Filed Pursuant to Rule 424(b)(5)

Registration No. 333-230476

Prospectus Supplement

(to prospectus dated April 11, 2019)

4,102,565 Shares

Common Stock

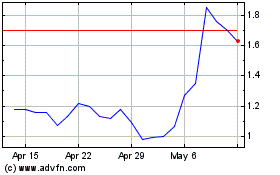

We are offering 4,102,565 shares of our common stock. Our common stock is listed on the Nasdaq Capital Market under the symbol “DZSI.” On May 15, 2019, the last reported sale price of our common stock on the Nasdaq Capital Market was $9.98 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-9 of this prospectus supplement and page 4 of the accompanying prospectus and the documents incorporated by reference herein and therein before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

$

|

9.750

|

|

|

$

|

40,000,008.75

|

|

|

Underwriting discounts and commissions

(1)

|

$

|

0.585

|

|

|

$

|

2,400,000.52

|

|

|

Proceeds to DASAN Zhone Solutions, Inc., before expenses

|

$

|

9.165

|

|

|

$

|

37,600,008.23

|

|

|

|

|

|

|

|

|

|

|

|

(1)

We have agreed to reimburse the underwriters for certain expenses incurred in this offering. See “Underwriting.”

|

|

|

|

|

|

|

|

We have granted the underwriters an option for a period of 30 days to purchase up to an additional 615,384 shares of our common stock on the same terms as set forth above. If the underwriters exercise their option in full, the total public offering price will be $46,000,002.75, underwriting discounts and commissions payable by us will be $2,760,000.16 and the total proceeds to us, before expenses, will be $43,240,002.59.

The underwriters expect to deliver the shares of common stock in book-entry form only, through the facilities of The Depository Trust Company, against payment in immediately available funds to purchasers on or about May 20, 2019.

Joint Book-Running Managers

|

|

|

|

B. Riley FBR

|

Craig-Hallum Capital Group

|

Lead Manager

Northland Capital Markets

Prospectus supplement, dated May 15, 2019

Table of

C

ontents

S-i

About this

P

rospectus

S

upplement

In this prospectus supplement, unless the context otherwise indicates, the terms “DZS,” the “Company,” “we,” “our” and “us” or similar terms refer to DASAN Zhone Solutions, Inc. (formerly known as Zhone Technologies, Inc.), including its consolidated subsidiaries.

This prospectus supplement and the accompanying prospectus dated April 11, 2019 are part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. This prospectus supplement and the accompanying prospectus relate to the offer by us of shares of our common stock to certain investors. We provide information to you about this offering of shares of our common stock in two separate documents that are bound together: (1) this prospectus supplement, which describes the specific details regarding this offering; and (2) the accompanying prospectus, which provides general information, some of which may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus supplement or the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates. You should read this prospectus supplement, the accompanying prospectus, the documents and information incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering when making your investment decision. You should also read and consider the information in the documents we have referred you to under the headings “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

You should rely only on information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. We have not, and the underwriters have not, authorized anyone to provide you with information that is different. We are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus supplement, the accompanying prospectus, the documents and information incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering are accurate only as of their respective dates, regardless of the time of delivery of this prospectus supplement or of any sale of our common stock.

This prospectus supplement and the accompanying prospectus and any free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus supplement and the accompanying prospectus or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus supplement and the accompanying prospectus and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus supplement. Accordingly, investors should not place undue reliance on this information.

We use our registered trademarks in this prospectus. All other trademarks, trade names and service marks appearing in this prospectus or the documents incorporated by reference herein are the property of their respective owners. Use or display by us of other parties’ trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the

®

and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

S-ii

Prospectus

S

upplement

S

umm

ary

This summary provides a brief overview of information contained elsewhere in or incorporated by reference into this prospectus supplement and the accompanying prospectus. Because it is abbreviated, this summary does not contain all of the information that you should consider before investing in our common stock. You should carefully read this entire prospectus supplement, the accompanying prospectus, and any free writing prospectus distributed by us before making an investment decision, including the information presented under the headings “Risk Factors” and “Special Note Regarding Forward-Looking Information” in this prospectus supplement and the financial statements and other information incorporated by reference into this prospectus supplement and the accompanying prospectus.

Company Overview

We are a global provider of ultra-broadband network access solutions and communications platforms deployed by advanced Tier 1, 2 and 3 service providers and enterprise customers. Our solutions are deployed by over 900 customers in more than 80 countries worldwide. According to an Ovum report, in 2018 we were the largest U.S.-based vendor and the second largest Western vendor selling into the global FTTx PON market based on revenues.

Our ultra-broadband solutions are focused on creating significant value for our customers by delivering innovative solutions that empower global communication advancement by shaping the internet connection experience. Every connection matters, and the first connection to the internet and cloud services applications matters the most. Our principal focus is centered around enabling our customers to connect everything and everyone to the internet-cloud economy via ultra-broadband connectivity solutions.

We research, develop, test, sell, manufacture and support platforms in five major areas: broadband access, mobile backhaul, Ethernet switching with Software Defined Networking (“SDN”) capabilities, new enterprise solutions based on Passive Optical LAN (“POL”), and new generation of SDN/ Network Function Virtualization (“NFV”) solutions for unified wired and wireless networks. We have extensive regional development and support centers around the world to support our customer needs. As of March 31, 2019, we employed over 670 personnel worldwide, of which approximately half were engineers or engaged in research and development.

Keymile Acquisition

On January 3, 2019, ZTI Merger Subsidiary III, Inc., a Delaware corporation and our wholly owned subsidiary, acquired all of the outstanding shares of

Keymile GmbH, a limited liability company organized under the laws of Germany (“Keymile”), from Riverside KM Beteiligung GmbH, also a limited liability company organized under the laws of Germany, pursuant to a share purchase agreement. We refer to this transaction as the “Keymile Acquisition.” The aggregate cash purchase price paid for all of the shares of Keymile and certain of its subsidiaries was EUR 10,250,000 (approximately $11.8 million), which was paid with a combination of cash, a loan from DASAN Networks, Inc., and a draw under our former senior secured credit facility with

Wells Fargo Bank, National Association (“Wells Fargo”)

. The net purchase price paid, after giving effect to cash received from the lockbox mechanism under the share purchase agreement, was approximately $9.3 million. Following the closing of the Keymile Acquisition

, Keymile became our indirect wholly owned subsidiary.

Keymile is a leading solution provider and manufacturer of telecommunication systems for broadband access. We b

elieve the

Keymile Acquisition complements and strengthens our portfolio of broadband access solutions, which now includes a series of multi-service access platforms, including ultra-fast broadband copper access based on very-high-bit-rate DSL (“VDSL/Vectoring”) and G. Fast technology.

Industry Background

We believe that expansion in our worldwide business is driven by the increased demand of subscribers and cloud service providers for mobile and fixed network access solutions and communications equipment that enable or support access to higher speed bandwidth access to the internet.

