By Danielle Chemtob

There's a silver lining when the stock market's most popular

technology stocks stumble: many large-cap mutual funds

outperform.

Those funds have fared better than the S&P 500 on most days

when one or more of the FANG stocks--the collective name for

Facebook Inc., Amazon.com Inc., Netflix Inc. and Google parent

Alphabet Inc.--has declined by 5% or more, according to a Goldman

Sachs analysis.

That's because the average large-cap mutual fund is underweight

three of the four FANG stocks, Goldman says. Those stocks have

propelled much of the U.S. stock market's gains this year, but the

bank's research suggests mutual funds are growing more skeptical of

the crowded trade, as The Wall Street Journal's Markets newsletter

noted Tuesday.

The average large-cap mutual fund holds 1.3% of its portfolio in

Facebook, 0.2 percentage points less than its benchmark; 2% in

Amazon, compared with the benchmark's 2.4%; and 0.3% in Netflix,

versus the benchmark's 0.5%. The funds are overweight only in

Alphabet, by 0.19 percentage points.

Those slim allocations helped shield the funds from the recent

losses suffered by Facebook and Netflix that bled over into the

broader tech sector and S&P 500. Large-cap growth funds have

outperformed the broad stock market index over the past month and

year to date, rising 3.9% and 11% over those periods, according to

Morningstar. That's versus gains of 3.3% and 6.6%, respectively,

for the S&P 500.

Facebook shares slumped 19% on July 26, losing $119.1 billion in

market value, after the social media giant warned of slowing growth

on its earnings call. That followed a 5.2% decline in Netflix

shares on July 17, the day after the streaming video company

reported weaker-than-expected subscriber growth.

Netflix shares have continued slumping, bring their losses for

the past month to 14%, while Facebook has recovered some of its

losses and is down 8.6%.

"There's definitely a feeling that it might be a decent time to

take profits and take some of that trade off the table," said Phil

Bak, chief executive of Exponential ETFs.

Mutual funds, particularly growth-oriented funds, have reduced

their exposure to the FANG stocks in recent years, according to

Goldman. They first dramatically cut their positions in the fourth

quarter of 2016 after Facebook shares lost more than 10% of their

value in the wake of scrutiny following the 2016 election, a period

when the S&P 500 surged. And the funds have generally continued

trimming their holdings since then.

Mark Stoeckle, senior portfolio manager of Adams Diversified

Equity Fund, said his fund cut its holdings in Facebook this spring

shortly before Chief Executive Mark Zuckerburg's testimony before

Congress and the European Union's privacy law went into effect.

"For us, it was managing risk relative to an unknown," he

said.

Brian Milligan, portfolio manager of the Ave Maria Growth Fund,

said his fund has never owned any of the FANG stocks--he says there

are inefficiencies in the business models of Facebook and Netflix

and not enough information about Amazon to properly value the

company.

"If you don't know why you own it from a fundamental standpoint,

how do you know what to do when it starts going down?" he said.

Despite their recent slide, the FANG stocks are still relatively

expensive compared with the S&P 500. The cheapest among the

group are shares of Facebook, which trades at a forward

price-to-earnings ratio of 23.7, versus 16.7 for the S&P 500.

Alphabet trades at 27.3, while Amazon and Netflix are at 85.4 and

94.8, respectively.

"At the type of valuations that the FANG stocks trade at, its

hard to rationalize trading them," said Mark DeVaul, equity

portfolio manager of the Hennessy Equity and Income fund, which

owns shares of Alphabet but none of the other FANG names.

To be sure, the funds that passed on the stocks have missed out

on significant gains. Despite their recent losses, shares of

Netflix have soared 83% in 2018, while Amazon has gained 58% and

Alphabet has risen 17%. Facebook is up a more modest 5.2%.

"If you didn't own some of these stocks last year, it was really

hard to outperform," Mr. Stoeckle said. His fund is still

overweight all of the FANG stocks, except for Netflix.

But as the bull market continues in its ninth year, some fund

managers are wary that slowing growth will leave the big technology

names particularly vulnerable.

"When you get into a market where multiples are starting to

compress, the stocks that led in the past will often become

laggards," Mr. DeVaul said. "At these types of valuations, [FANG

stocks] just don't offer the downside protection you would need in

that type of market."

--To receive our Markets newsletter every morning in your inbox,

click

here

.

(END) Dow Jones Newswires

August 07, 2018 08:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

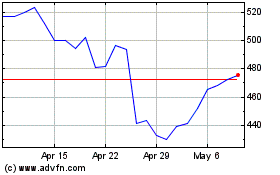

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Aug 2024 to Sep 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Sep 2023 to Sep 2024