0001488917

false

0001488917

2023-11-07

2023-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported):

November 7, 2023

ELECTROMED, INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Minnesota |

001-34839 |

41-1732920 |

|

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification

Number) |

500

Sixth Avenue NW

New

Prague, MN 56071

(Address of Principal Executive Offices)

(Zip Code)

(952)

758-9299

(Registrant’s Telephone Number, Including

Area Code)

Not

Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Common

Stock, $0.01 par value |

|

ELMD |

|

NYSE American LLC |

| (Title of each class) |

|

(Trading Symbol) |

|

(Name of each exchange

on which registered) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On November 7, 2023, Electromed, Inc., a Minnesota corporation

(the "Company"), issued a press release announcing its financial results for the fiscal quarter ended September 30, 2023. The full text

of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference into this Item 2.02.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ELECTROMED, INC. |

|

| |

|

|

| Date: November 7, 2023 |

By: /s/ Bradley M. Nagel |

|

| |

Name: |

Bradley M. Nagel |

|

| |

Title: |

Chief Financial Officer |

|

Exhibit 99.1

Electromed, Inc. Announces Fiscal 2024

First Quarter Financial Results

NEW PRAGUE, Minn.--(BUSINESS WIRE)-- Electromed, Inc. (“Electromed”

or the “Company”) (NYSE American: ELMD), a leader in innovative airway clearance technologies, today announced financial

results for the three months ended September 30, 2023 (“Q1 FY 2024”).

Q1 FY 2024 Financial Highlights

| ● | Net revenue increased 16% to $12.3 million in Q1 FY 2024, from $10.7

million in the first quarter of the prior fiscal year. |

| ● | Operating income was $142,000, compared with $44,000 in the first quarter

of the prior fiscal year. |

| ● | Net income was $155,000 for the quarter, or $0.02 per diluted share,

compared to $81,000, or $0.01 per diluted share in the first quarter of the prior fiscal year. |

“The

first quarter of our fiscal year ending June 30, 2024 was another strong quarter for Electromed, as our team performed at a high

level in pursuit of our multiple strategic growth initiatives, including continued expansion of our sales team and ongoing launch

of the new Clearway system,” said Jim Cunniff, President and Chief Executive Officer. “We generated strong revenue

growth versus the prior year across all three revenue categories, homecare, hospital and international. The team seamlessly executed

the reorganization of the reimbursement team for improved efficiency, more meaningful service metrics and service improvements

for a frictionless clinical experience. We also launched an improved way

of gathering, tracking and reporting patient quality of life feedback documentation to physicians. I am proud of the team for an

impressive start to fiscal year 2024 and look forward to building on this momentum in the remainder of the fiscal year.”

Q1 FY 2024 Results

Net revenue for Q1 FY 2024 grew 16% over the first quarter of

our fiscal year ended June 30, 2023 (“fiscal 2023”) to $12.3 million, from $10.7 million in the same period in fiscal

2023. The increase was primarily due to an increase in referrals, approvals and reimbursement rates.

Revenue in our direct

homecare business increased year-over-year by 15.8% to $11.2 million, from $9.6 million in

the same period in fiscal 2023.The increase in referrals was due to an increase in direct sales representatives. Field sales force

employees totaled 59 at quarter end, 51 of which were direct sales representatives. The annualized homecare revenue per weighted

average direct sales representative in Q1 was $876,000, within Electromed’s annual target range of $850,000 to $950,000.

Gross profit increased to $9,498,000, or 77.1% of

net revenues for Q1 FY 2024, from $8,331,000 or 78.2% of net revenues, in the same period in fiscal 2023. The increase in gross

profit dollars in fiscal 2024 was primarily due to increased revenue. Gross margin rate decreased year over year as a result of

increased material and labor costs.

Selling, general and administrative (“SG&A”)

expenses were $9,150,000 for Q1 FY 2024, representing an increase of $1,161,000 or 14.5%, compared to the same period in fiscal

2023. The increase in SG&A expense was primarily due to increased payroll and compensation expense related to the higher average

number of sales, sales support, marketing, and reimbursement personnel to process higher patient referrals.

Operating income for the quarter was $142,000, compared to $44,000

for the same period in the prior fiscal year. The increase in operating income was driven primarily by increased revenue.

Net income for Q1 FY 2024 was $155,000, or $0.02 per diluted

share, compared to $81,000, or $0.01 per diluted share, for the same period in the prior fiscal year.

As of September 30, 2023, Electromed had $7.0 million in cash,

$23.5 million in accounts receivable and no debt, achieving a working capital of $30.4 million and an increase in total shareholders’

equity of $0.6 million to $38.2 million. The cash balance reflects a decrease of $0.4 million compared to a decrease in cash of

$2.2 million in the same period in the prior fiscal year. The decrease primarily resulted from payment of annual incentive compensation

which is not expected to occur in the remaining quarters.

Conference Call and Webcast Information

The conference call with members of Electromed management will

be held at 5:00 p.m. Eastern Time on Tuesday, November 7, 2023.

Interested parties may participate in the call by dialing (844)

826-3033 (Domestic) or (412) 317-5185 (International).

