Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DASAN Zhone Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

22-3509099

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

7195 Oakport Street

Oakland, CA 94621

(510) 777-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael Golomb

Alex Yastremski

7195 Oakport Street

Oakland, CA 94621

(510) 777-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Vanina Guerrero

Louis Lehot

Brad Rock

DLA Piper LLP (US)

2000 University Ave

East Palo Alto, CA 94303

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

☐

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

☐

I

ndicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “sm

aller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

|

|

Accelerated filer

|

|

☐

|

|

Non-accelerated filer

|

|

☒

|

|

|

|

Smaller reporting company

|

|

☒

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of securities to be registered

|

Amount to be Registered

|

Proposed maximum offering price per unit

|

|

Proposed maximum aggregate

offering price

|

|

Amount of

registration fee

|

|

Primary Offering:

|

|

|

|

|

|

|

|

Common stock, par value $0.001 per share

|

(1)

|

|

|

$150,000,000(2)

|

|

$18,180.00(3)

|

|

Secondary Offering:

|

|

|

|

|

|

|

|

Common stock, par value $0.001 per share

|

9,493,015

|

$10.08500(4)

|

|

$95,737,056.28

|

|

$11,603.34

|

|

Total

|

9,493,015

|

|

|

$245,737,056.28

|

|

$29,783.34

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

With respect to the primary offering, the registrant is registering an indeterminate number of shares of common stock as may be issued from time to time at indeterminate prices.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee. With respect to the primary offering, the proposed maximum offering price per share of common stock will be determined from time to time by the registrant pursuant to General Instruction II.D. of Form S-3 under the Securities Act of 1933, as amended (the “Securities Act”) and has been estimated solely for the purpose of calculating the registration fee. The aggregate maximum offering price of all shares of common stock issued pursuant to this registration statement in the primary offering will not exceed $150,000,000.

|

|

(3)

|

With respect to the primary offering, the registration fee has been calculated in accordance with Rule 457(o) under the Securities Act.

|

|

(4)

|

Pursuant to Rule 457(c) under the Securities Act, and solely for the purpose of calculating the registration fee, the proposed maximum offering price per share is the average of the high and low prices reported for the registrant’s common stock quoted on t

he Nasdaq Capital Market on March 15, 2019.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed

. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any st

ate where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 22, 2019

PROSPECTUS

Dasan Zhone Solutions, Inc.

$150,000,000

Common Stock

9,493,015 Shares of Common Stock

Offered by the Selling Stockholder

We may offer and sell from time to time, in one or more issuances and on terms that we will determine at the time of the offering, shares of our common stock, up to an aggregate amount of $150,000,000. In addition, the selling stockholder may from time to time offer and sell up to 9,493,015 shares of our common stock. We will not receive any of the proceeds from the sale of our common stock by the selling stockholder.

This prospectus provides a general description of the securities we or the selling stockholder may offer. We will provide the specific terms of any offering in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. Any prospectus supplement and any related free writing prospectus may add, update or change information contained in this prospectus. You should read carefully this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as the documents incorporated or deemed to be incorporated by reference, before you make an investment decision. This prospectus may not be used to sell securities unless accompanied by a prospectus supplement which will describe the method and terms of the related offering.

We or the selling stockholder may sell the securities to or through one or more underwriters, to other purchasers, through dealers or agents, or through a combination of these methods on an immediate, continuous or delayed basis. The names of any underwriters, dealers or agents involved in the sale of our common stock will be stated in the applicable prospectus supplement.

Our common stock is listed on the Nasdaq Capital Market under the symbol “

DZSI

.” On March 21, 2019, the last reported sale price for our common stock was $12.21 per share.

Investing in our common stock involves significant risks. Before buying our common stock, you should carefully read the discussion of the material risks of investing in our common stock in “

Risk Factors

” beginning on page 4 of this prospectus.

You should rely only on the information contained in this prospectus, any prospectus supplement, any related free writing prospectus or amendment hereto. We have not authorized anyone to provide you with different information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

, 2019

.

TABLE OF CONTENTS

ABOUT THIS P

ROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf registration process, we or the selling stockholder may, at any time and from time to time, sell the shares of common stock as described in this prospectus.

This prospectus provides you with a general description of the securities we or the selling stockholder may offer. Each time we sell, or the selling stockholder sells, securities, we will provide you with a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus may also add to, update or change information contained in this prospectus or in any documents that we have incorporated by reference herein. Accordingly, to the extent inconsistent, the information in this prospectus is superseded by the information in the prospectus supplement or any related free writing prospectus.