Furthermore, increased competition between service providers for the subscriber business has resulted in significant investment pressure to upgrade network infrastructure to meet the growing bandwidth needs. Broadband access networks must be multiservice in nature and must have an extensive quality of service guarantees in order to support

S-1

5th generation wireless technologies (“5G”)

mobile backhaul, symmetric business services and residential services as well as virtual overlay

networks for alternative operators and wholesale access.

In recent years, the growth of social communications and networking has placed significant demands on legacy access infrastructure, which has been challenging for the industry, even for the newest and most advanced subscribers. Increased subscriber usage of smartphone, video streaming services, PC gaming services and high definition and ultra-high definition televisions has increased the demand for music, pictures, user-generated content (as found on many video-sharing sites) and high definition video, which have all become a growing part of subscribers’ regular exchange of information.

Trends such as SaaS, Cloud, IoT, and 5G have also increased the demand for broadband network access. All of these new technologies share a common dependency on high-bandwidth communication networks and sophisticated traffic management tools. As bandwidth demands continue to increase, carriers need to continue to upgrade their network infrastructure to support such demand. The infrastructure upgrade cycle typically has the effect of moving bandwidth bottlenecks from one part of the network to another (such as a carrier’s access network, core network or data centers), depending on the selection of technology and costs.

It is widely acknowledged in the industry that a fiber-optic broadband access network is the preferred network architecture for a broadband fixed network. The shift away from the legacy copper telephone TDM switches started in the early 2000’s as many carriers decommissioned their legacy telephone switches and moved services over to Voice over Internet Protocol (“VoIP”) platforms. Our broadband access products and solutions are designed to address all these fiber configurations commonly referred to as (FTTx) by allowing carriers and service providers to either use fiber-optic networks or leverage their existing deployed copper networks to offer broadband services to customer premises.

With respect to mobile wireless networks, the popularity of mobile smartphones and increasing demand for mobile data has forced mobile network operators to upgrade their mobile access technologies from 3rd generation wireless to 4th generation wireless (“4G” or “LTE”) and to plan for 5G. These technology upgrades are typically accompanied by network infrastructure upgrades, including upgrades to the carriers’ access networks (referred to as “mobile backhaul”), core networks and data centers. Our mobile backhaul products, which have features for time sensitive networks, provide a robust, manageable and scalable solution for mobile network operators that enable them to upgrade their mobile backhaul systems and migrate to 4G and 5G.

Another growing industry trend is the desire of carriers and service providers to simplify network operation and reduce costs. Increasingly, we see network operators seeking to reduce the number of active components in their networks and to centralize network data and control in data centers, both of which require network redesigns and upgrades. Our FiberLAN portfolio of POL products, as well as our Ethernet switching products and SDN and NFV tools and building blocks, are designed to address these market trends, with POL emerging as a popular customer choice for network upgrades.

Our Solutions and Platforms

Our ultra-broadband network access solutions and communications platforms include products in the following five major areas: broadband access, mobile backhaul, Ethernet switching, enterprise Passive Optical LAN and SDN/NFV solutions.

Broadband Access

Our broadband access products are at the core of our product strategy and offer a variety of options for carriers and service providers to provide broadband connections to residential and business customers. Our solutions allow carriers and service providers to either use high-speed fiber or leverage their existing deployed copper networks to offer broadband services to customer premises. Once our broadband access products are deployed, the service provider can offer voice, high-definition and ultra-high-definition video, high-speed internet access and business class services to their customers. We develop our broadband access products for all aspects of carrier and service provider access networks: customer premise equipment. Products include digital subscriber line (“DSL”) modems, Ethernet access demarcation devices, Gigabit passive optical network (“GPON”) terminals, 10 Gigabit (“10G”) passive optical network units and Gigabit and 10G point-to-point Active Ethernet optical network terminals (“ONTs”). We also develop central office products, such as broadband loop carriers for DSL and voice-grade telephone service, high-speed digital subscriber line access multiplexers with G. Fast and VDSL capabilities, optical line terminals (“OLTs”) for passive optical distribution networks like GPONs, 10G passive optical networks and

S-2

10G point-to-point Active Ethernet.

As a result of

the Keymile Acquisition,

our broadband access products now also include

multi-service access platforms,

such as

ultra-fast broadband copper access based on

V

DSL

and

G. Fast technology

.

Ethernet Switching

Our Ethernet switching products provide a high switching performance and manageable solution that bridges the gap from carrier access technologies to the core network. Over the past ten (10) years carriers have migrated access infrastructure to Ethernet from time-division multiplexing and asynchronous transfer mode systems. Our products can also be deployed in data centers, blurring the line between central office and data center. Our products support pure Ethernet switching as well as layer 3 IP and multiprotocol label switching (“MPLS”) and are currently being developed as part of the new programmable SDNs networks.

Mobile Backhaul

Our mobile backhaul products provide a robust, manageable and scalable solution for mobile operators that enable them to upgrade their mobile backhaul systems and migrate from 5G networks and beyond. We provide our mobile backhaul products to mobile operators or carriers who provide the transport for mobile operators.

Our mobile backhaul products may be collocated at the radio access node base station and can aggregate multiple radio access node base stations into a single backhaul for delivery of mobile traffic to the radio access node network controller. We provide standard Ethernet/IP or MPLS interfaces and interoperate with other vendors in these networks. In recent years, mobile backhaul networks have been providing carriers with significant revenue growth, which has led to mobile backhaul becoming one of the most important parts of their networks.

The successful deployment of 5G wireless networks relies heavily on very-high-capacity fiber-based wired backhaul connections to carry the high volume of data from mobile cell towers to the carrier’s core network. Our mobile backhaul solutions are well positioned to capitalize on 5G deployments around the globe. In September 2018, our wholly owned Korean subsidiary DASAN Network solutions, Inc. was awarded a contract by South Korean Tier 1 service provider LG U+ to deliver switches to be deployed in its 5G wireless network in South Korea, as part of a multi-year 5G backhaul deployment contract.

Enterprise Passive Optical LAN

Our FiberLAN™ portfolio of POL products are designed for enterprise, campus, hospitality and entertainment arena usage. Our portfolio includes high-performance, high-bandwidth switches connected to port extenders, which include units with integrated Power over Ethernet (“PoE”) to power a wide range of PoE-enabled access devices.

Our environmentally friendly FiberLAN POL solutions are one of the most cost-effective LAN technologies that can be deployed, allowing IT network managers to deploy a future-proof, low-maintenance, manageable solution that requires less space, air conditioning, copper and electricity than other alternatives.

The FiberLAN2.0 portfolio is focused on a “plug and play” turnkey architecture for a new generation of distributed enterprise IT infrastructure that allows enterprises to replace legacy copper LAN switching infrastructure with fiber-based solutions. Our products are both highly secure and bandwidth scalable with unified management of wireless and wireline end points/devices from a central network operations center with full visibility and management control of remote sites. Additionally, with SDN upgrades enterprise networks can be software programmed to autonomously monitor, reconfigure, diagnose and authenticate without the need for human intervention.

