Filed by Southwestern Energy Company

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Southwestern Energy Company

SEC File No.: 001-08246

Date: January 12, 2024

The slides below were distributed to employees of Southwestern Energy Company (“Southwestern”) on January 12, 2024 following

an employee town hall meeting discussing Southwestern's pending business combination with Chesapeake Energy Corporation.

Accelerating America’s Energy Reach Fueling a More Affordable, Reliable and Lower Carbon Future JANUARY 2024 – TOWN HALL

Classification: DCL - Internal Accelerating America’s Energy Reach 2 ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction between Chesapeake Energy Corporation (“Chesapeake”) and Southwestern Energy Comp any (“Southwestern”), Chesapeake intends to file with the U.S. Securities and Exchange Exchange Commission (the “SEC”) a registration statement on Form S - 4 (the “registration statement”) to register the shares of Ch esapeake’s common stock to be issued in connection with the proposed transaction. The transaction. The registration statement will include a joint proxy statement of Chesapeake and Southwestern and will also con sti tute a prospectus of Chesapeake (the “joint proxy statement/prospectus”). Each of Chesapeake Chesapeake and Southwestern may also file other documents regarding the proposed transaction with the SEC. This document is n ot a substitute for the joint proxy statement/prospectus or the registration statement or any statement or any other document that Chesapeake or Southwestern may file with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/ PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT MAY BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTI ON, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT CHE SAP EAKE, SOUTHWESTERN, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS. After the registration statement has been declared effective, a definitive joint proxy statement/prospectus will be mailed to th e stockholders of Chesapeake and Southwestern. Investors will be able to obtain free copies of the copies of the registration statement and joint proxy statement/prospectus and other relevant documents containing important i nfo rmation about Chesapeake, Southwestern and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov . Copies of the documents filed with the SEC by Chesapeake may be obtained free of charge on Chesapeake’s website at website at http://investors.chk.com/ . Copies of the documents filed with the SEC by Southwestern may be obtained free of charge on Southwestern’s website at https://ir.swn.com/CorporateProfile/default.aspx . PARTICIPANTS IN THE SOLICITATION Chesapeake and Southwestern and certain of their respective directors, executive officers and other members of management and em ployees may be deemed to be participants in the solicitation of proxies in connection connection with the proposed transaction contemplated by the joint proxy statement/prospectus. Information regarding Chesapeake’s direct ors and executive officers and their ownership of Chesapeake’s securities is set forth in Chesapeake’s filings with the SEC, including Chesapeake’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2022 , and its Proxy Statement on Schedule 14A, which was filed with the SEC on April 28, 2023. To the extent such person’s ownership of Chesapeake’s securities has changed since the filing of Chesapeake’s proxy sta tem ent, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC thereafter. Information regarding Southwestern’s directors and executive officers and their ownersh ip of Southwestern’s securities is set forth in Southwestern’s filings with the SEC, including Southwestern’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2022, and its Proxy Statement on Schedule 14A, which was filed with the SEC on April 5, 2023. To the extent such person’s ownership of Southwestern’s securities has changed since the filing of Southwestern’s proxy statement, such changes have been or will b e r eflected on Statements of Change in Ownership on Form 4 filed with the SEC thereafter. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proxy so licitations may be obtained by reading the joint proxy statement/prospectus and other relevant materials that will be filed with the SEC regarding the proposed transaction when such documents become available. Y ou may obtain free copies of these documents as described in the preceding paragraph. NO OFFER OR SOLICITATION This communication relates to the proposed transaction between Chesapeake and Southwestern. This communication is for informa tio nal purposes only and shall not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to th e p roposed transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Important Information for Investors and Stockholders