The prospectus supplement to be attached to the front of this prospectus may describe, as applicable, the terms of our common stock, the public offering price, the price paid for our common stock, the net proceeds and the other specific terms related to the offering of our common stock.

You should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement

or free writing prospectus relating to a particular offering

. We have not authorized anyone to provide you with any other information. If you receive any other information, you should not rely on it. No offer to sell our common stock contained in this prospectus, any prospectus supplement or any document incorporated by reference in this prospectus or any prospectus supplement, is accurate as of any date other than the date on the front cover of this prospectus or on the front cover of the applicable prospectus supplement or documents or as specifically indicated in the document. Our business, financial condition, results of operations and prospects may have changed since that date.

You should read both this prospectus and any prospectus supplement together with the additional information described under the caption “Where You Can Find Additional Information” in this prospectus.

1

SUMM

ARY

This summary highlights selected information from this prospectus and the documents incorporated herein by reference and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, including the risks of investing in our common stock discussed under “Risk Factors” beginning on page 4 of this prospectus, the information incorporated herein by reference, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part. All references in this prospectus to “we,” “us,” “our,” “DZS,” the “Company” and similar designations refer to DASAN Zhone Solutions, Inc. and its consolidated subsidiaries, unless otherwise indicated or as the context otherwise requires.

Business Overview

DASAN Zhone Solutions, Inc. (“DZS”, formerly known as Zhone Technologies, Inc.) was incorporated under the laws of the state of Delaware in June 1999. On September 9, 2016, DZS acquired Dasan Network Solutions, Inc. a California corporation (“DNS”), through the merger of a wholly owned subsidiary of Zhone Technologies, Inc. with and into DNS, with DNS surviving as our wholly owned subsidiary. We refer to this transaction as the “Merger.” At the effective date of the Merger, all issued and outstanding shares of capital stock of DNS held by its sole shareholder, DASAN Networks, Inc. (“DNI”), a company incorporated under the laws of the Republic of Korea (“Korea”), were canceled and converted into the right to receive shares of our common stock equal to 57.3% of our issued and outstanding common stock immediately following the Merger. In connection with the Merger, Zhone Technologies, Inc. changed its name to DASAN Zhone Solutions, Inc. The mailing address of our worldwide headquarters is 7195 Oakport Street, Oakland, California 94621, and our telephone number at that location is (510) 777-7000.

Company Overview

We are a global provider of ultra-broadband network access solutions and communications platforms deployed by advanced Tier 1, 2 and 3 service providers and enterprise customers. Our solutions are deployed by over 900 customers in more than 80 countries worldwide. Our ultra-broadband solutions are focused on creating significant value for our customers by delivering innovative solutions that empower global communication advancement by shaping the internet connection experience. Every connection matters, and the first connection to the internet and cloud services applications matters the most. Our principal focus is centered around enabling our customers to connect everything and everyone to the internet-cloud economy via ultra-broadband connectivity solutions.

We research, develop, test, sell, manufacture and support platforms in five major areas: broadband access, mobile backhaul, Ethernet switching with Software Defined Networking (“SDN”) capabilities, new enterprise solutions based on Passive Optical LAN (“POL”), and new generation of SDN/ Network Function Virtualization (“NFV”) solutions for unified wired and wireless networks. We have extensive regional development and support centers around the world to support our customer needs.

Keymile Acquisition

On January 3, 2019, ZTI Merger Subsidiary III Inc., a Delaware corporation and our wholly owned subsidiary, acquired all of the outstanding shares of Keymile GmbH, a limited liability company organized under the laws of Germany (“Keymile”), from Riverside KM Beteiligung GmbH, also a limited liability company organized under the laws of Germany, pursuant to a share purchase agreement. We refer to this transaction as the “Keymile Acquisition.” The aggregate cash purchase price paid for all of the shares of Keymile and certain of its subsidiaries was EUR 10,250,000 ($11.8 million), which was paid with a combination of cash, a loan from DNI, and a draw under our bank credit facility. Following the closing of the Keymile Acquisition, Keymile became our indirect wholly owned subsidiary.

2

Keymile is a leading solution provider and manufacturer of telecommunication systems for broadband access. We believe the Keymile Ac

quisition complements and strengthens our portfolio of broadband access solutions, which now includes a series of multi-service access platforms, including ultra-fast broadband copper access based on very-high-bit-rate DSL (“VDSL/Vectoring”) & G. Fast tech

nology.

