Filed by Southwestern

Energy Company

pursuant to Rule

425 under the Securities Act of 1933

and deemed filed

pursuant to Rule 14a 12

under the Securities

Exchange Act of 1934

Subject Company:

Southwestern Energy Company

SEC File No.: 001-08246

Date: January 11,

2024

The following transcript is being filed in connection with the

proposed transaction between Chesapeake Energy Corporation, an Oklahoma corporation (“Chesapeake”), and Southwestern Energy

Company, a Delaware corporation (“Southwestern”), pursuant to that certain Agreement and Plan of Merger, dated as of January

10, 2024, by and among Chesapeake, Southwestern, Hulk Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Chesapeake,

and Hulk LLC Sub, LLC, a Delaware limited liability company and a wholly owned Subsidiary of Chesapeake.

| COPYRIGHT © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved

spglobal.com/marketintelligence

1

Chesapeake Energy Corporation NasdaqGS:CHK

M&A Call

Thursday, January 11, 2024 2:00 PM GMT |

| Contents

COPYRIGHT © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved

spglobal.com/marketintelligence

2

Table of Contents

Call Participants .................................................................................. 3

Presentation .................................................................................. 4

Question and Answer .................................................................................. 7 |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 3

Call Participants

EXECUTIVES

Chris Ayres

VP of Investor Relations & Treasurer

Chesapeake Energy Corporation

Domenic J. Dell'Osso

President, CEO & Director

Chesapeake Energy Corporation

William J. Way

President, CEO & Director

Southwestern Energy Company

ANALYSTS

Arun Jayaram

JPMorgan Chase & Co, Research

Division

Bertrand William Donnes

Truist Securities, Inc., Research

Division

Douglas George Blyth Leggate

BofA Securities, Research Division

Joshua Ian Silverstein

UBS Investment Bank, Research

Division

Kevin McCurdy

Matthew Merrel Portillo

Tudor, Pickering, Holt & Co. Securities,

LLC, Research Division

Nitin Kumar

Mizuho Securities USA LLC, Research

Division

Umang Choudhary

Goldman Sachs Group, Inc., Research

Division |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 4

Presentation

Operator

Good morning, and welcome to the Chesapeake Energy Corporation and Southwestern Energy Merger Conference Call. [Operator

Instructions]. Please note today's event is being recorded. I'd now like to turn the conference over to Chris Ayres, Chesapeake's Vice

President of Investor Relations and Treasurer. Please go ahead, sir.

Chris Ayres

VP of Investor Relations & Treasurer

Thanks, Rocco. Good morning, everyone, and thank you for joining our call today to discuss Chesapeake and Southwestern's merger

announcement. What an exciting day. Hopefully, you've had a chance to review our press release in the updated investor presentation

that we posted to our website this morning. During this morning's call, we will be making forward-looking statements, which consist

of statements that cannot be confirmed by reference to existing information, including statements regarding our beliefs, goals,

expectations, forecasts, projections and future performance and the assumptions underlying the statements.

Please note there are a number of factors that will cause actual results to differ materially from our statements. Please recognize that

except as required by applicable law, we undertake no duty to update any forward-looking statements, and you should not place undue

reliance on such statements. may also refer to some non-GAAP financial measures, which will help facilitate comparisons across

periods and with peers.

For any non-GAAP measure we use a reconciliation to the nearest corresponding GAAP measure, which can be found on our website.

Additionally, throughout today, we're going to be discussing the merger of Chesapeake and Southwestern. We will avoid any sort of

fourth quarter specific questions for later in the year.

With me today on the call is Chesapeake's President and Chief Executive Officer, Nick Dell'Osso, and Southwestern's President and

Chief Executive Officer, Bill Way. Nick will give a brief overview of the announcement and then we will open up the teleconference

to the Q&A.

So with that, thank you again and now turn the time over to Nick.

Domenic J. Dell'Osso

President, CEO & Director

Good morning, and thanks for joining us today. This is an exciting day for Chesapeake Energy in Southwestern as we combine to

create an unmatched global natural gas company with the scale, asset quality, financial strength and people to create enormous value

for shareholders while accelerating America's energy reach, feeling a more affordable, reliable and lower carbon future. Over the

next few minutes, we want to highlight the compelling rationale and value proposition behind our combination. We will outline

the tremendous opportunity and synergies that will maximize value for shareholders and benefit consumers and all stakeholders by

reaching more markets with our valuable product.

Following our prepared remarks, we'll be happy to take your specific questions. Many of you know that we often speak about our

strategic pillars and nonnegotiables with respect to strategic decisions. They absolutely guide our decision-making and ensure that any

transaction serves to enhance returns, deepen inventory, strengthen our capital structure and allow us to lead in ESG. This combination

checks all these boxes and combines the best of Southwestern and Chesapeake that will materially advance these pillars. This is an all-stock merger that is immediately accretive to all key per share financial metrics on a pre-synergy basis. Under this structure, the value-enhancing features of the combination, including material synergies, will benefit both shareholders of both companies. The enterprise

value of the company will scale to approximately $24 billion, positioning us for eventual S&P 500 index inclusion.

