As filed with the Securities and Exchange Commission on September 29, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

INNOVATE CORP.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

Delaware | | 54-1708481 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

222 Lakeview Ave., Suite 1660

West Palm Beach, FL 33401

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul K. Voigt

Chief Executive Officer

222 Lakeview Ave., Suite 1660

West Palm Beach, FL 33401

(212) 235-2691

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Christopher R. Rodi, Esq.

Gregory W. Gribben, Esq.

Woods Oviatt Gilman LLP

1900 Bausch & Lomb Place

Rochester, New York 14604

Telephone: (585) 987-2800

Facsimile: (585) 454-3968

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

Large accelerated filer | ¨☐ | Accelerated filer | ☒ | |

Non-accelerated filer | ¨☐ | Smaller reporting company | ☒ | |

| | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 (the "Securities Act"), as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated September 29, 2023

PROSPECTUS

INNOVATE CORP.

Common Stock

Preferred Stock

Depositary Shares

Warrants

Subscription Rights

Purchase Contracts

and

Purchase Units

We may offer, issue and sell, together or separately:

•shares of our common stock;

•shares of our preferred stock, which may be issued in one or more series;

•depositary receipts, representing fractional shares of our preferred stock, which are called depositary shares;

•warrants to purchase shares of our common stock, shares of our preferred stock;

•subscription rights to purchase shares of our common stock, shares of our preferred stock;

•purchase contracts to purchase shares of our common stock, shares of our preferred stock; and

•purchase units, each representing ownership of a purchase contract, preferred securities, including U.S. treasury securities, or

•any combination of the foregoing, securing the holder’s obligation to purchase our common stock or other securities under the purchase contracts.

We will provide the specific prices and terms of these securities in one or more supplements to this prospectus at the time of offering. You should read this prospectus and the accompanying prospectus supplement carefully before you make your investment decision.

This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

We may offer securities through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents or directly to purchasers. These securities also may be resold by selling security holders. If required, the prospectus supplement for each offering of securities will describe the plan of distribution for that offering. For general information about the distribution of securities offered, please see “Plan of Distribution” in this prospectus.

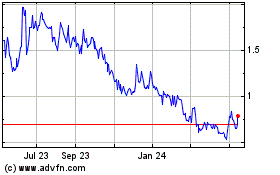

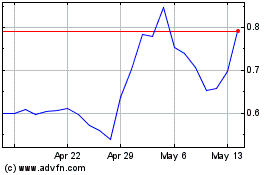

Our common stock is listed on the New York Stock Exchange under the trading symbol “VATE.” Each prospectus supplement will indicate whether the securities offered thereby will be listed on any securities exchange.

Our business and investment in our securities involve significant risks. See “Risk Factors” on page 6 before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus or any accompanying prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ____________

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under the shelf process, we may sell any combination of the securities described in this prospectus in one or more offerings. This prospectus only provides you with a general description of the securities that we may offer. Each time we sell securities, we will provide a supplement to this prospectus that contains specific information about the terms of that offering, including the specific amounts, prices and terms of the securities offered. The prospectus supplement may also add, update or change information contained in this prospectus. You should carefully read both this prospectus, any accompanying prospectus supplement and any free writing prospectus prepared by or on behalf of us, together with the additional information described under the heading “Where You Can Find More Information.”

We have not authorized anyone to provide you with any information other than that contained in or incorporated by reference into this prospectus, any accompanying prospectus supplement and any free writing prospectus prepared by or on behalf of us. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not making offers to sell the securities in any jurisdiction in which an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

The information in this prospectus is accurate as of the date on the front cover. You should not assume that the information contained in this prospectus is accurate as of any other date.

When used in this prospectus, the terms “INNOVATE,” the “Company,” “we,” “our” and “us” refer to INNOVATE Corp. and its consolidated subsidiaries, except otherwise specified or the context otherwise requires.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our SEC filings are available to the public at the SEC’s website at www.sec.gov.

The SEC allows us to “incorporate by reference” information into this prospectus and any accompanying prospectus supplement, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus and any accompanying prospectus supplement, except for any information superseded by information contained directly in this prospectus, any accompanying prospectus supplement, any subsequently filed document deemed incorporated by reference or any free writing prospectus prepared by or on behalf of us. This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that we have previously filed with the SEC (other than information deemed furnished and not filed in accordance with SEC rules, including Items 2.02 and 7.01 of Form 8-K).

•our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 14, 2023;

•the information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, from our definitive proxy statement on Schedule 14A, filed with the SEC on May 1, 2023;

•our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2023 and June 30, 2023, filed with the SEC on May 10, 2023 and August 9, 2023;

•our Current Reports on Form 8-K, filed with the SEC on March 7, 2023, April 3, 2023, April 25, 2023, May 2, 2023, June 15, 2023, July 24, 2023, July 25, 2023, and September 21, 2023;

•the description of our common stock contained in our Registration Statements on Form 8-A, filed with the SEC on May 11, 2017 and April 3, 2023, and any amendment or report filed for the purpose of updating such description.

All documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and before the termination of the offering also shall be deemed to be incorporated herein by reference. We are not, however, incorporating by reference any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K.

If requested, we will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus. Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference into such documents. To obtain a copy of these filings at no cost, you may write or telephone us at the following address:

INNOVATE Corp.

222 Lakeview Avenue, Suite 1660

West Palm Beach, FL 33401

(212) 235-2691

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any accompanying prospectus supplement and any documents incorporated by reference contain statements that are “forward-looking” within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements can often be identified by the use of forward-looking language such as "if," "may," "should," "believe," "anticipate," "future," "forward," "potential," "estimate," "opportunity," "goal," "objective," "growth," "outcome," "could," "expect," "intend," "plan," "strategy," "provide," "commitment," "result," "seek," "pursue," "ongoing," "include" or in the negative of such terms or comparable terminology. Our actual results, performance or achievements could be materially different from the results expressed in, or implied by, forward-looking statements. Factors that could cause actual results, events and developments to differ include, without limitation: the ability of our subsidiaries (including, target businesses following their acquisition) to generate sufficient net income and cash flows to make upstream cash distributions, capital market conditions, our and our subsidiaries’ ability to identify any suitable future acquisition opportunities, efficiencies/cost avoidance, cost savings, income and margins, growth, economies of scale, combined operations, future economic performance, conditions to, and the timetable for, completing the integration of financial reporting of acquired or target businesses with us or the applicable subsidiary of us, completing future acquisitions and dispositions, litigation, potential and contingent liabilities, management’s plans, changes in regulations and taxes.