SDN/NFV Solutions

Our SDN/NFV strategy is to develop tools and building blocks that will allow customers to migrate their networks’ full complement of legacy control plane and data plane devices to a centralized intelligent controller that can reconfigure the services of hundreds of network elements in real time for more controlled and efficient provision of services and bandwidth on a web scale basis. The latest evolution of our hardware-based solution are designed to support SDN/NFV architectures.

The adoption of SDN/NFV is a slow process in the service provider space, but is viewed as providing a better service for subscribers and a more efficient and cost-effective use of hardware resources for service providers. We intend to leverage our broadband access, mobile backhaul and Ethernet switching expertise to extract and virtualize many of the traditional legacy control and data plane functions to allow them to be run from the Cloud.

S-3

Competitive

Str

engths

We believe we differentiate ourselves from our competition and have been able to grow our business through the following demonstrated competitive strengths:

|

|

•

|

Global

Presence

. We have a diversified customer base that includes more than 900 customers in more than 80 countries worldwide. We provide our network access solutions to Tier 1 carriers in the Asia-Pacific region, the Middle East region and Europe, as well as Tier 2 and Tier 3 carriers in North America and Latin America. We leverage our global infrastructure, including sales offices all over the world, leading research and development centers in the United States, Germany, the Republic of Korea (“Korea”), and Vietnam, and manufacturing capabilities in the United States, Germany, Korea, and China, to support our customer base.

|

|

|

•

|

Leading FTTx Ma

rket Position

. We enjoy a strong leadership position in the FTTx network access space. As an industry global leader in FTTx ONT and OLT portfolio options, we shipped more than 2.5 million ONTs in 2018, which we believe positions us as a top two leader, by volume, in the broadband fiber access market, excluding Chinese equipment manufacturers.

In the FTTx OLT category, we offer the industry’s largest portfolio of modular chassis and single platform for deployment in datacenter, central office, extended temperature environments and multi dwelling unit (MDU) scenarios.

|

|

|

•

|

Comprehensive Product Portfolio

. We provide a wide array of reliable, cost-effective networking technologies that include broadband access, Ethernet switching, mobile backhaul, passive optical LAN and software-defined networks. Our Broadband Access solutions allow carriers and service providers to either use high-speed fiber, including 1 gigabyte, 10 gigabyte, and up to 100 gigabyte access speeds, or leverage their existing deployed copper networks to offer broadband services to customer premises. Further, the Keymile Multi-service Access Nodes (MSAN) portfolio complement the DZS existing portfolio by offering leading class point-to-point active FTTx Ethernet and copper based access technology based on VDSL/Vectoring and G. Fast technology as well as VoIP gateway features.

|

|

|

•

|

Manufacturing Agility

. Our manufacturing process uses a strategic combination of procurement from qualified suppliers as well as in-house manufacturing. We manufacture at our manufacturing facilities in Florida, USA and Hannover, Germany, and for certain products, we leverage contract manufacturers and original design manufacturers for primarily high volume, low mix products. Throughout the process we manage the assembly, quality assurance, customer testing, final inspection and shipping of our products with our in-house team of manufacturing and test engineers to assure the reliability and quality of our products.

|

|

|

•

|

Technology Leadership

.

We believe that our future success is built upon our investment in the development of advanced communications technologies. This belief is reflected in our employee base, where more than 50% of our workforce is in research and development. We also benefit from a strong engineering lineage, and we believe we were one of the pioneers of fiber based broadband access technology in the early 2000’s. We intend to continue to focus on research and development to maintain our leadership position in broadband network access solutions and communications equipment. These development efforts include innovating around 5G mobile backhaul technology with our leading Tier 1 carriers, developing a new generation of SDN/NFV solutions for unified wired and wireless networks, delivering a “plug and play” FiberLAN 2.0 solution to enhance usability and drive faster return on investment for our enterprise customers, upgrading our broadband access technology for 10 and 25/100 gigabyte access speeds, introducing our cloud managed Wi-Fi solutions and data analytics offering and exploring distributed ledger and block chain technology for the telecommunications industry.

|

S-4

Recent

D

evelopments

First Quarter 2019 Financial Results and Guidance for Second Quarter and Fiscal Year

For the quarter ended March 31, 2019, we generated net revenues of $74.1 million, a net loss of $1.5 million and Adjusted EBITDA of $1.8 million. For the same period, we reported total operating expenses of $25.7 million and Adjusted Operating Expenses of $23.6 million.

For the quarter ending June 30, 2019, we currently estimate that we will generate net revenues of between $82.5 to $86 million, gross margin of between 32.5% to 33.5%, Adjusted EBITDA of between $2.0 million to $3.0 million and Adjusted Operating Expenses of between $24.5 million to $26.0 million. For the year ending December 31, 2019, we currently estimate that we will generate net revenues of between $350 million to $360 million, gross margin of between 32.5% to 34%, Adjusted EBITDA of between $17 million to $20 million and Adjusted Operating Expenses of between $97 million to $102 million. These estimates are based on information currently available to us only and there can be no assurance that these estimates will be realized. Our actual results for these periods may differ materially from these estimates, and accordingly undue reliance should not be placed on these estimates. See “Risk Factors” and “Special Note Regarding Forward-Looking Information” elsewhere in this prospectus.

The prospective financial information included in the paragraph above has been prepared by, and is the responsibility of, the Company’s management. PricewaterhouseCoopers LLP has not audited, reviewed, examined, compiled nor applied agreed-upon procedures with respect to the accompanying prospective financial information and, accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto. The PricewaterhouseCoopers LLP report incorporated by reference in this prospectus supplement relates to the Company’s previously issued financial statements. It does not extend to this prospective financial information and should not be read to do so.

Adjusted EBITDA and Adjusted Operating Expenses are financial measures that are not calculated in accordance with generally accepted accounting principles in the United States of America (“GAAP”).

We define Adjusted EBITDA as net income (loss) plus (i) interest expense, net, (ii) provision (benefit) for taxes, (iii) depreciation and amortization, (iv) stock-based compensation, and (v) material non-recurring transactions or events, such as merger and acquisition transaction costs or a gain (loss) on sale of assets or impairment of fixed assets. We define

Adjusted Operating Expenses as total operating expenses less depreciation, amortization, share-based compensation expense and acquisition expenses.

