0001170010false00011700102023-12-212023-12-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

December 21, 2023

Date of Report (date of earliest event reported)

CARMAX, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Virginia | 1-31420 | 54-1821055 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

12800 Tuckahoe Creek Parkway | | 23238 |

Richmond, | Virginia | | |

(Address of Principal Executive Offices) | | (Zip Code) |

(804) 747-0422

Registrant's telephone number, including area code

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | KMX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

| | | | | |

| | |

| Item 2.02. | Results of Operations and Financial Condition. |

| | CarMax, Inc. (the “Company”) issued a press release on December 21, 2023, announcing its third quarter results. The press release is being furnished as Exhibit 99.1 hereto and is incorporated by reference into this Item 2.02. |

| |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| The following exhibit is being furnished pursuant to Item 2.02 above. |

| Press release, dated December 21, 2023, issued by CarMax, Inc., entitled “CarMax Reports Third Quarter Fiscal 2024 Results.” |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | CARMAX, INC. |

| | (Registrant) |

| | |

| | |

| Dated: December 21, 2023 | | By: /s/ Enrique N. Mayor-Mora |

| | Enrique N. Mayor-Mora |

| | Executive Vice President and |

| | Chief Financial Officer |

CARMAX REPORTS THIRD QUARTER FISCAL 2024 RESULTS

Richmond, Va., December 21, 2023 – CarMax, Inc. (NYSE:KMX) today reported results for the third quarter ended November 30, 2023.

Highlights:

•Net revenues were $6.1 billion, down 5.5% compared with the prior year third quarter.

•Retail used unit sales decreased 2.9% and comparable store used unit sales declined 4.1% from the prior year’s third quarter; strong gross profit per retail used unit of $2,277, in line with last year’s third quarter.

•Wholesale units increased 7.7% from the prior year’s third quarter; strong gross profit per wholesale unit of $961, in line with last year’s third quarter.

•Bought 250,000 vehicles from consumers and dealers, up 5.1% versus last year’s third quarter.

◦228,000 of these vehicles were purchased from consumers, up 1.6% over last year’s third quarter.

◦22,000 of these vehicles were purchased through dealers, up 61.7% from last year’s third quarter.

•SG&A of $560.0 million decreased 5.4% or $31.8 million from last year’s third quarter, driven primarily by continued cost management efforts.

•CarMax Auto Finance (CAF) income of $148.7 million, down 2.3% from the prior year third quarter due to compression in the net interest margin percentage, partially offset by a lower provision for loan losses and an increase in average managed receivables.

•Net earnings per diluted share of $0.52 versus $0.24 a year ago.

•Resumed share repurchases in the third quarter.

CEO Commentary:

“Our third quarter performance reflects the continued efforts of the team that have resulted in several quarters of sequential improvements across key components of our business, despite the persistent widespread pressures in the used car industry,” said Bill Nash, president and chief executive officer. “Key results this quarter include year-over-year growth in wholesale units, further SG&A reductions, a strengthened credit mix in CAF’s portfolio, strong retail and wholesale gross profit per unit, and year-over-year growth in profitability. In addition, we continue to be encouraged by the positive impact that our omni-channel investments are having on our business. Some of those benefits include incremental retail customers, web traffic growth and enhanced vehicle sourcing.”

Third Quarter Business Performance Review:

Sales. Combined retail and wholesale used vehicle unit sales were 302,666, an increase of 1.3% from the prior year’s third quarter. Online retail sales(1) accounted for 14% of retail unit sales, compared with 12% in the third quarter of last year. Revenue from online transactions(2), including retail and wholesale unit sales, was $1.9 billion, or approximately 31% of net revenues, up from 28% in last year’s third quarter.

Total retail used vehicle unit sales declined 2.9% to 174,766 compared to the prior year’s third quarter. Comparable store used unit sales declined 4.1% from the prior year’s third quarter. We believe vehicle affordability challenges continued to impact our third quarter unit sales performance, with ongoing headwinds due to widespread inflationary pressures, higher interest rates, tightened lending standards and low consumer confidence. Total retail used vehicle revenues decreased 7.2% compared with the prior year’s third quarter, driven by the decrease in average retail selling price, which declined approximately $1,300 per unit, or 4.6%, as well as the decrease in retail used units sold.

Total wholesale vehicle unit sales increased 7.7% to 127,900 versus the prior year’s third quarter. Total wholesale revenues increased 1.1% compared with the prior year’s third quarter due to an increase in wholesale units sold, partially offset by a decrease in the average wholesale selling price of approximately $600 per unit or 6.7%.

We bought 250,000 vehicles from consumers and dealers, up 5.1% versus last year’s third quarter. Of these vehicles, 228,000 were bought from consumers and 22,000 were bought through dealers, an increase of 1.6% and 61.7%, respectively, from last year’s results.

