Report of Foreign Issuer (6-k)

May 25 2018 - 4:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2018

Commission File Number 001-36906

INTERNATIONAL GAME TECHNOLOGY PLC

(Translation of registrant’s name into English)

66 Seymour Street, Second Floor

London, W1H 5BT

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

Other Events

On May 22, 2018, in connection with the previously announced variable forward transaction (the “Forward Transaction”) entered into by De Agostini S.p.A. (“De Agostini”), the majority shareholder of International Game Technology PLC (“IGT”), relating to 18,000,000 IGT ordinary shares, IGT entered into an underwriting agreement with International Game Technology, a wholly owned subsidiary of IGT, De Agostini, Credit Suisse Securities (USA) LLC (the “Underwriter”) and Credit Suisse International (“CS”) (the “Underwriting Agreement”). Pursuant to the Underwriting Agreement, CS agreed to sell to the Underwriter and the Underwriter agreed to purchase from CS 13,200,000 IGT ordinary shares at a price of $28.25 (gross of a 3% underwriting commission) per ordinary share upon the terms and conditions set forth in the Underwriting Agreement. The IGT ordinary shares were offered and sold in a secondary public offering (the “Offering”) registered under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to IGT’s automatic shelf registration statement on Form F-3 filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 21, 2018, which was effective upon filing (File No. 333-225078) (the “Registration Statement”), and were offered pursuant to a prospectus supplement, dated May 22, 2018, and a base prospectus, dated May 21, 2018 (collectively, the “Prospectus”), filed by IGT with the SEC pursuant to Rule 424(b) under the Securities Act. In addition, CS or its affiliates or agents expects to sell from time to time up to an additional 4,800,000 IGT ordinary shares (the “Additional Shares”) under the Registration Statement. The Additional Shares were not included in the Offering.

IGT is not a party to the Forward Transaction and is not issuing or selling any IGT ordinary shares in connection with the Forward Transaction. As such, IGT will not receive any proceeds from the sale of the IGT ordinary shares in the Forward Transaction.

IGT has made certain customary representations, warranties and covenants in the Underwriting Agreement. International Game Technology has agreed to indemnify the Underwriter and certain of its controlling persons against certain liabilities, including liabilities under the Securities Act.

The foregoing description of the Underwriting Agreement is qualified in its entirety by reference to the full text of the Underwriting Agreement, a copy of which is attached hereto as Exhibit 1.1 and is incorporated herein by reference.

The information contained in this Form 6-K is incorporated by reference into the Registration Statement and the Prospectus.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated as of May 22, 2018, by and among International Game Technology PLC, International Game Technology, De Agostini S.p.A., Credit Suisse Securities (USA) LLC and Credit Suisse International.

|

2

EXHIBIT INDEX

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated as of May 22, 2018, by and among International Game Technology PLC, International Game Technology, De Agostini S.p.A., Credit Suisse Securities (USA) LLC and Credit Suisse International.

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: May 25, 2018

|

INTERNATIONAL GAME TECHNOLOGY PLC

|

|

|

|

|

|

By:

|

/s/ Pierfrancesco Boccia

|

|

|

|

Pierfrancesco Boccia

|

|

|

|

Corporate Secretary

|

4

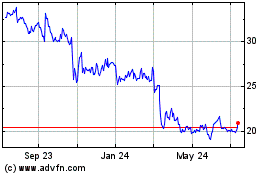

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Aug 2024 to Sep 2024

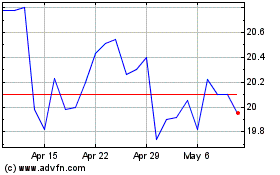

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Sep 2023 to Sep 2024