false000004676500000467652024-01-292024-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 29, 2024

HELMERICH & PAYNE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| DE | | 1-4221 | | 73-0679879 |

(State or other jurisdiction of

Incorporation) | | (Commission File

Number) | | (I.R.S. Employer

Identification No.) |

1437 South Boulder Avenue, Suite 1400

Tulsa, OK 74119

(Address of principal executive offices and zip code)

(918) 742-5531

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock ($0.10 par value) | HP | NYSE |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On January 29, 2024, Helmerich & Payne, Inc. issued a press release announcing its financial results for its first fiscal quarter ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K. This information is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| | | | | |

| Exhibit Number | DESCRIPTION |

| 99.1 | |

| 104 | Cover page Interactive Data File - the cover page XBRL tags are embedded within the inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | HELMERICH & PAYNE, INC. | |

| | | |

| By: | /s/ William H. Gault | |

| | Name: | William H. Gault |

| | Title: | Corporate Secretary

Date: January 29, 2024 |

NEWS RELEASE

FOR IMMEDIATE RELEASE: January 29, 2024

HELMERICH & PAYNE, INC. ANNOUNCES FISCAL FIRST QUARTER RESULTS

•The North America Solutions ("NAS") segment exited the first quarter of fiscal year 2024 with 151 active rigs and experienced an increase in revenue per day of approximately $1,000/day to $38,300/day on a sequential basis, while direct margins(1) per day increased by approximately $1,200/day to $18,700/day

•The Company reported fiscal first quarter net income of $95 million, or $0.94 per diluted share; including select items(2) of $(0.03) per diluted share

•Quarterly NAS operating income increased $16 million sequentially, while direct margins(1) increased $17 million to approximately $256 million, as revenues increased by $19 million to $594 million and expenses increased by $2 million to $338 million

•H&P's NAS segment anticipates exiting the second quarter of fiscal year 2024 between 154-159 active rigs

•The Company recently received preliminary notification of an award for seven super-spec rigs in the Middle East

•During the first fiscal quarter, the Company returned approximately $90 million of capital to shareholders as follows: $25 million in base dividends, $17 million in supplemental dividends and $47 million in share repurchases(3)

•On December 6, 2023, the Board of Directors of the Company declared a quarterly base cash dividend of $0.25 per share and a supplemental cash dividend of $0.17 per share; both dividends are payable on February 27, 2024 to stockholders of record at the close of business on February 13, 2024

Helmerich & Payne, Inc. (NYSE: HP) reported net income of $95 million, or $0.94 per diluted share, from operating revenues of $677 million for the quarter ended December 31, 2023, compared to net income of $78 million, or $0.77 per diluted share, from operating revenues of $660 million for the quarter ended September 30, 2023. The net income per diluted share for the first quarter of fiscal 2024 and fourth quarter of fiscal 2023 include $(0.03) and $0.08 of after-tax losses and gains, respectively, comprised of select items(2). For the first quarter of fiscal year 2024, select items were comprised of:

•$(0.03) of after-tax losses related to the non-cash fair market value adjustments to our equity investments

Net cash provided by operating activities was $175 million for the first quarter of fiscal year 2024 compared to net cash provided by operating activities of $215 million for the fourth quarter of fiscal year 2023.

Helmerich & Payne | 1437 South Boulder Ave. | Suite 1400

Tulsa, OK 74119 | 918.588.5190 | helmerichpayne.com

Page 2

News Release

January 29, 2024

President and CEO John Lindsay commented, "The Company performed well both operationally and financially during the first fiscal quarter of 2024 despite the persistent volatility in crude oil and natural gas prices. During the quarter, the Company's stock price continued to trade as it has historically, with a strong correlation to crude oil prices and industry rig count. Decoupling from these traditional macro measures will require proving our ability to maintain returns above our cost of capital through the cycles, and I believe our fiscal first quarter results are another step in that direction.

"Expectations for modest incremental rig adds during the quarter were further tempered to some extent by the ongoing churn we are experiencing in the market and, as a result, we exited the December quarter at 151 active rigs, towards the lower end of our guidance range. We expect this churn to continue in the March quarter as E&P budgets are being reset in a relatively weaker commodity price environment, particularly on the natural gas side. From a North America Solutions margin perspective, the Company delivered direct margins that were higher on a sequential basis, indicating that our direct margins, like our rig count, may have experienced a trough during our fourth fiscal quarter of 2023. Looking out, we project our North America Solutions direct margins to remain relatively flat to up slightly during the March quarter.