Forward-looking statements are subject to risks and uncertainties, including but not limited to the risks described in this prospectus, any accompanying prospectus supplement and any documents incorporated by reference, including the “Risk Factors” sections of this prospectus, any accompanying prospectus supplement and our reports and other documents filed with the SEC. When considering forward-looking statements, you should keep in mind the risks, uncertainties and other cautionary statements made in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference.

There can be no assurance that other factors not currently anticipated by us will not materially and adversely affect our business, financial condition and results of operations. These forward-looking statements inherently are not guarantees of performance and results, and you are cautioned not to place undue reliance on any forward-looking statements made by us or on our behalf. Please take into account that forward-looking statements speak only as of the date of this prospectus or, in the case of any accompanying prospectus supplement or documents incorporated by reference, the date of any such document. Except as required by applicable law, we do not undertake any obligation to publicly correct or update any forward-looking statement.

THE COMPANY

We are a diversified holding company with principal operations conducted through three operating platforms or reportable segments: Infrastructure, Life Sciences, Spectrum, and Other, which includes businesses that do not meet the separately reportable segment thresholds.

Infrastructure Segment (DBMG)

Our Infrastructure segment is comprised of DBM Global Inc. ("DBMG") and its wholly-owned subsidiaries. DBMG is a fully integrated industrial construction, structural steel and facility maintenance provider that provides fabrication and erection of structural steel and heavy steel plate services and also fabricates trusses and girders and specializes in the fabrication and erection of large-diameter water pipe and water storage tanks, as well as 3-D Building Information Modeling (“BIM”) and detailing. DBMG provides these services on commercial, industrial, and infrastructure construction projects such as high- and low-rise buildings and office complexes, hotels and casinos, convention centers, sports arenas and stadiums, shopping malls, hospitals, dams, bridges, mines, metal processing, refineries, pulp and paper mills and power plants. Through GrayWolf Industrial Inc. ("GrayWolf"), DBMG provides integrated solutions for digital engineering, modeling and detailing, construction, heavy equipment installation and facility services including maintenance, repair, and installation to a diverse range of end markets. Through Aitken Manufacturing, Inc., DBMG manufactures pollution control scrubbers, tunnel liners, pressure vessels, strainers, filters, separators and a variety of customized products. Through Banker Steel Holdco, LLC ("Banker Steel"), DBMG provides full-service fabricated structural steel and erection services primarily for the East Coast and Southeast commercial and industrial construction market, in addition to full design-assist services. The Company maintains an approximately 91% controlling interest in DBMG.

Life Sciences Segment (Pansend Life Sciences, LLC)

Our Life Sciences segment is comprised of Pansend Life Sciences, LLC ("Pansend"), its subsidiaries and equity method investments. Pansend maintains controlling interests of approximately 80% in Genovel Orthopedics, Inc. ("Genovel"), which seeks to develop products to treat early osteoarthritis of the knee and approximately 57% in R2 Technologies, Inc. ("R2"), which develops aesthetic and medical technologies for the skin. Pansend also invests in other early stage or developmental stage healthcare companies including an approximately 46% interest in MediBeacon Inc. ("MediBeacon"), a medical technology company specializing in the advances of fluorescent tracer agents and transdermal measurement, potentially enabling real-time, direct monitoring of kidney function, and an approximately 26% interest in Triple Ring Technologies, Inc. ("Triple Ring"), a science and technology co-development company.

Spectrum Segment (HC2 Broadcasting Holdings Inc.)

Our Spectrum segment is comprised of HC2 Broadcasting Holdings Inc. ("Broadcasting") and its subsidiaries. Broadcasting strategically acquired and operates over-the-air broadcasting stations across the United States. The Company maintains a 98% controlling interest in Broadcasting and maintains a controlling interest of approximately 77%, inclusive of approximately 10% proxy and voting rights from minority holders of DTV America Corporation ("DTV"). On a fully diluted basis, the Company would have an approximately 86% controlling interest in Broadcasting.

Other Segment

Our Other segment represents all other businesses or investments that do not meet the definition of a segment individually or in the aggregate. Included in the Other segment is TIC Holdco, Inc. ("TIC"), which is developing a multi-purpose cultural and performing arts space in Palm Beach, Florida, the former Marine Services segment, which includes its holding company, Global Marine Holdings, LLC ("GMH"), in which the Company maintains approximately 73% controlling interest. GMH's results include its subsidiary's prior 19% equity method investment in HMN International Co., Ltd., formerly known as Huawei Marine Networks Co. (“HMN”), until sold March 6, 2023.

Corporate Information

Our principal executive office is located at 222 Lakeview Avenue, Suite 1660, West Palm Beach, Florida 33401, and our telephone number is (212) 235-2691. We maintain a website at https://INNOVATEcorp.com. The information on our website is not incorporated by reference in this prospectus or any accompanying prospectus supplement, and you should not consider it a part of this prospectus or any accompanying prospectus supplement.

RISK FACTORS

Investing in our securities involves risk. See the risk factors described in our most recent Annual Report on Form 10-K (together with any material changes thereto contained in subsequently filed Quarterly Reports on Form 10-Q) and those contained in our other filings with the SEC that are incorporated by reference in this prospectus and any accompanying prospectus supplement. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus and any accompanying prospectus supplement. These risks could materially affect our business, financial condition or results of operations and cause the value of our securities to decline. You could lose all or part of your investment.

USE OF PROCEEDS

Except as otherwise set forth in any accompanying prospectus supplement, we expect to use the net proceeds from the sale of securities for general corporate purposes, including the financing of our operations, the possible repayment of indebtedness and possible business acquisitions. Unless set forth in an accompanying prospectus supplement, we will not receive any proceeds in the event that securities are sold by a selling security holder.

DESCRIPTION OF SECURITIES

This prospectus contains summary descriptions of the common stock, preferred stock, depository shares, warrants, subscription rights, purchase contracts and purchase units that may be offered and sold from time to time. These summary descriptions are not meant to be complete descriptions of each security. However, at the time of an offering and sale, this prospectus together with the accompanying prospectus supplement will contain the material terms of the securities being offered.

DESCRIPTION OF CAPITAL STOCK

General

The following summary description of our capital stock is based on the provisions of the General Corporation Law of the State of Delaware (the “DGCL”), our Second Amended Certificate of Incorporation, as amended (the “Certificate of Incorporation”), the Fourth Amended and Restated By-Laws, as amended (the “By-Laws”), and the Tax Benefits Preservation Plan (the “Preservation Plan”), dated as of April 1, 2023. This description does not purport to be complete and is qualified in its entirety by reference to the full text of the DGCL, as it may be amended from time to time, and to the terms of our Certificate of Incorporation, By-Laws, and Preservation Plan, as each may be amended from time to time, which are incorporated by reference as exhibits to the registration statement of which this prospectus is a part. See “Where You Can Find More Information.” As used in this “Description of Capital Stock,” the terms “INNOVATE,” the “Company”, “we,” “our” and “us” refer to INNOVATE Corp., a Delaware corporation, and do not, unless otherwise specified, include our subsidiaries.

