As filed with the Securities and Exchange Commission

on November 13, 2023

Registration No. 333-196971

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1

TO

FORM S-8

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Viper Energy, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware |

|

46-5001985 |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification Number) |

500 West Texas, Suite 100

Midland, Texas

(Address, including zip Code, of Principal Executive

Offices)

Viper Energy, Inc. Amended and Restated 2014

Long Term Incentive Plan

(Full title of the plan)

Teresa L. Dick

Chief Financial Officer, Executive Vice President

and Assistant Secretary

Viper Energy, Inc.

515 Central Park Drive, Suite 500

Oklahoma City, Oklahoma 73105

(405) 463-6900

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

John Goodgame

Akin Gump Strauss Hauer & Feld LLP

1111 Louisiana Street, 44th Floor

Houston, Texas 77002

(713) 220-8144

(713) 236-0822 (facsimile)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer x |

|

Accelerated Filer ¨ |

| Non-Accelerated Filer ¨ |

|

Smaller Reporting Company ¨ |

| Emerging Growth Company ¨ |

|

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. o

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 (this “Amendment”)

to Registration Statement No. 333-196971 (the “Registration Statement”) does not reflect any increase in the number of shares

issuable pursuant to the Viper Energy, Inc. Amended and Restated 2014 Long Term Incentive Plan (the “Amended LTIP”).

This Amendment is being filed pursuant to Rule 414(d) under the Securities Act of 1933, as amended (the “Securities Act”),

by Viper Energy, Inc., a Delaware corporation (“Viper Corp.”), as the successor registrant to Viper Energy Partners LP, a

Delaware limited partnership (“Viper LP”). Effective at 12:01 a.m. (Eastern Time) on November 13, 2023, Viper LP converted

from a Delaware limited partnership to a Delaware corporation (the “Conversion”). Viper Corp. expressly adopts the Registration

Statement, as modified by this Amendment, as its own registration statement for all purposes of the Securities Act and the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

For the purposes of this Amendment and the Registration

Statement, (i) as of any time prior to the Conversion, references to the “Partnership,” “Viper,” “we,”

“us,” “our” and similar terms mean Viper LP and its consolidated subsidiaries and, as of any time after the Conversion,

Viper Corp. and its consolidated subsidiaries, (ii) as of any time prior to the Conversion, references to “Viper Energy Partners

LP” and/or “Partnership” mean Viper LP and its consolidated subsidiaries and, as of any time after the Conversion, if

the context requires, references to “Viper Energy Partners LP” and/or “Partnership” are deleted and replaced with

“Viper Energy, Inc.” or “our company,” as applicable, which means Viper Corp. and its consolidated subsidiaries,

(iii) as of any time prior to the Conversion, references to the “General Partner” mean Viper Energy Partners GP LLC, which

acted as the general partner of Viper LP, and, as of any time after the Conversion, if the context requires, references to the “General

Partner” are deleted and, where applicable, replaced with “Company” or Diamondback Energy, Inc., Viper Corp.’s

parent entity, (iv) as of any time prior to the Conversion, references to “Board” mean the Board of Directors of the General

Partner and, as of any time after the Conversion, references to the “Board” shall mean the board of directors of Viper Corp.,

(v) as of any time prior to the Conversion, references to “unitholders” or “shareholders” mean the holders of

any limited partnership interest in Viper LP and, as of any time after the Conversion, if the context requires, references to “unitholders”

or “shareholders” are deleted and replaced with “stockholders” which means the holders of Class A common stock,

par value $0.000001 per share, of Viper Corp. and (vi) as of any time prior to the Conversion, references to “common units”

mean the common units of Viper LP and, as of any time after the Conversion, if the context requires, references to “common units”

are deleted and replaced with “common stock” which means Class A common stock, par value $0.000001 per share, of Viper Corp.

The prospectus contained in the Registration Statement

incorporates by reference all documents filed by Viper LP under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date

of the initial filing of the Registration Statement and will incorporate by reference all documents filed by Viper Corp. under Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act on or following the date of this Amendment. The prospectus contained in the Registration

Statement, as well as all documents filed by us under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act before the effective time

of the Conversion and incorporated by reference in the Registration Statement, will not reflect the change in our name, type of legal

entity or capital stock, among other things. With respect to such information, or any other information contained or incorporated by reference

in the Registration Statement that is modified by information subsequently incorporated by reference in the Registration Statement, the

statement or information previously contained or incorporated in the Registration Statement shall also be deemed modified or superseded

in the same manner.

In connection with the Conversion, Viper Corp.

has amended and restated the Viper Energy Partners LP 2014 Long Term Incentive Plan by adopting the Amended LTIP. The Amended LTIP is filed as an exhibit to this Amendment and is

hereby incorporated by reference into this Amendment.

