0001602409

true

2023

FY

0001602409

2022-03-01

2023-02-28

0001602409

2022-08-31

0001602409

2023-05-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

(Amendment

No. 1)

| (Mark

One) |

| ☒ |

Annual

Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

|

| For

the fiscal year ended: February 28, 2023 |

| |

|

| ☐ |

Transition

report under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

|

| For

the transition period from ______ to _______. |

Commission

file number: 001-41187

| FINGERMOTION, INC. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

20-0077155 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(IRS

Employer

Identification

Number) |

111 Somerset Road

Level 3, Singapore 238164

(Address

of principal executive offices)

Registrant’s

telephone number, including area code (347) 349-5339

Securities

registered under Section 12(b) of the Exchange Act:

| Title

of each class |

Trading

Symbol (s) |

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

FNGR |

The Nasdaq Stock Market LLC |

Securities

registered under Section 12(g) of the Exchange Act:

None.

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes ☒

No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated Filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction or an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recover analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to 240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ☐ No ☒

The

aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter ($0.93

on August 31, 2022) was approximately $25,121,402.

The

registrant had 51,988,030 common shares outstanding as of May 22, 2023.

table

of contents

EXPLANATORY

NOTE

Fingermotion,

Inc. (which may be referred to herein as “we,” “us,” “our” or the “Company”)

is filing this Amendment No. 1 to our Annual Report on Form 10-K for the fiscal year ended February 28, 2023, to:

| (a) | Correct

an error in the treatment of stock options in the Summary Compensation Table and the Director

Compensation Table included in Item 11 in relation to, respectively, our Named Executive

Officers and the Directors for the fiscal years ended February 28, 2023, and February 28,

2022, in accordance with items 402(n) and (r) of Regulation S-K, and Accounting Standards

Codification (“ASC”) Topic 718. In each case, the value of stock options

is now correctly reported based on the aggregate grant date fair value for the entire amount,

as per the definitions and guidelines outlined in ASC Topic 718. The valuation methodology,

using the Black-Scholes model, remains unchanged. This correction does not impact the financial

statements of the Company, as the Summary Compensation Table and the Director Compensation

Table are disclosure requirements under Items 402(n) and (r), respectively, of the Regulation

S-K and does not affect the Statement of Earnings or Shareholders’ Equity. |

| (b) | Add

Terren S. Peizer, Acuitas Group Holdings, LLC and Acuitas Capital LLC as major stockholders

to the table included in Item 12 which sets forth certain information concerning the number

of shares of our common stock owned beneficially as of May 22, 2023, by (i) each person (including

any group) known to us to own more than 5% of any class of our voting securities, (ii) each

of our officers and directors, and (iii) our officers and directors as a group. |

This

Amendment No. 1 to Form 10-K amends Items 11 and 12 of the Annual Report on Form 10-K that we filed on May 30, 2023 (the “Original

Form 10-K”). Except as expressly set forth herein, this Amendment No. 1 does not reflect events occurring after the date that

the Original Form 10-K was filed or modify or update any of the other disclosures contained therein in any way other than as required

to reflect the amendments discussed above. In addition, in connection with the filing of this Form 10-K/A and pursuant to Rule 12b-15

under the Securities Exchange Act of 1934, as amended, we are including new certifications from our Principal Executive Officer and Principal

Financial Officer dated as of the date of this Form 10-K/A. The remainder of the Original Form 10-K filed with the Securities and Exchange

Commission on May 30, 2023, remains unchanged.

PART

III

Centurion

ZD CPA & Co. Hong Kong 2769

ITEM

11. EXECUTIVE COMPENSATION

Summary

Compensation Table

Our

named executive officers for the fiscal year ended February 28, 2023 (“Fiscal 2023”) consist of (i) Martin J. Shen,

our current Chief Executive Officer, (ii) Yew Hon Lee, our current Chief Financial Officer and (iii) Li Li, the Legal Representative

and General Manager of our contractual controlled company, JiuGe Technology. Our named executive officers for the fiscal year ended February

28, 2022 (“Fiscal 2022”) consist of (i) Martin J. Shen, our current Chief Executive Officer, (ii) Yew Hon Lee, our

current Chief Financial Officer and (iii) Li Li. the Legal Representative and General Manager of our contractual controlled company,

JiuGe Technology. We have no other executive officers. The following Summary Compensation Table sets forth the compensation earned by

or paid to our named executive officers for Fiscal 2023 and Fiscal 2022 are as follows:

Name

and

Principal

Position |

Year |

Salary

($) |

Bonus

($) |

Stock

awards

($) |

Option

awards

($)(3) |

Non-equity

incentive

plan

compensation

($) |

Non-

qualified

deferred

compensation

earnings

($) |

All

other

compensation

($) |

Total

($) |

Martin

J. Shen (1)

CEO |

2023

2022 |

180,000

180,000 |

—

— |

—

— |

—

62,100 |

—

— |

—

— |

—

— |

180,000

242,100 |

Yew

Hon Lee (2)

CFO |

2023

2022 |

84,000

72,000 |

—

— |

—

— |

—

59,670 |

—

— |

—

— |

—

— |

84,000

131,670 |

Li

Li

Legal

Representative and General Manager of JiuGe Technology |

2023

2022

|

133,745

130,586

|

—

—

|

—

—

|

—

113,400

|

—

—

|

—

—

|

—

—

|

133,745

243,986

|

Notes:

| |

(1) |

Mr.

Shen was appointed as our CEO and CFO on December 1, 2018. Mr Shen resigned as our CFO effective December 10, 2020. |

| |

|

|

| |

(2) |

Mr.

Lee Yew Hon was appointed as our CFO on December 11, 2020. |

| |

|

|

| |

(3)

|

For

Fiscal 2022, these amounts represent the aggregate grant date fair value of stock options which was estimated using the Black-Scholes

option pricing model. The following assumptions were used to value the stock options granted on December 28, 2021: exercise price:

$8.00; expected risk free interest rate: 1.06%; expected annual volatility: 15.27%; expected life in years: 5.0; expected annual

dividend yield: $Nil; and Black-Scholes value: $235,170.

At

our annual meeting of stockholders held on February 17, 2023, the stockholders approved an amendment to the exercise price of the

outstanding stock options from $8.00 to $3.84. |

During

our most recently completed financial years, we did not pay any other executive compensation to our named executive officers.

Executive

Employment Agreements

As

of February 28, 2023, we did not have any employment agreements with any of our named executive officers.

Outstanding

Equity Awards Held by Named Executive Officers at Fiscal Year End

The

following table sets forth information as at February 28, 2023, relating to equity awards that have been granted to the Named Executive

Officers:

| Name |

Option

awards |

Stock

awards |

Number

of

securities

underlying

unexercised

options

(#)

exercisable |

Number

of

securities

underlying

unexercised

options

(#)

unexercisable |

Equity

incentive

plan

awards:

Number of

securities

underlying

unexercised

unearned

options

(#) |

Option

exercise

price

($) |

Option

expiration

date |

Number

of

shares

or units

of stock

that have

not

vested

(#) |

Market

value of

shares of

units of

stock

that have

not

vested

($) |

Equity

incentive

plan

awards:

Number

of

unearned

shares,

units or

other

rights that

have not

vested

(#) |

Equity

incentive

plan

awards:

Market or

payout

value of

unearned

shares,

units or

other

rights that

have not

vested

($) |

| Martin

J. Shen |

92,000 |

138,000 |

N/A |

$3.84 |

Dec.

28, 2026 |

N/A |

N/A |

N/A |

N/A |

| Yew

Hon Lee |

88,400 |

132,600 |

N/A |

$3.84 |

Dec.

28, 2026 |

N/A |

N/A |

N/A |

N/A |

| Li

Li |

168,000 |

252,000 |

N/A |

$3.84 |

Dec.

28, 2026 |

N/A |

N/A |

N/A |

N/A |

Pension

Plan Benefits

We

have no pension plans that provide for payments or benefits at, following or in connection with retirement.

Compensation

Policies and Practices and Risk Management

One

of the responsibilities of our Compensation Committee and our Board, in its role in setting executive compensation and overseeing our

various compensation programs, is to ensure that our compensation programs are structured so as to discourage inappropriate risk-taking.

We believe that our existing compensation practices and policies for all employees, including executive officers, mitigate against this

risk by, among other things, providing a meaningful portion of total compensation in the form of equity incentives. These equity incentives

have historically been in the form of stock grants to promote long-term rather than short-term financial performance and to encourage

employees to focus on sustained stock price appreciation. The Compensation Committee is responsible for monitoring our existing compensation

practices and policies and investigating applicable enhancements to align our existing practices and policies with the avoidance or elimination

of risk and the enhancement of long-term stockholder value.

Director

Compensation

Each

of our directors receives regular cash compensation of $2,000 per month, for serving on the Board.