Our authorized capital stock consists of 160,000,000 shares of common stock, par value $0.001 per share, and 20,000,000 shares of preferred stock, par value $0.001 per share.

Common Stock

Voting. The holders of the common stock are entitled to one vote for each outstanding share of common stock owned by that stockholder on every matter properly submitted to the stockholders for their vote. Stockholders are not entitled to vote cumulatively for the election of directors.

Dividend Rights. Subject to the dividend rights of the holders of any outstanding series of preferred stock, holders of the common stock are entitled to receive ratably such dividends and other distributions of cash or any other right or property as may be declared by the board of directors out of the assets or funds legally available for such dividends or distributions.

Liquidation Rights. In the event of any voluntary or involuntary liquidation, dissolution or winding up of our affairs, holders of the common stock would be entitled to share ratably in the assets that are legally available for distribution to stockholders after payment of liabilities and subject to the prior rights of any holders of preferred stock then outstanding. If we have any preferred stock outstanding at such time, holders of the preferred stock may be entitled to distribution and/or liquidation preferences, such as those discussed below with respect to the preferred stock. In either such case, we must pay the applicable distribution to the holders of the preferred stock before we may pay distributions to the holders of the common stock.

Conversion, Redemption and Preemptive Rights. Holders of the common stock have no conversion, redemption, preemptive, subscription or similar rights. There are no sinking fund provisions applicable to our common stock.

Preferred Stock

Under our Certificate of Incorporation, the board of directors of the Company is authorized, subject to limitations prescribed by law and any consent rights granted to holders of outstanding shares of preferred stock, to issue up to 20,000,000 shares of preferred stock, par value $0.001 per share, in one or more classes or series. The board of directors has discretion to determine the rights, preferences, privileges and restrictions of, including, without limitation, dividend rights, conversion rights, redemption privileges and liquidation preferences of, and to fix the number of shares of, each series of the preferred stock. The terms and conditions of any issued preferred stock could have the effect of delaying, deferring or preventing a transaction or a change in control that might involve a premium price for holders of the common stock or otherwise be in their best interest.

Of the 20,000,000 shares of preferred stock authorized for issuance under our Certificate of Incorporation, 6,125 shares are classified as Series A-3 Convertible Participating Preferred Stock (the “Series A-3 Preferred Stock”) and 10,000 shares are classified as Series A-4 Convertible Participating Preferred Stock (the “Series A-4 Preferred Stock” and, together with the Series A-3 Preferred Stock, the “Preferred Stock”).

On April 1, 2023, the Company entered into the Preservation Plan with Computershare Trust Company, N.A., as rights agent, and the Board of the Company declared a dividend distribution of one right (a “Right”) for each outstanding share of Common Stock of the Company to stockholders of record at the close of business on April 10, 2023. Each Right is governed by the terms of the Plan and entitles the registered holder to purchase from the Company a unit consisting of one one-thousandth of a share (a “Unit”) of Series B Preferred Stock, par value $0.001 per share, at a purchase price of $15.00 per Unit, subject to adjustment (the “Purchase Price”). The Company previously entered into a Tax Benefits Preservation Plan on August 30, 2021 (the “Prior Plan”), in order to help protect the Company’s ability to use its tax net operating losses and certain other tax assets (“Tax Benefits”) by deterring an “ownership change” as defined under Section 382 of the Internal Revenue Code of 1986, as amended, and the Treasury Regulations thereunder (the “Code”). The Prior Plan expired pursuant to its terms on March 31, 2023. Accordingly, the Preservation Plan is intended to help continue to preserve the Tax Benefits.

Series A-3 and Series A-4 Preferred Stock

We originally designated Series A Preferred Stock pursuant to a Certificate of Designation of Series A Convertible Participating Preferred Stock adopted on May 29, 2014 (the “Series A Certificate”). On September 22, 2014, we amended and restated the Series A Certificate. In connection with the issuance of the Series A-2 Preferred Stock on January 5, 2015, we adopted the Certificate of Designation of Series A-2 Convertible Participating Preferred Stock (the “Series A-2 Certificate”) and also amended and restated the Series A Certificate. On August 10, 2015, we adopted certain Certificates of Correction of the Certificates of Amendment to the Certificates of Designation of the Series A Certificate and the Series A-2 Certificate. The Series A Certificate and the Series A-2 Certificate together, as amended, are referred to as the “Certificates of Designation.”

On May 29, 2021, pursuant to the Certificate of Designation, holders of the Series A and A-2 Preferred Stock caused the Company to redeem the Series A and A-2 Preferred Stock at the accrued value per share plus accrued but unpaid dividends (to the extent not included in the accrued value of Series A and A-2 Preferred Stock), of which $10.4 million was paid in cash to holders of the Series A and A-2 Preferred Stock. Each share of Series A and A-2 Preferred Stock that was not so redeemed was automatically converted into shares of common stock at the conversion price then in effect, of which 50,410 shares of the Company's common stock were issued in lieu of cash to holders of the Series A Preferred Stock. In connection with the Stock Purchase Agreement, Continental Insurance Group ("CIG"), formerly a wholly owned subsidiary of the Company, entered into a letter agreement with the Company to not redeem at maturity or seek redemption of 6,125 shares of the Company's Series A and 10,000 shares of the Company's Series A-2 Preferred Stock.

On July 1, 2021 (the "Exchange Date") as a part of the sale of CIG, INNOVATE entered into an exchange agreement (the "Exchange Agreement") with Continental General Insurance Company ("CGIC"), also a former subsidiary, which held the remaining shares of the Series A and Series A-2 Preferred Stock and was eliminated in consolidation prior to the sale of the Company’s former Insurance segment on July 1, 2021. Per the Exchange Agreement, the Company exchanged 6,125 shares of the Series A and 10,000 shares of the Series A-2 shares that CGIC held for an equivalent number of Series A-3 Convertible Participating Preferred Stock ("Series A-3") and Series A-4 Convertible Participating Preferred Stock ("Series A-4"), respectively. The terms remained substantially the same, except that the Series A-3 and Series A-4 will mature on July 1, 2026. A cash payment of $0.3 million was made as a part of the exchange for accrued and unpaid dividends on the Series A and Series A-2 being exchanged.

Upon issuance of the Series A-3 and Series A-4 Preferred Stock on July 1, 2021, the Series A-3 and Series A-4 have been classified as temporary equity in the Company's Condensed Consolidated Balance Sheet with a combined redemption value of $16.1 million with a current fair value as of June 30, 2023 of $17.0 million.

