Apple (NASDAQ:AAPL) – Apple will obtain an

observer role on the OpenAI board as part of an AI agreement, with

Phil Schiller chosen for the position. This arrangement will allow

Schiller to attend board meetings without voting rights, starting

later this year. In other related news, a former Apple corporate

law director convicted of insider trading was ordered to pay a

$1.15 million fine by the U.S. SEC after avoiding prison. Gene

Levoff admitted to illegal trades based on insider information

about the company’s earnings announcements. Additionally, Apple is

trying to amend a court document in China even after winning the

case, highlighting the delicacy of its position in the world’s

largest smartphone market. The company wants to remove references

to its “dominant position” and phrases suggesting “unfair pricing

could harm consumers” in the final decision.

Logitech International SA (NASDAQ:LOGI) – Wendy

Becker, chair of Logitech’s board, will not seek re-election in

2025, following reports that the company’s founder, Daniel Borel,

proposed a vote to replace her, criticizing the lack of adequate

technological experience in the company’s leadership.

Microsoft (NASDAQ:MSFT) – State-sponsored

Russian hackers accessed emails between Microsoft and various Texas

state agencies and public universities through a leak within

Microsoft, revealed in January. This attack was attributed to the

Midnight Blizzard group, linked to Russian intelligence services.

In other related news, Microsoft and G42, a UAE-based AI company,

announced plans in May to invest $1 billion in projects in Kenya,

including a major data center powered by geothermal energy. This

deal was negotiated with input from the U.S. and UAE governments

and coincided with a summit in Washington between President Joe

Biden and Kenyan President William Ruto.

Nvidia (NASDAQ:NVDA) – Nvidia shares fell 1.2%

in pre-market trading on Wednesday due to concerns about export

restrictions. Despite a 148% increase this year, the stock has

dropped from a recent peak. Mizuho analyst Vijay Rakesh maintains

an “Outperform” rating, citing continuous demand, especially in

China, despite U.S. restrictions. In France, Nvidia is facing

imminent charges from the antitrust regulator for allegedly

violating competition practices. Investigations began with raids

conducted last September in the graphics card sector, part of a

broader probe into cloud computing. The surge in demand for its

chips, especially after the release of generative AI applications

like ChatGPT, has brought regulatory scrutiny in both Europe and

the United States. According to Reuters, the French authority is

concerned about the graphics card sector’s reliance on Nvidia’s

CUDA programming software, essential for accelerated computing.

Alphabet (NASDAQ:GOOGL) – Over five years,

Google’s emissions have risen nearly 50%, reaching 14.3 million

tons of CO2 equivalent in 2023, a 48% increase since 2019 and 13%

from 2022. This growth, driven by the intensive use of artificial

intelligence in the company’s core products, makes it challenging

to meet the goal of eliminating carbon emissions by 2030 due to

higher energy consumption in data centers and supply chain

emissions.

Super Micro Computer (NASDAQ:SMCI) – The

small-cap stock index, Russell 2000, is losing one of its key

components, Super Micro Computer. With Super Micro’s exit, which

doubled its market value this year, the Russell 2000, which was

marginally positive for the year, will face challenges without this

significant influence.

Simulations Plus (NASDAQ:SLP) – The modeling

and simulation software company suspended its quarterly dividend,

opting to invest the funds in growth initiatives to generate

long-term shareholder value. Additionally, it reported adjusted

earnings per share of 19 cents in the third quarter, exceeding

analysts’ estimates, with revenue of $18.5 million, a 14% increase

year-over-year.

Paramount Global (NASDAQ:PARA) – Shari

Redstone’s National Amusements reached a preliminary agreement to

sell its control of Paramount Global to David Ellison’s Skydance

Media. The $1.75 billion deal includes a 45-day period for other

offers.

Vodafone (NASDAQ:VOD) – If the merger between

Vodafone Group Plc and Three of CK Hutchison Holdings is approved,

the companies will sell part of their spectrum to Virgin Media O2

Ltd. The $16.4 billion (£13 billion) deal would create the UK’s

largest mobile operator and is under review by the UK’s Competition

and Markets Authority due to concerns about reduced competition.