"In our International Solutions segment we are very excited regarding recent developments that are tangible proof of our execution on our international expansion strategy. The Company recently received preliminary notification, subject to finalization of contractual agreements, that it has been awarded seven super-spec FlexRigs for work in a drilling campaign in the Middle East. These rigs are expected to commence operations shortly after delivery, which is currently scheduled for the first half of fiscal 2025. Additionally, these rigs will be sourced from our idle super-spec rigs in the U.S., converted to walking configurations, and further equipped to suit contractual specifications. Furthermore, in the Middle East we have been successful in contracting an additional rig in Bahrain. The super-spec rig to be utilized for this work is already located in the region as part of our Middle East hub and it is expected to commence operations during the summer of 2024. These are positive outcomes in our Middle East expansion strategy, and we look forward to further growth in the future."

Senior Vice President and CFO Mark Smith also commented, "During the quarter, we executed on our fiscal 2024 supplemental shareholder return plan, returning approximately $42 million to shareholders in the form of base and supplemental dividends. Additionally, we exhausted our calendar 2023 share repurchase authorization of 7 million shares by repurchasing roughly 1.3 million shares for approximately $47 million. At the start of the new calendar year, our share repurchase authorization was reset to 4 million shares. These actions demonstrate our prioritization of returning cash to shareholders and highlight our shareholder capital allocation strategy.

"Given the outlook for a lower level of crude oil production growth in the U.S. in 2024, combined with the recent volatility in commodity prices, we expect our rig count will only grow modestly in fiscal 2024. That is something we had already contemplated as part of our fiscal 2024 capex budget, so we do not currently believe we need to modify our capex plans. We believe current conditions highlight the continued need to remain focused on our NAS margins and reinforce support for the international expansion strategy we are undertaking. Along those lines, the planned capex for the recent seven-rig award was included in our fiscal 2024 capex budget that we announced last October. Furthermore, this award supports our goals of not only expanding internationally, but also reducing the available supply of our idle super-spec rigs in the U.S. market."

John Lindsay concluded, “Every year in this industry new challenges arise, many resulting from supply and demand dynamics that ultimately result in crude oil and natural gas price volatility. As difficult as it is to manage in these times, we also see these headwinds as opportunities to show-case the exceptional capabilities of our fleet and to demonstrate the value our technology, processes and people bring to providing drilling solutions for our customers. For our part, we will remain focused on our goals and execute toward their achievement in the long-term. Our recent successes on the international front are evidence of this with our announcement of securing work for eight rigs in the Middle East, subject to finalization of contractual agreements. Including the one rig contracted in August 2023, we now have plans to put nine additional rigs to work in the Middle East, which when they begin operations will nearly double our existing international active rig count."

Page 3

News Release

January 29, 2024

Operating Segment Results for the First Quarter of Fiscal Year 2024

North America Solutions:

This segment had operating income of $144.5 million compared to operating income of $128.5 million during the previous quarter. The increase in operating income was primarily attributable to sequentially higher operating revenues offset by only a modest increase in direct operating expenses. Direct margin(1) increased by $17.3 million to $256.1 million sequentially.

International Solutions:

This segment had operating income of $5.4 million compared to an operating loss of $5.0 million during the previous quarter. The increase in operating income was mainly due to prior quarter results being adversely impacted by costs associated with preparing U.S. rigs for international deployment, additional expat expenses and a relatively large foreign currency loss. Direct margin(1) during the first fiscal quarter was $10.2 million compared to a $0.5 million loss during the previous quarter. Current quarter results included a $1.8 million foreign currency loss compared to a $4.6 million foreign currency loss in the previous quarter.

Offshore Gulf of Mexico:

This segment had operating income of $3.1 million compared to operating income of $4.7 million during the previous quarter. Direct margin(1) for the quarter was $6.0 million compared to $7.4 million in the previous quarter primarily driven by the anticipated activity decline.

Operational Outlook for the Second Quarter of Fiscal Year 2024

North America Solutions:

•We expect North America Solutions direct margins(1) to be between $255-$275 million

•We expect to exit the quarter between approximately 154-159 contracted rigs

International Solutions:

•We expect International Solutions direct margins(1) to be between $1-$3 million, exclusive of any foreign exchange gains or losses; the projected sequential decline is due to one less rig operating in both Argentina and Colombia and expenses related to preparing rigs for export

Offshore Gulf of Mexico:

•We expect Offshore Gulf of Mexico direct margins(1) to be between $4-$7 million

Other Estimates for Fiscal Year 2024

•Gross capital expenditures are still expected to be approximately $450 to $500 million;

▪ongoing asset sales that include reimbursements for lost and damaged tubulars and sales of other used drilling equipment offset a portion of the gross capital expenditures, and are still expected to total approximately $50 million in fiscal year 2024

•Depreciation for fiscal year 2024 is still expected to be approximately $390 million

•Research and development expenses for fiscal year 2024 are still expected to be roughly $30 million

•General and administrative expenses for fiscal year 2024 are still expected to be approximately $230 million

•Cash taxes to be paid in fiscal year 2024 are still expected to be approximately $150-$200 million

Page 4

News Release

January 29, 2024

Select Items(1) Included in Net Income per Diluted Share

First quarter of fiscal year 2024 net income of $0.94 per diluted share included $(0.03) in after-tax losses comprised of the following:

•$(0.03) of non-cash after-tax losses related to fair market value adjustments to equity investments

Fourth quarter of fiscal year 2023 net income of $0.77 per diluted share included $0.08 in after-tax gains comprised of the following:

•$0.13 of non-cash after-tax gains related to fair market value adjustments to equity investments

•$0.05 of after-tax gains related to net settlements and accruals of certain outstanding claims

•$(0.01) of non-cash after-tax losses related to the change in the fair value of certain contingent liabilities

•$(0.09) of after-tax losses on a Blue Chip Swap transaction to repatriate cash to the U.S. from Argentina

Conference Call

A conference call will be held on Tuesday, January 30, 2024 at 11:00 a.m. (ET) with John Lindsay, President and CEO, Mark Smith, Senior Vice President and CFO, and Dave Wilson, Vice President of Investor Relations, to discuss the Company’s first quarter fiscal year 2024 results. Dial-in information for the conference call is (800) 895-3367 for domestic callers or (785) 424-1061 for international callers. The call access code is ‘Helmerich’. You may also listen to the conference call that will be broadcast live over the Internet by logging on to the Company’s website at http://www.helmerichpayne.com and accessing the corresponding link through the investor relations section by clicking on “Investors” and then clicking on “News and Events - Events & Presentations” to find the event and the link to the webcast.

About Helmerich & Payne, Inc.

Founded in 1920, Helmerich & Payne, Inc. (H&P) (NYSE: HP) is committed to delivering industry leading levels of drilling productivity and reliability. H&P operates with the highest level of integrity, safety and innovation to deliver superior results for its customers and returns for shareholders. Through its subsidiaries, the Company designs, fabricates and operates high-performance drilling rigs in conventional and unconventional plays around the world. H&P also develops and implements advanced automation, directional drilling and survey management technologies. At December 31, 2023, H&P's fleet included 233 land rigs in the United States, 22 international land rigs and seven offshore platform rigs. For more information, see H&P online at www.helmerichpayne.com.

Page 5

News Release

January 29, 2024

Forward-Looking Statements

This release includes “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, and such statements are based on current expectations and assumptions that are subject to risks and uncertainties. All statements other than statements of historical facts included in this release, including, without limitation, statements regarding the registrant’s business strategy, future financial position, operations outlook, future cash flow, future use of generated cash flow, dividend amounts and timing, supplemental shareholder return plans and amounts of any future dividends, future share repurchases, investments, active rig count projections, projected costs and plans, objectives of management for future operations, contract terms, financing and funding, capex spending and budgets, outlook for domestic and international markets, conversion of rig awards to definitive agreements on the terms and timing currently expected, and actions by customers are forward-looking statements. For information regarding risks and uncertainties associated with the Company’s business, please refer to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and other disclosures in the Company’s SEC filings, including but not limited to its annual report on Form 10‑K and quarterly reports on Form 10‑Q. As a result of these factors, Helmerich & Payne, Inc.’s actual results may differ materially from those indicated or implied by such forward-looking statements. Investors are cautioned not to put undue reliance on such statements. We undertake no duty to publicly update or revise any forward-looking statements, whether as a result of new information, changes in internal estimates, expectations or otherwise, except as required under applicable securities laws.

Helmerich & Payne uses its Investor Relations website as a channel of distribution for material company information. Such information is routinely posted and accessible on its Investor Relations website at www.helmerichpayne.com. Information on our website is not part of this release.

Note Regarding Trademarks. Helmerich & Payne, Inc. owns or has rights to the use of trademarks, service marks and trade names that it uses in conjunction with the operation of its business. Some of the trademarks that appear in this release or otherwise used by H&P include FlexRig, which may be registered or trademarked in the United States and other jurisdictions.

(1) Direct margin, which is considered a non-GAAP metric, is defined as operating revenues (less reimbursements) less direct operating expenses (less reimbursements) and is included as a supplemental disclosure. We believe it is useful in assessing and understanding our current operational performance, especially in making comparisons over time. See Non-GAAP Measurements for a reconciliation of segment operating income(loss) to direct margin. Expected direct margin for the second quarter of fiscal 2024 is provided on a non-GAAP basis only because certain information necessary to calculate the most comparable GAAP measure is unavailable due to the uncertainty and inherent difficulty of predicting the occurrence and the future financial statement impact of certain items. Therefore, as a result of the uncertainty and variability of the nature and amount of future items and adjustments, which could be significant, we are unable to provide a reconciliation of expected direct margin to the most comparable GAAP measure without unreasonable effort.

(2) Select items are considered non-GAAP metrics and are included as a supplemental disclosure as the Company believes identifying and excluding select items is useful in assessing and understanding current operational performance, especially in making comparisons over time involving previous and subsequent periods and/or forecasting future periods results. Select items are excluded as they are deemed to be outside the Company's core business operations. See Non-GAAP Measurements.