The following summary of the terms of the Preferred Stock is qualified in its entirety by the complete terms of the Certificates of Designation.

Dividends. The Series A-3 and Series A-4 Preferred Stock accrue a cumulative quarterly cash dividend at an annualized rate of 7.50%. The accrued values of the Series A-3 and Series A-4 Preferred Stock accrete quarterly at an annualized rate of 4.00% that is reduced to 2.00% or 0.0% if the Company achieves specified rates of growth measured by increases in its net asset value; provided, that the accreting dividend rate will be 7.25% in the event that (A) the daily volume weighted average price ("VWAP") of the Company's common stock is less than a certain threshold amount, (B) the Company's common stock is not registered under Section 12(b) of the Securities

Exchange Act of 1934, as amended, (C) the Company's common stock is not listed on certain national securities exchanges or the Company is delinquent in the payment of any cash dividends. The Series A-3 and Series A-4 Preferred Stock is also entitled to participate in cash and in-kind distributions to holders of shares of Company's common stock on an as-converted basis.

Subsequent Measurement. The Company has elected to account for the Series A-3 and Series A-4 Preferred Stock by immediately recognizing changes in the redemption value as they occur. The carrying value of the Series A-3 and Series A-4 Preferred Stock are adjusted to equal what the redemption amount would be as if the redemption were to occur at the end of the reporting period as if it were also the redemption date for the Series A-3 and Series A-4 Preferred Stock. Any cash dividends paid directly reduce the carrying value of the Series A-3 and Series A-4 Preferred Stock until the carrying value equals the redemption value. The Company has a history of paying dividends on its preferred stock and expects to continue to pay such dividends each quarter.

Optional Conversion. Each share of Series A-3 and Series A-4 may be converted by the holder into shares of the Company's common stock at any time based on the then-applicable Conversion Price. Each share of Series A-3 is initially convertible at a conversion price of $4.25 (as it may be adjusted from time to time, the "Series A-3 Conversion Price"), and each share of Series A-4 is initially convertible at a conversion price of $8.25 (as it may be adjusted from time to time, the "Series A-4 Conversion Price") (“collectively the “Conversion Prices”). The Conversion Prices are subject to adjustment for dividends, certain distributions, stock splits, combinations, reclassifications, reorganizations, mergers, recapitalizations and similar events, as well as in connection with issuances of equity or equity-linked or other comparable securities by the Company at a price per share (or with a conversion or exercise price or effective issue price) that is below the Conversion Prices’ (which adjustment shall be made on a weighted average basis). Actual conversion prices at the time of the exchange were $3.52 for the Series A and $5.33 for the Series A-2.

Redemption by the Holders / Automatic Conversion. On July 1, 2026, holders of the Series A-3 and Series A-4 shall be entitled to cause the Company to redeem the Series A-3 and Series A-4 at the accrued value per share plus accrued but unpaid dividends (to the extent not included in the accrued value of Series A-3 and Series A-4). Each share of Series A-3 and Series A-4 that is not so redeemed will be automatically converted into shares of the Company's common stock at the Conversion Price then in effect.

Upon a change of control (as defined in each Certificate of Designation) holders of the Series A-3 and Series A-4 shall be entitled to cause the Company to redeem their shares of Series A-3 and Series A-4 at a price per share of Series A-3 and Series A-4 equal to the greater of (i) the accrued value of the Series A-3 and Series A-4, plus any accrued and unpaid dividends (to the extent not included in the accrued value of Series A-3 and Series A-4 Preferred Stock), and (ii) the value that would be received if the share of Series A-3 and Series A-4 were converted into shares of the Company's common stock immediately prior to the change of control.

Redemption by the Company/Company Call Option. At any time after the third anniversary of the Original Issue Date, May 29, 2014, the Company may redeem the Series A-3/Series A-4, in whole but not in part, at a price per share generally equal to 150% of the accrued value per share, plus accrued but unpaid dividends (to the extent not included in the accrued value of the Series A-3/Series A-4), subject to the holder's right to convert prior to such redemption.

Forced Conversion. The Company may force conversion of the Series A-3 and Series A-4 into shares of the Company's common stock if the common stock's thirty-day VWAP exceeds 150% of the then-applicable Conversion Price and the Common Stock’s daily VWAP exceeds 150% of the then-applicable Conversion Price for at least twenty trading days out of the thirty trading day period used to calculate the thirty-day VWAP. In the event of a forced conversion, the holders of Series A-3 and Series A-4 will have the ability to elect cash settlement in lieu of conversion if certain market liquidity thresholds for the Company's common stock are not achieved.

Liquidation Preference. In the event of any liquidation, dissolution or winding up of the Company (any such event, a “Liquidation Event”), the holders of Series A-3 and Series A-4 will be entitled to receive per share the greater of (i) the accrued value of the Series A-3 and Series A-4, plus any accrued and unpaid dividends (to the extent not included in the accrued value of Series A-3 and Series A-4), and (ii) the value that would be received if the share of Series A-3 and Series A-4 were converted into shares of the Company's common stock immediately prior to such occurrence. The Series A-3 and Series A-4 will rank junior to any existing or future indebtedness but senior to the Company's common stock and any future equity securities other than any future senior or pari passu preferred stock issued in compliance with each Certificate of Designation. The Series A-3 Preferred Stock and the Series A-4 Preferred Stock rank at parity.

Voting Rights. Except as required by applicable law, the holders of the shares of the Series A-3 and Series A-4 will be entitled to vote on an as-converted basis with the holders of the Series A-3 Preferred Stock and the Series A-4 Preferred Stock (on an as-converted basis), as applicable, and the holders of the Company’s common stock on all matters submitted to a vote of the holders of the Company's common stock with the holders of Series A-3 Preferred Stock and Series A-4 Preferred Stock on certain matters, and separately as a class on certain limited matters.

Consent Rights. For so long as any of the Series A-3 and Series A-4 is outstanding, consent of the holders of shares representing at least 75% of certain of the Series A-3 and Series A-4 then outstanding is required for certain material actions.

Participation Rights. Pursuant to the securities purchase agreements entered into with the initial purchasers of the Series A-3 Preferred Stock and the Series A-4 Preferred Stock, subject to meeting certain ownership thresholds, certain purchasers of the Series A-3 Preferred Stock and the Series A-4 Preferred Stock are entitled to participate, on a pro-rata basis in accordance with their ownership percentage, determined on an as-converted basis, in issuances of equity and equity linked securities by the Company. In addition, subject to meeting certain ownership thresholds, certain initial purchasers of the Series A-3 Preferred Stock and the Series A-4 Preferred Stock will be entitled to participate in issuances of preferred securities and in debt transactions of the Company.

