Equity Commonwealth (NYSE: EQC) today reported financial results

for the quarter ended March 31, 2019. All per share results are

reported on a diluted basis.

Financial results for the quarter ended March 31,

2019

Net income attributable to common shareholders was $208.5

million, or $1.67 per share, for the quarter ended March 31, 2019.

This compares to net income attributable to common shareholders of

$185.6 million, or $1.48 per share, for the quarter ended March 31,

2018. The increase in net income was primarily due to a loss on

asset impairment in the prior period and increases in interest and

other income in the current period.

Funds from Operations, or FFO, as defined by the National

Association of Real Estate Investment Trusts, for the quarter ended

March 31, 2019, were $23.8 million, or $0.19 per share. This

compares to FFO for the quarter ended March 31, 2018 of $6.1

million, or $0.05 per share. The following items impacted FFO for

the quarter ended March 31, 2019, compared to the corresponding

2018 period:

- ($0.08) per share from properties

sold;

- $0.10 per of share of increase in

interest and other income;

- $0.05 per share of interest expense

savings; and

- $0.04 per share decrease in loss on

debt extinguishment.

Normalized FFO was $23.1 million, or $0.19 per share. This

compares to Normalized FFO for the quarter ended March 31, 2018 of

$17.5 million, or $0.14 per share. The following items impacted

Normalized FFO for the quarter ended March 31, 2019, compared to

the corresponding 2018 period:

- ($0.07) per share from properties

sold;

- $0.06 per share of increase in interest

income; and

- $0.05 per share of interest expense

savings.

Normalized FFO begins with FFO and eliminates certain items that

we view as nonrecurring or impacting comparability from period to

period. Definitions of FFO, Normalized FFO and reconciliations to

net income, determined in accordance with U.S. generally accepted

accounting principles, or GAAP, are included at the end of this

press release.

For the quarter ended March 31, 2019, the company’s cash and

cash equivalents balance was $3.1 billion. Total debt outstanding

was $275 million.

The weighted average number of diluted common shares outstanding

when calculating net income per share for the quarter ended March

31, 2019 was 125,822,059 shares, compared to 127,097,324 for the

quarter ended March 31, 2018. The weighted average number of

diluted common shares outstanding when calculating FFO or

Normalized FFO per share for the quarter ended March 31, 2019 was

123,304,504 shares, compared to 124,734,221 for the quarter ended

March 31, 2018.

Same property results for the quarter ended March 31,

2019

The company’s same property portfolio at the end of the quarter

consisted of 9 properties totaling 3.8 million square feet.

Operating results were as follows:

- The same property portfolio was 94.4%

leased as of March 31, 2019, compared to 95.5% as of December 31,

2018, and 92.3% as of March 31, 2018.

- The same property portfolio commenced

occupancy was 93.7% as of March 31, 2019, compared to 93.9% as of

December 31, 2018, and 91.2% as of March 31, 2018.

- Same property NOI increased 7.0% when

compared to the same period in 2018.

- Same property cash NOI increased 9.7%

when compared to the same period in 2018.

- The company entered into leases for

approximately 108,000 square feet, including renewal leases for

approximately 95,000 square feet and new leases for approximately

13,000 square feet.

- GAAP rental rates on new and renewal

leases were 17.9% higher compared to prior GAAP rental rates for

the same space.

- Cash rental rates on new and renewal

leases were 8.0% higher compared to prior cash rental rates for the

same space.

The definitions and reconciliations of same property NOI and

same property cash NOI to net income, determined in accordance with

GAAP, are included at the end of this press release. The same

property portfolio includes properties continuously owned from

January 1, 2018 through March 31, 2019 and excludes properties sold

or classified as held for sale during the period.

Significant events during the quarter ended March 31,

2019

- The company authorized the repurchase

of $150 million of its outstanding common shares, replacing the

expiring authorization.

- The company completed the sale of 1735

Market Street, a 1,287,000 square foot, office building in

Philadelphia, PA, for a gross price of $451.6 million. Proceeds

after credits for capital costs, contractual lease costs, and rent

abatements were approximately $435.4 million.

Subsequent Events

- The company sold 600 108th Avenue NE in

Bellevue, WA, for a gross price of $195 million. The property

includes a 254,510 square foot office building and additional

development rights.

