0001121702false00011217022023-11-142023-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 14, 2023

YIELD10 BIOSCIENCE, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| 001-33133 | | 04-3158289 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

19 Presidential Way, Woburn, Massachusetts | | 01801 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(617) 583-1700

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions ( see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | YTEN | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 14, 2023, Yield10 Bioscience, Inc. issued a press release announcing the financial results for the three and nine months ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1. This information, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | |

| No. | | Description |

| | Press Release dated November 14, 2023 announcing financial results for the three and nine months ending September 30, 2023 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | YIELD10 BIOSCIENCE, INC. |

| | | |

November 14, 2023 | By: | /s/ Oliver P. Peoples |

| | | Oliver P. Peoples |

| | | President & Chief Executive Officer |

Yield10 Bioscience Announces Third Quarter 2023 Financial Results

-Establishes "Camelina Seed Genetics to Biofuel" Platform

-Advances Herbicide Tolerant Camelina Varieties toward Commercialization

-Exercises Option to Finalize Exclusive, Global Commercial License to Advanced Omega-3 Technology

-Management will host a conference call today at 4:30 pm (ET)

WOBURN, Mass. - November 14, 2023 - Yield10 Bioscience, Inc. (Nasdaq:YTEN) ("Yield10" or the "Company"), an agricultural bioscience company, today reported financial results for the three and nine months ended September 30, 2023.

“During the third quarter of 2023, we established our “Camelina Seed Genetics to Biofuel” platform as we completed the harvest of spring and winter Camelina and delivered grain to a private biorefining company for processing into biofuel," said Oliver Peoples, Ph.D.President and CEO of Yield10 Bioscience. “In this harvest cycle, Yield10 and our Camelina growers derived proceeds from the delivery of Camelina grain to our customer. Leveraging our grower network, we also completed a new cycle of Camelina grain contracting for winter 2023/2024. On the business development front, we continue to hold discussions with companies interested in establishing collaborations in biofuels to support the planting of Camelina on large acreage.

“Yield10 prioritized the development of herbicide tolerant ("HT") Camelina to provide farmers with a robust weed control package supporting the broad adoption of the crop in North America. We are awaiting regulatory responses from USDA-APHIS and EPA to enable the use of glufosinate for control of broadleaf weeds in Camelina cultivation. With positive field data in-hand and seed scale-up activities underway, we remain on track to launch our first herbicide tolerant Camelina variety as early as 2025.

“Producing omega- 3 fatty acids (EPA, DHA) in Camelina represents a potential game-changer for the industry, enabling a plant-based, predictable supply of this nutritional ingredient. Based on our successful collaboration with Rothamsted Research, we are finalizing an exclusive, global commercial license to this advanced omega-3 technology in Camelina. Reflecting industry interest in

new sources of omega-3, we recently signed a letter of intent ("LOI") with BioMar Group, a global aquafeed producer, to collaborate on the production of omega-3 fatty acids in Camelina. We are making meaningful progress on the regulatory front, and we are working to scale-up omega-3 Camelina seed production to support additional planting in 2024.

"In the coming months, we will continue our focus on securing agreements for the biofuel market and the omega-3 market, expanding commercial activities, advancing our HT and omega-3 Camelina varieties toward launch, innovating to introduce high-value traits into Camelina, and building shareholder value," concluded Dr. Peoples.

Recent Accomplishments

•Successfully established Yield10's "Camelina Seed Genetics to Biofuel" platform

•Generated initial proceeds from seed shipments to growers and grain shipments to a biorefiner customer

•Signed Camelina grower contracts for the winter 2023/2024 season with farmers in the United States and Canada

•Reported positive field test data for stacked HT spring Camelina and initiated seed scale-up in Chile

•Exercised Yield10's option with Rothamsted to finalize a global, exclusive commercial license to omega-3 advanced technology for Camelina

•Signed an LOI with BioMar Group, a global aquafeed producer, for a partnership aimed at producing omega-3 oil on land

•Performed initial acre-scale field work with EPA8 Camelina and initiated seed scale-up in Chile

THIRD QUARTER 2023 FINANCIAL OVERVIEW

Cash Position

Yield10 Bioscience is managed with an emphasis on cash flow and deploys its financial resources in a disciplined manner to achieve its key strategic objectives.