Broadband Access

Our broadband access products are at the core of our product strategy and offer a variety of options for carriers and service providers to connect residential and business customers. Our solutions allow carriers and service providers to either use high-speed fiber or leverage their existing deployed copper networks to offer broadband services to customer premises. Once our broadband access products are deployed, the service provider can offer voice, high-definition and ultra-high-definition video, high-speed internet access and business class services to their customers. We develop our broadband access products for all aspects of carrier and service provider access networks: customer premise equipment. Products include digital subscriber line (“DSL”) modems, Ethernet access demarcation devices, Gigabit passive optical network (“GPON”) terminals, 10 Gigabit (“10G”) passive optical network (“GPON/GEPON/XGPON1/XGSPON/NGPON2/10GEPON”) units and, Gigabit and 10G point-to-point Active Ethernet optical network terminals (“ONTs”). We also develop central office products, such as broadband loop carriers for DSL and voice-grade telephone service (“POTS”), high-speed digital subscriber line access multiplexers (“DSLAMs”) with G. Fast and VDSL capabilities, optical line terminals (“OLTs”) for passive optical distribution networks like GPONs, 10G passive optical networks and 10G point-to-point Active Ethernet.

Ethernet Switching

Our Ethernet switching products provide a high switching performance and manageable solution that bridges the gap from carrier access technologies to the core network. Over the past ten (10) years carriers have migrated access infrastructure to Ethernet from time-division multiplexing and asynchronous transfer mode systems. Our products can also be deployed in data centers, blurring the line between central office and data center. Our products support pure Ethernet switching as well as layer 3 IP and multiprotocol label switching (“MPLS”) and are currently being developed as part of the new programmable SDNs networks.

Mobile Backhaul

Our mobile backhaul products provide a robust, manageable and scalable solution for mobile operators that enable them to upgrade their mobile backhaul systems and migrate from 5G networks and beyond. We provide our mobile backhaul products to mobile operators or carriers who provide the transport for mobile operators. Our mobile backhaul products may be collocated at the radio access node base station and can aggregate multiple radio access node base stations into a single backhaul for delivery of mobile traffic to the radio access node network controller. We provide standard Ethernet/IP or MPLS interfaces and interoperate with other vendors in these networks. In recent years, mobile backhaul networks have been providing carriers with significant revenue growth, which has led to mobile backhaul becoming one of the most important parts of their networks.

Enterprise Passive Optical LAN

Our FiberLAN

TM

portfolio of POL products are designed for enterprise, campus, hospitality and entertainment arena usage. Our portfolio includes high-performance, high-bandwidth switches connected to port extenders, which include units with integrated Power over Ethernet (

“

PoE

”

) to power a wide range of PoE-enabled access devices.

Our environmentally friendly FiberLAN POL solutions are one of the most cost-effective LAN technologies that can be deployed, allowing IT network managers to deploy a future-proof, low-maintenance, manageable solution that requires less space, air conditioning, copper and electricity than other alternatives.

3

The FiberLAN

™

2.0 portfolio is focused on a

“

plug and play

”

architecture for a new generation of distributed enterprise IT infrastructure that is both highly secure and bandwidth

scalable with unified management of wireless and wireline end points/devices from a central network operations center with full visibility and management control of remote sites. Additionally, with SDN upgrades enterprise networks can be software programm

ed to autonomously monitor, reconfigure, diagnose and authenticate without the need for human intervention.

Software Defined Networks

Our SDN/NFV strategy is to develop tools and building blocks that will allow customers to migrate their networks

’

full complement of legacy control plane and data plane devices to a centralized intelligent controller that can reconfigure the services of hundreds of network elements in real time for more controlled and efficient provision of services and bandwidth on a web scale basis. The latest evolution of our hardware-based solution are designed to support SDN/NFV architectures.

The adoption of SDN/NFV is a slow process in the service provider space, but is viewed as providing a better service for subscribers and a more efficient and cost-effective use of hardware resources for service providers. We will leverage our broadband access, mobile backhaul and Ethernet switching expertise to extract and virtualize many of the traditional legacy control and data plane functions to allow them to be run from the Cloud.

Website and Available Information

Our investor website address is

http://investor-dzsi.com

. The information on our website does not constitute part of this Registration Statement on Form S-3, or any other report, schedule or document we file or furnish to the SEC. On the

“

Investor Relations

”

section of our website at

http://investor-dzsi.com

, we make available the following filings available free of charge as soon as reasonably practicable after they are electronically filed with or furnished to the SEC: our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act.

