discloses the trade secrets of the Group Companies, or conducts related party transactions with the Group Companies and damages

the benefits of the Group Companies, then (A) the unexercised Option held by the Optionee (including the Option that has been or

has not been vested) shall expire upon receipt of the written notice from the Group Companies. If the Optionee has prepaid the Exercise

Price for such expired Option, the Company shall by itself or cause other Group Companies to repay such prepaid Exercise Price; (B) if

the Optionee holds any Optioned Shares at the time, the Optionee shall, within ten (10) business days upon his/her receipt of the

written notice from the Company, sell the Optioned shares to the Company or a third party designated by the Company at the Exercise Price

of such Optioned Shares. In respect of any loss caused due to the disclosure of the trade secrets of the Group Companies by the Optionee

or the conduct of related party transactions by the Optionee with the Group Companies, the Optionee shall make compensation to the Group

Companies.

(iii) Default.

Under any circumstance provided in Section 6(k)(i) or Section 6(k)(ii), the Optionee shall cooperate with the Company to

complete the repurchase of his/her Optioned Shares in accordance with Section 6(k)(i) or Section 6(k)(ii), as the case

may be, by the Company. If the repurchase is not completed within the stipulated time limit for the reason of the Optionee, the Optionee

shall be deemed in material breach and shall pay the Company or any other Group Company designated by the Company liquidated damages equivalent

to 0.05% of Fair Market Value of the Optioned Shares held by such Optionee on the date of repurchase notice for each day of delay.

(iv) For

the avoidance of any doubt, Sections 6(k)(i) shall not apply to Qualified Former Employees.

(l) Restrictions

on Transfer of Shares. Shares issued upon exercise of an Option shall be subject to such special forfeiture conditions, rights of

repurchase or redemption, rights of first refusal, market stand-offs, and other transfer restrictions as the Administrator may determine.

The restrictions described in the preceding sentence shall be set forth in the applicable Option Agreement and shall apply in addition

to any restrictions that may apply to holders of Shares generally.

7. Terms

and Conditions of Restricted Share Purchase Rights.

(a) Restricted

Share Purchase Agreement. Each Restricted Share Purchase Right under the Plan shall be evidenced by a Restricted Share Purchase Agreement,

respectively, between the Purchaser and the Company. Each Restricted Share Purchase Right shall be subject to all applicable terms and

conditions of the Plan and may be subject to any other terms and conditions that are not inconsistent with the Plan and that the Administrator

deems appropriate for inclusion in a Restricted Share Purchase Agreement, including without limitation, (i) the number of Shares

subject to such Restricted Share Purchase Agreement, as applicable, or a formula for determining such number, (ii) the purchase price

of the Shares, if any, and the means of payment for the Shares, (iii) the performance and other criteria, if any, and level of achievement

versus these criteria that shall determine the number of Shares granted, issued, retainable and/or vested, (iv) such terms and conditions

on the grant, issuance, vesting, settlement and/or forfeiture of the Shares as may be determined from time to time by the Administrator

and (v) restrictions on the transferability of the Award. The provisions of the various Restricted Share Purchase Agreements entered

into under the Plan need not be identical.

(b) Duration

of Offers of Restricted Share Purchase Rights. Any Restricted Share Purchase Rights granted under the Plan shall automatically expire

if not exercised by the Purchaser within such time as is specified in the Restricted Share Purchase Agreement.

(c) Purchase

Price. The Purchase Price, if any, shall be determined by the Administrator in its sole discretion. The Purchase Price, if any, shall

be payable in a form described in Section 9 hereof.

(d) Restrictions

on Transfer of Shares. Any Shares awarded or sold pursuant to Restricted Share Purchase Rights shall be subject to such special forfeiture

conditions, rights of repurchase or redemption, rights of first refusal, market stand-offs, and other transfer restrictions as the Administrator

may determine. The restrictions described in the preceding sentence shall be set forth in the applicable Restricted Share Purchase Agreement,

as applicable, and shall apply in addition to any restrictions that may apply to holders of Shares generally. Unless otherwise determined

by the Administrator and subject to Applicable Law, vesting of Shares acquired pursuant to a Restricted Share Purchase Agreement shall

be suspended during any unpaid leave of absence.

