Current Report Filing (8-k)

August 10 2020 - 5:28PM

Edgar (US Regulatory)

false 0001464423 0001464423 2020-08-04 2020-08-04 0001464423 us-gaap:CommonStockMember 2020-08-04 2020-08-04 0001464423 us-gaap:SeriesAPreferredStockMember 2020-08-04 2020-08-04 0001464423 us-gaap:SeriesBPreferredStockMember 2020-08-04 2020-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4, 2020

PennyMac Mortgage Investment Trust

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

|

001-34416

|

|

27-0186273

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

3043 Townsgate Road, Westlake Village, California

|

|

91361

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(818) 224-7442

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Shares of Beneficial Interest, $0.01 par value

|

|

PMT

|

|

New York Stock Exchange

|

|

8.125% Series A Cumulative Redeemable Preferred Shares of Beneficial Interest, $0.01 par value

|

|

PMT/PA

|

|

New York Stock Exchange

|

|

8.00% Series B Cumulative Redeemable Preferred Shares of Beneficial Interest, $0.01 par value

|

|

PMT/PB

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

PennyMac Mortgage Investment Trust (the “Company”), as guarantor, and its subsidiary PennyMac Corp. (“PMC”), as seller, entered into Joint Amendment No. 1 to the Series 2017-VF1 Repurchase Agreement and Amendment No. 2 to the Pricing Side Letter (“VF1 Amendment”) on August 4, 2020 with Credit Suisse First Boston Mortgage Capital LLC, as administrative agent (the “Administrative Agent”), and Credit Suisse AG, Cayman Islands Branch (“CSCIB”) and Citibank, N.A. (“Citi”), as syndicated buyers (together, the “Syndicated Buyers”). In addition, the Company entered into Amendment No. 2 to the Series 2017-VF1 Indenture Supplement (“Indenture Supplement Amendment” and together with the VF1 Amendment, “FMSR VF1 Amendments”) by and among the Company’s indirect subsidiary PMT ISSUER TRUST—FMSR, as issuer, Citibank N.A., as indenture trustee (“Indenture Trustee”), PMC, as servicer and administrator, and the Administrative Agent. The FMSR VF1 Amendments are part of a structured finance transaction (“PMT MSR Facility”), pursuant to which PMC finances its Fannie Mae mortgage servicing rights (“MSRs”) through the issuance of a Series 2017-VF1 Note (“VFN”) that is secured by the MSRs and sold to the Syndicated Buyers under an agreement to repurchase. The primary purposes of the FMSR VF1 Amendments are to (a) increase the committed borrowing capacity to $700 million (with each Syndicated Buyer committing to a pro rata $350 million share and CSCIB committing to an additional $25 million) and (b) extend the VFN termination date to August 3, 2021.

The foregoing description of the FMSRVF1 Amendments do not purport to be complete and are qualified in their entirety by reference to the following: (i) the full text of the FMSRVF1 Amendments, which have been filed with this Current Report on Form 8-K as Exhibit 10.1 and Exhibit 10.2, respectively; (ii) the description of the PMT MSR Facility in the Company’s Current Report on Form 8-K as filed with the SEC on December 20, 2017, including the full text of the Master Repurchase Agreement and Base Indenture attached thereto as Exhibit 10.7 and Exhibit 10.1, respectively; (iii) the description of the Amended Base Indenture in the Company’s Current Report on Form 8-K as filed with the SEC on April 30, 2018, including the full text of the Amended Base Indenture attached thereto as Exhibit 10.1; (iv) the description of the Amended and Restated Master Repurchase Agreement and Indenture Supplement in the Company’s Current Report on Form 8-K as filed with the SEC on July 6, 2018, including the full text of the Amended and Restated Master Repurchase Agreement, Indenture Supplement and guaranty attached thereto as Exhibit 10.1, Exhibit 10.3 and Exhibit 10.2, respectively; (v) the description of the Amended Base Indenture in the Company’s Current Report on Form 8-K as filed with the SEC on April 30, 2018, including the full text of the Amended Base Indenture attached thereto as Exhibit 10.1; (vi) the Amended Base Indenture in the Company’s Periodic Report on Form 10-Q as filed with the SEC on August 7, 2020, including the full text of the Amended Base Indenture attached thereto as Exhibit 10.7; and (vii) the full text of all other amendments to the foregoing filed thereafter with the SEC.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

Joint Amendment No. 1 to the Series 2017-VF1 Repurchase Agreement and Amendment No. 2 to the Pricing Side Letter, dated as of August 4, 2020, by and among PennyMac Mortgage Investment Trust, PennyMac Corp., Credit Suisse First Boston Mortgage Capital LLC, and Credit Suisse AG, Cayman Islands Branch and Citibank, N.A.

|

|

|

|

|

10.2

|

|

Amendment No. 2 to the Series 2017-VF1 Indenture Supplement, dated as of August 4, 2020, by and among PMT ISSUER TRUST-FMSR, Citibank, N.A., PennyMac Corp. and Credit Suisse First Boston Mortgage Capital LLC.

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PENNYMAC MORTGAGE INVESTMENT TRUST

|

|

|

|

|

|

|

Dated: August 10, 2020

|

|

|

|

|

|

/s/ Andrew S. Chang

|

|

|

|

|

|

|

|

Andrew S. Chang

Senior Managing Director and Chief Financial Officer

|

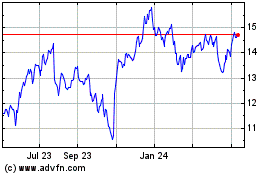

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Aug 2024 to Sep 2024

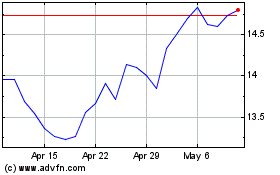

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Sep 2023 to Sep 2024