Sprouts Farmers Market, Inc. (Nasdaq:SFM) today reported results

for the 13-week third quarter ended October 1, 2017.

Third Quarter Highlights:

- Net sales of $1.2 billion; a 16% increase from the same period

in 2016

- Comparable store sales growth of 4.6% and two-year comparable

store sales growth of 5.9%

- Net income of $31 million; a 32% increase from the same period

in 2016

- Diluted earnings per share of $0.23; a 44% increase from the

same period in 2016

- Increased full-year sales, comps and EPS guidance for 2017

“Sprouts is pleased to report strong top-line growth and

demonstrate our ability to leverage those sales into exceptional

earnings growth for the quarter. Sprouts’ hallmark of fresh,

healthy, affordable products continues to resonate with our

customers and positions us as a leader in the industry,” said Amin

Maredia, chief executive officer of Sprouts Farmers Market. “We’ll

continue to accelerate strategic priorities that will enhance our

business – from product assortment to the digital experience to

customer service. These, coupled with our technology investments to

drive efficiencies, will provide the flexibility to make future

investments where needed to ensure Sprouts is well-positioned for

the future.”

Third Quarter 2017 Financial Results

Net sales for the third quarter of 2017 were $1.2 billion, a 16%

increase compared to the same period in 2016. Net sales growth was

driven by a 4.6% increase in comparable store sales and strong

performance in new stores opened.

Gross profit for the quarter increased 19% to $346 million,

resulting in a gross profit margin of 28.7%, an increase of 60

basis points compared to the same period in 2016. This

improvement was primarily driven by cycling a heightened

promotional environment in the third quarter of 2016, in addition

to leverage from increased comparable store sales.

Direct store expense (“DSE”) for the quarter increased 15% to

$250 million, or 20.7% of sales, compared to 20.9% in the same

period in 2016. This leverage is primarily driven by improved

comparable store sales, as well as operating efficiencies,

partially offset by higher benefit costs.

Selling, general and administrative expenses (“SG&A”) for

the quarter increased 35% to $40 million, or 3.3% of sales,

compared to 2.9% in the same period in 2016. This primarily

reflects higher bonus expense due to improved performance and other

corporate costs versus the prior year.

Net income for the quarter was $31 million, a 32% increase

compared to net income for the same period in 2016. Diluted

earnings per share was $0.23, an increase of $0.07 or 44%, as

compared to diluted earnings per share of $0.16 for the same period

in 2016. This increase was driven by higher sales and margins,

fewer shares outstanding due to our repurchase program and a lower

effective tax rate.

Fiscal Year-to-Date Financial Results

For the 39-week period ended October 1, 2017, net sales were

$3.5 billion, a 15% increase compared to the same period in

2016. Growth was driven by a 2.4% increase in comparable

store sales and solid performance in new stores opened. Net

income was $119 million, an 11% increase compared to net income for

the same period in 2016. Diluted earnings per share was $0.86, an

increase of $0.15 or 21%, compared to diluted earnings per share of

$0.71 for the same period in 2016.

Growth and Development

During the third quarter of 2017, we opened 8 new stores: one

each in Arizona and Florida, and two each in California, Nevada and

Tennessee. Three additional stores have been opened in the

fourth quarter to date, resulting in a total of 32 new stores

opened year-to-date for a total of 285 stores in 15 states as of

November 2, 2017.

Leverage and Liquidity

We generated cash from operations of $259 million year-to-date

through October 1, 2017 and invested $151 million in capital

expenditures net of landlord reimbursement, primarily for new

stores. In addition, we repurchased 3.2 million shares of common

stock for a total investment of $72 million during the third

quarter. We ended the quarter with a $349 million balance on our

revolving credit facility, $25 million of letters of credit

outstanding under the facility, $19 million in cash and cash

equivalents, and $138 million available under our current share

repurchase authorization. Year-to-date through October 31,

2017, we have repurchased 9.1 million shares of common stock for a

total investment of $192 million.

