Current Report Filing (8-k)

January 17 2020 - 4:51PM

Edgar (US Regulatory)

0001451505false00014515052020-01-172020-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (date of earliest event reported): January 17, 2020

TRANSOCEAN LTD.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Switzerland

|

|

001-38373

|

|

98-0599916

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

Turmstrasse 30

|

|

|

|

Steinhausen, Switzerland

|

|

CH-6312

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(zip code)

|

Registrant’s telephone number, including area code: +41 (41) 749-0500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered:

|

|

Shares, CHF 0.10 par value

|

RIG

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01Entry into a Material Definitive Agreement

On January 17, 2020, in connection with the closing of the previously-announced offering by Transocean Inc. (the “Offering”), a wholly-owned subsidiary of Transocean Ltd., of U.S. $750 million in aggregate principal amount of 8.00% Senior Notes due 2027 (the “Notes”), Transocean Inc. entered into an indenture (the “Indenture”) with Transocean Ltd., Transocean Holdings 1 Limited, Transocean Holdings 2 Limited and Transocean Holdings 3 Limited (collectively, the “Guarantors”) and Wells Fargo Bank, National Association, as trustee (the “Trustee”). The Notes are fully and unconditionally guaranteed, jointly and severally, by the Guarantors on a senior unsecured basis (the “Guarantees”). The Notes have not been registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or under any state securities laws, and were offered only to qualified institutional buyers under Rule 144A under the Securities Act and outside the United States in compliance with Regulation S under the Securities Act.

The terms of the Notes are governed by the Indenture, which contains covenants that, among other things, limit Transocean Inc.’s ability to allow its subsidiaries to incur certain additional indebtedness, incur certain liens on its drilling rigs or drillships without equally and ratably securing the Notes, engage in certain sale and lease-back transactions covering any of its drilling rigs or drillships and consolidate, merge or enter into a scheme of arrangement qualifying as an amalgamation. The Indenture also contains customary events of default. Indebtedness under the Notes may be accelerated in certain circumstances upon an event of default as set forth in the Indenture.

The description above does not purport to be complete and is qualified in its entirety by the Indenture which is filed herewith as Exhibit 4.1 to this Current Report on Form 8-K and is incorporated by reference herein.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information described in Item 1.01 is incorporated herein by reference.

Item 8.01Other Events

On January 17, 2020, Transocean provided a notice (the “Notice of Redemption”) to Wells Fargo Bank, National Association, as trustee (the “9.00% Notes Trustee”), of the redemption in full of its outstanding 9.00% Senior Notes due 2023 (the “9.00% Notes”), pursuant to the indenture, dated as of July 21, 2016 (as amended or supplemented from time to time, the “9.00% Notes Indenture”), among Transocean Inc., the guarantors party thereto, and the 9.00% Notes Trustee. The redemption date is February 16, 2020 (the “Redemption Date”). The description of the Notice of Redemption is not complete and is qualified in its entirety by reference to Exhibit 99.1.

This report does not constitute a notice of redemption under the 9.00% Notes Indenture nor an offer to tender for, or purchase, any 9.00% Notes or any other security.

Item 9.01Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

TRANSOCEAN LTD.

|

|

|

|

|

|

|

|

Date: January 17, 2020

|

By:

|

/s/ Daniel Ro-Trock

|

|

|

|

Daniel Ro-Trock

|

|

|

|

Authorized Person

|

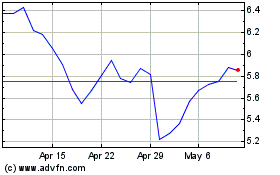

Transocean (NYSE:RIG)

Historical Stock Chart

From Aug 2024 to Sep 2024

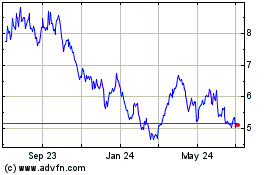

Transocean (NYSE:RIG)

Historical Stock Chart

From Sep 2023 to Sep 2024