The spectrum sale aims to mitigate these concerns.

Charter Communications (NASDAQ:CHTR) – Citi

analysts downgraded Charter’s shares from “Neutral” to “Sell” and

reduced the price target from $280 to $255.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media announced that the conversion of warrants into shares

between June 20 and July 1 generated over $105 million.

Additionally, $41 million in restricted cash became available,

resulting in over $350 million in cash and no debt by July 1.

Walmart (NYSE:WMT), Humana

(NYSE:HUM) – Walmart is in talks to sell its closed medical

clinics. In April, it shut down all 51 health clinics and virtual

operations, deeming them unsustainable. The discussions include

health insurers like Humana, aiming to recover massive

investments.

Eli Lilly (NYSE:LLY) – The Food and Drug

Administration (FDA) approved Eli Lilly’s treatment for early

Alzheimer’s, the second available in the U.S. to slow disease

progression. Donanemab, marketed as Kisunla, was endorsed by the

agency’s external experts, who recommended its use due to benefits

outweighing risks.

Moderna (NASDAQ:MRNA) – The pharmaceutical

company Moderna received $176 million from the U.S. government to

develop a human avian flu vaccine based on messenger RNA. The

funding was granted by the Biomedical Advanced Research and

Development Authority during an unprecedented outbreak of avian

influenza in the U.S.

Grifols SA (NASDAQ:GRFS) – Scranton

Enterprises, the majority shareholder of the Spanish pharmaceutical

company Grifols SA, is negotiating a $140 million (€130 million)

credit line with Oaktree Capital Management, according to a report

by El Confidencial. The six-year loan would replace existing debts

with Spanish banks.

GSK plc (NYSE:GSK) – The British pharmaceutical

company announced it is restructuring its partnership with German

biotech CureVac, taking control of several jointly developed

vaccines. GSK will pay CureVac $429.44 million initially and up to

an additional $1.13 billion in future milestones, along with tiered

royalties.

U.S. Steel (NYSE:X) – Nippon Steel Vice

President Takahiro Mori will return to the U.S. to discuss

acquiring U.S. Steel. The $15 billion offer is supported by U.S.

Steel management but faces resistance from the White House and the

USW union. Mori will visit several states and meet with local

leaders.

Rio Tinto (NYSE:RIO) – Global miner Rio Tinto

is negotiating with workers at its Oyu Tolgoi copper operations in

Mongolia to avoid further strikes due to a sharp drop in wages that

caused a strike in May. Copper production is scheduled to reach

500,000 tons annually starting in 2028.

Exxon Mobil (NYSE:XOM),

Chevron (NYSE:CVX), Hess Corp

(NYSE:HES) – A three-person arbitration panel has been chosen to

resolve Exxon Mobil’s dispute over Chevron’s $53 billion

acquisition of Hess Corp, a process that delayed the planned

closure for the first half of 2024. The dispute centers on Exxon’s

rights to Hess’s assets in Guyana.

Schlumberger (NYSE:SLB) – The oilfield services

company announced it received a second request for additional

information from the U.S. Department of Justice regarding its $7.75

billion acquisition of smaller rival ChampionX. The deal is now

expected to close in the fourth quarter or first quarter of

2025.

Constellation Energy (NASDAQ:CEG) –

Constellation Energy is in advanced talks with the Pennsylvania

governor’s office and state legislators to fund a possible restart

of part of its Three Mile Island power facility, the site of a

nuclear meltdown in the 1970s. The project faces logistical,

financial, and environmental safety challenges.

Progressive (NYSE:PGR) – Progressive agreed to

pay $48 million to settle a class-action lawsuit accusing the

insurer of systematically undervaluing claims by New York drivers

whose vehicles were totaled. The suit alleged that Progressive used

software that underestimated vehicle values before declaring them

total losses.

