TIDMWSP

RNS Number : 1985Q

Wynnstay Properties PLC

15 June 2015

Wynnstay Properties PLC

Preliminary Results for Year Ended 25th March 2014

CHAIRMAN'S STATEMENT

On behalf of the Board, I am delighted to report on another

encouraging year for Wynnstay. We have ended the year with the

portfolio being virtually fully-let and benefitting from an

enhanced lease profile, with the annual revaluation producing a

significant increase over the prior year and with net asset value

per share rising substantially. We made two additions to the

portfolio during the financial year and, since the year-end, we

have exchanged contracts to make a further substantial

acquisition.

Overview of financial performance

Wynnstay's financial performance for the year may be summarised

as follows:

Change 2015 2014

3.4% GBP1,663,000 GBP1,609,000

* Property income

(11.1%) GBP899,000 GBP1,011,000

* Profit before movement in fair value of investment

properties and taxation

* Earnings per share 81.8p 34.9p

* Dividends per share, paid and proposed 4.2% 12.3p 11.8p

* Net asset value per share 15.2% 531p 461p

* Net gearing 45.7% 41.4%

Property income for the year, at just over GBP1.66 million, was

slightly higher than last year, reflecting a number of underlying

changes arising from the active management of the portfolio.

Profits before fair value movement and taxation for the year, at

just under GBP900,000 were slightly lower than in the prior year

largely due to higher overall finance costs.

Our annual property revaluation delivered an increase over the

value for the prior year and the resulting surplus of GBP1,530,000

has contributed to an increase of over 15% in net asset value per

share.

Property Management and Portfolio

Wynnstay currently has a geographically dispersed portfolio

focussed in various towns in the South and East of England with 59

tenants occupying over 71 separate properties in 19 locations. At

the end of the financial year, the portfolio was virtually

fully-let, with just one small vacant unit at our Quarry Wood

Industrial Estate in Aylesford.

A considerable proportion of our tenants have been in occupation

for many years; some tenants have joined us more recently. We aim

to build strong, constructive relationships with our tenants and to

meet their changing property needs, for instance by enlargement or

reduction in space required, by undertaking alterations and

improvements to the properties or by varying lease terms, where

these are commercially practicable and beneficial.

During the course of the year, we have agreed lease renewals or

extensions of leases with 8 tenants in 4 locations and have

welcomed 7 new tenants. I reported on a number of these when I

wrote to you in November 2014 with the interim results. Since then,

we have also agreed new leases or lease extensions on one unit at

Hailsham and on two units at St Neots and we have agreed lease

variations that defer tenant breaks on two units at Basingstoke.

However, the main focus in the second half of the year has been on

our estate in Aylesford and on our property at Chessington.

At Aylesford, we are in the course of negotiations with a number

of our existing tenants with a view to facilitating moves within

the estate to accommodate their requirements which should lead to

lease extensions or new leases on a number of units. I anticipate

that these negotiations will be completed shortly and I will report

to you further with our interim results in November.

The tenant of two of our units at Chessington vacated at the

year-end following the disposal of that part of their business

occupying these premises. I am pleased to report that we negotiated

a satisfactory cash settlement with them regarding the

dilapidations that needed to be undertaken. The units are being

actively marketed and there has been some interest, but it is too

early to say whether this will lead to successful lettings. In the

meantime, we are carrying out an extensive refurbishment of the

property funded by the monies received from the outgoing tenant. I

hope that there will be progress to report to you at the time of

our interim results in November.

In addition to the trade counter acquisition in Ipswich on which

I reported to you in my statement last year, we also acquired

towards the end of the financial year a freehold retail warehouse

unit with car parking in an established out-of-town location in

Weston-super-Mare, Somerset. This is occupied by Majestic Wine on a

full repairing and insuring lease until October 2020 at an annual

rent of GBP41,500 subject to an upward only review. The price of

GBP625,000 provides, after costs, a net initial yield of 6.3%.

Shortly after the end of the financial year, we entered into

negotiations to acquire off-market an industrial estate in

Hampshire and I am pleased to report that contracts have recently

been exchanged, with completion due in the near future. The

acquisition price of GBP2.6 million will be funded from our

borrowing facility and our cash resources. Further details will be

provided with the interim results in November and in our Accounts

for the current year in due course.

Portfolio Valuation

As at 25 March 2015, our Independent Valuers, BNP Paribas Real

Estate (who have succeeded Sanderson Weatherall), have undertaken

the annual revaluation of the company's portfolio at GBP21,780,000

representing, as already mentioned, a revaluation surplus of

GBP1,530,000. The Board considers this to be an excellent

outcome.