Gross Profit. Total gross profit was $612.9 million, up 6.3% versus last year’s third quarter. Retail used vehicle gross profit declined 1.2%, primarily reflecting the decline in retail unit sales. Retail gross profit per used unit was $2,277, in line with last year’s third quarter.

Wholesale vehicle gross profit increased 7.2% versus the prior year’s quarter, reflecting higher wholesale unit volume. Gross profit per unit was $961, in line with last year’s third quarter.

Other gross profit increased 55.4% largely reflecting a $33.4 million year-over-year improvement in service gross profit driven by the efficiency and cost coverage measures that we have put in place.

SG&A. Compared with the third quarter of fiscal 2023, SG&A expenses decreased 5.4% to $560.0 million. This reduction reflects the continuation of our cost and efficiency efforts that we implemented a year ago. This quarter delivered decreases in costs related to staffing, non-CAF uncollectible receivables and a reduced level of spend for our technology platforms. Partially offsetting these items was an increase in advertising and stock-based compensation expense. SG&A as a percent of gross profit decreased by 11.2 percentage points to 91.4% as compared to the prior year’s third quarter.

CarMax Auto Finance.(3) CAF income decreased 2.3% to $148.7 million, driven by the decline in CAF’s net interest margin percentage, which outweighed a $17.4 million year-over-year decrease in the provision for loan

losses and the growth in CAF’s average managed receivables. This quarter’s provision was $68.3 million compared to $85.7 million in the prior year’s third quarter.

As of November 30, 2023, the allowance for loan losses was 2.92% of ending managed receivables, down from 3.08% as of August 31, 2023. The decrease in the allowance percentage primarily reflected the effect of the previously disclosed tightening of CAF’s underwriting standards.

CAF’s total interest margin percentage, which represents the spread between interest and fees charged to consumers and our funding costs, was 5.9% of average managed receivables, down slightly from this year’s second quarter and down from 6.7% in the prior year’s third quarter, as increases in our customer rates were more than offset by the rising cost of funds. Year-over-year performance was also negatively impacted by the mark-to-market effects of our derivative instruments not designated as hedges for accounting purposes. After the effect of 3-day payoffs, CAF financed 44.0% of units sold in the current quarter, down from 44.4% in the prior year’s third quarter. CAF’s weighted average contract rate was 11.3% in the quarter, up from 9.8% in the third quarter last year.

Share Repurchase Activity. During the third quarter of fiscal year 2024, we resumed our share repurchase program after a pause initiated during the third quarter of fiscal year 2023. We repurchased 648,500 shares of common stock for $41.9 million in the quarter. As of November 30, 2023, we had $2.41 billion remaining available for repurchase under the outstanding authorization.

Location Openings. During the fourth quarter of fiscal year 2024, we will open four stores including two in the New York metro market and one in each of the Los Angeles and Chicago metro markets. We will also open our first stand-alone reconditioning center in the Atlanta metro market.

(1) An online retail unit sale is defined as a sale where the customer completes all four of these major transactional activities remotely: reserving the vehicle; financing the vehicle, if needed; trading-in or opting out of a trade in; and creating a remote sales order.

(2) Revenue from online transactions is defined as revenue from retail sales that qualify for an online retail sale, as well as any EPP and third-party finance contribution, wholesale sales where the winning bid was an online bid, and all revenue earned by Edmunds.

(3) Although CAF benefits from certain indirect overhead expenditures, we have not allocated indirect costs to CAF to avoid making subjective allocation decisions.

Supplemental Financial Information

Amounts and percentage calculations may not total due to rounding.

Sales Components

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| (In millions) | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Used vehicle sales | $ | 4,832.1 | | | $ | 5,204.6 | | | (7.2) | % | | $ | 16,424.7 | | | $ | 18,503.2 | | | (11.2) | % |

| Wholesale vehicle sales | 1,165.2 | | | 1,152.2 | | | 1.1 | % | | 4,001.5 | | | 4,959.1 | | | (19.3) | % |

| Other sales and revenues: | | | | | | | | | | | |

| Extended protection plan revenues | 90.8 | | | 91.8 | | | (1.0) | % | | 303.8 | | | 318.1 | | | (4.5) | % |

| Third-party finance (fees)/income, net | (1.2) | | | 1.0 | | | (227.5) | % | | (2.4) | | | 7.1 | | | (133.7) | % |

Advertising & subscription revenues (1) | 36.7 | | | 33.3 | | | 10.4 | % | | 101.6 | | | 101.9 | | | (0.3) | % |

| Other | 25.0 | | | 23.1 | | | 7.8 | % | | 80.2 | | | 73.1 | | | 9.8 | % |

| Total other sales and revenues | 151.3 | | | 149.2 | | | 1.4 | % | | 483.2 | | | 500.2 | | | (3.4) | % |

| Total net sales and operating revenues | $ | 6,148.5 | | | $ | 6,506.0 | | | (5.5) | % | | $ | 20,909.4 | | | $ | 23,962.4 | | | (12.7) | % |

(1) Excludes intersegment revenues that have been eliminated in consolidation.