We believe that the presentation of Adjusted EBITDA and

Adjusted Operating Expenses

enhances the usefulness of our financial information by presenting measures that management uses internally to monitor and evaluate our operating performance and to evaluate the effectiveness of our business strategies. We believe Adjusted EBITDA and Adjusted Operating Expenses also assist investors and analysts in comparing our performance across reporting periods on a consistent basis because they exclude the impact of items that we do not believe reflect our core operating performance. Adjusted EBITDA and Adjusted Operating Expenses should not be considered in isolation or as a substitute for net income (loss) or total operating expenses or any other performance measures calculated in accordance with GAAP. Management understands the limitations of these non-GAAP measures and compensates for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA and Adjusted Operating Expenses only as supplemental measures.

The tables below set forth reconciliations of net loss to Adjusted EBITDA and total operating expenses to Adjusted Operating Expenses for the quarter ended March 31, 2019:

S-5

|

|

|

Three Months

|

|

|

|

|

Ended

|

|

|

Reconciliation of net loss to Adjusted EBITDA (unaudited, in thousands):

|

|

March 31, 2019

|

|

|

Net loss

|

|

$

|

(1,457

|

)

|

|

Add (less):

|

|

|

|

|

|

Interest expense, net

|

|

|

783

|

|

|

Income tax provision

|

|

|

77

|

|

|

Depreciation and amortization

|

|

|

1,417

|

|

|

Stock-based compensation

|

|

|

825

|

|

|

Acquisition costs

|

|

|

337

|

|

|

Inventory step-up valuation amortization

|

|

|

201

|

|

|

Bargain purchase gain

|

|

|

(334

|

)

|

|

Adjusted EBITDA

|

|

$

|

1,849

|

|

|

|

|

Three Months

|

|

|

|

|

Ended

|

|

|

Reconciliation of total operating expenses to Adjusted Operating Expenses (unaudited, in thousands):

|

|

March 31, 2019

|

|

|

Total operating expenses

|

|

$

|

25,695

|

|

|

Less:

|

|

|

|

|

|

Depreciation and amortization

|

|

|

(900

|

)

|

|

Stock-based compensation

|

|

|

(815

|

)

|

|

Acquisition costs

|

|

|

(337

|

)

|

|

Adjusted Operating Expenses

|

|

$

|

23,643

|

|

No reconciliations of the forecasted ranges for Adjusted EBITDA and Adjusted Operating Expenses for the quarter ending June 30, 2019 or year ending December 31, 2019 are included because we are unable to quantify certain amounts that would be required to be included in the corresponding GAAP measures without unreasonable effort and we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors.

Refinancing of Senior Secured Credit Facilities

DASAN Zhone Solutions, Inc. and its wholly owned subsidiary ZTI Merger Subsidiary III, Inc. (“ZTI”, and together with DZS, the “Borrowers”), and certain direct and indirect subsidiaries of the Borrowers, as guarantors, entered into that certain Revolving Credit, Term Loan, Guaranty and Security Agreement (the “Domestic Credit Agreement”) and that certain Export-Import Revolving Credit, Guaranty and Security Agreement (the “Ex-Im Credit Agreement,” and together with the Domestic Credit Agreement, the “Credit Agreements”), each dated as of February 27, 2019, in each case with PNC Bank, National Association (“PNC”) and Citibank, N.A. as lenders, and PNC as agent for the lenders. We refer to such facilities as the “PNC Facility.”

The Credit Agreements provide for a $25 million term loan and a $15 million revolving line of credit (including subfacilities for Ex-Im transactions, letters of credit and swing loans). The amount we are able to borrow on the revolving line of credit at any time is based on eligible accounts receivable and other conditions, less certain reserves. Borrowings under the PNC Facility bear interest, at our option, at either (i) a base rate equal to the highest of the federal funds rate plus 0.50%, PNC’s prime rate, or the daily LIBOR rate plus 1.00%, or (ii) the LIBOR rate for the applicable interest period, subject to a floor of 1.00% (with respect to the term loans only), plus in each case, an applicable margin. The applicable margin for term loans is 5.00% for base rate loans and 6.00% for LIBOR rate loans, and the applicable margin for borrowings under the revolving line of credit is 1.50% for base rate loans and 2.50% for LIBOR rate loans.

S-6

As of March 31

, 2019,

we

had $25.0 million in outstanding term loan borrowings under

our

PNC Facility, and no outstanding borrowings under the revolving line of credit. The interest rate

applicable to our term loan borrowings under

the PNC Facility was 8.63% at March 31

, 2019.

We used a portion of the funds borrowed from the term loan under the Credit Agreements to (i) repay $5.0 million of existing related party indebtedness with

DASAN Networks, Inc. (“

DNI”) plus accrued interest, (ii) repay a $1.5 million revolving line of credit outstanding balance plus accrued interest and fees and a cash collateralized $3.6 million outstanding letter of credit under our

former senior secured

credit facilities with Wells Fargo, and (iii) repay $5.6 million of short-term debt in Korea and Japan. We will use the remaining funds for ongoing working capital needs. Our obligations under the Credit Agreements are secured by substantially all of the personal property assets of the Borrowers and the subsidiaries that guarantee the Credit Agreements, including their intellectual property. In connection with the entry into the PNC Facility, on February 27, 2019, we also terminated our

former senior secured

credit facilities with Wells Fargo.

The maturity date under the Credit Agreements is February 27, 2022. The term loan under the Credit Agreements is repayable in eight quarterly installments of $625,000 beginning June 30, 2019, followed by quarterly installments of $937,500 beginning on June 30, 2021, with all remaining unpaid principal and accrued interest due on the maturity date.

The Credit Agreements contain certain covenants, limitations, and conditions with respect to the Borrowers and their subsidiaries, including a maximum leverage ratio, a minimum fixed charge coverage ratio, and a minimum liquidity covenant, as well as financial reporting obligations, and usual and customary events of default. If an event of default occurs, the agent and the lenders will be entitled to take various actions, including requiring the immediate repayment of all outstanding amounts under the Credit Agreements, terminating commitments to make additional advances and selling the assets of the Borrowers and their subsidiary guarantors to satisfy the obligations under the Credit Agreements.

Corporate Information

DZS (formerly known as Zhone Technologies, Inc.) was incorporated under the laws of the state of Delaware in June 1999. On September 9, 2016, DZS acquired Dasan Network Solutions, Inc. a California corporation (“DNS”), through the merger of a wholly owned subsidiary of Zhone Technologies, Inc. with and into DNS, with DNS surviving as our wholly owned subsidiary. We refer to this transaction as the “Merger” and, for periods through September 8, 2016, we refer to Zhone Technologies, Inc. as “Legacy Zhone.” At the effective date of the Merger, all issued and outstanding shares of capital stock of DNS held by its sole shareholder, DNI, a company incorporated under the laws of Korea, were canceled and converted into the right to receive shares of our common stock equal to 58% of our issued and outstanding common stock immediately following the Merger. In connection with the Merger, Zhone Technologies, Inc. changed its name to DASAN Zhone Solutions, Inc. The mailing address of our worldwide headquarters is 7195 Oakport Street, Oakland, California 94621, and our telephone number at that location is (510) 777-7000.