Following the revaluation, as at the year-end, the industrial

sector within the portfolio accounted for 58% by value, with the

retail and office elements comprising 24% and 18% respectively.

Borrowings and Gearing

Total borrowings at the year-end were GBP7.6 million (2014 -

GBP6.0 million) and net gearing at the year-end was 45.7% compared

to 41.4% last year. The increased borrowings reflect the drawdown

under our borrowing facility made to facilitate the purchase of the

Ipswich and Weston-super-Mare properties during the year.

In December 2013, you will recall that we signed a new five year

facility of GBP10 million, the main terms of which are broadly the

same as those under the previous facility, other than an increase

in the margin to 2.65% and an increase in the non-utilization fee

to 1%. This higher margin, coupled with the increase in borrowings

mentioned above, is reflected in higher financing costs for the

year compared to the prior year.

Interest rates remain at an historic low level and the outlook,

according to most commentators, seems to be for limited prospect of

any meaningful increase in rates in the near future and rates are

currently not forecast in the medium term to return to the levels

prevailing in the pre-financial crisis period.

Costs

Our property costs in this year were marginally higher than in

the prior year as we invested in some improvements jointly with

tenants which are generally reflected in better lease terms. These

costs remain under strict control, as do our administrative

costs.

Dividend

In the light of the satisfactory results for the year, the Board

is recommending a total dividend for the year of 12.3p per share

(2014 - 11.8p). An increased interim dividend of 4.5p per share

(2014 - 4.2p) was paid in December

2014. Accordingly, subject to approval of Shareholders at the

Annual General Meeting, a final dividend of 7.8p per share (2014 -

7.6p) will be paid on 17th July 2015 to Shareholders on the

register on 26th June 2015.

The increase in dividends this year should not be taken as an

indication of further increases in the current year as this will

depend on performance during the year, including our ability to

maintain high levels of occupancy as well as to find suitable

additions to the portfolio.

Outlook

Along with many other businesses, Wynnstay has undoubtedly

benefitted from the greatly improved economic conditions and

prospects that have developed over the recent past. Whether these

prevail depends to a large extent upon political decisions taken by

the new government following the outcome of the recent general

election and developments affecting the UK economy, particularly

anything that affects the prospects for small and medium- sized

businesses and for consumer spending.

It is to be hoped that the election of the new government with

broadly similar economic objectives to the previous government, but

without the complications resulting from a coalition, will provide

a sound basis for continued economic growth and further increases

in employment. If this proves to be the case, it should greatly

assist both our tenants and growth prospects in the commercial

property market. Against this encouraging background, Wynnstay is

in robust health and, in the Board's view, continues to offer

opportunities for profitable growth. We will continue to make

changes to enhance the value of the portfolio as and when

opportunities to do so arise.

Unsolicited approaches to Shareholders

In common with warnings issued by many other companies and by

regulators and in the media, I remind Shareholders that unsolicited

approaches regarding their shares may be from fraudsters. If you

are in any doubt, please refer to the letter I sent to all

Shareholders in January 2014 (also available on our website:

www.wynnstayproperties.co.uk) or to the website of the Financial

Conduct Authority (www.fca.org.uk/consumers/ scams).

Annual General Meeting

Our Annual General Meeting will be held at the Royal Automobile

Club on Thursday 16th July 2015. As always, I hope that as many

Shareholders as possible will take the opportunity to come to

London for the meeting and to meet the Board and other Shareholders

informally to discuss the Company's affairs as well as to take part

in the formal business.

Colleagues and Advisers

Our two executive directors - Paul Williams, our Managing

Director, and Toby Parker, our Finance Director - have continued to

manage Wynnstay with their customary efficiency and insight. The

two executive directors and I, as your Chairman, also benefit from

the wisdom and experience of our two non-executive directors -

Charles Delevingne and Terence Nagle. I would like to thank all

four of them, as well as our advisers, for their contributions over

the past year.

Philip G.H. Collins

Chairman

12th June 2015

For further information please contact:

Wynnstay Properties Plc

Toby Parker, Finance Director 020 7554 8766

Charles Stanley Securities - Nominated

Adviser 020 7149 6000

Dugald J. Carlean

STATEMENT OF COMPREHENSIVE INCOME FOR YEAR ENDED 25TH MARCH

2015

Notes 2015 2014

GBP'000 GBP'000

Property Income 1,663 1,609

Property Costs 2 (87) (79)

Administrative Costs 3 (414) (443)

========= =======

1,162 1,087

Movement in Fair Value of: Investment

Properties 9 1,530 170

Profit on Sale of Investment

Property - 52

========= =======

Operating Income 2,692 1,309

Investment Income 5 2 1

Finance Costs 5 (265) (129)

========= =======

Income before Taxation 2,429 1,181

Taxation 6 (210) (235)

========= =======

Income after Taxation 2,219 946

========= =======

Basic and diluted earnings per

share 8 81.8p 34.9p

The company has no items of other comprehensive income.

