false000105628500010562852024-01-192024-01-19

Top of Form

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

Date of Report (Date of Earliest Event Reported): |

|

January 19, 2024 |

Kirkland's, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Tennessee |

|

000-49885 |

|

62-1287151 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

5310 Maryland Way, Brentwood, Tennessee |

|

|

|

37027 |

(Address of principal executive offices) |

|

|

|

(Zip Code) |

|

|

|

Registrant’s telephone number, including area code: |

|

615-872-4800 |

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

KIRK |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Top of Form

Item 2.02 Results of Operations and Financial Condition.

On January 19, 2024, Kirkland’s, Inc. (the “Company”) issued a press release reporting its fourth fiscal quarter sales results through December 30, 2023 (the “Press Release”).

A copy of the Press Release is attached hereto as Exhibit 99.1, and is being furnished, not filed, under Item 2.02 of this Current Report on Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 19, 2024, the Company announced that it had promoted Amy A. Sullivan to the position of Chief Executive Officer to be effective February 4, 2024. Ms. Sullivan will also join the Company’s Board of Directors (the “Board”) at that time. Ms. Sullivan, age 45, has served as the Company’s President and Chief Operating Officer since April 2023, and as the Company’s Chief Merchandising and Stores Officer since May 2022. Prior to that time and since 2012, she served in a number of merchandising roles with the Company. Concurrent with Ms. Sullivan’s promotion, Ann Joyce, the Company’s Interim Chief Executive Officer, will serve as an executive consultant for the Company through February 29, 2024, at which time she will no longer be employed by the Company. Ms. Joyce will remain on the Company’s Board of Directors.

On January 19, 2024, the Company and Ms. Sullivan entered into an employment agreement (the “Employment Agreement”), with an effective term that will commence on February 4, 2024, and will continue for an indefinite term (the “Term”), until terminated as provided in the Employment Agreement. The Employment Agreement provides Ms. Sullivan with the following compensation and benefits: (a) annual base salary of no less than $525,000, subject to periodic review and adjustment at the discretion of the Compensation Committee of the Board (the “Compensation Committee”); (b) participation in any annual bonus plans maintained by the Company for its senior executives, with a target amount for such bonus to be 100% of Ms. Sullivan’s base salary and the actual bonus payable with respect to a particular year to be determined by the Compensation Committee, based on the achievement of corporate and individual performance objectives established by the Compensation Committee; (c) participation in any equity-based compensation plans maintained by the Company, with a recommended annual equity award amount equal to 100% of Ms. Sullivan’s base salary; and (d) participation in all employee benefit plans or programs for which any member of the Company’s senior management is eligible under any existing or future Company plan or program.

Under the terms of the Employment Agreement, the Company may terminate Ms. Sullivan’s employment at any time either for any or no reason, and Ms. Sullivan may terminate her employment for Good Reason or upon thirty days’ advance notice without Good Reason. The term "Good Reason” is defined in the Employment Agreement to mean the occurrence of any of the following: (i) the assignment to Ms. Sullivan of any duties inconsistent with Ms. Sullivan’s position, authority, duties or responsibilities, or any other action by the Company which results in a material diminution in such position, authority, duties or responsibilities; (ii) a reduction by the Company in Ms. Sullivan’s annual salary or potential annual bonus, provided that if the salaries and/or bonuses of substantially all of the Company’s senior executive officers are contemporaneously and proportionately reduced, a reduction in Ms. Sullivan’s salary will not constitute "Good Reason”; (iii) the failure by the Company, without Ms. Sullivan’s consent, to pay to her any portion of her current compensation, except pursuant to a compensation deferral elected by Ms. Sullivan, other than an isolated and inadvertent failure which is remedied by the Company promptly after receipt thereof given by Ms. Sullivan; (iv) the relocation of the Company’s principal executive offices to a location more than 35 miles from the current location of such offices, or the Company’s requiring Ms. Sullivan to be based anywhere other than the Company’s principal executive offices, except for required travel on the Company’s business; or (v) the failure of the Company to obtain a satisfactory agreement from any successor to assume and agree to perform under the Employment Agreement.

Except as provided below, if the Company terminates Ms. Sullivan’s employment without Cause (as defined below) or if Ms. Sullivan resigns for Good Reason, the Company shall pay Ms. Sullivan one times her base salary for the year in which such termination shall occur in regular payroll cycles. If the termination occurs after December 31, 2025, then the severance will increase to one and a half times her base salary paid over 18 months. The term “Cause” is defined in the Employment Agreement to mean the occurrence of any of the following, as determined in good faith by the Board: (i) alcohol abuse or use of controlled drugs (other than in accordance with a physician’s prescription) by Ms. Sullivan; (ii) illegal conduct or gross misconduct of Ms. Sullivan which is materially and demonstrably injurious to the Company or its Affiliates including, without limitation, fraud, embezzlement, theft or proven dishonesty; (iii) Ms. Sullivan’s conviction of a misdemeanor involving moral turpitude or a felony; (iv) Ms. Sullivan’s entry of a guilty or nolo contendere plea to a misdemeanor involving moral turpitude or a felony; (v) Ms. Sullivan’s material breach of any agreement with, or duty owed

Top of Form

to, the Company or its affiliates; or (vi) Ms. Sullivan’s failure, refusal or inability to perform, in any material respect, her duties to the Company, which failure continues for more than 15 days after written notice thereof from the Company.