Upon closing, the company will assume a new name as we mark a fresh start for both of our organizations and redefine the natural

gas producer. The rationale for this combination is compelling. Our assets fit together exceptionally well. We will have the industry's

premier natural gas portfolio with daily production of nearly 8 bcfe per day and more than 5,000 gross locations or over 15 years of

inventory across the Haynesville and Appalachia. With over 15 tcfe equivalent in proved developed reserves, our portfolio will span

across 1.2 million net acres in Appalachia and 650,000 net acres in the Haynesville. This will be an unparalleled natural gas portfolio

in terms of scale and quantity. |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 5

We will have unrivaled access to premium markets and the flexibility to seamlessly move capital and best operating practices across

two premier basins to create capital efficiencies, maximize returns and reduce risks. We will have flexibility across basins with access

to more than 25 unique sales points to ensure the best prices for our products and reliable delivery for customers. We have identified

more than $400 million in annual cost and capital synergies to date that will benefit shareholders of both companies over the next

decade. These are material synergies. More than half of these synergies will come to reduce corporate costs as we streamline how we

work.

In addition, our overlapping operations create a great opportunity to share proven operating practices and optimize the use of common

field infrastructure. We know we will be able to drive additional meaningful synergies as we effectively integrate assets, [ teams

suite]. This combination will create a global platform for us to expand our marketing and trading business, which we will run from our

material presence in Houston.

The primary goal of this business will be to enhance the value of our equity production and access to domestic and international

customers alike. Our scale and balance sheet strength will allow us to serve new domestic customers and compete in rapidly

expanding global LNG markets. Our assets will be strategically positioned in the best natural gas basins with proximity and access to

premium markets along the East Coast and Gulf Coast.

With our size and investment-grade quality balance sheet, we will be in the driver seat to supply lower cost, lower carbon energy to

meet growing global LNG demand. By combining our companies, we are LNG-ready. We expect to ultimately link up to 20% of our

production to international pricing to reprice our molecule to the global markets, which will enhance revenues and reduce pricing

volatility. Our proforma balance sheet and capital structure will remain strong. Combined, we will have an investment-grade quality

balance sheet and expect to achieve a net leverage ratio of less than 1x within 1 year of closing. We also expect to reduce absolute

debt by approximately $1.1 billion by year-end 2025 using cash on hand and free cash flow from the business.

Lastly, this combination strengthens our ability to return more cash to shareholders through cycles, and we will continue our best-in-class equity return framework, driven by increased free cash flow. When compared to a stand-alone basis, this combination will allow

us to increase pro forma dividends per share by more than 20% over the next 5 years. We are incredibly excited about this transaction.

We will have more scale, be stronger, more flexible and financially advantaged, allowing us to access new markets for our products,

deliver more low-carbon energy to consumers while returning significant cash and value to shareholders through the cycles.

Before I turn the call over to Bill for a few comments, I would like to congratulate Bill and the entire Southwestern team. Today's

transaction is a testament to the talent, drive and culture they built together, and I look forward to seeing what our two companies can

accomplish when combined as one organization. I will turn the mic over to Bill now.

William J. Way

President, CEO & Director

Thanks, Nick, and good morning, everyone. This is a great day for Southwestern and Chesapeake, and we are confident that this

merger provides for the delivery of increased shareholder value and provides an opportunity to achieve great things that neither

company could do on a stand-alone basis. While there are many similarities in our asset bases and the operating practices, the

integration of these two special cultures will allow the best of both to rise to the top to enhance returns and progress our competitive

advantages.

The benefits of scale are undeniable today. Our industry has been consolidating into larger financially stronger enterprises with

best-in-class operating and environmental practices. The company will be well positioned to lead with premier assets and an

increased ability to serve domestic and international end users, with responsibly sourced gas while delivering sustainable value to

our shareholders. We are confident that shareholders from both companies will recognize the meaningful synergies created by this

combination, and we look forward to moving quickly on integration and gaining market recognition for the value we see in our

combined organizations.

And finally, I'd like to acknowledge our employees. Today's announcement will not have been possible without our people, which I

firmly believe is Southwestern's greatest asset. Leading this company has been an honor in my career, and I would like to thank each

and every one of our employees for their commitment and dedication to our company and to one another. We'll pass the mic back to

Nick.

Domenic J. Dell'Osso

President, CEO & Director |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 6

Thanks, Bill. Before opening up the call for questions, let me reiterate what a compelling investment opportunity we are creating

in this pro forma company. We're very excited about the growth and long-term demand of natural gas as we believe it is the most

important fuel to improve access to affordable, reliable, lower carbon energy. Simply put, natural gas makes people's lives better. This

new company will be a market leader through its ability to reach more markets, mitigate price volatility and increase the revenue per

unit of the product we sell.

Fundamentally, this company is built to make decisions that will reward shareholders through cycles of natural gas volatility by

having the flexibility to make decisions differently than independent gas companies have been able to over the past 20 years. The large

installed base of production and cash flow, the flexibility of capital allocation and the ability to adjust rig activity is differentiated from

today's natural gas producer.

This combination will lead to increased profitability and shareholder returns through cycles. That is the opportunity we are excited

about today for our shareholders and our people. Operator, we are now ready to take questions. |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 7

Question and Answer

Operator

[Operator Instructions] Today's first question comes from Matt Portillo with TPH.