As of June 30, 2023, Series A-3 Preferred Stock and Series A-4 Preferred Stock were convertible into 1,740,700 and 1,875,533 shares, respectively, of INNOVATE's common stock.

Anti-Takeover Effects of Provisions of the Certificate of Incorporation, Bylaws and Other Agreements

Our certificate of incorporation expressly provides that the Company shall not be governed by Section 203 of the DGCL, which would have otherwise imposed additional requirements regarding mergers and other business combinations.

Listing

Our common stock is listed on the New York Stock Exchange under the symbol “VATE.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A.

DESCRIPTION OF DEPOSITARY SHARES

We may offer depositary receipts representing fractional shares of our preferred stock, rather than full shares of preferred stock. The shares of preferred stock represented by depositary shares will be deposited under a depositary agreement between us and a bank or trust company that meets certain requirements and is selected by us (the “Bank Depositary”). Each owner of a depositary share will be entitled to all the rights and preferences of the preferred stock represented by the depositary share.

The description in an accompanying prospectus supplement of any depositary shares we offer will not necessarily be complete and will be qualified in its entirety by reference to the applicable depositary agreement, which will be filed with the SEC if we offer depositary shares. For more information on how you can obtain copies of any depositary agreement if we offer depositary shares, see “Where You Can Find More Information.” We urge you to read the applicable depositary agreement and any accompanying prospectus supplement in their entirety.

Dividends and Other Distributions

If we pay a cash distribution or dividend on a series of preferred stock represented by depositary shares, the Bank Depositary will distribute such dividends to the record holders of such depositary shares. If the distributions are in property other than cash, the Bank Depositary will distribute the property to the record holders of the depositary shares. However, if the Bank Depositary determines that it is not feasible to make the distribution of property, the Bank Depositary may, with our approval, sell such property and distribute the net proceeds from such sale to the record holders of the depositary shares.

Redemption of Depositary Shares

If we redeem a series of preferred stock represented by depositary shares, the Bank Depositary will redeem the depositary shares from the proceeds received by the Bank Depositary in connection with the redemption. The redemption price per depositary share will equal the applicable fraction of the redemption price per share of the preferred stock. If fewer than all the depositary shares are redeemed, the depositary shares to be redeemed will be selected by lot or pro rata as the Bank Depositary may determine.

Voting the Preferred Stock

Upon receipt of notice of any meeting at which the holders of the preferred stock represented by depositary shares are entitled to vote, the Bank Depositary will mail the notice to the record holders of the depositary shares relating to such preferred stock. Each record holder of these depositary shares on the record date, which will be the same date as the record date for the preferred stock, may instruct the Bank Depositary as to how to vote the preferred stock represented by such holder’s depositary shares. The Bank Depositary will endeavor, insofar as practicable, to vote the amount of the preferred stock represented by such depositary shares in accordance with such instructions, and we will take all action that the Bank Depositary deems necessary in order to enable the Bank Depositary to do so. The Bank Depositary will abstain from voting shares of the preferred stock to the extent it does not receive specific instructions from the holders of depositary shares representing such preferred stock.

Amendment and Termination of the Depositary Agreement

The form of depositary receipt evidencing the depositary shares and any provision of the depositary agreement may be amended by agreement between the Bank Depositary and us. However, any amendment that materially and adversely alters the rights of the holders of depositary shares will not be effective unless such amendment has been approved by the holders of at least a majority of the depositary shares then outstanding. The depositary agreement may be terminated by the Bank Depositary or us only if (1) all outstanding depositary shares have been redeemed or (2) there has been a final distribution in respect of the preferred stock in connection with any liquidation, dissolution or winding up of our company and such distribution has been distributed to the holders of depositary receipts.

Withdrawal of Preferred Stock

Except as may be provided otherwise in an accompanying prospectus supplement, upon surrender of depositary receipts at the principal office of the Bank Depositary, subject to the terms of the depositary agreement, the owner of the depositary shares may demand delivery of the number of whole shares of preferred stock and all money and other property, if any, represented by those depositary shares. Partial shares of preferred stock will not be issued. If the depositary receipts delivered by the holder evidence a number of depositary shares in excess of the number of depositary shares representing the number of whole shares of preferred stock to be withdrawn, the Bank Depositary will deliver to such holder at the same time a new depositary receipt evidencing the excess number of depositary shares. Holders of withdrawn preferred stock may not thereafter deposit those shares under the depositary agreement or receive depositary receipts evidencing depositary shares therefor.

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of shares of our common stock or shares of preferred stock. We may issue warrants independently or together with other securities, and they may be attached to or separate from the other securities. Each series of warrants will be issued under a separate warrant agreement that we will enter into with a bank or trust company, as warrant agent, as detailed in an accompanying prospectus supplement. The warrant agent will act solely as our agent in connection with the warrants and will not assume any obligation, or agency or trust relationship, with you.

The prospectus supplement relating to a particular issue of warrants will describe the terms of those warrants, including, when applicable:

•the offering price;

•the currency or currencies, including composite currencies, in which the purchase price and/or exercise price of the warrants may be payable;

•the number of warrants offered;

•the exercise price and the amount of securities you will receive upon exercise;

•the procedure for exercise of the warrants and the circumstances, if any, that will cause the warrants to be automatically exercised;

•the rights, if any, we have to redeem the warrants;

•the date on which the right to exercise the warrants will commence and the date on which the warrants will expire;

•the name of the warrant agent; and

•any other material terms of the warrants.

After warrants expire they will become void. The prospectus supplement may provide for the adjustment of the exercise price of the warrants.

Warrants may be exercised at the appropriate office of the warrant agent or any other office indicated in an accompanying prospectus supplement. Before the exercise of warrants, holders will not have any of the rights of holders of the securities purchasable upon exercise and will not be entitled to payments made to holders of those securities.

The description in an accompanying prospectus supplement of any warrants we offer will not necessarily be complete and will be qualified in its entirety by reference to the applicable warrant agreement, which will be filed with the SEC if we offer warrants. For more information on how you can obtain copies of any warrant agreement if we offer warrants, see “Where You Can Find More Information.” We urge you to read the applicable warrant agreement and any accompanying prospectus supplement in their entirety.

DESCRIPTION OF SUBSCRIPTION RIGHTS

We may issue subscription rights to purchase shares of our common stock, or shares of our preferred stock. We may issue subscription rights independently or together with any other offered security, which may or may not be transferable by the stockholder. In connection with any offering of subscription rights, we may enter into a standby arrangement with one or more underwriters or other purchasers pursuant to which the underwriters or other purchasers may be required to purchase any securities remaining unsubscribed for after such offering.