(3) During the first fiscal quarter of fiscal 2024, H&P repurchased approximately 1.3 million shares for approximately $47 million.

Contact: Dave Wilson, Vice President of Investor Relations

investor.relations@hpinc.com

(918) 588‑5190

Page 6

News Release

January 29, 2024

| | | | | | | | | | | | | | | | | | | | | |

| HELMERICH & PAYNE, INC. |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| Three Months Ended | | |

| (in thousands, except per share amounts) | December 31, | | September 30, | | December 31, | | |

| 2023 | | 2023 | | 2022 | | | | |

| OPERATING REVENUES | | | | | | | | | |

| Drilling services | $ | 674,565 | | | $ | 657,258 | | | $ | 717,170 | | | | | |

| Other | 2,582 | | | 2,348 | | | 2,467 | | | | | |

| 677,147 | | | 659,606 | | | 719,637 | | | | | |

| OPERATING COSTS AND EXPENSES | | | | | | | | | |

| Drilling services operating expenses, excluding depreciation and amortization | 403,303 | | | 408,555 | | | 428,251 | | | | | |

| Other operating expenses | 1,137 | | | 1,160 | | | 1,126 | | | | | |

| Depreciation and amortization | 93,991 | | | 94,593 | | | 96,655 | | | | | |

| Research and development | 8,608 | | | 7,326 | | | 6,933 | | | | | |

| Selling, general and administrative | 56,577 | | | 56,076 | | | 48,455 | | | | | |

| Asset impairment charges | — | | | — | | | 12,097 | | | | | |

| | | | | | | | | |

| Gain on reimbursement of drilling equipment | (7,494) | | | (10,233) | | | (15,724) | | | | | |

| Other (gain) loss on sale of assets | (2,443) | | | 8,410 | | | (2,379) | | | | | |

| 553,679 | | | 565,887 | | | 575,414 | | | | | |

| OPERATING INCOME | 123,468 | | | 93,719 | | | 144,223 | | | | | |

| Other income (expense) | | | | | | | | | |

| Interest and dividend income | 10,734 | | | 7,885 | | | 4,705 | | | | | |

| Interest expense | (4,372) | | | (4,365) | | | (4,355) | | | | | |

| Gain (loss) on investment securities | (4,034) | | | 5,176 | | | (15,091) | | | | | |

| | | | | | | | | |

| Other | (543) | | | 10,299 | | | 58 | | | | | |

| 1,785 | | | 18,995 | | | (14,683) | | | | | |

| Income before income taxes | 125,253 | | | 112,714 | | | 129,540 | | | | | |

| Income tax expense | 30,080 | | | 35,092 | | | 32,395 | | | | | |

| NET INCOME | $ | 95,173 | | | $ | 77,622 | | 0 | $ | 97,145 | | | | | |

| | | | | | | | | |

| Basic earnings per common share | $ | 0.95 | | | $ | 0.78 | | | $ | 0.92 | | | | | |

| | | | | | | | | |

| Diluted earnings per common share | $ | 0.94 | | | $ | 0.77 | | | $ | 0.91 | | | | | |

| | | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | | |

| Basic | 99,143 | | | 99,427 | | | 105,248 | | | | | |

| Diluted | 99,628 | | | 99,884 | | | 106,104 | | | | | |

Page 7

News Release

January 29, 2024

| | | | | | | | | | | |

| HELMERICH & PAYNE, INC. |

| UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

| December 31, | | September 30, |

| (in thousands except share data and share amounts) | 2023 | | 2023 |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 214,104 | | | $ | 257,174 | |

| Restricted cash | 65,137 | | | 59,064 | |

| Short-term investments | 84,121 | | | 93,600 | |

Accounts receivable, net of allowance of $3,948 and $2,688, respectively | 435,819 | | | 404,188 | |

| Inventories of materials and supplies, net | 101,419 | | | 94,227 | |

| Prepaid expenses and other, net | 88,080 | | | 97,727 | |

| Assets held-for-sale | — | | | 645 | |

| Total current assets | 988,680 | | | 1,006,625 | |

| | | |

| Investments | 263,443 | | | 264,947 | |

| Property, plant and equipment, net | 2,970,371 | | | 2,921,695 | |

| Other Noncurrent Assets: | | | |

| Goodwill | 45,653 | | | 45,653 | |

| Intangible assets, net | 58,968 | | | 60,575 | |

| Operating lease right-of-use asset | 62,254 | | | 50,400 | |

| Other assets, net | 31,959 | | | 32,061 | |

| Total other noncurrent assets | 198,834 | | | 188,689 | |

| | | |

| Total assets | $ | 4,421,328 | | | $ | 4,381,956 | |

| | | |

| LIABILITIES & SHAREHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 157,302 | | | $ | 130,852 | |