Website

Our investor website address is

http://investor-dzsi.com

. The information on, or accessible through, our website is not part of, and is not incorporated into, this prospectus supplement or the accompanying prospectus and should not be considered part of this prospectus supplement or the accompanying prospectus.

S-7

The

O

ffering

|

|

|

|

Issuer

|

DASAN Zhone Solutions, Inc.

|

|

Common Stock Offered by Us

|

4,102,565 shares of common stock (or 4,717,949 shares of common stock if the underwriters exercise their option to purchase additional shares in full)

|

|

Common Stock to Be Outstanding

after this Offering

|

20,699,048 shares of common stock (or 21,314,432 shares if the underwriters exercise their option to purchase additional shares in full)

|

|

Option to Purchase Additional Shares

|

We have granted the underwriters an option to purchase up to an additional 615,384 shares of our common stock. This option is exercisable, in whole or in part, for a period of 30 days from the date of this prospectus supplement.

|

|

Use of Proceeds

|

We intend to use the net proceeds from this offering for general corporate purposes, which may include research and development, the development of our products, sales and marketing initiatives, expansion of our U.S. and global commercial organizations, and general administrative expenses, working capital and capital expenditures. See “Use of Proceeds.”

|

|

Risk Factors

|

You should read the “Risk Factors” section of this prospectus supplement and the accompanying prospectus and in the documents incorporated by reference herein and therein for a discussion of factors to consider before deciding to invest in our common stock.

|

|

Listing

|

Our common stock is listed on the Nasdaq Capital Market under the symbol “DZSI.”

|

The number of shares of common stock to be outstanding after this offering is based on 16,596,483 shares outstanding as of March 31, 2019, and excludes as of that date:

|

|

•

|

1,788,973 shares of common stock issuable upon the exercise of outstanding stock options, at a weighted average exercise price of $8.17 per share;

|

|

|

•

|

21,540 shares of common stock issuable upon the vesting of outstanding restricted stock

units under the DASAN Zhone Solutions, Inc.

2017 Incentive Award Plan (as amended, the “2017 Incentive Award Plan”)

; and

|

|

|

•

|

1,358,358 shares of common stock reserved for future issuance under our 2017 Incentive Award Plan and

the DASAN Zhone Solutions, Inc.

2018 Employee Stock Purchase Plan.

|

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise by the underwriters of their option to purchase up to an additional 615,384 shares of our common stock.

S-8

Risk F

actors

You should consider carefully the risks described below and discussed under the section captioned “Risk Factors” contained in our annual report on Form 10-K for the year ended December 31, 2018 and our quarterly report on Form 10-Q for the quarter ended March 31, 2019, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are incorporated by reference in this prospectus supplement and the accompanying prospectus in their entirety, together with other information in this prospectus supplement, the accompanying prospectus and the information and documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering before you make a decision to invest in our common stock. If any of the following events actually occur, our business, operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of our common stock to decline and you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business operations.

Risks Relating to this Offering

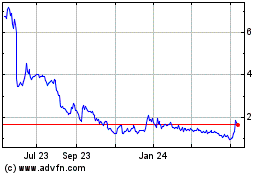

We expect our stock price to be volatile, and you may lose some or all of your investment

.

An active, liquid and o

rderly market for our common stock may not develop or be sustained, which could depress the trading price of our common stock. Moreover, the market price of our common stock has been volatile in the past. For example, since January 1, 2017, the market price for our common stock (as adjusted for the reverse stock split in February 2017) has ranged from $4.32 to $15.59.

Volatility in the market price of our common stock may prevent you from being able to sell your shares at or above the price you paid for your shares or at all. The market price of our common stock could fluctuate significantly for various reasons, which include:

|

|

•

|

commercial acceptance of our products and services;

|

|

|

•

|

fluctuations in demand for network access products;

|

|

|

•

|

fluctuation in gross margin;

|

|

|

•

|

our ability to attract and retain qualified and key personnel;

|

|

|

•

|

the timing and size of orders from customers;

|

|

|

•

|

the ability of our customers to finance their purchase of our products as well as their own operations;

|

|

|

•

|

new product introductions, enhancements or announcements by our competitors;

|

|

|

•

|

our ability to develop, introduce and ship new products and product enhancements that meet customer requirements in a timely manner;

|

|

|

•

|

changes in our pricing policies or the pricing policies of our competitors;

|

|

|

•

|

the ability of our company and our contract manufacturers to attain and maintain production volumes and quality levels for our products;

|

|

|

•

|

our ability to obtain sufficient supplies of sole or limited source components;

|

|

|

•

|

increases in the prices of the components we purchase, or quality problems associated with these components;

|

|

|

•

|

unanticipated changes in regulatory requirements which may require us to redesign portions of our products;

|

|

|

•

|

changes in accounting rules;

|

|

|

•

|

integrating and operating any acquired businesses;

|

|

|

•

|

our ability to achieve targeted cost reductions;

|

|

|

•

|

how well we execute on our strategy and operating plans; and

|

|

|

•

|

general economic conditions as well as those specific to the communications, internet and related industries.

|

In addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies. Broad market and industry factors may seriously affect the market price of our common stock, regardless of actual operating performance. In addition,

S-9

in the past, following periods of volatility in the overall market and the market price of a particular company’s securities, securities class action litigation has of

ten been instituted against these companies. If litigation is instituted against us, it could result in substantial costs and a diversion of our management’s attention and resources.

Between December 2016 and February 2017, the bid price for our common stock traded below the $1.00 minimum per share bid price required for continued inclusion on the Nasdaq Capital Market under Marketplace Rule 5550(a)(2), and we received letters from Nasdaq requiring us to regain compliance within a specified period. A failure to regain compliance could result in our stock being delisted, subject to a right of appeal. On February 28, 2017, we effected a one-for-five reverse stock split of our outstanding shares of common stock. As a result of this, in March 2017, we received written notification from Nasdaq advising us that we had regained compliance with the minimum bid price rule as the closing bid price of our common stock had been $1.00 per share or greater for ten consecutive business days. There can be no assurance that our stock price will remain above the minimum bid price or that we will be able to regain compliance if our stock price falls below the minimum bid price again in the future. In addition, if our average market capitalization falls below the carrying value of our assets for an extended period of time as it has done during recent years, this may indicate that the fair value of our net assets is below their carrying value, and may result in recording impairment charges.

There is a limited public market of our common stock.

There is a limited public market for our common stock. The average daily trading volume in our common stock during the 12 months ended March 31, 2019 was approximately 23,274 shares per day. We cannot provide assurances that a more active trading market will develop or be sustained. As a result of low trading volume in our common stock, the purchase or sale of a relatively small number of shares of our common stock could result in significant price fluctuations and it may be difficult for holders to sell their shares without depressing the market price of our common stock.

Future sales of our common stock could cause the market price for our common stock to decline.