RI

SK FACTORS

Investment in our common stock involves risks. Prior to making a decision about investing in our common stock, you should consider carefully all of the information included and incorporated by reference or deemed to be incorporated by reference in this prospectus or the applicable prospectus supplement, including the risk factors incorporated by reference herein from our Annual Report on Form 10-K for the year ended December 31, 2018, as updated by our subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports and documents we file with the Securities and Exchange Commission, or the SEC, after the date of this prospectus and that are incorporated by reference herein or in the applicable prospectus supplement. Each of these risk factors could have a material adverse effect on our business, results of operations, financial position or cash flows, which may result in the loss of all or part of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This prospectus, any prospectus supplement and the documents incorporated herein and therein by reference contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on our management’s current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to us. Discussions containing these forward-looking statements may be found, among other places, in the Sections entitled “Business Overview,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference from our most recent Annual Report on Form 10-K and in our subsequent Quarterly Reports on Form 10-Q, as well as any amendments thereto, filed with the SEC. This prospectus, any prospectus supplement and the documents incorporated by reference herein and therein also contain estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

4

All statements, other than statements of historical fact, included or incorporated herein regarding our strategy, future

operations, financial position, future revenues, projected costs, plans, prospects and objectives are forward-looking statements. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,”

“forecast,” “project,”

“think,” “may,”

“could,” “will,” “would,” “should,” “continue,” “potential,” “likely,” “opportunity” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking sta

tements. Additionally, statements concerning future matters such as our expectations of business and market conditions, development and commercialization of new products, enhancements of existing products or technologies, and other statements regarding mat

ters that are not historical are forward-looking statements. Such statements are based on currently available operating, financial and competitive information and are subject to various risks, uncertainties and assumptions that could cause actual results t

o differ materially from those anticipated or implied in our forward-looking statements due to a number of factors including, but not limited to, those set forth above under the section entitled “Risk Factors” in this prospectus and any accompanying prospe

ctus supplement. Given these risks, uncertainties and other factors, many of which are beyond our control, you should not place undue reliance on these forward-looking statements.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements to reflect events or developments occurring after the date of this prospectus, even if new information becomes available in the future.

USE OF PROCEEDS

Except as described in any applicable prospectus supplement and in any free writing prospectuses in connection with a specific offering, we currently intend to use the net proceeds from the sale of the securities offered hereby for general corporate purposes, including research and development, license or technology acquisitions, the development of our products, sales and marketing initiatives, expansion of our U.S. and global commercial organizations, and general administrative expenses, working capital and capital expenditures. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business. As a result, unless otherwise indicated in any prospectus supplement, our management will have broad discretion to allocate the net proceeds of the offerings. Pending these ultimate uses, we intend to invest the net proceeds in investment-grade, interest-bearing securities.

All of the shares of common stock offered by the selling stockholder pursuant to this prospectus will be sold by the selling stockholder for its own accounts. We will not receive any of the proceeds from any sale of common stock by the selling stockholder.

SELLING STOCKHOLDER

The following table sets forth information regarding beneficial ownership of our common stock as of February 28, 2019, as adjusted to reflect the securities that may be sold from time to time pursuant to this prospectus, by DASAN Networks Inc. (“DNI” or the “selling stockholder”)

.

The shares of common stock offered hereunder include 9,493,015

shares of common stock held by DNI.

All of the shares of our common stock that are held by DNI were acquired by DNI on September 9, 2016, as part of the Merger transaction in which we acquired DASAN Network Solutions, Inc. a California corporation (“DNS”), as described in the summary under the caption “Business Overview.” At the effective date of the Merger, all issued and outstanding shares of capital stock of DNS held by DNI (which was its sole shareholder) were canceled and converted into the right to receive shares of our common stock equal to 57.3% of our issued and outstanding common stock immediately following the merger.

In connection with the Merger, we entered into a Registration Rights Agreement with DNI, which among other things provides that DNI has the right to require us to register under a shelf registration statement, all of the shares of our common stock DNI obtained as a result of the merger. DNI has requested that all of their shares be registered.

5

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless othe

rwise indicated below, to our knowledge, the

entity

named in the table ha

s

sole voting and sole investment power with respect to all shares that

it

beneficially own

s

.

|

|

|

Shares Beneficially Owned

Prior to the Offering

(1)

|

|

|

Shares

Being

|

|

|

|

|

Shares Beneficially Owned

After the Offering

(3

)

|

|

|

|

|

|

Shares

|

|

|

Percentage

|

|

|

Offered

|

|

|

|

|

Shares

|

|

|

Percentage

|

|

|

|

Selling Stockholder:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DASAN Networks, Inc.