The prospectus supplement relating to any subscription rights we may offer will contain the specific terms of the subscription rights. These terms may include the following:

•the price, if any, for the subscription rights;

•the number and terms of each share of common stock or preferred stock which may be purchased per each subscription right;

•the exercise price payable for each share of common stock or preferred stock upon the exercise of the subscription rights;

•the extent to which the subscription rights are transferable;

•any provisions for adjustment of the number or amount of securities receivable upon exercise of the subscription rights or the exercise price of the subscription rights;

•any other terms of the subscription rights, including the terms, procedures and limitations relating to the exchange and exercise of the subscription rights;

•the date on which the right to exercise the subscription rights shall commence, and the date on which the subscription rights shall expire;

•the extent to which the subscription rights may include an over-subscription privilege with respect to unsubscribed securities; and

•if applicable, the material terms of any standby underwriting or purchase arrangement entered into by us in connection with the offering of subscription rights.

The description in an accompanying prospectus supplement of any subscription rights we offer will not necessarily be complete and will be qualified in its entirety by reference to the applicable subscription rights certificate or subscription rights agreement, which will be filed with the SEC if we offer subscription rights. For more information on how you can obtain copies of any subscription rights certificate or subscription rights agreement if we offer subscription rights, see “Where You Can Find More Information.” We urge you to read the applicable subscription rights certificate, the applicable subscription rights agreement and any accompanying prospectus supplement in their entirety.

DESCRIPTION OF PURCHASE CONTRACTS AND PURCHASE UNITS

We may issue purchase contracts, including contracts obligating holders to purchase from us, and obligating us to sell to the holders, a specified number of shares of our common stock, shares of our preferred stock or at a future date or dates, which we refer to in this prospectus as purchase contracts. The price of the securities and the number of securities may be fixed at the time the purchase contracts are issued or may be determined by reference to a specific formula set forth in the purchase contracts, and may be subject to adjustment under anti-dilution formulas. The purchase contracts may be issued separately or as part of units consisting of a stock purchase contract and our preferred securities of third parties, including U.S. treasury securities, or any combination of the foregoing, securing the holders’ obligations to purchase the securities under the purchase contracts, which we refer to herein as purchase units. The purchase contracts may require holders to secure their obligations under the purchase contracts in a specified manner. The purchase contracts also may require us to make periodic payments to the holders of the purchase contracts or the purchase units, as the case may be, or vice versa, and those payments may be unsecured or pre-funded in whole or in part.

The description in an accompanying prospectus supplement of any purchase contract or purchase unit we offer will not necessarily be complete and will be qualified in its entirety by reference to the applicable purchase contract or purchase unit, which will be filed with the SEC if we offer purchase contracts or purchase units. For more information on how you can obtain copies of any purchase contract or purchase unit we may offer, see “Where You Can Find More Information.” We urge you to read the applicable purchase contract or applicable purchase unit and any accompanying prospectus supplement in their entirety.

SELLING SECURITYHOLDERS

Information about selling security holders, where applicable, will be set forth in a prospectus supplement, in a post-effective amendment or in filings we make with the SEC under the Exchange Act which are incorporated by reference into this prospectus.

PLAN OF DISTRIBUTION

We or the selling security holders may sell the applicable securities offered by this prospectus from time to time in one or more transactions, including without limitation:

• directly to one or more purchasers;

• through agents;

• to or through underwriters, brokers or dealers; or

• through a combination of any of these methods.

A distribution of the securities offered by this prospectus may also be effected through the issuance of derivative securities, including without limitation, warrants, subscriptions, exchangeable securities, forward delivery contracts and the writing of options.

In addition, the manner in which we may sell some or all of the securities covered by this prospectus include, without limitation, through:

• a block trade in which a broker-dealer will attempt to sell as agent, but may position or resell a portion of the block, as principal, in order to facilitate the transaction;

• purchases by a broker-dealer, as principal, and resale by the broker-dealer for its account;

• ordinary brokerage transactions and transactions in which a broker solicits purchasers; or

• privately negotiated transactions;

• settlement of short sales;

• transactions through broker-dealers to sell a specified number of such securities at a stipulated price per security;

• an exchange distribution in accordance with the rules of the applicable exchange; or

• a combination of any such methods of sale.

We may also enter into hedging transactions. For example, we may:

• enter into transactions with a broker-dealer or affiliate thereof in connection with which such broker-dealer or affiliate will engage in short sales of shares of our common stock pursuant to this prospectus, in which case such broker-dealer or affiliate may use shares of common stock received from us to close out its short positions;

• sell securities short and redeliver such shares to close out our short positions;

• enter into option or other types of transactions that require us to deliver shares of common stock to a broker-dealer or an affiliate thereof, who will then resell or transfer shares of common stock under this prospectus; or loan or pledge shares of common stock to a broker-dealer or an affiliate thereof, who may sell the loaned shares or, in an event of default in the case of a pledge, sell the pledged shares pursuant to this prospectus.

In addition, we may enter into derivative or hedging transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. In connection with such a transaction, the third parties may sell the applicable securities covered by and pursuant to this prospectus and an applicable prospectus supplement or pricing supplement, as the case may be. If so, the third party may use securities borrowed from us to settle such sales and may use securities received from us to close out any related short positions. We may also loan or pledge securities covered by this prospectus and an applicable prospectus supplement to third parties, who may sell the loaned securities or, in an event of default in the case of a pledge, sell the pledged securities pursuant to this prospectus and the applicable prospectus supplement or pricing supplement, as the case may be.

A prospectus supplement with respect to each offering of securities will state the terms of the offering of the securities, including:

• the name or names of any underwriters or agents and the amounts of securities underwritten or purchased by each of them, if any;

• the public offering price or purchase price of the securities and the net proceeds to be received by us from the sale;

• any delayed delivery arrangements;

• any underwriting discounts or agency fees and other items constituting underwriters’ or agents’ compensation;

• any discounts or concessions allowed or reallowed or paid to dealers; and

• any securities exchange or markets on which the securities may be listed.

The offer and sale of the securities described in this prospectus by us, the underwriters or the third parties described above may be effected from time to time in one or more transactions, including privately negotiated transactions, either:

• at a fixed price or prices, which may be changed;

• at market prices prevailing at the time of sale;

• at prices related to the prevailing market prices; or

• at negotiated prices.