- The company currently has one property

totaling 1.1 million square feet in the sale process.

Earnings Conference Call & Supplemental Data

Equity Commonwealth will host a conference call to discuss first

quarter results on Tuesday, April 30, 2019, at 8:00 A.M. CDT. The

conference call will be available via live audio webcast on the

Investor Relations section of the company’s website

(www.eqcre.com). A replay of the audio webcast will also be

available following the call.

A copy of EQC’s First Quarter 2019 Supplemental Operating and

Financial Data is available on the Investor Relations section of

EQC’s website at www.eqcre.com.

About Equity Commonwealth

Equity Commonwealth (NYSE: EQC) is a Chicago based, internally

managed and self-advised real estate investment trust (REIT) with

commercial office properties in the United States. As of April 29,

2019, EQC’s portfolio comprised 8 properties and 3.6 million square

feet.

Regulation FD Disclosures

We intend to use any of the following to comply with our

disclosure obligations under Regulation FD: press releases, SEC

filings, public conference calls, or our website. We routinely post

important information on our website at www.eqcre.com, including

information that may be deemed to be material. We encourage

investors and others interested in the company to monitor these

distribution channels for material disclosures.

Forward-Looking Statements

Some of the statements contained in this press release

constitute forward-looking statements within the meaning of the

federal securities laws including, but not limited to, statements

pertaining to the marketing of certain properties for sale,

consummating any sales, and future share repurchases. Any

forward-looking statements contained in this press release are

intended to be made pursuant to the safe harbor provisions of

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements relate to expectations, beliefs,

projections, future plans and strategies, anticipated events or

trends and similar expressions concerning matters that are not

historical facts. In some cases, you can identify forward-looking

statements by the use of forward-looking terminology such as “may,”

“will,” “should,” “expects,” “intends,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” or “potential” or the negative

of these words and phrases or similar words or phrases which are

predictions of or indicate future events or trends and which do not

relate solely to historical matters. You can also identify

forward-looking statements by discussions of strategy, plans or

intentions.

The forward-looking statements contained in this press release

reflect the company’s current views about future events and are

subject to numerous known and unknown risks, uncertainties,

assumptions and changes in circumstances that may cause the

company’s actual results to differ significantly from those

expressed in any forward-looking statement. We do not guarantee

that the transactions and events described will happen as described

(or that they will happen at all). We disclaim any obligation to

publicly update or revise any forward-looking statement to reflect

changes in underlying assumptions or factors, of new information,

data or methods, future events or other changes. For a further

discussion of these and other factors that could cause the

company’s future results to differ materially from any

forward-looking statements, see the section entitled “Risk Factors”

in the company’s Annual Report on Form 10-K for the year ended

December 31, 2018.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(amounts in thousands, except share

data)

March 31, 2019

December 31, 2018 ASSETS

Real estate properties: Land $ 110,395 $ 135,142

Buildings and improvements 704,142 1,004,500 814,537

1,139,642 Accumulated depreciation (245,528 ) (375,968 ) 569,009

763,674 Acquired real estate leases, net 183 275 Cash and cash

equivalents 3,069,501 2,400,803 Marketable securities — 249,602

Restricted cash 1,767 3,298 Rents receivable 31,151 51,089 Other

assets, net 42,326 62,031

Total

assets $ 3,713,937 $

3,530,772

LIABILITIES AND EQUITY Senior

unsecured debt, net $ 248,689 $ 248,473 Mortgage notes payable, net

26,288 26,482 Accounts payable, accrued expenses and other 42,280

62,368 Rent collected in advance 5,119 9,451

Total liabilities $ 322,376

$ 346,774 Shareholders'

equity: Preferred shares of beneficial interest, $0.01 par value:

50,000,000 shares authorized; Series D preferred shares; 6 1/2%

cumulative convertible; 4,915,196 shares issued and outstanding,

aggregate liquidation preference of $122,880 $ 119,263 $ 119,263

Common shares of beneficial interest, $0.01 par value: 350,000,000

shares authorized; 121,899,625 and 121,572,155 shares issued and

outstanding, respectively 1,219 1,216 Additional paid in capital

4,304,560 4,305,974 Cumulative net income 3,081,492 2,870,974

Cumulative other comprehensive loss — (342 ) Cumulative common

distributions (3,420,512 ) (3,420,548 ) Cumulative preferred

distributions (695,733 ) (693,736 ) Total shareholders’ equity

3,390,289 3,182,801 Noncontrolling interest 1,272

1,197

Total equity $

3,391,561 $ 3,183,998

Total liabilities and equity $

3,713,937 $ 3,530,772

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(amounts in thousands, except per share

data)

Three Months Ended March 31,

2019 2018 Revenues: Rental revenue $

38,890 $ 55,273 Other revenue 2,862 3,315

Total revenues $ 41,752

$ 58,588 Expenses: Operating

expenses $ 15,780 $ 24,599 Depreciation and amortization 8,585

13,903 General and administrative 12,096 13,339 Loss on asset

impairment — 12,087

Total

expenses $ 36,461 $

63,928 Interest and other income, net 17,775

5,780 Interest expense (including net amortization of debt

discounts, premiums and deferred financing fees of $165 and $801,

respectively) (4,206 ) (10,115 ) Loss on early extinguishment of

debt — (4,867 ) Gain on sale of properties, net 193,037

205,211 Income before income taxes 211,897 190,669 Income

tax expense (1,300 ) (3,007 )

Net income

$ 210,597 $

187,662 Net income attributable to noncontrolling

interest (79 ) (63 )

Net income attributable to

Equity Commonwealth $ 210,518

$ 187,599 Preferred distributions

(1,997 ) (1,997 )

Net income attributable to

Equity Commonwealth common shareholders $

208,521 $ 185,602

Weighted average common shares outstanding — basic (1) 121,960

123,867 Weighted average common shares outstanding —

diluted (1) 125,822 127,097 Earnings per

common share attributable to Equity Commonwealth common

shareholders: Basic $ 1.71 $ 1.50 Diluted $ 1.67

$ 1.48 Certain reclassifications were made to conform

the prior period to our presentation of the condensed consolidated

statements of operations due to the impact of adopting ASU 2016-02.

Amounts that were previously disclosed as "Tenant reimbursements

and other income" are now included in "Rental revenue" and are no

longer presented as a separate line item. Parking revenues that do

not represent components of leases and were previously disclosed as

"Rental income" are now included in "Other revenue." Subsequent to

January 1, 2019, provisions for credit losses are included in

"Rental revenue." Provisions for credit losses prior to January 1,

2019 were disclosed as "Operating expenses" and were not

reclassified to conform prior periods to the current presentation.

(1) Weighted average common shares outstanding for the three

months ended March 31, 2019 and 2018 includes 187 and 307 unvested,

earned RSUs, respectively.

CALCULATION OF FUNDS FROM OPERATIONS

(FFO) AND NORMALIZED FFO

(amounts in thousands, except per share

data)

Three Months Ended March 31,

2019 2018 Calculation of FFO

Net income $ 210,597 $ 187,662

Real estate depreciation and amortization 8,277 13,603 Loss on

asset impairment — 12,087 Gain on sale of properties, net (193,037

) (205,211 ) FFO attributable to Equity Commonwealth 25,837 8,141

Preferred distributions (1,997 ) (1,997 )

FFO

attributable to EQC common shareholders and unitholders

$ 23,840 $ 6,144

Calculation of Normalized

FFO FFO attributable to EQC common

shareholders and unitholders $ 23,840 $ 6,144 Lease value

amortization (39 ) 98 Straight line rent adjustments (837 ) (1,528

) Loss on early extinguishment of debt — 4,867 Loss on sale of

securities — 4,987 Income taxes related to gains on property sales,

net 150 2,969

Normalized FFO

attributable to EQC common shareholders and unitholders

$ 23,114 $ 17,537

Weighted average common shares and units outstanding --

basic (1) 122,006 123,910 Weighted average common

shares and units outstanding -- diluted (1) 123,305 124,734

FFO attributable to EQC common shareholders and

unitholders per share and unit -- basic $ 0.20 $ 0.05

FFO attributable to EQC common shareholders and unitholders per

share and unit -- diluted $ 0.19 $ 0.05 Normalized

FFO attributable to EQC common shareholders and unitholders per

share and unit -- basic $ 0.19 $ 0.14 Normalized FFO

attributable to EQC common shareholders and unitholders per share

and unit -- diluted $ 0.19 $ 0.14 (1)

Our calculations of FFO and Normalized FFO

attributable to EQC common shareholders and unitholders per share and unit - basic

for the three months ended March 31, 2019 and 2018 include 46 and

43 LTIP/Operating Partnership Units, respectively, that are

excluded from the calculation of basic earnings per common share

attributable to EQC common shareholders

(only).