The live conference call webcast will be accessible in the

Investor Relations section of Electromed’s web site and directly via the following link: https://viavid.webcasts.com/starthere.jsp?ei=1638052&tp_key=fe01719b63

For those who cannot listen to the live broadcast, a replay

will be available by dialing (844) 512-2921 (Domestic) or (412) 317-6671 (International) and referencing the replay pin number

10183240. Additionally, an online replay will be available in the Investor Relations

section of Electromed’s web site at: Events & Presentations | SmartVest

About Electromed, Inc.

Electromed, Inc. manufactures, markets, and sells products

that provide airway clearance therapy, including the SmartVest® Airway Clearance System, to patients with compromised pulmonary

function. It is headquartered in New Prague, Minnesota, and was founded in 1992. Further information about Electromed can be found

at www.smartvest.com.

Cautionary Statements

Certain statements in this press release constitute forward-looking

statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can generally be

identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “plan” “potential,” “should,” “will,” and similar expressions,

including the negative of these terms, but they are not the exclusive means of identifying such statements. Forward-looking statements

cannot be guaranteed, and actual results may vary materially due to the uncertainties and risks, known or unknown associated with

such statements. Examples of risks and uncertainties for the Company include, but are not limited to, the duration, extent and

severity of the Covid-19 pandemic, including its effects on our business, operations and employees as well as its impact on our

customers and distribution channels and on economies and markets more generally; the competitive nature of our market; changes

to Medicare, Medicaid, or private insurance reimbursement policies; changes to state and federal health care laws; changes affecting

the medical device industry; our ability to develop new sales channels for our products such as the homecare distributor channel;

our need to maintain regulatory compliance and to gain future regulatory approvals and clearances; new drug or pharmaceutical discoveries;

general economic and business conditions; our ability to renew our line of credit or obtain additional credit as necessary; our

ability to protect and expand our intellectual property portfolio; the risks associated with expansion into international markets,

as well as other factors we may describe from time to time in the Company’s reports filed with the Securities and Exchange

Commission (including the Company’s most recent Annual Report on Form 10-K, as amended from time to time, and subsequent

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K). Investors should not consider any list of such factors to be an

exhaustive statement of all the risks, uncertainties or potentially inaccurate assumptions investors should take into account when

making investment decisions. Shareholders and other readers should not place undue reliance on “forward-looking statements,”

as such statements speak only as of the date of this press release. We undertake no obligation to update them in light of new information

or future events.

Electromed, Inc.

Condensed Balance Sheets

| | |

September 30, 2023 | | |

June 30, 2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| Assets | |

| | |

| |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 7,024,000 | | |

$ | 7,372,000 | |

| Accounts receivable (net of allowances for doubtful accounts of $45,000) | |

| 23,455,000 | | |

| 24,130,000 | |

| Contract assets | |

| 544,000 | | |

| 487,000 | |

| Inventories | |

| 4,480,000 | | |

| 4,221,000 | |

| Prepaid expenses and other current assets | |

| 692,000 | | |

| 1,577,000 | |

| Total current assets | |

| 36,195,000 | | |

| 37,787,000 | |

| Property and equipment, net | |

| 5,534,000 | | |

| 5,672,000 | |

| Finite-life intangible assets, net | |

| 613,000 | | |

| 605,000 | |

| Other assets | |

| 143,000 | | |

| 161,000 | |

| Deferred income taxes | |

| 1,581,000 | | |

| 1,581,000 | |

| Total assets | |

$ | 44,066,000 | | |

$ | 45,806,000 | |

| | |

| | | |

| | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

| 1,057,000 | | |

| 1,372,000 | |

| Accrued compensation | |

| 1,844,000 | | |

| 3,018,000 | |

| Income tax payable | |

| 110,000 | | |

| 336,000 | |

| Warranty reserve | |

| 1,424,000 | | |

| 1,378,000 | |

| Other accrued liabilities | |

| 1,341,000 | | |

| 1,949,000 | |

| Total current liabilities | |

| 5,776,000 | | |

| 8,053,000 | |

| Other long-term liabilities | |

| 68,000 | | |

| 86,000 | |

| Total liabilities | |

| 5,844,000 | | |

| 8,139,000 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ Equity | |

| | | |

| | |

| Common stock, $0.01 par value per share, 13,000,000 shares authorized; 8,579,050 and 8,555,238

shares issued and outstanding, as of September 30, 2023 and June 30, 2023, respectively | |

| 86,000 | | |

| 86,000 | |

| Additional paid-in capital | |

| 19,188,000 | | |

| 18,788,000 | |

| Retained earnings | |

| 18,948,000 | | |

| 18,793,000 | |

| Total shareholders’ equity | |

| 38,222,000 | | |

| 37,667,000 | |

| Total liabilities and shareholders’ equity | |

$ | 44,066,000 | | |

$ | 45,806,000 | |

Electromed, Inc.