(2)

|

|

|

9,493,015

|

|

|

|

57.2%

|

|

|

|

9,493,015

|

|

|

|

|

|

|

--

|

|

|

|

--%

|

|

|

(1)

|

The percentage of beneficial ownership is calculated based on

16,596,483

shares of our common stock outstanding as of February 28, 2019.

|

|

(2)

|

Consists of

9,493,015

shares of our common stock held by DASAN Networks, Inc. The business address of DASAN Networks, Inc. is

DASAN Tower, 49, Daewangpangyo-ro644Beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, 463-400 Korea.

|

|

(3

)

|

Assumes the sale of all shares of common stock registered pursuant to this prospectus, although, to our knowledge, the selling stockholder is not under any obligation to sell any shares of common stock at this time.

|

PLAN OF DISTRIBUTION

We or the selling stockholder may sell the common stock from time to time pursuant to underwritten public offerings, negotiated transactions, block trades or a combination of these methods. We may sell the securities to or through underwriters or dealers, through agents, or directly to one or more purchasers. We may distribute securities from time to time in one or more transactions:

|

|

▪

|

at a fixed price or prices, which may be changed;

|

|

|

▪

|

at market prices prevailing at the time of sale;

|

|

|

▪

|

at prices related to such prevailing market prices; or

|

We or the selling stockholder may engage in at-the-market offerings into an existing trading market in accordance with Rule 415(a)(4). Any at-the-market offering will be through an underwriter or underwriters acting as principal or agent for us. Such offering may be made into an existing trading market for such securities in transactions at other than a fixed price on or through the Nasdaq Capital Market or any other securities exchange or quotation or trading service on which such securities may be listed, quoted or traded at the time of sale.

Any prospectus supplement or any related free writing prospectus that we may authorize to be provided to you will describe the terms of the offering of the securities, including, to the extent applicable:

|

|

▪

|

the name or names of any underwriters or distributing agents, if any;

|

|

|

▪

|

the purchase price of the securities and the proceeds we will receive from the sale;

|

|

|

▪

|

any over-allotment options under which underwriters may purchase additional securities from us;

|

|

|

▪

|

any agency fees or underwriting discounts and other items constituting agents’ or underwriters’ compensation;

|

|

|

▪

|

any public offering price;

|

|

|

▪

|

any discounts or concessions allowed or reallowed or paid to dealers; and

|

|

|

▪

|

any securities exchange or market on which the securities may be listed.

|

Only underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement.

6

If underwriters are used in the sale, they will acquire the

securities for their own account and may resell the securities from time to time in one or more transactions at a fixed public offering price or at varying prices determined at the time of sale. The obligations of the underwriters to purchase the securiti

es will be subject to the conditions set forth in the applicable underwriting agreement. We may offer the securities to the public through underwriting syndicates represented by managing underwriters or by underwriters without a syndicate. Subject to certa

in conditions, the underwriters will be obligated to purchase all of the securities offered by the prospectus supplement. Any public offering price and any discounts or concessions allowed or reallowed or paid to dealers may change from time to time. We ma

y use underwriters with whom we have a material relationship. We will describe in the prospectus supplement, naming the underwriter, the nature of any such relationship.

We may sell common stock directly or through agents we designate from time to time. We will name any agent involved in the offering and sale of common stock, and we will describe any commissions we will pay the agent in the prospectus supplement. Unless the prospectus supplement states otherwise, our agent will act on a best-efforts basis for the period of its appointment.

We may authorize agents or underwriters to solicit offers by certain types of institutional investors to purchase common stock from us at the public offering price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. We will describe the conditions to these contracts and the commissions we must pay for solicitation of these contracts in the prospectus supplement.

We may provide agents and underwriters with indemnification against civil liabilities related to this offering, including liabilities under the Securities Act, or contribution with respect to payments that the agents or underwriters may make with respect to these liabilities. Agents and underwriters may engage in transactions with, or perform services for, us in the ordinary course of business.

Any underwriter may engage in overallotment, stabilizing transactions, short covering transactions and penalty bids in accordance with Regulation M under the Exchange Act. Overallotment involves sales in excess of the offering size, which create a short position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum. Short covering transactions involve purchases of the common stock in the open market after the distribution is completed to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a dealer when the common stock originally sold by the dealer are purchased in a stabilizing or covering transaction to cover short positions. Those activities may cause the price of the common stock to be higher than it would otherwise be. If commenced, the underwriters may discontinue any of the activities at any time.