The payment of any severance by the Company to Ms. Sullivan is conditioned upon the execution and delivery by Ms. Sullivan of a release in the form of the release attached as an exhibit to the Employment Agreement. If Ms. Sullivan’s employment with the Company ceases for any reason (including but not limited to termination (a) by the Company for Cause, (b) as a result of Ms. Sullivan’s death, (c) as a result of Ms. Sullivan’s Disability (as defined in the Employment Agreement) or (d) by Ms. Sullivan without Good Reason) other than as a result of the Company terminating her without Cause or by her resignation for Good Reason, then the Company’s obligation to Ms. Sullivan will be limited solely to the payment of accrued and unpaid base salary through the date of such cessation.

The Employment Agreement also contains a non-competition agreement from Ms. Sullivan by which she agrees not to, directly or indirectly, among other things, be employed by or otherwise participate in the management of certain competitive companies or their affiliates, each of which are identified in the Employment Agreement, for a period equal to the length of her severance payout. The Company also has the option to extend the term of Ms. Sullivan’s non-competition agreement for up to an additional 12 months by agreeing to pay her base salary in substantially equal monthly installments for the number of months that the Company elects to extend the non-competition agreement as severance. The Employment Agreement also contains other standard restrictive covenants such as confidentiality, works for hire and non-solicitation of customers and employees that will extend for a period of 24 months following termination of employment.

In addition to her base compensation, Ms. Sullivan will receive a signing bonus (the “Signing Bonus”), payable in a mix of Restricted Stock Units (“RSUs”) and Performance Stock Options (“PSOs”) of the Company. She will receive 50,000 RSUs, with half vesting in February 2026 and the remaining half vesting in February 2027, and 50,000 PSOs, with half vesting in February 2026 and the remaining half vesting in February 2027. The PSOs will have an exercise price of $5.00 per share, which is approximately 198% above yesterday’s closing price of $2.52 for the Company’s common stock.

There is no arrangement or understanding between Ms. Sullivan and any other person pursuant to which Ms. Sullivan was selected as an officer and director. In connection with Ms. Sullivan’s appointment to the Board, the size of the Board will increase from seven (7) directors to eight (8) directors, effective February 4, 2024. Ms. Sullivan is not a party to any transaction with any related person required to be disclosed pursuant to Item 404(a) of Regulation S-K. The foregoing description of the Employment Agreement is a summary only, does not purport to be complete, and is qualified in its entirety by reference to Exhibit 10.1.

Item 8.01 Other Events.

A copy of the Company’s press release dated January 19, 2024 announcing the events described under Item 5.02 above is included in this filing as Exhibit 99.2.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Top of Form

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Kirkland's, Inc. |

|

|

|

|

January 19, 2024 |

|

By: |

/s/ Carter R. Todd |

|

|

|

Name: Carter R. Todd |

|

|

|

Title: Vice President and General Counsel |

Exhibit 10.1

EMPLOYMENT AGREEMENT

This EMPLOYMENT AGREEMENT (this “Agreement”) is entered into as of January 19, 2024, between Amy Sullivan (the “Executive”) and KIRKLAND’S, INC., a Tennessee corporation with principal offices in Nashville, Tennessee (the “Company”).

RECITALS

WHEREAS, the Company desires to employ the Executive as its Chief Executive Officer, and the Executive desires to serve in such capacity pursuant to the terms of this Agreement;

NOW, THEREFORE, in consideration of the premises and the parties’ mutual covenants, it is agreed:

(a)“Affiliate” means any person or entity controlling, controlled by or under common control with the Company.

(b)“Base Salary” means Executive’s current annual base salary as defined in Section 4(a).

(c)“Board” means the Board of Directors of the Company.

(d)“Cause” means the occurrence of any of the following, as determined in good faith by the Board: (i) alcohol abuse or use of controlled drugs (other than in accordance with a physician’s prescription) by Executive; (ii) illegal conduct or gross misconduct of Executive which is materially and demonstrably injurious to the Company or its Affiliates including, without limitation, fraud, embezzlement, theft or proven dishonesty; (iii) Executive’s conviction of a misdemeanor involving moral turpitude or a felony; (iv) Executive’s entry of a guilty or nolo contendere plea to a misdemeanor involving moral turpitude or a felony, (v) Executive’s material breach of any agreement with, or duty owed to, the Company or its Affiliates, or (vi) Executive’s failure, refusal or inability to perform, in any material respect, Executive’s duties to the Company or its Affiliates, which failure continues for more than fifteen (15) days after written notice thereof from the Company.

(e)“Code” shall mean the Internal Revenue Code of 1986, as amended from time to time.

(f)“Committee” means the Compensation Committee of the Board of Directors.

(g)“Confidential Information” means all information respecting the business and activities of the Company, or any Affiliate, including, without limitation, the terms and provisions of this Agreement, information relating to vendor relations, inventory procurement and management, inventory distribution, marketing and sales, store operations, the clients, customers, suppliers, employees, consultants, computer or other files, projects, products, computer disks or other media, computer hardware or computer software programs, marketing plans, financial

1

information, methodologies, know-how, processes, practices, approaches, projections, forecasts, formats, systems, data gathering methods and/or strategies of the Company or any Affiliate. Notwithstanding the immediately preceding sentence, Confidential Information shall not include any information that is, or becomes, generally available to the public (unless such availability occurs as a result of Executive's breach of any portion of Section 7(a) of this Agreement).

(h) “Disability” means Executive’s termination of employment with the Company as a result of Executive’s incapacity due to reasonably documented physical or mental illness that is reasonably expected to prevent Executive from performing Executive’s duties for the Company on a full-time basis for more than six consecutive months; provided however, that no such incapacity will be deemed to be a “Disability” unless Executive would also be deemed to be “Disabled” under Code Section 409A.