The

following table set forth information relating to the compensation paid to our non-executive directors for Fiscal 2023:

| Name |

Fees

earned

or paid in

cash

($) |

Stock

awards

($) |

Option

awards

($) |

Non-equity

incentive plan

compensation

($) |

Nonqualified

deferred

compensation

earnings

($) |

All

other

compensation

($) |

Total

($) |

| Yew

Poh Leong |

24,000 |

— |

— |

— |

— |

— |

24,000 |

| Michael

Chan |

24,000 |

— |

— |

— |

— |

— |

24,000 |

| Hsien

Loong Wong |

24,000 |

— |

— |

— |

— |

— |

24,000 |

| Eng

Ho Ng |

24,000 |

— |

— |

— |

— |

— |

24,000 |

As

at February 28, 2023, our directors held stock options to acquire an aggregate of 298,500 shares of our common stock as follows: Yew

Poh Leong – 78,500 stock options; Michael Chan – 78,500 stock options; Hsien Loong Wong – 78,500 stock options; and

Eng Ho Ng – 63,000 stock options.

ITEM

12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The

following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of May 22, 2023

by (i) each person (including any group) known to us to own more than 5% of any class of our voting securities, (ii) each of our officers

and directors, and (iii) our officers and directors as a group. Unless otherwise indicated, it is our understanding and belief that the

shareholders listed possess sole voting and investment power with respect to the shares shown.

| Name

and Address of Beneficial Owner (1) | |

Amount and

Nature of

Beneficial

Ownership (1) | | |

Percentage of

Beneficial

Ownership | |

| Directors and Officers: | |

| | | |

| | |

| | |

| | | |

| | |

Martin J. Shen, Chief Executive Officer

c/o 111 Somerset Road, Level 3, Singapore, 238164 | |

| 797,000 | (2) | |

| 1.5 | % |

| | |

| | | |

| | |

Yew Hon Lee, Chief Financial Officer

c/o 111 Somerset Road, Level 3, Singapore, 238164 | |

| 538,400 | (3) | |

| 1.0 | % |

| | |

| | | |

| | |

Yew Poh Leong, Director

c/o 111 Somerset Road, Level

3, Singapore, 238164 | |

| 281,400 | (4) | |

| * | |

| | |

| | | |

| | |

Michael Chan, Director

c/o 111 Somerset Road, Level

3, Singapore, 238164 | |

| 281,400 | (5) | |

| * | |

| | |

| | | |

| | |

Hsien Loong Wong, Director

c/o 111 Somerset Road,

Level 3, Singapore, 238164 | |

| 401,400 | (6) | |

| * | |

| | |

| | | |

| | |

Eng Ho Ng, Director

c/o 111 Somerset Road, Level

3, Singapore, 238164 | |

| 25,200 | (7) | |

| * | |

| | |

| | | |

| | |

Li Li, Legal Representative and General Manager of JiuGe

Technology

c/o 111 Somerset Road, Level 3, Singapore, 238164 | |

| 2,368,000 | (8) | |

| 4.5 | % |

| | |

| | | |

| | |

All directors and executive officers as a group

(7 persons) | |

| 4,692,800 | (9) | |

| 8.9 | % |

| | |

| | | |

| | |

| Major Stockholders: | |

| | | |

| | |

| | |

| | | |

| | |

Choe Yang Yeat

6-11-1 V Square PJ City Centre

Jalan Utara PJ

Selangor 46200

Malaysia | |

| 7,238,400 | (10) | |

| 13.9 | % |

| | |

| | | |

| | |

Cheong Chee Ming

Unit A 19/F Times Media Centre

133 Wan Chai Road

Wan Chai

Hong Kong | |

| 3,970,000 | | |

| 7.6 | % |

| | |

| | | |

| | |

Liew Yow Ming

190 Depot Road, #18-19

The Interlace Condominium

Singapore 109689 | |

| 3,220,200 | (11) | |

| 6.2 | % |

| | |

| | | |

| | |

Terren

S. Peizer Acuitas

Group Holdings, LLC Acuitas

Capital LLC

2001 Wilshire Boulevard, Suite 330

Santa Monica, California 90403 | |

| 4,000,000 | (12) | |

| 7.7 | % |

Notes:

| (1) |

Under

Rule 13d-3 of the Exchange Act, a beneficial owner of a security includes any person who, directly or indirectly, through any contract,

arrangement, understanding, relationship or otherwise, has or shares: (i) voting power, which includes the power to vote, or to direct

the voting of such security; and (ii) investment power, which includes the power to dispose or direct the disposition of the security.