We compute FFO in accordance with standards established by

NAREIT. NAREIT defines FFO as net income (loss), calculated in

accordance with GAAP, excluding real estate depreciation and

amortization, gains (or losses) from sales of depreciable property,

impairment of depreciable real estate, and our portion of these

items related to equity investees and noncontrolling interests. Our

calculation of Normalized FFO differs from NAREIT’s definition of

FFO because we exclude certain items that we view as nonrecurring

or impacting comparability from period to period. FFO and

Normalized FFO are supplemental non-GAAP financial measures. We

consider FFO and Normalized FFO to be appropriate measures of

operating performance for a REIT, along with net income (loss), net

income (loss) attributable to EQC common shareholders, and cash

flow from operating activities.

We believe that FFO and Normalized FFO provide useful

information to investors because by excluding the effects of

certain historical amounts, such as depreciation expense, FFO and

Normalized FFO may facilitate a comparison of our operating

performance between periods and with other REITs. FFO and

Normalized FFO do not represent cash generated by operating

activities in accordance with GAAP and should not be considered as

alternatives to net income (loss), net income (loss) attributable

to EQC common shareholders, or cash flow from operating activities,

determined in accordance with GAAP, or as indicators of our

financial performance or liquidity, nor are these measures

necessarily indicative of sufficient cash flow to fund all of our

needs. These measures should be considered in conjunction with net

income (loss), net income (loss) attributable to EQC common

shareholders, and cash flow from operating activities as presented

in our condensed consolidated statements of operations, condensed

consolidated statements of comprehensive income and condensed

consolidated statements of cash flows. Other REITs and real estate

companies may calculate FFO and Normalized FFO differently than we

do.

CALCULATION OF SAME PROPERTY NET

OPERATING INCOME (NOI) AND SAME PROPERTY CASH BASIS NOI

(amounts in thousands)

For the Three Months Ended 3/31/2019

12/31/2018 9/30/2018

6/30/2018 3/31/2018 Calculation of Same

Property NOI and Same Property Cash Basis NOI:

Rental revenue $ 38,890 $ 39,756 $ 43,770 $ 45,569 $

55,273 Other revenue 2,862 3,169 3,103 3,067 3,315 Operating

expenses (15,780 ) (15,539 ) (20,257 )

(19,521 ) (24,599 )

NOI $ 25,972

$ 27,386 $

26,616 $ 29,115

$ 33,989 Straight line rent adjustments (837 )

(986 ) (1,435 ) (1,022 ) (1,528 ) Lease value amortization (39 )

(22 ) (4 ) (18 ) 98 Lease termination fees —

(19 ) (395 ) (1,557 ) (965 )

Cash Basis

NOI $ 25,096 $

26,359 $ 24,782

$ 26,518 $ 31,594

Cash Basis NOI from non-same properties (1) (3,718 )

(6,240 ) (4,696 ) (6,511 ) (12,101 )

Same

Property Cash Basis NOI $ 21,378

$ 20,119 $ 20,086

$ 20,007 $

19,493 Non-cash rental income and lease termination

fees from same properties (7 ) 45 (22 )

284 483

Same Property NOI

$ 21,371 $ 20,164

$ 20,064 $ 20,291

$ 19,976

Reconciliation of Same Property NOI to GAAP Net Income:

Same Property NOI $ 21,371

$ 20,164 $

20,064 $ 20,291

$ 19,976 Non-cash rental income and lease

termination fees from same properties 7 (45 )

22 (284 ) (483 )