Yield10 ended the third quarter of 2023 with $2.8 million in unrestricted cash and cash equivalents; a net increase of $0.5 million from unrestricted cash and cash equivalents of $2.3 million reported as of June 30, 2023. The net increase in the Company's cash balance as of the end of the third quarter was the result of completing a public offering of common stock and warrants during August 2023 that resulted in net proceeds of $3.1 million after issuance costs.

Net cash used by operating activities during the third quarter of 2023 was $2.6 million compared to $2.7 million used in the third quarter of 2022. The Company continues to estimate total net cash usage for the full year ended December 31, 2023 in a range of $12.5 - $13.0 million, as a result of aligning its resources to further develop and commercialize its proprietary Camelina plant varieties for its two near-term markets; biofuel feedstock and omega-3 for use in aquaculture feed, pharmaceuticals and nutrition. Cash used for operating activities will continue to support seed scale-up and other pre-commercial Camelina production activities, as well as the expansion of the Company's crop trial programs focused on herbicide tolerance and higher yielding oil traits.

There is substantial doubt about the Company's ability to continue as a going concern. Yield10's cash and cash equivalents of $2.8 million as of September 30, 2023, will only fund its operations into early December 2023. The Company's management is urgently evaluating and pursuing different strategies to obtain the required funding for its operations in the near term. These strategies may include, but are not limited to: public and private placements of equity and/or debt, licensing and/or collaboration arrangements and strategic alternatives with third parties,and other funding from the government or third parties. There can be no assurance that these funding efforts will be successful. If Yield10 is unable to obtain funds by early December 2023 or on acceptable terms, the Company may be required to curtail its current development programs, cut operating costs, forego future development and other opportunities or even terminate its operations, which may involve seeking bankruptcy protection.

Operating Results

Yield10 did not record grant revenue during the three months ended September 30, 2023. As of March 31, 2023, the Company's work in support of its DOE sub-award with Michigan State University ("MSU") was completed, with no further revenue to be recognized from the grant. Grant revenue for the third quarter of 2022 was $0.1 million. Research and development expenses were $2.2 million and $2.1 million during the three months ended September 30, 2023 and three months ended September 30, 2022, respectively. During the three months ended September 30, 2023, we recorded $0.1 million in offsets to research and development expense from payments received or due to us from shipments of seed and harvested grain to growers and offtake partners that were completed during the period. General and administrative expenses were consistent at $1.5 million for both the quarters ended September 30, 2023 and September 30, 2022.

Yield10 reported a net loss of $3.7 million for the quarter ended September 30, 2023, or $0.41 per share, as compared to a net loss of $3.5 million, or $0.71 per share, for the quarter ended September 30, 2022.

For the nine months ended September 30, 2023, the Company reported a net loss of $11.2 million, or $1.70 per share, compared to a net loss of $10.3 million, or $2.09 per share, during the nine months ended September 30, 2022. Year-to-date grant revenue earned on the completed DOE sub-award with MSU totaled $0.1 million during the nine months ended September 30, 2023 and $0.4 million during the nine months ended September 30, 2022. Research and development expenses were $6.4 million and $5.9 million during the nine months ended September 30, 2023 and September 30, 2022, respectively. General and administrative expenses were $4.9 million and $4.7 million during the nine months ended September 30, 2023 and September 30, 2022, respectively.

Conference Call

Yield10 Bioscience management will host a conference call today at 4:30 p.m. (ET) to discuss the third quarter 2023 results. The Company also will provide a corporate update and answer questions from the investor community. A live webcast of the call with slides can be accessed through the Company's website at www.yield10bio.com in the investor relations events section. To participate in the call, dial toll-free 1-800-715-9871 or 1-646-307-1963. The Conference ID for entry is Yield10.

A replay of the call will be available approximately three hours after the end of the call through Tuesday, November 28, 2023. The replay may be accessed via the Company’s website on the investor relations event page, or by dialing 877-660-6853 (toll-free) or +1-201-612-7415. The audio replay passcode is 13742262. The replay will be available until November 28, 2023. In addition, the webcast will be archived on the Company's website in the investor relations events section.