Certain shares of common stock may be deemed to be beneficially owned by more than one person (if, for example, persons share the

power to vote or the power to dispose of the shares). In addition, shares of common stock are deemed to be beneficially owned by

a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as

of which the information is provided. In computing the percentage ownership of any person, the amount of shares of common stock outstanding

is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition

rights. As a result, the percentage of outstanding shares of common stock of any person as shown in this table does not necessarily

reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding

as of the date of this Proxy Statement. As of May 22, 2023, there were 51,988,030 shares of common stock of the Company issued and

outstanding. |

| |

|

| (2) |

This

figure represents (i) 705,000 shares of common stock, and (ii) stock options to purchase 92,000 shares of our common stock, which

have vested or will vest within 60 days of the date hereof. |

| |

|

| (3) |

This

figure represents (i) 450,000 shares of common stock, and (ii) stock options to purchase 88,400 shares of our common stock, which

have vested or will vest within 60 days of the date hereof. |

| |

|

| (4) |

This

figure represents (i) 250,000 shares of common stock, and (ii) stock options to purchase 31,400 shares of our common stock, which

have vested or will vest within 60 days of the date hereof. |

| |

|

| (5) |

This

figure represents (i) 250,000 shares of common stock, and (ii) stock options to purchase 31,400 shares of our common stock, which

have vested or will vest within 60 days of the date hereof. |

| |

|

| (6) |

This

figure represents (i) 370,000 shares of common stock, and (ii) stock options to purchase 31,400 shares of our common stock, which

have vested or will vest within 60 days of the date hereof. |

| |

|

| (7) |

This

figure represents stock options to purchase 25,200 shares of our common stock, which have vested or will vest within 60 days of the

date hereof. |

| |

|

| (8) |

This

figure represents (i) 2,200,000 shares of common stock, and (ii) stock options to purchase 168,000 shares of our common stock, which

have vested or will vest within 60 days of the date hereof. |

| |

|

| (9) |

This

figure represents (i) 4,225,000 shares of common stock, and (ii) stock options to purchase 467,800 shares of our common stock, which

have vested or will vest within 60 days of the date hereof. |

| |

|

| (10) |

This

figure represents (i) 7,200,000 shares of common stock held by Ever Sino International Limited over which Mr. Choe Yang Yeat has

sole voting and dispositive power, and (ii) stock options held directly by Mr. Choe to purchase 38,400 shares of our common stock,

which have vested or will vest within 60 days of the date hereof. |

| |

|

| (11) |

This

figure represents 3,220,200 shares of common stock. |

| |

|

| (12) |

This

figure represents (i) 1,000,000 shares of common stock held directly by Acuitas Group Holdings, LLC, a California limited liability

company (“Acuitas”), and (ii) 3,000,000 shares of common stock held directly by Acuitas Capital LLC, a Delaware

limited liability company (“Acuitas Capital”) wholly-owned by Acuitas. Acuitas is a private investment

vehicle beneficially owned and controlled by Terren S. Peizer. Mr. Peizer is the sole member and Chairman and managing member of

Acuitas and, in such capacity, exercises the sole voting and investment power over the shares of common stock held for the accounts

of Acuitas and Acuitas Capital. |

Changes

in Control

We

are unaware of any contract, or other arrangement or provision, the operation of which may at a subsequent date result in a change of

control of our Company.

Securities

Authorized for Issuance Under Equity Compensation Plans

| Plan

category |

Number

of securities to be

issued upon exercise of

outstanding options, warrants,

rights |

Weighted-average

exercise

price of outstanding options,

warrants and rights |

Number

of securities

remaining available for future

issuance under equity

compensation plans

(excluding securities reflected

in column (a)) |

| |

(a) |

(b) |

(c) |

| Equity

compensation plans approved by security holders |

3,571,000 |

$3.84(1) |

5,429,000 |

| Equity

compensation plans not approved by security holders |

N/A |

N/A |

N/A |

| Total |

3,571,000 |

|

5,429,000 |

Note:

| (1) | At

the annual meeting of stockholders held on February 17, 2023, the stockholders approved the

amendment to the exercise price of outstanding stock options from $8.00 to $3.84. |

Effective

September 27, 2021, our Board of Directors authorized and approved the adoption by the Company of the 2021 Stock Incentive Plan (the

“2021 Stock Incentive Plan”), pursuant to which an aggregate of 7,000,000 shares of our common stock may be issued

pursuant to awards that may be granted under the 2021 Stock Incentive Plan. The 2021 Stock Incentive Plan was approved by our stockholders

at our annual meeting of stockholders held on November 22, 2021.