(i)“Good Reason” means the occurrence of any of the following: (i) the assignment to Executive of any duties inconsistent with Executive’s position, authority, duties or responsibilities, or any other action by the Company which results in a material diminution in such position, authority, duties or responsibilities; (ii) a reduction by the Company in Executive’s annual salary, provided that if the salaries of substantially all of the Company’s senior executive officers (including the Company’s President and CEO) are contemporaneously and proportionately reduced, a reduction in Executive’s salary will not constitute “Good Reason” hereunder; (iii) the failure by the Company, without Executive’s consent, to pay to her any portion of her current compensation, except pursuant to a compensation deferral elected by Executive, other than an isolated and inadvertent failure which is remedied by the Company promptly after receipt thereof given by Executive; (iv) the relocation of the Company’s principal executive offices to a location more than 35 miles from the location of such offices on the Effective Date, or the Company’s requiring Executive to be based anywhere other than the Company’s principal executive offices, except for required travel on the Company’s business; or (v) the failure of the Company to obtain a satisfactory agreement from any successor to assume and agree to perform this Agreement.

Notwithstanding the foregoing, Good Reason shall not be deemed to exist unless Executive gives the Company written notice within ninety (90) days after the occurrence of the event which Executive believes constitutes the basis for Good Reason, specifying the particular act or failure to act which Executive believes constitutes the basis for Good Reason. If the Company fails to cure such act or failure to act, within thirty (30) days after receipt of such notice, Executive may terminate employment for Good Reason within thirty (30) days following the end of that cure period. For the avoidance of doubt, if such act is not curable, Executive may terminate employment for Good Reason upon providing such notice.

(j)“Invention” means any invention, discovery, improvement or innovation with regard to any facet of the business of the Company or its Affiliates, whether or not patentable, made, conceived, or first actually reduced to practice by Executive, alone or jointly with others, in the course of, in connection with, or as a result of service as an employee of the Company or any of its Affiliates, including any art, method, process, machine, manufacture, design or composition of matter, or any improvement thereof. Each Invention shall be the sole and exclusive property of the Company.

2

(k)“Restricted Non-Competition Period” means, subject to the Company’s ability to extend the Restricted Non-Competition Period as described in Section 8(d) below, twelve (12) months after any termination of Executive’s employment hereunder, provided that the Restricted Non-Competition Period shall be extended for the period, if any, that Executive is in default under the restrictions contained in Section 7(d). Notwithstanding the foregoing, in the event Executive receives eighteen (18) months of severance, then the Restricted Non-Competition Period will be for eighteen (18) months rather than twelve (12) months.

(l)“Restricted Non-Solicitation Period” means twenty-four (24) months after any termination of Executive's employment hereunder, provided that the Restricted Non-Solicitation Period shall be extended for the period, if any, that Executive is in default under the restrictions contained in Section 7(e).

2.Employment; Scope of Duties. The Company hereby employs Executive, and Executive accepts employment, as the Company’s Chief Executive Officer. During the term of this Agreement, Executive shall report to the Company’s Board of Directors, and shall perform those duties as from time to time assigned by the Board. Upon her appointment as Chief Executive Officer, Executive will also be appointed to the Board of Directors of the Company. Thereafter, as long Executive is employed as Chief Executive, the Board or a duly authorized committee of the Board shall nominate Executive to serve as a member of the Board each year that Executive is slated for reelection. Executive agrees to serve in such capacity, if so elected by the shareholders. Executive agrees that on the termination of her service as Company’s Chief Executive Officer for any reason, she will resign from the Company’s Board of Directors, effective immediately.

3.Term. The term of this Agreement will commence on February 4, 2024 (the “Effective Date”), and shall continue until terminated as provided herein.

4.Compensation and Benefits.

(a)Base Salary. As base compensation for the services rendered hereunder to the Company, Executive shall be paid an annual base salary of $525,000, payable in accordance with the Company’s standard payroll practices as in effect from time to time. The Committee will review Executive’s base salary on an annual basis and such base salary shall be subject to upward (but not downward) adjustment, as determined in the discretion of the Committee.

(b)Annual Bonus. For each fiscal year ending during Executive’s employment, Executive will be eligible to earn an annual bonus. The target amount of that bonus will be 100% percent of Executive's Base Salary for the applicable fiscal year. The actual bonus payable with respect to a particular year will be determined by the Committee in its discretion, based on the achievement of corporate and individual performance objectives established by the Committee. Any bonus payable under this paragraph will be paid within 2 ½ months following the end of the applicable fiscal year and will only be paid if Executive remains continuously employed by the Company through the actual bonus payment date.

(c)Equity Incentives. Equity incentives may be granted to Executive from time to time pursuant to the terms and conditions of the Amended and Restated 2002 Equity Incentive Plan (the “Plan”) at the discretion of the Committee. It shall be recommended to the Committee

3

that Executive be granted annual equity awards in the amount of 100% of her base salary in accordance with the Company’s standard practices of awarding annual equity grants in effect from time to time and subject to all of the provisions of the Plan, including the availability sufficient shares under the Plan at the time of grant.

(d)Benefit Plans. Executive shall be eligible to participate in and be covered on the same basis as other senior management of the Company, under all employee benefit plans and programs maintained by the Company, including without limitation retirement, health insurance and life insurance.

(e)Paid Time Off. Executive will be entitled to paid time off each year in accordance with the policies of the Company, as in effect from time to time.