Matthew Merrel Portillo

Tudor, Pickering, Holt & Co. Securities, LLC, Research Division

Good morning Nick and Bill. This is an extremely interesting deal on a lot of levels. Maybe my first question kicks off on marketing.

It was something you might be able to provide some insight on how this transaction may not only improve your in-basin marketing

opportunities in the Haynesville and the Northeast, but also your strategy around marketing molecules on a global basis.

Domenic J. Dell'Osso

President, CEO & Director

Thanks, Matt, and a great question. This combination of these two companies has so many really obvious benefits to shareholders

through the traditional ways that you think about a really productive oil and gas merger opportunity. Obviously, we save a lot of

costs together. We can improve our business practices by bringing the best of both organizations together. And those things are pretty

evident in this transaction, we believe. The piece of it that we believe is a new strategic element that is now available to the combined

company that was not available to each organization independently is to be able to market our product differently. As a company that

has a clearly investment-grade quality balance sheet and a scale of production to be attractive to customers both in domestic markets

as well as international markets.

We have an opportunity to expand and build out a more robust marketing effort that will be unlike what independent gas producers

traditionally do. We'll be able to access incremental infrastructure, build better relationships with customers and contract for gas in

a more constructive way that ensures that our product can be delivered to markets where it's needed most in a timely fashion and

flexibly through cycles. This should absolutely lead to a better meeting of supply to demand and better value for our shareholders over

time. And it's a strategic part of this transaction that we're very excited about.

To be clear, when we think about this, this effort is focused on enhancing the value of our equity production as a company, and that's

the #1 priority of the marketing organization that we will seek to build.

Matthew Merrel Portillo

Tudor, Pickering, Holt & Co. Securities, LLC, Research Division

Perfect. And then as a follow-up question, I was hoping maybe you touch on the synergy side, obviously, very meaningful synergies

coming with the deal, wanted to see if you might be able to speak to some of the operational synergies you're expecting from a

D&C perspective, is that being driven by faster cycle fines, changes in the completion design, just any broad strokes around how

confident you are in achieving that $130 million synergy target? And then at a high level, just curious how you're thinking about

capital allocation, kind of across the basins given that you've got four inventory in three distinct areas within the U.S. from a gas

perspective.

Domenic J. Dell'Osso

President, CEO & Director

Sure. Great questions, again, Matt. So first, on the drilling and completion synergy, we're very excited about these opportunities. The

synergy opportunities here, like I said a minute ago, are really significant when you have to offsetting assets like this and familiarity

across both companies with the assets. We are definitely focused on improving cycle times of drilling across both companies. And

that drives the biggest amount of the synergies that we've quantified in this analysis. It is $130 million of D&C synergies alone. There

are some additional capital synergies that you'll see highlighted on the slide in our presentation today. That said, with the focus of

that number being primarily on drilling, one of the things that we're excited about, which would be beyond the synergies that we've

modeled is bringing the two organizations together and leveraging the best of the experience of both teams to optimize the approach to

completions as well. We think there's a pretty big opportunity here, and we have not counted on very much of that in our estimate of

synergies.

Your second question was on capital allocation across the basins. I would note that today, we think the companies have a fairly

efficient capital allocation across the entire portfolio. And in the near term, it's certainly focused on maximizing free cash flow from

both of our asset bases given the current market conditions. So I would expect that as a starting point, it will look pretty similar to |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 8

where it is today. What's great about a portfolio like this is that we can be very flexible over time. And as we identify synergies and

the assets truly evolve and the way that they compete with each other in the combined portfolio, we expect to create, again, additional

value, not contemplated in our current synergy number by optimizing how we allocate capital over basins. But as a starting point, we

kind of like where we are.

Operator

Thank you. And our next question today comes from Doug Leggate with Bank of America Securities.

Douglas George Blyth Leggate

BofA Securities, Research Division

Guys, I think both sides obviously see the logic to this. So congratulations to both of you. I would like to ask each of your questions, if

you wouldn't mind, one to -- to make it one to Bill.

Nick, I guess the first question is kind of a follow-up to Matts. If we look at some of the granular detail behind your philosophy on

development in the Haynesville, your well costs per lateral foot at about 1/3 lower, maybe a little -- I guess, a bit more than that, but

40% lower than the Southwestern. And you've told me in the past that deliberately you didn't want to go after the biggest completion

and completion was a big part of that philosophical difference in cost. Southwest on other hand has tremendous productivity but

significantly higher cost per lateral foot. So I guess my question is, why are we not seeing any of that in the capital synergy number

because it doesn't look like that's included? And if it is, what would that synergy number look like?

Domenic J. Dell'Osso

President, CEO & Director

Sure. Thanks, Doug, for that question. So again, I mean, I think as we think about the completion opportunity here, the drilling and

completion opportunity combined there is a real opportunity to reduce costs across the combined portfolio. Our cycle times for drilling

are lower. We have a really long history in this basin, and we've improved upon our drilling practices and targeting and monitoring

over the course of more than 10 years in this basin, and we bring that expertise and our team brings that knowledge and all of the data

behind it every day to execute extremely well through the drill bit.