Any underwriters who are qualified market makers on the Nasdaq Capital Market may engage in passive market making transactions in the common stock on the Nasdaq Capital Market in accordance with Rule 103 of Regulation M, during the business day prior to the pricing of the offering, before the commencement of offers or sales of the common stock. Passive market makers must comply with applicable volume and price limitations and must be identified as passive market makers. In general, a passive market maker must display its bid at a price not in excess of the highest independent bid for such security; if all independent bids are lowered below the passive market maker’s bid, however, the passive market maker’s bid must then be lowered when certain purchase limits are exceeded. Passive market making may stabilize the market price of the common stock at a level above that which might otherwise prevail in the open market and, if commenced, may be discontinued at any time.

7

DESCRIPTION OF

COMMON

STOCK

TO BE REGISTERED

The following summary of the material terms of our common stock summarizes the material terms, is not complete, and is subject to, and qualified in its entirety by reference to, the terms and provisions of our restated certificate of incorporation and our amended and restated bylaws. For the complete terms of our common stock, please refer to our restated certificate of incorporation and our amended and restated bylaws, each as may be amended from time to time.

General

We have authorized 61,000,000 shares of capital stock, par value $0.001 per share, of which 36,000,000 are shares of common stock and 25,000,000 are shares of preferred stock. As of March 6, 2019, there were 16,596,483 shares of common stock issued and outstanding and no shares of preferred stock issued and outstanding. The rights, preferences and privileges of holders of common stock are subject to the rights of the holders of any series of preferred stock which we may designate and issue in the future. Our common stock is listed on NASDAQ under the symbol “DZSI”.

Dividends

We have never paid or declared any cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of the Board of Directors, subject to any applicable restrictions under our debt and credit agreements, and will be dependent upon our financial condition, results of operations, capital requirements, general business condition and such other factors as the Board of Directors may deem relevant.

Voting Rights

Except as otherwise required by law or by our restated certificate of incorporation, each holder of common stock is entitled to cast one vote for each share of common stock standing in such holder’s name on the stock transfer records of the Company.

Liquidation and Distribution

Upon the liquidation, dissolution or winding up of the Company, the holders of common stock are entitled to ratably receive our net assets remaining for distribution after the payment of all debts and other liabilities and subject to the prior rights of any outstanding preferred stock.

The terms of the offering price and the net proceeds to us will be contained in the applicable prospectus supplement, and other offering material, relating to such offer.

Transfer Agent and Registrar

Our transfer agent and registrar for our capital stock is Computershare Trust Company, N.A. The transfer agent

’

s address is P.O. Box 505000, Louisville, KY 40233, and its telephone number is (800) 942-5909.

LEGAL MATTERS

The validity of the shares of common stock offered through this prospectus has been passed on by DLA Piper LLP (US), East Palo Alto, California.

8

EXPE

RTS

The financial statements of DASAN Zhone Solutions, Inc. incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2018 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

The audited historical financial statements of Keymile GmbH included in Exhibit 99.3 of DASAN Zhone Solutions, Inc.’s Current Report on Form 8-K/A (filed on March 18, 2019) have been so incorporated in reliance on the report (which contains a qualified opinion relating to the consolidated financial statements not including comparative figures or required transition disclosures as required by IFRS 1, “First-time adoption of International Financial Reporting Standards,” as discussed in Note 1 to the consolidated financial statements) of PricewaterhouseCoopers GmbH, independent auditors, given on the authority of said firm as experts in auditing and accounting. PricewaterhouseCoopers GmbH Wirtschaftsprüfungsgesellschat is a member of the Chamber of Public Accountants (Wirtschaftsprüferkammer), Berlin, Germany.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We have filed a registration statement on Form S-3 under the Securities Act with the SEC with respect to the shares of our common stock offered by this prospectus. This prospectus was filed as a part of that registration statement but does not contain all of the information contained in the registration statement and exhibits. Reference is thus made to the omitted information. Statements made in this prospectus are summaries of the material terms of contracts, agreements and documents and are not necessarily complete; however, all information we considered material has been disclosed. Reference is made to each exhibit for a more complete description of the matters involved and these statements are qualified in their entirety by the reference. You may inspect the registration statement, exhibits and schedules filed with the SEC at the SEC’s principal office in Washington, D.C. Copies of all or any part of the registration statement may be obtained from the Public Reference Section of the SEC, 100 F. Street, N.E., Washington, D.C. 20549. The SEC also maintains a website (http://www.sec.gov) that contains this filed registration statement, reports, proxy statements and information regarding us that we have filed electronically with the Commission. For more information pertaining to our company and the common stock offered in this prospectus, reference is made to the registration statement.