8. Withholding

Taxes. As a condition to the exercise of an Option or purchase of Restricted Shares, the Awardee (or in the case of the Awardee’s

death or in the event of a permissible transfer of Awards hereunder, the person exercising the Option or purchasing Restricted Shares)

shall make such arrangements as the Administrator may require for the satisfaction of any applicable withholding taxes arising in connection

with the exercise of an Option or purchase of Restricted Shares under the laws of any applicable jurisdictions including the Cayman Islands,

the PRC, the U.S., Hong Kong, the EU and any other jurisdictions. The Awardee (or in the case of the Awardee’s death or in the event

of a permissible transfer of Awards hereunder, the person exercising the Option or purchasing Restricted Shares) also shall make such

arrangements as the Administrator may require for the satisfaction of any applicable British Virgin Islands, PRC, Hong Kong, U.S., the

EU or non-Cayman Islands, non-PRC, non-Hong Kong, non-U.S. and non-EU withholding tax obligations that may arise in connection with the

disposition of Shares acquired by exercising an Option or purchasing Restricted Shares. The Company shall not be required to issue any

Shares under the Plan until the foregoing obligations are satisfied. Without limiting the generality of the foregoing, upon the exercise

of the Option or delivery of Restricted Shares or Share or Award, the Company shall have the right to withhold taxes from any compensation

or other amounts that the Company may owe to the Awardee, or to require the Awardee to pay to the Company the amount of any taxes that

the Company may be required to withhold with respect to the Shares issued to the Awardee. Without limiting the generality of the foregoing,

the Administrator in its discretion may authorize the Awardee to satisfy all or part of any withholding tax liability by (i) having

the Company withhold from the Shares that would otherwise be issued upon the exercise of an Option or purchase of Restricted Shares that

number of Shares having a Fair Market Value, as of the date the withholding tax liability arises, equal to the portion of the Company’s

withholding tax liability to be so satisfied or (ii) by delivering to the Company previously owned and unencumbered Shares having

a Fair Market Value, as of the date the withholding tax liability arises, equal to the amount of the Company’s withholding tax liability

to be so satisfied.

9. Payment

for Shares. The consideration to be paid for the Shares to be issued under the Plan, including the method of payment, shall be determined

by the Administrator (and, in the case of an Incentive Stock Option, shall be determined on the Date of Grant), subject to the provisions

in this Section 9.

(a) General

Rule. The entire Purchase Price or Exercise Price (as the case may be) for Shares issued under the Plan shall be payable in cash or

cash equivalents at the time when the Shares are purchased, except as otherwise provided in this Section 9.

(b) Surrender

of Shares. To the extent that an Option Agreement or a Restricted Share Purchase Agreement so provides, all or any part of the Exercise

Price or Purchase Price (as the case may be) may be paid by surrendering, or attesting to the ownership of, Shares that are already owned

by the Awardee. These Shares shall be surrendered to the Company in good form for transfer and shall be valued at their Fair Market Value

on the date the Option is exercised or Restricted Shares are purchased. The Awardee shall not surrender, or attest to the ownership of,

Shares in payment of the Exercise Price or Purchase Price (as the case may be) if this action would subject the Company to adverse accounting

consequences and is objected by the Company, as determined by the Administrator.

(c) Services

Rendered. At the discretion of the Administrator and to the extent so provided in the agreements, Shares may be awarded under the

Plan in consideration of services rendered to the Company or any Parent or Subsidiary prior to the Award.

(d) Exercise/Sale.

At the discretion of the Administrator and to the extent an Option Agreement so provides, and if the Shares are publicly traded, payment

may be made all or in part by the delivery (on a form prescribed by the Company) of an irrevocable direction to a securities broker approved

by the Company to sell Shares and to deliver all or part of the sales proceeds to the Company in payment of all or part of the Exercise

Price and any withholding taxes.

(e) Exercise/Pledge.

At the discretion of the Administrator and to the extent an Option Agreement so provides, and if the Shares are publicly traded, payment

may be made all or in part by the delivery (on a form prescribed by the Company) of an irrevocable direction to pledge Shares to a securities

broker or lender approved by the Company, as security for a loan, and to deliver all or part of the loan proceeds to the Company in payment

of all or part of the Exercise Price and any withholding taxes.

(f) Other

Forms of Consideration. At the discretion of the Administrator and to the extent an Option Agreement or a Restricted Share Purchase

Agreement so provides, all or a portion of the Exercise Price or Purchase Price may be paid by any other form of consideration and method

of payment to the extent permitted by Applicable Law.