2017 Outlook

The following provides information on our guidance for 2017:

| |

Full-Year 2017Current Guidance |

|

|

Full-Year 2017Prior Guidance |

| Net sales growth |

14.5%

to 15% |

|

|

13% to

14% |

| Unit

growth |

32 new

stores |

|

|

32 new

stores |

|

Comparable store sales growth |

2.5%

to 3.0% |

|

|

1.5%

to 2.0% |

| Diluted earnings per

share |

$0.98

to $0.99(1) |

|

|

$0.88

to $0.92 |

| Capital

expenditures |

Approximately $170M |

|

|

$155M

to $165M |

| (net of landlord

reimbursements) |

|

|

|

|

| |

|

|

|

|

|

(1) Guidance includes an estimated effective

tax rate of 32.5% for 2017. The lower effective tax rate is due to

the 2017 change in accounting standards related to the recognition

of excess tax benefits for stock-based compensation and the

associated effect of actual and estimated option exercises for the

year. |

Third Quarter 2017 Conference Call

We will hold a conference call at 7 a.m. Pacific Daylight Time

(10 a.m. Eastern Daylight Time) on Thursday, November 2, 2017,

during which Sprouts executives will further discuss our third

quarter 2017 financial results.

A webcast of the conference call will be available through

Sprouts’ investor webpage located at investors.sprouts.com.

Participants should register on the website approximately 10

minutes prior to the start of the webcast.

The conference call will be available via the following dial- in

numbers:

- U.S. Participants: 877-398-9481

- International Participants: Dial +1-408-337-0130

- Conference ID: 97150787

The audio replay will remain available for 72 hours and can be

accessed by dialing 855-859-2056 (toll-free) or 404-537-3406

(international) and entering the confirmation code: 97150787.

Important Information Regarding Outlook

There is no guarantee that Sprouts will achieve its projected

financial expectations, which are based on management estimates,

currently available information and assumptions that management

believes to be reasonable. These expectations are

inherently subject to significant economic, competitive and other

uncertainties and contingencies, many of which are beyond the

control of management. See “Forward-Looking Statements”

below.

Forward-Looking Statements

Certain statements in this press release are forward-looking as

defined in the Private Securities Litigation Reform Act of 1995.

Any statements contained herein that are not statements of

historical fact (including, but not limited to, statements to the

effect that Sprouts Farmers Market or its management "anticipates,"

"plans," "estimates," "expects," or "believes," or the negative of

these terms and other similar expressions) should be considered

forward-looking statements, including, without limitation,

statements regarding the company’s guidance, outlook and future

investments and positioning. These statements involve certain risks

and uncertainties that may cause actual results to differ

materially from expectations as of the date of this release.

These risks and uncertainties include, without limitation, risks

associated with the company’s ability to successfully compete in

its intensely competitive industry; the company’s ability to

successfully open new stores; the company’s ability to manage its

rapid growth; the company’s ability to maintain or improve its

operating margins; the company’s ability to identify and react to

trends in consumer preferences; product supply disruptions; general

economic conditions; and other factors as set forth from time to

time in the company’s Securities and Exchange Commission filings,

including, without limitation, the company’s Annual Report on Form

10-K. The company intends these forward-looking statements to

speak only as of the time of this release and does not undertake to

update or revise them as more information becomes available, except

as required by law.

Corporate Profile

Sprouts Farmers Market, Inc. specializes in fresh, natural and

organic products at prices that appeal to everyday grocery

shoppers. Based on the belief that healthy food should be

affordable, Sprouts’ welcoming environment and knowledgeable team

members continue to drive its growth. Sprouts offers a complete

shopping experience that includes an array of fresh produce in the

heart of the store, a deli with prepared entrees and side dishes,

The Butcher Shop, The Fish Market, an expansive vitamins and

supplements department and more. Headquartered in Phoenix, Arizona,

Sprouts employs more than 27,000 team members and operates more

than 280 stores in 15 states from coast to coast. For more

information, visit sprouts.com or @sproutsfm on Twitter.

