Union Pacific Reports Volumes Picked Up in 4Q

January 21 2021 - 8:53AM

Dow Jones News

By Micah Maidenberg

Union Pacific Corp. reported better demand during the fourth

quarter, a sign the railroad may be seeing hints of a broader

recovery from the economic downturn caused by the coronavirus last

year.

The Omaha-based railroad reported a profit of $1.38 billion, or

$2.05 a share, compared with $1.4 billion, or $2.02 a share, for

the year earlier. Excluding a $278 million pretax, non-cash

impairment charge, profit was $2.36 a share, 11 cents more than

what analysts were looking for on that earnings metric.

The charge related to the company's Brazos Yard property,

located in Texas.

Revenue slipped to $5.14 billion from $5.21 billion, the company

said, and was roughly in line with what analysts had forecast,

according to FactSet.

The pandemic and the economic recession it caused hampered

demand for rail shipments for much of last year. Overall, during

the first 52 weeks of last year, U.S. railroads reported a 13%

decline in carload volumes compared with the year earlier and a 2%

drop in intermodal volumes, the Association of American Railroads

said last month. However, demand has been better so far in the new

year.

Union Pacific said volumes increased 3% in the fourth quarter,

led by premium shipments. Bulk volumes were flat while industrial

demand declined. Volume growth and price increases were more than

offset by decreased fuel surcharges and a less favorable mix in

shipments, the company said.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

January 21, 2021 08:38 ET (13:38 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

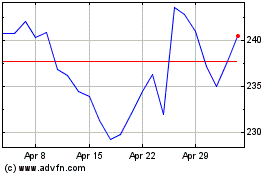

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Aug 2024 to Sep 2024

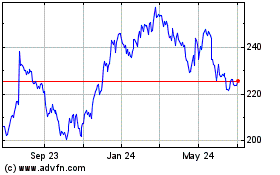

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Sep 2023 to Sep 2024