Same Property Cash

Basis NOI $ 21,378 $

20,119 $ 20,086

$ 20,007 $ 19,493

Cash Basis NOI from non-same properties (1) 3,718

6,240 4,696 6,511

12,101

Cash Basis NOI $ 25,096

$ 26,359 $

24,782 $ 26,518

$ 31,594 Straight line rent adjustments 837

986 1,435 1,022 1,528 Lease value amortization 39 22 4 18 (98 )

Lease termination fees — 19 395

1,557 965

NOI

$ 25,972 $ 27,386

$ 26,616 $ 29,115

$ 33,989 Depreciation and

amortization (8,585 ) (10,830 ) (11,287 ) (13,021 ) (13,903 )

General and administrative (12,096 ) (8,973 ) (10,905 ) (11,222 )

(13,339 ) Loss on asset impairment — — — — (12,087 ) Interest and

other income, net 17,775 15,741 12,626 12,668 5,780 Interest

expense (including net amortization of debt discounts, premiums and

deferred financing fees of $165 and $801, respectively) (4,206 )

(5,035 ) (5,085 ) (6,350 ) (10,115 ) Loss on early extinguishment

of debt — (719 ) — (1,536 ) (4,867 ) Gain (loss) on sale of

properties, net 193,037 (1,608 ) 20,877

26,937 205,211

Income before

income taxes $ 211,897

$ 15,962 $ 32,842

$ 36,591 $ 190,669

Income tax (expense) benefit (1,300 ) (540 )

(65 ) 456 (3,007 )

Net income

$ 210,597 $ 15,422

$ 32,777 $

37,047 $ 187,662

Same Property capitalized external legal

costs(2) N/A $ —

$ 9 $ 63

$ 76 (1) Cash Basis NOI

from non-same properties for all periods presented includes the

operations of properties disposed or classified as held for sale

and land parcels. (2) Effective January 1, 2019, with the adoption

of ASU 2016-02, we no longer capitalize external legal costs

incurred when we enter into leases. We did not recast the

comparative prior periods presented for the external legal leasing

costs capitalized in those periods.

NOI is income from our real estate including lease termination

fees received from tenants less our property operating expenses.

NOI excludes amortization of capitalized tenant improvement costs

and leasing commissions and corporate level expenses. Cash Basis

NOI is NOI excluding the effects of straight line rent adjustments,

lease value amortization, and lease termination fees. The

quarter-to-date same property versions of these measures include

the results of properties continuously owned from January 1, 2018

through March 31, 2019. Land parcels and properties classified as

held for sale within our condensed consolidated balance sheets are

excluded from the same property versions of these measures.

We consider these supplemental non-GAAP financial measures to be

appropriate supplemental measures to net income (loss) because they

may help to understand the operations of our properties. We use

these measures internally to evaluate property level performance,

and we believe that they provide useful information to investors

regarding our results of operations because they reflect only those

income and expense items that are incurred at the property level

and may facilitate comparisons of our operating performance between

periods and with other REITs. Cash Basis NOI is among the factors

considered with respect to acquisition, disposition and financing

decisions. These measures do not represent cash generated by

operating activities in accordance with GAAP and should not be

considered as an alternative to net income (loss), net income

(loss) attributable to Equity Commonwealth common shareholders, or

cash flow from operating activities, determined in accordance with

GAAP, or as indicators of our financial performance or liquidity,

nor are these measures necessarily indicative of sufficient cash

flow to fund all of our needs. These measures should be considered

in conjunction with net income (loss), net income (loss)

attributable to EQC common shareholders, and cash flow from

operating activities as presented in our condensed consolidated

statements of operations, condensed consolidated statements of

comprehensive income and condensed consolidated statements of cash

flows. Other REITs and real estate companies may calculate these

measures differently than we do.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190429005683/en/

Sarah Byrnes, Investor Relations(312) 646-2801ir@eqcre.com

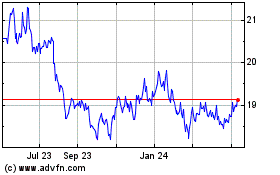

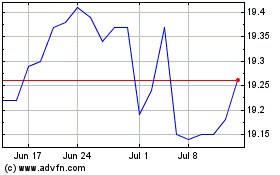

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Sep 2023 to Sep 2024