STATEMENT OF FINANCIAL POSITION 25TH MARCH 2015

2015 2014

Notes GBP'000 GBP'000

Non-Current Assets

Investment Properties 9 21,780 18,515

Investments 12 3 3

======= =======

21,783 18,518

Current Assets

Accounts Receivable 13 489 267

Cash and Cash Equivalents 1,050 776

======= =======

1,539 1,043

Current Liabilities

Accounts Payable 14 (1,086) (876)

Income Taxes Payable (225) (235)

======= =======

(1,311) (1,111)

======= =======

Net Current Assets 228 68

======= =======

Total Assets Less Current Liabilities 22,011 18,450

Non-Current Liabilities

Bank Loans Payable 15 (7,621) (5,951)

======= =======

Net Assets 14,390 12,499

======= =======

Capital and Reserves

Share Capital 17 789 789

Treasury Shares (1,570) (1,570)

Share Premium Account 1,135 1,135

Capital Redemption Reserve 205 205

Retained Earnings 13,831 11,940

======= =======

14,390 12,499

======= =======

STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 25TH MARCH 2015

2015 2014

GBP'000 GBP'000

Cashflow from operating activities

Income before taxation 2,429 1,181

Adjusted for:

Amortisation of deferred finance costs - 3

Increase in fair value of investment properties (1,530) (170)

Interest income (2) (1)

Interest expense 265 129

Profit on disposal of investment properties - (52)

Changes in:

Trade and other receivables (221) (93)

Trade and other payables 210 31

Income taxes paid (221) (380)

Interest paid (255) (129)

========== ==========

Net cash from operating activities 675 519

========== ==========

Cashflow from investing activities

Interest and other income received 2 1

Purchase of investment properties (1,735) (945)

Sale of investment properties - 352

========== ==========

Net cash from investing activities (1,733) (592)

========== ==========

Cashflow from financing activities

Dividends paid (328) (320)

Repayments on bank loans - (5,998)

Drawdown on bank loans 1,660 6,596

========== ==========

Net cash from financing activities 1,332 278

========== ==========

Net increase in cash and cash equivalents 274 205

Cash and cash equivalents at beginning of

period 776 571

========== ==========

Cash and cash equivalents at end of period 1,050 776

========== ==========

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 25th MARCH

2015

YEAR ENDED 25 MARCH 2015

Capital Share

Share Capital Redemption Premium Treasury Retained

Reserve Account Shares Earnings Total

GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000

Balance at 26 March

2014 789 205 1,135 (1,570) 11,940 12,499

Total comprehensive

income for the year - - - - 2,219 2,219

Dividends - note

7 - - - - (328) (328)

================= ================= ========== ========== ========

Balance at 25 March

2015 789 205 1,135 (1,570) 13,831 14,390

================= ================= ========== ========== ========

YEAR ENDED 25 MARCH 2014

Capital Share Premium

Share Capital Redemption Account Treasury Retained

Reserve Shares Earnings Total

GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000

Balance at 26 March

2013 789 205 1,135 (1,570) 11,314 11,873

Total comprehensive

income for the year - - - - 946 946

Dividends - note

7 - - - - (320) (320)

================= ================= ========== ========== ========

Balance at 25 March

2014 789 205 1,135 (1,570) 11,940 12,499

================= ================= ========== ========== ========

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 25TH MARCH

2015

1. BASIS OF PREPARATION, ACCOUNTING POLICIES AND ESTIMATES

Wynnstay Properties Plc is a public limited company incorporated

and domiciled in England and Wales. The principal activity of the

Company is property investment, development and management. The

Company's ordinary shares are traded on the Alternative Investment

Market. The Company's registered number is 00022473.

1.1 Basis of Preparation

The financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the EU. The financial statements have been presented in Pounds

Sterling being the functional currency of the Company. The

financial statements have been prepared under the historical cost

basis modified for the revaluation of investment properties and

financial assets measured at fair value through profit or loss, and

investments.

The financial statements comprise the results of the Company

drawn up to 25th March each year.