On

December 12, 2022, our Board of Directors authorized and approved the adoption of the Company’s 2023 Stock Incentive Plan (the

“2023 Stock Incentive Plan”), under which an aggregate of 9,000,000 of our shares of common stock may be issued which

consists of: (i) 3,571,000 shares issuable pursuant to awards previously granted that were outstanding under the 2021 Stock Incentive

Plan as of December 12, 2022; (ii) 3,429,000 shares remaining available for issuance under the 2021 Stock Incentive Plan as of December

12, 2022; and (iii) 2,000,000 additional shares that may be issued pursuant to awards that may be granted under the 2023 Stock Incentive

Plan. The 2023 Stock Incentive Plan supersedes and replaces the Company’s 2021 Stock Incentive Plan, which was approved by our

stockholders at the annual meeting of stockholders held on February 17, 2023. The terms of the 2023 Stock Incentive Plan are the same

as the 2021 Stock Incentive Plan other than the increase in the aggregate number of shares reserved for awards under the 2023 Stock Incentive

Plan.

The

2023 Stock Incentive Plan is administered by our Board of Directors, or the Compensation Committee, or any other committee appointed

by the Board of Directors to administer the 2023 Stock Incentive Plan, and the Board of Directors shall determine, among other things:

(i) the persons to be granted awards under the 2023 Stock Incentive Plan; (ii) the number of shares or amount of other awards to be granted;

and (iii) the terms and conditions of the awards granted. The Company may issue restricted shares, stock options, restricted stock units,

stock appreciation rights, deferred stock rights and dividend equivalent rights, among others, under the 2023 Stock Incentive Plan. As

indicated above, an aggregate of 9,000,000 of our shares may be issued pursuant to the grant of awards under the 2023 Stock Incentive

Plan.

An

award may not be exercised after the termination date of the award and may be exercised following the termination of an eligible participant’s

continuous service only to the extent provided by the administrator under the 2023 Stock Incentive Plan. If the administrator under the

2023 Stock Incentive Plan permits a participant to exercise an award following the termination of continuous service for a specified

period, the award terminates to the extent not exercised on the last day of the specified period or the last day of the original term

of the award, whichever occurs first. In the event an eligible participant’s service has been terminated for “cause”,

he or she shall immediately forfeit all rights to any of the awards outstanding.

The

2023 Stock Incentive Plan includes the following best practice provisions to reinforce the alignment between stockholders’ interests

and equity compensation arrangements. These provisions include, but are not limited to:

| |

● |

No

discounted awards: the exercise price of an award must not be lower than 100% of the fair market value of the shares on the stock

exchange or system on which the shares are traded or quoted at the time the award is granted; |

| |

● |

No

buyout without shareholder approval: outstanding options or non-qualified stock options (“SARs”) may not be

bought out or surrendered in exchange for cash unless shareholder approval is received; |

| |

● |

No

repricing without shareholder approval: the Company may not, without shareholder approval,

reprice an award by reducing the exercise price of a stock option or exchanging a stock option for cash, other awards or a new stock

option with a reduced exercise price; |

| |

● |

Minimum

vesting requirements for “full-value” awards: except in the case of an award granted in substitution and cancellation

of an award granted by an acquired organization and shares delivered in lieu of fully vested cash awards, any equity-based awards

granted under the 2023 Stock Incentive Plan will have a vesting period of not less than one year from the date of grant; provided,

however, that this minimum vesting restriction will not be applicable to equity-based awards not in excess of 5% of the number of

shares available for grant under the 2023 Stock Incentive Plan. For avoidance of doubt, the foregoing restrictions do not apply to

the Board’s discretion to provide for accelerated exercisability or vesting of any award in case of death or disability. The

treatment of awards in connection with a change of control are described below; |

| |

● |

No

accelerated vesting of outstanding unvested awards and double-trigger change of control requirements: no acceleration of any

unvested awards shall occur except in the case of the death or disability of the grantee or upon a change of control. In this respect

the 2023 Stock Incentive Plan requires a “double-trigger” – both a change of control and a qualifying termination

of continuing services – to accelerate the vesting of awards. In connection with a change in control, time-based awards shall

only be accelerated if the awards are not assumed or converted following the change in control and performance based awards shall

only be accelerated: (i) to the extent of actual achievement of the performance conditions; or (ii) on a prorated basis for time

elapsed in ongoing performance period(s) based on target or actual level achievement. In connection with vesting of outstanding awards

following a qualifying termination after a change in control (i.e., double-trigger vesting), the same conditions set forth in the

preceding sentence will apply; |

| |

● |

No

dividends for unvested awards: holders of any awards which have not yet vested are not entitled to receive dividends, however,

dividends may be accrued and paid upon the vesting of such awards; |

| |

● |

No

liberal share recycling: shares issued under the 2023

Stock Incentive Plan pursuant to an award, or shares retained by or delivered to the Company