Unit Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Used vehicles | 174,766 | | 180,050 | | (2.9) | % | | 593,515 | | 637,939 | | (7.0) | % |

| Wholesale vehicles | 127,900 | | 118,757 | | 7.7 | % | | 430,785 | | 464,741 | | (7.3) | % |

Average Selling Prices

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Used vehicles | $ | 27,228 | | | $ | 28,530 | | | (4.6) | % | | $ | 27,331 | | | $ | 28,692 | | | (4.7) | % |

| Wholesale vehicles | $ | 8,674 | | | $ | 9,294 | | | (6.7) | % | | $ | 8,887 | | | $ | 10,280 | | | (13.6) | % |

Vehicle Sales Changes

| | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| 2023 | 2022 | | 2023 | 2022 |

| Used vehicle units | (2.9) | % | (20.8) | % | | (7.0) | % | (12.6) | % |

| Used vehicle revenues | (7.2) | % | (19.1) | % | | (11.2) | % | (1.0) | % |

| | | | | |

| Wholesale vehicle units | 7.7 | % | (36.7) | % | | (7.3) | % | (16.6) | % |

| Wholesale vehicle revenues | 1.1 | % | (40.1) | % | | (19.3) | % | (0.8) | % |

Comparable Store Used Vehicle Sales Changes (1)

| | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| 2023 | 2022 | | 2023 | 2022 |

| Used vehicle units | (4.1) | % | (22.4) | % | | (8.5) | % | (14.3) | % |

| Used vehicle revenues | (8.3) | % | (21.0) | % | | (12.7) | % | (3.2) | % |

(1) Stores are added to the comparable store base beginning in their fourteenth full month of operation. Comparable store calculations include results for a set of stores that were included in our comparable store base in both the current and corresponding prior year periods.

Used Vehicle Financing Penetration by Channel (Before the Impact of 3-day Payoffs) (1)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| 2023 | | 2022 | | 2023 | | 2022 |

CAF (2) | 46.5 | % | | 47.3 | % | | 46.1 | % | | 44.9 | % |

Tier 2 (3) | 18.0 | % | | 20.5 | % | | 18.9 | % | | 22.6 | % |

Tier 3 (4) | 6.9 | % | | 6.1 | % | | 6.7 | % | | 6.4 | % |

Other (5) | 28.6 | % | | 26.1 | % | | 28.3 | % | | 26.1 | % |

| Total | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

(1) Calculated as used vehicle units financed for respective channel as a percentage of total used units sold.

(2) Includes CAF's Tier 2 and Tier 3 loan originations, which represent less than 2% of total used units sold.

(3) Third-party finance providers who generally pay us a fee or to whom no fee is paid.

(4) Third-party finance providers to whom we pay a fee.

(5) Represents customers arranging their own financing and customers that do not require financing.

Selected Operating Ratios

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| (In millions) | 2023 | % (1) | | 2022 | % (1) | | 2023 | % (1) | | 2022 | % (1) |

| Net sales and operating revenues | $ | 6,148.5 | | 100.0 | | | $ | 6,506.0 | | 100.0 | | | $ | 20,909.4 | | 100.0 | | | $ | 23,962.4 | | 100.0 | |

| Gross profit | $ | 612.9 | | 10.0 | | | $ | 576.7 | | 8.9 | | | $ | 2,127.0 | | 10.2 | | | $ | 2,189.2 | | 9.1 | |

| CarMax Auto Finance income | $ | 148.7 | | 2.4 | | | $ | 152.2 | | 2.3 | | | $ | 421.0 | | 2.0 | | | $ | 539.5 | | 2.3 | |

Selling, general, and administrative expenses | $ | 560.0 | | 9.1 | | | $ | 591.7 | | 9.1 | | | $ | 1,705.5 | | 8.2 | | | $ | 1,914.5 | | 8.0 | |

| Interest expense | $ | 31.3 | | 0.5 | | | $ | 30.2 | | 0.5 | | | $ | 93.3 | | 0.4 | | | $ | 91.7 | | 0.4 | |

| Earnings before income taxes | $ | 110.6 | | 1.8 | | | $ | 50.0 | | 0.8 | | | $ | 576.1 | | 2.8 | | | $ | 554.2 | | 2.3 | |

| Net earnings | $ | 82.0 | | 1.3 | | | $ | 37.6 | | 0.6 | | | $ | 428.9 | | 2.1 | | | $ | 415.8 | | 1.7 | |

(1)Calculated as a percentage of net sales and operating revenues.