| SPROUTS FARMERS MARKET, INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (UNAUDITED) |

| (IN THOUSANDS, EXCEPT PER SHARE

AMOUNTS) |

| |

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

Thirteen Weeks Ended |

|

Thirty-nine Weeks Ended |

|

Thirty-nine Weeks Ended |

| |

|

October 1, 2017 |

|

October 2, 2016 |

|

October 1,2017 |

|

October 2,2016 |

| |

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

1,206,059 |

|

|

$ |

1,035,801 |

|

|

$ |

3,520,679 |

|

|

$ |

3,060,685 |

|

| Cost of sales, buying

and occupancy |

|

|

859,650 |

|

|

|

744,288 |

|

|

|

2,494,998 |

|

|

|

2,156,857 |

|

| Gross

profit |

|

|

346,409 |

|

|

|

291,513 |

|

|

|

1,025,681 |

|

|

|

903,828 |

|

| Direct store

expenses |

|

|

250,191 |

|

|

|

216,932 |

|

|

|

715,336 |

|

|

|

617,817 |

|

| Selling, general and

administrative expenses |

|

|

39,955 |

|

|

|

29,664 |

|

|

|

110,312 |

|

|

|

91,482 |

|

| Store pre-opening

costs |

|

|

2,456 |

|

|

|

3,446 |

|

|

|

10,055 |

|

|

|

11,625 |

|

| Store closure and other

costs |

|

|

803 |

|

|

|

24 |

|

|

|

992 |

|

|

|

159 |

|

| Income

from operations |

|

|

53,004 |

|

|

|

41,447 |

|

|

|

188,986 |

|

|

|

182,745 |

|

| Interest expense |

|

|

(5,609 |

) |

|

|

(3,723 |

) |

|

|

(15,447 |

) |

|

|

(10,985 |

) |

| Other income |

|

|

162 |

|

|

|

135 |

|

|

|

388 |

|

|

|

326 |

|

| Income

before income taxes |

|

|

47,557 |

|

|

|

37,859 |

|

|

|

173,927 |

|

|

|

172,086 |

|

| Income tax

provision |

|

|

(16,071 |

) |

|

|

(13,974 |

) |

|

|

(55,186 |

) |

|

|

(64,785 |

) |

| Net

income |

|

$ |

31,486 |

|

|

$ |

23,885 |

|

|

$ |

118,741 |

|

|

$ |

107,301 |

|

| Net income per

share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.23 |

|

|

$ |

0.16 |

|

|

$ |

0.87 |

|

|

$ |

0.72 |

|

|

Diluted |

|

$ |

0.23 |

|

|

$ |

0.16 |

|

|

$ |

0.86 |

|

|

$ |

0.71 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

134,320 |

|

|

|

147,743 |

|

|

|

136,063 |

|

|

|

149,202 |

|

|

Diluted |

|

|

136,770 |

|

|

|

150,024 |

|

|

|

138,860 |

|

|

|

151,568 |

|

| SPROUTS FARMERS MARKET, INC. AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (IN THOUSANDS, EXCEPT SHARE AND PER SHARE

AMOUNTS) |

| |

|

|

|

October 1, 2017 |

|

January 1, 2017 |

|

ASSETS |

|

(Unaudited) |

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

18,892 |

|

$ |

12,465 |

| Accounts

receivable, net |

|

|

23,231 |

|

|

25,228 |

|

Inventories |

|

|

222,216 |

|

|

204,464 |

| Prepaid

expenses and other current assets |

|

|

25,594 |

|

|

21,869 |

| Total current

assets |

|

|

289,933 |

|

|

264,026 |

| Property and equipment,

net of accumulated depreciation |

|

|

690,763 |

|

|

604,660 |

| Intangible assets, net

of accumulated amortization |

|

|

196,556 |

|

|

197,608 |

| Goodwill |

|

|

368,078 |

|

|

368,078 |

| Other assets |

|

|

5,886 |

|

|

5,521 |

|

Total assets |

|

$ |

1,551,216 |

|

$ |

1,439,893 |

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

179,482 |

|

$ |

157,550 |

| Accrued

salaries and benefits |

|

|

41,219 |

|

|

32,859 |

| Other

accrued liabilities |

|

|

60,683 |

|

|

56,376 |

| Current

portion of capital and financing lease obligations |

|

|

8,776 |

|

|

12,370 |

| Total current

liabilities |

|

|

290,160 |

|

|

259,155 |

| Long-term capital and

financing lease obligations |

|

|

126,806 |

|

|

117,366 |

| Long-term debt |

|

|

349,000 |

|

|

255,000 |

| Other long-term

liabilities |

|

|

126,127 |

|

|

116,200 |

| Deferred income tax

liability |

|

|

42,508 |

|

|

19,263 |

| Total

liabilities |

|

|

934,601 |

|

|

766,984 |

| Commitments and

contingencies |

|

|

|

|

| Stockholders'