(a) New Interpretations and Revised Standards Effective for the

year ended 25th March 2015 The Directors have adopted all new and

revised standards and interpretations issued by the International

Accounting Standards Board ("IASB") and the International Financial

Reporting Interpretations Committee ("IFRIC") of the IASB that are

relevant to the operations and effective for accounting periods

beginning on or after 26th March 2014.

(b) Standards and Interpretations in Issue but not yet

Effective

The International Accounting Standards Board ("IASB") and

International Financial Reporting Interpretations Committee

("IFRIC") have issued revisions to a number of existing standards

and new interpretations with an effective date of implementation

after the date of these financial statements.

It is not anticipated that the adoption of these revised

standards and interpretations will have a material impact on the

figures included in the financial statements in the period of

initial application other than the following:

IFRS 9: Financial Instruments

The standard makes substantial changes to the recognition and

measurement of financial assets and liabilities and de-recognition

of financial assets.

There will only be three categories of financial assets whereby

financial assets are recognised at either fair value through profit

or loss, fair value through other comprehensive income or measured

at amortised cost. On adoption of the standard, the Company will

have to re-determine the classification of its financial assets

based on the business model for each category of financial asset.

This is not considered likely to give rise to any significant

adjustments.

Financial liabilities of the Company are expected to continue to

be recognised at amortised cost. The standard is effective for

accounting periods beginning on or after 1 January 2018.

1.2 ACCOUNTING POLICIES

Investment Properties

All the Company's investment properties are revalued annually

and stated at fair value at 25th March. The aggregate of any

resulting surpluses or deficits are taken to profit or loss.

Non-current assets are classified as held for sale if their

carrying amount will be recovered through a sale transaction rather

than through continuing use. This condition is regarded as met only

when the sale is highly probable and the asset is available for

immediate sale in its present condition. Management must be

committed to the sale, which should be expected to qualify for

recognition as a completed sale within one year from the date of

classification. Non-current assets classified as held for sale are

measured at the lower of the assets' previous carrying amount and

fair value less cost to sell.

Depreciation

In accordance with IAS 40, freehold investment properties are

included in the Statement of Financial Position at fair value, and

are not depreciated.

Other plant and equipment is recognised at cost and depreciated

on a straight line basis calculated at annual rates estimated to

write off each asset over its useful life of 5 years.

Disposal of Investments

The gains and losses on the disposal of investment properties

and other investments are included in profit or loss in the year of

disposal.

Property Income

Property income is recognised on a straight line basis over the

period of the lease. Revenue is measured at the fair value of the

consideration receivable. All income is derived in the United

Kingdom.

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax. Current tax is the expected tax payable on the

taxable income for the year based on the tax rate enacted or

substantially enacted at the reporting date, and any adjustment to

tax payable in respect of prior years. Taxable profit differs from

income before tax because it excludes items of income or expense

that are deductible in other years, and it further excludes items

that are never taxable or deductible.

Deferred taxation is the tax expected to be payable or

recoverable on differences between the carrying amounts of assets

and liabilities in the financial statements and the corresponding

tax bases used in the computation of taxable profits, and is

accounted for using the statement of financial position liability

method. Deferred tax liabilities are recognised for all taxable

temporary differences (including unrealised gains on revaluation of

investment properties) and deferred tax assets are recognised to

the extent that it is probable that taxable profits will be

available against which deductible temporary differences can be

utilised.

The Company provides for deferred tax on investment properties

by reference to the tax that would be due on the sale of the

investment properties. Deferred tax is calculated at the rates that

are expected to apply in the period when the liability is settled,

or the asset is realised. Deferred tax is charged or credited to

profit or loss, including deferred tax on the revaluation of

investment property.

Trade and Other Accounts Receivable

Trade and other receivables are initially measured at fair value

and subsequently measured at amortised cost as reduced by

appropriate allowances for estimated irrecoverable amounts. All

receivables do not carry any interest and are short term in

nature.

Cash and Cash Equivalents

Cash comprises cash at bank and on demand deposits. Cash

equivalents are short term (less than three months from inception),

repayable on demand and are subject to an insignificant risk of

change in value.

Trade and Other Accounts Payable

Trade and other payables are initially measured at fair value

and subsequently measured at amortised cost. All trade and other

accounts payable are non-interest bearing.

Pensions

Pension contributions towards employees' pension plans are

charged to the statement of comprehensive income as incurred. The

pension scheme is a defined contribution scheme.

Borrowings

Interest rate borrowings are recognised at fair value, being

proceeds received less any directly attributable transaction costs.