Gross Profit (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| (In millions) | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Used vehicle gross profit | $ | 397.9 | | | $ | 402.8 | | | (1.2) | % | | $ | 1,364.6 | | | $ | 1,461.3 | | | (6.6) | % |

| Wholesale vehicle gross profit | 122.9 | | | 114.7 | | | 7.2 | % | | 427.3 | | | 447.0 | | | (4.4) | % |

| Other gross profit | 92.1 | | | 59.2 | | | 55.4 | % | | 335.1 | | | 280.9 | | | 19.2 | % |

| Total | $ | 612.9 | | | $ | 576.7 | | | 6.3 | % | | $ | 2,127.0 | | | $ | 2,189.2 | | | (2.8) | % |

(1) Amounts are net of intercompany eliminations.

Gross Profit per Unit (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| 2023 | 2022 | | 2023 | 2022 |

| $ per unit(2) | %(3) | $ per unit(2) | %(3) | | $ per unit(2) | %(3) | $ per unit(2) | %(3) |

| Used vehicle gross profit per unit | $ | 2,277 | | 8.2 | | $ | 2,237 | | 7.7 | | | $ | 2,299 | | 8.3 | | $ | 2,291 | | 7.9 | |

| Wholesale vehicle gross profit per unit | $ | 961 | | 10.5 | | $ | 966 | | 10.0 | | | $ | 992 | | 10.7 | | $ | 962 | | 9.0 | |

| Other gross profit per unit | $ | 527 | | 60.9 | | $ | 329 | | 39.7 | | | $ | 564 | | 69.3 | | $ | 440 | | 56.2 | |

| | | | | | | | | |

(1) Amounts are net of intercompany eliminations. Those eliminations had the effect of increasing used vehicle gross profit per unit and wholesale vehicle gross profit per unit and decreasing other gross profit per unit by immaterial amounts.

(2) Calculated as category gross profit divided by its respective units sold, except the other category, which is divided by total used units sold.

(3) Calculated as a percentage of its respective sales or revenue.

SG&A Expenses (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| (In millions) | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Compensation and benefits: | | | | | | | | | | | |

Compensation and benefits, excluding share-based compensation expense | $ | 286.3 | | | $ | 306.2 | | | (6.5) | % | | $ | 922.7 | | | $ | 985.2 | | | (6.3) | % |

| Share-based compensation expense | 19.9 | | | 17.2 | | | 15.7 | % | | 86.5 | | | 64.0 | | | 35.2 | % |

Total compensation and benefits (2) | $ | 306.2 | | | $ | 323.4 | | | (5.3) | % | | $ | 1,009.2 | | | $ | 1,049.2 | | | (3.8) | % |

| Occupancy costs | 70.3 | | | 70.1 | | | 0.2 | % | | 204.2 | | | 204.8 | | | (0.3) | % |

| Advertising expense | 63.3 | | | 58.7 | | | 7.9 | % | | 201.5 | | | 230.5 | | | (12.6) | % |

Other overhead costs (3) | 120.2 | | | 139.5 | | | (13.9) | % | | 290.6 | | | 430.0 | | | (32.4) | % |

| Total SG&A expenses | $ | 560.0 | | | $ | 591.7 | | | (5.4) | % | | $ | 1,705.5 | | | $ | 1,914.5 | | | (10.9) | % |

| SG&A as a % of gross profit | 91.4 | % | | 102.6 | % | | (11.2) | % | | 80.2 | % | | 87.5 | % | | (7.3) | % |

(1) Amounts are net of intercompany eliminations.

(2) Excludes compensation and benefits related to reconditioning and vehicle repair service, which are included in cost of sales.

(3) Includes IT expenses, non-CAF bad debt, preopening and relocation costs, insurance, charitable contributions, travel and other administrative expenses.

Components of CAF Income and Other CAF Information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| (In millions) | 2023 | % (1) | 2022 | % (1) | | 2023 | % (1) | 2022 | % (1) |

| Interest margin: | | | | | | | | | |

| Interest and fee income | $ | 426.9 | | 9.8 | | $ | 365.4 | | 8.8 | | | $ | 1,244.3 | | 9.6 | | $ | 1,069.3 | | 8.8 | |

| Interest expense | (170.2) | | (3.9) | | (88.8) | | (2.1) | | | (464.8) | | (3.6) | | (200.1) | | (1.6) | |

| Total interest margin | 256.7 | | 5.9 | | 276.6 | | 6.7 | | | 779.5 | | 6.0 | | 869.2 | | 7.2 | |

| Provision for loan losses | (68.3) | | (1.6) | | (85.7) | | (2.1) | | | (239.0) | | (1.8) | | (219.0) | | (1.8) | |