| Dividends payable | 41,993 | | | 25,194 | |

| | | |

| | | |

| Accrued liabilities | 269,691 | | | 262,885 | |

| Total current liabilities | 468,986 | | | 418,931 | |

| | | |

| Noncurrent Liabilities: | | | |

| Long-term debt, net | 545,292 | | | 545,144 | |

| Deferred income taxes | 510,015 | | | 517,809 | |

| Other | 137,389 | | | 128,129 | |

| | | |

| Total noncurrent liabilities | 1,192,696 | | | 1,191,082 | |

| | | |

| Shareholders' Equity: | | | |

Common stock, $0.10 par value, 160,000,000 shares authorized, 112,222,865 shares issued as of December 31, 2023 and September 30, 2023, and 98,623,747 and 99,426,526 shares outstanding as of December 31, 2023 and September 30, 2023, respectively | 11,222 | | | 11,222 | |

Preferred stock, no par value, 1,000,000 shares authorized, no shares issued | — | | | — | |

| Additional paid-in capital | 506,672 | | | 525,369 | |

| Retained earnings | 2,743,794 | | | 2,707,715 | |

| Accumulated other comprehensive loss | (7,847) | | | (7,981) | |

Treasury stock, at cost, 13,599,118 shares and 12,796,339 shares as of December 31, 2023 and September 30, 2023, respectively | (494,195) | | | (464,382) | |

| Total shareholders’ equity | 2,759,646 | | | 2,771,943 | |

| Total liabilities and shareholders' equity | $ | 4,421,328 | | | $ | 4,381,956 | |

Page 8

News Release

January 29, 2024

| | | | | | | | | | | | | |

| HELMERICH & PAYNE, INC. | | |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | | |

| Three Months Ended December 31, |

| (in thousands) | 2023 | | 2022 | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | |

| Net income | $ | 95,173 | | | $ | 97,145 | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation and amortization | 93,991 | | | 96,655 | | | |

| Asset impairment charges | — | | | 12,097 | | | |

| | | | | |

| | | | | |

| Provision for credit loss | 1,309 | | | 3,358 | | | |

| Stock-based compensation | 7,672 | | | 8,273 | | | |

| Loss on investment securities | 4,034 | | | 15,091 | | | |

| Gain on reimbursement of drilling equipment | (7,494) | | | (15,724) | | | |

| Other gain on sale of assets | (2,443) | | | (2,379) | | | |

| | | | | |

| Deferred income tax expense (benefit) | (7,829) | | | 188 | | | |

| Other | (856) | | | 7,274 | | | |

| Changes in assets and liabilities | (8,759) | | | (36,603) | | | |

| Net cash provided by operating activities | 174,798 | | | 185,375 | | | |

| | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | |

| Capital expenditures | (136,411) | | | (96,027) | | | |

| | | | | |

| Purchase of short-term investments | (46,250) | | | (41,641) | | | |

| Purchase of long-term investments | (291) | | | (16,237) | | | |

| | | | | |

| Proceeds from sale of short-term investments | 57,956 | | | 40,758 | | | |

| | | | | |

| | | | | |

| Proceeds from asset sales | 11,929 | | | 30,978 | | | |

| | | | | |

| | | | | |

| Net cash used in investing activities | (113,067) | | | (82,169) | | | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | |

| Dividends paid | (42,294) | | | (51,764) | | | |

| | | | | |

| | | | | |

| | | | | |

| Payments for employee taxes on net settlement of equity awards | (8,820) | | | (9,483) | | | |

| Payment of contingent consideration from acquisition of business | (250) | | | (250) | | | |

| | | | | |

| | | | | |

| Share repurchases | (47,364) | | | (39,060) | | | |

| | | | | |

| Net cash used in financing activities | (98,728) | | | (100,557) | | | |

| Net increase (decrease) in cash and cash equivalents and restricted cash | (36,997) | | | 2,649 | | | |

| Cash and cash equivalents and restricted cash, beginning of period | 316,238 | | | 269,009 | | | |

| Cash and cash equivalents and restricted cash, end of period | $ | 279,241 | | | $ | 271,658 | | | |

Page 9

News Release

January 29, 2024

| | | | | | | | | | | | | | | | | | | | | |

| HELMERICH & PAYNE, INC. |

| SEGMENT REPORTING |

| Three Months Ended | | |

| December 31, | | September 30, | | December 31, | | |

| (in thousands, except operating statistics) | 2023 | | 2023 | | 2022 | | | | |

| NORTH AMERICA SOLUTIONS | | | | | | | | | |

| Operating revenues | $ | 594,282 | | | $ | 575,188 | | | $ | 627,163 | | | | | |

| Direct operating expenses | 338,208 | | | 336,374 | | | 366,855 | | | | | |

| Depreciation and amortization | 87,019 | | | 87,883 | | | 89,814 | | | | | |

| Research and development | 8,689 | | | 7,406 | | | 7,059 | | | | | |

| Selling, general and administrative expense | 15,876 | | | 15,003 | | | 14,190 | | | | | |

| Asset impairment charges | — | | | — | | | 3,948 | | | | | |

| | | | | | | | | |

| Segment operating income | $ | 144,490 | | | $ | 128,522 | | | $ | 145,297 | | | | | |