From a completion standpoint, both companies have a pretty interesting approach to completions, and we are really eager to get these

teams together and optimize around what that completion design looks like. We think there is further upside beyond what we have

modeled in the way of synergies here. We're very focused on that, and we think the opportunity is real.

Douglas George Blyth Leggate

BofA Securities, Research Division

Okay. We'll wait on the update. I guess, Bill, sorry to see you go, but at the same time, I'm curious on why now, there's obviously an

inflection going on in gas markets longer term and obviously, a lot of leverage to that upside potential for Southwestern. Obviously,

shareholders get that for the combined company. But I'm curious what -- why you decided to kind of press the bottom at this point.

William J. Way

President, CEO & Director

Well, thanks for your question, and good to hear from you. Quite frankly, we recognize and believe the market recognizes as well the

synergy and value enhancement of our asset positions that they're quite complementary. Our collective positioning for the substantial

near-term increase in natural gas from LNG, which we'd all talk about a lot, created some impetus to move. Moreover, we were able to

arrive at a shared ownership that we believe is fair for both shareholders, reflecting the through-the-cycle contributions and respective

enterprises. Given the all-equity nature of the combination, our shareholders -- both shareholders will participate in greater potential

reward and what we believe is a lower risk profile from scale, cost and leverage perspective while benefiting from a robust return to

capital program when we joined forces with Chesapeake.

Douglas George Blyth Leggate

BofA Securities, Research Division

We'll look forward to seeing how this plays out. Thank you, guys. Congratulations again.

Operator

And our next question today comes from Josh Silverstein with UBS. |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 9

Joshua Ian Silverstein

UBS Investment Bank, Research Division

Nick, can you just talk about free cash flow allocation. The pro forma balance sheet isn't as strong as if you stand-alone, it looks like

you're going to want to take that down around $1 billion of debt. But how do you think about the allocation for that versus the base

dividend and additional kind of variable and buybacks?

Domenic J. Dell'Osso

President, CEO & Director

Great question. Thanks, Josh. So we're really pleased that we're continuing our -- what we think is the best formulated capital return to

equity program in the industry. We have our base dividend. We have our variable dividend. None of that changes the philosophy and

the calculation as we approach the way we return capital to shareholders isn't changing here at all. So both shareholders will benefit

from that. As you know, we -- it's been our practice to have a buyback in place. We look forward to restarting that in the future here

as we are able to post the disclosure of everything in the transaction. And so for us, the capital return to equity, we believe, looks very

similar. Now the business is going to generate a lot of cash flow and Chesapeake has today quite a bit of cash on the balance sheet.

And so we are looking forward to reducing debt. We have thought fully about the pro forma balance sheet. We are very pleased that

the pro forma company sits in a place where we are maintaining our very firm commitment around staying below 1x net leverage and

we know that we will definitively be there within a year.

And then I would just lastly point out, Josh, and this is sort of recently hitting this morning that two of the agencies have now put out

notes that indicate that we should be investment grade under their expectations at closing, which is a pretty big accomplishment for

this combined organization.

Joshua Ian Silverstein

UBS Investment Bank, Research Division

Okay. That's helpful, Nick. And then both companies have midstream commitments in the Haynesville right now as you guys

have gotten bigger in the basin over the course of the past few years, how does the combined company optimize the new capacity

additions? And does this change any of your strategies down there?

Domenic J. Dell'Osso

President, CEO & Director

Great question. Look, the combined company being able to access as many markets as it can, and we've referenced 25 sales points

across the entire portfolio. A lot of those obviously in Louisiana as well as everywhere, the flexibility is really important to us. As we

all know, demand for natural gas is very volatile. And therefore, the price that you receive for natural gas can be very volatile.

And so the ability to move supply to the places where it is needed most, when it is needed most and be flexible in how you do that is

super important to customers as well as to the value that you receive. We're really excited about having as many outlets as we have,

having more access to infrastructure and we're really excited about having the scale of portfolio that will allow us to build out, like I

said, a more robust marketing organization that's going to allow us to be more proactive in how we manage our exposure to and access

to incremental infrastructure.

That incremental infrastructure allows you to build better relationships with customers and to drive contracts that can meet demand

in a more efficient and effective way over time, supplying gas, when and how and where it's needed. So we think the opportunity to

improve upon the overall access to infrastructure of this combined portfolio is tremendous. And again, as we talked about, what is a

synergy in this assumed transaction and what is not. I think our gas is not assumed as a synergy here, but it is an enormous opportunity

and something we expect to deliver really significant value out of.

Operator

Thank you. And our next question today comes from Arun Jayaram with JPMorgan Chase.

Arun Jayaram

JPMorgan Chase & Co, Research Division

Nick, I wanted to ask you around how the pro forma operating business will be run. In particular, Southwestern had vertical

integration in terms of some of its OFS, including the ownership of some rigs and frac crews. So I was wondering your thoughts on

that? And is that something that you'd like to maintain, expand or perhaps get away from in the future as you think about the pro

forma entity? |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 10

Domenic J. Dell'Osso

President, CEO & Director

Great question, Arun. We've obviously looked at this really closely as we've considered this combination. We're really pleased to

integrate the rigs and frac crews that Southwestern has owned. We've looked at their performance very carefully and believe that those

assets are performing at least as well as what our third-party service providers are performing today. So to be able to leverage those

owned assets as you move through cycles, we think, is a real advantage.