Ford Motor (NYSE:F) – Ford Motor is encouraging

more managers to acquire electric vehicles, now limiting the

leasing program so they choose an electric Mustang Mach-E SUV or

F-150 Lightning pickup. This is the first time Ford has imposed

this restriction, aiming to increase familiarity with EV technology

among its employees.

General Motor (NYSE:GM) – GM reported slower

U.S. sales growth in the second quarter, affected by reduced sales

to rental companies and a cyber incident at CDK that impacted

dealerships. Total sales rose about 0.6% to 696,086 units, compared

to a roughly 19% increase in the same period last year.

Toyota Motor (NYSE:TM) – Toyota Motor North

America reported a roughly 9.2% increase in U.S. auto sales in the

second quarter. The company sold 621,549 vehicles in the quarter,

compared to 568,962 units a year earlier, with SUVs like the Land

Cruiser and 4Runner being standout performers.

Stellantis (NYSE:STLA) – Stellantis will invest

an additional $55 million in Archer Aviation following the

successful transition flight of its flagship aircraft last month.

With this, Stellantis, already the largest shareholder of the eVTOL

manufacturer, reinforces its support in the electric vertical

takeoff and landing sector.

Tesla (NASDAQ:TSLA) – Tesla reported a 5% drop

in vehicle deliveries in the second quarter, less than expected.

Shares closed up 10% on Tuesday, reaching the highest level in

nearly six months. The company delivered 443,956 vehicles,

surpassing Wall Street expectations of 438,019. In China, Tesla’s

sales of domestically made vehicles in June fell 24.2% year-on-year

to 71,007 units, according to data from the China Passenger Car

Association (CPCA). Deliveries of the American automaker’s Model 3

and Model Y in China fell 2.2% from May. Shares were up 2.40% in

pre-market trading.

Rivian Automotive (NASDAQ:RIVN) – Rivian denied

plans to produce vehicles with Volkswagen after reports that it was

in early discussions to expand a recent partnership beyond

software. The company maintains its plans to produce the R2 SUV in

Illinois and Georgia.

Chinese Electric Vehicles – EU countries are

divided on supporting additional tariffs on Chinese electric

vehicles, facing challenges in gaining support due to threats of

retaliation from Beijing. Germany opposes, while France strongly

supports. An advisory vote will soon decide on provisional tariffs

of up to 37.6%, with a final decision expected in October.

Polestar Automotive (NASDAQ:PSNY) – The Swedish

electric vehicle manufacturer is implementing further cost cuts

after deepening its losses to $232 million in the first quarter,

due to increased tariff barriers and pricing pressures in the

sector. The company also plans to adapt its business plan to

achieve breakeven cash flow by the end of 2025.

Nikola (NASDAQ:NKLA) – Nikola reported an 80%

increase in deliveries of its hydrogen fuel cell trucks in the

second quarter, exceeding its own expectations. With 72 units

delivered, the company signals strong demand for heavy-duty trucks

after a tumultuous transition from battery-electric vehicles.

Boeing (NYSE:BA), Spirit

AeroSystems (NYSE:SPR) – Boeing announced the repurchase

of Spirit AeroSystems and is searching for a new CEO after Dave

Calhoun announced he would step down. Patrick Shanahan, the current

CEO of Spirit, is among the candidates. Shanahan is recognized for

his engineering experience and for resolving issues in Boeing’s

troubled programs.

American Airlines (NASDAQ:AAL) – American

Airlines agreed to a preliminary deal to acquire 100

hydrogen-electric engines from aviation startup ZeroAvia for use in

aircraft on its regional routes. This investment increases its

support for alternative propulsion technology aiming to reduce

carbon emissions in commercial aviation by 2050.

Ryanair Holdings (NASDAQ:RYAAY) – In June,

Ryanair transported a record 19.3 million passengers, an 11%

increase from the previous year. Europe’s largest airline by

passenger numbers expects to reach between 198 million and 200

million people during its fiscal year ending March 2025.