Classification: DCL - Internal Accelerating America’s Energy Reach 3 This communication contains “forward - looking statements” within the meaning of the federal securities laws. Forward - looking stat ements may be identified by words such as “anticipates,” “believes,” “cause,” “continue,” “could,” “depend,” “develop,” “estimates,” “expects,” “forecasts,” “goal,” “guidance,” “have,” “impact,” “implement,” “increa se, ” “intends,” “lead,” “maintain,” “may,” “might,” “plans,” “potential,” “possible,” “projected,” “reduce,” “remain,” “result,” “scheduled,” “seek,” “should,” “will,” “would” and other similar words or expressions. The abse nce of such words or expressions does not necessarily mean the statements are not forward - looking. Forward - looking statements are not statements of historical fact and reflect Chesapeake’s and Southwestern’s current views about future events. These forward - looking statements include, but are not limited to, statements regarding the proposed transaction between Chesapeake and Southwestern, the expected closing of the proposed transaction and the timing thereof and the proforma combined company and its operations, strategies and plans, integration, debt levels and leverage ratio, capital expenditures, liquidity, return on capital employed, net asset va lue , cost of capital, operating cash flows, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, capital structure, achievement of investment - grade credit rating, expected accretion to earn ings NAV, ROCE, cash flow and free cash flow, anticipated dividends, and natural gas portfolio, demand for products, quality of inventory and ability to deliver affordable lower carbon energy. Information adjusted for the pr oposed transaction should not be considered a forecast of future results. Although we believe our forward - looking statements are reasonable, statements made regarding future results are not guarantees of future performance and are subject to numerous assumptions, uncertainties and risks that are difficult to predict. Forward - looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncer tainties that could cause actual results to differ materially from those projected. Actual outcomes and results may differ materially from the results stated or implied in the forward - looking statements included in this communication due to a number of factors, including, but not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the possibility tha t C hesapeake stockholders may not approve the issuance of Chesapeake’s common stock in connection with the proposed transaction; the possibility that the stockholders of Southwestern may not approve the merger ag ree ment; the risk that Chesapeake or Southwestern may be unable to obtain governmental and regulatory approvals required for the proposed transaction, or required governmental and regulatory approvals may delay the m erg er or result in the imposition of conditions that could cause the parties to abandon the merger; the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; ri sks related to disruption of management time from ongoing business operations due to the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market pr ice of Chesapeake’s common stock or Southwestern’s common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; t he risk that the proposed transaction and its announcement could have an adverse effect on the ability of Chesapeake and Southwestern to retain and hire key personnel, on the ability of Chesapeake and Southwestern to attract third - par ty customers and maintain its relationships with derivatives counterparties and on Chesapeake’s and Southwestern’s operating results and businesses generally; the risk that problems may arise in successfully integrating t he businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected; the risk that the combined company may be unable to achieve synergies or other antic ipa ted benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits and other important factors that could cause actual results to differ materially from those projected; the volatility in commodity prices for crude oil and natural gas, the presence or recoverability of estimated reserves; the ability to replace reserves; environmental risks, drilling and operating risks, including the potential liabili ty for remedial actions or assessments under existing or future environmental regulations and litigation; exploration and development risks; the effect of future regulatory or legislative actions on the companies or the industry in wh ich they operate, including the risk of new restrictions with respect to oil and natural gas development activities; the risk that the credit ratings of the combined business may be different from what the companies expect; the ab ili ty of management to execute its plans to meet its goals and other risks inherent in Chesapeake’s and Southwestern’s businesses; public health crises, such as pandemics and epidemics, and any related government policies and act ion s; the potential disruption or interruption of Chesapeake’s or Southwestern’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other natural or human caus es beyond Chesapeake’s or Southwestern’s control; and the combined company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry. Other unpredictable or unknown factors no t d iscussed in this communication could also have material adverse effects on forward - looking statements. All such factors are difficult to predict and are beyond Chesapeake’s or Southwestern’s control, including those detailed in Che sapeake’s annual reports on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K that are available on its website at http://investors.chk.com/ and on the SEC’s website at http://www.sec.gov , and those detailed in Southwestern’s annual reports on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K that are available on Southwestern’s website at https://ir.swn.com/CorporateProfile/default.aspx and on the SEC’s website at http://www.sec.gov . Forward - looking statements are based on the estimates and opinions of management at the time the statements are made. Chesapeake and Southwestern undertake no obligation to publicly correct or update the forward - looking statements in this communication, in other documents, or on their respective websites to reflect new information, future events or otherwise, except as required b y a pplicable law. All such statements are expressly qualified by this cautionary statement. Readers are cautioned not to place undue reliance on these forward - looking statements that speak only as of the date hereof. This presentation contains certain financial measures that are not prepared or presented in accordance with generally accepte d a ccounting principles (“GAAP”). These non - GAAP financial measures include EBITDAX and net debt. Non - GAAP financial measures are not measurements of financial performance under GAAP and should not be alternatives to amounts presented in accordance with GAAP. Chesapeake and Southwestern view these non - GAAP financial measures as supplemental and they are not intended to be a substitute for, or superior to, the information pr ovided by GAAP financial results. Forward - Looking Statements

Classification: DCL - Internal Accelerating America’s Energy Reach 4 Accelerating America’s Energy Reach Pro Forma Ownership ~60% / ~40% Chesapeake / Southwestern Stock - for - Stock Exchange 0.0867 shares of CHK common stock for each share of SWN common stock Combined Enterprise Value ~$24 billion TRANSACTION OVERVIEW Expanding Board: 7 CHK / 4 SWN Non - Exec Chairman: Mike Wichterich President and CEO: Nick Dell’Osso Company will assume a new name upon close HQ in OKC with material presence in Houston Significant synergies and accretive to all financial metrics including shareholder returns Creates platform to expand marketing and trading business to reach more markets, mitigate price volatility and increase revenue Investment Grade quality capital structure that handles volatility and buffers returns Sustainability leadership through 100% certified Responsibly Sourced Gas (RSG) volumes Premier natural gas portfolio with favorable market access and growth upside to deliver affordable energy for consumers