But mostly what I would point out to you is, on a combined basis, it's not a huge percentage of the total service contracting capacity

that we need at any given time. So we're looking forward to making it work for us and think it could add some value.

Arun Jayaram

JPMorgan Chase & Co, Research Division

Okay. And just in terms of the pro forma and technical operating team, how should we think about this? Is this a transaction where

you bring the best athletes from both the organization or will have a little bit more of a Chesapeake feel. But give us the thoughts on

how that pro forma entity will look like.

Domenic J. Dell'Osso

President, CEO & Director

Yes. Another great question and one that we're really excited about here. These are two big companies with a lot of history and a lot

of great talent in both organizations. If you bring things together on what is a 60, 40 ownership split, it is incumbent upon us to ensure

that we get the best talent out of both organizations together to drive a completely different outcome and better outcome than either

company can achieve on their own. This goes all the way through to the point, Arun, that we're rebranding this company. This is not

Chesapeake is adding a bunch of things. This is a completely new organization that is coming together to build a differentiated clear

natural gas leader in the marketplace, and it will require the absolute best talent for both organizations to do that.

Operator

And our next question today comes from Kevin MacCurdy with Pickering Energy Partners.

Kevin McCurdy

Congratulations on getting the deal announced. My question is on pro forma activity. Realizing you still have some work to do. I think

the market assumes that Chesapeake and Southwestern would be adding some rigs here in early 2024. Is that still the plan? And will

you consider slowing activity once the company is combined?

Domenic J. Dell'Osso

President, CEO & Director

Thanks, Kevin. I noted earlier that I think both companies have a current rig allocation that is pretty appropriately focused on

generating free cash flow in 2024 given the market conditions. And that's certainly how I think about this business at the moment. I

mean gas prices, I guess, if you look in super recent term of the last few days have improved a bit. But overall, we still have a market

that looks fairly heavily supplied and does not look for growth today. And I don't think either company is positioned for growth today

and I think that's appropriate given the supply-demand fundamentals that are present.

Kevin McCurdy

Great. I appreciate that color. And then just maybe a question on taxes. Do you see any tax benefit from this deal? And what should

we kind of be assuming for cash taxes this year and next?

Domenic J. Dell'Osso

President, CEO & Director

Yes. We're -- as we bring these companies together, Chesapeake's cash position, the cash tax position, I think, is pretty well

understood. It's going to be a several months here before we close and depending on when and how we close, will have an impact

on what year you're thinking about here. But we will hit AMT over a period of a few years across the combined organization. That's

probably how you should think about modeling it.

Operator |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 11

And our next question comes from Umang Choudhary with Goldman Sachs.

Umang Choudhary

Goldman Sachs Group, Inc., Research Division

My first question is on the balance sheet. In the past, you have indicated a focus on having a strong balance sheet to have options on

-- including on share repurchase. Curious on your thoughts around the optimal debt level of the combined company longer term? And

then as you think about the opportunity set to bring -- to improve the balance sheet sooner, are there any asset sales or noncore asset

sales, which you would look to persecute here?

Domenic J. Dell'Osso

President, CEO & Director

Thanks for that question. So again, our balance sheet on a combined basis is very strong. We will have less than 1x net leverage within

a year. We have a clear plan in front of us to be able to reduce gross debt outstanding by over $1 billion by the end of 2025, given the

cash that we have on the balance sheet as well as the cash flow that we expect to generate over time. And when we think about a target

for the business, we think $4.5 billion is a pretty good net debt target, would equate to 1x leverage on a $3 long-term gas strip. That

seems to be a reasonable way to think about a mid-cycle price.

You've seen us be pretty, I would say, diligent in detection of our balance sheet. Over the last couple of years, you shouldn't expect

anything different out of this combined organization. And the cash flow generation of the business gives us a lot of confidence that,

that will continue to be the case.

Umang Choudhary

Goldman Sachs Group, Inc., Research Division

That's very helpful. And then quickly on the opportunity set, which you highlighted on extended lateral on the synergy camp. Can you

help us understand what that opportunity is? And then any thoughts around how the free cash flow breakeven before hedges of the

combined entity looks like compared to stand-alone Chesapeake.

Domenic J. Dell'Osso

President, CEO & Director

Sure, just first on the extended laterals. When you have offsetting acreage positions like this, there are a lot of opportunities to

put together units to drill more efficient wells. It's a pretty significant opportunity for us. We're excited about it. You also have an

opportunity with this more contiguous land position to then add other in between sections and units across the portfolio. So that

opportunity will grow over time as well. And that's included in our -- what we can see clearly today through the combined is included

in our synergy number.

When you think about the breakevens of the companies, I'm really glad you asked about this, Umang. When I think about the

breakevens of both Chesapeake and Southwestern, we sit at the higher end of the spectrum across the industry. And we do because

we own a pretty significant position in the Haynesville. And so when we combine this business, we own a bigger position in the

Haynesville and on a pro forma basis before any changes we remain with a breakeven that is not as low as Appalachian only

producers.