Borrowings are subsequently stated at amortised cost. Any

difference between the proceeds (net of transaction costs) and the

redemption value is recognised in profit or loss over the period of

the borrowings using the effective interest method. Borrowings are

classified as current liabilities unless the Company has an

unconditional right to defer settlement of the liability for at

least 12 months after the reporting date.

1.3 Key Sources of Estimation Uncertainty and Judgements

The preparation of the financial statements requires management

to make judgements, estimates and assumptions that may affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expenses.

Revisions to accounting estimates are recognised in the period

in which the estimate is revised if the revision affects only that

period. The key sources of estimation uncertainty that have a

significant risk of causing material adjustment to the carrying

amounts of assets and liabilities within the next financial year

are those relating to the fair value of investment properties.

There are no judgemental areas identified by management that

could have a material effect on the financial statements at the

reporting date.

2. PROPERTY COSTS 2015 2014

GBP'000 GBP'000

Rents payable - 3

Empty rates - 12

Property management 12 9

======= =======

12 24

Legal fees 22 26

Agents fees 53 29

======= =======

87 79

======= =======

3. ADMINISTRATIVE COSTS 2015 2014

GBP'000 GBP'000

Rents payable - operating lease rentals 21 20

General administration, including staff costs 357 357

Fees relating to potential equity issue - 26

Auditors' remuneration: Audit fees 32 32

Tax services 4 4

Amortisation of deferred finance costs - 3

======= =======

414 443

======= =======

4. STAFF COSTS 2015 2014

GBP'000 GBP'000

Staff costs, including Directors, during the year

were as follows:

Wages and salaries 189 178

Social security costs 21 21

Other pension costs 11 10

======= =======

221 209

======= =======

Details of Directors' emoluments, totaling GBP199,260 (2014: GBP189,393),

are shown in the Directors' Report on page 8. There are no other

key management personnel.

No. No.

The average number of employees, including Directors,

engaged wholly in management and administration was: 5 5

==== ===

The number of Directors for whom the Company paid

pension benefits during the year was: 1 1

==== ===

5. FINANCE COSTS (NET) 2015 2014

GBP'000 GBP'000

Interest payable on bank loans 265 129

Less: Bank interest receivable (2) (1)

======= =======

263 128

======= =======

6. TAXATION 2015 2014

(a) Analysis of the tax charge for the year: GBP'000 GBP'000

UK Corporation tax at 21% (2014: 23%) 225 235

Overprovision in previous year (15) -

======= =======

Total current tax charge 210 235

Deferred tax - temporary differences - -

======= =======

Tax charge for the year 210 235

======= =======

(b) Factors affecting the tax charge for the

year:

======= =======

Net Income before taxation 2,429 1,181

======= =======

Current Year:

Corporation tax thereon at 21% (2014 - 23%) 510 27

Expenses not deductible for tax purposes 19 18

Excess of capital allowances over depreciation (3) (3)

Investment gain on fair value not taxable (321) (39)

Investment gain not taxable - (13)

Other timing differences 20 -

Overprovision in previous year (15) -

======= =======

Current tax charge 210 235

======= =======

7. DIVIDENDS 2015 2014

Final dividend paid in year of 7.6p per share GBP'000 GBP'000

(2014: 7.6p per share) 206 206

Interim dividend paid in year of 4.5p per

share

======= =======

(2014: 4.2p per share) 122 114

======= =======

328 320

======= =======

The Board recommends the payment of a final dividend of 7.8P per

share, which will be recorded in the Financial Statements for the

year ending 25(th) March 2016.

8. EARNINGS PER SHARE

Basic earnings per share are calculated by dividing Income after

Taxation attributable to Ordinary Shareholders of GBP2,219,000

(2014: GBP946,000) by the weighted average number of 2,711,617

(2014: 2,711,617) ordinary shares in issue during the period

excluding shares held as treasury. There are no instruments in

issue that would have the effect of diluting earnings per

share.

9. INVESTMENT PROPERTIES 2015 2014

GBP'000 GBP'000

Investment Properties

Balance at 25th March 2014 18,515 17,700

Additions 1,735 945

Disposals - (300)

======= =======

20,250 18,345

Revaluation Surplus 1,530 170

======= =======

Balance at 25th March 20 21,780 18,515

======= =======

The Company's freehold investment properties are carried at fair

value as at 25th March 2015. The fair value of the properties has

been calculated by independent valuers, BNP Paribas Real Estate, on

the basis of market value, defined as:

"The estimated amount for which a property should exchange on

the date of valuation between a willing buyer and a willing seller

in an arm's-length transaction, after proper marketing wherein the

parties had each acted knowledgeably, prudently and without

compulsion."