Classification: DCL - Internal LA TX OH WV PA PA NY Clear Industrial Logic with Complementary Positions in Premium Basins Accelerating America’s Energy Reach 5 Premier Natural Gas Portfolio Note: 3 Q23 actual production for CHK and SWN from public filings; Excludes Eagle Ford CHK SWN ~ 7.9 bcfe/d >5,000 gross locations > 15 years of inventory ▪ Provides capital allocation flexibility and the ability to grow volumes ▪ >25 geographically diverse sales points ▪ Improves scale and credit quality, enhancing deliverability to consumers HAYNESVILLE Louisiana: ~650,000 net acres, ~3.3 bcfe/d, 100% dry gas Ohio & West Virginia: ~530,000 net acres, ~1.8 bcfe/d, 65% dry gas Pennsylvania: ~650,000 net acres, ~2.8 bcfe/d, 100% dry gas APPALACHIA

Classification: DCL - Internal NewCo 6 Defining NewCo’s Vision Accelerating America’s Energy Reach Defining NewCo’s Culture Accelerating America’s Energy Reach – Fueling a More Reliable, Affordable and Lower Carbon Future Cost Leadership Customer Relevance Marketing and Trading Market Relevance • Lowest cost per unit of U.S. producers • Significant and strategic position in Appalachia and Haynesville • Leading fundamental research, Marketing and Trading organization • The premier natural gas producer in the S&P 500 • Lean organization driven by data and technology to maximize flexibility with asset base • ~7.9 bcfe/d nat gas production to demonstrate stability to worldwide customer base • Optimize profits through hedging, infrastructure capacity, storage and trading • Investment Grade credit rating • Sustainability leadership Enhanced visibility and communication of goals and performance to foster collaboration across new corporate footprint Culture that embraces continuous improvement through diverse perspectives and all available data to achieve best - in - class performance Technology driven innovation to improve business outcomes

Classification: DCL - Internal Creates a Globally Relevant Natural Gas Producer 3Q23 Actual Gas Production (bcf/d) 7.9 7.7 7.1 7.0 5.7 5.0 4.9 3.1 2.9 2.3 2.3 2.1 1.8 1.7 1.6 1.4 1.4 1.4 1.1 CVX XOM CHK + SWN SHEL BP EQT EQNR TTE COP CTRA TOU AR WDS OXY EOG OVV RRC CNX ARX DVN Accelerating America’s Energy Reach 7 Scale Enhances Ability to Deliver Affordable Gas to Consumers 7.3 Note: 3 Q23 actual production for CHK and SWN from public filings; Excludes Eagle Ford

Classification: DCL - Internal Accelerating America’s Energy Reach 8 Our Competitive Challenge $0.92 $2.43 $2.49 $2.57 $2.59 $2.68 $2.78 $3.12 $3.23 CTRA RRC EQT AR CNX GPOR NFG CHK SWN 2024 Pre - Dividend FCF Breakevens Excluding Hedging Impacts

Classification: DCL - Internal Accelerating America’s Energy Reach 9 ▪ Diversified portfolio with >25 sales points ▪ Scaled assets in proximity to Gulf Coast / LNG corridor ▪ Link up to 20% of production to international markets ▪ Establishes global platform to enhance marketing and trading business based in Houston Together We Are LNG Ready Results in: ▪ Improved access to new domestic and international markets through delivery enhanced by infrastructure, storage and customer relationships ▪ Reduced sensitivity to commodity price volatility and enhanced revenues ▪ Increased cash flow certainty and returns APP: Northeast/ Citygate: ~10% APP: Greater Appalachia: ~30% APP: Midwest: ~1 % HV: GC LNG Corridor: ~ 20% HV: Gulf Coast: ~26% APP: Southeast: ~3% APP: GC LNG Corridor: ~2 % APP: Gulf Coast: ~7% APP: Canada: ~1% CHK SWN Corporate HQ Marketing and Trading Org

Classification: DCL - Internal Accelerating America’s Energy Reach 10 Strategic Roadmap to Connect Supply to Growing Markets ▪ Solidified midstream flow assurance ▪ Focused on equity gas marketing ▪ Established Be LNG Ready pathway – credit rating and production scale limit market access Setting the Foundation ▪ Create premier, value focused marketing, trading and LNG team in Houston ▪ Expand transportation connectivity with renewed focus on end - use consumers ▪ Establish LNG partnerships for deeper value chain capture in global markets ▪ Enhance energy trading risk management system ▪ Establish a fundamentals research team to use proprietary plus market data to inform our trading and operating businesses Reprice the Constrained U.S. Gas Molecule ▪ Fully integrated, global trading presence ▪ Destination flexibility to access dislocated markets ▪ Market diversity mitigates the impact of price volatility Global Optimization Past 12 Months Current Focus Future State Leverage scale to provide e nergy supply solutions for a global customer base through LNG

Classification: DCL - Internal Accelerating America’s Energy Reach 11 Safety is a Continuous Journey, Not a Destination Let’s remain proactive, vigilant and committed to the highest safety standards

Accelerating America’s Energy Reach Fueling a More Affordable, Reliable and Lower Carbon Future JANUARY 2024 – TOWN HALL

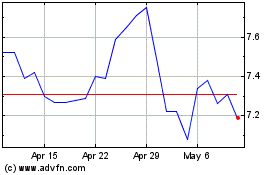

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Apr 2023 to Apr 2024