(f)Signing Bonus. As additional compensation in exchange for the Restrictive Covenants set forth in Section 7, the Company shall award Executive a signing bonus (the “Signing Bonus”), comprised of Restricted Stock Units (“RSUs) and Performance Stock Options (“PSOs”) of the Company in the amounts and subject to the terms and conditions described in the award agreements and in the Plan. The Signing Bonus shall consist of 50,000 RSUs, with half vesting in February 2026 and the remaining half vesting in February 2027, and 50,000 PSOs, with a $5.00 strike price with half vesting in February 2026 and the remaining half vesting in February 2027.

5.Expense Reimbursement. Executive shall be reimbursed for those reasonable expenses (as determined by the Company in accordance with then existing policies) necessarily incurred by Executive in the performance of the duties herein as are specifically approved by the Company and as verified by vouchers, receipts, or other evidence of expenditure and business necessity as from time to time required by the Company. All reimbursements provided under this Agreement shall be made or provided in accordance with the requirements of Code Section 409A to the extent that such reimbursements are subject to Code Section 409A, including, where applicable, the requirements that (i) the amount of expenses eligible for reimbursement during a calendar year may not affect the expenses eligible for reimbursement in any other calendar year, (ii) the reimbursement of an eligible expense will be made on or before the last day of the calendar year following the year in which the expense is incurred and (iii) the right to reimbursement is not subject to set off or liquidation or exchange for any other benefit.

6.Other Employment; Conduct. Executive agrees to devote all working time and efforts to performing the duties required hereunder. Executive shall not engage in other employment or become involved in other business ventures requiring Executive’s time, absent the prior written consent of the Board, which consent may be withheld or denied in the sole discretion of the Board of Directors. Executive shall at all times conduct such duties and Executive’s personal affairs in a manner that is satisfactory to the Company and so as to not in any manner injure the reputation of or unfavorably reflect upon the Company or third persons or entities connected therewith.

7.Restrictive Covenants. To induce the Company to enter into this Agreement and in recognition of the compensation to be paid to Executive pursuant to this Agreement, Executive agrees to be bound by the provisions of this Section 7 (the “Restrictive Covenants”). These Restrictive Covenants will apply without regard to whether any termination or cessation of

4

Executive's employment is initiated by the Company or Executive, and without regard to the reason for that termination or cessation. All provisions of this Section 7 shall survive the termination of this Agreement.

(a)Confidentiality. Executive shall not, during the term of this Agreement and at any time thereafter, without the prior express written consent of the Company, directly or indirectly divulge, disclose or make available or accessible any Confidential Information to any person, firm, partnership, corporation, trust or any other entity or third party (other than when required to do so in good faith to perform Executive's duties and responsibilities or when required to do so by a lawful order of a court of competent jurisdiction, any governmental authority or agency, or any recognized subpoena power). In addition, Executive shall not create any derivative work or other product based on or resulting from any Confidential Information (except in the good faith performance of her duties under this Agreement). Executive shall also proffer to the Board's designee, no later than the effective date of any termination of Executive’s employment with the Company for any reason, and without retaining any copies, notes or excerpts thereof, all memoranda, computer disks or other media, computer programs, diaries, notes, records, data, customer or client lists, marketing plans and strategies, and any other documents consisting of or containing Confidential Information that are in Executive's actual or constructive possession or which are subject to her control at such time.

(b)Ownership of Inventions. Each Invention made, conceived or first actually reduced to practice by Executive, whether alone or jointly with others, during the term of this Agreement and each Invention made, conceived or first actually reduced to practice by Executive, within one year after the termination of this Agreement, which relates in any way to work performed for the Company or its Affiliates during the term of this Agreement, shall be promptly disclosed in writing to the Board. Such report shall be sufficiently complete in technical detail and appropriately illustrated by sketch or diagram to convey to one skilled in the art of which the invention pertains, a clear understanding of the nature, purpose, operations, and, to the extent known, the physical, chemical, biological or other characteristics of the Invention. Executive agrees to execute an assignment to the Company or its nominee of Executive’s entire right, title and interest in and to any Invention, without compensation beyond that provided in this Agreement. Executive further agrees, upon the request of the Company and at its expense, that Executive will execute any other instrument and document necessary or desirable in applying for and obtaining patents in the United States and in any foreign country with respect to any Invention. Executive further agrees, whether or not Executive is then an employee of the Company, to cooperate to the extent and in the manner reasonably requested by the Company in the prosecution or defense of any claim involving a patent covering any Invention or any litigation or other claim or proceeding involving any Invention covered by this Agreement, but all expenses thereof shall be paid by the Company.

(c)Works for Hire. Executive also acknowledges and agrees that all works of authorship, in any format or medium, created wholly or in part by Executive, whether alone or jointly with others, in the course of performing Executive’s duties for the Company or any of its Affiliates, or while using the facilities or money of the Company or any of its Affiliates, whether or not during Executive’s work hours, are works made for hire (“Works”), as defined under United States copyright law, and that the Works (and all copyrights arising in the Works) are owned exclusively by the Company. To the extent any such Works are not deemed to be works made for

5

hire, Executive agrees, without compensation beyond that provided in this Agreement, to execute an assignment to the Company or its nominee of all right, title and interest in and to such Work, including all rights of copyright arising in or related to the Works.