10. Non-transferability

of Awards. Unless otherwise determined by the Administrator and so provided in this Plan, the applicable Option Agreement or Restricted

Share Purchase Agreement (or be amended to provide), no Award shall be sold, pledged, assigned, hypothecated, transferred, or disposed

of in any manner (whether by operation of law or otherwise) other than (i) by inheritance or distribution by will or (except in the

case of an Incentive Stock Option) pursuant to an effective civil judgment or ruling or (ii) by trusts or companies established in

connection with any employee benefit plan of the Company (including the Plan) for the benefit of a Service Provider or Service Providers,

in each case of (i) and (ii), subject to Applicable Law, and shall not be subject to execution, attachment, or similar process. In

the event the Administrator in its sole discretion makes an Award transferable, only a Non-statutory Stock Option, Restricted Share Purchase

Right may be transferred provided such Award is transferred without payment of consideration to members of the Awardee’s immediate

family (as such term is defined in Rule 16a-1(e) of the Exchange Act) or to trusts or partnerships established exclusively for

the benefit of the Awardee and the members of the Awardee’s immediate family, all as permitted by Applicable Law. Upon any attempt

to pledge, assign, hypothecate, transfer, or otherwise dispose of any Award or of any right or privilege conferred by this Plan contrary

to the provisions hereof, or upon the sale, levy or attachment or similar process upon the rights and privileges conferred by this Plan,

such Award shall thereupon terminate and become null and void. Incentive Stock Options may be exercised during the lifetime of the Awardee

only by the Awardee.

11. Rights

as a Member. Until the Shares actually are issued (as evidenced by the appropriate entry on the books of the Company or of a duly

authorized transfer agent of the Company), no right to receive dividends or any other rights as a member shall exist with respect to the

Shares, notwithstanding the exercise of the Award. No adjustment shall be made for a dividend or other right for which the record date

is prior to the date the Shares are issued, except as provided in Section 12 of the Plan.

12. Adjustment

of Shares.

(a) Changes

in Capitalization. Subject to any required action by the members of the Company in accordance with Applicable Law, the class(es) and

number and type of Shares that have been authorized for issuance under the Plan but as to which no Awards have yet been granted or that

have been returned to the Plan upon cancellation or expiration of an Award, and the class(es), number, and type of Shares covered by each

outstanding Award or outstanding award under the Prior Plans (the “Prior Awards”), as well as the price per Share covered

by each outstanding Award or Prior Award, shall be proportionately adjusted for any increase, decrease, or change in the number or type

of outstanding Shares or other securities of the Company or exchange of outstanding Shares or other securities of the Company into or

for a different number or type of shares or other securities of the Company or successor entity, or for other property (including, without

limitation, cash) or other change to the Shares resulting from a share split, reverse share split, share dividend, dividend in property

other than cash, combination of shares, exchange of shares, consolidation, recapitalization, reincorporation, reorganization, change in

corporate structure, reclassification, or other distribution of the Shares effected without receipt of consideration by the Company; provided,

however, that the conversion of any convertible securities of the Company shall not be deemed to have been “effected without receipt

of consideration.” The adjustment contemplated in this Section 12(a) shall be made by the Board, whose determination shall

be final, binding and conclusive. Except as expressly provided herein, no issuance by the Company of equity securities of the Company

of any class, or securities convertible into equity securities of the Company of any class, shall affect, and no adjustment by reason

thereof shall be made with respect to, the number, type, or price of Shares subject to an Award or Prior Award. Where an adjustment under

this Section 12(a) is made to an Incentive Stock Option, the adjustment shall be made in a manner that will not be considered

a “modification” under the provisions of Section 424(h)(3) of the Code.

(b) Dissolution

or Liquidation. In the event of the proposed dissolution or liquidation of the Company, the Administrator shall notify each Awardee

and awardee of the Prior Awards as soon as practicable prior to the effective date of such proposed transaction. The Administrator in

its discretion may provide for an Optionee to have the right to exercise his or her Option, or an optionee to have the right to exercise

his or her outstanding option under the Prior Plans, until fifteen (15) days prior to the proposed dissolution or liquidation as to all

of the Optioned Shares covered thereby or optioned Shares covered by the Prior Plans, including Shares as to which the Option or option

under the Prior Plans would not otherwise be exercisable. In addition, the Administrator may provide that any Company repurchase or redemption

option applicable to any Shares purchased upon exercise of an Option or Restricted Shares purchased under a Restricted Share Purchase

Right shall lapse as to all such Shares, provided the proposed dissolution or liquidation takes place at the time and in the manner contemplated.

To the extent any Options or options under the Prior Plans have not been previously exercised, and all Restricted Shares covered by a

Restricted Share Purchase Right or restricted shares covered by a restricted share purchase right under the Prior Plans have not been

purchased, such Awards and Prior Awards will terminate immediately prior to the consummation of such proposed action.