About Yield10 Bioscience

Yield10 Bioscience, Inc. ("Yield10" or the "Company") is an agricultural bioscience company that is leveraging advanced genetics to develop the oilseed Camelina sativa ("Camelina") as a platform crop for large-scale production of sustainable seed products. These seed products include feedstock oils for renewable diesel and sustainable aviation biofuels; omega-3 (EPA and DHA+EPA) oils for pharmaceutical, nutraceutical and aquafeed applications; and, in the future, PHA bioplastics for use as biodegradable bioplastics. Our commercial plan is based on establishing a grain contracting business leveraging our proprietary elite Camelina seed varieties, focusing on the growing demand for low-carbon intensity feedstock oil for biofuels and omega-3 oils for nutritional applications. Yield10 is headquartered in Woburn, MA and has a Canadian subsidiary, Yield10 Oilseeds Inc., located in Saskatoon, Canada.

For more information about the Company, please visit www.yield10bio.com, or follow the Company on X (formerly Twitter), Facebook and LinkedIn. (YTEN-E)

Safe Harbor for Forward-Looking Statements

This press release contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements in this release do not constitute guarantees of future performance. Investors are cautioned that statements in this press release which are not strictly historical statements, including, without limitation, expectations regarding Yield10’s cash position, cash forecasts and runway, expectations related to research and development and commercialization activities, intellectual property, the expected path for regulatory approvals, reproducibility of data from field tests, the outcomes of its seed production activities,

Camelina planting under growers contracts and seed scale-up activities, the finalization and signing of research licenses and collaborations, including whether the objectives of those collaborations will be met, the potential for Camelina and the technology developed by the Company to provide sustainable alternatives to existing means of omega-3 production, and value creation as well as the overall progress of Yield10, constitute forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated, including but not limited to, the risks and uncertainties detailed in Yield10’s filings with the Securities and Exchange Commission. Yield10 assumes no obligation to update any forward-looking information contained in this press release or with respect to the announcements described herein.

Contacts:

Yield10 Bioscience:

Lynne H. Brum, (617) 682-4693, LBrum@yield10bio.com

Investor Relations:

Bret Shapiro, (561) 479-8566, brets@coreir.com

Managing Director, CORE IR

Media Inquiries:

Eric Fischgrund, eric@fischtankpr.com

FischTank Marketing and PR

(FINANCIAL TABLES FOLLOW)

YIELD10 BIOSCIENCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

UNAUDITED

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Grant revenue | $ | — | | | $ | 111 | | | $ | 60 | | | $ | 363 | |

| Total revenue | — | | | 111 | | | 60 | | | 363 | |

| | | | | | | |

| Expenses: | | | | | | | |

| Research and development | 2,204 | | | 2,083 | | | 6,363 | | | 5,862 | |

| General and administrative | 1,499 | | | 1,518 | | | 4,867 | | | 4,748 | |

| Total expenses | 3,703 | | | 3,601 | | | 11,230 | | | 10,610 | |

| Loss from operations | (3,703) | | | (3,490) | | | (11,170) | | | (10,247) | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Other income (expense), net | (23) | | | 10 | | | (19) | | | 11 | |

| Total other income (expense) | (23) | | | 10 | | | (19) | | | 11 | |

| Loss from operations before income taxes | (3,726) | | | (3,480) | | | (11,189) | | | (10,236) | |

| Income tax provision | — | | | (9) | | | — | | | (27) | |

| Net loss | $ | (3,726) | | | $ | (3,489) | | | $ | (11,189) | | | $ | (10,263) | |

| | | | | | | |

| Basic and diluted net loss per share | $ | (0.41) | | | $ | (0.71) | | | $ | (1.70) | | | $ | (2.09) | |

| Number of shares used in per share calculations: | | | | | | | |

| Basic and diluted | 8,987,957 | | | 4,924,606 | | | 6,586,801 | | | 4,904,737 | |