| | | | | | | | | |

Total interest margin after provision for loan losses | 188.4 | | 4.3 | | 190.9 | | 4.6 | | | 540.5 | | 4.2 | | 650.2 | | 5.4 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total direct expenses | (39.7) | | (0.9) | | (38.8) | | (0.9) | | | (119.5) | | (0.9) | | (110.7) | | (0.9) | |

| CarMax Auto Finance income | $ | 148.7 | | 3.4 | | $ | 152.2 | | 3.7 | | | $ | 421.0 | | 3.2 | | $ | 539.5 | | 4.4 | |

| | | | | | | | | |

| Total average managed receivables | $ | 17,508.9 | | | $ | 16,540.2 | | | | $ | 17,276.0 | | | $ | 16,177.8 | | |

| Net loans originated | $ | 1,953.4 | | | $ | 2,147.2 | | | | $ | 6,491.0 | | | $ | 6,928.0 | | |

| Net penetration rate | 44.0 | % | | 44.4 | % | | | 43.1 | % | | 41.4 | % | |

| Weighted average contract rate | 11.3 | % | | 9.8 | % | | | 11.1 | % | | 9.4 | % | |

| | | | | | | | | |

| Ending allowance for loan losses | $ | 511.9 | | | $ | 491.0 | | | | $ | 511.9 | | | $ | 491.0 | | |

| | | | | | | | | |

| Warehouse facility information: | | | | | | | | | |

Ending funded receivables | $ | 4,529.6 | | | $ | 3,420.9 | | | | $ | 4,529.6 | | | $ | 3,420.9 | | |

Ending unused capacity | $ | 1,070.4 | | | $ | 1,979.1 | | | | $ | 1,070.4 | | | $ | 1,979.1 | | |

| | | | | | | | | |

(1)Annualized percentage of total average managed receivables.

Earnings Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| (In millions except per share data) | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Net earnings | $ | 82.0 | | | $ | 37.6 | | | 118.2 | % | | $ | 428.9 | | | $ | 415.8 | | | 3.2 | % |

Diluted weighted average shares outstanding | 158.8 | | | 158.5 | | | 0.2 | % | | 158.9 | | | 160.2 | | | (0.8) | % |

| Net earnings per diluted share | $ | 0.52 | | | $ | 0.24 | | | 116.7 | % | | $ | 2.70 | | | $ | 2.60 | | | 3.8 | % |

Conference Call Information

We will host a conference call for investors at 9:00 a.m. ET today, December 21, 2023. Domestic investors may access the call at 1-800-274-8461 (international callers dial 1-203-518-9814). The conference I.D. for both domestic and international callers is 3171396. A live webcast of the call will be available on our investor information home page at investors.carmax.com.

A replay of the webcast will be available on the company’s website at investors.carmax.com through April 10, 2024, or via telephone (for approximately one week) by dialing 1-800-374-1216 (or 1-402-220-0681 for international access) and entering the conference ID 3171396.

Fourth Quarter Fiscal 2024 Earnings Release Date

We currently plan to release results for the fourth quarter ending February 29, 2024, on Thursday, April 11, 2024, before the opening of trading on the New York Stock Exchange. We plan to host a conference call for investors at 9:00 a.m. ET on that date. Information on this conference call will be available on our investor information home page at investors.carmax.com in early April 2024.

About CarMax

CarMax, the nation’s largest retailer of used autos, revolutionized the automotive retail industry by driving integrity, honesty and transparency in every interaction. The company offers a truly personalized experience with the option for customers to do as much, or as little, online and in-store as they want. During the fiscal year ended February 28, 2023, CarMax sold approximately 810,000 used vehicles and 590,000 wholesale vehicles at its auctions. In addition, CarMax Auto Finance originated nearly $9 billion in receivables during fiscal 2023, adding to its nearly $17 billion portfolio. CarMax has over 240 stores, more than 30,000 associates, and is proud to have been recognized for 19 consecutive years as one of the Fortune 100 Best Companies to Work For®. CarMax is committed to making a positive impact on people, communities and the environment. Learn more in the 2023 Responsibility Report. For more information, visit www.carmax.com.

Forward-Looking Statements

We caution readers that the statements contained in this release that are not statements of historical fact, including statements about our future business plans, operations, challenges, opportunities or prospects, including without limitation any statements or factors regarding expected operating capacity, sales, inventory, market share, financial targets, revenue, margins, expenses, liquidity, loan originations, capital expenditures, share repurchase plans, debt obligations or earnings, are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “positioned,” “predict,” “should,” “target,” “will” and other similar expressions, whether in the negative or affirmative. Such forward-looking statements are based upon management’s current knowledge, expectations and assumptions and involve risks and uncertainties that could cause actual results to differ materially from anticipated results. Among the factors that could cause actual results and outcomes to differ materially from those contained in the forward-looking statements are the following:

•Changes in the competitive landscape and/or our failure to successfully adjust to such changes.