General

Any public offering price and any discounts, commissions, concessions or other items constituting compensation allowed or reallowed or paid to underwriters, dealers, agents or remarketing firms may be changed from time to time. The underwriters, dealers, agents and remarketing firms that participate in the distribution of the offered securities may be “underwriters” as defined in the Securities Act. Any discounts or commissions they receive from us and any profits they receive on the resale of the offered securities may be treated as underwriting discounts and commissions under the Securities Act. We will identify any underwriters, agents or dealers and describe their commissions, fees or discounts in the applicable prospectus supplement or pricing supplement, as the case may be.

Underwriters and Agents

If underwriters are used in a sale, they will acquire the offered securities for their own account. The underwriters may resell the offered securities in one or more transactions, including negotiated transactions. These sales may be made at a fixed public offering price or prices, which may be changed, at market prices prevailing at the time of the sale, at prices related to such prevailing market price or at negotiated prices. We may offer the securities to the public through an underwriting syndicate or through a single underwriter. The underwriters in any particular offering will be mentioned in the applicable prospectus supplement or pricing supplement, as the case may be.

Unless otherwise specified in connection with any particular offering of securities, the obligations of the underwriters to purchase the offered securities will be subject to certain conditions contained in an underwriting agreement that we will enter into with the underwriters at the time of the sale to them. The underwriters will be obligated to purchase all of the securities of the series offered if any of the securities are purchased, unless otherwise specified in connection with any particular offering of securities. Any initial offering price and any discounts or concessions allowed, reallowed or paid to dealers may be changed from time to time.

We may designate agents to sell the offered securities. Unless otherwise specified in connection with any particular offering of securities, the agents will agree to use their best efforts to solicit purchases for the period of their appointment. We may also sell the offered securities to one or more remarketing firms, acting as principals for their own accounts or as agents for us. These firms will remarket the offered securities upon purchasing them in accordance with a redemption or repayment pursuant to the terms of the offered securities. A prospectus supplement or pricing supplement, as the case may be will identify any remarketing firm and will describe the terms of its agreement, if any, with us and its compensation.

In connection with offerings made through underwriters or agents, we may enter into agreements with such underwriters or agents pursuant to which we receive our outstanding securities in consideration for the securities being offered to the public for cash. In connection with these arrangements, the underwriters or agents may also sell securities covered by this prospectus to hedge their positions in these outstanding securities, including in short sale transactions. If so, the underwriters or agents may use the securities received from us under these arrangements to close out any related open borrowings of securities.

Dealers

We may sell the offered securities to dealers as principals. We may negotiate and pay dealers’ commissions, discounts or concessions for their services. The dealer may then resell such securities to the public either at varying prices to be determined by the dealer or at a fixed offering price agreed to with us at the time of resale. Dealers engaged by us may allow other dealers to participate in resales.

Direct Sales

We may choose to sell the offered securities directly. In this case, no underwriters or agents would be involved.

At-the-Market Offerings

We may also sell the securities offered by any applicable prospectus supplement in “at-the-market offerings” within the meaning of Rule 415 of the Securities Act of 1933, to or through a market maker or into an existing trading market, on an exchange or otherwise.

Institutional Purchasers

We may authorize agents, dealers or underwriters to solicit certain institutional investors to purchase offered securities on a delayed delivery basis pursuant to delayed delivery contracts providing for payment and delivery on a specified future date. The applicable prospectus supplement or pricing supplement, as the case may be, will provide the details of any such arrangement, including the offering price and commissions payable on the solicitations.

We will enter into such delayed contracts only with institutional purchasers that we approve. These institutions may include commercial and savings banks, insurance companies, pension funds, investment companies and educational and charitable institutions.

Indemnification; Other Relationships

We may have agreements with agents, underwriters, dealers and remarketing firms to indemnify them against certain civil liabilities, including liabilities under the Securities Act. Agents, underwriters, dealers and remarketing firms, and their affiliates, may engage in transactions with, or perform services for, us in the ordinary course of business. This includes commercial banking and investment banking transactions.

Market-Making, Stabilization and Other Transactions

There is currently no market for any of the offered securities, other than shares of our common stock, which are listed on the NYSE. If the offered securities are traded after their initial issuance, they may trade at a discount from their initial offering price, depending upon prevailing interest rates, the market for similar securities and other factors. While it is possible that an underwriter could inform us that it intends to make a market in the offered securities, such underwriter would not be obligated to do so, and any such market-making could be discontinued at any time without notice. Therefore, no assurance can be given as to whether an active trading market will develop for the offered securities. We have no current plans for listing of the preferred stock, depositary shares, warrants, subscription rights, purchase contracts or purchase units on any securities exchange or quotation system; any such listing with respect to any particular preferred stock, depositary shares, warrants, subscription rights, purchase contracts or purchase units will be described in the applicable prospectus supplement or pricing supplement, as the case may be.

In connection with any offering of shares of common stock, preferred stock, depositary shares, warrants, subscription rights, purchase contracts or purchase units or securities that provide for the issuance of shares of our common stock upon conversion, exchange or exercise, as the case may be, the underwriters may purchase and sell shares of common stock, preferred stock, depositary shares, warrants, subscription rights, purchase contracts or purchase units in the open market. These transactions may include short sales, syndicate covering transactions and stabilizing transactions. Short sales involve syndicate sales of shares of common stock in excess of the number of shares to be purchased by the underwriters in the offering, which creates a syndicate short position. “Covered” short sales are sales of shares made in an amount up to the number of shares represented by the underwriters’ over-allotment option. In determining the source of shares to close out the covered syndicate short position, the underwriters will consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through the over-allotment option. Transactions to close out the covered syndicate short involve either purchases of the shares of common stock in the open market after the distribution has been completed or the exercise of the over-allotment option. The underwriters may also make “naked” short sales of shares in excess of the over-allotment option. The underwriters must close out any naked short position by purchasing shares of common stock in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the shares in the open market after pricing that could adversely affect investors who purchase in the offering. Stabilizing transactions consist of bids for or purchases of shares in the open market while the offering is in progress for the purpose of pegging, fixing or maintaining the price of the securities.

In connection with any offering, the underwriters may also engage in penalty bids. Penalty bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence of the transactions. The underwriters may, if they commence these transactions, discontinue them at any time.

LEGAL MATTERS

Certain legal matters will be passed upon us by Woods Oviatt Gilman LLP. Any underwriters will be advised about legal matters by their own counsel, which will be named in an accompanying prospectus supplement.