Financial Data and Other Operating Statistics1: | | | | | | | | | |

Direct margin (Non-GAAP)2 | $ | 256,074 | | | $ | 238,814 | | | $ | 260,308 | | | | | |

Revenue days3 | 13,711 | | 13,672 | | 16,578 | | | | |

Average active rigs4 | 149 | | 149 | | 180 | | | | |

Number of active rigs at the end of period5 | 151 | | 147 | | 184 | | | | |

| Number of available rigs at the end of period | 233 | | 233 | | 235 | | | | |

| Reimbursements of "out-of-pocket" expenses | $ | 69,728 | | | $ | 65,582 | | | $ | 79,159 | | | | | |

| | | | | | | | | |

| INTERNATIONAL SOLUTIONS | | | | | | | | | |

| Operating revenues | $ | 54,752 | | | $ | 53,183 | | | $ | 54,801 | | | | | |

| Direct operating expenses | 44,519 | | | 53,650 | | | 40,977 | | | | | |

| Depreciation | 2,334 | | | 2,400 | | | 1,392 | | | | | |

| Selling, general and administrative expense | 2,476 | | | 2,156 | | | 2,709 | | | | | |

| Asset impairment charges | — | | | — | | | 8,149 | | | | | |

| | | | | | | | | |

| Segment operating income (loss) | $ | 5,423 | | | $ | (5,023) | | | $ | 1,574 | | | | | |

Financial Data and Other Operating Statistics1: | | | | | | | | | |

Direct margin (Non-GAAP)2 | $ | 10,233 | | | $ | (467) | | | $ | 13,824 | | | | | |

Revenue days3 | 1,173 | | 1,170 | | 1,140 | | | | |

Average active rigs4 | 13 | | 13 | | 12 | | | | |

Number of active rigs at the end of period5 | 12 | | 13 | | 13 | | | | |

| Number of available rigs at the end of period | 22 | | 22 | | 20 | | | | |

| Reimbursements of "out-of-pocket" expenses | $ | 3,384 | | | $ | 2,484 | | | $ | 2,856 | | | | | |

| | | | | | | | | |

| OFFSHORE GULF OF MEXICO | | | | | | | | | |

| Operating revenues | $ | 25,531 | | | $ | 28,880 | | | $ | 35,164 | | | | | |

| Direct operating expenses | 19,579 | | | 21,489 | | | 25,691 | | | | | |

| Depreciation | 2,068 | | | 1,951 | | | 1,894 | | | | | |

| Selling, general and administrative expense | 832 | | | 772 | | | 833 | | | | | |

| | | | | | | | | |

| Segment operating income | $ | 3,052 | | | $ | 4,668 | | | $ | 6,746 | | | | | |

Financial Data and Other Operating Statistics1: | | | | | | | | | |

Direct margin (Non-GAAP)2 | $ | 5,952 | | | $ | 7,391 | | | $ | 9,473 | | | | | |

Revenue days3 | 289 | | 368 | | 368 | | | | |

Average active rigs4 | 3 | | 4 | | 4 | | | | |

Number of active rigs at the end of period5 | 3 | | 4 | | 4 | | | | |

| Number of available rigs at the end of period | 7 | | 7 | | 7 | | | | |

| Reimbursements of "out-of-pocket" expenses | $ | 7,827 | | | $ | 7,439 | | | $ | 7,189 | | | | | |

(1)These operating metrics and financial data, including average active rigs, are provided to allow investors to analyze the various components of segment financial results in terms of activity, utilization and other key results. Management uses these metrics to analyze historical segment financial results and as the key inputs for forecasting and budgeting segment financial results.

(2)Direct margin, which is considered a non-GAAP metric, is defined as operating revenues less direct operating expenses and is included as a supplemental disclosure because we believe it is useful in assessing and understanding our current operational performance, especially in making comparisons over time. See — Non-GAAP Measurements below for a reconciliation of segment operating income (loss) to direct margin.

(3)Defined as the number of contractual days we recognized revenue for during the period.

(4)Active rigs generate revenue for the Company; accordingly, 'average active rigs' represents the average number of rigs generating revenue during the applicable time period. This metric is calculated by dividing revenue days by total days in the applicable period (i.e. 92 days for the three months ended December 31, 2023 and 2022 and the three months ended September 30, 2023).

(5)Defined as the number of rigs generating revenue at the applicable end date of the time period.