Upon the effective date of this Registration Statement and thereafter, we will file with the SEC annual and quarterly periodic reports on Forms 10-K and 10-Q, respectively, current reports on Form 8-K, as well as proxy statements on Schedule DEF 14A, as needed. We are not required to deliver annual reports to our stockholders and at this time we do not intend to do so. We encourage our stockholders, however, to access and review all materials that we will file with the SEC at http://www.sec.gov. Our SEC file number is 000-32743.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information about us by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus. This prospectus incorporates by reference the documents and reports listed below (other than portions of these documents deemed to have been furnished and not filed in accordance with SEC rules):

|

|

•

|

Our Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on March 12

,

2019 (File No. 000-32743);

|

Our Current Reports on Form 8-K filed with the SEC on

January 3, 2019 (and the related Form 8-K/A filed on March 18, 2019), February 28, 2019 and February 28, 2019

(each with File No. 000-32743); and

|

|

•

|

The description of our common stock contained in our Registration Statement on Form 8-A, filed with the SEC on May 11, 2001 (File No. 000-32743), including any amendment or report filed for the purpose of updating such description.

|

9

We also incorporate by reference the information contained in all other documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d)

of the Exchange Act (other than documents or portions of these documents that are deemed to have been furnished and not filed in accordance with SEC rules, unless otherwise indicated therein) after the date of the initial registration statement of which t

his prospectus forms a part and prior to the effectiveness of such registration statement, and after the date of this prospectus and prior to the termination of this offering. The information contained in any such document will be considered part of this p

rospectus from the date the document is filed with the SEC.

Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

On the “Investor Relations” section of our website at http://investor-dzsi.com, we make available our public filings available free of charge as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. We will provide you, without charge, a copy of any or all of the information incorporated by reference into this prospectus, if requested in writing or by telephone, any such request should be directed to:

DASAN Zhone Solutions, Inc.

7195 Oakport Street

Oakland, California 94621

Attention: Pei Hung

(510) 7777000

Transfer Agent and Registrar

The Transfer Agent and Registrar for our common stock is Computershare Trust Company, N.A., whose address is Computershare, P.O. Box 505000, Louisville, KY 40233.

Listing

Our common stock is listed on NASDAQ under the symbol “DZSI”.

10

PROSPECTUS

Dasan Zhone Solutions, Inc.

$150,000,000

Common Stock

9,493,015 Shares of Common Stock

Offered by the Selling Stockholder

, 2019

11

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth all costs and expenses, other than underwriter discounts, payable in connection with the sale of the shares of common stock to be registered. All amounts shown are estimates.

|

|

|

|

|

|

|

Item

|

|

|

Amount

|

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

29,783.34

|

|

|

Accountants’ fees and expenses

|

|

$

|

*

|

|

|

Legal fees and expenses

|

|

$

|

*

|

|

|

Printing expenses

|

|

$

|

*

|

|

|

Miscellaneous expenses

|

|

$

|

*

|

|

|

Total

|

|

$

|

*

|

|

|

*

|

These fees and expenses depend on the shares of common stock offered and the number of issuances, and accordingly cannot be estimated at this time.

|

Item 15. Indemnification of Officers and Directors

Section 145 of the DGCL provides that a corporation may indemnify directors and officers as well as other employees and individuals against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with any threatened, pending or completed actions, suits or proceedings in which such person is made a party by reason of such person being or having been a director, officer, employee or agent to the corporation. The DGCL provides that Section 145 is not exclusive of other rights to which those seeking indemnification may be entitled under any bylaw, agreement, vote of stockholders or disinterested directors or otherwise.

Section 102(b)(7) of the DGCL permits a corporation to provide in its certificate of incorporation that a director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability for any breach of the director’s duty of loyalty to the corporation or its stockholders, for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, for unlawful payments of dividends or unlawful stock repurchases, redemptions or other distributions, or for any transaction from which the director derived an improper personal benefit.

Our restated certificate of incorporation include provisions to (i) eliminate the personal liability of our directors for monetary damages resulting from breaches of their fiduciary duty and (ii) require the registrant to indemnify its directors and officers to the fullest extent permitted the DGCL. Pursuant to Section 145 of the DGCL, a corporation generally has the power to indemnify its present and former directors, officers, employees and agents against expenses incurred by them in connection with any suit to which they are, or are threatened to be made, a party by reason of their serving in such positions so long as they acted in good faith and in a manner they reasonably believed to be in or not opposed to, the best interests of the corporation and with respect to any criminal action, they had no reasonable cause to believe their conduct was unlawful. We believe that these provisions are necessary to attract and retain qualified persons as directors and officers. These provisions do not eliminate the directors’ duty of care, and, in appropriate circumstances, equitable remedies such as injunctive or other forms of non-monetary relief will remain available under DGCL. In addition, each director will continue to be subject to liability for breach of the director’s duty of loyalty to the registrant, for acts or omissions not in good faith or involving intentional misconduct, for knowing violations of law, for acts or omissions that the director believes to be contrary to the best interests of the registrant or its stockholders, for any transaction from which the director derived an improper personal benefit, for acts or omissions involving a reckless disregard for the director’s duty to the registrant or its stockholders when the director was aware or should have been aware of a risk of serious injury to the registrant or its stockholders, for acts or omissions that constitute an unexcused pattern of inattention that amounts to an abdication of the director’s duty to the registrant or its stockholders, for improper transactions between the director and the registrant and for improper distributions to stockholders and loans to directors and officers. The provision also does not affect a director’s responsibilities under any other law, such as the federal securities law or state or federal environmental laws.