(d)Restrictive Non-Competition Covenant. Executive agrees that during the term of this Agreement and for the Restricted Non-Competition Period, Executive will not, directly or indirectly, own, manage, operate, control, be employed by, participate in, lend money, advise or furnish services or information of any kind (including consulting services) to, be compensated in any manner by, or be connected in any way with the management, ownership, operation or control of any of the entities list on Exhibit A hereto. Executive understands and acknowledges that the type of retail business conducted by the Company is national in scope. Executive further acknowledges that these restrictions are reasonable and necessary to protect the legitimate interests of the Company and its Affiliates and that the duration and geographic scope of these restrictions are reasonable given the nature of this Agreement and the position Executive will hold within the Company. Executive further acknowledges that these restrictions are included herein in order to induce the Company to employ Executive pursuant to this Agreement and in connection with the increased compensation and benefits provided hereunder and that the Company would not have entered into this Agreement, increased Executive’s compensation and other benefits or otherwise employed Executive in the absence of these restrictions.

During the term of this Agreement and for the Restricted Non-Competition Period, Executive agrees to (a) notify any prospective employer of the existence of this restrictive non-competition covenant, and (b) notify the Company of Executive’s commencement of employment with any other employer, along with the identity of such new employer.

(e)Restrictive Non-Solicitation Covenant.

1.Covenant Not to Solicit Company Employees. During the term of this Agreement and for the Restricted Non-Solicitation Period, Executive agrees that Executive shall not directly or indirectly on Executive’s own behalf or on behalf or any other employer solicit any present employee of the Company to terminate their employment relationship with the Company.

2.Covenant Not to Solicit Customers. During the term of this Agreement and for the Restricted Non-Solicitation Period, Executive shall not (except on the Company’s behalf), directly or indirectly, on Executive’s own behalf or on behalf of any other person, firm, partnership, corporation or other entity, contact, solicit, divert, induce, call on, take away, do business or otherwise harm the Company’s relationship, or attempt to contact, solicit, divert, induce, call on, take away, do business or otherwise harm the Company’s relationship, with any past, present or prospective customer of the Company or any of its Affiliates (each, a “Customer”). Following the term of this Agreement, a past or prospective Customer shall be limited to such Customer measured within the two (2) year period prior to the date of termination hereunder.

6

(a)Termination Rights. The Company may terminate Executive’s employment hereunder at any time either for any or no reason, and Executive may terminate Executive’s employment hereunder for Good Reason or upon thirty (30) days advance notice without Good Reason. Upon any such termination, Executive shall and shall be deemed to have immediately resigned from any and all officer, director and other positions she then holds with the Company and its Affiliates (and this Agreement shall act as notice of resignation by Executive without any further action required by Executive). Upon any such termination, Executive shall be entitled only to such compensation and benefits described in this Section 8.

(b)Company Terminates Executive Without Cause or Executive Resigns for Good Reason. If the Company terminates Executive’s employment without Cause or if Executive resigns for Good Reason, the Company shall, subject to Section 8(e) below, pay the Executive one (1) times Executive’s Base Salary for the year in which such termination shall occur in regular payroll cycles. Notwithstanding the foregoing, if the Company terminates Executive’s employment without Cause or if Executive resigns for Good Reason after December 31, 2025, the Company shall, subject to Section 8(e) below, pay the Executive one and a half (1 ½ ) times Executive’s Base Salary for the year in which such termination shall occur in eighteen (18) substantially equal monthly installments.

(c)Other Terminations. If Executive’s employment with the Company ceases for any reason other than as described in Section 8(b), above (including but not limited to termination (a) by the Company for Cause, (b) as a result of Executive’s death, (c) as a result of Executive’s Disability or (d) by Executive without Good Reason), then the Company’s obligation to Executive will be limited solely to the payment of accrued and unpaid base salary through the date of such cessation. All compensation and benefits will cease at the time of such cessation and, except as otherwise provided by COBRA, the Company will have no further liability or obligation by reason of such termination.

(d)Extension of Restricted Non-Competition Period. At any time during the sixty (60) day period immediately following Executive’s termination of employment hereunder for any reason, the Company may elect to extend the Restricted Non-Competition Period for up to an additional twelve (12) month period (or such lesser period, as determined in accordance with the Company’s election). In the event that the Company provides written notice to Executive that the Restricted Non-Competition Period will be extended pursuant to this Section 8(d), in addition to any amounts owed to executive under Section 8(b), Executive will be entitled to receive her Base Salary in substantially equal monthly installments for the number of months that the Company elects to extend the applicable Restricted Non-Competition Period. Such payments will commence on the first anniversary of Executive’s termination of employment and continue monthly for the duration of any such Restricted Non-Competition Period.

(e)Severance Conditioned Upon Release. Notwithstanding any other provision of this Agreement, no amount will be paid or benefit provided under Section 8(b) hereof unless Executive executes and delivers to the Company a release substantially identical to that attached hereto as Exhibit B (a “Release”) that becomes irrevocable within 30 days following Executive’s separation from service. Subject to satisfaction of the foregoing Release requirement

7

and to any delay required by the next paragraph, the payments described in Section 8(b) above will commence on the 30th day following Executive’s separation from service. Notwithstanding any other provision of this Agreement, the Company’s refusal to provide severance benefits under Section 8(b) due to Executive’s failure or refusal to execute and deliver the Release in accordance with this paragraph, or due to Executive’s breach or purported revocation of that Release, will not relieve Executive of any obligation under Section 7 of this Agreement. Rather, in such a case, Executive’s obligations under Section 7 will apply as though such severance benefits had been provided.