YIELD10 BIOSCIENCE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

UNAUDITED

(In thousands, except share and per share amounts)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 2,817 | | | $ | 2,356 | |

| Short-term investments | — | | | 1,991 | |

| | | |

| | | |

| Unbilled receivables | — | | | 30 | |

| Prepaid expenses and other current assets | 545 | | | 641 | |

| | | |

| Total current assets | 3,362 | | | 5,018 | |

| | | |

| Restricted cash | 264 | | | 264 | |

| Property and equipment, net | 594 | | | 775 | |

| Right-of-use assets, net | 1,769 | | | 1,961 | |

| Other assets | 53 | | | 67 | |

| Total assets | $ | 6,042 | | | $ | 8,085 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 381 | | | $ | 109 | |

| Accrued expenses | 1,944 | | | 926 | |

| Current portion of lease liabilities | 651 | | | 575 | |

| Convertible note payable, net of issuance costs | 977 | | | — | |

| Total current liabilities | 3,953 | | | 1,610 | |

| Lease liabilities, net of current portion | 1,697 | | | 2,075 | |

| Total liabilities | 5,650 | | | 3,685 | |

| Commitments and contingencies | | | |

| Stockholders’ Equity: | | | |

Preferred stock ($0.01 par value per share); 5,000,000 shares authorized; no shares issued or outstanding | — | | | — | |

Common stock ($0.01 par value per share); 60,000,000 shares authorized at September 30, 2023 and December 31, 2022; 11,901,780 and 4,944,202 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | 119 | | | 49 | |

| Additional paid-in capital | 411,406 | | | 404,277 | |

| Accumulated other comprehensive loss | (247) | | | (229) | |

| Accumulated deficit | (410,886) | | | (399,697) | |

| Total stockholders’ equity | 392 | | | 4,400 | |

| Total liabilities and stockholders’ equity | $ | 6,042 | | | $ | 8,085 | |

YIELD10 BIOSCIENCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

UNAUDITED

(In thousands)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net loss | $ | (11,189) | | | $ | (10,263) | |

| Adjustments to reconcile net loss to cash used in operating activities: | | | |

| Depreciation and amortization | 217 | | | 197 | |

| Charge for 401(k) company common stock match | 91 | | | 111 | |

| Stock-based compensation | 1,209 | | | 1,458 | |

| Non-cash lease expense | 192 | | | 291 | |

| Deferred income tax provision | — | | | 37 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | — | | | 127 | |

| Unbilled receivables | 30 | | | (5) | |

| Prepaid expenses and other assets | 121 | | | 52 | |

| Accounts payable | 272 | | | 21 | |

| Accrued expenses | 1,002 | | | 17 | |

| Lease liabilities | (302) | | | (385) | |

| Net cash used in operating activities | (8,357) | | | (8,342) | |

| | | |

| Cash flows from investing activities | | | |

| Purchase of property and equipment | (26) | | | (154) | |

| Purchase of investments | — | | | (1,195) | |

| Proceeds from the maturity of short-term investments | 1,991 | | | 8,371 | |

| Net cash provided by investing activities | 1,965 | | | 7,022 | |

| | | |

| Cash flows from financing activities | | | |

| Proceeds from issuance of common stock and warrants in equity offerings, net of issuance costs | 5,842 | | | — | |

| Proceeds from At-the-Market offering, net of issuance costs | 103 | | | — | |

| Proceeds for convertible debt note | 967 | | | — | |

| Taxes paid on employees' behalf related to vesting of stock awards | (41) | | | (37) | |

| Net cash provided by (used in) financing activities | 6,871 | | | (37) | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (18) | | | (50) | |

| | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 461 | | | (1,407) | |

| Cash, cash equivalents and restricted cash at beginning of period | 2,620 | | | 5,593 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 3,081 | | | $ | 4,186 | |

| | | |

| Supplemental disclosure of non-cash information: | | | |

| Right-of-use assets acquired in exchange for lease liabilities | $ | 138 | | | $ | — | |

| | | |

| | | |

| | | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

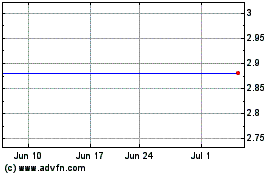

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

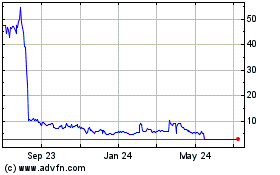

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Apr 2023 to Apr 2024