Apple (NASDAQ:AAPL) – Apple has appointed Kevan

Parekh as its new CFO, replacing Luca Maestri starting January 1,

2025. Parekh, who has been with Apple for over a decade, will lead

the company during a period of significant iPhone updates, focusing

on AI to boost sales.

Sony Group (NYSE:SONY) – Sony will increase the

price of the PlayStation 5 in Japan by 19% to nearly $550 (¥80,000)

due to economic fluctuations. The hike comes despite slowing sales

and a potential console update. Sony will also raise prices for

accessories and other products. Shares rose 1.8% in pre-market

trading.

Santander SA (NYSE:SAN) – Banco Santander

announced a share buyback program of up to $1.7 billion as part of

its commitment to return 50% of underlying profit to shareholders.

The program runs until January 3 and represents about 2.14% of the

bank’s share capital. Shares rose 2.9% in pre-market trading after

closing down 0.8% on Monday.

Nvidia (NASDAQ:NVDA) – Nvidia is expected to

report a 112% jump in second-quarter revenue to $28.68 billion

after the market closes on Wednesday. However, the company faces

concerns about delays in Blackwell chip production and potential

production cost increases by TSMC. Nvidia’s stock has surged 150%

in 2024 but recently dipped 20% due to these concerns. Analysts are

also watching the impact of new regulations and competition in the

Chinese market. Shares rose 0.5% in pre-market trading.

Applied Materials (NASDAQ:AMAT) – Applied

Materials has received a subpoena from the U.S. Department of

Justice to provide information about its federal grant

applications. The company is cooperating with the investigation,

which examines its requests for support for a research center and

its negotiations with China over chip technologies.

Meta Platforms (NASDAQ:META) – Meta has struck

a deal with Sage Geosystems to acquire geothermal energy for its

data centers, starting with a 150-megawatt project to be completed

by 2027. The project, to be implemented in the eastern Rocky

Mountains, aims to support the growing energy demands of AI and

increase geothermal energy usage in the U.S. In another

development, Mark Zuckerberg stated that Facebook was pressured by

the U.S. government in 2021 to censor content about Covid-19 and

regretted caving in. He noted that although the decision to remove

the content was Meta’s, government pressure was inappropriate. The

company removed over 20 million virus-related posts. Shares rose

0.3% in pre-market trading.

Paramount Global (NASDAQ:PARA) – Edgar Bronfman

Jr. has dropped his bid to buy Paramount Global, allowing Skydance

Media to proceed with the acquisition. Bronfman failed to secure

the necessary financing, while Paramount will move forward with the

$8.4 billion deal with Skydance, pending regulatory approval to

close the transaction in 2025. Shares fell 4.4% in pre-market

trading.

Walt Disney (NYSE:DIS) – Walt Disney is

negotiating with DirecTV to renew a critical contract. Without an

agreement, channels like ABC and ESPN could be blacked out starting

September 1. DirecTV is seeking more specific channel packages, and

Disney is willing to consider this proposal.

PDD Holdings (NASDAQ:PDD) – PDD Holdings shares

dropped 28.5% on Monday after disappointing quarterly results and

pessimistic comments about competition and the global outlook. The

company, which operates Pinduoduo and Temu, saw nearly $55 billion

in market value wiped out due to market challenges and rising

operational costs. Shares rose 2.6% in pre-market trading.

MercadoLibre (NASDAQ:MELI) – MercadoLibre

accused Argentine banks of trying to harm its fintech unit, Mercado

Pago, with anti-competitive tactics through the MODO platform.

MercadoLibre claimed that the banks formed a cartel to limit

competition in the fintech sector.

Ford Motor (NYSE:F) – Ford is cutting back on

the production of new electric vehicles but is betting on continued

government tax incentives. The automaker will invest in a $2.5

billion battery plant in Michigan and move Mustang Mach-E battery

production to the U.S. to take advantage of more IRA incentives.

Shares rose 0.2% in pre-market trading.

Tesla (NASDAQ:TSLA) – Elon Musk supported

California’s SB 1047 bill, which requires safety testing for AI

models, arguing that AI should be regulated like dangerous products

to protect the public. In Canada, starting October 1, a 100% tariff

will be applied to electric vehicles imported from China, including

Tesla’s, and a 25% tariff on Chinese steel and aluminum, aiming to

counter unfair practices. This may prompt Tesla to reconsider its

export strategy. Additionally, a federal court reopened Tesla’s

case against Louisiana’s ban on direct vehicle sales, partially

reversing the previous decision for further analysis. SpaceX

delayed the launch of the Polaris Dawn mission, which aimed to

conduct the first commercial spacewalk, due to a helium leak. The

new launch is scheduled for after August 28. The mission, led by

Jared Isaacman, will include Starlink connectivity tests and space

radiation research and will last about five days, flying 1,400 km

above Earth. Shares rose 0.8% in pre-market trading after closing

down 3.2% on Monday.