(f)Compliance with Code Section 409A. If the termination giving rise to the payments described in Section 8(b) is not a “Separation from Service” within the meaning of Treas. Reg. § 1.409A-1(h)(1) (or any successor provision), then the amounts otherwise payable pursuant to that section will instead be deferred without interest and will not be paid until Executive experiences a Separation from Service. In addition, to the extent compliance with the requirements of Treas. Reg. § 1.409A-3(i)(2) (or any successor provision) is necessary to avoid the application of an additional tax under Code Section 409A to payments due to Executive upon or following Separation from Service, then notwithstanding any other provision of this Agreement (or any otherwise applicable plan, policy, agreement or arrangement), any such payments that are otherwise due within six months following Executive’s Separation from Service (taking into account the preceding sentence of this paragraph) will be deferred without interest and paid to Executive in a lump sum immediately following that six month period. This paragraph should not be construed to prevent the application of Treas. Reg. § 1.409A-1(b)(9)(iii)(or any successor provision) to amounts payable hereunder. For purposes of the application of Treas. Reg. § 1.409A-1(b)(4)(or any successor provision), each payment in a series of payments will be deemed a separate payment.

(g)Compliance with Code Section 280G. If any payment or distribution by the Company to or for the benefit of Executive, whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise pursuant to or by reason of any other agreement, policy, plan, program or arrangement or the lapse or termination of any restriction on or the vesting or exercisability of any payment or benefit (each a “Payment”), would be subject to the excise tax imposed by Section 4999 of the Code (or any successor provision thereto) or to any similar tax imposed by state or local law (such tax or taxes are hereafter collectively referred to as the “Excise Tax”), then the aggregate amount of Payments payable to Executive shall be reduced to the aggregate amount of Payments that may be made to Executive without incurring an excise tax (the “Safe-Harbor Amount”) in accordance with the immediately following sentence; provided that such reduction shall only be imposed if the aggregate after-tax value of the Payments retained by Executive (after giving effect to such reduction) is equal to or greater than the aggregate after-tax value (after giving effect to the Excise Tax) of the Payments to Executive without any such reduction. Any such reduction shall be made in the following order: (i) first, any future cash payments (if any) shall be reduced (if necessary, to zero); (ii) second, any current cash payments shall be reduced (if necessary, to zero); (iii) third, all non-cash payments (other than equity or equity derivative related payments) shall be reduced (if necessary, to zero); and (iv) fourth, all equity or equity derivative payments shall be reduced.

9.Injunctive Relief. Executive understands and agrees that any breach by Executive of the Restrictive Covenants will cause continuing and irreparable injury to the Company for which

8

monetary damages would not be an adequate remedy. Executive shall not, in any action or proceeding to enforce any of the provisions of this Agreement, assert the claim or defense that such an adequate remedy at law exists. In the event of such breach by Executive, the Company shall have the right to enforce the Restrictive Covenants by seeking injunctive or other relief in any court and this Agreement shall not in any way limit remedies of law or in equity otherwise available to the Company.

10.Waiver of Breach. Any waiver by the Company of a breach of any provision hereof shall not operate as or constitute a waiver of any of the terms hereof with regard to any subsequent breach.

11.Assignment. Neither this Agreement nor any rights or obligations hereunder may be assigned except by the Company to a business entity which is a successor to the Company by merger, stock exchange, consolidation, or other reorganization, or to an entity which results from a purchase or sale or other transfer or transaction involving third parties, or except to an entity owned or controlled by the principals of the Company. This Agreement (and all rights and benefits hereunder) is for Executive’s personal services and is, therefore, not assignable by Executive.

12.Entire Agreement; Modification. This Agreement is the entire agreement of the parties with regard to Executive’s employment and all other agreements and understandings, whether written or oral, if prior hereto, are merged herein so that the provisions of any prior agreement(s) are void and of no further force and effect. Notwithstanding the above, the Employment Agreement between the Company and the Executive dated July 14, 2022, as amended (the “Existing Agreement”), shall not be superseded and replaced by this Agreement unless and until this Agreement becomes effective on the Effective Date, and the Existing Agreement shall govern the relationship between Executive and the Company until such time. If Executive’s employment is terminated by the Company or by Executive for any reason, including without limitation due to Executive’s death, prior to the Effective Date, this Agreement shall automatically terminate immediately upon such termination of employment. This Agreement may not be modified except by a writing signed by both parties.

13.Applicable Law; Venue. This Agreement shall be construed in accordance with the laws of the State of Tennessee, without regard to the principles of conflicts of law, even if Employee executed this Agreement outside Tennessee or Davidson County, Tennessee, and even if some or all of Executive’s services are to be rendered outside Tennessee. All legal disputes between the parties shall have a venue in the courts of Davidson County, Tennessee.

14.Notices. Any notice or communication required or permitted under this Agreement will be made in writing and (a) sent by overnight courier, (b) mailed by overnight U.S. express mail, return receipt requested or (c) sent by telecopier. Any notice or communication to Executive will be sent to the address contained in Executive’s personnel file. Any notice or communication to the Company will be sent to the Company’s principal executive offices, to the attention of its Vice President- Human Resources. Notwithstanding the foregoing, either party may change the address for notices or communications hereunder by providing written notice to the other in the manner specified in this paragraph.

9

15.Provisions Severable. Any provision hereof adjudged void or voidable by a court of competent jurisdiction shall be deemed severable such that the remaining provisions are in full force and effect. To the extent that any provision hereof is adjudged to be overly broad, then such provision shall be deemed automatically replaced by a similar provision as near to the original provision as possible but still enforceable.

16.Section Headings. The headings of sections and paragraphs of this Agreement are inserted for convenience only and will not in any way affect the meaning or construction of any provision of this Agreement.