We may in the future sell additional shares of common stock in subsequent public or private offerings. In April 2019, the SEC declared effective a universal shelf registration statement (of which this prospectus supplement forms a part) for the future sale of up to $150 million in aggregate amount of common stock and the resale of up to approximately 9.5 million shares of our common stock held by DNI (as the selling stockholder named therein). The shares may be offered from time to time, separately or together, directly by us or DNI or through underwriters, dealers or agents at amounts, prices, interest rates and other terms to be determined at the time of the offering.

We may also issue additional shares of common stock to finance future acquisitions through the use of equity. For example, we issued approximately 9.5 million shares of our common stock to DNI in connection with the Merger. In addition, a substantial number of shares of our common stock is reserved for issuance upon the exercise of stock options, restricted stock units and other equity awards pursuant to our employee benefit plans.

We cannot predict the size of future issuances of our common stock or the effect, if any, that future sales and issuances of shares of our common stock will have on the market price of our common stock prevailing from time to time. Sales of substantial amounts of shares of our common stock in the public market, or the perception that those sales will occur, could cause the market price of our common stock to decline or be depressed.

The shares of common stock issued in connection with this offering will be freely tradable without restriction or further registration under the Securities Act. In connection with this offering, we, our directors and executive officers and DNI (as our controlling stockholder) have agreed with the underwriters to a “lock-up,” pursuant to which neither we nor they will sell, hedge or otherwise dispose of any shares without the prior written consent of B. Riley FBR, Inc. and Craig-Hallum Capital Group LLC for 90 days after the date of this prospectus supplement, or 180 days in the case of shares held by DNI, subject to certain exceptions. See “Underwriting.” Following the expiration of the applicable lock-up period, all these shares of our common stock will also be eligible for future sale.

In the future, we may also issue our securities if we need to raise capital in connection with a capital expenditure or acquisition. The amount of shares of our common stock issued in connection with a capital expenditure or acquisition could constitute a material portion of our then-outstanding shares of common stock. Any perceived

S-10

excess in the supply of our shares in the market could negatively impact our share price and any issuance of additional securities in connection with investments or acquisitions may result in addit

ional dilution to you.

Our management team may invest or spend the proceeds of this offering in ways with which you may not agree or in ways which may not yield a significant return.

Our management will have broad discretion over the use of proceeds from this offering. We intend to use a portion of the net proceeds from this offering for general corporate purposes. See “Use of Proceeds.” As a result, our management will have considerable discretion in the application of such net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. Such net proceeds may be used for corporate purposes that do not increase our operating results or enhance the value of our common stock.

DNI, the majority owner of our outstanding common stock, controls our ability to obtain financing and other matters requiring stockholder approval, and DNI’s interests may conflict with our interests and the interests of other stockholders.

As of March 31, 2019, DNI owned approximately 57.2% of the outstanding shares of our common stock. Accordingly, as long as DNI and its affiliates hold shares representing a majority of the votes entitled to be cast by the holders of our outstanding common stock at a stockholder meeting, (a) DNI generally will have the ability to control the outcome of any matter submitted for the vote of our stockholders, except in certain circumstances set forth in our certificate of incorporation or bylaws, and (b) DNI will be able to freely nominate and elect all the members of our board of directors, subject only to a requirement that a certain number of directors qualify as “independent directors” under Nasdaq listing rules and applicable laws.

We have elected to be treated as a “controlled company” under Nasdaq Marketplace Rules because more than fifty percent (50%) of the voting power for the election of directors is held by DNI. As a “controlled company,” we may rely on exemptions from certain corporate governance requirements under Nasdaq Marketplace Rules, including the requirement that we have a majority of independent directors on the Board of Directors and requirements with respect to compensation and nominating and corporate governance committees.

The directors elected by DNI have the authority to make decisions affecting our capital structure, including the issuance of additional capital stock or options, the incurrence of additional indebtedness, the implementation of stock repurchase programs, and the declaration of dividends. The interests of DNI may conflict with the interests of our other stockholders or with holders of our indebtedness. As a result of DNI’s controlling vote over matters submitted to our stockholders for approval (subject to any applicable limitations in our certificate of incorporation and bylaws), we may take actions that our stockholders or holders of our indebtedness do not view as beneficial. In addition, the existence of a controlling stockholder may make it more difficult for a third party to acquire us or discourage a third party from seeking to acquire us. A potential third party acquirer would be required to negotiate any such transaction with DNI, and the interests of DNI with respect to such transaction may be different from the interests of our other stockholders or with holders of our indebtedness. In addition, provisions of our certificate of incorporation, bylaws and applicable laws, including Delaware law, could make it more difficult for a third party to acquire us, even if doing so would be beneficial to certain stockholders.

Because we do not expect to pay any dividends on our common stock for the foreseeable future, investors in this offering may never receive a return on their investment.

We do not anticipate that we will pay any cash dividends to holders of our common stock in the foreseeable future. Instead, we plan to retain any earnings to maintain and expand our existing operations. In addition, our ability to pay cash dividends is currently limited by the terms of our senior secured credit facilities, which restrict our ability to declare or pay dividends on our capital stock, and any future financing agreements may restrict or prohibit us from declaring or paying dividends. Accordingly, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any return on their investment. As a result, investors seeking cash dividends should not purchase our common stock.

S-11

Risks Relating to Our Business and Industry

Our level of indebtedness could adversely affect our business, operations, financial condition, and liquidity.

We have a significant amount of indebtedness. As of March 31, 2019, the aggregate principal amount of our outstanding indebtedness was $57.5 million, consisting of $25.0 million in principal amount of term loan borrowings under the PNC Facility, $23.4 million in principal amount of outstanding borrowings under our short-term debt obligations and $9.1 million in long-term related party borrowings. We may incur additional indebtedness in the future, including additional borrowings under the PNC Facility or other future credit facilities with other financial institutions.

Our level of indebtedness could have important consequences and could materially and adversely affect us in a number of ways, including:

|

|

•

|

limiting our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions or general corporate purposes;

|

|

|

•

|

limiting our flexibility to plan for, or react to, changes in our business or market conditions;

|

|

|

•

|

requiring us to use a significant portion of any future cash flow from operations to repay or service the debt, thereby reducing the amount of cash available for other purposes;

|

|

|

•

|

making us more highly leveraged than some of our competitors, which could place us at a competitive disadvantage; and

|

|

|

•

|

making us more vulnerable to the impact of adverse economic and industry conditions and increases in interest rates.

|

The PNC Facility and the instruments governing our other indebtedness contain certain covenants, limitations, and conditions that could restrict our ability to operate our business. The covenants include a maximum leverage ratio, a minimum fixed charge coverage ratio, and a minimum liquidity covenant, as well as financial reporting obligations, and usual and customary events of default. If an event of default occurs under the PNC Facility, the agent and the lenders will be entitled to take various actions, including requiring the immediate repayment of all outstanding amounts, terminating commitments to make additional advances and selling our assets to satisfy the obligations under the outstanding indebtedness.