12

The foregoing statements are subject to the detailed provisions of the D

GCL and our

restated certificate of incorporation

.

Item 16. Exhibits and Financial Statement Schedules.

|

(a)

|

Exhibits: The list of Exhibits is set forth on page 15 of this Registration Statement and is incorporated herein by reference.

|

Item 17. Undertakings

The undersigned registrant hereby undertakes:

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

|

(i)

|

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) promulgated under the Securities Act of 1933, if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided, however

, that paragraphs (i), (ii), and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

|

|

(i)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

13

|

|

(ii)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration s

tatement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in th

e registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability pu

rposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the o

ffering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

Provided

,

however

, that no statement made

in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to

a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prio

r to the effective date.

|

|

(5)

|

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this Registration Statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

|

(i)

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

|

|

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

|

|

|

(iv)

|

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

|

(6)

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(7)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

|

14

EXHIB

IT INDEX

|

*

|

To be filed in an exhibit to a Current Report on Form 8-K or on any other proper Form and incorporated by reference, if applicable.

|

15

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned thereunto duly authorized on March 22, 2019.

|

DASAN ZHONE SOLUTIONS, INC.

|

|

|

|

|

By:

|

|

/s/ IL YUNG KIM

|

|

|

|

Il Yung Kim

|

|

|

|

President, Chief Executive Officer and Director

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose individual signature appears below hereby authorizes and appoints

Il Yung Kim

with full power of substitution and resubstitution and full power to act without the other, as his true and lawful attorney-in-fact and agent to act in his name, place and stead and to execute in the name and on behalf of each person, individually and in each capacity stated below, and to file any and all amendments (including post-effective amendments) to this registration statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing, ratifying and confirming all that said attorneys-in-fact and agents or any of them or their or his substitute or substitutes may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ IL YUNG KIM

|

|

President, Chief Executive Officer (Principal Executive Officer), Director

|

|

March 22, 2019

|

|

Il Yung Kim

|

|

|

|

|

|

/s/ MICHAEL GOLOMB

|

|

Chief Financial Officer (Principal Financial and Accounting Officer), Corporate Treasurer, Corporate Secretary

|

|

March 22, 2019

|

|

Michael Golomb

|

|

|

|

|

|

|

|

|

|

|

|

/s/ MIN WOO NAM

|

|

Chairman of the Board of Directors, Director

|

|

March 22, 2019

|

|

Min Woo Nam

|

|

|

|

|

|

|

|

|

|

|

|

/s/ MICHAEL CONNORS

|

|

Director

|

|

March 22, 2019

|

|

Michael Connors

|

|

|

|

|

|

|

|

|

|

|

|

/s/ SEONG GYUN KIM

|

|

Director

|

|

March 22, 2019

|

|

Seong Gyun Kim

|

|

|

|

|

|

|

|

|

|

|

|

/s/ SUNG-BIN PARK

|

|

Director

|

|

March 22, 2019

|

|

Sung-Bin Park

|

|

|

|

|

|

/s/ DAVID SCHOPP

|

|

Director

|

|

March 22, 2019

|

|

David Schopp

|

|

|

|

|

|

|

|

|

|

|

|

/s/ ROLF UNTERBERGER

|

|

Director

|

|

March 22, 2019

|

|

Rolf Unterberger

|

|

|

|

|

16

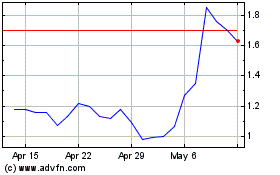

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Aug 2024 to Sep 2024

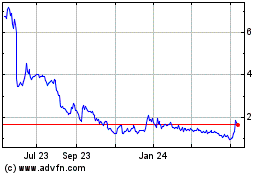

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Sep 2023 to Sep 2024