17.Parties Bound. This Agreement shall bind the parties’ respective heirs, legal representatives, successors and permitted assigns.

18.Other Agreements. Executive represents and warrants to the Company that there are no restrictions, agreements or understandings whatsoever to which Executive is party (or by which Executive is otherwise bound) that would prevent or make unlawful Executive’s execution of this Agreement or employment by the Company, or that would in any way prohibit, limit or impair (or purport to prohibit, limit or impair) Executive’s provision of services to the Company.

19.Counterparts; Facsimile. This Agreement may be executed in multiple counterparts (including by facsimile signature), each of which will be deemed to be an original, but all of which together will constitute but one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

20.Clawback. Executive acknowledges and agrees that Executive’s rights, payments and benefits with respect to any incentive compensation (in the form of cash or equity) shall be subject to any reduction, cancellation, forfeiture or recoupment, in whole or in part, upon the occurrence of certain specified events, as may be required by any rule or regulation or as set forth in a separate “clawback” policy as may be adopted from time to time by the Board or its Compensation Committee.

10

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed by its duly authorized officer, and Executive has executed this Agreement, in each case as of the date first above written.

|

|

|

|

|

|

|

|

KIRKLAND'S, INC. |

|

|

|

|

|

|

|

By: |

|

/s/ W. Michael Madden |

|

|

Title: |

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

AMY SULLIVAN |

|

|

|

|

|

|

|

By: |

|

/s/ Amy E. Sullivan |

|

11

Exhibit 99.1

Kirkland’s Home Announces Holiday 2023 Comparable Sales Results

Strategic Repositioning is Resonating with Consumers as Holiday 2023 Comparable Sales Increased 3.1% Year-Over-Year

NASHVILLE, Tenn. (January 19, 2024) — Kirkland’s, Inc. (Nasdaq: KIRK) (“Kirkland’s Home” or the “Company”), a specialty retailer of home décor and furnishings, announced its comparable sales results for the 2023 holiday season, which include the first two months of the Company’s fiscal fourth quarter.

Comparable sales for the first two months of the fiscal fourth quarter (through December 30, 2023) increased 3.1% compared to the same prior-year period. This includes an increase of 1.5% for November 2023 and an increase of 4.8% for December 2023, both compared to the same prior-year period. The positive comparable sales increase was largely driven by strong in-store performance from increased traffic and conversion.

Commenting on the results, interim CEO Ann Joyce stated, “Overall, we are pleased with our performance this holiday season as the changes in our marketing efforts and merchandise assortments resonated with our customer base. Although we remained promotional due to the persistent challenges in the broader consumer environment, our merchandise margin strongly improved year-over-year as we continued to benefit from lower freight rates and better product flow. While there remains much work to be done, we believe the strategic pivots we’ve implemented are gaining traction with our loyal customer base and also generating interest from new customers. We move into 2024 with a renewed sense of optimism for the long-term success of Kirkland’s Home.”

About Kirkland’s, Inc.

Kirkland’s, Inc. is a specialty retailer of home décor and furnishings in the United States, currently operating 338 stores in 35 states as well as an e-commerce website, www.kirklands.com, under the Kirkland’s Home brand. The Company provides its customers with an engaging shopping experience characterized by a curated, affordable selection of home décor along with inspirational design ideas. This combination of quality and stylish merchandise, value pricing and a stimulating online and store experience allows the Company’s customers to furnish their home at a great value. More information can be found at www.kirklands.com.

Preliminary Financial Results

The preliminary financial results contained in this release are based on current information as of December 30, 2023, and are subject to change. There can be no assurance that final results for the applicable period will not differ from these preliminary results, including as a result of year-end closing procedures or audit adjustments. In addition, these preliminary results should not be viewed as a substitute for full financial statements prepared in accordance with GAAP that have been audited by the Company’s external auditors.

Forward-Looking Statements

Except for historical information contained herein, certain statements in this release, constitute forward-looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are subject to the finalization of the Company’s quarterly financial and accounting procedures. Forward-looking statements deal with potential future circumstances and developments and are, accordingly, forward-looking in nature. You are cautioned that such forward-looking statements, which may be identified by words such as "anticipate," "believe," "expect," "estimate," "intend," "plan," "seek," "may," "could," "strategy," and similar expressions, involve known and unknown risks and uncertainties, many of which are outside of the Company’s control, which may cause the Company's actual results to differ materially from forecasted results. Those risks and uncertainties include, among other things, risks associated with the Company's liquidity including cash flows from operations and the amount of borrowings under the secured revolving credit facility, the Company’s actual and anticipated progress towards its short-term and long-term objectives including its brand strategy, the risk that natural disasters, pandemic outbreaks (such as COVID-19), global political events, war and terrorism could impact the Company’s revenues, inventory and supply chain, the continuing consumer impact of inflation and countermeasures, including raising interest rates, the effectiveness of the Company’s marketing campaigns, risks related to changes in U.S. policy related to imported merchandise, particularly with regard to the impact of tariffs on goods imported from China and strategies undertaken to mitigate such impact, the Company’s ability to retain its senior management team, continued volatility in the price of the Company’s common stock, the competitive environment in the home décor industry in general and in the Company's specific market areas, inflation, fluctuations in cost and availability of inventory, increased transportation costs and potential interruptions in supply chain, distribution systems and delivery network, including our e-commerce systems and channels, the ability to control employment and other operating costs, availability of suitable retail locations and other growth opportunities, disruptions in information technology systems including

the potential for security breaches of the Company's information or its customers’ information, seasonal fluctuations in consumer spending, and economic conditions in general. Those and other risks are more fully described in the Company's filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K filed on April 4, 2023 and subsequent reports. Forward-looking statements included in this release are made as of the date of this release. Any changes in assumptions or factors on which such statements are based could produce materially different results. Except as required by law, the Company disclaims any obligation to update any such factors or to publicly announce results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