Page 10

News Release

January 29, 2024

Segment operating income (loss) for all segments is a non-GAAP financial measure of the Company’s performance, as it excludes gain on sale of assets, corporate selling, general and administrative expenses and corporate depreciation. The Company considers segment operating income (loss) to be an important supplemental measure of operating performance for presenting trends in the Company’s core businesses. This measure is used by the Company to facilitate period-to-period comparisons in operating performance of the Company’s reportable segments in the aggregate by eliminating items that affect comparability between periods. The Company believes that segment operating income (loss) is useful to investors because it provides a means to evaluate the operating performance of the segments and the Company on an ongoing basis using criteria that are used by our internal decision makers. Additionally, it highlights operating trends and aids analytical comparisons. However, segment operating income (loss) has limitations and should not be used as an alternative to operating income or loss, a performance measure determined in accordance with GAAP, as it excludes certain costs that may affect the Company’s operating performance in future periods.

Income from discontinued operations was presented as a separate line item on our Unaudited Condensed Consolidated Statements of Operations during the three months ended December 31, 2022. To conform with the current fiscal year presentation, we reclassified amounts previously presented in Income from discontinued operations, which were not material, to Other within Other income (expense) on our Unaudited Condensed Consolidated Statements of Operations for the three months ended December 31, 2022.

The following table reconciles operating income (loss) per the information above to income (loss) from continuing operations before income taxes as reported on the Unaudited Condensed Consolidated Statements of Operations:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | | |

| December 31, | | September 30, | | December 31, | | | | | |

| (in thousands) | 2023 | | 2023 | | 2022 | | | | | | | |

| Operating income (loss) | | | | | | | | | | | | |

| North America Solutions | $ | 144,490 | | | $ | 128,522 | | | $ | 145,297 | | | | | | | | |

| International Solutions | 5,423 | | | (5,023) | | | 1,574 | | | | | | | | |

| Offshore Gulf of Mexico | 3,052 | | | 4,668 | | | 6,746 | | | | | | | | |

| Other | (67) | | | 2,272 | | | 4,677 | | | | | | | | |

| Eliminations | 334 | | | 158 | | | 2,310 | | | | | | | | |

| Segment operating income | $ | 153,232 | | | $ | 130,597 | | | $ | 160,604 | | | | | | | | |

| Gain on reimbursement of drilling equipment | 7,494 | | | 10,233 | | | 15,724 | | | | | | | | |

| Other gain (loss) on sale of assets | 2,443 | | | (8,410) | | | 2,379 | | | | | | | | |

| Corporate selling, general and administrative costs and corporate depreciation | (39,701) | | | (38,701) | | | (34,484) | | | | | | | | |

| Operating income | $ | 123,468 | | | $ | 93,719 | | | $ | 144,223 | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | |

| Interest and dividend income | 10,734 | | | 7,885 | | | 4,705 | | | | | | | | |

| Interest expense | (4,372) | | | (4,365) | | | (4,355) | | | | | | | | |

| | | | | | | | | | | | |

| Gain (loss) on investment securities | (4,034) | | | 5,176 | | | (15,091) | | | | | | | | |

| | | | | | | | | | | | |

| Other | (543) | | | 10,299 | | | 58 | | | | | | | | |

| Total unallocated amounts | 1,785 | | | 18,995 | | | (14,683) | | | | | | | | |

| Income before income taxes | $ | 125,253 | | | $ | 112,714 | | | $ | 129,540 | | | | | | | | |

Page 11

News Release

January 29, 2024

SUPPLEMENTARY STATISTICAL INFORMATION

Unaudited

U.S. LAND RIG COUNTS & MARKETABLE FLEET STATISTICS | | | | | | | | | | | | | | | | | | | | | | | |

| January 29, | | December 31, | | September 30, | | Q1FY24 |

| 2024 | | 2023 | | 2023 | | Average |

| U.S. Land Operations | | | | | | | |

| Term Contract Rigs | 93 | | | 89 | | | 85 | | | 87 | |

| Spot Contract Rigs | 61 | | | 62 | | | 62 | | | 62 | |

| Total Contracted Rigs | 154 | | | 151 | | | 147 | | | 149 | |

| Idle or Other Rigs | 79 | | | 82 | | | 86 | | | 84 | |

| Total Marketable Fleet | 233 | | | 233 | | | 233 | | | 233 | |

H&P GLOBAL FLEET UNDER TERM CONTRACT STATISTICS

Number of Rigs Already Under Long-Term Contracts(*)

(Estimated Quarterly Average — as of 12/31/23) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 |

| Segment | FY24 | | FY24 | | FY24 | | FY25 | | FY25 | | FY25 | | FY25 |

| U.S. Land Operations | 91.3 | | | 85.0 | | | 74.0 | | | 43.0 | | | 30.5 | | | 22.3 | | | 20.9 | |

| International Land Operations | 7.0 | | | 6.7 | | | 5.9 | | | 5.0 | | | 4.4 | | | 3.7 | | | 3.0 | |

| Offshore Operations | — | | | — | | | — | | | — | | | — | | | — | | | |

| Total | 98.3 | | | 91.7 | | | 79.9 | | | 48.0 | | | 34.9 | | | 26.0 | | | 23.9 | |

(*) All of the above rig contracts have original terms equal to or in excess of six months and include provisions for early termination fees.