In the past, we have violated the covenants in our credit facilities and received waivers for these violations. As of December 31, 2017, we were in technical violation of covenants under our former senior secured credit facility with Wells Fargo to pledge the stock of certain foreign subsidiaries and transfer certain funds to Wells Fargo bank accounts. On March 19, 2018, we executed an agreement with Wells Fargo, which cured the breach.

We cannot assure you that we will be able to comply with our financial or other covenants in the future, or that any covenant violations will be waived in the future. Any acceleration of amounts due could have a material adverse effect on our business, operations, financial condition, and liquidity.

We cannot assure you that we will be able to generate cash flow in amounts sufficient to enable us to service our debt or to meet our working capital and capital expenditure requirements. If we are unable to generate sufficient cash flow from operations or to borrow sufficient funds to service our debt, due to borrowing base restrictions or otherwise, we may be required to sell assets, reduce capital expenditures, purchase credit insurance or obtain additional financing. We cannot assure you that we will be able to engage in any of these actions on reasonable terms, if at all.

Our ability to obtain additional capital could require us to reduce our operations and product development and result in harm to our financial condition, our operations, our prospects and our ability to grow and compete effectively.

S-12

We need sufficient capi

tal to fund our ongoing operations. Our ability to meet our obligations will depend on our ability to access funds. We cannot be certain that additional funds will be available to us on favorable terms when required, or at all. If we cannot raise additiona

l funds when we need them, our business, operations, financial condition, and liquidity could be materially and adversely affected.

As of March 31, 2019, we had approximately $20.9 million in cash and cash equivalents and $57.5 million in aggregate principal amount of outstanding indebtedness, as described in the preceding risk factor. Our cash and cash equivalents as of March 31, 2019 included $12.2 million in cash balances held by our international subsidiaries. Our current lack of liquidity could harm us by:

|

|

•

|

increasing our vulnerability to adverse economic conditions in our industry or the economy in general;

|

|

|

•

|

requiring substantial amounts of cash to be used for debt servicing, rather than other purposes, including operations and new product innovation;

|

|

|

•

|

limiting our ability to plan for, or react to, changes in our business and industry; and

|

|

|

•

|

influencing investor and customer perceptions about our financial stability and limiting our ability to obtain financing or acquire customers.

|

Our current lack of liquidity could be further harmed, and we may incur significant losses or expend significant amounts of capital if:

|

|

•

|

the market for our products develops more slowly than anticipated;

|

|

|

•

|

we fail to establish market share or generate revenue at anticipated levels;

|

|

|

•

|

our capital expenditure forecasts change or prove inaccurate; or

|

|

|

•

|

we fail to respond to unforeseen challenges or take advantage of unanticipated opportunities.

|

To meet our liquidity needs and to finance our capital expenditures and working capital needs for our business, we may be required to raise substantial additional capital or reduce our operations. Raising additional capital could require selling assets, issuing debt or equity securities, purchasing credit insurance, borrowing additional capital or other methods. Additional capital, if required, may not be available on acceptable terms, or at all.

If we elect to raise additional capital through the issuance of debt securities or other debt financing, if we are able to incur additional debt at all, the terms of such debt may include unfavorable covenants, restrictions and financial ratios that may restrict our ability to operate our business.

If we elect to raise additional capital through the issuance of equity securities, such as in this offering, such issuance may be dilutive to existing stockholders and could reduce the trading price of our common stock. Volatility in our stock price may make it difficult and costly for us to raise capital through the issuance of common stock, preferred stock or other equity securities.

Our ability to grow our business requires a significant commitment of capital, and we currently lack liquid funds. If we are unable to meet our liquidity needs through obtaining additional capital on acceptable terms or reducing costs, we may become unable to maintain our existing operations, pay ordinary expenses, fund our business expansion or product innovation, pursue future business opportunities, respond to unanticipated capital requirements, or respond to competitive pressures, any of which could have a material adverse effect on our business, operations, financial condition, and liquidity. In addition, we may be required to reduce the scope of our planned product development and sales and marketing efforts beyond the reductions that we have previously taken, and reduce operations in low margin regions, including reductions in headcount, which could have a material adverse effect on our business, operations, financial condition and liquidity.

We have experienced significant losses and we may incur losses in the future. If we fail to generate sufficient revenue to sustain our profitability, our stock price could decline.

S-13

Although we had

net income of

$2.8 million and $1.2 million for the years

ended December 31, 2018 and 2017

, respectively

, we had a net loss of $1.

5

million for the quarter ended March 31, 2019 and have

incurred significant losses in prior years. We have an accumulated deficit of $

17.

4

million as of

March

31, 201

9

. We have signif

icant fixed expenses and expect that we will continue to incur substantial manufacturing, research and product development, sales and marketing, customer support, administrative and other expenses in connection with the ongoing development of our business.

In addition, we may be required to spend more on research and product development than originally budgeted to respond to industry trends. We may also incur significant new costs related to acquisitions and the integration of new technologies and other acq

uisitions that may occur in the future. We may not be able to adequately manage costs and expenses or achieve or maintain adequate operating margins. As a result, our ability to sustain profitability in future periods will depend on our ability to generate

and sustain higher revenue while maintaining reasonable costs and expense levels. If we fail to generate sufficient revenue to sustain profitability in future periods, we may incur operating losses, which could be substantial, and our stock price could de

cline.

In connection with the Keymile Acquisition, we assumed certain of Keymile’s liabilities, which could harm our business, operations, financial condition, and liquidity.

Pursuant to the definitive agreement for the Keymile Acquisition, we assumed certain of Keymile’s liabilities, including tax and pension liabilities, and any liabilities that may arise related to representations and warranties of Keymile in connection with a prior sale of assets with representations and warranties that survive through 2022. Although the definitive agreement for the Keymile Acquisition entitles us to indemnification for losses incurred related to any such claims or liabilities, our right to indemnification may be limited to the purchase price of Keymile, or EUR 10,250,000, and our and third party provided warranty and indemnity liability insurance coverage of up to EUR 35,285,000. If such claims or losses exceed such amount, or if they are not indemnifiable under the Keymile Acquisition definitive agreement, any such losses would negatively impact our financial situation. In addition, our closing of the Keymile Acquisition could give rise to substantial tax liabilities under German law, which could negatively impact our financial condition and liquidity.

We may not realize the anticipated benefits of the Keymile Acquisition if the integration of Keymile is not implemented successfully or cost-effectively.