Of course, the benefit of being in the Haynesville is that you have a differential revenue opportunity, being closer to market and being

better connected to infrastructure. The opportunity for us that is in front of us today is to close the gap on that breakeven. That is

something that this combined organization will have as a top priority. It is something that I believe we can achieve through lowering

our costs and delivering a lower-cost product to consumers that will benefit everyone.

In addition, the better access to infrastructure will offer us as well as having an investment-grade balance sheet, which gives us better

customer relationships, will allow us to deliver gas to markets where it is needed better today which better serves customers but also

offers a better revenue opportunity for our business. So I think the opportunity to close that breakeven gap is absolutely fundamental

to the value opportunity in this combination and something that this organization will have as a top priority.

Operator

Our next question comes from Bertrand Donnes with Truist.

Bertrand William Donnes

Truist Securities, Inc., Research Division |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 12

Congrats Nick and Bill. I will say I am disappointed to see our coverage list shrinking so fast. But the -- on the M&A side, you've

clearly addressed the synergies from today's deal. But do you think you've reached the optimal size? I mean, is the plan to continue

consolidation or I mean I assume at one point, there's a limit to the synergies you can gain outside of G&A. So I just wanted to see if

you thought maybe you've kind of reached optimal sale.

Domenic J. Dell'Osso

President, CEO & Director

Thanks, Bert. We have a lot in front of us to do to integrate this business, and there is so much value for us to go and capture. I think

our attention will be solely focused on that for quite some time.

Bertrand William Donnes

Truist Securities, Inc., Research Division

Got it. And then maybe the follow-up is on kind of the same topic of M&A. Is there any regulatory risk to this deal that -- like we've

seen in other deals? And is that maybe come about a specific topic, maybe production or midstream or any areas that would be the

primary concern.

Domenic J. Dell'Osso

President, CEO & Director

Sure. It's certainly been topical in the market lately. We believe in the combination value of this new enterprise, not just for

shareholders, but for the market broadly. As I've talked about, Natural gas is a commodity that has growing demand, and there has

been inconsistent and inadequate access to infrastructure for natural gas relative to where the demand centers are. We're looking

forward to this company having a better ability to deliver gas to markets where it's needed. So we'll be ready to talk about that. And

we think that this is a great transaction for everyone involved and believe it should be something that is ready for the market to accept.

Operator

And our final question today comes from Nitin Kumar with Mizuho Securities.

Nitin Kumar

Mizuho Securities USA LLC, Research Division

First of all, congratulations. Nick, I want to kind of go back to the synergies. Doug talked about the D&C synergies. But if I look at

the P&L synergies in your presentation, they're only about $145 million. So a quick 2-parter here. I think you're looking -- you said

you're looking for these synergies to be achieved by 2036. So is that an 18-month time frame from when you close the deal? And then

two, there was a difference in the cost structure for the two companies. Your LOE was much lower. And I think it was about $0.30 to

$0.35. Can you give us some color on how you expect to achieve the P&L synergies beyond G&A?

Domenic J. Dell'Osso

President, CEO & Director

Sure. So a more efficient operation is certainly the target of bringing two organizations of this size together. We can be more efficient

in how we can track for everyday services, how we allocate our human resources across the organization and how we deliver on our

business every day. It's through process, it's through technology. It's through how we communicate. It's through just generally how we

work.

We have a lot of confidence that we can do that. In addition, there would be cost savings from -- on the P&L side through shared

infrastructure around water infrastructure as well as gas gathering. So there's quite a bit to do from a P&L standpoint here. I think the

opportunity is big. And just like I said on the capital synergies, the $400 million is a very good starting place for us from a synergy

expectation standpoint. We will not stop at that number, and we think the opportunity is quite a bit bigger over time.

Nitin Kumar

Mizuho Securities USA LLC, Research Division

Great. And maybe -- I don't think you answered this question. You spent over the last 3 years kind of making Chesapeake stand-alone

or dry gas company. Now you get a little bit of liquids. Arun mentioned the vertical integration at Southwestern. Any thoughts on

asset sales or things that you think could help accelerate the debt reduction as you look at that target?

Domenic J. Dell'Osso

President, CEO & Director |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 13

Great question. Look, we're really excited to bring this portfolio together. The assets in the portfolio all contribute and work together

to create a really attractive set of cash flows. We don't have any plans for asset sales as of today. But one thing that we like about

big portfolios is that there are things that come up over time that makes sense. And so while there are no plans to do that today, a big

portfolio gives you choices and you can act on that when and how it makes sense.

But as of today, we're really happy to put all this together, add a lot of value to the combined business across the entire portfolio. And

there could be opportunities for that in the future, but that's not our initial focus.

Operator

Ladies and gentlemen, this concludes the question-and-answer session. I'd like to turn the conference back over to the management

team for any final remarks.

Domenic J. Dell'Osso

President, CEO & Director

Great. Thank you again for joining our call this morning. We could not be more excited to launch this new company into the market

to represent the clear leader in the natural gas space. We will reach more markets, we will be able to mitigate price volatility and

achieve a higher value of revenue for our product every day. We're very excited about the opportunities before us of bringing both

organizations together to create a greater outcome than either organization could create on their own. And we look forward to seeing

you all out on the road and continuing to engage about the future of this great company. Thank you for your time today.

