UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2018

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified

in its charter)

Nuestra Señora de los Ángeles

179

Las Condes, Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GEOPARK LIMITED

TABLE OF CONTENTS

|

ITEM

|

|

|

1.

|

Press Release dated November 27, 2018 titled “GeoPark

Announces an agreement to acquire Colombia and Chile oil and gas assets from LG International”

|

Item 1

FOR IMMEDIATE DISTRIBUTION

GEOPARK ANNOUNCES AN AGREEMENT TO ACQUIRE

COLOMBIA AND CHILE

OIL AND GAS ASSETS FROM LG INTERNATIONAL

Bogota,

Colombia – November 27, 2018 - GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading

independent Latin American oil and gas explorer, operator and consolidator with operations and growth platforms in Colombia, Peru,

Argentina, Brazil and Chile, today announced an agreement to acquire the LG International Corporation (“LGI”) interest

in GeoPark’s Colombian and Chilean operations and subsidiaries.

This

acquisition will increase GeoPark’s equity interest to 100% in its Colombian and Chilean businesses, which consist of multiple

hydrocarbon blocks and associated oil and gas production and reserves, including the Llanos 34 block (GeoPark operated, 45% WI)

in Colombia. This acquisition will also help streamline financial, tax, organizational, and cost structures.

The

acquisition price includes a fixed payment of $81 million payable at closing, plus two equal installments of $15 million each,

to be paid in June 2019 and June 2020, respectively. Additionally, three contingent payments of $5 million each could be payable

over the next three years, subject to certain production thresholds being exceeded. Closing of this transaction is expected by

November 28, 2018.

James

F. Park, Chief Executive Officer of GeoPark, said: “LGI has been an exceptional strategic partner for GeoPark for over eight

years and we are grateful for their support and guidance, which were instrumental in the early development of our regional portfolio

of assets and our tremendous growth in recent years. We have made many good friends in the LG organization and are confident that

our partnership will continue to grow and lead to important new opportunities in the future. We are also pleased to be able to

increase our ownership in our key operating companies, bringing more income to our bottom line.”

For further information

please contact:

INVESTORS:

|

Stacy Steimel – Shareholder Value

Director

Santiago, Chile

T: +562 2242 9600

|

ssteimel@geo-park.com

|

|

|

|

|

Miguel Bello – Market Access Director

Santiago, Chile

T: +562 2242 9600

|

mbello@geo-park.com

|

MEDIA:

|

Jared Levy – Sard Verbinnen &

Co

New York, USA

T: +1 (212) 687-8080

|

jlevy@sardverb.com

|

|

|

|

|

Kelsey Markovich – Sard Verbinnen

& Co

New York, USA

T: +1 (212) 687-8080

|

kmarkovich@sardverb.com

|

GeoPark can be visited online at

www.geo-park.com

NOTICE

Additional information about GeoPark can

be found in the “Investor Support” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain

amounts and percentages included in this press release have been rounded for ease of presentation. Percentage figures included

in this press release have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts

prior to rounding. For this reason, certain percentage amounts in this press release may vary from those obtained by performing

the same calculations using the figures in the financial statements. In addition, certain other amounts that appear in this press

release may not sum due to rounding.

This press release contains certain oil

and gas metrics, including information per share, operating netback, reserve life index, and others, which do not have standardized

meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by other

companies. Such metrics have been included herein to provide readers with additional measures to evaluate the Company's performance;

however, such measures are not reliable indicators of the future performance of the Company and future performance may not compare

to the performance in previous periods.

CAUTIONARY

STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that

constitute forward-looking statements. Many of the forward looking statements contained in this press release can be identified

by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’

‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’

‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in

a number of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations,

regarding various matters, including expected production growth and operating and financial performance, operating netback per

boe and capital expenditures plan. Forward-looking statements are based on management’s beliefs and assumptions, and on information

currently available to the management. Such statements are subject to risks and uncertainties, and actual results may differ materially

from those expressed or implied in the forward-looking statements due to various factors.

Forward-looking statements speak only as

of the date they are made, and the company does not undertake any obligation to update them in light of new information or future

developments or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to

reflect the occurrence of unanticipated events. For a discussion of the risks facing the company which could affect whether these

forward-looking statements are realized, see filings with the U.S. Securities and Exchange Commission.

Oil and gas production figures included

in this release are stated before the effect of royalties paid in kind, consumption and losses. Annual production per day is obtained

by dividing total production for 365 days.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

GeoPark Limited

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Andrés Ocampo

|

|

|

|

|

Name:

|

Andrés Ocampo

|

|

|

|

|

Title:

|

Chief Financial Officer

|

|

Date: November 27, 2018

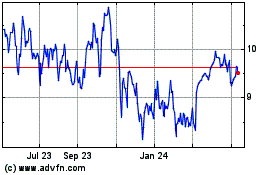

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Aug 2024 to Sep 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Sep 2023 to Sep 2024