to pay either the exercise price of an outstanding stock option or the withholding taxes in connection with the vesting of incentive

stock awards or SARs, and shares purchased by the Company in the open market using the proceeds of option exercises, do not become

available for issuance as future awards under the 2023 Stock Incentive Plan; |

| |

● |

Transferability: the

awards granted under the 2023 Stock Incentive Plan generally may not be sold,

transferred, pledged, assigned or otherwise alienated or hypothecated, other than by will, by the laws of descent and distribution; |

| |

● |

No

automatic grants: the 2023 Stock Incentive

Plan does not provide for automatic grants to any eligible participant; and |

| |

● |

No

evergreen provision: the 2023 Stock Incentive Plan does not provide for an “evergreen” feature pursuant to which

the shares authorized for issuance under the 2023

Stock Incentive Plan can be automatically replenished. |

The

foregoing summary of the 2023 Stock Incentive Plan is not complete and is qualified in its entirety by reference to the 2023 Stock Incentive

Plan, which is attached as Exhibit 4.1 to our Form S-8 that we filed with the SEC on February 28, 2023.

PART

IV

ITEM

15 – EXHIBITS

| Exhibit

No. |

|

Document |

| 2.1(4) |

|

Share

Exchange Agreement among FingerMotion, Inc., Finger Motion Company Limited and the Shareholders of Finger Motion Company Limited,

dated July 13, 2017 |

| 3.1(1) |

|

Certificate

of Incorporation |

| 3.2(2) |

|

Certificate

of Designation, Preferences and Rights of Series A Convertible Preferred Stock dated May 15, 2017 |

| 3.3(3) |

|

Certificate

of Amendment of Certificate of Incorporation dated June 21, 2017 |

| 3.4(7) |

|

Amended

and Restated Bylaws |

| 4.1(14) |

|

Description

of Registrant’s Securities |

| 10.1(2) |

|

Software

License Agreement between Finger Motion Company Limited and Property Management Corporation or America dated April 28, 2017 |

| 10.2(5) |

|

Exclusive

Consulting Agreement between Shanghai JiuGe Business Management Co., Ltd. and Shanghai JiuGe Information Technology Co., Ltd. dated

October 16, 2018 |

| 10.3(5) |

|

Loan

Agreement between Shanghai JiuGe Business Management Co., Ltd. and Shanghai JiuGe Information Technology Co., Ltd. dated October

16, 2018 |

| 10.4(5) |

|

Power

of Attorney Agreement between Shanghai JiuGe Business Management Co., Ltd. and Shanghai JiuGe Information Technology Co., Ltd. dated

October 16, 2018 |

| 10.5(5) |

|

Exclusive

Call Option Agreement between Shanghai JiuGe Business Management Co., Ltd. and Shanghai JiuGe Information Technology Co., Ltd. dated

October 16, 2018 |

| 10.6(12) |

|

Share

Pledge Agreement between Shanghai JiuGe Business Management Co., Ltd. and Shanghai JiuGe Information Technology Co., Ltd. dated October

16, 2018 |

| 10.7(6) |

|

English

Translation of Yunnan Unicom Electronic Sales Platform Construction and Operation Cooperation Agreement, dated as of July 7, 2019,

between Shanghai JiuGe Information Technology Co., Ltd. and China United Network Communications Limited Yunnan Branch |

| 10.8(10) |

|

2021

Stock Incentive Plan |

| 10.9(9) |

|

Convertible

Promissory Note in the amount of US$730,000 issued by FingerMotion, Inc. in favor of Dr. Liew Yow Ming, dated May 1, 2022 |

| 10.10(11) |

|

Securities

Purchase Agreement between FingerMotion, Inc. and Lind Global Fund II LP, dated August 9, 2022 |

| 10.11(11) |

|

Senior

Secured Convertible Promissory Note, dated August 9, 2022, issued by FingerMotion, Inc. to Lind Global Fund II LP(†) |

| 10.12(11) |

|

Security

Agreement between FingerMotion, Inc. and Lind Global Fund II LP, dated August 9, 2022 |

| 10.13(11) |

|

Guaranty,

dated August 9, 2022, made by each of Finger Motion Company Limited, Finger Motion (CN) Global Limited, Finger Motion (CN) Limited,

