Quarterly Report (10-q)

October 30 2020 - 4:15PM

Edgar (US Regulatory)

false

0001024795

0001024795

2020-10-28

2020-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 28, 2020

HELIOS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

0-21835

|

59-2754337

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1500 West University Parkway, Sarasota, Florida

|

|

34243

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (941) 362-1200

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock $.001 Par Value

|

|

HLIO

|

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01Entry Into a Material Definitive Agreement

On July 29, 2016, Helios Technologies, Inc. (formerly known as Sun Hydraulics Corporation), a Florida corporation (“Helios”), entered into a credit facility (the “Original Credit Facility”) syndicated by PNC Bank, National Association (“PNC Bank”) on behalf of multiple lenders pursuant to which such lenders extended a $100 million revolving line of credit to Helios. The Original Credit Facility was amended and restated by the Amended and Restated Credit Agreement, dated as of November 22, 2016, (as amended, supplemented or modified, the “Existing Credit Facility”) which provided for a revolving line of credit of up to $300 million and included an accordion feature to increase the facility by up to an additional $100 million in the form of additional revolving credit loans or in the form of term loans. The Existing Credit Facility was amended on April 1, 2018 to increase the revolving line of credit up to $400 million and to provide a term loan in the aggregate principal amount of $100 million.

On October 28, 2020 (“Credit Facility Closing Date”), Helios entered into a Second Amended and Restated Credit Agreement (the “Second Amended and Restated Credit Agreement”) with PNC Bank, as administrative agent on behalf of the lenders, pursuant to which the Existing Credit Facility was amended and restated to provide (i) a revolving credit facility in the aggregate principal amount of $400 million as of the Credit Facility Closing Date and (ii) a term loan facility in the aggregate principal amount of $200 million as of the Credit Facility Closing Date, with the option to increase the revolver or incur additional term loans by a maximum of $300 million, subject to new or existing lenders agreeing to participate in the increase and other customary conditions. The total commitments under the Second Amended and Restated Credit Agreement are not to exceed $900 million.

Pursuant to the Second Amended and Restated Credit Agreement, Helios can select an interest rate for its revolving credit loans and term loans from the following options:

|

|

•

|

Revolving credit loans that are Dollar Loans and term loans can accrue interest at a variable rate equal to the greater of (i) the Overnight Bank Funding Rate, plus 0.5%; (ii) the Prime Rate, and (iii) the Daily Libor Rate, plus 1.00% for each applicable Interest Period, plus a margin of between 0.5% and 1.75% depending on Helios’s Leverage Ratio.

|

|

|

•

|

All revolving credit loans and term loans can accrue interest at a rate equal to the Euro Rate for each applicable Interest Period plus a margin of between 1.50% and 2.75% depending on Helios’s Leverage Ratio.

|

Only the option applicable to revolving credit loans will apply to any Swing Loans made.

Under the Second Amended and Restated Credit Agreement, beginning April 2021, principal payments on the initial term loan will be due quarterly, beginning at $2.5 million before increasing to $3.75 million in April 2022 and $5.0 million in March 2024. All remaining principal and unpaid accrued interest are due on October 28, 2025.

As of the Credit Facility Closing Date, the obligations under the Second Amended and Restated Credit Agreement are guaranteed by Enovation Controls, LLC, Sun Hydraulics, LLC, and Faster, Inc.

All capitalized terms used in this Item 1.01 but not otherwise defined shall have the meanings ascribed to them in the Second Amended and Restated Credit Agreement. The foregoing description of the Second Amended and Restated Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amended and Restated Credit Agreement, which is attached as Exhibit 10.1 to this Form 8-K and incorporated herein by reference.

On October 30, 2020, the Company issued a press release in connection with foregoing. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01Financial Statements and Exhibits

(d)Exhibits

|

10.1*

|

|

Second Amended and Restated Credit Agreement, dated October 28, 2020, by and among Helios Technologies, Inc. as Borrower, the Guarantor parties thereto, the financial institutions party thereto from time to time as lenders, and PNC Bank, National Association, as Administrative Agent.

|

|

99.1

|

|

Press release dated October 30, 2020

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

*Certain portions of the exhibit have been omitted pursuant to Rule 601(b)(10) of Regulation S-K. The omitted information is (i) not material and (ii) would likely cause competitive harm to Helios if publicly disclosed.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

HELIOS TECHNOLOGIES, INC.

|

|

|

|

|

|

|

Dated: October 30, 2020

|

|

By:

|

/s/ Tricia L. Fulton

|

|

|

|

|

Tricia L. Fulton

|

|

|

|

|

Chief Financial Officer

(Principal Financial and

Accounting Officer)

|

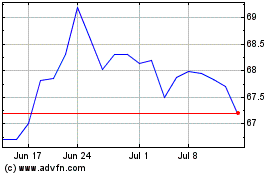

Equity Residential (NYSE:EQR)

Historical Stock Chart

From Aug 2024 to Sep 2024

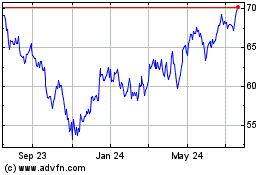

Equity Residential (NYSE:EQR)

Historical Stock Chart

From Sep 2023 to Sep 2024