Xpeng (NYSE:XPEV) – Xpeng is planning to set up

a manufacturing unit in Europe to reduce the impact of import

tariffs and expand its production in the region. The Chinese

automaker is considering locations within the European Union and

plans to establish a data center to enhance its smart driving

capabilities. Shares rose 3.3% in pre-market trading after closing

up 7.1% on Monday.

Boeing (NYSE:BA) – Boeing forecasts that China

will need 8,830 new airplanes by 2043 due to growth and

modernization of its aviation industry. This estimate is higher

than the previous forecast of 8,560 airplanes by 2042. Boeing has

accumulated approximately $1.5 billion in future losses related to

the Starliner program, according to Jefferies. These costs include

additional expenses for tests and necessary adjustments after

failures in previous missions. The delay of the crewed mission and

issues such as leaks and propellant failures significantly

contributed to these losses, along with a negative impact on

Boeing’s budget for 2024 and 2025. The Starliner’s delay and issues

also hurt its contract with NASA. The initial mission included an

eight-day stay at the ISS, but the astronauts have been there for

over 70 days.

Southwest Airlines (NYSE:LUV) – Elliott

Investment Management has increased its stake in Southwest Airlines

to 9.7%, nearly reaching the 10% threshold needed to call a special

shareholder meeting and attempt to replace the company’s board. The

activist investor criticizes the lack of reforms at the company and

seeks leadership and operational changes. Elliott will meet with

Southwest Airlines on September 9 to discuss changes but may

proceed with a proxy battle.

Norfolk Southern (NYSE:NSC) – Norfolk Southern

and BNSF Railway reported that embargoes related to the Canadian

labor strike have been lifted, and rail traffic has been restored.

The strike, which affected the movement of goods between the U.S.

and Canada, was suspended after binding arbitration. Full rail

recovery may take weeks.

Exxon Mobil (NYSE:XOM) – Exxon Mobil expects

crude oil demand to remain above 100 million barrels per day until

2050, outpacing BP’s forecast by 25%. The company believes that oil

demand will stay high until 2050, even with the growing adoption of

electric vehicles and the energy transition, due to the expected

increase in global energy demand. Additionally, Nigerian regulators

expect to finalize approval of Exxon Mobil’s sale of assets to

Seplat Energy within four months. Announced in February 2022 and

delayed by regulatory objections, the $1.3 billion transaction

could boost Seplat’s oil production to over 130,000 barrels per

day. Shares rose 0.1% in pre-market trading after closing up 2.1%

on Monday.

BHP Group (NYSE:BHP) – BHP Group reported

annual underlying profit of $13.66 billion, beating the estimate of

$13.26 billion. The mining company is focused on expanding its

copper business after a failed bid to acquire Anglo American. The

company faced a net loss of $5.7 billion due to issues with nickel

and the Samarco dam. It announced an annual dividend of $1.46 per

share, the lowest since 2020. Shares rose 0.5% in pre-market

trading.

Shell Plc (NYSE:SHEL) – Shell announced it will

close parts of the Zydeco pipeline for three to four days starting

September 24 for maintenance. This will affect the flow of light

crude to Louisiana. Zydeco transports oil from Houston to St. James

and alleviates congestion in crude oil transportation.

Woodside Energy (NYSE:WDS) – Woodside Energy

reported a first-half profit of $1.63 billion, down 14% due to

lower oil prices but above the estimate of $1.38 billion. Its

dividends of 69 cents per share also exceeded expectations. The

company is focused on selling stakes in the Driftwood project, with

final investment decisions planned for the first quarter of 2025.

Shares rose 1.5% in pre-market trading after closing up 1.3% on

Monday.

First Solar (NASDAQ:FSLR) – First Solar is

shining in 2024, with shares up 59% in six months while most solar

companies struggle. The company benefits from a strong order book

through 2030 and advanced technology.

SolarEdge (NASDAQ:SEDG) – SolarEdge shares

dropped after the announcement of CEO Zvi Lando’s resignation. CFO

Ronen Faier will assume the role temporarily. The company is facing

challenges due to high inventory levels and rising interest rates,

with shares down 62% over the past six months and 84% over the past

year. Shares rose 0.7% in pre-market trading after closing down

9.2% on Monday.

GE Vernova (NYSE:GEV) – GE Vernova is dealing

with issues with its offshore wind turbine blades, including a

recent break at the Dogger Bank Wind Farm. Despite this, Morgan

Stanley believes the impact will be limited and won’t negatively

affect the company’s fundamentals. Shares have only dropped 3%

since the incident, reflecting continued investor confidence.