•Changes in general or regional U.S. economic conditions, including inflationary pressures, climbing interest rates and the potential impact of international events.

•Changes in the availability or cost of capital and working capital financing, including changes related to the asset-backed securitization market.

•Events that damage our reputation or harm the perception of the quality of our brand.

•Significant changes in prices of new and used vehicles.

•A reduction in the availability of or access to sources of inventory or a failure to expeditiously liquidate inventory.

•Our inability to realize the benefits associated with our omni-channel initiatives and strategic investments.

•Factors related to geographic and sales growth, including the inability to effectively manage our growth.

•Our inability to recruit, develop and retain associates and maintain positive associate relations.

•The loss of key associates from our store, regional or corporate management teams or a significant increase in labor costs.

•Changes in economic conditions or other factors that result in greater credit losses for CAF’s portfolio of auto loans receivable than anticipated.

•The failure or inability to realize the benefits associated with our strategic transactions.

•The effect and consequences of the Coronavirus public health crisis on matters including U.S. and local economies; our business operations and continuity; the availability of corporate and consumer financing; the health and productivity of our associates; the ability of third-party providers to continue uninterrupted service; and the regulatory environment in which we operate.

•Changes in consumer credit availability provided by our third-party finance providers.

•Changes in the availability of extended protection plan products from third-party providers.

•The performance of the third-party vendors we rely on for key components of our business.

•Adverse conditions affecting one or more automotive manufacturers, and manufacturer recalls.

•The inaccuracy of estimates and assumptions used in the preparation of our financial statements, or the effect of new accounting requirements or changes to U.S. generally accepted accounting principles.

•The failure or inability to adequately protect our intellectual property.

•The occurrence of severe weather events.

•Factors related to the geographic concentration of our stores.

•Security breaches or other events that result in the misappropriation, loss or other unauthorized disclosure of confidential customer, associate or corporate information.

•The failure of or inability to sufficiently enhance key information systems.

•Factors related to the regulatory and legislative environment in which we operate.

•The effect of various litigation matters.

•The volatility in the market price for our common stock.

For more details on factors that could affect expectations, see our Annual Report on Form 10-K for the fiscal year ended February 28, 2023, and our quarterly or current reports as filed with or furnished to the U.S. Securities and Exchange Commission. Our filings are publicly available on our investor information home page at investors.carmax.com. Requests for information may also be made to the Investor Relations Department by email to investor_relations@carmax.com or by calling (804) 747-0422 x7865. We undertake no obligation to update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

CarMax, Inc.

Page 10 of 13

Contacts:

Investors:

David Lowenstein, Assistant Vice President, Investor Relations

investor_relations@carmax.com, (804) 747-0422 x7865

Media:

pr@carmax.com, (855) 887-2915

CarMax, Inc.

Page 11 of 13

CARMAX, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EARNINGS

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended November 30 | | Nine Months Ended November 30 |

| (In thousands except per share data) | 2023 | %(1) | 2022 | %(1) | | 2023 | | %(1) | | 2022 | | %(1) |

| SALES AND OPERATING REVENUES: | | | | | | | | | | | | |

| Used vehicle sales | $ | 4,832,077 | | 78.6 | | $ | 5,204,584 | | 80.0 | | | $ | 16,424,691 | | | 78.6 | | | $ | 18,503,159 | | | 77.2 | |

| Wholesale vehicle sales | 1,165,204 | | 19.0 | | 1,152,207 | | 17.7 | | | 4,001,542 | | | 19.1 | | | 4,959,050 | | | 20.7 | |

| Other sales and revenues | 151,257 | | 2.5 | | 149,165 | | 2.3 | | | 483,204 | | | 2.3 | | | 500,171 | | | 2.1 | |

| NET SALES AND OPERATING REVENUES | 6,148,538 | | 100.0 | | 6,505,956 | | 100.0 | | | 20,909,437 | | | 100.0 | | | 23,962,380 | | | 100.0 | |

| COST OF SALES: | | | | | | | | | | | | |

| Used vehicle cost of sales | 4,434,165 | | 72.1 | | 4,801,790 | | 73.8 | | | 15,060,045 | | | 72.0 | | | 17,041,898 | | | 71.1 | |

| Wholesale vehicle cost of sales | 1,042,303 | | 17.0 | | 1,037,534 | | 15.9 | | | 3,574,200 | | | 17.1 | | | 4,512,053 | | | 18.8 | |

| Other cost of sales | 59,207 | | 1.0 | | 89,944 | | 1.4 | | | 148,174 | | | 0.7 | | | 219,205 | | | 0.9 | |