Condensed Statements of Operations

| | |

Three Months Ended

September 30 | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Net revenues | |

$ | 12,324,000 | | |

$ | 10,658,000 | |

| Cost of revenues | |

| 2,826,000 | | |

| 2,327,000 | |

| Gross profit | |

| 9,498,000 | | |

| 8,331,000 | |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| Selling, general and administrative | |

| 9,150,000 | | |

| 7,989,000 | |

| Research and development | |

| 206,000 | | |

| 298,000 | |

| Total operating expenses | |

| 9,356,000 | | |

| 8,287,000 | |

| Operating income | |

| 142,000 | | |

| 44,000 | |

| Interest income, net | |

| 77,000 | | |

| 4,000 | |

| Net income before income taxes | |

| 219,000 | | |

| 48,000 | |

| | |

| | | |

| | |

| Income tax expense (benefit) | |

| 64,000 | | |

| (33,000 | ) |

| | |

| | | |

| | |

| Net income | |

$ | 155,000 | | |

$ | 81,000 | |

| | |

| | | |

| | |

| Income per share: | |

| | | |

| | |

| Basic | |

$ | 0.02 | | |

$ | 0.01 | |

| | |

| | | |

| | |

| Diluted | |

$ | 0.02 | | |

$ | 0.01 | |

| | |

| | | |

| | |

| Weighted-average common shares outstanding: | |

| | | |

| | |

| Basic | |

| 8,537,388 | | |

| 8,445,893 | |

| Diluted | |

| 8,782,824 | | |

| 8,689,377 | |

Electromed, Inc.

Condensed Statements of Cash Flows

| | |

Three Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Cash Flows From Operating Activities | |

| | | |

| | |

| Net income | |

$ | 155,000 | | |

$ | 81,000 | |

| Adjustments to reconcile net income to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 202,000 | | |

| 134,000 | |

| Amortization of finite-life intangible assets | |

| 12,000 | | |

| 20,000 | |

| Share-based compensation expense | |

| 371,000 | | |

| 95,000 | |

| Deferred income taxes | |

| - | | |

| 6,000 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 675,000 | | |

| 95,000 | |

| Contract assets | |

| (57,000 | ) | |

| (167,000 | ) |

| Inventories | |

| (240,000 | ) | |

| (500,000 | ) |

| Prepaid expenses and other current assets | |

| 901,000 | | |

| (125,000 | ) |

| Income tax payable, net | |

| (226,000 | ) | |

| (175,000 | ) |

| Accounts payable and accrued liabilities | |

| (863,000 | ) | |

| (26,000 | ) |

| Accrued compensation | |

| (1,174,000 | ) | |

| (1,132,000 | ) |

| Net cash used in operating activities | |

| (244,000 | ) | |

| (1,694,000 | ) |

| | |

| | | |

| | |

| Cash Flows From Investing Activities | |

| | | |

| | |

| Expenditures for property and equipment | |

| (109,000 | ) | |

| (241,000 | ) |

| Expenditures for finite-life intangible assets | |

| (24,000 | ) | |

| (15,000 | ) |

| Net cash used in investing activities | |

| (133,000 | ) | |

| (256,000 | ) |

| | |

| | | |

| | |

| Cash Flows From Financing Activities | |

| | | |

| | |

| Issuance of common stock upon exercise of options | |

| 29,000 | | |

| - | |

| Taxes paid on net share settlement of stock option exercises | |

| - | | |

| (60,000 | ) |

| Repurchase of common stock | |

| - | | |

| (145,000 | ) |

| Net cash provided by (used in) financing activities | |

| 29,000 | | |

| (205,000 | ) |

| Net decrease in cash | |

| (348,000 | ) | |

| (2,155,000 | ) |

| | |

| | | |

| | |

| Cash And Cash Equivalents | |

| | | |

| | |

| Beginning of period | |

| 7,372,000 | | |

| 8,153,000 | |

| End of period | |

$ | 7,024,000 | | |

$ | 5,998,000 | |

Brad Nagel, Chief Financial Officer

(952) 758-9299

investorrelations@electromed.com

Mike Cavanaugh, Investor Relations

ICR Westwicke

(617) 877-9641

mike.cavanaugh@westwicke.com

Source: Electromed, Inc.

v3.23.3

Cover

|

Nov. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2023

|

| Entity File Number |

001-34839

|

| Entity Registrant Name |

ELECTROMED, INC.

|

| Entity Central Index Key |

0001488917

|

| Entity Tax Identification Number |

41-1732920

|

| Entity Incorporation, State or Country Code |

MN

|

| Entity Address, Address Line One |

500

Sixth Avenue NW

|

| Entity Address, City or Town |

New

Prague

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

56071

|

| City Area Code |

(952)

|

| Local Phone Number |

758-9299

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.01 par value

|

| Trading Symbol |

ELMD

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

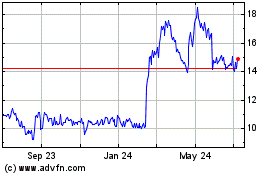

Electromed (AMEX:ELMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

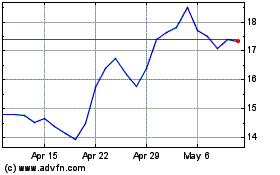

Electromed (AMEX:ELMD)

Historical Stock Chart

From Apr 2023 to Apr 2024