Kroger (NYSE:KR), Albertsons

(NYSE:ACI) – FTC Chair Lina Khan is testing the use of antitrust

laws to protect workers in a trial over the Kroger-Albertsons

merger. The FTC argues that the merger would reduce the bargaining

power of unionized workers, especially in California, while Kroger

promises to maintain jobs and improve wages. Additionally, the FTC

argues that the $25 billion merger would raise food prices. Kroger

contends that the merger would lower prices and help compete with

large retailers.

Lowe’s (NYSE:LOW) – Lowe’s has revised its

diversity, equity, and inclusion (DEI) policies, discontinuing its

participation in Human Rights Campaign surveys and combining

diverse resource groups into a single organization. The company

also suspended sponsorships of community events and may make

further changes.

Chipotle Mexican Grill (NYSE:CMG) – The

National Labor Relations Board (NLRB) found that Chipotle may have

illegally denied raises to unionized workers in Michigan. If the

company doesn’t resolve the issue, the NLRB will issue a formal

complaint. In 2022, Lansing employees unionized but still lack a

contract. Shares fell 0.7% in pre-market trading after closing up

1.9% on Monday.

Nike (NYSE:NKE) – Nike will bring NBA stars,

including Luka Dončić and Zion Williamson, to China this fall to

promote the Jordan brand. The goal is to revitalize the brand’s

presence in China, where it has struggled due to economic slowdown

and consumer nationalism. The tour will include events in Beijing

and Shanghai.

McKesson (NYSE:MCK) – McKesson acquired 70% of

Florida Cancer Specialists’ Core Ventures unit for $2.49 billion.

The unit manages administrative functions, while FCS remains

independent. McKesson seeks to diversify its specialty services,

facing competition from Cencora and Cardinal Health. FCS created

Core Ventures to tackle challenges related to drug shortages and

pricing.

Warburg Pincus (NYSE:WPCA) – Warburg Pincus and

Lendlease announced the acquisition of real estate assets in

Singapore for $1.2 billion. The portfolio includes business parks

and facilities for life sciences companies. The transaction, one of

the largest industrial asset deals there, was completed with

entities associated with Blackstone.

JPMorgan Chase (NYSE:JPM) – JPMorgan is facing

a class-action lawsuit alleging it funneled clients’ idle cash into

accounts with very low interest rates, resulting in excessive

benefits for the bank. The lawsuit, filed in Manhattan, is similar

to actions against other financial institutions, including

Ameriprise and Wells Fargo. The action seeks damages for alleged

fiduciary violations and unjust enrichment. In China, JPMorgan

Chase hired Yang Ruo to lead the telecommunications, media, and

technology team. Yang, a former CFO at Shopline and Xiaohongshu,

with experience at Citigroup, will work in Hong Kong on mergers and

acquisitions, replacing Crystal Zhu, who moved to Morgan

Stanley.

Goldman Sachs (NYSE:GS) – Scott Rubner of

Goldman Sachs predicts that the S&P 500 could reach a new

all-time high this week due to strong corporate buybacks and

systematic investments, with demand estimated at $17 billion daily.

The rally is expected to continue until mid-September unless demand

wanes.

Bank of New York Mellon (NYSE:BK) – Bank of New

York Mellon (BNY Mellon) will pay $5 million to settle CFTC charges

for failing to correctly report 5 million swap transactions and

violating a prior order. The company will also hire an independent

compliance consultant to review its processes.

Apollo Global Management (NYSE:APO),

BlackRock (NYSE:BLK) – Apollo Global Management

and BlackRock are negotiating new financing for the merger of two

Amazon aggregators, Branded and Heyday, which will form Essor. The

merger, valued at over $1 billion, aims to help Essor acquire new

brands and expand its e-commerce presence.

Icahn Enterprises LP (NASDAQ:IEP) – Icahn

Enterprises shares fell on Monday after the company announced plans

to sell up to $400 million in depository units and agreed to pay $2

million in fines for failing to disclose personal loans. Shares

have lost more than 70% since a critical report by Hindenburg

Research, while the S&P 500 is up 18% this year.

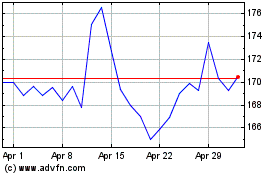

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Oct 2024 to Nov 2024

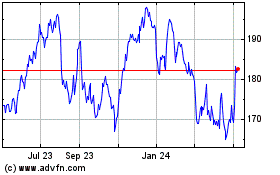

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Nov 2023 to Nov 2024