Our ability to realize the anticipated benefits of the Keymile Acquisition will depend, to a large extent, on our ability to successfully integrate Keymile with our businesses. Integrating and coordinating certain aspects of the operations and personnel of Keymile involves complex operational, technological and personnel-related challenges. Such integration may require a significant amount of management’s time and attention. The potential difficulties, and resulting costs and delays, relating to the integration of Keymile include, among others:

|

|

•

|

the diversion of management’s attention from day-to-day operations;

|

|

|

•

|

the management of an additional subsidiary and business unit;

|

|

|

•

|

the assimilation of Keymile employees and the integration of the two business cultures;

|

|

|

•

|

challenges in attracting and retaining key personnel;

|

|

|

•

|

the need to integrate information, accounting, finance, sales, billing, payroll and regulatory compliance systems;

|

|

|

•

|

challenges in keeping existing customers and obtaining new customers; and

|

|

|

•

|

challenges in combining product offerings and sales and marketing activities.

|

If we are unable to implement and maintain an effective system of internal controls, the existence of one or more internal control deficiencies could result in errors in our financial statements, and substantial costs and resources may be required to rectify internal control deficiencies. If we cannot produce reliable financial reports, investors could lose confidence in our reported financial information, the market price of our stock could decline significantly, we may be unable to obtain additional financing to operate and expand our business, and our business, operations,

S-14

financial condition, and liquidity could be materially harmed. In addition, the integration process may cause an interruption of, or loss of momentum in, the activities of our busin

ess. If our management is not able to effectively manage the integration process, or if any significant business activities are interrupted as a result of the integration process, our business could suffer and its results of operations, financial condition

, and liquidity may be harmed.

Even if Keymile is successfully integrated into our businesses, we may not realize the full benefits of the Keymile Acquisition, including anticipated cost synergies, growth opportunities and other financial and operating benefits, within the expected timeframe or at all. In addition, we expect to incur significant integration and restructuring expenses to realize these synergies. However, many of the expenses that will be incurred are, by their nature, difficult to estimate accurately. These expenses could, particularly in the near term, exceed the savings that we expect to achieve from elimination of duplicative expenses and the realization of economies of scale and cost savings. Although we expect that the realization of efficiencies related to the integration of the businesses may offset incremental transaction, Keymile Acquisition-related and restructuring costs over time, we cannot give any assurance that this net benefit will be achieved in the near term, or at all. Any of these matters could adversely affect our business, operations, financial condition, and liquidity.

Any strategic acquisitions or investments we make could disrupt our operations and harm our business, operations, financial condition, and liquidity.

Integrating acquired organizations and their products and services, including the integration of completed acquisitions, may be expensive, time-consuming and a strain on our resources and our relationships with employees, customers, distributors and suppliers, and ultimately may not be successful. The benefits or synergies we may expect from the acquisition of complementary or supplementary businesses may not be realized to the extent or in the time frame we initially anticipated. Mergers and acquisitions of high-technology companies are inherently risky and subject to many factors outside of our control, and we cannot be certain that our previous or future acquisitions will be successful and will not materially adversely affect our business, operations, financial condition, and liquidity. Any failure to successfully acquire and integrate acquired organizations and their products and services could seriously harm our business, operations, financial condition, and liquidity.

Some of the risks that could affect our ability to successfully integrate acquired businesses, including Keymile’s telecommunication systems business, include those associated with:

|

|

•

|

failure to successfully further develop the acquired products or technology;

|

|

|

•

|

insufficient revenues to offset increased expenses associated with acquisitions and where competitors in such markets have stronger market positions;

|

|

|

•

|

conforming the acquired company’s standards, policies, processes, procedures and controls with our operations;

|

|

|

•

|

difficulties in entering markets in which we have no or limited prior experience;

|

|

|

•

|

difficulties in integrating the operations, technologies, products and personnel of the acquired companies;

|

|

|

•

|

coordinating new product and process development, especially with respect to highly complex technologies;

|

|

|

•

|

potential loss of key employees, customers, distributors, vendors and other business partners of the companies we acquire following and continuing after the announcement of acquisition plans or transactions;

|

|

|

•

|

hiring additional management and other critical personnel;

|

|

|

•

|

in the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political and regulatory risks associated with specific countries;

|

S-15

|

|

•

|

increasing the scope, geographic diversity and complexity of our operations;

|

|

|

•

|

diversion of management’s time and attention away from normal daily operations of the business and the challenges of managing larger and more widespread operations resulting from acquisitions;

|

|

|

•

|

consolidation of facilities, integration of the acquired company’s accounting, human resource and other administrative functions and coordination of product, engineering and sales and marketing functions;

|

|

|

•

|

the geographic distance between the companies;

|

|

|

•

|

failure to comply with covenants related to the acquired business;

|

|

|

•

|

unknown, underestimated, and/or undisclosed liabilities for activities of the acquired company before the acquisition, including patent and trademark infringement claims, violations of laws, employment claims, pension liabilities, commercial disputes, tax liabilities and other known and unknown liabilities; and

|

|

|

•

|

litigation or other claims in connection with the acquired company, including claims for terminated employees, customers, former stockholders or other third parties.

|

In addition, if we do complete future acquisitions, we could:

|

|

•

|

issue stock that could dilute our current stockholders’ percentage ownership;

|

|

|

•

|

consume a substantial portion of our cash resources;

|

|

|

•

|

incur substantial debt;

|

|

|

•

|

increase our ongoing operating expenses and level of fixed costs;

|

|

|

•

|

record goodwill and non-amortizable intangible assets that will be subject to impairment testing and potential periodic impairment charges;

|

|

|

•

|

incur amortization expenses related to certain intangible assets;

|

|

|

•

|

incur large and immediate write-offs; and

|

|

|

•

|

become subject to litigation.

|

We have identified material weaknesses in our internal control over financial reporting, and we cannot provide assurances that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future. If our internal control over financial reporting or our disclosure controls and procedures are not effective, we may not be able to accurately report our financial results, prevent fraud or file our periodic reports in a timely manner, which may cause investors to lose confidence in our reported financial information and which may lead to a decline in our stock price.

We are responsible for establishing and maintaining adequate internal control over financial reporting to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. We assessed the effectiveness of our internal control over financial reporting as of December 31, 2018, the end of our fiscal year. In making this assessment, management used the criteria established in Internal Control - Integrated Framework (2013) issued by the Committee Sponsoring Organizations of the Treadway Commission. Based on our assessment, we have concluded that, as of December 31, 2018, our internal control over financial reporting was not effective because of the unremediated material weaknesses in our internal control over financial reporting described below.

S-16

On February 20, 2017, our Audit Committee concluded, in consultation

with management, and after informing our independent registered public accounting firm, that, due to incorrect application of generally accepted accounting principles that resulted in material misstatements and a restatement of our unaudited condensed cons

olidated financial statements, our previously issued interim unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2016 should no longer be relied upon.

On March 21, 2017, our Audit Committee concluded, in consultation with management and after informing our former independent registered public accounting firm, that Legacy Zhone’s unaudited condensed consolidated financial statements for the quarter ended June 30, 2016 should also no longer be relied upon due to material errors associated with the sale and subsequent return of certain products sold in December 2014.