EXPERTS

The consolidated financial statements as of December 31, 2022 and 2021 and for each of the two years in the period ended December 31, 2022 and management's assessment of the effectiveness of internal control over financial reporting as of December 31, 2022 incorporated by reference in this Prospectus and in the Registration Statement have been so incorporated in reliance on the reports of BDO USA, LLP (n/k/a BDO USA, P.C.), an independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

PART II INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The expenses relating to the registration of the securities will be borne by the registrant.

| | | | | | | | | | | |

| |

Securities and Exchange Commission Registration Fee | $ | 5,510.00 |

Accounting Fees and Expenses | $ | * |

Legal Fees and Expenses | $ | * |

Printing Fees | $ | * |

Transfer Agents’ Fees and Expenses | $ | * |

Stock Exchange Listing Fees | $ | * |

Miscellaneous | $ | * |

Total | $ | * |

* These fees and expenses depend on the securities offered and the number of issuances, and accordingly cannot be estimated at this time and will be reflected in the applicable prospectus supplement.

Item 15. Indemnification of Directors and Officers

The registrant is a Delaware corporation. Reference is made to Section 102(b)(7) of the General Corporation Law of the State of Delaware (the “DGCL”), which enables a corporation in its certificate of incorporation to eliminate or limit the personal liability of a director or officer for violations of such director or officer’s fiduciary duty, except:

•a director or officer for any breach of such director or officer’s duty of loyalty to the corporation or its stockholders;

•a director or officer for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

•a director, pursuant to Section 174 of the DGCL (providing for liability of directors for unlawful payment of dividends or unlawful stock purchases or redemptions);

•a director of officer for any transaction from which such director or officer derived an improper personal benefit; and

•an officer in any action by or in the right of the corporation.

Reference is also made to Section 145 of the DGCL, which provides that a corporation may indemnify any persons, including officers and directors, who are, or are threatened to be made, parties to any threatened, pending or completed legal action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation), by reason of the fact that such person is or was a director, officer, employee or agent of such corporation or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided such director, officer, employee or agent acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe that the person’s conduct was unlawful. A Delaware corporation may indemnify officers and directors in an action by or in the right of the corporation under the same conditions, except that no indemnification is permitted without judicial approval if the officer or director is adjudged to be liable to the corporation. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him or her against the expenses that such officer or director actually and reasonably incurred. The indemnification permitted under the DGCL is not exclusive, and a corporation is empowered to purchase and maintain insurance against liabilities whether or not indemnification would be permitted by statute.

The registrant’s Second Amended and Restated Certificate of Incorporation and Fourth Amended and Restated By-Laws provide for indemnification of its directors and officers to the fullest extent currently permitted by the DGCL. The registrant also has indemnification agreements with its directors and officers. In addition, the registrant maintains liability insurance for its directors and officers.

Item 16. List of Exhibits.

The following exhibits to this registration statement are incorporated by reference herein.

| | | | | | | | |

| Exhibit No. | | Description of Exhibits |

| 1.1* | | Form of Underwriting Agreement. |

| | |

| 4.1 | | |

| | |

| 4.2 | | |

| | |

| 4.3 | | |

| | |

| 4.4 | | |

| | |

| 4.5 | | |

| | |

| 4.6 | | |

| | |

| 4.7 | | |

| | |

| 4.8 | | |

| | |

| 4.9* | | Form of Certificate of Designations with respect to any preferred stock issued hereunder. |

| | |

| 4.10 | | |

| | |

| 4.11 | | |

| | |

| 4.12 | | Secured Note dated October 24, 2019, by and among HC2 Station, HC2 LPTV, HC2 Broadcasting Inc. ("HC2 Broadcasting"), HC2 Network Inc. ("HC2 Network") (collectively the "Subsidiary Borrowers"), HC2 Broadcasting Intermediate Holdings Inc. ("HC2 Intermediate") (the "Intermediate Parent"), HC2 Broadcasting Holdings (the "Parent Borrower" and, together with the Intermediate Parent and the Subsidiary Borrowers, the "Borrowers"), and MSD PCOF Partners XVIII, LLC ("MSD") (incorporated by reference to Exhibit 4.12 to INNOVATE's Annual Report on Form 10-K, filed on March 16, 2020) (File No. 001-35210) |

| | |

| 4.13 | | Amended and Restated Secured Note dated October 24, 2019, by and among HC2 Station, HC2 LPTV, HC2 Broadcasting, HC2 Network (collectively, the "Subsidiary Borrowers"), HC2 Intermediate (the "Intermediate Parent), HC2 Broadcasting Holdings (the "Parent Borrower" and, together with the Intermediate Parent and the Subsidiary Borrowers, the "Borrowers", Great American Life Insurance Company ("GALIC") and Great American Insurance Company ("GAIC"). (collectively, the "Subsidiary Borrowers"), HC2 Intermediate (the "Intermediate Parent), HC2 Broadcasting Holdings (the "Parent Borrower" and, together with the Intermediate Parent and the Subsidiary Borrowers, the "Borrowers", Great American Life Insurance Company ("GALIC") and Great American Insurance Company ("GAIC") (incorporated by reference to Exhibit 4.13 to INNOVATE's Annual Report on Form 10-K, filed on March 16, 2020) (File No. 001-35210) |

| | |

| | | | | | | | |

| 4.14 | | First Omnibus Amendment to Secured Notes and Intercreditor Agreement by and among Station Group, LPTV, Broadcasting, Network, and HC2 Broadcasting Inc., Intermediate Parent, Parent Borrower, and MSD PCOF Partners, XVIII, LLC ("MSD"), GALIC and GAIC (incorporated by reference to Exhibit 4.1 to INNOVATE’s Quarterly Report on Form 10-Q, filed on May 11, 2020) (File No. 001-35210) |

| | |

| 4.15 | | |

| | |

| 4.16 | | |

| | |

| 4.17 | | |

| | |

| 4.18 | | |

| | |

| 4.19 | | |

| | |

| 4.20 | | |

| | |

| 4.21 | | |

| | |

| 4.22 | | |

| | |

| 4.23 | | |

| | |

| 4.24* | | Form of Depositary Agreement (including form of Depositary Receipt). |

| | |

| 4.25* | | Form of Warrant Agreement (including form of Warrant Certificate). |

| | |

| 4.26* | | Form of Subscription Rights Agreement (including form of Subscription Rights Certificate). |

| | |

| 4.27* | | Form of Purchase Contract Agreement (including form of Purchase Contract Certificate). |

| | |

| 4.28* | | Form of Purchase Unit Agreement (including form of Purchase Unit Certificate). |

| | |

| 5.1 | | |

| | |

| 23.1 | | |

| | |

| 23.3 | | |

| | |

| 24.1 | | |

| | |

| 107.1 | | |

* To be filed by amendment to the Registration Statement or incorporated by reference from documents filed or to be filed with the SEC under the Securities Exchange Act of 1934, as amended.

Item 17. Undertakings

The undersigned registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

i. To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

ii. To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

iii. To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement;

2.That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

4. That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

i. Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of this registration statement as of the date the filed prospectus was deemed part of and included in this registration statement; and