The rights of holders of Viper Corp.’s Class

A common stock are now governed by its Delaware certificate of incorporation, its Delaware bylaws and the Delaware General Corporation

Law, each of which is described in Amendment No. 1 to Viper Corp.’s Registration Statement on Form 8-A.

The Registration Statement shall remain unchanged

in all other respects. Accordingly, this Amendment consists only of this explanatory note and revised versions of the following parts

of the Form S-8: Part I, Part II, the signatures, the exhibit index and the exhibits filed in connection with this Amendment.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Items 1 and 2 of Part

I of the Form S-8 is omitted from this filing in accordance with the provisions of Rule 428 under the Securities Act and the introductory

note to Part I of the Form S-8. The documents containing the information specified in Part I will be delivered to the participants in

the Amended LTIP covered by this Registration Statement, as is defined by this Amendment, as required by Rule 428(b)(1).

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed with the Commission

by Viper pursuant to the Securities Act and the Exchange Act, are hereby incorporated by reference in this Registration Statement:

| (c) | The Current Reports on Form 8-K filed with the Commission on March 30, 2023, June 6, 2023, September 7, 2023, September 28, 2023,

October 12, 2023 (two reports), October 17, 2023, October 25, 2023, November 2, 2023, November 7, 2023 and November 13, 2023 and on Form 8-K/A filed on November 13, 2023. |

All documents filed by Viper with the Commission

pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this Amendment and prior to the filing of a post-effective

amendment that indicates that all securities offered hereby have been sold or that deregisters all offerings of securities then remaining

unsold shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of

such documents.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Amendment to the extent

that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference herein

modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this Registration Statement.

In no event, however, will any information that

Viper discloses under Item 2.02 or Item 7.01 of any Current Report on Form 8-K that Viper may from time to time furnish to the Commission

be incorporated by reference into, or otherwise become a part of, this Registration Statement. Any statement contained in a document that

is deemed to be incorporated by reference or deemed to be part of this Registration Statement after the most recent effective date may

modify or replace existing statements contained in this Registration Statement.

Item 5. Interests of Named Experts and Counsel.

The validity of the Class A common stock will be

passed upon for us by Akin Gump Strauss Hauer & Feld LLP, Houston, Texas.

Item 6. Indemnification of Directors and Officers.

Under the Registrant’s certificate of incorporation

and bylaws, in most circumstances, the Registrant will indemnify to the fullest extent permitted by law, from and against all expenses,

liability and losses, each member of the board of directors of the Registrant and each officer of the Registrant.

The Registrant also has indemnification agreements

with each of the current directors and executive officers. These agreements require the Registrant to indemnify these individuals to the

fullest extent permitted by law against expenses incurred as a result of any proceeding in which they are involved by reason of their

service to the Registrant and, if requested, to advance expenses incurred as a result of any such proceeding. The Registrant also intends

to enter into indemnification agreements with future directors and executive officers. The underwriting agreement that the Registrant

has entered into with its underwriters also contains indemnification and contribution provisions that will indemnify and hold harmless

the directors and officers of the Registrant.

The Amended LTIP provides that the committee that

administers the Amended LTIP and all members thereof are entitled to, in good faith, rely or act upon any report or other information

furnished to them by any officer or employee of the Registrant, any of its subsidiaries, the Registrant’s legal counsel, independent

auditors, consultants or any other agents assisting in the administration of the Amended LTIP. Members of the committee and any

officer or employee of the Registrant or any of its subsidiaries acting at the direction or on behalf of the committee shall not be personally

liable for any action or determination taken or made in good faith with respect to the Amended LTIP, and shall, to the fullest extent

permitted by law, be indemnified and held harmless by the Registrant with respect to any such action or determination.

Item 8. Exhibits.

The following exhibits are filed as part of this Amendment:

# Previously filed.

* Filed herewith.

Item 9. Undertakings.

(a) The undersigned registrant hereby

undertakes:

(1) To file, during any period in which offers or sales are

being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required

by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any

facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which,

individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed

that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the

form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no

more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the

effective registration statement.