(c) Corporate

Transactions. Unless the Option Agreement or Restricted Share Purchase Agreement or any other agreement between the Company and the

Optionee provides otherwise, if the Board or the Committee anticipates the occurrence, or upon the occurrence, of a Corporate Transaction,

the Board or the Committee may, in its sole discretion, provide for (i) any and all Awards outstanding hereunder and any and all

Prior Awards to terminate at a specific time in the future and shall give each Awardee and awardee of the Prior Awards (as applicable)

the right to exercise the vested portion of such Awards and Prior Awards (as applicable) during a period of time as the Board or the Committee

shall determine, or (ii) the purchase of any Awards or Prior Awards for an amount of cash equal to the amount that could have been

attained upon the exercise of such Awards or Prior Awards (and, for the avoidance of doubt, if as of such date the Board or the Committee

determines in good faith that no amount would have been attained upon the exercise of such Awards or Prior Awards, then such Awards or

Prior Awards may be terminated by the Company without payment), or (iii) the replacement of such Awards or Prior Awards with other

rights or property selected by the Board or the Committee in its sole discretion or the assumption of or substitution of such Awards or

Prior Awards by the successor or surviving corporation, or a Parent or Subsidiary thereof, with appropriate adjustments as to the number

and kind of Shares and prices, or (iv) payment of such Awards or Prior Awards in cash based on the value of Shares on the date of

the Corporate Transaction plus reasonable interest on the Awards or Prior Awards through the date as determined by the Board or the Committee

when such Awards or Prior Awards would otherwise be vested or have been paid in accordance with its original terms, if necessary to comply

with Section 409A of the Code.

(d) Outstanding

Awards – Other Changes. In the event of any other change in the capitalization of the Company or corporate change other than

those specifically referred to in this Section 12, the Board or the Committee may, in its absolute discretion, make such adjustments

in the number and class of shares subject to Awards or Prior Awards outstanding on the date on which such change occurs and in the per

Share grant of each Award or Prior Award, Exercise Price of each Option or Purchase Price of each Restricted Share Purchase Right as the

Board or the Committee may consider appropriate to prevent dilution or enlargement of rights.

(e) Reservation

of Rights. Except as provided in this Section 12 and in the applicable Option Agreement or Restricted Share Purchase Agreement,

an Awardee or awardee of any Prior Awards shall have no rights by reason of (i) any subdivision or consolidation of Shares or other

securities of any class, (ii) the payment of any dividend, or (iii) any other increase or decrease in the number of Shares or

other securities of any class. Any issuance by the Company of equity securities of any class, or securities convertible into equity securities

of any class, shall not affect, and no adjustment by reason thereof shall be made with respect to, the number or Exercise Price of Optioned

Shares or exercise price of optioned Shares under Prior Plans. The grant of an Option, Restricted Share Purchase Right shall not affect

in any way the right or power of the Company to make adjustments, reclassifications, reorganizations, or changes of its capital or business

structure, to merge or consolidate or to dissolve, liquidate, sell, or transfer all or any part of its business or assets.

13. Date

of Grant. The Date of Grant of an Award shall, for all purposes, be the date on which the applicable Option Agreement or Restricted

Share Purchase Agreement is duly executed and delivered by the Company and the applicable Awardee, or such other later date as is determined

by the Administrator; provided, however, that the Date of Grant of an Incentive Stock Option shall be no earlier than the date on which

the Service Provider becomes an Employee.

14. Securities

Law Requirements.

(a) Legal

Compliance. Notwithstanding any other provision of the Plan or any agreement entered into by the Company pursuant to the Plan, the

Company shall not be obligated, and nor shall it have any liability for failure to deliver any Shares under the Plan unless the issuance

and delivery of Shares comply with (or are exempt from) all Applicable Law, including, without limitation, the applicable securities laws

in the PRC, and the Cayman Islands, the Securities Act, U.S. state securities laws and regulations, the Hong Kong Listing Rules, the Singapore

Listing Manual and the regulations of any stock exchange or other securities market on which the Company’s securities may then be

traded, and shall be further subject to the approval of counsel for the Company with respect to such compliance.

(b) Investment

Representations. Shares delivered under the Plan shall be subject to transfer restrictions, and the person acquiring the Shares shall,

as a condition to the exercise of an Option or the purchase or acquisition of Restricted Shares if requested by the Company, provide such

assurances and representations to the Company as the Company may deem necessary or desirable to assure compliance with Applicable Law,

including, without limitation, the representation and warranty at the time of acquisition of Shares that the Shares are being acquired

only for investment purposes and without any present intention to sell, transfer, or distribute the Shares.