2

Exhibit 99.2

Kirkland’s Home Promotes Amy Sullivan to CEO

Sullivan to Also Join the Company’s Board of Directors

NASHVILLE, Tenn. (January 19, 2024) — Kirkland’s, Inc. (Nasdaq: KIRK) (“Kirkland’s Home” or the “Company”), a specialty retailer of home décor and furnishings, has promoted Amy Sullivan to Chief Executive Officer (“CEO”), effective February 4, 2024, and she will also join the Company’s board of directors. She succeeds interim CEO Ann Joyce, who will remain on the Company’s board of directors. Sullivan, who has been with the Company for more than a decade, was promoted to President and Chief Operating Officer in the spring of 2023. As a member of the executive team, she has helped lead the organization through significant strategic repositioning initiatives, including refocusing marketing efforts and aligning product assortments to drive customer demand. Prior to Kirkland’s Home, she held senior-level positions for Express, Lands’ End, Kohl’s and JCPenney.

“Amy is an invaluable leader within our organization, and over the past nine months she has been instrumental in returning the Company to a positive trajectory, including improved 2023 holiday season sales, that we hope to build off of in 2024,” said R. Wilson Orr, Chairman of Kirkland’s Home. “Since transitioning to an executive leadership role, Amy has been integral to the execution of our repositioning strategy and we believe, as CEO, she is poised to return Kirkland’s Home to profitable growth over the long-term.

“On behalf of the board of directors, I would also like to recognize Ann Joyce for leading the organization through a period of rapid and positive change. She brought a wealth of experience and insight that proved invaluable in navigating the Company through challenging times. Her decisive actions helped set the foundation to revitalize our brand. We look forward to continuing to have her strategic guidance as part of our board of directors.”

“This is a dynamic time to step into the role of CEO at Kirkland’s Home as we start to see our strategic initiatives pay off, with almost a full year of valuable insights and data from our initial repositioning efforts,” said Sullivan. “We have a fantastic team in place and great momentum coming off the 2023 holiday season. I look forward to leading the Company through this next chapter and unlocking the long-term growth potential we see for Kirkland’s Home.”

About Kirkland’s, Inc.

Kirkland’s, Inc. is a specialty retailer of home décor and furnishings in the United States, currently operating 338 stores in 35 states as well as an e-commerce website, www.kirklands.com, under the Kirkland’s Home brand. The Company provides its customers with an engaging shopping experience characterized by a curated, affordable selection of home décor along with inspirational design ideas. This combination of quality and stylish merchandise, value pricing and a stimulating online and store experience allows the Company’s customers to furnish their home at a great value. More information can be found at www.kirklands.com.

Forward-Looking Statements

Except for historical information contained herein, certain statements in this release, constitute forward-looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are subject to the finalization of the Company’s quarterly financial and accounting procedures. Forward-looking statements deal with potential future circumstances and developments and are, accordingly, forward-looking in nature. You are cautioned that such forward-looking statements, which may be identified by words such as "anticipate," "believe," "expect," "estimate," "intend," "plan," "seek," "may," "could," "strategy," and similar expressions, involve known and unknown risks and uncertainties, many of which are outside of the Company’s control, which may cause the Company's actual results to differ materially from forecasted results. Those risks and uncertainties include, among other things, risks associated with the Company's liquidity including cash flows from operations and the amount of borrowings under the secured revolving credit facility, the Company’s actual and anticipated progress towards its short-term and long-term objectives including its brand strategy, the risk that natural disasters, pandemic outbreaks (such as COVID-19), global political events, war and terrorism could impact the Company’s revenues, inventory and supply chain, the continuing consumer impact of inflation and countermeasures, including raising interest rates, the effectiveness of the Company’s marketing campaigns, risks related to changes in U.S. policy related to imported merchandise, particularly with regard to the impact of tariffs on goods imported from China and strategies undertaken to mitigate such impact, the Company’s ability to retain its senior management team, continued volatility in the price of the Company’s common stock, the competitive environment in the home décor industry in general and in the Company's specific market areas, inflation, fluctuations in cost and availability of inventory, increased transportation costs and potential interruptions in supply chain, distribution systems and delivery network, including our e-commerce systems and channels, the ability to control employment and other operating costs, availability of suitable retail locations and other growth opportunities, disruptions in information technology systems including the potential for security breaches of the Company's information or its customers’ information, seasonal fluctuations in consumer spending, and economic conditions in general. Those and other risks are more fully described in the Company's filings with the Securities

and Exchange Commission, including the Company’s Annual Report on Form 10-K filed on April 4, 2023 and subsequent reports. Forward-looking statements included in this release are made as of the date of this release. Any changes in assumptions or factors on which such statements are based could produce materially different results. Except as required by law, the Company disclaims any obligation to update any such factors or to publicly announce results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

2

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

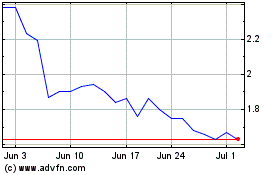

Kirklands (NASDAQ:KIRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kirklands (NASDAQ:KIRK)

Historical Stock Chart

From Apr 2023 to Apr 2024