Intuitive Machines (NASDAQ:LUNR) – Intuitive

Machines shares rose 5.2% in pre-market trading as the space

exploration company approaches its next mission to the Moon. The

company’s IM-1 mission made history by successfully landing on the

Moon, and they now focus on the IM-2 mission, scheduled for late

2024.

UBS Group AG (NYSE:UBS) – South Korea imposed a

record $19.5 million fine on two Credit Suisse subsidiaries,

acquired by UBS last year, to combat illegal short-selling. The

fines were distributed between Credit Suisse AG and Credit Suisse

Singapore Ltd.

HSBC Holdings Plc (NYSE:HSBC) – HSBC is slowing

hiring and asking investment bankers to cut back on travel and

entertainment expenses as CEO Noel Quinn seeks to reduce costs at

Europe’s largest bank, according to Bloomberg. In some cases, the

bank is not replacing staff who have left or resigned recently, and

some areas have been instructed to pause new hires entirely, though

this should not affect customer-facing positions.

Icahn Enterprises (NASDAQ:IEP) – CVR Energy,

controlled by billionaire Carl Icahn, made a binding offer in an

auction for shares of Citgo Petroleum’s parent company, owned by

Venezuela. CVR, which operates two refineries in the U.S., seeks to

acquire stakes to pay creditors with claims of $21.3 billion

against Venezuela.

Blackstone (NYSE:BX) – Blackstone is selling

Japanese pharmaceutical company Alinamin to private equity firm MBK

Partners. The deal is valued at $2.17 billion. Blackstone, which

acquired Alinamin in 2020, will reinvest a minority indirect stake

after the transaction closes.

Robinhood Markets (NASDAQ:HOOD) – Brokerage

Robinhood Markets is considering offering cryptocurrency futures in

the U.S. and Europe in the coming months, according to Bloomberg.

The platform, known for commission-free trading, plans to use

Bitstamp’s licenses, acquired for $200 million, to launch CME-based

futures for Bitcoin and Ether in the U.S. On Monday, Robinhood

announced the acquisition of Pluto, an investment research company

that uses artificial intelligence to develop personalized

investment strategies. Jacob Sansbury, founder and CEO of Pluto,

joined Robinhood’s leadership team to help integrate AI-driven

capabilities.

Chewy (NYSE:CHWY) – Keith Gill, also known as

Roaring Kitty, revealed a 6.6% stake in Chewy, briefly boosting the

online pet retailer’s shares. Despite the initial surge, the shares

closed down 6.6% on Monday and -2.2% on Tuesday. The disclosure

increased the stock’s volatility. The shares are down -0.1% in

pre-market trading.

Tempur Sealy (NYSE:TPX) – The U.S. Federal

Trade Commission voted unanimously to block Tempur Sealy’s proposed

$4 billion acquisition of Mattress Firm, citing concerns that the

deal would reduce competition in the sector. The agency issued an

administrative complaint and allowed a federal court process,

alleging that Tempur Sealy, as the world’s largest mattress

supplier and manufacturer, would have the ability and incentive to

suppress competition and raise prices for millions of

consumers.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle

shares fell after a 50-to-1 stock split last Wednesday, revealing

weaknesses in its high valuation. Although the stock has risen more

than 60% in the past 12 months, the high valuation has worried

investors, but it is too early to predict a sustained decline.

Constellation Brands (NYSE:STZ) – The seller of

Modelo Especial and Corona brands expects to report a 19% increase

in earnings per share to $3.46 and a 6% rise in total revenue to

$2.67 billion in the fiscal first quarter, which will be reported

today.

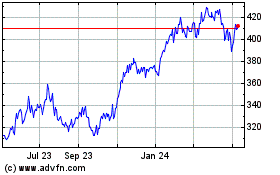

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Oct 2024 to Nov 2024

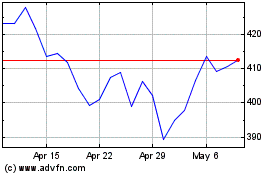

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Nov 2023 to Nov 2024