Shanghai JiuGe Business Management Co., Ltd., Finger Motion Financial Group Limited and Finger Motion Financial Company Limited,

in favor of Lind Global Fund II LP |

| 10.14(13) |

|

2023

Stock Incentive Plan |

| 14.1(8) |

|

Code

of Business Conduct and Ethics |

| 21.1(14) |

|

Subsidiaries

of FingerMotion, Inc. |

| 23.1(14) |

|

Consent

of Centurion ZD CPA & Co. |

| 31.1(*) |

|

Certification

of Chief Executive Officer pursuant to the Securities Exchange Act of 1934 Rule 13a-14(a) or 15d-14(a). |

| 31.2(*) |

|

Certification

of Chief Financial Officer pursuant to the Securities Exchange Act of 1934 Rule 13a-14(a) or 15d-14(a). |

| 32.1(**) |

|

Certifications

pursuant to the Securities Exchange Act of 1934 Rule 13a-14(b) or 15d-14(b) and 18 U.S.C. Section 1350, as adopted pursuant to Section

906 of the Sarbanes-Oxley Act of 2002. |

| 101.INS(*) |

|

XBRL

Instance Document |

| 101.SCH(*) |

|

XBRL

Taxonomy Extension Schema Document |

| 101.CAL(*) |

|

XBRL

Taxonomy Extension Calculation Linkbase Document |

| 101.DEF(*) |

|

XBRL

Taxonomy Extension Definitions Linkbase Document |

| 101.LAB(*) |

|

XBRL

Taxonomy Extension Label Linkbase Document |

| 101.PRE(*) |

|

XBRL

Taxonomy Extension Presentation Linkbase Document |

| 104(*) |

|

Cover

Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101 attachments) |

Notes:

| (*) |

Filed

herewith |

| |

|

| (**) |

Furnished

herewith |

| |

|

(†) |

Portions

of this exhibit have been omitted |

| |

|

| (1) |

Previously

filed as an exhibit to our Registration Statement on Form S-1 filed with the SEC on May 8, 2014 (No. 333-196503) |

| |

|

| (2) |

Previously

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on May 16, 2017 |

| |

|

| (3) |

Previously

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on July 12, 2017 |

| |

|

| (4) |

Previously

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on July 20, 2017 |

| |

|

| (5) |

Previously

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on December 27, 2018 |

| |

|

| (6) |

Previously

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on August 9, 2019 |

| |

|

| (7) |

Previously

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on August 25, 2021 |

| |

|

| (8) |

Previously

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on December 21, 2021 |

| |

|

| (9) |

Previously

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on May 5, 2022 |

| |

|

| (10) |

Previously

filed as an exhibit to our Annual Report on Form 10-K filed with the SEC on May 31, 2022 |

| |

|

| (11) |

Previously

filed as an exhibit to our Current Report on Form 8-K filed with the SEC on August 15, 2022 |

| |

|

| (12) |

Previously

filed as an exhibit to our Registration Statement on Form S-1/A filed with the SEC on January 5, 2023 (No. 333-267332) |

| |

|

| (13) |

Previously

filed as an exhibit to our Registration Statement on Form S-8 filed with the SEC on February 28, 2023 (No. 333-270094) |

| |

|

| (14) |

Previously

filed as an exhibit to our Annual Report on Form 10-K filed with the SEC on May 30, 2023 |

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| |

FINGERMOTION,

INC. |

| |

|

| Dated: August

31, 2023 |

By: |

/s/

Martin J. Shen |

|

|

| |

Martin

J. Shen, Chief Executive Officer |

| |

(Principal

Executive Officer) |

EXHIBIT

31.1

CERTIFICATION

I,

Martin J. Shen, certify that:

1.

I have reviewed this Amendment No. 1 to the Form 10-K of FingerMotion, Inc.;

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the

period covered by this report; and

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report.

Date:

August 31, 2023

Martin

J. Shen, Chief Executive Officer

(Principal

Executive Officer)

EXHIBIT

31.2

CERTIFICATION

I,

Yew Hon Lee, certify that:

1.

I have reviewed this Amendment No. 1 to the Form 10-K of FingerMotion, Inc.;

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the

period covered by this report; and

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report.

Date:

August 31, 2023

Yew

Hon Lee, Chief Financial Officer

(Principal

Financial Officer and Principal Accounting Officer)

EXHIBIT

32.1

CERTIFICATION

PURSUANT TO

18

U.S.C. SECTION 1350

AS

ADOPTED PURSUANT TO

SECTION

906 OF THE SARBANES-OXLEY ACT OF 2002

The

undersigned, Martin J. Shen, the Chief Executive Officer of FingerMotion, Inc. (the “Company”), and Yew Hon Lee, the Chief

Financial Officer of the Company, each hereby certifies, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the

Sarbanes-Oxley Act of 2002, that, to his or her knowledge, Amendment No. 1 to the Annual Report on Form 10-K for the year ended February

28, 2023, fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, and that

the information contained in the Annual Report on Form 10-K fairly presents in all material respects the financial condition and results

of operations of the Company.