| TOTAL COST OF SALES | 5,535,675 | | 90.0 | | 5,929,268 | | 91.1 | | | 18,782,419 | | | 89.8 | | | 21,773,156 | | | 90.9 | |

| GROSS PROFIT | 612,863 | | 10.0 | | 576,688 | | 8.9 | | | 2,127,018 | | | 10.2 | | | 2,189,224 | | | 9.1 | |

| CARMAX AUTO FINANCE INCOME | 148,659 | | 2.4 | | 152,196 | | 2.3 | | | 421,004 | | | 2.0 | | | 539,538 | | | 2.3 | |

Selling, general, and administrative expenses | 559,962 | | 9.1 | | 591,727 | | 9.1 | | | 1,705,493 | | | 8.2 | | | 1,914,508 | | | 8.0 | |

| Depreciation and amortization | 60,623 | | 1.0 | | 57,377 | | 0.9 | | | 177,859 | | | 0.9 | | | 170,717 | | | 0.7 | |

| Interest expense | 31,265 | | 0.5 | | 30,150 | | 0.5 | | | 93,316 | | | 0.4 | | | 91,670 | | | 0.4 | |

| Other income | (886) | | — | | (363) | | — | | | (4,730) | | | — | | | (2,303) | | | — | |

| Earnings before income taxes | 110,558 | | 1.8 | | 49,993 | | 0.8 | | | 576,084 | | | 2.8 | | | 554,170 | | | 2.3 | |

| Income tax provision | 28,555 | | 0.5 | | 12,413 | | 0.2 | | | 147,148 | | | 0.7 | | | 138,420 | | | 0.6 | |

| NET EARNINGS | $ | 82,003 | | 1.3 | | $ | 37,580 | | 0.6 | | | $ | 428,936 | | | 2.1 | | | $ | 415,750 | | | 1.7 | |

| WEIGHTED AVERAGE COMMON SHARES: | | | | | | | | | | | | |

| Basic | 158,446 | | | 158,003 | | | | 158,347 | | | | | 159,044 | | | |

| Diluted | 158,799 | | | 158,536 | | | | 158,866 | | | | | 160,195 | | | |

| NET EARNINGS PER SHARE: | | | | | | | | | | | | |

| Basic | $ | 0.52 | | | $ | 0.24 | | | | $ | 2.71 | | | | | $ | 2.61 | | | |

| Diluted | $ | 0.52 | | | $ | 0.24 | | | | $ | 2.70 | | | | | $ | 2.60 | | | |

(1) Percents are calculated as a percentage of net sales and operating revenues and may not total due to rounding.

CarMax, Inc.

Page 12 of 13

CARMAX, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | |

| | As of |

| | November 30 | | February 28 | | November 30 |

| (In thousands except share data) | 2023 | | 2023 | | 2022 |

| ASSETS | | | | | |

| CURRENT ASSETS: | | | | | |

| Cash and cash equivalents | $ | 605,375 | | | $ | 314,758 | | | $ | 688,618 | |

| Restricted cash from collections on auto loans receivable | 483,570 | | | 470,889 | | | 466,525 | |

| Accounts receivable, net | 212,406 | | | 298,783 | | | 246,794 | |

| Inventory | 3,638,946 | | | 3,726,142 | | | 3,414,937 | |

| Other current assets | 169,653 | | | 230,795 | | | 167,143 | |

| TOTAL CURRENT ASSETS | 5,109,950 | | | 5,041,367 | | | 4,984,017 | |

| Auto loans receivable, net | 17,081,891 | | | 16,341,791 | | | 16,240,832 | |

| Property and equipment, net | 3,623,697 | | | 3,430,914 | | | 3,375,001 | |

| Deferred income taxes | 121,219 | | | 80,740 | | | 87,262 | |

| Operating lease assets | 533,387 | | | 545,677 | | | 529,781 | |

| Goodwill | 141,258 | | | 141,258 | | | 141,258 | |

| Other assets | 561,848 | | | 600,989 | | | 580,790 | |

| TOTAL ASSETS | $ | 27,173,250 | | | $ | 26,182,736 | | | $ | 25,938,941 | |

| | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | |

| CURRENT LIABILITIES: | | | | | |

| Accounts payable | $ | 762,594 | | | $ | 826,592 | | | $ | 802,780 | |

| Accrued expenses and other current liabilities | 494,365 | | | 478,964 | | | 496,202 | |

| Accrued income taxes | 10,581 | | | — | | | — | |

| Current portion of operating lease liabilities | 56,410 | | | 53,287 | | | 51,215 | |

| | | | | | |

| Current portion of long-term debt | 312,744 | | | 111,859 | | | 112,708 | |

| Current portion of non-recourse notes payable | 446,544 | | | 467,609 | | | 474,147 | |