equity: |

|

|

|

|

|

Undesignated preferred stock; $0.001 par value; 10,000,000 shares

authorized, no shares issued and outstanding |

|

|

- |

|

|

- |

| Common

stock, $0.001 par value; 200,000,000 shares authorized, 133,070,570

and 140,256,313 shares issued and outstanding, October 1, 2017 and

January 1, 2017, respectively |

|

|

133 |

|

|

140 |

|

Additional paid-in capital |

|

|

614,232 |

|

|

597,269 |

| Retained

earnings |

|

|

2,250 |

|

|

75,500 |

| Total stockholders'

equity |

|

|

616,615 |

|

|

672,909 |

|

Total liabilities and stockholders' equity |

|

$ |

1,551,216 |

|

$ |

1,439,893 |

| SPROUTS FARMERS MARKET, INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (UNAUDITED) |

| (IN THOUSANDS) |

| |

Thirty-nineWeeks Ended |

|

Thirty-nineWeeks Ended |

| |

October 1, 2017 |

|

October 2, 2016 |

| Cash flows from

operating activities |

|

|

|

| |

$ |

118,741 |

|

|

$ |

107,301 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization expense |

|

70,875 |

|

|

|

59,997 |

|

| Accretion

of asset retirement obligation and closed store reserve |

|

168 |

|

|

|

237 |

|

|

Amortization of financing fees and debt issuance costs |

|

347 |

|

|

|

347 |

|

| Loss on

disposal of property and equipment |

|

820 |

|

|

|

226 |

|

|

Equity-based compensation |

|

10,325 |

|

|

|

10,322 |

|

| Deferred

income taxes |

|

23,245 |

|

|

|

20,119 |

|

| Changes

in operating assets and liabilities: |

|

|

|

| Accounts

receivable |

|

1,660 |

|

|

|

(1,336 |

) |

|

Inventories |

|

(17,752 |

) |

|

|

(29,784 |

) |

| Prepaid

expenses and other current assets |

|

(3,734 |

) |

|

|

(1,212 |

) |

| Other

assets |

|

(702 |

) |

|

|

(1,480 |

) |

| Accounts

payable |

|

31,669 |

|

|

|

24,050 |

|

| Accrued

salaries and benefits |

|

8,360 |

|

|

|

(4,959 |

) |

| Other

accrued liabilities and income taxes payable |

|

4,288 |

|

|

|

(2,762 |

) |

| Other

long-term liabilities |

|

10,659 |

|

|

|

14,971 |

|

| Cash

flows from operating activities |

|

258,969 |

|

|

|

196,037 |

|

| |

|

|

|

| Cash

flows used in investing activities |

|

|

|

| Purchases of property

and equipment |

|

(158,459 |

) |

|

|

(142,571 |

) |

| Proceeds from sale of

property and equipment |

|

30 |

|

|

|

662 |

|

| Purchase of leasehold

interests |

|

- |

|

|

|

(491 |

) |

| Cash

flows used in investing activities |

|

(158,429 |

) |

|

|

(142,400 |

) |

| |

|

|

|

| Cash

flows used in financing activities |

|

|

|

| Proceeds from revolving

credit facility |

|

134,000 |

|

|

|

45,000 |

|

| Payments on revolving

credit facility |

|

(40,000 |

) |

|

|

- |

|

| Payments on capital and

financing lease obligations |

|

(3,053 |

) |

|

|

(3,144 |

) |

| Cash from landlord

related to financing lease obligations |

|

300 |

|

|

|

- |

|

| Repurchase of common

stock |

|

(192,000 |

) |

|

|

(187,836 |

) |

| Proceeds from exercise

of stock options |

|

6,640 |

|

|

|

2,616 |

|

| Excess tax benefit for

exercise of stock options |

|

- |

|

|

|

3,948 |

|

| Cash

flows used in financing activities |

|

(94,113 |

) |

|

|

(139,416 |

) |

| Increase

/ (Decrease) in cash and cash equivalents |

|