These recurring fair value measurements for non-financial assets

use inputs that are not based on observable market data, and

therefore fall within level 3 of the fair value hierarchy.

The significant unobservable market data used is property yields

which range from 5.5% to 10%, with an average yield of 7.89% and an

average weighted yield of 7.61% for the portfolio.

There have been no transfers between levels of the fair value

hierarchy. Movements in the fair value are recognised in profit or

loss.

A 0.5% increase or decrease in the yield would result in a

corresponding decrease or increase of GBP1.36 million in the fair

value movement through profit or loss.

10. OTHER PROPERTY, PLANT AND EQUIPMENT

2015 2014

GBP'000 GBP'000

Cost

Balance at 25th March 2015 and

at 25th March 2014 47 47

Depreciation

Balance at 25th March 2014 47 41

Charge for the Year - 6

======== ========

Balance at 25th March 2015 47 47

Net Book Values at 25th March 2014 - -

and 25th March 2015

====================================== ======== ========

11. OPERATING LEASES RECEIVABLE

2015 2014

The future minimum lease payments GBP'000 GBP'000

receivable under non-cancellable operating leases

which expire:

Not later than one year 1,422 1,494

Between 2 and 5 years 2,973 2,922

Over 5 years 997 1,102

========= =========

5,392 5,518

========= =========

Rental income under operating leases recognised in the profit or

loss amounted to GBP1,663,000 (2014:

GBP1,609,000).

Typically, the properties were let for a term of between 5 and

15 years at a market rent with rent reviews every 5 years. The

above maturity analysis reflects future minimum lease payments

receivable to the next break clause in the operating lease. The

properties are leased on terms where the tenant has the

responsibility for repairs and running costs for each individual

unit with a service charge payable to cover common services

provided by the landlord on certain properties.

12. INVESTMENTS 2015 2014

GBP'000 GBP'000

Quoted investments 3 3

======= =======

13. ACCOUNTS RECEIVABLE 2015 2014

GBP'000 GBP'000

Trade receivables 486 264

Other receivables 3 3

======= =======

489 267

======= =======

Trade receivables include an allowance for bad debts of

GBP28,000 (2014: GBP28,000). Trade receivables of

GBP22,600 (2014: GBP18,000) are considered past due but not

impaired.

14. ACCOUNTS PAYABLE 2015 2014

GBP'000 GBP'000

Trade payables 7 40

Other creditors 107 163

Accruals and deferred income 972 673

======= =======

1,086 876

======= =======

15. BANK LOANS PAYABLE 2015 2014

GBP'000 GBP'000

Non-current position 7,658 5,998

===========

less: deferred finance costs (37) (47)

======== ===========

7,621 5,951

======== ===========

In December 2013, the bank loan was re-financed providing a

credit facility of up to GBP10 million.

Interest was charged at 1.25% per annum over LIBOR on funds

drawn down until 17th December 2013 and at 2.65% per annum over

LIBOR thereafter.

The loan is repayable in one instalment on 18 December 2018. The

bank loan includes the following financial covenants:

-- Rental income shall not be less than 2.25 times the interest costs

-- The bank loan shall at no time exceed 50% of the market value of the properties secured.

The borrowing facility is secured by fixed charges over a number

of freehold land and buildings owned by the Company, which at the

year end had a combined value of GBP21,780,000 (2014:

GBP17,155,000). The undrawn element of the borrowing facility

available at 25th March 2015 was GBP2.3million (2014:

GBP4.0million). A commitment fee of 1% per annum is payable on the

undrawn amount.

16. DEFERRED TAX

A deferred tax asset of GBP44,145 (2014: GBP250,286) in respect

of the investment property has not been recognised, as the

Directors do not intend to sell the properties and therefore

crystallise the potential deferred tax assets. If the investment

properties were to be sold, the Directors believe it is unlikely

that there would be suitable taxable profits from which the future

reversal of the underlying timing differences could be

deducted.

17. SHARE CAPITAL 2015 2014

GBP'000 GBP'000

Authorised

8,000,000 Ordinary Shares of 25p each: 2,000 2,000

Allotted, Called Up and Fully Paid

3,155,267 Ordinary shares of 25p each 789 789

========

All shares rank equally in respect of Shareholder rights.

In March 2010, the company acquired 443,650 Ordinary shares of

Wynnstay Properties Plc from Channel Hotels and Properties Ltd at a

price of GBP3.50 per share. These shares, representing in excess of

14% of the total shares in issue, are held in Treasury.