Page 12

News Release

January 29, 2024

NON-GAAP MEASUREMENTS

NON-GAAP RECONCILIATION OF SELECT ITEMS AND ADJUSTED NET INCOME(**)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| (in thousands, except per share data) | Pretax | | Tax Impact | | Net | | EPS |

| Net income (GAAP basis) | | | | | $95,173 | | $ | 0.94 | |

| (-) Fair market adjustment to equity investments | $ | (4,102) | | | $ | (1,005) | | | $ | (3,097) | | | $ | (0.03) | |

| Adjusted net income | | | | | $ | 98,270 | | | $ | 0.97 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| (in thousands, except per share data) | Pretax | | Tax Impact | | Net | | EPS |

| Net income (GAAP basis) | | | | | $ | 77,622 | | | $ | 0.77 | |

| (-) Fair market adjustment to equity investments | $ | 17,286 | | | $ | 4,715 | | | $ | 12,571 | | | $ | 0.13 | |

| (-) Net settlements and accruals related to certain outstanding claims | $ | 7,112 | | | $ | 1,913 | | | $ | 5,199 | | | $ | 0.05 | |

| (-) Contingent liabilities | $ | (2,000) | | | $ | (583) | | | $ | (1,417) | | | $ | (0.01) | |

| (-) Losses on a Blue Chip Swap transaction | $ | (12,158) | | | $ | (3,270) | | | $ | (8,888) | | | $ | (0.09) | |

| Adjusted net income | | | | | $ | 70,157 | | | $ | 0.69 | |

(**)The Company believes identifying and excluding select items is useful in assessing and understanding current operational performance, especially in making comparisons over time involving previous and subsequent periods and/or forecasting future period results. Select items are excluded as they are deemed to be outside of the Company's core business operations.

Page 13

News Release

January 29, 2024

NON-GAAP RECONCILIATION OF DIRECT MARGIN

Direct margin is considered a non-GAAP metric. We define "direct margin" as operating revenues less direct operating expenses. Direct margin is included as a supplemental disclosure because we believe it is useful in assessing and understanding our current operational performance, especially in making comparisons over time. Direct margin is not a substitute for financial measures prepared in accordance with GAAP and should therefore be considered only as supplemental to such GAAP financial measures.

The following table reconciles direct margin to segment operating income (loss), which we believe is the financial measure calculated and presented in accordance with GAAP that is most directly comparable to direct margin.

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| (in thousands) | North America Solutions | | International Solutions | | Offshore Gulf of Mexico |

| Segment operating income | $ | 144,490 | | | $ | 5,423 | | | $ | 3,052 | |

| Add back: | | | | | |

| Depreciation and amortization | 87,019 | | | 2,334 | | | 2,068 | |

| Research and development | 8,689 | | | — | | | — | |

| Selling, general and administrative expense | 15,876 | | | 2,476 | | | 832 | |

| | | | | |

| | | | | |

| Direct margin (Non-GAAP) | $ | 256,074 | | | $ | 10,233 | | | $ | 5,952 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| (in thousands) | North America Solutions | | International Solutions | | Offshore Gulf of Mexico |

| Segment operating income (loss) | $ | 128,522 | | | $ | (5,023) | | | $ | 4,668 | |

| Add back: | | | | | |

| Depreciation and amortization | 87,883 | | | 2,400 | | | 1,951 | |

| Research and development | 7,406 | | | — | | | — | |

| Selling, general and administrative expense | 15,003 | | | 2,156 | | | 772 | |

| | | | | |

| | | | | |

| Direct margin (Non-GAAP) | $ | 238,814 | | | $ | (467) | | | $ | 7,391 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 |

| (in thousands) | North America Solutions | | International Solutions | | Offshore Gulf of Mexico |

| Segment operating income | $ | 145,297 | | | $ | 1,574 | | | $ | 6,746 | |

| Add back: | | | | | |

| Depreciation and amortization | 89,814 | | | 1,392 | | | 1,894 | |

| Research and development | 7,059 | | | — | | | — | |

| Selling, general and administrative expense | 14,190 | | | 2,709 | | | 833 | |

| Asset impairment charges | 3,948 | | | 8,149 | | | — | |

| | | | | |

| Direct margin (Non-GAAP) | $ | 260,308 | | | $ | 13,824 | | | $ | 9,473 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

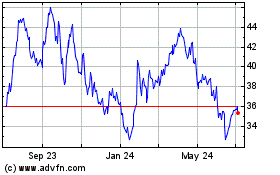

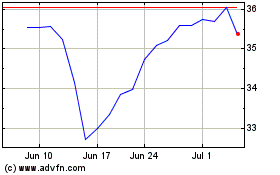

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Apr 2023 to Apr 2024