6,427 |

|

|

|

(85,779 |

) |

| Cash and cash

equivalents at beginning of the period |

|

12,465 |

|

|

|

136,069 |

|

| Cash and cash

equivalents at the end of the period |

$ |

18,892 |

|

|

$ |

50,290 |

|

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with

accounting principles generally accepted in the United States

(“GAAP”), the company has referenced EBITDA. This measure is not in

accordance with, and is not intended as an alternative to, GAAP.

The company's management believes that this presentation provides

useful information to management, analysts and investors regarding

certain additional financial and business trends relating to its

results of operations and financial condition. In addition,

management uses this measure for reviewing the financial results of

the company and as a component of incentive compensation. The

company defines EBITDA as net income before interest expense,

provision for income tax, and depreciation, amortization and

accretion.

Non-GAAP measures are intended to provide additional information

only and do not have any standard meanings prescribed by GAAP. Use

of these terms may differ from similar measures reported by other

companies. Because of their limitations, non-GAAP measures should

not be considered as a measure of discretionary cash available to

use to reinvest in the growth of the company’s business, or as a

measure of cash that will be available to meet the company’s

obligations. Each non-GAAP measure has its limitations as an

analytical tool, and you should not consider them in isolation or

as a substitute for analysis of the company’s results as reported

under GAAP.

The following table shows a reconciliation of EBITDA to net

income for the thirteen and thirty-nine weeks ended October 1, 2017

and October 2, 2016:

| SPROUTS FARMERS MARKET, INC. AND

SUBSIDIARIES |

| NON-GAAP MEASURE RECONCILIATION |

| (UNAUDITED) |

| (IN THOUSANDS) |

| |

|

|

|

|

|

|

|

|

|

| |

|

ThirteenWeeks Ended |

|

Thirteen Weeks Ended |

|

Thirty-nineWeeks Ended |

|

Thirty-nineWeeks Ended |

|

| |

|

October 1, 2017 |

|

October 2,2016 |

|

October 1,2017 |

|

October 2,2016 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

31,486 |

|

$ |

23,885 |

|

$ |

118,741 |

|

$ |

107,301 |

|

| Income tax

provision |

|

|

16,071 |

|

|

13,974 |

|

|

55,186 |

|

|

64,785 |

|

| Interest expense,

net |

|

|

5,608 |

|

|

3,723 |

|

|

15,447 |

|

|

10,985 |

|

| Earnings before

interest and taxes (EBIT) |

|

|

53,165 |

|

|

41,582 |

|

|

189,374 |

|

|

183,071 |

|

| Depreciation,

amortization and accretion |

|

|

24,808 |

|

|

21,245 |

|

|

71,043 |

|

|

60,234 |

|

| Earnings before

interest, taxes, depreciation and amortization (EBITDA) |

|

$ |

77,973 |

|

$ |

62,827 |

|

$ |

260,417 |

|

$ |

243,305 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investor

Contact: |

Media

Contact: |

|

| Susannah

Livingston |

Donna Egan |

|

| (602) 682-1584 |

(602) 682-3152 |

|

|

susannahlivingston@sprouts.com |

media@sprouts.com |

|

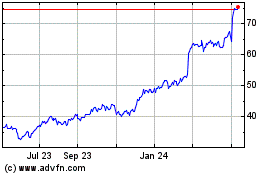

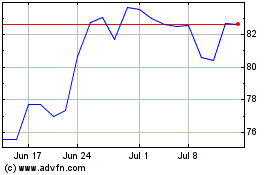

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Sprouts Farmers Market (NASDAQ:SFM)

Historical Stock Chart

From Sep 2023 to Sep 2024