Date:

August 31, 2023

Martin

J. Shen, Chief Executive Officer

(Principal

Executive Officer)

Yew

Hon Lee, Chief Financial Officer

(Principal

Financial Officer and Principal Accounting Officer)

A

signed original of this written statement required by Section 906, or other document authenticating, acknowledging, or otherwise adopting

the signature that appears in typed form within the electronic version of this written statement required by Section 906, has been provided

to the Company and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request.

v3.23.2

Cover - USD ($)

|

12 Months Ended |

|

|

Feb. 28, 2023 |

May 22, 2023 |

Aug. 31, 2022 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Amendment Description |

Fingermotion,

Inc. (which may be referred to herein as “we,” “us,” “our” or the “Company”)

is filing this Amendment No. 1 to our Annual Report on Form 10-K for the fiscal year ended February 28, 2023, to:

(a)Correct

an error in the treatment of stock options in the Summary Compensation Table and the Director

Compensation Table included in Item 11 in relation to, respectively, our Named Executive

Officers and the Directors for the fiscal years ended February 28, 2023, and February 28,

2022, in accordance with items 402(n) and (r) of Regulation S-K, and Accounting Standards

Codification (“ASC”) Topic 718. In each case, the value of stock options

is now correctly reported based on the aggregate grant date fair value for the entire amount,

as per the definitions and guidelines outlined in ASC Topic 718. The valuation methodology,

using the Black-Scholes model, remains unchanged. This correction does not impact the financial

statements of the Company, as the Summary Compensation Table and the Director Compensation

Table are disclosure requirements under Items 402(n) and (r), respectively, of the Regulation

S-K and does not affect the Statement of Earnings or Shareholders’ Equity.

(b)Add

Terren S. Peizer, Acuitas Group Holdings, LLC and Acuitas Capital LLC as major stockholders

to the table included in Item 12 which sets forth certain information concerning the number

of shares of our common stock owned beneficially as of May 22, 2023, by (i) each person (including

any group) known to us to own more than 5% of any class of our voting securities, (ii) each

of our officers and directors, and (iii) our officers and directors as a group.

This

Amendment No. 1 to Form 10-K amends Items 11 and 12 of the Annual Report on Form 10-K that we filed on May 30, 2023 (the “Original

Form 10-K”). Except as expressly set forth herein, this Amendment No. 1 does not reflect events occurring after the date that

the Original Form 10-K was filed or modify or update any of the other disclosures contained therein in any way other than as required

to reflect the amendments discussed above. In addition, in connection with the filing of this Form 10-K/A and pursuant to Rule 12b-15

under the Securities Exchange Act of 1934, as amended, we are including new certifications from our Principal Executive Officer and Principal

Financial Officer dated as of the date of this Form 10-K/A. The remainder of the Original Form 10-K filed with the Securities and Exchange

Commission on May 30, 2023, remains unchanged.

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Document Period End Date |

Feb. 28, 2023

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Document Fiscal Year Focus |

2023

|

|

|

| Current Fiscal Year End Date |

--02-28

|

|

|

| Entity File Number |

001-41187

|

|

|

| Entity Registrant Name |

FINGERMOTION, INC.

|

|

|

| Entity Central Index Key |

0001602409

|

|

|

| Entity Tax Identification Number |

20-0077155

|

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

|

| Entity Address, Address Line One |

111 Somerset Road

|

|

|

| Entity Address, City or Town |

Level 3

|

|

|

| Entity Address, Country |

SG

|

|

|

| Entity Address, Postal Zip Code |

238164

|

|

|

| City Area Code |

(347)

|

|

|

| Local Phone Number |

349-5339

|

|

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value

|

|

|

| Trading Symbol |

FNGR

|

|

|

| Security Exchange Name |

NASDAQ

|

|

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

|

| Entity Small Business |

true

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Public Float |

|

|

$ 25,121,402

|

| Entity Common Stock, Shares Outstanding |

|

51,988,030

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Auditor Name |

Centurion

ZD CPA & Co.

|

|

|

| Auditor Location |

Hong Kong

|

|

|

| Auditor Firm ID |

2769

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

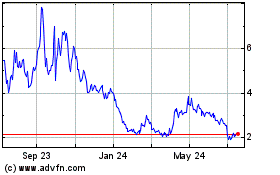

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

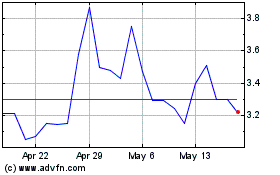

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Apr 2023 to Apr 2024