Operator

Thank you. This concludes today's conference call. We thank you all for attending today's presentation. You may now disconnect your

lines, and have a wonderful day. |

| CHESAPEAKE ENERGY CORPORATION M&A CALL JAN 11, 2024

Copyright © 2024 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

spglobal.com/marketintelligence 14

Copyright © 2024 by S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved.

These materials have been prepared solely for information purposes based upon information generally available to the public and from sources believed to be reliable.

No content (including index data, ratings, credit-related analyses and data, research, model, software or other application or output therefrom) or any part thereof

(Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior

written permission of S&P Global Market Intelligence or its affiliates (collectively, S&P Global). The Content shall not be used for any unlawful or unauthorized

purposes. S&P Global and any third-party providers, (collectively S&P Global Parties) do not guarantee the accuracy, completeness, timeliness or availability of

the Content. S&P Global Parties are not responsible for any errors or omissions, regardless of the cause, for the results obtained from the use of the Content. THE

CONTENT IS PROVIDED ON "AS IS" BASIS. S&P GLOBAL PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING,

BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS,

SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE

WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Global Parties be liable to any party for any direct, indirect, incidental,

exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits

and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. S&P Global

Market Intelligence's opinions, quotes and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or

recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P Global Market

Intelligence may provide index data. Direct investment in an index is not possible. Exposure to an asset class represented by an index is available through investable

instruments based on that index. S&P Global Market Intelligence assumes no obligation to update the Content following publication in any form or format. The Content

should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making

investment and other business decisions. S&P Global Market Intelligence does not act as a fiduciary or an investment advisor except where registered as such. S&P

Global keeps certain activities of its divisions separate from each other in order to preserve the independence and objectivity of their respective activities. As a result,

certain divisions of S&P Global may have information that is not available to other S&P Global divisions. S&P Global has established policies and procedures to

maintain the confidentiality of certain nonpublic information received in connection with each analytical process.

S&P Global may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P Global reserves

the right to disseminate its opinions and analyses. S&P Global's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free

of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription), and may be distributed through other means, including via S&P Global

publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

© 2024 S&P Global Market Intelligence. |

IMPORTANT

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction between

Chesapeake Energy Corporation (“Chesapeake”) and Southwestern Energy Company (“Southwestern”), Chesapeake intends

to file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “registration

statement”) to register the shares of Chesapeake’s common stock to be issued in connection with the proposed transaction.

The registration statement will include a joint proxy statement of Chesapeake and Southwestern and will also constitute a prospectus of

Chesapeake (the “joint proxy statement/prospectus”). Each of Chesapeake and Southwestern may also file other documents regarding

the proposed transaction with the SEC. This document is not a substitute for the joint proxy statement/prospectus or the registration

statement or any other document that Chesapeake or Southwestern may file with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS

ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR

THAT MAY BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS,

AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT CHESAPEAKE, SOUTHWESTERN, THE PROPOSED TRANSACTION,

THE RISKS RELATED THERETO AND RELATED MATTERS.

After the registration

statement has been declared effective, a definitive joint proxy statement/prospectus will be mailed to the stockholders of Chesapeake

and Southwestern. Investors will be able to obtain free copies of the registration statement and joint proxy statement/prospectus and

other relevant documents containing important information about Chesapeake, Southwestern and the proposed transaction, once such documents

are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with

the SEC by Chesapeake may be obtained free of charge on Chesapeake’s website at https://investors.chk.com/. Copies of the

documents filed with the SEC by Southwestern may be obtained free of charge on Southwestern’s website at https://ir.swn.com/CorporateProfile/default.aspx.

Participants

in the Solicitation

Chesapeake and Southwestern and certain of their

respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation

of proxies in connection with the proposed transaction contemplated by the joint proxy statement/prospectus. Information regarding Chesapeake’s

directors and executive officers and their ownership of Chesapeake’s securities is set forth in Chesapeake’s filings with

the SEC, including Chesapeake’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and its Proxy

Statement on Schedule 14A, which was filed with the SEC on April 28, 2023. To the extent such person’s ownership of Chesapeake’s

securities has changed since the filing of Chesapeake’s proxy statement, such changes have been or will be reflected on Statements

of Change in Ownership on Form 4 filed with the SEC thereafter. Information regarding Southwestern’s directors and executive

officers and their ownership of Southwestern’s securities is set forth in Southwestern’s filings with the SEC, including Southwestern’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and its Proxy Statement on Schedule 14A, which was filed

with the SEC on April 5, 2023. To the extent such person’s ownership of Southwestern’s securities has changed since the

filing of Southwestern’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4

filed with the SEC thereafter. Additional information regarding the interests of those persons and other persons who may be deemed participants

in the proxy solicitations may be obtained by reading the joint proxy statement/prospectus and other relevant materials that will be filed

with the SEC regarding the proposed transaction when such documents become available. You may obtain free copies of these documents as

described in the preceding paragraph.

