By Zeke Turner

FRANKFURT -- Book publishers are giving an advance review of the

industry's future, and it looks a lot like the past.

After a decade of technological upheaval and lackluster growth,

executives at the top four U.S. consumer book publishers say they

are done relying on newfangled formats to boost growth.

It has been nearly 10 years since Amazon.com Inc. introduced its

Kindle e-book reader amid the financial crisis, destabilizing

publishers and challenging their well-honed business models.

Now, e-book sales are on the decline, making up a fraction of

publishers' revenue, and traditional book sales are rising. The

consumer books industry is enjoying steady growth in the U.S., with

total revenue increasing about 5% from 2013 to 2016, according to

the Association of American Publishers.

Executives gathered in Frankfurt for the industry's biggest

trade fair said they are returning to fundamentals: buying and

printing books that readers want to buy -- and they are

streamlining their businesses to get them out faster than ever

before.

It is about "knowing what [readers] want," said Markus Dohle,

chief executive of Bertelsmann SE and Pearson PLC's joint venture

Penguin Random House, "to drive demand at scale."

The shift is a surprise reversal for an industry that experts

just a decade ago predicted was facing radical change, if not a

slow death, because of digitization and changing reading habits.

Instead, e-book sales in the U.S. were down about 17% last year,

according to the AAP industry group, while printed book revenue

rose 4.5%.

Interviews at the Frankfurt Book Fair with the top four consumer

book publishers in the U.S. -- Penguin Random House, CBS

Corporation's Simon & Schuster Inc., Lagardère SCA's Hachette

Livre and News Corp's HarperCollins Publishers -- showed the decade

of seeking cover from outside threats is over, but the fight to

overcome the lackluster growth it left behind has just begun.

One thing all agree on is the need for speed. Companies are

reinvesting in printed books after years of cost-cutting, and they

are building pipelines to bring author's words into readers' hands

faster.

The effort has been spurred on by the success of books that

resonate with the political moment such as HarperCollins's

"Hillbilly Elegy," by J.D. Vance, about rural American culture and

Penguin Random House's "Devil's Bargain," by Joshua Green, about

former White House chief strategist Steve Bannon.

HarperCollins is printing two million copies of "Hillbilly

Elegy," CEO Brian Murray said, after an initial pre-election print

run of just 15,000 copies. "Everyone on the coasts wanted to know

how Donald Trump got elected...and to understand the view from the

heartland of America," Mr. Murray said. HarperCollins, like The

Wall Street Journal, is owned by News Corp.

Mr. Murray blamed flagging e-book sales on "screen fatigue," and

said HarperCollins was upping investment in printed books, "the

value anchor" for the entire business.

Printed books are "more beautiful now," he said. "You'll see

endpapers [and] a lot more design sensibility going into the print

editions because we recognized that they can't be throwaway."

When Simon & Schuster published the hardback edition of

Hillary Clinton's "What Happened" last month, it sold 167,000

copies in its first week, more than any hardcover nonfiction book

since 2012, according to the company and NPD Bookscan data. CEO

Carolyn Reidy said a million copies would ship by the end of the

year.

And after years "spent taking pennies out of the cost of making

a book," the company is raising the quality of its print editions

again, she said. As examples, the company cited last year's

"Principles," by Bridgewater Associates founder Ray Dalio, and

Walter Isaacson's " Leonardo da Vinci," out in hardcover next

week.

Publishers say the quickening pace of politics, especially in

the U.S., has made speed all the more crucial.

"Previous presidents moved more slowly," said Eric Nelson,

executive editor for the Harper imprint of HarperCollins. "You

could write to where you'd think the political world would be in a

year and likely be correct. Now, you could spend an entire chapter

on a prominent political figure in President Trump's administration

and that person could be gone by the time the book comes out."

Next January, Harper is expected to publish "Trumpocracy: The

Corruption of the American Republic," by David Frum, a former

speechwriter for President George W. Bush. Mr. Nelson said the book

deal was signed in May and will be in the stores eight months later

-- more than twice as fast as the company's standard.

Penguin Random House, the world's biggest book publisher,

already has a title in the works on the 2018 midterm elections. The

publisher declined to comment on the specifics of the deal.

Political books are in high demand in Europe, too, said Arnaud

Nourry, the CEO of Lagardère SA's Hachette Livre, citing the

success last year of "Un president ne devrait pas dire ça,"

(translated as "A President Should Not Say Things Like That"), by

Gérard Davet and Fabrice Lhomme, based on five years of interviews

with former French President François Hollande.

In France, Hachette makes about 9% of its revenue from digital

sales because of national rules limiting discounts on the price of

e-books, Mr. Nourry said. In the U.S., they have stabilized at

about one-fifth of the big four publishers' revenue.

Simon & Schuster's Ms. Reidy said a young generation of

internet natives has been turning to print books -- a trend she

noticed when her company signed a deal with Rupi Kaur, a poet based

on Instagram, to sell and distribute her work in the U.S.

Her young fans "don't want the e-book at all. They want the

physical object," Ms. Reidy said. "They want to own something that

is connected to the person they like online and, number two,

because they can share it."

Jeffrey A. Trachtenberg contributed to this article.

(END) Dow Jones Newswires

October 14, 2017 08:39 ET (12:39 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

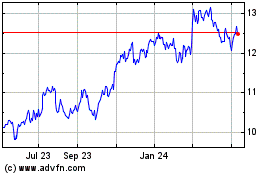

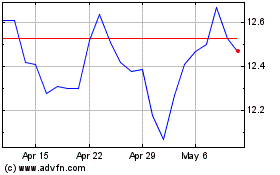

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024