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information

in the registration statement;

provided, however, that Paragraphs (a)(1)(i) and (a)(1)(ii)

above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports

filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of

1934 (15 U.S.C. 78m or 78o(d)) that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under

the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) That, for purposes of determining any liability under the Securities

Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of

1934 that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities

Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or

otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against

public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling

person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling

person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-8 and has duly caused this Post-Effective Amendment No. 1 to be signed on its behalf by the undersigned, thereunto duly authorized,

in the City of Midland, in the State of Texas, on November 13, 2023.

| |

VIPER ENERGY, INC. |

| |

|

|

| |

By: |

/s/ Teresa L. Dick |

| |

|

Name: |

Teresa L. Dick |

| |

|

Title: |

Chief Financial Officer, Executive Vice President and Assistant Secretary |

Pursuant to the requirements of the Securities

Act of 1933, as amended, this Post-Effective Amendment No. 1 to the Registration Statement has been signed by the following persons in

the capacities and on the dates indicated below.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Travis D. Stice |

|

Chief Executive Officer and Director

|

|

November 13, 2023 |

|

Travis D. Stice

|

|

(Principal Executive Officer) |

|

|

| /s/ Teresa L. Dick |

|

Chief Financial Officer

(Principal Financial and Accounting Officer) |

|

November 13, 2023 |

|

Teresa L. Dick

|

|

|

| * |

|

Director |

|

November 13, 2023 |

|

Steven E. West

|

|

|

| /s/ Kaes Van’t Hof |

|

Director |

|

November 13, 2023 |

|

Kaes Van’t Hof

|

|

|

|

|

| |

|

Director |

|

November 13, 2023 |

|

Spencer D. Armour

|

|

|

|

|

| |

|

Director |

|

November 13, 2023 |

|

Frank C. Hu

|

|

|

|

|

| * |

|

Director |

|

November 13, 2023 |

|

W. Wesley Perry

|

|

|

|

|

| * |

|

Director |

|

November 13, 2023 |

|

James L. Rubin

|

|

|

|

|

| |

|

Director |

|

November 13, 2023 |

| Laurie H. Argo |

|

|

|

|

| |

*By: | /s/ Teresa L. Dick |

|

| |

| Teresa L. Dick, Attorney-in-Fact |

|

Exhibit 5.1

November 13, 2023

Viper Energy, Inc.

500 West Texas, Suite 100

Midland, Texas 79701

| Re: | Viper Energy, Inc.

Registration Statement on Form S-8 |

Ladies and Gentlemen:

We have acted as counsel to Viper Energy, Inc.,

a Delaware corporation (the “Company”), in connection with Post-Effective Amendment No. 1 to the Registration

Statement on Form S-8 (File No. 333-196971) of the Company (as amended, the “Registration Statement”),

being filed on the date hereof with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Act”),

relating to the issuance of up to 9,144,000 shares (the “Shares”) of the Company’s Class A common

stock, par value $0.000001 per share (“Class A Common Stock”). The Shares were authorized for issuance

under the Viper Energy, Inc. Amended and Restated Long Term Incentive Plan, which amended and restated the Viper Energy Partners

LP 2014 Long Term Incentive Plan (as so amended and restated, the “Plan”). This opinion is being furnished in

accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Act.

We have examined originals or certified copies

of such corporate records of the Company and other certificates and documents of officials of the Company, public officials and others

as we have deemed appropriate for purposes of this letter. We have assumed the genuineness of all signatures, the legal capacity of all

natural persons, the authenticity of all documents submitted to us as originals, and the conformity to authentic original documents of

all copies submitted to us as conformed, certified or reproduced copies. We have also assumed that (i) the Shares are uncertificated

and valid book-entry notations for the issuance of the Shares in uncertificated form will have been duly made in the share register of

the Company, (ii) each award agreement setting forth the terms of each award granted pursuant to the Plan is consistent with

the Plan and has been duly authorized and validly executed and delivered by the parties thereto, (iii) at the time of each issuance

of Shares, there will be sufficient shares of Class A Common Stock authorized for issuance under the Company’s certificate

of incorporation that have not otherwise been issued or reserved or committed for issuance, and (iv) the price per share paid for

Shares issued pursuant to the Plan is not less than the par value of the Shares. We have also assumed the existence and entity power of

each party to any document referred to herein other than the Company. As to various questions of fact relevant to this letter, we have

relied, without independent investigation, upon certificates of public officials and certificates of officers of the Company, all of which

we assume to be true, correct and complete.

2300 N. Field Street, Suite 1800 | Dallas,

Texas 75201-4675 | 214.969.2800 | fax: 214.969.4343 | akingump.com

Page 2

November 13, 2023

Viper Energy, Inc.

Based upon the foregoing, and subject to the assumptions,

exceptions, qualifications and limitations stated herein, we are of the opinion that when the Shares have been issued and delivered upon

payment therefor in accordance with the terms of the Plan, the Company’s certificate of incorporation and bylaws, as they may be

amended from time to time, and the applicable award agreement, the Shares will be duly authorized, validly issued, fully paid and non-assessable.