| TOTAL CURRENT LIABILITIES | 2,083,238 | | | 1,938,311 | | | 1,937,052 | |

| Long-term debt, excluding current portion | 1,605,638 | | | 1,909,361 | | | 1,903,223 | |

| Non-recourse notes payable, excluding current portion | 16,558,053 | | | 15,865,776 | | | 15,737,459 | |

| Operating lease liabilities, excluding current portion | 509,141 | | | 523,828 | | | 509,106 | |

| Other liabilities | 372,815 | | | 332,383 | | | 364,528 | |

| TOTAL LIABILITIES | 21,128,885 | | | 20,569,659 | | | 20,451,368 | |

| | | | | | |

| Commitments and contingent liabilities | | | | | |

| SHAREHOLDERS’ EQUITY: | | | | | |

| Common stock, $0.50 par value; 350,000,000 shares authorized; 158,021,407 and 158,079,033 shares issued and outstanding as of November 30, 2023 and February 28, 2023, respectively | 79,011 | | | 79,040 | | | 79,010 | |

| Capital in excess of par value | 1,786,924 | | | 1,713,074 | | | 1,697,062 | |

| Accumulated other comprehensive income | 60,667 | | | 97,869 | | | 57,420 | |

| Retained earnings | 4,117,763 | | | 3,723,094 | | | 3,654,081 | |

| TOTAL SHAREHOLDERS’ EQUITY | 6,044,365 | | | 5,613,077 | | | 5,487,573 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 27,173,250 | | | $ | 26,182,736 | | | $ | 25,938,941 | |

| | | | | | |

CarMax, Inc.

Page 13 of 13

CARMAX, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | | | |

| Nine Months Ended November 30 |

| (In thousands) | 2023 | | 2022 |

| OPERATING ACTIVITIES: | | | |

| Net earnings | $ | 428,936 | | | $ | 415,750 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Depreciation and amortization | 193,528 | | | 202,655 | |

| Share-based compensation expense | 90,479 | | | 64,974 | |

| Provision for loan losses | 238,952 | | | 218,967 | |

| Provision for cancellation reserves | 62,587 | | | 79,924 | |

| Deferred income tax benefit | (28,290) | | | (2,178) | |

| Other | 8,534 | | | 8,879 | |

| Net decrease (increase) in: | | | |

| Accounts receivable, net | 86,377 | | | 314,190 | |

| Inventory | 87,196 | | | 1,709,632 | |

| Other current assets | 91,793 | | | 149,777 | |

| Auto loans receivable, net | (979,052) | | | (1,170,098) | |

| Other assets | (8,775) | | | (43,502) | |

| Net decrease in: | | | |

| Accounts payable, accrued expenses and other | | | |

| current liabilities and accrued income taxes | (60,365) | | | (195,154) | |

| Other liabilities | (62,921) | | | (91,739) | |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | 148,979 | | | 1,662,077 | |

| INVESTING ACTIVITIES: | | | |

| Capital expenditures | (355,442) | | | (319,486) | |

| Proceeds from disposal of property and equipment | 1,299 | | | 3,806 | |

| | | |

| Purchases of investments | (4,641) | | | (6,460) | |

| Sales and returns of investments | 1,562 | | | 3,486 | |

| | | |

| NET CASH USED IN INVESTING ACTIVITIES | (357,222) | | | (318,654) | |

| FINANCING ACTIVITIES: | | | |

| | | |

| Proceeds from issuances of long-term debt | 134,600 | | | 2,863,500 | |

| Payments on long-term debt | (242,989) | | | (4,116,775) | |

| Cash paid for debt issuance costs | (15,576) | | | (13,987) | |

| Payments on finance lease obligations | (12,177) | | | (10,056) | |

| Issuances of non-recourse notes payable | 9,099,929 | | | 11,351,696 | |

| Payments on non-recourse notes payable | (8,430,615) | | | (10,581,076) | |

| Repurchase and retirement of common stock | (44,287) | | | (333,814) | |

| Equity issuances | 28,430 | | | 13,504 | |

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | 517,315 | | | (827,008) | |

| Increase in cash, cash equivalents, and restricted cash | 309,072 | | | 516,415 | |

| Cash, cash equivalents, and restricted cash at beginning of year | 951,004 | | | 803,618 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH AT END OF PERIOD | $ | 1,260,076 | | | $ | 1,320,033 | |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

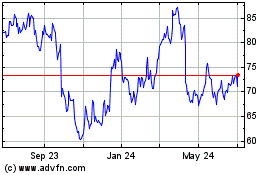

CarMax (NYSE:KMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CarMax (NYSE:KMX)

Historical Stock Chart

From Apr 2023 to Apr 2024