Tritium Reports Record Revenue And Plans For Growth Amid New Partnerships

September 27 2023 - 8:45AM

IH Market News

Tritium (NASDAQ:DCFC), a prominent provider of electric vehicle

(EV) charging solutions, has reported record-breaking revenue for

the fiscal year ending on June 30, 2023, reaching an impressive

$185 million, marking a substantial 115% year-over-year increase.

Notably, the company has also achieved a substantial enhancement in

its gross margin, which reached 4% for the initial half of the

calendar year. Tritium’s Tennessee manufacturing facility has

effectively expanded its operations, attaining record unit

production, and the company has successfully established new

strategic partnerships with customers. Furthermore, Tritium is set

to unveil its MyTritium software platform before the end of the

year and has plans to introduce a modular and scalable 400-kilowatt

charger in 2024.

Key highlights from the earnings call include:

1. Tritium has reported remarkable revenue growth, with sales

orders totaling $146 million and a backlog of approximately $99

million.

2. The company’s production has experienced a substantial

increase, with 7,800 units manufactured during the fiscal year and

5,100 units produced during the six-month period concluding on June

30.

3. Tritium has secured financing commitments of up to $75

million to meet the anticipated strong demand in 2024.

4. The company has formed new customer partnerships, including a

major European utility, a global fleet company, and a global

automotive OEM.

5. Tritium plans to introduce a high-power, 250-mile range

addition in just 10 minutes, aiming to appeal to operators of

public charging networks and fleet customers.

6. Tritium anticipates achieving a positive EBITDA in the first

half of the upcoming year.

During the earnings call, Tritium discussed the notable

improvement in its financial performance over the past two years,

attributing a significant portion of this success to the expansion

of its Tennessee facility. The company has witnessed consistent

growth in its gross margin and anticipates this positive trend to

continue. Tritium achieved a 4% gross margin in the first half of

the calendar year and aims to achieve a guidance range of 10% to

12% in the latter half.

Tritium also disclosed that it maintains inventory worth $140

million, encompassing spare parts, finished products, and chargers

in transit. The company is confident that remote monitoring

services will emerge as a substantial source of revenue and intends

to aggressively roll out this service. Different customer segments,

including fuel, fleet, and charging networks, contribute to varying

volumes and margins.

The company intends to align its overhead and SG&A expenses

with sales forecasts. Tritium also outlined its strategy to address

interest expenses and debt servicing, mentioning the potential

conversion of certain debt into equity and the use of cash

generated from operations to retire debt. Tritium enjoys a

supportive relationship with its debt providers.

Tritium’s CEO, Jane Hunter, explained that the strong revenue

performance in the first half was partly due to delayed orders from

the previous year. Production records were achieved in May and

June, although July and August witnessed reduced production due to

inventory management and optimization of manufacturing processes.

Hunter expressed confidence in the second half and highlighted

strategic customers with imminent purchase orders, along with

ongoing negotiations with American CPOs.

Tritium anticipates its expected CapEx for 2023 to amount to

$7.95 million, with modest requirements anticipated for 2024.

Hunter noted that the transition from order backlog-driven to

flow-driven orders may result in a slightly lower backlog entering

2024, as customers now provide forecasts and letters of intent

instead of secured purchase orders. Nevertheless, the company

remains confident in its prospects for revenue and margin

growth.

Tritium DCFC (NASDAQ:DCFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

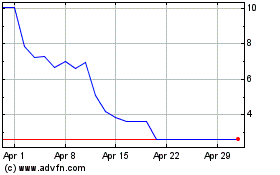

Tritium DCFC (NASDAQ:DCFC)

Historical Stock Chart

From Apr 2023 to Apr 2024