The opinions and other matters in this letter are

qualified in their entirety and subject to the following:

| A. | We express no opinion as to the laws of any jurisdiction other than the General Corporation Law of the State of Delaware. |

| B. | This opinion letter is limited to the matters expressly stated herein and no opinion is to be inferred or implied beyond the opinion

expressly set forth herein. We undertake no, and hereby disclaim any, obligation to make any inquiry after the date hereof or to advise

you of any changes in any matter set forth herein, whether based on a change in the law, a change in any fact relating to the Company

or any other person or any other circumstance. |

We hereby consent to the filing of this opinion

as an exhibit to the Registration Statement. In giving this consent, we do not thereby admit that we are within the category of persons

whose consent is required under Section 7 of the Act and the rules and regulations thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ AKIN GUMP STRAUSS HAUER & FELD LLP |

| |

|

| |

AKIN GUMP STRAUSS HAUER & FELD LLP |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We have issued our reports dated February 23, 2023 with respect to

the consolidated financial statements and internal control over financial reporting of Viper Energy Partners LP (now known as Viper Energy,

Inc.) included in the Annual Report on Form 10-K for the year ended December 31, 2022, which are incorporated by reference in this Registration

Statement. We consent to the incorporation by reference of the aforementioned reports in this Registration Statement.

/s/ GRANT THORNTON LLP

Oklahoma City, Oklahoma

November 13, 2023

Exhibit 23.2

CONSENT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

We have issued our report dated November 13, 2023 with respect to the

combined financial statements of Royalty Asset Holdings, LP, Royalty Asset Holdings II, LP, and Saxum Asset Holdings, LP included in the

current report of Viper Energy, Inc. on Form 8-K/A, which are incorporated by reference in this Registration Statement. We consent to

the incorporation by reference of the aforementioned report in this Registration Statement.

/s/ GRANT THORNTON LLP

Oklahoma City, Oklahoma

November 13, 2023

Exhibit 23.3

CONSENT OF RYDER SCOTT COMPANY, L.P.

We have issued our report dated January 5, 2023 on estimates of proved

reserves, future production and income attributable to certain royalty interests of Viper Energy Partners LP (now known as Viper Energy,

Inc.) (“Viper”), prepared as of December 31, 2022 (the “Reserve Report”), included in Viper’s Annual Report

on Form 10-K for the year ended December 31, 2022 (the “Annual Report”). As independent oil and gas consultants, we hereby

consent to (i) the incorporation by reference of the Reserve Report in this Post-Effective Amendment to the Registration Statement on

Form S-8 (this “Registration Statement”) and (ii) the use in this Registration Statement of the information contained in the

Reserve Report and in our prior reserve reports referenced in this Registration Statement or in the Annual Report, which is incorporated

by reference in this Registration Statement.

| |

Ryder Scott Company, L.P. |

| |

|

| |

/s/ Ryder Scott Company, L.P. |

| |

|

| |

RYDER SCOTT COMPANY, L.P. |

| |

TBPE Firm Registration No. F-1580 |

Houston, Texas

November 13, 2023

Exhibit 23.4

CONSENT OF DEGLOYER AND MACNAUGHTON

We have issued our reports, each dated October 25, 2023, on estimates

of proved reserves, future production and income attributable to certain royalty interests acquired by Viper Energy Partner LP (now known

as Viper Energy, Inc.) (“Viper”), from Royalty Asset Holdings, LP, Royalty Asset Holdings II, LP and Saxum Asset Holdings,

LP, prepared as of December 31, 2022 and December 31, 2021 (the “Reserve Reports”), included as Exhibit 99.4 and 99.5, respectively,

in the Current Report on Form 8-K/A of Viper filed on November 13, 2023, which reports are incorporated by reference in this Post-Effective

Amendment No. 1 to the Registration Statement on Form S-8 (this “Post-Effective Amendment”). As independent petroleum engineers,

we hereby consent to (i) the incorporation by reference of the Reserve Reports in this Post-Effective Amendment and (ii) the use in this

Post-Effective Amendment of the information contained in the Reserve Reports.

| |

DeGloyer and MacNaughton |

| |

|

| |

/s/ DeGloyer and MacNaughton |

| |

|

| |

DEGLOYER AND MACNAUGHTON |

Houston, Texas

November 13, 2023

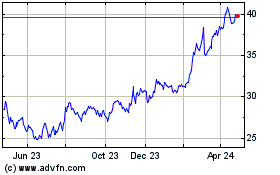

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

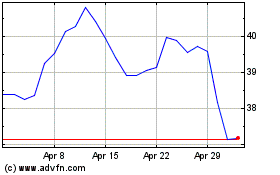

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Apr 2023 to Apr 2024