18. FINANCIAL INSTRUMENTS

The objective of the Company's policies is to manage the

Company's financial risk, secure cost effective funding for the

Company's operations and minimise the adverse effects of

fluctuations in the financial markets on the value of the Company's

financial assets and liabilities, on reported profitability and on

the cash flows of the Company.

At 25th March 2015 the Company's financial instruments comprised

borrowings and cash at bank and in hand, with short term

receivables and short term payables excluded from IFRS 7. The main

purpose of these financial instruments was to raise finance for the

Company's operations. Throughout the period under review, the

Company has not traded in any other financial instruments. The

Board reviews and agrees policies for managing each of these risks

and they are summarised below:

Credit Risk

The risk of financial loss due to a counterparty's failure to

honour its obligations arises principally in connection with

property leases and the investment of surplus cash.

Tenant rent payments are monitored regularly and appropriate

action is taken to recover monies owed or, if necessary, to

terminate the lease. Funds are invested and loan transactions

contracted only with banks and financial institutions with a high

credit rating.

The Company has no significant concentration of credit risk

associated with trading counterparties (considered to be over 5% of

net assets) with exposure spread over a large number of

tenancies.

Concentration of credit risk exists to the extent that at 25th

March 2015 and 2014, current account and short term deposits were

held with two financial institutions, Svenska Handelsbanken AB and

C Hoare & Co. Maximum exposure to credit risk on cash and cash

equivalents at 25th March 2015 was GBP1,050,000 (2014:

GBP776,000).

Currency Risk

As all of the Company's assets and liabilities are denominated

in Pounds Sterling, there is no exposure to currency risk.

Interest Rate Risk

The Company is exposed to cash flow interest rate risk as it

currently borrows at floating interest rates. The Company monitors

and manages its interest rate exposure on a periodic basis but does

not take out financial instruments to mitigate the risk. The

Company finances its operations through a combination of retained

profits and bank borrowings.

Interest Rate Sensitivity

Financial instruments affected by interest rate risk include

loan borrowings and cash deposits. The analysis below shows the

sensitivity of the statement of comprehensive income and equity to

a 0.5% change in interest rates:

Interest Rate Sensitivity

Financial instruments affected by interest rate risk include

loan borrowings and cash deposits. The analysis below shows the

sensitivity of the statement of comprehensive income and equity to

a 0.5% change in interest rates:

0.5% increase 0.5% decrease

in interest rates in interest rates

2015 2014 2014 2014

GBP'000 GBP'000 GBP'000 GBP'000

38 30 (38) (30)

Impact on interest payable -

gain/(loss)

Impact on interest receivable

- (loss)/gain (6) (4) 6 4

----------- ----------- ---------- ------------

Total impact on pre tax profit

and equity 32 26 (32)26 (26)

----------- ----------- ---------- ------------

The net exposure of the Company to interest rate fluctuations

was as follows:

2015 2014

GBP'000 GBP'000

Floating rate borrowings (bank loans) (7,658) (5,998)

Less: cash and cash equivalents 1,050 776

---------- ----------

(6,608) (5,222)

---------- ----------

Fair Value of Financial Instruments

Except as detailed in the following table, management consider

the carrying amounts of financial assets and financial liabilities

recognised at amortised cost approximate to their fair value.

2014

2015 2015 2014 Fair Value

Book Value Fair Value Book Value GBP'000

GBP'000 GBP'000 GBP'000

Interest bearing borrowings

(note 15) (7,621) (7,672) (5,951) (5,998)

============ ============ ===========

Total (7,621) (7,672) (5,951) (5,998)

============ ============ ===========

Categories of Financial Instruments

2015 2014

GBP'000 GBP'000

Financial assets:

Quoted investments 3 3

Loans and receivables 489 267

Cash and cash equivalents 1,050 776

======= =======

Total financial assets 1,542 1,046

Non-financial assets 21,780 18,515

======= =======

Total assets 23,322 19,561

======= =======

Financial liabilities at amortised

cost 8,932 7,062

======= =======

Total liabilities 8,932 7,062

Shareholders' equity 14,390 12,499

======= =======

Total shareholders' equity and liabilities 23,322 19,561

======= =======

The only financial instruments measured subsequent to initial

recognition at fair value as at 25th March are quoted investments.

These are included in level 1 in the IFRS 7 hierarchy as they are

based on quoted prices in active markets.

Capital Management

The primary objectives of the Company's capital management

are:

-- to safeguard the Company's ability to continue as a going

concern, so that it can continue to provide returns for

shareholders: and

-- to enable the Company to respond quickly to changes in market

conditions and to take advantage of opportunities.