No Offer

or Solicitation

This material relates to the proposed transaction

between Chesapeake and Southwestern. This material is for informational purposes only and shall not constitute an offer to sell or exchange,

or the solicitation of an offer to buy or exchange, any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant

to the proposed transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in

this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

FORWARD-LOOKING STATEMENTS

This material contains “forward-looking

statements” within the meaning of the federal securities laws. Forward-looking statements may be identified by words such as “anticipates,”

“believes,” “cause,” “continue,” “could,” “depend,” “develop,”

“estimates,” “expects,” “forecasts,” “goal,” “guidance,” “have,”

“impact,” “implement,” “increase,” “intends,” “lead,” “maintain,”

“may,” “might,” “plans,” “potential,” “possible,” “projected,”

“reduce,” “remain,” “result,” “scheduled,” “seek,” “should,” “will,”

“would” and other similar words or expressions. The absence of such words or expressions does not necessarily mean the statements

are not forward-looking. Forward-looking statements are not statements of historical fact and reflect Chesapeake’s and Southwestern’s

current views about future events. These forward-looking statements include, but are not limited to, statements regarding the proposed

transaction between Chesapeake and Southwestern, the expected closing of the proposed transaction and the timing thereof and the proforma

combined company and its operations, strategies and plans, integration, debt levels and leverage ratio, capital expenditures, liquidity,

return on capital employed, net asset value, cost of capital, operating cash flows, cash flows and anticipated uses thereof, synergies,

opportunities and anticipated future performance, capital structure, achievement of investment-grade credit rating, expected accretion

to earnings and free cash flow, anticipated dividends, and natural gas portfolio, demand for products, quality of inventory and ability

to deliver affordable lower carbon energy. Information adjusted for the proposed transaction should not be considered a forecast of future

results. Although we believe our forward-looking statements are reasonable, statements made regarding future results are not guarantees

of future performance and are subject to numerous assumptions, uncertainties and risks that are difficult to predict. Forward-looking

statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause

actual results to differ materially from those projected.

Actual outcomes and results may differ materially

from the results stated or implied in the forward-looking statements included in this material due to a number of factors, including,

but not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement;

the possibility that the stockholders of Chesapeake may not approve the issuance of Chesapeake’s common stock in connection with

the proposed transaction; the possibility that the stockholders of Southwestern may not approve the merger agreement; the risk that Chesapeake

or Southwestern may be unable to obtain governmental and regulatory approvals required for the proposed transaction, or required governmental

and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger;

the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related

to disruption of management time from ongoing business operations due to the proposed transaction; the risk that any announcements relating

to the proposed transaction could have adverse effects on the market price of Chesapeake’s common stock or Southwestern’s

common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating

to the proposed transaction; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of

Chesapeake and Southwestern to retain and hire key personnel, on the ability of Chesapeake and Southwestern to attract third-party customers

and maintain its relationships with derivatives counterparties and on Chesapeake’s and Southwestern’s operating results and

businesses generally; the risk that problems may arise in successfully integrating the businesses of the companies, which may result in

the combined company not operating as effectively and efficiently as expected; the risk that the combined company may be unable to achieve

synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or

benefits and other important factors that could cause actual results to differ materially from those projected; the volatility in commodity

prices for crude oil and natural gas, the presence or recoverability of estimated reserves; the ability to replace reserves; environmental

risks, drilling and operating risks, including the potential liability for remedial actions or assessments under existing or future environmental

regulations and litigation; exploration and development risks; the effect of future regulatory or legislative actions on the companies

or the industry in which they operate, including the risk of new restrictions with respect to oil and natural gas development activities;

the risk that the credit ratings of the combined business may be different from what the companies expect; the ability of management to

execute its plans to meet its goals and other risks inherent in Chesapeake’s and Southwestern’s businesses; public health

crises, such as pandemics and epidemics, and any related government policies and actions; the potential disruption or interruption of

Chesapeake’s or Southwestern’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats,

terrorist acts, or other natural or human causes beyond Chesapeake’s or Southwestern’s control; and the combined company’s

ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry. Other unpredictable or unknown

factors not discussed in this material could also have material adverse effects on forward-looking statements.

All such factors

are difficult to predict and are beyond Chesapeake’s or Southwestern’s control, including those detailed in Chesapeake’s

annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its

website at https://investors.chk.com/ and on the SEC’s website at http://www.sec.gov, and those detailed in

Southwestern’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that

are available on Southwestern’s website at https://ir.swn.com/CorporateProfile/default.aspx and on the SEC’s website

at http://www.sec.gov. Forward-looking statements are based on the estimates and opinions of management at the time the statements

are made. Chesapeake and Southwestern undertake no obligation to publicly correct or update the forward-looking statements in this material,

in other documents, or on their respective websites to reflect new information, future events or otherwise, except as required by applicable

law. All such statements are expressly qualified by this cautionary statement. Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date hereof.

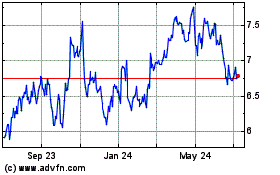

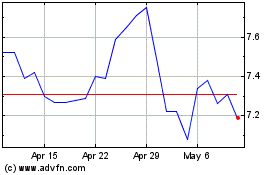

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Apr 2023 to Apr 2024