15. Inability

to Obtain Authority. The inability of the Company to obtain authority from any regulatory body having jurisdiction, which authority

is deemed by the Company’s counsel to be necessary to the lawful issuance and sale of any Shares hereunder, shall relieve the Company

of any liability in respect of the failure to issue or sell such Shares as to which such requisite authority shall not have been obtained.

16. Approval

by Board. The Plan shall be subject to approval by the Board. Such Board’s approval shall be obtained in the degree and manner

required under Applicable Law.

17. Duration

and Amendment.

(a) Term

of Plan. The Plan shall become effective on February 7, 2024. Unless sooner terminated under Section 17(b) hereof,

the Plan shall continue in effect for a term of five (5) years.

(b) Amendment

and Termination. The Board may at any time amend, alter, suspend, or terminate the Plan.

(c) Approval

by Members. The Board shall obtain approval of the members of this Plan or any Plan amendment to the extent necessary and desirable

to comply with Applicable Law.

(d) Effect

of Amendment or Termination. No amendment, alteration, suspension, or termination of the Plan shall materially and adversely impair

the rights of any Awardee with respect to an outstanding Award, unless mutually agreed otherwise between the Awardee and the Administrator,

which agreement must be in writing and signed by the Awardee and the Company. Termination of the Plan shall not affect the Administrator’s

ability to exercise the powers granted to it hereunder with respect to Awards granted under the Plan prior to the date of such termination.

No Shares shall be issued or sold under the Plan after the termination thereof, except upon exercise of an Award granted prior to the

termination of the Plan.

18. Legending

Share Certificates. In order to enforce any restrictions imposed upon Shares issued upon the exercise of Options or the acquisition

of Restricted Shares, including, without limitations, the restrictions described in Sections 6(l), 7(d), and 14(b) hereof,

the Administrator may cause a legend or legends to be placed on any share certificates representing the Shares, which legend or legends

shall make appropriate reference to the restrictions, including, without limitation, a restriction against sale of the Shares for any

period as may be required by Applicable Law.

19. Clawback

Policy or Requirement. To the extent required by Applicable Law or stock exchange listing standards, or as otherwise determined by

the Company, any Award granted, vested or paid under the Plan shall be subject to the terms and conditions of any clawback policy or requirement

of the Company, which may provide for the recovery of erroneously awarded compensation received by current or former executive officers

in connection with a financial restatement, regardless of fault or misconduct. Notwithstanding any provision of the Plan to the contrary,

the Company reserves the right, in its sole discretion, to adopt, terminate, suspend or amend any such clawback policy or requirement

without consent of any Awardee.

20. No

Retention Rights. Neither the Plan nor any Award shall confer upon any Awardee any right to continue his or her relationship as a

Service Provider with the Company for any period of specific duration or interfere in any way with his or her right or the right of the

Company (or any Parent or Subsidiary employing or retaining the Awardee), which rights are hereby expressly reserved by each, to terminate

this relationship at any time, with or without cause, and with or without notice.

21. No

Registration Rights. The Company may, but shall not be obligated to, register or qualify the sale of Shares under the Securities Act,

the Hong Kong Listing Rules, the Singapore Listing Manual or any other Applicable Law. The Company shall not be obligated to take any

affirmative action in order to cause the sale of Shares under this Plan to comply with any law.

22. No

Trust or Fund Created. Neither the Plan nor any Award shall create or be construed to create a trust or separate fund of any kind

or a fiduciary relationship between the Company or any Parent or Subsidiary and an Awardee or any other person. To the extent that any

Awardee acquires a right to receive payments from the Company or any Parent or Subsidiary pursuant to an Award, such right shall be no

greater than the right of any unsecured general creditor of the Company, a Parent, or any Subsidiary.

23. No

Rights to Awards. No Awardee, eligible Service Provider, or other person shall have any claim to be granted any Award under the Plan,

and there is no obligation for uniformity of treatment of a Service Provider, Awardee, or holders or beneficiaries of Awards under the

Plan. The terms and conditions of Awards need not be the same with respect to any Awardee or with respect to different Awardees.

24. Language.

This document is prepared in English. The Chinese language translation is provided for reference only. In the event there is

any discrepancy between the two versions, the English version shall prevail.

[Remainder of Page Intentionally Left Blank]

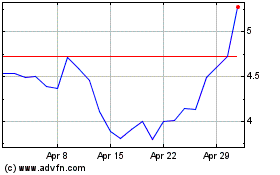

NIO (NYSE:NIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

NIO (NYSE:NIO)

Historical Stock Chart

From Apr 2023 to Apr 2024