Capital comprises Shareholders' equity plus net borrowings. The

Company monitors capital using loan to value and gearing ratios.

The former is calculated by reference to total net debt as a

percentage of the year end valuation of the investment property

portfolio. Gearing ratio is the percentage of net borrowings

divided by Shareholders' equity. Net borrowings comprise total

borrowings less cash and cash equivalents.

The Company's policy is that the loan to value ratio should not

exceed 50% and the gearing ratio should not exceed 100%.

2015 2014

GBP'000 GBP'000

Net borrowings and overdraft 7,621 5,951

Cash and cash equivalents (1,050) (776)

======= =======

Net borrowings 6,571 5,175

======= =======

Shareholders' equity 14,390 12,499

======= =======

Investment properties 21,780 18,515

======= =======

Loan to value ratio 30.2% 28.0%

Net gearing ratio 45.7% 41.4%

19. STATEMENT OF CASH FLOWS

Analysis of Net Debt 25th March Cash 26th March

2015 Movement 2014

GBP'000 GBP'000 GBP'000

Cash and cash equivalents (1,050) (274) (776)

Bank loan 7,658 1,660 5,998

Net Debt 6,608 1,386 5,222

20. COMMITMENTS UNDER OPERATING LEASES

Future rental commitments at 25th March 2015 under non-cancellable

operating leases are as follows:-

2015 2014

GBP'000 GBP'000

Within one year 20 19

Between two to five years 3 24

23 43

21. RELATED PARTY TRANSACTIONS

The Company had entered into an agreement with I.F.M.

Consultants Ltd, a company owned and controlled by T.J.C. Parker, a

Director of the Company, for that company to provide certain

consultancy services. During the year to 25th March 2015, I.F.M.

Consultants Ltd was paid GBPnil (2014: GBP38,480). As of 26th March

2014, the Company terminated its agreement with I.F.M. Consultants

Ltd and entered into a new agreement with T.J.C.P. Consultants Ltd,

a company owned and controlled by T.J.C. Parker which during the

year was paid GBP40,404 (2014: GBP38,480). There were no other

related party transactions other than with the Directors, which

have been disclosed under Directors' Emoluments in the Directors'

Report on page 8.

22. EVENTS AFTER THE END OF THE REPORTING PERIOD

Shortly after the end of the financial year, the Directors

entered into negotiations off the market to acquire an industrial

estate in Hampshire. Contracts have recently been exchanged, with

completion due in the near future. The acquisition price of GBP2.6

million will be funded from the borrowing facility and cash

resources.

23. SEGMENTAL REPORTING

Industrial Retail Office Total

2015 2014 2015 2014 2015 2014 2015 2014

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Rental Income 1,015 1,107 351 163 297 339 1,663 1,609

======== ======== ======== ======== ======== ======== ======== ========

Profit/(loss) on property

investments at fair value 1,143 230 210 25 178 (85) 1,530 170

======== ======== ======== ======== ======== ======== ======== ========

Total income and gain/(loss) 2,157 1,337 561 188 475 254 3,193 1,779

Property expenses (87) (79) - - - - (87) (79)

======== ======== ======== ======== ======== ======== ======== ========

Segment profit/(loss) 2,070 1,258 561 188 475 254 3,106 1,700

======== ======== ======== ======== ======== ========

Unallocated corporate

expenses (414) (443)

Profit on sale of investment

property 52 - - - - - 52

======== ========

Operating income 2,692 1,309

Interest expense (all

relating to property

loans) (265) (129)

Interest income and other

income 2 1

======== ========

Income before taxation 2,429 1,181

======== ========

Other information Industrial Retail Office Total

2015 2014 2015 2014 2015 2014 2015 2014

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

========== ======= ======= ======= ======== ========

Segment assets 12,605 11,462 5,245 3,300 3,930 3,753 21,780 18,515

========== ======== ======= ======= ======= ======= ======== ========

Segment assets held

as security 12,605 10,102 5,245 3,300 3,930 3,753 21,780 17,155

========== ======== ======= ======= ======= ======= ======== ========

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PKPDNNBKDBAD

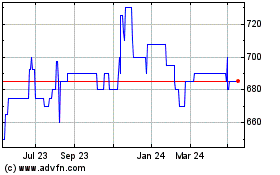

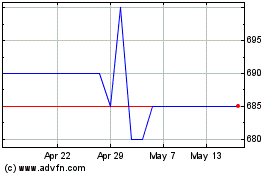

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jul 2023 to Jul 2024